Professional Documents

Culture Documents

Mca Accounts Model Question

Uploaded by

Anonymous 1ClGHbiT0J0 ratings0% found this document useful (0 votes)

2 views2 pagesCopyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesMca Accounts Model Question

Uploaded by

Anonymous 1ClGHbiT0JCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

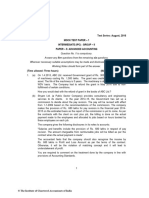

Reg. No.

Wages 3,620 Sales returns 700

Closing stock 4,420 Purchase returns 900

SRI VENKATESWARA COLLEGE OF COMPUTER APPLICATIONS Sales 32,00 General expenses 900

AND MANAGEMENT 0

(An Exclusive Institute for World Class MCA & MBA) Carriage on purchase 500 Discount to customers 360

Carriage on sales 400 Interest from bank 200

M.C.A. – DEGREE MODEL EXAMINATIONS

DECEMBER 2023

(OR)

Second Semester

(b) To Find: 1. Gross profit ratio, 2.Net profit ratio, 3. Current ratio, 4.

MC4104 FUNDAMENTALS ACCOUNTING

Liquid ratio 5. Proprietary ratio, 6. Debt Equity ratio.

(Regulations 2021)

Amou Amou

Particular nt Particular nt 13. (a) Prepare a

Time: 3 Hours Max. Marks: 100

PART - A (10 x 2=20 Marks) 30,00, 15,40, flexible budget for the

Sales 000 Fixed asset 000 production of 80% and

ANSWER ALL THE QUESTIONS: Cost of 20,00, 15,00, 100% activity on the

Sales 000 Net Worth 000 basis of the following

1. Define accounting.

2. List out any three objectives of accounting. 4,00,0 Debts 9,00,0 information.

3. How to calculate current Ratio? Net Profit 00 ( Long) 00

4. What is mean by cash book? Avge. 8,00,0 Current 5,00,0

5. Define Budget. Inventory 00 Liabilities 00

6. What is Cash Budget? Current 7,00,0 8,00,0

7. What is Mean by Depreciation? assets 00 NBIT 00

8. Write short note on Suspense account? Production at 50% Capacity 5,000 Units

9. What is Bank Reconciliation Statement? Raw Material Rs.80 per unit

10. What is Insurance Claim?

Direct Labor Rs.50 per unit

PART B - (5 x13=65 Marks) Direct Expenses Rs.15 per unit

ANSWER ALL THE QUESTIONS: Factory Expenses Rs.50,000 (50) (Fixed)

11. (a) Explain the Process and scope of accounting. Administration Expenses Rs.60,000 (Variable)

(OR)

(b) Explain the Generally Accepted Accounting Principles. (OR)

12. (a) Prepare trading and profit and loss account from the (b). Explain the types of Budget.

Information given below.

Particulars Rs. Particulars Rs.

Opening Stock 3,600 Rent (Factory) 400

Purchase 18,26 Rent (office) 500

0

14. (a) Rectify the following errors identified in the books of GFG as

on 31 March 2022. The Trial Balance did not match. It shows Rs.7,465 Doubtful Debts

being extra credit. Pass necessary journal entries and open suspense Sundry Debtors 10,000 Bad Debts 300

account. Closing stock at the

1. Returns Inward Book was short casted by Rs.500. Sundry Creditors 12,000 end 8,000

2. A Purchase of Rs.1,035 was posted to Creditor’s Account as Additional Information

Rs.1,000. 1. Outstanding Salaries Rs. 500

3. An amount of Rs.5,000 owed by Sabena was omitted from 2. Interest on Capital at 10% P.A.

sundry debtors. 3. Depreciation on Plant and Machinery at 10% P.A. and

4. Namur paid Rs.2,500, but her account was wrongly credited Buildings at 5% P.A.

with Rs.4,500. 4. Prepaid of Interest Rs. 100

(OR) 5. Provision for Bad and Doubtful Debts at 10% on Debtors

(b) On July 01, 2010, Ashok Ltd. purchased a machine for Rs. (OR)

1,08,000 and spent Rs.12,000 on its installation. At the time of (b) Journalize the following transactions:

purchase it was estimated that the effective commercial life of the 2017 (Rs.)

