Professional Documents

Culture Documents

Information For Residents of Ontario: What's New For 2005?

Uploaded by

api-3836185Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Information For Residents of Ontario: What's New For 2005?

Uploaded by

api-3836185Copyright:

Available Formats

Information for Residents of Ontario

A ll the information you need to calculate your Ontario tax and credits is included on the following pages. You will find

two copies of Form ON428, Ontario Tax, and Form ON479, Ontario Credits, in this book. Complete the forms that apply

to you, and attach a copy to your return.

You will be issued a receipt that can be used with your 2006

What’s new for 2005? return. For more information about gifts to government, see

line 349 in the General Income Tax and Benefit Guide.

O ntario is matching several measures announced in the

2005 federal budget. These include medical expenses,

disability amounts, and the treatment of charitable

Your donation will not be processed if it is less than $2.00,

or if the refund you have calculated is reduced by $2.00 or

donations for tsunami relief. There is also a new more when your return is assessed.

non-refundable tax credit for adoption expenses. If you prefer to make a separate monetary contribution to

The income threshold used in the calculation of the Ontario this fund, please make your cheque or money order payable

Property and Sales Tax Credits has been increased for to the “Minister of Finance – Ontario Opportunities Fund”

senior couples. and mail it to the Ontario Financing Authority, 14th Floor,

1 Dundas Street West, Toronto ON M7A 1Y7.

The Ontario home ownership savings plan, graduate

transitions, workplace child care, workplace accessibility,

and educational technology tax credits expired in 2004.

Ontario research employee stock

Form ON428, Ontario Tax, and Form ON479, Ontario Credits

reflect these changes. option credit

Ontario Child Care Supplement for I f you are an eligible research employee with stock options

granted after December 21, 2000 and before May 18, 2004,

you may be eligible for a tax credit for Ontario income tax

Working Families purposes. If you have stock option benefits and/or taxable

capital gains arising from the sale of the related shares,

contact the Ontario Ministry of Finance for more details.

T he Ontario Child Care Supplement for Working

Families (OCCS) is a non-taxable monthly payment to

qualifying Ontario families to help with the cost of raising

children. For each child under age seven, the monthly If you have questions...

supplement is up to $91.67 in a two-parent family and up to

$109.17 in a single-parent family.

This is not an automatic payment. Each year, the Ontario

Ministry of Finance sends out preprinted applications to

I f you have general questions about your income tax

return, visit the Canada Revenue Agency (CRA) Web site

at www.cra.gc.ca or call the CRA at 1-800-959-8281.

qualifying families. Families must complete and return the

To get forms, visit the CRA Web site at

application to the Ontario Ministry of Finance.

www.cra.gc.ca/forms or call 1-800-959-2221.

File your tax return – You (and your spouse or

common-law partner) should file your 2005 tax return(s) as If you have specific questions about Ontario tax and credits,

soon as possible. The amount of your OCCS payment, or one of the above programs, contact the Ontario Ministry

starting in July 2006, will be based on the information from of Finance Information Centre at the following address and

the return(s) and on your OCCS application. toll-free numbers:

Income Tax Related Programs Branch

Ontario Ministry of Finance

Ontario Opportunities Fund P.O. Box 624, 33 King Street West

Oshawa ON L1H 8H8

English .......................................................... 1-800-263-7965

T he Ontario Opportunities Fund has been set up to give

Ontarians a chance to reduce the province’s debt. If you

want to make a monetary contribution to the Ontario

French............................................................ 1-800-668-5821

OCCS Information Line .............................. 1-877-533-2188

Opportunities Fund from your 2005 tax refund, complete Teletypewriter (TTY)................................... 1-800-263-7776

the “Ontario Opportunities Fund” area on page 4 of your Facsimile ...................................................... 1-905-433-6777

return. Tax Fax Service ..........1-877-4-TAX-FAX (1-877-482-9329)

Web site........................................... www.trd.fin.gov.on.ca

5006-PC

You might also like

- Howdoi Adjust My Tax Withholding?: Publication 919Document20 pagesHowdoi Adjust My Tax Withholding?: Publication 919randyfranklinNo ratings yet

- IRS Pub 2194 - Disaster Relief Tax AddendumDocument136 pagesIRS Pub 2194 - Disaster Relief Tax AddendumdonlucekNo ratings yet

