Professional Documents

Culture Documents

Atasha and Beth Decided To Combine Their Businesses and Form A Partnership

Atasha and Beth Decided To Combine Their Businesses and Form A Partnership

Uploaded by

Mayuki Takizawa0 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

Atasha and Beth decided to combine their businesses and form a partnership

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views1 pageAtasha and Beth Decided To Combine Their Businesses and Form A Partnership

Atasha and Beth Decided To Combine Their Businesses and Form A Partnership

Uploaded by

Mayuki TakizawaCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

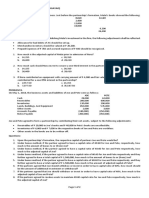

1. Atasha and Beth decided to combine their businesses and form a partnership.

The

following were their assets before formation:

Atasha Beth

Assets 421,500 206,000

Liabilities 183,000 72,000

The following were the agreements made to adjust their assets and liabilities:

Both parties will provide P10,000 for doubtful accounts.

Atasha and Beth’s fixed assets were over-depreciated by P2,000 and under-

depreciated by P1,000 respectively.

Accrued expenses are to be recognized in the books of Atasha and Beth in the

amount of P2,400 and P2,000 respectively.

Obsolete inventory to be written off by Atasha amounted to P7,000

Atasha and Beth also agreed to share profits and losses equally.

What is the total asset of the partnership after formation?

a. 595,100

b. 601,500

c. 607,100

d. 597,100

You might also like

- HQ01 Partnership Formation and OperationDocument9 pagesHQ01 Partnership Formation and OperationJean Ysrael Marquez50% (4)

- Practical Accounting 2: Angelito R. Punzalan, CPA, MBADocument33 pagesPractical Accounting 2: Angelito R. Punzalan, CPA, MBADaniella Mae Elip100% (1)

- Multiple Choice Questions: Partnership FormationDocument118 pagesMultiple Choice Questions: Partnership Formationfghhnnnjml100% (1)

- PartnershipDocument4 pagesPartnershipComan Nocat Eam83% (6)

- Homework ch2Document35 pagesHomework ch2KristineTwo CorporalNo ratings yet

- Partnership Formation 001Document20 pagesPartnership Formation 001Ma Teresa B. Cerezo50% (2)

- Solution Chapter 11Document38 pagesSolution Chapter 11Anonymous CuUAaRSNNo ratings yet

- Partnership ExercisesDocument37 pagesPartnership ExercisesVilma TayumNo ratings yet

- Basic Concepts of PartnershipDocument7 pagesBasic Concepts of PartnershipKhim CortezNo ratings yet

- 9101 - Partnership FormationDocument2 pages9101 - Partnership FormationGo FarNo ratings yet

- Chapter 1 - PartnershipDocument72 pagesChapter 1 - PartnershipJohn Lloyd Yasto100% (5)

- Partnership FormationDocument4 pagesPartnership FormationAlyssa Quiambao50% (2)

- Partnership Formation ReviewerDocument24 pagesPartnership Formation ReviewerJyasmine Aura V. AgustinNo ratings yet

- Parcor Ho1Document20 pagesParcor Ho1Angerica BongalingNo ratings yet

- Partnership ExercisesDocument36 pagesPartnership ExercisesKristel SumabatNo ratings yet

- Partnership Formation Sample Questions With AnswersDocument3 pagesPartnership Formation Sample Questions With AnswersWednesday AddamsNo ratings yet

- St. Scholasticas College: Leon Guinto, ManilaDocument13 pagesSt. Scholasticas College: Leon Guinto, Manilamaria evangelistaNo ratings yet

- Partnership PDFDocument1 pagePartnership PDFAoiNo ratings yet

- Afar Review HandoutsDocument19 pagesAfar Review HandoutsAlisonNo ratings yet

- UE Center For Review & Special Studies (UECRSS), Inc.: Multiple Choice QuestionsDocument17 pagesUE Center For Review & Special Studies (UECRSS), Inc.: Multiple Choice QuestionsIya DelacruzNo ratings yet

- Homework TaxDocument1 pageHomework Taxlesstooth87No ratings yet

- Soal AKL21bDocument5 pagesSoal AKL21bIzzatul kamilaNo ratings yet

- Partnership QuizzerDocument21 pagesPartnership QuizzeragbpaulinoNo ratings yet

- AST Discussion 1 - PARTNERSHIP FORMATIONDocument2 pagesAST Discussion 1 - PARTNERSHIP FORMATIONYvone Claire Fernandez SalmorinNo ratings yet

- Afar - Partnership Formation - BagayaoDocument2 pagesAfar - Partnership Formation - BagayaoRejay VillamorNo ratings yet

- Specacc ReviewerDocument11 pagesSpecacc ReviewerKianna Jhade MoralesNo ratings yet

- Partnership SBCDocument10 pagesPartnership SBChyosunglover100% (1)

- Formation of Partnership1Document3 pagesFormation of Partnership1itik meowmeowNo ratings yet

- Partnership FormationDocument4 pagesPartnership Formationchokie0% (1)

- BADVAC2X - MOD 1 Partnership FormationDocument4 pagesBADVAC2X - MOD 1 Partnership FormationAlice WuNo ratings yet

- Testbank For ParnetshipDocument4 pagesTestbank For ParnetshipKristel Joyce LaureñoNo ratings yet

