Professional Documents

Culture Documents

Financial Expressions in Daily Life 4 STR

Uploaded by

PaulinaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Expressions in Daily Life 4 STR

Uploaded by

PaulinaCopyright:

Available Formats

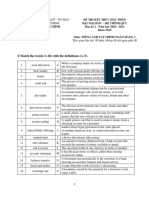

Financial Expressions in Daily Life

1 Can You Fill in the Blanks?

quote, property, tight, broke, lump, interest, loaded, debt, rates (2), will, consumer, penniless,

fee, exchange, society, hard, sum, means, wealthy, take, beyond, out, instalments, up, quid,

balance, black, fisted, meet, stock, penalty, deposit, fare, fine, currency, rip-off, market, make

(3), affluent, payments, transfers, mortgage

My boss lives in an _____(1) neighbourhood.

I usually use a cash machine to check my _____(2).

Can I borrow some money? I’m _____(3).

We live in a _____(4) _____(5) where everybody wants to buy something new.

What’s the _____(6) in Vietnam? Is it the Vietnamese dong?

We have already paid a _____(7) on the house.

Our currency is unstable and _____(8) _____(9) fluctuate a lot.

What’s the bus _____(10) these days?

My lawyer charges an unreasonably high _____(11).

I had to pay a parking _____(12).

I’m always _____(13) _____(14) by the end of the month.

We paid for the car in _____(15).

People who have loans have to pay high _____(16) _____(17).

You don’t know what money problems are. You’re _____(18)!

I had to _____(19) _____(20) a loan to buy a new car.

She was given a _____(21) _____(22) when she was made redundant.

I never use online banking to _____(23) _____(24).

Can you _____(25) _____(26) into your bank account from your computer?

I can’t get a _____(27) because I don’t earn much money.

There will be a _____(28) for late payment of the bills.

She arrived in 1978 as a virtually _____(29) refugee.

He invested in _____(30) and lost most of his money.

This hat only cost me five _____(31) in a charity shop.

I got the builder to give me a _____(32), but it was so expensive we decided to do it ourselves.

Some people make money by buying and selling shares on the _____(33) _____(34).

He was a _____(35) old man. He lived in a mansion and had a luxury yacht.

My mum left me all her paintings in her _____(36).

20 pounds for a pizza?! What a _____(37)!

We managed to stay in the _____(38) this year, so we might have enough money for a short

holiday.

I’m in _____(39) – my account is £200 in the red.

I’m not surprised they went bankrupt. They were clearly living _____(40) their _____(41).

I can’t _____(42) ends _____(43) ever since I got fired.

I wouldn’t waste my time asking him for money. He’s _____(44)‑_____(45).

2 Can You Match These Words to Their Definitions?

1 debt a the money paid for transportation, such as bus or train tickets.

2 payments b having little or no money; extremely poor.

3 mortgage c the community of people living in a particular country or region and

having shared customs, laws, and organizations.

4 instalments d an amount of money charged for a service.

5 broke e having no money; financially destitute.

6 penniless f charging excessively high prices for goods or services.

7 affluent g moving money from one account to another electronically.

8 wealthy h having a great deal of money, resources, or assets.

9 fine i British slang for a pound sterling.

10 well-off j money owed to someone else, typically borrowed and expected to be

repaid.

11 society k a loan taken out to buy property or land, with the property serving as

collateral.

12 penalty l having a lot of money and possessions; rich.

13 fee m having enough money to live comfortably; financially secure.

14 quid n a punishment imposed for breaking a law or rule.

15 property o payments made at regular intervals over a period of time until a debt

is fully paid off.

16 fare p amounts of money given in exchange for goods or services.

17 transfers q a sum of money imposed as a penalty for breaking a law or rule.

18 deposit r something owned by a person, such as land, buildings, or

possessions.

19 currency s a sum of money placed or kept in a bank account, usually to gain

interest.

20 rip-off t the system of money used in a particular country.

3 Let's Discuss These Interesting Questions!

1 How does society's view of wealth impact individuals' financial decisions?

2 Have you ever experienced the stress of being in debt or facing penalties for late

payments?

3 What strategies do you use to manage your finances and avoid ending up penniless?

4 In what ways can currency transfers affect international business transactions?

5 Do you believe that property ownership is a key factor in determining one's wealth

status?

