Professional Documents

Culture Documents

UNIT 2 professional ethics of auditors

Uploaded by

primhaile assefaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UNIT 2 professional ethics of auditors

Uploaded by

primhaile assefaCopyright:

Available Formats

UNIT 2: THE AUDITING PROFESSION

2.0 AIMS AND OBJECTIVES

When you have studied this unit you should be able to:

o understand independence in fact and in appearance.

o understand the AICPA code of professional ethics.

o define the major legal concepts that relate to auditors’ liability.

o describe the auditor’s responsibility for the detection of fraud and error.

2.1 Introduction

This unit covers the basic codes of professional conduct, which the auditors need to bear in mind

in carrying out their duties. The main source of material for code of professional conduct in this

unit is the AICPA’s code of professional ethics.

This unit also covers the duties and legal liabilities of auditors.

Broadly defined, the term ethics represents the moral principles or rules of conduct recognized

by an individual or group of individuals. Ethics apply when an individual has to make a decision

from various alternatives regarding moral principles.

2.2 INDEPENDENCE

The AICPA code of professional conduct requires a member in public practice to be independent

in the performance of professional services as required by standards promulgated by bodies

designated by council.

The requirement is stated in terms of “standards promulgated by bodies designated by council”

to conveniently permit inclusion or exclusion of independence requirements for certain types of

services provided by CPA firms. For example, independence is required for audits of annual

financial statement but a CPA firm can do tax return and provide management services without

being independent. Independence in auditing means an unbiased viewpoint in the performance

of audit test, the evaluation of results, and the issuance of the audit report.

1 | Compiled by Tesfaye N. (MSc)

Independence has two distinct aspects. First, the public accountants must in fact be independent

toward any enterprise they audit. Second, the relationships of public accountants with audit

clients must be such that they will appear independent to third parties.

Independences in fact refers to the auditor’s ability to maintain unbiased and impartial mental

attitude or state of mind in all aspects of work. As such independence in fact is not subject to

objective measurement and therefore can be judged only by the auditor.

Independence in appearance refers to the auditor’s freedom from conflict of interest, which third

parties may infer from circumstantial evidence.

The following paragraphs illustrate some of the common situations, which may impair

independence.

Investment interest in audit client: - An auditor’s investment in shares, bonds, mortgage,

and notes of an audit client or its associates, either direct or indirect, may impair

independence. In this situation, an auditor may be in a position to issue an opinion or to

influence the client’s financial statements for personal financial gains at the expense of

his/her capacity as auditor. Such an investment is not limited to the auditor but also applies

to his or her immediately family and to partners and their immediate families.

Non audit functions and services: - Certain functions are incompatible with the auditing

function. These include functioning as a director, officers or employee of an audit client.

The auditor’s involvement in these functions and services creates a conflict of interest.

Litigation between CPA firm and client: When there is a lawsuit or intent to start a lawsuit

between a CPA firm and its client, the ability of the CPA firm and client to remain objective

is questionable.

Hospitality or goods and services: - This will affect independence unless it is modest.

Undue dependence on income: - If the amount of income from a client is very large as

compared to the total annual income of the audit firm, independence will be impaired since

the auditors want to maintain this financial interest.

2 | Compiled by Tesfaye N. (MSc)

2.3 PROFESSIONAL QUALIFICATION REQUIREMENTS

A professional accountant should perform professional services with due care, competence and

diligence and has a continuing duty to maintain professional knowledge and skill at a level

required to ensure that a client or employer receives the advantage of competent professional

service based on up-to-date development in practice, legislation and techniques.

Auditing standards require auditors to have adequate educational requirement as well as other

moral and legal criteria fulfillment. The educational requirements are composed of theoretical

knowledge and practical experience.

2.4 PROFESSIONAL ETHICS

All recognized professions have developed codes of professional ethics. Professional ethics refer

to the basic principles of right action for the member of a profession. Professional ethics may be

regarded as a mixture of moral and practical concepts. Thus the professional ethics of an

accountant would signify his behavior towards his fellows in the profession and other

professions and towards members of the public.

The fundamental purpose of such codes is to provide members with guidelines for maintaining a

professional attitude and conducting themselves in a manner that will enhance the professional

stature of their discipline.

The AICPA code of professional conduct considers the following to be followed by auditors

(accountants) in the conduct of professional relations with others.

- Integrity: - An accountant should be straightforward, honest and sincere in his approach to

his professional work.

