Professional Documents

Culture Documents

Inventory Practice

Inventory Practice

Uploaded by

vutlhariclimatiaveeCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Inventory Practice

Inventory Practice

Uploaded by

vutlhariclimatiaveeCopyright:

Available Formats

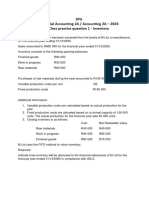

Inventory Practice Question 2024

Inyathi Ltd.’s inventories consist of the following:

Opening Closing inventories Net realisable value

inventories

Rand Rand Rand

Raw materials 35 000 15 000 14 500

Work in progress 15 000 25 500 20 000

Finished 40 000 20 500 30 000

Packing materials 1 750 1 600 1 450

The following information for the year ended 31 December 2022 is available:

Rand

Revenue 275 000

Administrative expenses 25 000

Raw material purchases 90 000

Transport costs- raw materials 250

Variable production overheads costs 50 250

Fixed production overheads costs 41 250

Selling expenses 2 750

Inyathi Ltd.’s measures raw materials and work in progress according to the FIFO method.

Finished goods and consumables are measured using the weighted average method. Fixed

production overhead costs are allocated at 4 cents per unit based and the normal capacity of

1 000 000 units were produced.

Required:

1. Calculate the cost per classification of inventory at 30 June 20X12 so as to comply

with the requirements of IFRS.

2. Prepare the disclosure related to all matters in the financial statements of Univen Ltd

for the reporting date 30 June 20X12 in compliance with IFRS.

Suggested Solution

1. Cost per classification of inventory

Raw materials on 31 December 2022

Opening inventories R35 000

Raw materials purchased R95 000

Transportation costs-raw materials R250

Transfers to work in progress (R110 250)

Closing inventory R15 000

Work in progress on 31 December 2022

Opening inventories 15 000

Raw materials used R110 250

Variable production overheads R50 250

Fixed production overheads (1) R40 000

Transfers to finished goods (R190 000)

Closing inventories (R25 500)

Finished goods on 31 December 2022

Opening inventories R40 000

Transfers from work in progress R190 000

Goods already sold (R209 500)

Closing inventory R20 500

Cost of sales

Transfers from finished goods R209 500

Fixed production overheads - under -recovery (41 250 -40 000) R1 250

Consumable written down to net realizable value (1 600 – 1 450) R150

Total cost of sales R210 900

INYATHI LIMITED

Statement of Financial Position as at 31 December 2022

Assets Note

Current assets

Inventories 3 62 450

INYATHI LIMITED

Statement of Profit or Loss and Other Comprehensive Income for the Year

ended

31 December 2022

Revenue R275 000

Cost of sales (R210 900)

Gross profit R64 100

Less: Expenses (27 750)

Administrative expenses (R25 000)

Selling expenses (R2 750)

Profit for the year R36 350

NYATHI LIMITED

Notes for the year ended 31 December 2022

1. Accounting policy

1.1. Inventories

Inventories are measured at the lower of cost and net realizable value using the

following measurement methods:

Raw materials and work in progress: first-in, first-out.

Finished goods and consumables: weighted average method.

2. Profit before tax includes the following item:

Administrative expenses 25 000

Selling expenses 2 750

Remeasurement of consumables to net realizable value (1 600 -1 450) 150

3. Inventories

Raw materials 15 000

Work in progress 25 500

Finished goods 20 500

Consumables 1 450

62 450

You might also like

- Module-2-Exercises Final - JFCDocument10 pagesModule-2-Exercises Final - JFCJARED DARREN ONGNo ratings yet

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellNo ratings yet

- MANUFACTURING and Partnership AccountsDocument40 pagesMANUFACTURING and Partnership Accountslord67% (3)

- Session 1 Practice 3Document4 pagesSession 1 Practice 3yimin liuNo ratings yet

- 03 SAP Revenue Acc and Reporting WhitePaper 20160513Document28 pages03 SAP Revenue Acc and Reporting WhitePaper 20160513Roger SudatiNo ratings yet

