Professional Documents

Culture Documents

Trading Guidelines 21 Nov

Trading Guidelines 21 Nov

Uploaded by

sambhajipatere80 ratings0% found this document useful (0 votes)

9 views3 pagesOriginal Title

trading guidelines 21 nov

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

9 views3 pagesTrading Guidelines 21 Nov

Trading Guidelines 21 Nov

Uploaded by

sambhajipatere8Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 3

1) Entry on stochastic 50 crossing with supertrend

confirmation

2) Stop loss type A -- 20 EMA

type B – Super trend.

type C – stochastic 50 reversal (30).

type D – 100 EMA Final stop loss.

3) In profit hold position till Heikin Ashi candle changes colour

or trail stop loss of 20 EMA or Supertrend.

4) if price is (between) the candle and stochastic is moving

around 50 line again and again , then trades will give very

small target with strict stop loss of 20 EMA or Supertrend.

5) Never hold loss making trades more than 30-45 minutes.

(Copyright © 2019 Technical Trade Consultancy . All rights reserved)

Extra Check Points to be Considered.

1) N pattern

2) ST + STD Confirmation.

3) Insider The Candle Trade

4)Between the candle. (BTC)

5) Double cross.

6) Both Stochastic in Over bought or Over

sold Zone = Confirm Hold.

7) 15 min international Chart Confirmation

8) International OTC.

9) Yellow Line.

(Copyright © 2019 Technical Trade Consultancy . All rights reserved)

Do’s & Don'ts

Avoid buy below previous two TVR’s and vice versa.(upto

6pm)

Avoid buy below previous low and vice versa. (upto 6pm)

Avoid buy near & below prev. high and vice versa. (upto

6pm)

When price is inside (between) the candle, avoid buy at

new high & vice versa. (upto 6pm)

Always maintain stop loss of Supertrend or stochastic 50

reversal.

(Copyright © 2019 Technical Trade Consultancy . All rights reserved)

You might also like

- ICT Trade ConceptsDocument5 pagesICT Trade Conceptsthiagorch87% (23)

- Summary of Al Brooks's Trading Price Action TrendsFrom EverandSummary of Al Brooks's Trading Price Action TrendsRating: 5 out of 5 stars5/5 (1)

- Crash and Boom StrategyDocument12 pagesCrash and Boom StrategyCarla Banessa Jimenez Reyes94% (31)

- Ats StrategyDocument9 pagesAts StrategypradeephdNo ratings yet

- High Probability Swing Trading Strategies: Day Trading Strategies, #4From EverandHigh Probability Swing Trading Strategies: Day Trading Strategies, #4Rating: 4.5 out of 5 stars4.5/5 (4)

- Forex Math RulesDocument9 pagesForex Math Rulesbent7867% (3)

- Breakout Play (Trend Following) - Trading Plan - Full (Sample)Document15 pagesBreakout Play (Trend Following) - Trading Plan - Full (Sample)Olegario S. Sumaya III88% (8)

- 20 Forex Trading Strategies CollectionDocument35 pages20 Forex Trading Strategies Collectionherlina margaretha100% (14)

- Supply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.From EverandSupply, Demand and Deceleration - Day Trading Forex, Metals, Index, Crypto, Etc.No ratings yet

- Algorithm Specifics - SSLDocument3 pagesAlgorithm Specifics - SSLrexNo ratings yet

- Profile CheatsheetDocument3 pagesProfile Cheatsheetjadie aliNo ratings yet

- Transparent FX Cheat Sheet: 1) Is The 4h Showing One of These Scenarios?Document1 pageTransparent FX Cheat Sheet: 1) Is The 4h Showing One of These Scenarios?Sebastián Rebollo100% (1)

- Camrilla Pivot Trading SystemDocument5 pagesCamrilla Pivot Trading SystemNittin G Bagda100% (1)

- Bitcoin Trading Terminology: Crypto VIP SignalDocument9 pagesBitcoin Trading Terminology: Crypto VIP SignalBen AdamteyNo ratings yet

- Deep Diagonals Trading PlanDocument3 pagesDeep Diagonals Trading Plannaplesdental0% (1)

- Trading NotesDocument4 pagesTrading Notesarhaanshaik569No ratings yet

- Profitable FX SystemsDocument37 pagesProfitable FX SystemsscriberoneNo ratings yet

- Magic CourseDocument19 pagesMagic CourseVenu Gopal RaoNo ratings yet

- My MM TradingNotesDocument5 pagesMy MM TradingNotesnyagweyaNo ratings yet

- FX Strategies To Profit FromDocument37 pagesFX Strategies To Profit FromscriberoneNo ratings yet

- Trading Notes CompilationDocument12 pagesTrading Notes CompilationmarkbryanrealNo ratings yet

- Symmetrical TriangleDocument6 pagesSymmetrical Trianglekarthick sudharsanNo ratings yet

- Rules Never Forget: 2. Order Type Is Always - MISDocument2 pagesRules Never Forget: 2. Order Type Is Always - MISDaleep SinghalNo ratings yet

- Order Type Is Always - MIS: 1 Strategy of Option Trading - Dated 14 Oct 18Document2 pagesOrder Type Is Always - MIS: 1 Strategy of Option Trading - Dated 14 Oct 18Daleep SinghalNo ratings yet

- Basic of TradingDocument9 pagesBasic of TradingRoxana Mihaela IsailăNo ratings yet