- Objectivity: - An accountant should be fair and should not allow bias to override his

objectivity. When reporting on financial statements, which come his review, he should

maintain an impartial attitude.

- Independence: - When in public practice, an accountant should both be and appear to be

free of any interest which might be regarded, whatever its actual effect, as being

incompatible with integrity and objectivity.

3 | Compiled by Tesfaye N. (MSc)

- Confidentiality:

Confidentiality: - A professional accountant should respect the confidentiality of

information acquired in the course of his work and should not disclose any such information

to a third party without specific authority or unless there is a legal or professional duty to

disclose.

- Technical standards: - An accountant should carry out his professional work in accordance

with the technical and professional standards relevant to that work.

- Professional competence: - An accountant has a duty to maintain his level of competence

throughout his professional career. He should only undertake works, which he or his firm

can expect to complete with professional competence.

- Ethical behavior: - An accountant should conduct himself with a good reputation of the

profession and refrain from any conduct, which might bring discredit to the profession.

- Contingent fess: - The AICPA code of professional conduct prohibits a CPA firm from

rendering any professional services on a contingent fee basis.

- Responsibilities to colleagues: - The auditor should promote cooperation and good relations

with other members of the profession.

- Advertising: - The advertising should not be false or misleading,” should not contravene

“professional good taste,” should not make “unfavorable reflection on the competence or

integrity of the profession,” and should not” involve a statement the contents of which”

cannot be substantiated.

2.5 LEGAL RESPONSIBILITY AND LIABILITY OF AUDITORS

The auditor is responsible for his report. The auditor then has certain duties to fulfill to the users

of the financial statements that he reports on.

Responsibilities impose liabilities if things go wrong.

Liable for what?

The CPA can be sued under the following legal concepts.

(i) Prudent man concept: - The auditor is responsible for exercising due professional

care, and he is subject to lawsuit if he fails to do so.

4 | Compiled by Tesfaye N. (MSc)

(ii) Liable for acts of others: - The partners are jointly liable for civil actions against a

partner.

(iii) Lack of privileged communication: - CPAS do not have the right under common

law to withhold information from the courts on the grounds that the information is

privileged.

Definition of Terms

Negligence: is violation of legal duty to exercise a degree of care that an ordinary prudent

person would exercise under similar circumstances with resultant damages to another party.

Gross negligence: is lack of event slight care. Many jurisdictions consider gross negligence

equivalent to constructive fraud.

fraud.

Fraud: is defined a misrepresentation by a person of a material fact, known by that person to be

untrue.

Constructive fraud: differs from fraud as defined above in that constructive fraud does not

involve a misrepresentation with the intent to deceive.

Privity: is the relationship between parties to a contract.

Breach of contact: is failure of one or both parties to a contract to perform in accordance with

the contract’s provisions.

Proximate cause: exists when damage to another is directly attributable to a wrongdoer’s act.

Contributory negligence: is negligence on the part of the client that has contributed to his or her

having incurred a loss.

5 | Compiled by Tesfaye N. (MSc)

A. Auditors’ liability to their clients

When CPAS take on any type of engagement, they are obliged to render due professional care.

This obligation exists whether or not it is specifically set forth in the written contract with the

client. Thus, CPAS are liable to their clients for any losses proximately caused by the CPA’ S

failure to exercise due professional care. That is to recover its losses, an injured client need only

prove that the auditors were guilty of negligence and that the auditors’ negligence was the

proximate cause of the client’s losses.

B. Auditors’ liability to third parties

Bankers and other creditors or investors who utilize financial statements covered by an audit

report can recover damages from the auditors if it can be shown that the auditors were guilty of

fraud or gross negligence in the performance of their professional duties.

Moreover, the auditors can be held liable for negligence to a limited class of third parties if the

auditors have actual knowledge of such third parties or if there exists a special relationship

between the auditors and the third parties.

The clients (plaintiffs) must prove that they sustained losses, that they relied on the audited

financial statements, which were misleading, that this reliance was the primate cause of their

losses, and that the auditors were negligent.

C. Auditors’ responsibility for the detection of fraud and error

The detection and prevention of error and fraud is the management’s responsibility by designing

and implementing appropriate internal control systems. The auditor is not responsible for the

prevention and detection of error and fraud. The auditor is responsible to design audit

procedures to reduce the risk of not detecting a material error or fraud, to an appropriate level to

provide reasonable assurance. Accordingly, the auditor must exercise due care in planning,

performing, and evaluating the results of audit procedures.

