Professional Documents

Culture Documents

GSTR3B 36fjypk4832a1zy 122023

Uploaded by

saiakhiltataOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B 36fjypk4832a1zy 122023

Uploaded by

saiakhiltataCopyright:

Available Formats

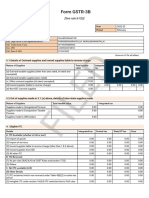

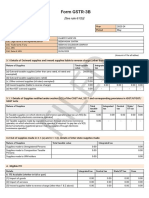

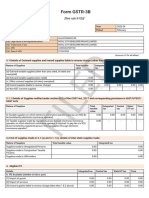

Form GSTR-3B

[See rule 61(5)]

Year 2023-24

Period December

1. GSTIN 36FJYPK4832A1ZY

2(a). Legal name of the registered person KILLI SANTHOSH KUMAR

2(b). Trade name, if any SRI JANANI ENGG.WORKS

2(c). ARN AA3612236840377

2(d). Date of ARN 20/01/2024

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

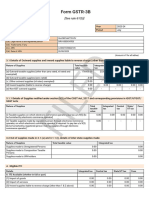

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

123500.00

0.00

0.00

0.00

0.00

tax

16470.00

-

0.00

0.00

tax

2880.00

-

-

-

0.00

tax

2880.00

-

-

-

0.00

0.00

0.00

-

0.00

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

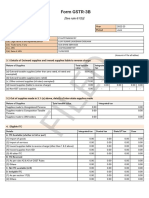

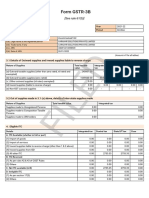

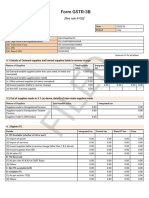

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 0.00 0.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 0.00 41889.08 41889.08 0.00

B. ITC Reversed

(1) As per rules 38,42 & 43 of CGST Rules and section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

C. Net ITC available (A-B) 0.00 41889.08 41889.08 0.00

(D) Other Details 0.00 0.00 0.00 0.00

(1) ITC reclaimed which was reversed under Table 4(B)(2) in earlier tax 0.00 0.00 0.00 0.00

period

(2) Ineligible ITC under section 16(4) & ITC restricted due to PoS rules 0.00 0.00 0.00 0.00

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 0.00 0.00 -

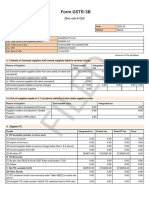

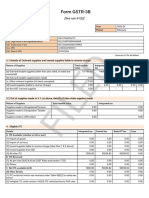

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid Late fee

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

tax

16470.00

2880.00

2880.00

0.00

0.00

Integrated tax

-

0.00

0.00

0.00

ED

Central tax

16470.00

2880.00

-

-

-

State/UT tax

-

0.00

2880.00

-

-

Cess

-

-

-

0.00

cash

0.00

0.00

0.00

0.00

0.00

in cash

-

0.00

0.00

0.00

0.00

paid in cash

-

0.00

0.00

FIL

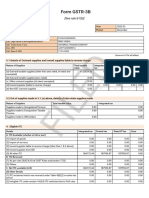

Central tax 0.00 - - - - 0.00 - -

State/UT tax 0.00 - - - - 0.00 - -

Cess 0.00 - - - - 0.00 - -

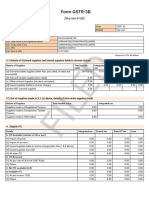

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

December 2023 16470.00 2880.00 2880.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 20/01/2024 Name of Authorized Signatory

KILLI KUMAR

Designation /Status

PROPRIERTOR

You might also like

- GSTR3B 36fjypk4832a1zy 032023Document2 pagesGSTR3B 36fjypk4832a1zy 032023saiakhiltataNo ratings yet

- GSTR3B 03CJQPK1907B2ZL 072023Document2 pagesGSTR3B 03CJQPK1907B2ZL 072023nstradingcompany2023No ratings yet

- GSTR3B 36fjypk4832a1zy 042023Document2 pagesGSTR3B 36fjypk4832a1zy 042023saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 082022Document2 pagesGSTR3B 36fjypk4832a1zy 082022saiakhiltataNo ratings yet

- GSTR3B 07ahepk2148n1z5 072023Document2 pagesGSTR3B 07ahepk2148n1z5 072023Rishabh Naresh JainNo ratings yet

- GSTR3B 33axcps7298d1z7 082022Document2 pagesGSTR3B 33axcps7298d1z7 082022Logesh Waran KmlNo ratings yet