- Partnership FormationDocument2 pagesPartnership FormationMaria LopezNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationnoNo ratings yet

- AFAR - PartnershipDocument19 pagesAFAR - PartnershipAlisonNo ratings yet

- Partnership Formation 001Document3 pagesPartnership Formation 001John GacumoNo ratings yet

- AKL 1 Tugas 1Document3 pagesAKL 1 Tugas 1Dwi PujiNo ratings yet

- Partnership FormationDocument3 pagesPartnership FormationAngelica Francine GuanlaoNo ratings yet

- Partnership Formation Operation SessionDocument29 pagesPartnership Formation Operation SessionNelmae Jean VegaNo ratings yet

- Illustrative Examples 8Document2 pagesIllustrative Examples 8Banjo A. ReyesNo ratings yet

- Soal Latihan PersekutuanDocument6 pagesSoal Latihan PersekutuanRio DjaraNo ratings yet

- Seatwork #4Document2 pagesSeatwork #4Shiela Mae CalangiNo ratings yet

- 9201 - Partnership FormationDocument4 pages9201 - Partnership FormationBrian Dave OrtizNo ratings yet

- Partnership Formation ReviewerDocument3 pagesPartnership Formation ReviewerangelovilladoresNo ratings yet

- Quiz On Partnership FormationDocument2 pagesQuiz On Partnership FormationVher Christopher DucayNo ratings yet

- QuizDocument5 pagesQuizmiss independent100% (1)

- ProblemsDocument12 pagesProblemsJoy MarieNo ratings yet

- Emil andDocument38 pagesEmil andAyesha ReyesNo ratings yet

- 8901 - Partnership FormationDocument3 pages8901 - Partnership FormationRica Jane Santos Marcelo100% (1)

- Review Materials 1 - Partnership Formation (Concised)Document5 pagesReview Materials 1 - Partnership Formation (Concised)Jason RadamNo ratings yet

- 9301 - Partnership FormationDocument2 pages9301 - Partnership Formationomer 2 gerdNo ratings yet

- Quiz 32321Document2 pagesQuiz 32321john carlo0% (1)

- Ac Far Quiz3Document3 pagesAc Far Quiz3Kristine Joy CutillarNo ratings yet

- Parcor 001Document16 pagesParcor 001Vincent Larrie Moldez0% (2)

- Advanced Financial Accounting and Reporting Problem 2Document5 pagesAdvanced Financial Accounting and Reporting Problem 2Zovia LucioNo ratings yet

- Partnership Formation: AssignmentDocument6 pagesPartnership Formation: AssignmentLee SuarezNo ratings yet

- Weaver Company Sells Magazine Subscriptions For A 1Document1 pageWeaver Company Sells Magazine Subscriptions For A 1Mayuki TakizawaNo ratings yet

- Elaine and Faith Form PartnershipDocument1 pageElaine and Faith Form PartnershipMayuki TakizawaNo ratings yet

- Cash Received by Individual PartnersDocument1 pageCash Received by Individual PartnersMayuki TakizawaNo ratings yet

- On June 30Document1 pageOn June 30Mayuki TakizawaNo ratings yet

- PastDocument1 pagePastMayuki TakizawaNo ratings yet

- The Condensed Statement of Financial Position of The Partnership of EdoraDocument1 pageThe Condensed Statement of Financial Position of The Partnership of EdoraMayuki TakizawaNo ratings yet

- Competition From Other Medical CentersDocument2 pagesCompetition From Other Medical CentersMayuki TakizawaNo ratings yet

- On July 09Document1 pageOn July 09Mayuki TakizawaNo ratings yet

- Kris and Ranz Are Combining Their Separate Business To Form A PartnershipDocument1 pageKris and Ranz Are Combining Their Separate Business To Form A PartnershipMayuki TakizawaNo ratings yet

- As of My Last Knowledge Update in January 2022Document2 pagesAs of My Last Knowledge Update in January 2022Mayuki TakizawaNo ratings yet

- Competition and Increased Demand For Medical ServicesDocument2 pagesCompetition and Increased Demand For Medical ServicesMayuki TakizawaNo ratings yet

- Central Location in Urban PlanningDocument3 pagesCentral Location in Urban PlanningMayuki TakizawaNo ratings yet

- Technological Advances in Healthcare Present Numerous Opportunities To Enhance Patient CareDocument2 pagesTechnological Advances in Healthcare Present Numerous Opportunities To Enhance Patient CareMayuki TakizawaNo ratings yet

- The Literature On The Vulnerability of Roads Leading To Hospitals To Floods During Heavy Rains Highlights A Range of Threats and Challenges That Can Significantly Impact Emergency Medical ResponsesDocument2 pagesThe Literature On The Vulnerability of Roads Leading To Hospitals To Floods During Heavy Rains Highlights A Range of Threats and Challenges That Can Significantly Impact Emergency Medical ResponsesMayuki TakizawaNo ratings yet

- Strong Commitment and FundDocument2 pagesStrong Commitment and FundMayuki TakizawaNo ratings yet

- Resources and Lab Instruments in Scientific ResearchDocument2 pagesResources and Lab Instruments in Scientific ResearchMayuki TakizawaNo ratings yet

- Republic Act 8344Document2 pagesRepublic Act 8344Mayuki TakizawaNo ratings yet