machine will be 12 year and prepare machine account and March 1 Shyam Sunder & Sons commenced business with80,000

depreciation Account in the books of Ashok Ltd. For first 4 years, if cash

depreciation is straight line method with 10%. The account is closed 2 Purchased goods for cash 36,000

on December 31st, every year. 3 Machinery purchased for cash 4,000

15. (a) Explain the procedure for Bank reconciliation statement. 4 Purchased goods from :

(OR) Raghu 22,000

(b) Explain the Insurance Claim Methods. Dilip 30,000

6 Returned goods to Raghu 4,000

PART C - (1 x 15=15 Marks)

8 Paid to Raghu, in full settlement of his account 17,500

ANSWER ALL THE QUESTIONS:

10 Sold goods to Mahesh Chand & Co 32,000

16. (a) From the following particulars of Mrs. Raman & Co.,

13 Received cash from Mahesh Chand & Co. 19,800

you are required to prepare Trading, Profit and Loss Account and

Balance Sheet for the year ended 31st Dec. 2003 Discount allowed 200

Rs. Rs. 15 Paid cash to Dilip 14,850

Sales 65,000 Discount Allowed 100 Discount received 150

Sales Return 500 Discount Received 500 20 Sold goods for cash 25,000

Stock at the beginning 8,000 Salaries 3,000 24 Sold goods for cash to Sudhir Ltd. 18,000

Purchases 29,000 Interest paid 400 25 Paid for Rent 1,500

Purchases Return 300 Furniture 3,000 26 Received for Commission 2,000

Direct Wages 5,000 Buildings 20,000 28 Withdrew by Proprietor for his personal use 5,000

Direct Expenses 5,000 Plant and Machinery 20,000 28 Purchased a fan for Proprietor's house 1,200

Carriage Inwards 4,000 Cash in Hand 1,000

Capital at the

beginning 30,000 Bills Payable 6,200

Drawings 5,000 Reserve for Bad and 500

You might also like

- Mca Accounts Model QuestionDocument2 pagesMca Accounts Model QuestionAnonymous 1ClGHbiT0JNo ratings yet

- Time Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationDocument4 pagesTime Allowed: 3 Hours Max Marks: 100: Colleges 2nd SimulationKashifNo ratings yet

- Acc Mba Int - 1 Dec 2022Document3 pagesAcc Mba Int - 1 Dec 2022Hema LathaNo ratings yet

- 13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Document15 pages13 Financial Accounting - April May 2021 (Freshers CBCS 2020-21 and Onwards)Rakesh MaliNo ratings yet

- Q.P. Code: 62202: Managerial AccountingDocument6 pagesQ.P. Code: 62202: Managerial Accountinganshul bhutangeNo ratings yet

- May 4519201 May 2019Document4 pagesMay 4519201 May 2019PILLO PATELNo ratings yet

- Accounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-2: First Semester MBA Degree ExaminationRohan Chaugule0% (1)

- Co 2101Document3 pagesCo 2101PRIYA LAKSHMANNo ratings yet

- SP - XI - AccountancyDocument3 pagesSP - XI - AccountancyPriyankadevi PrabuNo ratings yet

- Gtu Mba Ma Winter 2018Document4 pagesGtu Mba Ma Winter 2018umangrathod613No ratings yet

- Accounting For Decision Making or Management AU Question Paper'sDocument41 pagesAccounting For Decision Making or Management AU Question Paper'sAdhithiya dhanasekarNo ratings yet

- Mba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDocument4 pagesMba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDeepakNo ratings yet

- Amity MBA 1 ST Sem ASODL AccountingDocument12 pagesAmity MBA 1 ST Sem ASODL AccountingBhavna Jain67% (9)

- 15-Mca-Nr-Accounting and Financial ManagementDocument4 pages15-Mca-Nr-Accounting and Financial ManagementSRINIVASA RAO GANTA0% (2)

- 5 6305198873144984587 PDFDocument112 pages5 6305198873144984587 PDFNbut ddgfNo ratings yet

- 943 Question PaperDocument3 pages943 Question PaperPacific TigerNo ratings yet

- Gujarat Technological UniversityDocument3 pagesGujarat Technological UniversityMehul VarmaNo ratings yet

- Financial Management - II CA QPDocument4 pagesFinancial Management - II CA QPSivaramkrishna KasilingamNo ratings yet

- Fin Mang 2020Document3 pagesFin Mang 2020vinayakraj jamreNo ratings yet

- Gujarat Technological UniversityDocument6 pagesGujarat Technological UniversitymansiNo ratings yet