- Bitcoin Trading Terminology: Crypto VIP SignalDocument9 pagesBitcoin Trading Terminology: Crypto VIP SignalBen AdamteyNo ratings yet

- Basic of TradingDocument9 pagesBasic of TradingAdam ChoNo ratings yet

- 5 6244486808881595360Document14 pages5 6244486808881595360aIDa100% (1)

- Revision Live SessionsDocument19 pagesRevision Live SessionsYash GangwalNo ratings yet

- Forex Strategy 'Vegas-Wave'Document5 pagesForex Strategy 'Vegas-Wave'douy2t12geNo ratings yet

- Trading Strategies NotesDocument3 pagesTrading Strategies Notesrnjuguna100% (1)

- Comfirmations of Forex TradingDocument6 pagesComfirmations of Forex TradingThatipamula RsmeshNo ratings yet

- Creating Low-Risk Trading Strategies Using Derivative ProductsDocument12 pagesCreating Low-Risk Trading Strategies Using Derivative Productsshaikhnazneen100No ratings yet

- Kumo Breakout Trade MainDocument27 pagesKumo Breakout Trade MainThuy Nguyen Thi NgocNo ratings yet

- Currency TrendsDocument1 pageCurrency Trendsarvin4dNo ratings yet

- How This Digital Indicator WorksDocument2 pagesHow This Digital Indicator WorksA. Vafaie ManeshNo ratings yet

- 8 - 9) ALGO Trading Session 14 - 15 - 16 - 17 (8 Hours - (9th - 30th Sept)Document16 pages8 - 9) ALGO Trading Session 14 - 15 - 16 - 17 (8 Hours - (9th - 30th Sept)tempacc9322No ratings yet

- Multiple Time-Frame Trading Techniques For Swing Trading. (For Swing Trader To Read Approve, Modify or Dismiss)Document6 pagesMultiple Time-Frame Trading Techniques For Swing Trading. (For Swing Trader To Read Approve, Modify or Dismiss)sariful hidayahNo ratings yet

- Craig Harris MethodDocument5 pagesCraig Harris MethodEngr Fazal AkbarNo ratings yet

- Trading Triangle Like A Pro: Demo Webinaar RecordingDocument11 pagesTrading Triangle Like A Pro: Demo Webinaar RecordingYahya ShaikhNo ratings yet

- Manual 1Document5 pagesManual 1rubencito1No ratings yet

- Bearish Principles For Day TradingDocument1 pageBearish Principles For Day TradingKotaexclusiveNo ratings yet

- Z Winner PDFDocument19 pagesZ Winner PDFTim Johnson100% (1)

- ST Sir Swing Trade With Smaller StoplossDocument6 pagesST Sir Swing Trade With Smaller StoplossUsha JagtapNo ratings yet

- Introduction To Market Structures and Order Blocks: by Alex MwegaDocument13 pagesIntroduction To Market Structures and Order Blocks: by Alex MwegaHenry Jura100% (5)

- InvestmentDocument4 pagesInvestmentTebogo MakofaneNo ratings yet

- Cci and Bullbear PowerDocument1 pageCci and Bullbear PowerLawrence LawrenceNo ratings yet

- MTF Stochastic Trading: TRADING GUIDELINES FOR THE ORIGINAL TEMPLATE (Both Stochastics Are Set at 11,3,3Document2 pagesMTF Stochastic Trading: TRADING GUIDELINES FOR THE ORIGINAL TEMPLATE (Both Stochastics Are Set at 11,3,3Irvan HidanNo ratings yet

- Cryptopak Newsletter.716Document8 pagesCryptopak Newsletter.716MomiRazaNo ratings yet

- Trading Channels Using AndrewsDocument6 pagesTrading Channels Using AndrewsAnonymous sDnT9yuNo ratings yet

- Commodity Channel Index: by Suniiel A MangwaniDocument4 pagesCommodity Channel Index: by Suniiel A MangwanigmbobsNo ratings yet

- Powerful 1 Min Scalping SystemDocument4 pagesPowerful 1 Min Scalping SystemPanayiotis PeppasNo ratings yet

- My Trend Trading StrategyDocument2 pagesMy Trend Trading StrategyJones OrwobaNo ratings yet

- Trading Setups (Observable)Document2 pagesTrading Setups (Observable)Mohd IzwanNo ratings yet

- Financial FreedomDocument51 pagesFinancial FreedomBillionaireka100% (1)

- Intraday Trading SystemDocument6 pagesIntraday Trading SystemJagadeesh SundaramNo ratings yet

- Risk Management (Ii)Document2 pagesRisk Management (Ii)Joseph UkohaNo ratings yet

- Important Technical Analysis Terms 1694528472Document12 pagesImportant Technical Analysis Terms 1694528472Samarth PahariaNo ratings yet

- Network Technologies 12.03.23Document4 pagesNetwork Technologies 12.03.23sambhajipatere8No ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word Documentsambhajipatere8No ratings yet

- Mca Student Login - Sheet1Document4 pagesMca Student Login - Sheet1sambhajipatere8No ratings yet

- SPM PaperDocument4 pagesSPM Papersambhajipatere8No ratings yet

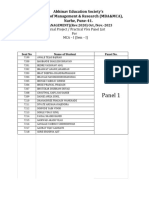

- FY Panel ListDocument3 pagesFY Panel Listsambhajipatere8No ratings yet