6 Have you ever felt ripped off by a product or service, and how did it impact your trust in

that company?

7 How do mortgage instalments differ from regular rent payments in terms of long-term

financial planning?

8 What are some common fees and fines that people often overlook when budgeting their

expenses?

9 Can being well-off financially lead to a sense of security and stability in today's society?

10 How do affluent individuals approach investments and savings compared to those who are

broke?

You might also like

- How To Buy A Business by William Bruce PDFDocument64 pagesHow To Buy A Business by William Bruce PDFNajihah Zahir100% (1)

- Banking Domain DetailsDocument44 pagesBanking Domain DetailsAmit Rathi100% (5)

- Portfolio Risk AnalysisDocument30 pagesPortfolio Risk Analysismentor_muhaxheriNo ratings yet

- Cryptocurrency & the New Black Wall Street: A Beginner's Guide to Crypto InvestingFrom EverandCryptocurrency & the New Black Wall Street: A Beginner's Guide to Crypto InvestingNo ratings yet

- Insolvency T1 Full AnswerDocument10 pagesInsolvency T1 Full AnswerSI LI YEENo ratings yet

- Cashflow Rules PDFDocument16 pagesCashflow Rules PDFUtiyyala100% (2)

- The Great Banking Scam: Is the American Banking System Stealing Your Money?From EverandThe Great Banking Scam: Is the American Banking System Stealing Your Money?No ratings yet

- Money Vocabulary PDFDocument2 pagesMoney Vocabulary PDFIstvan DanielNo ratings yet

- Project On Working Capital Management On NalcoDocument56 pagesProject On Working Capital Management On NalcoItishree Mohapatra100% (3)

- Exercise 1. Choose The Correct Alternative To Complete Each SentenceDocument8 pagesExercise 1. Choose The Correct Alternative To Complete Each SentenceGliqeria PlasariNo ratings yet

- Summary of Mel Lindauer, Taylor Larimore, Michael LeBoeuf & John C. Bogle's The Bogleheads' Guide to InvestingFrom EverandSummary of Mel Lindauer, Taylor Larimore, Michael LeBoeuf & John C. Bogle's The Bogleheads' Guide to InvestingNo ratings yet

- English For BusinessDocument142 pagesEnglish For Businessotelea_vasileNo ratings yet

- Banking FullDocument83 pagesBanking FullLan Anh BùiNo ratings yet

- Accounting System and Financial Reporting of NGOsDocument18 pagesAccounting System and Financial Reporting of NGOsAllen Alfred100% (2)

- Formula For Future Worth Compound InterestDocument6 pagesFormula For Future Worth Compound Interestniaz kilamNo ratings yet

- Ready For B2 First - SB - Unit 1Document16 pagesReady For B2 First - SB - Unit 1PaulinaNo ratings yet

- SEE Diversey ProFormaDocument34 pagesSEE Diversey ProFormaJose Luis Becerril BurgosNo ratings yet

- Coastal Pacific Trading vs. Southern Rolling MillsDocument1 pageCoastal Pacific Trading vs. Southern Rolling Millssherryblossoms50% (2)

- Leather Industry Report 1transparentDocument18 pagesLeather Industry Report 1transparentvikramullalNo ratings yet

- Unit Three Money - Forms and FunctionsDocument6 pagesUnit Three Money - Forms and FunctionsMihai TudorNo ratings yet

- Presentation On Money & BankingDocument15 pagesPresentation On Money & BankingRahul VyasNo ratings yet

- Objectives: Barter SystemDocument5 pagesObjectives: Barter SystemAmit MittalNo ratings yet

- Tutorialch5 MoneyfederalreserveDocument75 pagesTutorialch5 MoneyfederalreserveRashid AyubiNo ratings yet

- BC Ielts Reading Test 6Document18 pagesBC Ielts Reading Test 6Pham YenNo ratings yet

- Phrasal Verbs About Finance and StatisticsDocument14 pagesPhrasal Verbs About Finance and StatisticsEdita NiaurieneNo ratings yet

- Important Quess) Tions ch-3Document9 pagesImportant Quess) Tions ch-3AnnaNo ratings yet

- CHP#1 The Nature and Function of MoneyDocument24 pagesCHP#1 The Nature and Function of MoneyMuhammad HasnainNo ratings yet