- r7 Mba Financial Accounting and Analysis Set1Document3 pagesr7 Mba Financial Accounting and Analysis Set1Sunil RaparthiNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisAsad Rehman100% (1)

- Management Programme: MS-04: Accounting and Finance For ManagersDocument5 pagesManagement Programme: MS-04: Accounting and Finance For Managersanon_323108No ratings yet

- MQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Document5 pagesMQP - MBA - Sem1 - Financial and Management Accounting (DMBA104)Rohit SoodNo ratings yet

- FinancialManagement October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 386E9789Document3 pagesFinancialManagement October2019 B B A WithCredits RegularJune-2017PatternSecondYearB B A 386E9789Mubin Shaikh NooruNo ratings yet

- AFM Q-BankDocument42 pagesAFM Q-Banks BNo ratings yet

- 3562 Question PaperDocument3 pages3562 Question PaperKimberly MataruseNo ratings yet

- Trimester - 1 EMBA Examinations - October 2020Document2 pagesTrimester - 1 EMBA Examinations - October 2020amitabh kumarNo ratings yet

- Adv Accounts MTP M19 S2Document22 pagesAdv Accounts MTP M19 S2Harshwardhan PatilNo ratings yet

- Cainterseries 2 CompleteDocument70 pagesCainterseries 2 CompleteNishanthNo ratings yet

- Accountancy - Holiday Homework-Class12Document8 pagesAccountancy - Holiday Homework-Class12Ahill sudershanNo ratings yet

- Fma PaperDocument2 pagesFma Paperfishy18No ratings yet

- Allama Iqbal Open University, Islamabad (Department of Commerce)Document5 pagesAllama Iqbal Open University, Islamabad (Department of Commerce)Akhbar-ul- AkhyarNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034Document3 pagesLoyola College (Autonomous), Chennai - 600 034Harish KapoorNo ratings yet

- FUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19Document2 pagesFUFA Question Paper - Compre - FOFA (ECON F212) 1st Sem 2018-19vineetchahar0210No ratings yet

- Ent 2-2Document4 pagesEnt 2-2danielzashleybobNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Accounting For Managers Model Question Paper-1: First Semester MBA Degree ExaminationDocument5 pagesAccounting For Managers Model Question Paper-1: First Semester MBA Degree ExaminationRohan ChauguleNo ratings yet

- Exercise Problems SECTION-A (6 Marks) : Page - 1Document14 pagesExercise Problems SECTION-A (6 Marks) : Page - 1Saa RaaNo ratings yet

- ACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2Document14 pagesACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2727822TPMB005 ARAVINTHAN.SNo ratings yet

- Ratio AnalysisDocument2 pagesRatio AnalysisRamakrishna J RNo ratings yet

- Sample Paper - Accountancy XI Term 2Document3 pagesSample Paper - Accountancy XI Term 2Manaswi WareNo ratings yet

- JayathDocument5 pagesJayathJayaprakash JayathNo ratings yet

- HB2B CHB2BDocument7 pagesHB2B CHB2BAswinBhimaNo ratings yet

- Financial ManagementDocument20 pagesFinancial Managementsanthanaaknal22No ratings yet

- Practice Question Paper - Financial AccountingDocument6 pagesPractice Question Paper - Financial AccountingNaomi SaldanhaNo ratings yet

- Advanced Accounts MTP M21 S2Document19 pagesAdvanced Accounts MTP M21 S2Harshwardhan PatilNo ratings yet

- Test Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingDocument6 pagesTest Series: April, 2021 Mock Test Paper - 2 Intermediate (New) : Group - Ii Paper - 5: Advanced AccountingOcto ManNo ratings yet

- Valuation of GoodwillDocument15 pagesValuation of Goodwillbtsa1262013No ratings yet

- Caf 5 Far1 Spring 2019xsxDocument5 pagesCaf 5 Far1 Spring 2019xsxMustafa ZaheerNo ratings yet

- 4 CO4CRT11 - Corporate Accounting II (T)Document5 pages4 CO4CRT11 - Corporate Accounting II (T)emildaraisonNo ratings yet

- MTP Nov 16 Grp-2 (Series - I)Document58 pagesMTP Nov 16 Grp-2 (Series - I)keshav rakhejaNo ratings yet

- All Questions Are Compulsory, Closed BookDocument2 pagesAll Questions Are Compulsory, Closed BookMAYANK JAINNo ratings yet