6 | Compiled by Tesfaye N. (MSc)

You might also like

- 2 Legal LiabilityDocument68 pages2 Legal LiabilityEmilia Ahmad Zam ZamNo ratings yet

- UNIT 2 Professional Ethics of AuditorsDocument6 pagesUNIT 2 Professional Ethics of Auditorszelalem kebedeNo ratings yet

- AU Chapter 2Document6 pagesAU Chapter 2Addi Såïñt GeorgeNo ratings yet

- Audit I CH IIDocument6 pagesAudit I CH IIAhmedNo ratings yet

- UNIT 2 Professional Ethics of AuditorsDocument4 pagesUNIT 2 Professional Ethics of AuditorsKhalid MuhammadNo ratings yet

- Chapter 2Document24 pagesChapter 2Ram KumarNo ratings yet

- Amala Kee Yaa ShureeDocument4 pagesAmala Kee Yaa ShureeAkkamaNo ratings yet

- Auditing TheoryDocument3 pagesAuditing TheoryJereza Joy LastreNo ratings yet

- Code of EthicsDocument37 pagesCode of EthicsDawn Rei Dangkiw100% (1)

- 2.1. What Is Auditing Standard?: General Standards Standards of Fieldwork Standards of ReportingDocument56 pages2.1. What Is Auditing Standard?: General Standards Standards of Fieldwork Standards of ReportingFackallofyouNo ratings yet

- Professional ethics, liability and auditor positionDocument2 pagesProfessional ethics, liability and auditor positionFaul EmailNo ratings yet

- Audit I-Chapter TwoDocument11 pagesAudit I-Chapter Twothedalesh weldeNo ratings yet

- Auditing Chapter2Document7 pagesAuditing Chapter2Getachew JoriyeNo ratings yet

- BKAA 3023 Â " Topic 1 - Code of Ethics For AuditorsDocument20 pagesBKAA 3023 Â " Topic 1 - Code of Ethics For AuditorsDarren 雷丰威No ratings yet

- Audit I CHAPTER 2Document38 pagesAudit I CHAPTER 2Samuel GirmaNo ratings yet

- Key Concepts in AccountingDocument9 pagesKey Concepts in AccountingSunday OcheNo ratings yet

- The Auditing Profession's Code of EthicsDocument8 pagesThe Auditing Profession's Code of EthicsSeid KassawNo ratings yet

- Chapter One: Ethical Issues and Financial Statement Fraud in Advanced AccountingDocument74 pagesChapter One: Ethical Issues and Financial Statement Fraud in Advanced AccountingYismawNo ratings yet

- Chapter 1Document19 pagesChapter 1ReshmajitKaurNo ratings yet

- 4.1 MIA By-Law (On Professional Conducts and Ethics)Document84 pages4.1 MIA By-Law (On Professional Conducts and Ethics)Yaya-Nadia AhmadNo ratings yet

- Introduction - What Is AuditingDocument29 pagesIntroduction - What Is AuditingMoinul HossainNo ratings yet

- Chapter One Intro to AuditingDocument56 pagesChapter One Intro to AuditingSnn News TubeNo ratings yet

- A$a L2 EditedDocument6 pagesA$a L2 EditedKimosop Isaac KipngetichNo ratings yet

- Chapter 2 - Professinal Ethics Legal LiabilityDocument29 pagesChapter 2 - Professinal Ethics Legal LiabilityThị Hải Yến TrầnNo ratings yet

- Introduction to professional ethical values and standardsDocument15 pagesIntroduction to professional ethical values and standardsAsfawosen DingamaNo ratings yet

- WV&PE Lesson 3Document14 pagesWV&PE Lesson 3Daniel S. GonzalesNo ratings yet

- Ch.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryDocument6 pagesCh.4-5 PROFESSIONAL ETHICS & LEGAL ENVIRONMENT - SummaryAndi PriatamaNo ratings yet

- Auditor's Legal Liability and DefensesDocument6 pagesAuditor's Legal Liability and DefensesFerial FerniawanNo ratings yet

- Lecture Notes - Code of EthicsDocument5 pagesLecture Notes - Code of EthicsHalim Matuan MaamorNo ratings yet

- MBA Internal Audit AssignmentDocument20 pagesMBA Internal Audit AssignmentHarveen KaurNo ratings yet

- 2 Legal LiabilityDocument68 pages2 Legal Liabilitycamillediaz100% (1)