- 2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovDocument76 pages2012 Kentucky Individual Income Tax Forms: WWW - Revenue.ky - GovJason GrohNo ratings yet

- Chapter 8 - Refundable Tax Credits, Benefits and T1 AdjustmentsDocument62 pagesChapter 8 - Refundable Tax Credits, Benefits and T1 AdjustmentsRyan YangNo ratings yet

- General Income Tax and Benefit Guide: Canada Revenue AgencyDocument63 pagesGeneral Income Tax and Benefit Guide: Canada Revenue AgencyvolvoproNo ratings yet

- Form 1040-ES (NR) : U.S. Estimated Tax For Nonresident Alien IndividualsDocument9 pagesForm 1040-ES (NR) : U.S. Estimated Tax For Nonresident Alien IndividualsBrokerANo ratings yet

- Your Custom Guide To Start A Business in Ontario - March 06, 2024Document5 pagesYour Custom Guide To Start A Business in Ontario - March 06, 2024masha.brarNo ratings yet

- US Internal Revenue Service: F1040es - 2004Document7 pagesUS Internal Revenue Service: F1040es - 2004IRSNo ratings yet

- FederalDocument24 pagesFederalNeil NitinNo ratings yet

- Rc4070-09e Guide For Canadian Small BusinessesDocument56 pagesRc4070-09e Guide For Canadian Small Businessesapi-31394357No ratings yet

- US Internal Revenue Service: F1040esn - 2004Document5 pagesUS Internal Revenue Service: F1040esn - 2004IRSNo ratings yet

- 1-ON Trillium Aug-2019Document6 pages1-ON Trillium Aug-2019moizitouNo ratings yet

- General Information: Which Form Should I File? Need A Copy of Your Tax Return?Document32 pagesGeneral Information: Which Form Should I File? Need A Copy of Your Tax Return?tahlokoNo ratings yet

- PIT IT1040 InstructionsDocument46 pagesPIT IT1040 InstructionsLisa GibsonNo ratings yet

- M2 - Lecturas ComplementariasDocument31 pagesM2 - Lecturas ComplementariasKarydawsonNo ratings yet

- Eir GuideDocument14 pagesEir Guidemasha.brarNo ratings yet

- 2019 760 Instructions PDFDocument52 pages2019 760 Instructions PDFLelosPinelos123No ratings yet

- Answers To Concept ChecksDocument5 pagesAnswers To Concept ChecksSuhaybAhmed100% (1)

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Doing Your Own Taxes is as Easy as 1, 2, 3.From EverandDoing Your Own Taxes is as Easy as 1, 2, 3.Rating: 1 out of 5 stars1/5 (1)

- US Internal Revenue Service: F1040es - 2001Document7 pagesUS Internal Revenue Service: F1040es - 2001IRSNo ratings yet

- US Internal Revenue Service: F1040es - 2000Document7 pagesUS Internal Revenue Service: F1040es - 2000IRSNo ratings yet

- File by Mail Instructions For Your 2009 Federal Tax ReturnDocument11 pagesFile by Mail Instructions For Your 2009 Federal Tax ReturnjakeNo ratings yet

- US Internal Revenue Service: p514 - 1995Document31 pagesUS Internal Revenue Service: p514 - 1995IRSNo ratings yet

- GET Slip Form Construction For Chimneys PDF NOW!Document4 pagesGET Slip Form Construction For Chimneys PDF NOW!rifqimuizNo ratings yet

- US Internal Revenue Service: F1040esn - 2003Document5 pagesUS Internal Revenue Service: F1040esn - 2003IRSNo ratings yet

- Hours and ProceduresDocument4 pagesHours and ProceduresttawniaNo ratings yet

- 1060Document8 pages1060jbkmailNo ratings yet

- 2008 Publication 553 Highlights of 2008 Tax ChangesDocument38 pages2008 Publication 553 Highlights of 2008 Tax ChangesgrosofNo ratings yet

- P 4235Document2 pagesP 4235AlbertNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Notice of Reassessment 2021 05 31 09 31 59 853056Document4 pagesNotice of Reassessment 2021 05 31 09 31 59 853056api-676582318No ratings yet

- US Internal Revenue Service: F1040es - 1996Document7 pagesUS Internal Revenue Service: F1040es - 1996IRSNo ratings yet