- Ratio Analysis-1Document3 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- Commerce Syllabus Degree Part 3Document21 pagesCommerce Syllabus Degree Part 3मनोज गुप्ता उपाध्यक्षNo ratings yet

- Ratio Analysis-1Document4 pagesRatio Analysis-1Aakash RamakrishnanNo ratings yet

- Bba Iii CfaDocument3 pagesBba Iii Cfasaksham sikhwalNo ratings yet

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- Handbook of Asset and Liability Management: From Models to Optimal Return StrategiesFrom EverandHandbook of Asset and Liability Management: From Models to Optimal Return StrategiesNo ratings yet

- Master of International BusinessDocument31 pagesMaster of International BusinessAnonymous 1ClGHbiT0JNo ratings yet

- BA4206 Business Analytics: Dr.N.Ramesh KumarDocument32 pagesBA4206 Business Analytics: Dr.N.Ramesh KumarAnonymous 1ClGHbiT0JNo ratings yet

- Unit 7 Inward and Ouiw Ard Mail: 7.0 ObjectivesDocument13 pagesUnit 7 Inward and Ouiw Ard Mail: 7.0 ObjectivesAnonymous 1ClGHbiT0JNo ratings yet

- UNI 6 Filing Eouipmen1: T U UreDocument15 pagesUNI 6 Filing Eouipmen1: T U UreAnonymous 1ClGHbiT0JNo ratings yet

- Export and Import Documentation (Study Material) : Sri Vidya Mandir Arts and Science College (Autonomous)Document45 pagesExport and Import Documentation (Study Material) : Sri Vidya Mandir Arts and Science College (Autonomous)Anonymous 1ClGHbiT0JNo ratings yet

- Production and Materials Management (Study Material) : Sri Vidya Mandir Arts and Science College (Autonomous)Document87 pagesProduction and Materials Management (Study Material) : Sri Vidya Mandir Arts and Science College (Autonomous)Anonymous 1ClGHbiT0JNo ratings yet

- 16793theory of CostDocument55 pages16793theory of CostAnonymous 1ClGHbiT0JNo ratings yet

- Exim SVM MaterialDocument67 pagesExim SVM MaterialAnonymous 1ClGHbiT0JNo ratings yet

- Xiinity: 4 121011162233abarna PDocument3 pagesXiinity: 4 121011162233abarna PAnonymous 1ClGHbiT0JNo ratings yet

- FIL NG Syst M: StructureDocument20 pagesFIL NG Syst M: StructureAnonymous 1ClGHbiT0JNo ratings yet

- Cost Output RelationshipDocument17 pagesCost Output RelationshipAnonymous 1ClGHbiT0JNo ratings yet

- Om 02 - Block 2Document44 pagesOm 02 - Block 2Anonymous 1ClGHbiT0JNo ratings yet

- ED Unit 2Document34 pagesED Unit 2Anonymous 1ClGHbiT0JNo ratings yet

- Operations ManagementDocument42 pagesOperations ManagementAnonymous 1ClGHbiT0JNo ratings yet

- Unit IiDocument42 pagesUnit IiAnonymous 1ClGHbiT0JNo ratings yet

- Unit-Iii: Production Planning and ControlDocument105 pagesUnit-Iii: Production Planning and ControlAnonymous 1ClGHbiT0JNo ratings yet

- Unit VDocument109 pagesUnit VAnonymous 1ClGHbiT0JNo ratings yet

- Come To The Cinema by SlidesgoDocument50 pagesCome To The Cinema by SlidesgoAnonymous 1ClGHbiT0JNo ratings yet

- Presented By: Shahbaz Abdullah Mba 3 Sem. 12MBAK-02Document19 pagesPresented By: Shahbaz Abdullah Mba 3 Sem. 12MBAK-02Anonymous 1ClGHbiT0JNo ratings yet

- A Comparative Study of Product Life Cycle and Its Marketing ApplicationsDocument8 pagesA Comparative Study of Product Life Cycle and Its Marketing ApplicationsAnonymous 1ClGHbiT0JNo ratings yet

- Company Final Accounts: Balance SheetDocument8 pagesCompany Final Accounts: Balance SheetAnonymous 1ClGHbiT0JNo ratings yet

- FULLTEXT01Document82 pagesFULLTEXT01Anonymous 1ClGHbiT0JNo ratings yet

- Structure of Capital Market: Dr. Deepa Soni Assistant Professor Department of Economics Mlsu (Ucssh) UdaipurDocument5 pagesStructure of Capital Market: Dr. Deepa Soni Assistant Professor Department of Economics Mlsu (Ucssh) UdaipurAnonymous 1ClGHbiT0J0% (1)