- Code of Ethics for CPAs in the PhilippinesDocument24 pagesCode of Ethics for CPAs in the PhilippinesQueenie QuisidoNo ratings yet

- AUD 15 Professional Responsibilities 2021Document43 pagesAUD 15 Professional Responsibilities 2021nicgNo ratings yet

- Code of Ethics For Professional Accountants in The PhilippinesDocument4 pagesCode of Ethics For Professional Accountants in The PhilippinesAlex Ong0% (1)

- Code of Ethics: Prof. Zeus A. Aboy, CPA MBA EDL (Candidate)Document75 pagesCode of Ethics: Prof. Zeus A. Aboy, CPA MBA EDL (Candidate)Io AyaNo ratings yet

- MCQ-for lecture-QUIZ REVISED-QUESTIONS For StudentsDocument6 pagesMCQ-for lecture-QUIZ REVISED-QUESTIONS For Studentstinesa ambikapathyNo ratings yet

- Code of EthicsDocument5 pagesCode of EthicsZeus GamoNo ratings yet

- Chap 4-5. Aulia RahmayantiDocument8 pagesChap 4-5. Aulia Rahmayantiahmad RifaiNo ratings yet

- Chapter 2Document21 pagesChapter 2Danish NabilNo ratings yet

- Unit 2 Regulation of The Practice of Public Accountancy and Within The Accounting FirmDocument136 pagesUnit 2 Regulation of The Practice of Public Accountancy and Within The Accounting FirmDia Mae Ablao GenerosoNo ratings yet

- The Code of Professional EthicsDocument33 pagesThe Code of Professional EthicsLaezelie PalajeNo ratings yet

- Ethics For CaDocument3 pagesEthics For CaRaghvendra SinghNo ratings yet

- Code of Ethics For Professional Accountants: B&P Inter ConsultDocument12 pagesCode of Ethics For Professional Accountants: B&P Inter ConsultKalimullah KhanNo ratings yet

- Solution Manual For Auditing Canadian 7th Edition Smieliauskas Bewley 1259259870 9781259259876Document36 pagesSolution Manual For Auditing Canadian 7th Edition Smieliauskas Bewley 1259259870 9781259259876charlesblackdmpscxyrfi100% (30)

- Nature of Auditing and Ethics in the ProfessionDocument5 pagesNature of Auditing and Ethics in the ProfessionAsadul islam sajibNo ratings yet

- 2014december14codeofprofessionalconduct PDFDocument227 pages2014december14codeofprofessionalconduct PDFBeomiNo ratings yet

- Professional Ethics P2Document19 pagesProfessional Ethics P2chandrsenNo ratings yet

- Ethics The Code of Ethics-IOPCPDocument6 pagesEthics The Code of Ethics-IOPCPEe LiseNo ratings yet

- Auditors Independence Review - 1Document22 pagesAuditors Independence Review - 1Mohammad Abu Kawsar FcaNo ratings yet

- Ethics and The Accountancy Profession: The Duties of Man To SocietyDocument36 pagesEthics and The Accountancy Profession: The Duties of Man To Societyamelya asryNo ratings yet

- A&a Unit 2 NotesDocument8 pagesA&a Unit 2 NotesMohanrajNo ratings yet

- Bacc307 Assignment 1Document7 pagesBacc307 Assignment 1Denny ChakauyaNo ratings yet

- Code of Ethics QuestionsDocument11 pagesCode of Ethics QuestionsAiAiNo ratings yet

- Corp - Gov Text Module 5Document6 pagesCorp - Gov Text Module 5Rony GhoshNo ratings yet

- The Auditing ProfessionDocument10 pagesThe Auditing Professionmqondisi nkabindeNo ratings yet

- 4 JawapanDocument5 pages4 JawapanNad Adenan100% (1)

- Ethics and AcceptanceDocument41 pagesEthics and AcceptanceTaimur ShahidNo ratings yet

- M1. Professional BehaviourDocument12 pagesM1. Professional BehaviourZHI KANG KONGNo ratings yet

- The Professional and Ethical Duties of the Accountant. ACCA. Paper P2. Students notes.: ACCA studies, #2From EverandThe Professional and Ethical Duties of the Accountant. ACCA. Paper P2. Students notes.: ACCA studies, #2Rating: 4 out of 5 stars4/5 (2)

- 1040 Exam Prep Module XI: Circular 230 and AMTFrom Everand1040 Exam Prep Module XI: Circular 230 and AMTRating: 1 out of 5 stars1/5 (1)