- D1Z7 122022Document2 pagesD1Z7 122022Logesh Waran KmlNo ratings yet

- GSTR3B 03lmypk3229a1zy 122022Document2 pagesGSTR3B 03lmypk3229a1zy 122022nstradingcompany2023No ratings yet

- GSTR3B 29ajbpm5064c1zd 022023Document2 pagesGSTR3B 29ajbpm5064c1zd 022023raghav shettyNo ratings yet

- GSTR3B 27ahtpc4965g1zy 062022Document2 pagesGSTR3B 27ahtpc4965g1zy 062022MEETNo ratings yet

- May GSTR3B - 27AAJCB3358E1ZP - 052023Document2 pagesMay GSTR3B - 27AAJCB3358E1ZP - 052023calmincometax36No ratings yet

- GSTR3B 33axcps7298d1z7 032023Document2 pagesGSTR3B 33axcps7298d1z7 032023Logesh Waran KmlNo ratings yet

- GSTR3B 03lmypk3229a1zy 012023Document2 pagesGSTR3B 03lmypk3229a1zy 012023nstradingcompany2023No ratings yet

- GSTR3B 36fjypk4832a1zy 012024Document2 pagesGSTR3B 36fjypk4832a1zy 012024saiakhiltataNo ratings yet

- GSTR3B 09aaeci2181f2zn 052022Document2 pagesGSTR3B 09aaeci2181f2zn 052022Pushan SrivastavaNo ratings yet

- GSTR3B 29alqpm0868b1zu 042022Document3 pagesGSTR3B 29alqpm0868b1zu 042022ThangaiSiddharthNo ratings yet

- GSTR3B 52022Document2 pagesGSTR3B 52022Logesh Waran KmlNo ratings yet

- GSTR3B 03alnpk4728k1zv 052021Document2 pagesGSTR3B 03alnpk4728k1zv 052021Harish VermaNo ratings yet

- GSTR3B 09aespa0177j1za 032023Document2 pagesGSTR3B 09aespa0177j1za 032023ali arshadNo ratings yet

- GSTR3B 23aywpp5389h1zl 122023Document2 pagesGSTR3B 23aywpp5389h1zl 122023riturajasati4205No ratings yet

- GSTR3B 01DFHPD8348B1ZX 122023Document2 pagesGSTR3B 01DFHPD8348B1ZX 122023Ishtiyaq RatherNo ratings yet

- GSTR3B 21ahhpn3658h1zd 042021Document2 pagesGSTR3B 21ahhpn3658h1zd 042021GOOGLE NETNo ratings yet

- GSTR3B 01aagff0848r1z8 122022Document2 pagesGSTR3B 01aagff0848r1z8 122022Ishtiyaq RatherNo ratings yet

- GSTR3B 07ahepk2148n1z5 022023Document2 pagesGSTR3B 07ahepk2148n1z5 022023Rishabh Naresh JainNo ratings yet

- $RYYV1H3Document2 pages$RYYV1H3akxerox47No ratings yet

- GSTR3B 09aaeci2181f2zn 062022Document2 pagesGSTR3B 09aaeci2181f2zn 062022Pushan SrivastavaNo ratings yet

- GSTR3B 29aaoca4244p1zz 062021Document2 pagesGSTR3B 29aaoca4244p1zz 062021HEMANTH kumarNo ratings yet

- GSTR3B 33abppc1495f1zs 052023Document3 pagesGSTR3B 33abppc1495f1zs 052023Arun Nahendran SNo ratings yet

- GSTR3B 29alqpm0868b1zu 062022Document3 pagesGSTR3B 29alqpm0868b1zu 062022ThangaiSiddharthNo ratings yet

- GSTR3B 09BWDPS4346H1Z7 082022Document3 pagesGSTR3B 09BWDPS4346H1Z7 082022birpal singhNo ratings yet

- GSTR3B 29aaoca4244p1zz 122021Document2 pagesGSTR3B 29aaoca4244p1zz 122021HEMANTH kumarNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3BLogesh Waran KmlNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 062022Document3 pagesGSTR3B 27BCGPS7468K1ZR 062022Aman JaiswalNo ratings yet

- GSTR3B 37adcfs8516j1zp 012018Document2 pagesGSTR3B 37adcfs8516j1zp 012018ravi kiranNo ratings yet

- GSTR3B 24CZKPP4309Q1ZQ 032024Document3 pagesGSTR3B 24CZKPP4309Q1ZQ 032024Zalak PatelNo ratings yet