- Tax HandbookDocument37 pagesTax HandbookChouchir SohelNo ratings yet

- Tax Return in CanadaDocument75 pagesTax Return in CanadaAlejandro VelizNo ratings yet

- US Internal Revenue Service: F1040es - 2003Document7 pagesUS Internal Revenue Service: F1040es - 2003IRSNo ratings yet

- 2017 Form 760 InstructionsDocument56 pages2017 Form 760 InstructionsicanadaaNo ratings yet

- Reconnect Ontario 2022 Application Guide: Ministry of Heritage, Sport, Tourism and Culture IndustriesDocument13 pagesReconnect Ontario 2022 Application Guide: Ministry of Heritage, Sport, Tourism and Culture IndustriesShruti GanapathyNo ratings yet

- J.K. Lasser's 1001 Deductions and Tax Breaks 2009: Your Complete Guide to Everything DeductibleFrom EverandJ.K. Lasser's 1001 Deductions and Tax Breaks 2009: Your Complete Guide to Everything DeductibleRating: 3 out of 5 stars3/5 (1)

- US Internal Revenue Service: p1468Document12 pagesUS Internal Revenue Service: p1468IRSNo ratings yet

- J.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedFrom EverandJ.K. Lasser's Real Estate Investors Tax Edge: Top Secret Strategies of Millionaires ExposedNo ratings yet

- FEIN Assignment LetterDocument2 pagesFEIN Assignment LetterKealamākia Foundation0% (1)

- 2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”From Everand2016 - 2017 Estate Planning Guide for Ontarians - “Completing the Puzzle”No ratings yet

- North Carolina Individual Income Tax Instructions: EfileDocument24 pagesNorth Carolina Individual Income Tax Instructions: EfileQunariNo ratings yet

- Td1on Fill 22eDocument2 pagesTd1on Fill 22eOluwafeyikemi olusogaNo ratings yet

- General Income Tax and Benefit Guide 2015: How To Fill in and File Your 2015 Tax ReturnDocument79 pagesGeneral Income Tax and Benefit Guide 2015: How To Fill in and File Your 2015 Tax ReturnEmad MerganNo ratings yet

- 2011 Tax Reference GuideDocument11 pages2011 Tax Reference GuideSaver PlusNo ratings yet

- Tax 2011Document42 pagesTax 2011murabitomNo ratings yet

- Payroll Deductions Formulas For Computer Programs: 92nd Edition Effective July 1, 2010Document12 pagesPayroll Deductions Formulas For Computer Programs: 92nd Edition Effective July 1, 2010Muhammad AshfaqNo ratings yet

- Mrs M Altman 2019-20 Tax ReturnDocument22 pagesMrs M Altman 2019-20 Tax Returnyochanan altman100% (1)

- 2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFDocument45 pages2021 Tax Return Documents (DE CARVALHO COSTA RAF - Client Copy) PDFRafael CarvalhoNo ratings yet

- US Internal Revenue Service: F1040esn - 2006Document6 pagesUS Internal Revenue Service: F1040esn - 2006IRSNo ratings yet

- IRS Form 1040es 2016Document12 pagesIRS Form 1040es 2016Freeman Lawyer100% (1)

- Provincial Tuition and Education Amounts: Schedule ON (S11)Document1 pageProvincial Tuition and Education Amounts: Schedule ON (S11)api-3836185No ratings yet

- Provincial Amounts Transferred From Your Spouse or Common-Law PartnerDocument1 pageProvincial Amounts Transferred From Your Spouse or Common-Law Partnerapi-3836185No ratings yet

- CPP Contributions On Self-Employment and Other Earnings Schedule 8Document1 pageCPP Contributions On Self-Employment and Other Earnings Schedule 8api-3836185No ratings yet

- Federal Amounts Transferred From Your Spouse or Common-Law Partner Schedule 2Document1 pageFederal Amounts Transferred From Your Spouse or Common-Law Partner Schedule 2api-3836185No ratings yet

- Statement of Investment Income Schedule 4: Line 305 - Amount For An Eligible DependantDocument1 pageStatement of Investment Income Schedule 4: Line 305 - Amount For An Eligible Dependantapi-3836185No ratings yet