- ዘምዘምDocument4 pagesዘምዘምprimhaile assefaNo ratings yet

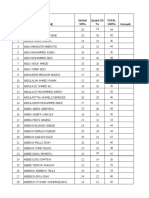

- Hawassa District Bank Trainee Exam ResultDocument45 pagesHawassa District Bank Trainee Exam Resultprimhaile assefaNo ratings yet

- HNS COC Level 4 Practice Exam Full Package NewDocument8 pagesHNS COC Level 4 Practice Exam Full Package Newprimhaile assefa100% (2)

- Exam Results TableDocument39 pagesExam Results Tableprimhaile assefaNo ratings yet

- Chapter 2Document14 pagesChapter 2primhaile assefaNo ratings yet

- G9 Chemistry TG 2023 Web 38 75Document50 pagesG9 Chemistry TG 2023 Web 38 75primhaile assefaNo ratings yet

- Unit 3 Auding Principles and ToolsDocument9 pagesUnit 3 Auding Principles and Toolszelalem kebedeNo ratings yet

- Docker+Course+ProfileDocument7 pagesDocker+Course+Profileprimhaile assefaNo ratings yet

- Student Exam ResultsDocument21 pagesStudent Exam Resultsprimhaile assefaNo ratings yet

- Entrepreneurship and Small Business Management For Year III, Horticulture Students, 2020/21Document225 pagesEntrepreneurship and Small Business Management For Year III, Horticulture Students, 2020/21primhaile assefaNo ratings yet

- University of Gondar: Multimedia Systems Chapter-OneDocument31 pagesUniversity of Gondar: Multimedia Systems Chapter-OneTesfahun MaruNo ratings yet

- To: Merqconsultancy PLC: Application For Qualitative and Quantitative DatacollectorDocument3 pagesTo: Merqconsultancy PLC: Application For Qualitative and Quantitative Datacollectorprimhaile assefaNo ratings yet

- A.A Bank Trainee 2022 Exam ResultDocument102 pagesA.A Bank Trainee 2022 Exam Resultprimhaile assefaNo ratings yet

- Mentenance Chapter 3Document10 pagesMentenance Chapter 3primhaile assefaNo ratings yet

- Financial Management 3RD Degree AcctnDocument154 pagesFinancial Management 3RD Degree Acctnprimhaile assefaNo ratings yet

- CH 2-Part2Document20 pagesCH 2-Part2hayelomNo ratings yet

- 2nd Week Exam ScheduleDocument1 page2nd Week Exam Scheduleprimhaile assefaNo ratings yet

- Chap 2Document31 pagesChap 2primhaile assefaNo ratings yet

- E-Learning Test Guidance (Examinee Version)Document4 pagesE-Learning Test Guidance (Examinee Version)primhaile assefaNo ratings yet

- Try Applying An Ice Pack Wrapped in A Thin Towel For 10Document1 pageTry Applying An Ice Pack Wrapped in A Thin Towel For 10primhaile assefaNo ratings yet

- 1principle of Marketing EditedDocument99 pages1principle of Marketing Editedprimhaile assefaNo ratings yet

- SP - Chapter Two1Document148 pagesSP - Chapter Two1primhaile assefaNo ratings yet

- Gouty ADocument24 pagesGouty Aprimhaile assefaNo ratings yet

- Huawei QuestionDocument60 pagesHuawei Questionprimhaile assefaNo ratings yet

- Full - Final Project Document TemplateDocument16 pagesFull - Final Project Document Templateprimhaile assefaNo ratings yet

- Presentation1 GroupDocument25 pagesPresentation1 Groupprimhaile assefaNo ratings yet

- AduDocument1 pageAduprimhaile assefaNo ratings yet

- Chap 3Document41 pagesChap 3primhaile assefaNo ratings yet

- G - Final Pro Group 6 (Seca)Document15 pagesG - Final Pro Group 6 (Seca)primhaile assefaNo ratings yet

- Mussie BaDocument11 pagesMussie Baprimhaile assefaNo ratings yet

- Mary Ann Villa-Abrille Seeks Annulment of Sale of Conjugal PropertyDocument2 pagesMary Ann Villa-Abrille Seeks Annulment of Sale of Conjugal PropertyEdison Flores100% (1)

- Gonzales Vs CA - Digest G.R. No. L-59495-97 June 26, 1987Document1 pageGonzales Vs CA - Digest G.R. No. L-59495-97 June 26, 1987Don BallesterosNo ratings yet