- Assignment DFA6127Document3 pagesAssignment DFA6127parwez_0505No ratings yet

- Normal CostingDocument3 pagesNormal Costingrose llar67% (3)

- Marketing (Hons) 3rd Year Project ReportDocument6 pagesMarketing (Hons) 3rd Year Project ReportPritam BanikkNo ratings yet

- SOP For Fixed Assets Management PPTX JN9OBYJQDocument20 pagesSOP For Fixed Assets Management PPTX JN9OBYJQAnkit_cooldudeNo ratings yet

- Financial Statement Analysis ExerciseDocument5 pagesFinancial Statement Analysis ExerciseMelanie SamsonaNo ratings yet

- FinAcc3 Chap4Document9 pagesFinAcc3 Chap4Iyah AmranNo ratings yet

- ACCA F8 Audit and Assurance Revision Notes 2017 PDFDocument84 pagesACCA F8 Audit and Assurance Revision Notes 2017 PDFJudithNo ratings yet

- Use Worksheet Felipe Aguilar Has A Now Account at TheDocument1 pageUse Worksheet Felipe Aguilar Has A Now Account at TheAmit PandeyNo ratings yet

- Activity 1 FinMaDocument3 pagesActivity 1 FinMaDiomela BionganNo ratings yet

- UNIT 5 Tutorial Question - Cost DeterminationDocument2 pagesUNIT 5 Tutorial Question - Cost DeterminationZano Zaza NgomaneNo ratings yet

- Case StudyDocument3 pagesCase Study203560No ratings yet

- Cost Concepts Building Blocks (S) - 1Document12 pagesCost Concepts Building Blocks (S) - 1Manan ShahNo ratings yet

- Class Practice Question 1 - InventoryDocument1 pageClass Practice Question 1 - InventoryAmanda KatsioNo ratings yet

- CAPE Accounting 2015 U2 P2Document6 pagesCAPE Accounting 2015 U2 P2Dede HarrisNo ratings yet

- CMA Vol 1-1Document211 pagesCMA Vol 1-1Shahaer MumtazNo ratings yet

- Pgp26 Cma 4 CostsheetDocument15 pagesPgp26 Cma 4 CostsheetRaghav khannaNo ratings yet

- Spring 2024 - MGT401 - 1Document3 pagesSpring 2024 - MGT401 - 1Wahab AftabNo ratings yet

- Abellano - Activity 1 & 2Document4 pagesAbellano - Activity 1 & 2Nelia AbellanoNo ratings yet

- Tutorial 5 A212 Foreign OperationsDocument9 pagesTutorial 5 A212 Foreign OperationsFatinNo ratings yet

- BSR410 ST1 2019 Final Students Q&ADocument9 pagesBSR410 ST1 2019 Final Students Q&AGideon van der VyverNo ratings yet

- COGS F2F Practise Questions With SolutionsDocument5 pagesCOGS F2F Practise Questions With Solutionsak8ballpool111No ratings yet

- ASSIGNMENT 411 - Audit of FS PresentationDocument4 pagesASSIGNMENT 411 - Audit of FS PresentationWam OwnNo ratings yet

- COST SHEET OnlineDocument13 pagesCOST SHEET OnlineSoumendra RoyNo ratings yet

- Llagas 01 Laboratory Exercise 1Document5 pagesLlagas 01 Laboratory Exercise 1Angela Fye LlagasNo ratings yet

- Trading StockDocument5 pagesTrading Stockk.c sedibeNo ratings yet

- Assignment AnsDocument6 pagesAssignment AnsVAIGESWARI A/P MANIAM STUDENTNo ratings yet

- MBAG-9 YR1 - ACCFI - 17 August 2021 - S1Document12 pagesMBAG-9 YR1 - ACCFI - 17 August 2021 - S1landu.connieNo ratings yet