- GSTR3B 37BWZPT3110J1ZW 082023Document3 pagesGSTR3B 37BWZPT3110J1ZW 082023satyathirumani5No ratings yet

- GSTR3B 24emypa4455b1z3 032023Document3 pagesGSTR3B 24emypa4455b1z3 032023anant1111No ratings yet

- GSTR3B 07adlpj9003g2zl 122022Document2 pagesGSTR3B 07adlpj9003g2zl 122022Renu JindalNo ratings yet

- GSTR3B 29aaacq3842r1zr 022023Document3 pagesGSTR3B 29aaacq3842r1zr 022023vasanth.sNo ratings yet

- GSTR3B 27bjlpa8487j1zm 112022Document2 pagesGSTR3B 27bjlpa8487j1zm 112022SHAIKH MOINNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 072022Document3 pagesGSTR3B 27BCGPS7468K1ZR 072022Aman JaiswalNo ratings yet

- GSTR3B 01aagff0848r1z8 112023Document2 pagesGSTR3B 01aagff0848r1z8 112023Ishtiyaq RatherNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 042022Document3 pagesGSTR3B 27BCGPS7468K1ZR 042022Aman JaiswalNo ratings yet

- GSTR3B 36acbfs4677g1zv 042023Document3 pagesGSTR3B 36acbfs4677g1zv 042023Srilakshmi MNo ratings yet

- GSTR3B 36bmypp9150m1zx 012023Document3 pagesGSTR3B 36bmypp9150m1zx 012023RAJESH DNo ratings yet

- GSTR3B 36aafcr5625q1zr 022024Document3 pagesGSTR3B 36aafcr5625q1zr 022024Kri ShnaNo ratings yet

- GSTR3B 10jespk0829a1zs 042023Document3 pagesGSTR3B 10jespk0829a1zs 042023Pratik RajNo ratings yet

- GSTR3B 36acbfs4677g1zv 072023Document3 pagesGSTR3B 36acbfs4677g1zv 072023Srilakshmi MNo ratings yet

- GSTR3B 36acbfs4677g1zv 112023Document3 pagesGSTR3B 36acbfs4677g1zv 112023Srilakshmi MNo ratings yet

- Gstr3b PurchaseDocument3 pagesGstr3b PurchaseAVR CONSULTANCYNo ratings yet

- GSTR3B 24FDSPM9863D1ZX 092022Document3 pagesGSTR3B 24FDSPM9863D1ZX 092022Atmos GamingNo ratings yet

- GSTR3B 21CBZPM0638N1Z3 032023Document3 pagesGSTR3B 21CBZPM0638N1Z3 032023sssadangiNo ratings yet

- GSTRDocument6 pagesGSTRmohnishsainiNo ratings yet

- GSTR3B 01CMSPK6157J1ZP 092022Document3 pagesGSTR3B 01CMSPK6157J1ZP 092022ANIL VERMANo ratings yet

- GSTR3B 36fjypk4832a1zy 072022Document2 pagesGSTR3B 36fjypk4832a1zy 072022saiakhiltataNo ratings yet

- GSTR3B 27BCGPS7468K1ZR 012022Document3 pagesGSTR3B 27BCGPS7468K1ZR 012022Aman JaiswalNo ratings yet

- GSTR3B 36acbfs4677g1zv 022023Document3 pagesGSTR3B 36acbfs4677g1zv 022023Srilakshmi MNo ratings yet

- Apr 23Document3 pagesApr 23sbmsalesassociatsNo ratings yet

- 04 July-2022Document3 pages04 July-2022Sunil NNo ratings yet

- GSTR3B 36fjypk4832a1zy 062022Document2 pagesGSTR3B 36fjypk4832a1zy 062022saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 052022Document2 pagesGSTR3B 36fjypk4832a1zy 052022saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 062022Document2 pagesGSTR3B 36fjypk4832a1zy 062022saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 072022Document2 pagesGSTR3B 36fjypk4832a1zy 072022saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 022024Document2 pagesGSTR3B 36fjypk4832a1zy 022024saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 052022Document2 pagesGSTR3B 36fjypk4832a1zy 052022saiakhiltataNo ratings yet

- GSTR3B 36fjypk4832a1zy 072022Document2 pagesGSTR3B 36fjypk4832a1zy 072022saiakhiltataNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BameygandhiNo ratings yet

- GSTR3B 36fjypk4832a1zy 022024Document2 pagesGSTR3B 36fjypk4832a1zy 022024saiakhiltataNo ratings yet

- FIN AL: Form GSTR-3BDocument3 pagesFIN AL: Form GSTR-3BAkshita PorwalNo ratings yet