- Schedule 3 Capital Gains (Or Losses) in 2005Document1 pageSchedule 3 Capital Gains (Or Losses) in 2005api-3836185No ratings yet

- 5006 TC 05eDocument2 pages5006 TC 05eapi-3836185No ratings yet

- Bogardus V CommissionerDocument2 pagesBogardus V CommissionerPatrick Anthony Llasus-NafarreteNo ratings yet

- Challan E7Document2 pagesChallan E7BasavarajBusnurNo ratings yet

- Invoice 39618325Document1 pageInvoice 39618325sam huangNo ratings yet

- Tax Effects On AmalgamationDocument15 pagesTax Effects On AmalgamationPrakhar KesharNo ratings yet

- Ashley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305Document2 pagesAshley Dixon-Harrison 293 Whittenton ST Apt 1Ft TAUNTON MA 02780-1305ashcat227 DNo ratings yet

- The University of Lahore College of Law Fee Structure Fall 2021 Bachelor of Law BallbDocument1 pageThe University of Lahore College of Law Fee Structure Fall 2021 Bachelor of Law BallbAli SohuNo ratings yet

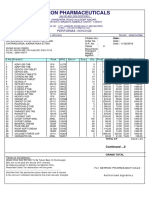

- Payroll For MedLab Emp-TemplateDocument8 pagesPayroll For MedLab Emp-TemplateAries VeeNo ratings yet

- Business Taxation Solman Tabag@garcia PDFDocument42 pagesBusiness Taxation Solman Tabag@garcia PDFJoey AbrahamNo ratings yet

- IT CalculatorDocument49 pagesIT CalculatorMotheesh ReddyNo ratings yet

- Form GST REG-06: (Amended)Document3 pagesForm GST REG-06: (Amended)Mehak LohiaNo ratings yet

- Basic Principles of TaxationDocument33 pagesBasic Principles of TaxationHenicel Diones San Juan100% (1)

- Dr. Taddes Lencho Thesis SummaryDocument10 pagesDr. Taddes Lencho Thesis Summaryalex sisayNo ratings yet

- Learning Objective 11-1: Chapter 11 Current Liabilities and PayrollDocument50 pagesLearning Objective 11-1: Chapter 11 Current Liabilities and PayrollMarqaz MarqazNo ratings yet

- EinDocument1 pageEinruovzuffNo ratings yet

- Gas Taxes in FloridaDocument9 pagesGas Taxes in FloridaGary DetmanNo ratings yet

- Buckwold12e Solutions Ch11Document40 pagesBuckwold12e Solutions Ch11Fang YanNo ratings yet

- Enter Per Month AmountDocument7 pagesEnter Per Month AmountRakesh KumarNo ratings yet

- Departmental Finals Answer KeyDocument6 pagesDepartmental Finals Answer KeyRichard de Leon50% (4)

- E20934 Payslip Aug2022Document1 pageE20934 Payslip Aug2022vikramNo ratings yet

- Receipt Template TopDocument1 pageReceipt Template Topniesa08No ratings yet

- R2 NotesDocument15 pagesR2 NotesAmar Guli100% (2)

- Basic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationDocument1 pageBasic Requirements For New Applicants and For Bmbes Applying For Renewal of RegistrationReyLouiseNo ratings yet

- Notification No. 01-2021-Central ExciseDocument4 pagesNotification No. 01-2021-Central ExciseRetvik PrakashNo ratings yet

- Ansh Engineering Works: QuotationDocument2 pagesAnsh Engineering Works: QuotationAarambh EngineeringNo ratings yet

- Module 8 - Inclusion of Gross IncomeDocument4 pagesModule 8 - Inclusion of Gross IncomeReicaNo ratings yet

- GST Management System: A Project Report ONDocument5 pagesGST Management System: A Project Report ONRohit GadekarNo ratings yet

- City of Miami: Inter-Office MemorandumDocument17 pagesCity of Miami: Inter-Office Memorandumal_crespoNo ratings yet

- COI - MelvanoDocument1 pageCOI - MelvanoSushantNo ratings yet

- Fort Bonifacio Development Vs CIR GR No 158885Document3 pagesFort Bonifacio Development Vs CIR GR No 158885Alfonso Dimla100% (1)

- CIR V CA, CTA, YMCADocument2 pagesCIR V CA, CTA, YMCAChil Belgira100% (3)