- Đề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Document4 pagesĐề thi tiếng Anh chuyên ngành Tài chính Ngân hàng 1Hoang TrieuNo ratings yet

- ESL Conversation QuestionsDocument8 pagesESL Conversation QuestionsjaycoolerfulNo ratings yet

- Money and Banking SystemDocument65 pagesMoney and Banking SystemfabyunaaaNo ratings yet

- Назін УА 19 1з Business and Money PracticeDocument2 pagesНазін УА 19 1з Business and Money PracticeТатьяна ЛужненкоNo ratings yet

- IELTS MONEY VocabularyDocument4 pagesIELTS MONEY VocabularyVera ErastovaNo ratings yet

- Tek Dis ShitDocument3 pagesTek Dis ShitChloe NembhardNo ratings yet

- Banking Finance Tax Test SK2019 - 1Document4 pagesBanking Finance Tax Test SK2019 - 1Vishwas JNo ratings yet

- Retail BankingDocument4 pagesRetail BankingTop VideosNo ratings yet

- Economics AssignmentsDocument12 pagesEconomics AssignmentsDj DannexNo ratings yet

- Housing For Purpose: A Guide to Investing in Real Estate for Both Profit and Social GoodFrom EverandHousing For Purpose: A Guide to Investing in Real Estate for Both Profit and Social GoodNo ratings yet

- TIẾNG ANH TCNH CLC 2023Document48 pagesTIẾNG ANH TCNH CLC 2023Quỳnh Trần Thị DiễmNo ratings yet

- Midterm Test English 2Document4 pagesMidterm Test English 2Nguyễn Ánh NgọcNo ratings yet

- Money: Credit Card, Wallet, Bank Check, 100-Dollar Bill, Coin, Automated Teller Machine, Cash Register, BankDocument7 pagesMoney: Credit Card, Wallet, Bank Check, 100-Dollar Bill, Coin, Automated Teller Machine, Cash Register, BankSantosh Kumar SinghNo ratings yet

- Basic FinanceDocument10 pagesBasic FinanceJozele DalupangNo ratings yet

- Eco 531 - Chapter 3Document22 pagesEco 531 - Chapter 3Nurul Aina IzzatiNo ratings yet

- Financial Intermediaries: RD THDocument4 pagesFinancial Intermediaries: RD THasekur_teeNo ratings yet

- ENGLISH For BUSISNESS 5Document11 pagesENGLISH For BUSISNESS 5Charles 14No ratings yet

- Money Is Any Item or Verifiable Record That Is Generally Accepted As Payment For Goods and Services and Repayment of DebtsDocument2 pagesMoney Is Any Item or Verifiable Record That Is Generally Accepted As Payment For Goods and Services and Repayment of DebtsWilson ScofieldNo ratings yet

- E BookDocument21 pagesE BookNatsuyuki HanaNo ratings yet

- .S.3 Commerce - 1630400614000Document74 pages.S.3 Commerce - 1630400614000Ssonko EdrineNo ratings yet

- PCR 4 y 6 JJ 3 VKPX6 MF02 TUy H3 RM RFC 4 DDG XT Nexu JVWDocument18 pagesPCR 4 y 6 JJ 3 VKPX6 MF02 TUy H3 RM RFC 4 DDG XT Nexu JVWapriliantiNo ratings yet

- Week 4 - History of MoneyDocument4 pagesWeek 4 - History of MoneyAmrita GangaramNo ratings yet

- Critical Thinking Lecture 02Document5 pagesCritical Thinking Lecture 02Dj TroubleNo ratings yet

- Fmi BazaDocument18 pagesFmi BazaАнель ПакNo ratings yet

- Bài Tập Unit 17Document16 pagesBài Tập Unit 17Nguyệt Như BùiNo ratings yet

- Money and CreditDocument5 pagesMoney and CreditBhargav Srinivas100% (1)

- Lesson 02 - Personal FinanceDocument9 pagesLesson 02 - Personal FinanceLily AqajaniNo ratings yet

- SL5 Review Test 1Document5 pagesSL5 Review Test 1solsol0125No ratings yet

- Book NQN KeyDocument86 pagesBook NQN KeyQuỳnh Trần Thị DiễmNo ratings yet

- Required ChaptersDocument41 pagesRequired ChaptersPhương Nguyễn Trương LợiNo ratings yet