- Paper 6 PDFDocument657 pagesPaper 6 PDFTeddy BearNo ratings yet

- Asiain V JalandoniDocument1 pageAsiain V JalandoniBGodNo ratings yet

- Hon'ble Justice Deepak Verma, Hon'ble Justice DR B.S ChauhanDocument9 pagesHon'ble Justice Deepak Verma, Hon'ble Justice DR B.S Chauhanasokan_spNo ratings yet

- MP CJ Paper IV (Phaseiv)Document14 pagesMP CJ Paper IV (Phaseiv)Mohd SuhailNo ratings yet

- Rex Calupaz DosDocument2 pagesRex Calupaz DosAlex MolinyaweNo ratings yet

- Lawsuit Summary Judgment Reply: KingCast v. Quincy KingCast v. City of Quincy MGL 66 10 Public Records Request On James Berlo PropertyDocument13 pagesLawsuit Summary Judgment Reply: KingCast v. Quincy KingCast v. City of Quincy MGL 66 10 Public Records Request On James Berlo PropertyChristopher KingNo ratings yet

- Frenzel Vs Catito GR143958Document2 pagesFrenzel Vs Catito GR143958Pam Otic-Reyes100% (2)

- Republic of The Philippines vs. Harry RoqueDocument5 pagesRepublic of The Philippines vs. Harry RoqueMary Joyce Blancaflor GarciaNo ratings yet

- Environment and Land Petition 2 of 2020 PDFDocument19 pagesEnvironment and Land Petition 2 of 2020 PDFEsther NyaimNo ratings yet

- Dioso Vs TomasDocument2 pagesDioso Vs TomasBenBulacNo ratings yet

- First, Your Marriage Is NOT Valid Here in The PhilippinesDocument3 pagesFirst, Your Marriage Is NOT Valid Here in The PhilippinesReal TaberneroNo ratings yet

- Publication Right FormDocument1 pagePublication Right FormInsaf SaifiNo ratings yet

- Abatement of SuitDocument7 pagesAbatement of SuitfreakedwithcollegeliNo ratings yet

- SMC vs Teodosio Labor CaseDocument1 pageSMC vs Teodosio Labor CaseMJ DecolongonNo ratings yet

- sbp-MurabahaAgreement Doc 1 MMFADocument7 pagessbp-MurabahaAgreement Doc 1 MMFAnadeemuzairNo ratings yet

- People's Broadcasting v. SecretaryDocument3 pagesPeople's Broadcasting v. SecretaryCarlo PajoNo ratings yet

- Two Types of EjectmentDocument2 pagesTwo Types of EjectmentMarvin ChoyansNo ratings yet

- Ipc Capital SentenceDocument25 pagesIpc Capital SentenceSHUBHAM RAJNo ratings yet

- G R No 195671 ROGELIO J GONZAGA Vs PEOPLE OF THE PHILIPPINESDocument7 pagesG R No 195671 ROGELIO J GONZAGA Vs PEOPLE OF THE PHILIPPINESRuel FernandezNo ratings yet

- Om Prakash Gupta Vs Parveen Kumar and Anr On 19 May 2000Document12 pagesOm Prakash Gupta Vs Parveen Kumar and Anr On 19 May 2000Debmallya SinhaNo ratings yet

- Kauer Et. Al. v. Nostalgia Products GroupDocument5 pagesKauer Et. Al. v. Nostalgia Products GroupPriorSmartNo ratings yet

- Court Rules Negligence by Travel Agency and Client in Missed Flight CaseDocument8 pagesCourt Rules Negligence by Travel Agency and Client in Missed Flight CaseTris LeeNo ratings yet

- MOA land expropriationDocument5 pagesMOA land expropriationKath ThakNo ratings yet

- United States v. Edward Neal Bonavia, 927 F.2d 565, 11th Cir. (1991)Document9 pagesUnited States v. Edward Neal Bonavia, 927 F.2d 565, 11th Cir. (1991)Scribd Government DocsNo ratings yet

- Kinds of Equity JurisdictionDocument2 pagesKinds of Equity JurisdictionAdan Hooda0% (1)

- Stages of a Civil SuitDocument3 pagesStages of a Civil SuitAnkit Sharma50% (2)

- A Was Charged With HomicideDocument4 pagesA Was Charged With Homicidejoey celesparaNo ratings yet

- Clog On RedemptionDocument1 pageClog On RedemptionZeesahn100% (1)