- Contact DetailsDocument14 pagesContact DetailsSunil KumarNo ratings yet

- 29.EURO 18635 To 19846Document1 page29.EURO 18635 To 19846saiakhiltataNo ratings yet

- Assignment IDocument6 pagesAssignment Imark assainNo ratings yet

- Tax Invoice: Excitel Broadband Pvt. LTDDocument1 pageTax Invoice: Excitel Broadband Pvt. LTDPankaj AzadNo ratings yet

- Invoice - HitDocument1 pageInvoice - HitAnkit MaheshwariNo ratings yet

- SI - Sales SI 2023 24 0467Document2 pagesSI - Sales SI 2023 24 0467Ankur GoelNo ratings yet

- Uppcs Current 2024Document41 pagesUppcs Current 2024varshayadav231020No ratings yet

- MS TJDocument3 pagesMS TJRajesh KumarNo ratings yet

- Goods & Services Tax (GST) & Customs Law: Department of Commerce University of DelhiDocument2 pagesGoods & Services Tax (GST) & Customs Law: Department of Commerce University of DelhiStanzin LundupNo ratings yet

- Filed: Form GSTR-3BDocument2 pagesFiled: Form GSTR-3BpkberliaNo ratings yet

- Tax: Ot-2,/22-L2 No. T Challanno:: InvoiceDocument1 pageTax: Ot-2,/22-L2 No. T Challanno:: Invoiceomkar daveNo ratings yet

- Solutions of Chapter 8Document14 pagesSolutions of Chapter 8Nishant BodhNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)tushar jainNo ratings yet

- Vendor Set Up FormDocument3 pagesVendor Set Up FormDELICIAS PASCAL CHILEAN FOODNo ratings yet

- Sold By: Tax InvoiceDocument1 pageSold By: Tax Invoiceneerajkori932No ratings yet

- BIMDocument50 pagesBIMSam PeterNo ratings yet

- JBL T450BT Extra Bass Bluetooth Headset: TL0400-LK0099436Document1 pageJBL T450BT Extra Bass Bluetooth Headset: TL0400-LK0099436Arbaz khanNo ratings yet

- Date Product Name (As Listed in Software)Document31 pagesDate Product Name (As Listed in Software)Sayed PattambiNo ratings yet

- State Bank of India Recruitment of Junior Associates (Customer Support & Sales) Advertisement No. CRPD/CR/2022-23/15Document4 pagesState Bank of India Recruitment of Junior Associates (Customer Support & Sales) Advertisement No. CRPD/CR/2022-23/15Vikash KushwahaNo ratings yet

- Pranayam Resident Welfare Association (Regd.) : Cam Cum Utility InvoiceDocument1 pagePranayam Resident Welfare Association (Regd.) : Cam Cum Utility InvoiceDeepak VermaNo ratings yet

- November, 2020Document189 pagesNovember, 2020CHaranNo ratings yet

- List of Ledgers Group in TallyDocument8 pagesList of Ledgers Group in TallyAMIT KUMARNo ratings yet

- Cess Applicability Rate Vimal Pan Masala MRP Rs.-4 60% V-1 Brand Jarda Scented Tobacco MRP Rs. - 1 160% Vimal Pan Masala MRP Rs. - 8.5 60%Document4 pagesCess Applicability Rate Vimal Pan Masala MRP Rs.-4 60% V-1 Brand Jarda Scented Tobacco MRP Rs. - 1 160% Vimal Pan Masala MRP Rs. - 8.5 60%Darth VaderNo ratings yet

- CMR Invoice 96Document1 pageCMR Invoice 96SuryakamalBourishettyNo ratings yet

- Invoice 24-01-23Document1 pageInvoice 24-01-23Mohan DoifodeNo ratings yet

- Invoice 277370 PDFDocument1 pageInvoice 277370 PDFAmrit Kumar PatiNo ratings yet

- Tally Ledger List in Excel Format - TeachooDocument12 pagesTally Ledger List in Excel Format - TeachooGaurav RawatNo ratings yet

- GST in IndiaDocument11 pagesGST in IndiarameshNo ratings yet

- GST RUP11 Patch Document 2342288.1Document11 pagesGST RUP11 Patch Document 2342288.1lkalidas1998No ratings yet

- Invoice 1553736Document1 pageInvoice 1553736yashuNo ratings yet

- Amazon - in Iphone 11Document1 pageAmazon - in Iphone 11Gift MensahNo ratings yet

- Bill No 4Document1 pageBill No 4Dharmendra DubeyNo ratings yet