- Chapter 16 (29) Practice Test: The Monetary System: Multiple ChoiceDocument11 pagesChapter 16 (29) Practice Test: The Monetary System: Multiple ChoiceRaymund GatocNo ratings yet

- 1lmd - Test 02 - THE SUPPLY OF MONEY (2nd Version)Document6 pages1lmd - Test 02 - THE SUPPLY OF MONEY (2nd Version)imen DEBBANo ratings yet

- Macroeconomics 1Document25 pagesMacroeconomics 1Bảo Châu VươngNo ratings yet

- Pers - Finance and IndicatorsDocument6 pagesPers - Finance and Indicatorsmariam alkorrNo ratings yet

- Vocabulary - Money, Finance, Bank Accounts, Public FinanceDocument2 pagesVocabulary - Money, Finance, Bank Accounts, Public FinanceNachø MV0% (1)

- Revision - Final Test. 1. Types of BusinessesDocument4 pagesRevision - Final Test. 1. Types of BusinessesAnna Musińska100% (1)

- Section 1 Questions 1-13Document13 pagesSection 1 Questions 1-13ielts Ice GiangNo ratings yet

- Bo TugasDocument8 pagesBo TugasCharles 14No ratings yet

- Chapter 29-6-Monetary SystemDocument8 pagesChapter 29-6-Monetary SystemTkank TkảoNo ratings yet

- How The Rich Get RicherDocument65 pagesHow The Rich Get RicherMerciful Tanveer AhmedNo ratings yet

- International Business Opportunities and Challenges in A Flattening World 1St Edition Carpenter Test Bank Full Chapter PDFDocument40 pagesInternational Business Opportunities and Challenges in A Flattening World 1St Edition Carpenter Test Bank Full Chapter PDFKathrynBurkexziq100% (10)

- BC Ielts Reading Test 6 (Hương Quế)Document17 pagesBC Ielts Reading Test 6 (Hương Quế)ahaNo ratings yet

- BR B1, IB B1 - Filling in The GapsDocument2 pagesBR B1, IB B1 - Filling in The GapsPaulinaNo ratings yet

- Phrasal Verbs 1 1 STRDocument2 pagesPhrasal Verbs 1 1 STRPaulinaNo ratings yet

- Phrasal Verbs 3 STRDocument3 pagesPhrasal Verbs 3 STRPaulinaNo ratings yet

- RfFB2 - SB WordlistDocument76 pagesRfFB2 - SB WordlistPaulinaNo ratings yet

- Ef4e Adv Plus Wordlist PLDocument121 pagesEf4e Adv Plus Wordlist PLPaulinaNo ratings yet

- Ef4e Int Plus Wordlist PL From File 8Document2 pagesEf4e Int Plus Wordlist PL From File 8PaulinaNo ratings yet

- Advert 4 2 STRDocument2 pagesAdvert 4 2 STRPaulinaNo ratings yet

- Art 4Document1 pageArt 4PaulinaNo ratings yet

- DziełoDocument21 pagesDziełoPaulinaNo ratings yet

- Easter Traditions Around The World 8 STRDocument8 pagesEaster Traditions Around The World 8 STRPaulinaNo ratings yet

- A Life Without Pain 4Document1 pageA Life Without Pain 4PaulinaNo ratings yet

- Chat 2Document1 pageChat 2PaulinaNo ratings yet

- Expressions and Phrasal Verbs With - Get 2 STRDocument2 pagesExpressions and Phrasal Verbs With - Get 2 STRPaulinaNo ratings yet

- Meningitis 2Document1 pageMeningitis 2PaulinaNo ratings yet

- Neuroscience 4. Gap FillingDocument1 pageNeuroscience 4. Gap FillingPaulinaNo ratings yet

- QuestionsDocument1 pageQuestionsPaulinaNo ratings yet

- Neuroscience 3. Gap FillingDocument1 pageNeuroscience 3. Gap FillingPaulinaNo ratings yet

- Meningitis 1Document1 pageMeningitis 1PaulinaNo ratings yet

- Heart DiseaseDocument1 pageHeart DiseasePaulinaNo ratings yet

- RfB2F - SB Audioscripts - Unit 1Document2 pagesRfB2F - SB Audioscripts - Unit 1PaulinaNo ratings yet