- Acc Concepts PP QnsDocument9 pagesAcc Concepts PP Qnsmoots altNo ratings yet

- Master BudgetDocument2 pagesMaster BudgetAli SwizzleNo ratings yet

- Lecture 3 - Practice QuestionDocument6 pagesLecture 3 - Practice QuestionBhunesh KumarNo ratings yet

- HAC Intro To FInancial Management QuestionPaperDocument6 pagesHAC Intro To FInancial Management QuestionPaperfortune maviyaNo ratings yet

- Assignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMDocument5 pagesAssignment On Merchandising Business Answer Only. TH 12:00-3:00 Due Sunday 10/2 6:00 PMMarinella LosaNo ratings yet

- Royal Escape LTD - Co Balance Sheet For The Month Ended, Dec.31,2020Document9 pagesRoyal Escape LTD - Co Balance Sheet For The Month Ended, Dec.31,2020KemerutNo ratings yet

- Statement of Profit or Loss and Other Comprehensive Income Trial Balance For The Year Ended 31 December 20X1. Item Debit ( ) Credit ( )Document3 pagesStatement of Profit or Loss and Other Comprehensive Income Trial Balance For The Year Ended 31 December 20X1. Item Debit ( ) Credit ( )Ezra Mikah CaalimNo ratings yet

- Cost Accounting (Tooba)Document6 pagesCost Accounting (Tooba)Ali AbbasNo ratings yet

- Test Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingDocument7 pagesTest Series: March, 2022 Mock Test Paper - 1 Intermediate: Group - I Paper - 3: Cost and Management AccountingMusic WorldNo ratings yet

- Tanza EngDocument2 pagesTanza Engisabella.desa04No ratings yet

- MGT 401 Ms WordDocument3 pagesMGT 401 Ms Wordtk143821No ratings yet

- MGT 401Document3 pagesMGT 401tk143821No ratings yet

- Practical AssignmentDocument2 pagesPractical AssignmentMahmoud IbrahimNo ratings yet

- Assignment 04 Financial AccountingDocument1 pageAssignment 04 Financial Accountingismailahmedali900No ratings yet

- MAY 2016 SkillsDocument188 pagesMAY 2016 SkillsOnaderu Oluwagbenga EnochNo ratings yet

- OSA Question - Cost AccountingDocument9 pagesOSA Question - Cost AccountingMohola Tebello GriffithNo ratings yet

- Illustrative Examples - Financial StatementsDocument6 pagesIllustrative Examples - Financial StatementsChuchi SubardiagaNo ratings yet

- CA Inter Costing Practical Questions With SolutionsDocument311 pagesCA Inter Costing Practical Questions With SolutionsAnkit KumarNo ratings yet

- Act 5Document1 pageAct 5Unknowingly AnonymousNo ratings yet

- CFAS - Asynchronus ActivityDocument10 pagesCFAS - Asynchronus ActivityAira Santos VibarNo ratings yet

- 1.3 เฉลย File 1.1 Ch 1 2-2022Document14 pages1.3 เฉลย File 1.1 Ch 1 2-2022Chokthawee RattanawetwongNo ratings yet

- Cost AccountingDocument5 pagesCost AccountingLhaizsa PalmagilNo ratings yet

- 1.1 Class 2 + Class3 CH 1 2-2022Document13 pages1.1 Class 2 + Class3 CH 1 2-2022Chokthawee RattanawetwongNo ratings yet

- Assignment # 1 - ManufacturingDocument1 pageAssignment # 1 - ManufacturingSyed Zohaib WarisNo ratings yet

- Cost Accounting Question BankDocument28 pagesCost Accounting Question BankdeepakgokuldasNo ratings yet

- SOLUTION TO SCHEDULE 3gDocument4 pagesSOLUTION TO SCHEDULE 3gKrushna Omprakash MundadaNo ratings yet

- IAS 7 - Statement of CashflowsDocument7 pagesIAS 7 - Statement of CashflowsidarausungNo ratings yet