- Netflix 10k AnalysisDocument9 pagesNetflix 10k Analysisapi-659042881No ratings yet

- Test Bank For Principles of Macroeconomics 11 e 11th Edition Karl e Case Ray C Fair Sharon e OsterDocument47 pagesTest Bank For Principles of Macroeconomics 11 e 11th Edition Karl e Case Ray C Fair Sharon e OsterJonMartinezrdtob100% (43)

- BM 204 2020 Module Investment ApprochesDocument36 pagesBM 204 2020 Module Investment ApprochesPhebieon MukwenhaNo ratings yet

- What Is The MUR (Mauritius Rupee) ?Document3 pagesWhat Is The MUR (Mauritius Rupee) ?Jonhmark AniñonNo ratings yet

- Sekai WaDocument2 pagesSekai WaMicaela EncinasNo ratings yet

- CB Insights Venture Report Q3 2023Document243 pagesCB Insights Venture Report Q3 2023施詠柔No ratings yet

- BS Delhi English 27-12-2023Document20 pagesBS Delhi English 27-12-2023rajkumaryogi6172No ratings yet

- Entrep Handout Wk2Document5 pagesEntrep Handout Wk2julialynsantos008No ratings yet

- Ipos, Their Pros, Cons, and The Ipo Process: GlossaryDocument6 pagesIpos, Their Pros, Cons, and The Ipo Process: GlossaryMESRETNo ratings yet

- Portillo's Inc.: United States Securities and Exchange Commission Form S-1 Registration StatementDocument254 pagesPortillo's Inc.: United States Securities and Exchange Commission Form S-1 Registration StatementAnn DwyerNo ratings yet

- Chapter 2 Accounting For Budgetary AccountsDocument33 pagesChapter 2 Accounting For Budgetary AccountsRia BagoNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument2 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceVeeresh ShettarNo ratings yet

- Atp 108 - DDocument17 pagesAtp 108 - Dcfirm23No ratings yet

- REIT NAV Model ExamplesDocument5 pagesREIT NAV Model Examplesmerag76668No ratings yet

- Vision and Mission of Impiana Hotel BerhadDocument8 pagesVision and Mission of Impiana Hotel BerhadAlia NursyifaNo ratings yet

- DD309Document23 pagesDD309James CookeNo ratings yet

- Chapter2 AdvocatesDocument40 pagesChapter2 Advocatesaymane dibNo ratings yet

- Price Setting Steps - Stages For Establishing Prices: 1. Pricing ObjectivesDocument2 pagesPrice Setting Steps - Stages For Establishing Prices: 1. Pricing ObjectivesHamza ZainNo ratings yet

- Final CBR 21Document142 pagesFinal CBR 21Prashant TiwariNo ratings yet

- The US Economy Sadanand Garde Rohit MishraDocument12 pagesThe US Economy Sadanand Garde Rohit Mishrasadanand_gardeNo ratings yet

- Financial Management NotesDocument6 pagesFinancial Management NotesRAVI SONKARNo ratings yet

- Lesson 4 Sources of IncomeDocument9 pagesLesson 4 Sources of IncomeErick MeguisoNo ratings yet

- Time Value of Money Mini-CaseDocument2 pagesTime Value of Money Mini-CaseZelalem GashawNo ratings yet

- My WorkDocument47 pagesMy Workmuzo213No ratings yet

- Chapter Sixteen: Personal Selling and Sales PromotionDocument42 pagesChapter Sixteen: Personal Selling and Sales PromotionRashmeet AroraNo ratings yet

- Sison VS AnchetaDocument3 pagesSison VS AnchetabelleferiesebelsaNo ratings yet

- MCQ - BankingDocument4 pagesMCQ - Bankingbhaskar51178No ratings yet

- Monthly One Liner Current Affairs PDF NovemberDocument55 pagesMonthly One Liner Current Affairs PDF NovemberPiyush VaghelaNo ratings yet

- Chapter 4 - Commodity ChainsDocument41 pagesChapter 4 - Commodity ChainsThanh ChauNo ratings yet

- Dry Bulk Full Report SMOO Q1 2024Document8 pagesDry Bulk Full Report SMOO Q1 2024bill duan100% (1)