- Heart Disease 2Document1 pageHeart Disease 2PaulinaNo ratings yet

- Neuroscience 1. Gap FillingDocument1 pageNeuroscience 1. Gap FillingPaulinaNo ratings yet

- DO's and DON'Ts For Speaking ExamDocument1 pageDO's and DON'Ts For Speaking ExamPaulinaNo ratings yet

- Scope and SequenceDocument2 pagesScope and SequencePaulinaNo ratings yet

- Ready For B2 First - WB - Unit 1Document8 pagesReady For B2 First - WB - Unit 1PaulinaNo ratings yet

- WordlistDocument7 pagesWordlistPaulinaNo ratings yet

- Travel 1Document1 pageTravel 1PaulinaNo ratings yet

- Abstract Nouns 3Document1 pageAbstract Nouns 3PaulinaNo ratings yet

- Abstract Nouns 2Document1 pageAbstract Nouns 2PaulinaNo ratings yet

- Capital StructureDocument8 pagesCapital StructureKalpit JainNo ratings yet

- Panduan Mengisi (Bahasa Melayu) - ForM ADocument2 pagesPanduan Mengisi (Bahasa Melayu) - ForM Amuhammad irfan mohdNo ratings yet

- Management - Accounting-February 2024Document51 pagesManagement - Accounting-February 2024Somesh AgrawalNo ratings yet

- Lecture On Amortization and Amortization ScheduleDocument3 pagesLecture On Amortization and Amortization ScheduleAeiaNo ratings yet

- CF Berk DeMarzo Harford Chapter 13 Problem AnswerDocument9 pagesCF Berk DeMarzo Harford Chapter 13 Problem AnswerRachel Cheng0% (1)

- UNIT - 4 Handout PurposeDocument47 pagesUNIT - 4 Handout PurposemelaNo ratings yet

- DGPC Tariff Review Report 2019 2022Document24 pagesDGPC Tariff Review Report 2019 2022Sonam PhuntshoNo ratings yet

- Internal and Sustainable Growth RatesDocument4 pagesInternal and Sustainable Growth RatesdjmphdNo ratings yet

- ACCT 3312 - Chap 17 Practice QuestionsDocument5 pagesACCT 3312 - Chap 17 Practice QuestionsVernon Dwanye LewisNo ratings yet

- SyllabusDocument11 pagesSyllabusMuhammad Qaisar LatifNo ratings yet

- BATELEC I Performance Study PDFDocument11 pagesBATELEC I Performance Study PDFAnonymous ic2CDkFNo ratings yet

- Financial Info - ExegerDocument37 pagesFinancial Info - ExegerTom' AsNo ratings yet

- Credit Management Strategies and Loan Performance of Selected Deposit Money Banks in Ogun State, NigeriaDocument32 pagesCredit Management Strategies and Loan Performance of Selected Deposit Money Banks in Ogun State, NigeriaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- What We Get Wrong About Closing The Racial Wealth GapDocument67 pagesWhat We Get Wrong About Closing The Racial Wealth GapAnonymous H7mNlJT27100% (2)

- Invt Chapter 1Document19 pagesInvt Chapter 1Khadar MaxamedNo ratings yet

- Understanding Fixed-Income Risk and Return: © 2016 CFA Institute. All Rights ReservedDocument60 pagesUnderstanding Fixed-Income Risk and Return: © 2016 CFA Institute. All Rights ReservedNam Hoàng ThànhNo ratings yet

- Basic AccountingDocument4 pagesBasic Accountingkanding21No ratings yet

- Appendix A Pamantasan NG Lungsod NG MarikinaDocument14 pagesAppendix A Pamantasan NG Lungsod NG MarikinaAllen ArcenasNo ratings yet

- Simple and Compound Interest - M9Document24 pagesSimple and Compound Interest - M9Sage Juniper'Ashe V. EinsofNo ratings yet

- Nirc of Icai: Ban On Physical Share Transfer of Listed Co-Last Date 31.3.2019 - Problem and SolutionsDocument36 pagesNirc of Icai: Ban On Physical Share Transfer of Listed Co-Last Date 31.3.2019 - Problem and SolutionsABHAYNo ratings yet