- 2020 MayDocument15 pages2020 MaySenomi JayasingheNo ratings yet

- Banitog, Brigitte C. BSA 211Document8 pagesBanitog, Brigitte C. BSA 211MyunimintNo ratings yet

- Gilbert CompanyDocument15 pagesGilbert CompanyThricia Mae IgnacioNo ratings yet

- FABMDocument3 pagesFABMAprodithe BoncolmoNo ratings yet

- Jose C. Feliciano College FoundationDocument5 pagesJose C. Feliciano College FoundationJa CalibosoNo ratings yet

- Republic of The Philippines Bacolor, Pampanga: ST ST ST ST ST ST ST STDocument2 pagesRepublic of The Philippines Bacolor, Pampanga: ST ST ST ST ST ST ST STNoel CarpioNo ratings yet

- Tata KelolaDocument23 pagesTata KelolaWisnu0% (1)

- Cost Accounting Chapter 5Document11 pagesCost Accounting Chapter 5ali chahilNo ratings yet

- CertIFR Module-2Document46 pagesCertIFR Module-2Tran AnhNo ratings yet

- AccountDocument37 pagesAccountGaurang MakwanaNo ratings yet

- Week 6 - Sarah AleigraDocument5 pagesWeek 6 - Sarah AleigrafiqoNo ratings yet

- Ac 114 Pratice Final Exam QuestionsDocument200 pagesAc 114 Pratice Final Exam QuestionsChad Vincent B. BollosaNo ratings yet

- CH PDFDocument68 pagesCH PDFFabrienne Kate Eugenio LiberatoNo ratings yet

- RBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddDocument3 pagesRBGH Financials 31 December 2020 Colour 18.03.2021 3 Full PageseddFuaad DodooNo ratings yet

- A Worldwide Empirical Analysis of The Accounting Behaviour in The Waste Management SectorDocument15 pagesA Worldwide Empirical Analysis of The Accounting Behaviour in The Waste Management SectorNur Hidayah K FNo ratings yet

- FAR1 Solution ManualDocument4 pagesFAR1 Solution ManualChristian OliverosNo ratings yet

- Activity Based Costing (ABC) .Document70 pagesActivity Based Costing (ABC) .irwansyah1617100% (4)

- Ias No.8Document41 pagesIas No.8rafikaNo ratings yet

- F1.3-FinancialAccounting Notes 2Document280 pagesF1.3-FinancialAccounting Notes 2seremcornelius24No ratings yet

- Chapter 2 - An Introduction To Coct Terms and PurposesDocument4 pagesChapter 2 - An Introduction To Coct Terms and Purposesنجم الدين طه الشرفيNo ratings yet

- AC216 Unit 1 Inventory Methods - Practice With SolutionsDocument8 pagesAC216 Unit 1 Inventory Methods - Practice With SolutionsRaymond BarbosaNo ratings yet

- Exam MB 310 Microsoft Dynamics 365 Finance Skills MeasuredDocument9 pagesExam MB 310 Microsoft Dynamics 365 Finance Skills Measuredvanishri mogerNo ratings yet

- Cost Accounting Quiz AnswersDocument2 pagesCost Accounting Quiz AnswersGlessey Mae Baito LuvidicaNo ratings yet

- AnalysisDocument8 pagesAnalysisradhika1991No ratings yet

- SLAuS 705Document5 pagesSLAuS 705naveen pragashNo ratings yet

- Pas 16 Property, Plant and EquipmentDocument2 pagesPas 16 Property, Plant and Equipmentamber_harthartNo ratings yet

- Accounting For PPEDocument4 pagesAccounting For PPEMaureen Derial PantaNo ratings yet

- Code of Professional Ethics-AnsDocument5 pagesCode of Professional Ethics-AnsShahid MahmudNo ratings yet

- Audited Financial Statements 2020Document37 pagesAudited Financial Statements 2020Tan NguyenNo ratings yet