Professional Documents

Culture Documents

SSRN-id4433959 (1)

Uploaded by

June AlvarezCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SSRN-id4433959 (1)

Uploaded by

June AlvarezCopyright:

Available Formats

THE ROLE OF GOVERNMENT IN THE ECONOMY

ASSESSING THE AWARENESS OF PEOPLE IN PHILIPPINE TAXES AS PART OF

THE ROLE OF THE GOVERNMENT IN THE ECONOMY

Kris Anne F. Malicdem, CPA, Florinda G. Vigonte, Ph.D.,

Marmelo V. Abante, Ph.D, DIT, MBA

World Citi Colleges, Graduate School Department

960 Aurora Boulevard, Bagumbuhay, Quezon City

ABSTRACT

The government's engagement in the economy is required because the private sector cannot

meet some duties and obligations. Governments are responsible for directing and guiding the

country's economic activity. In addition, it must ensure constant growth, substantial employment,

and price stability. Governments must also modify tax rates and spending to boost or hinder

economic growth. The study aims to evaluate one of the government's financial duties, income

redistribution through taxation, and to develop an information dissemination campaign for

Filipinos. PRISMA was employed in the study to obtain and communicate information about

awareness. According to the findings, approximately 26 million Filipinos pay taxes out of a total

population of 100 million, and a public awareness initiative is required to understand the

significance of taxation. The importance of taxes should be highlighted because they contribute

to building up the nation. Every nation's lifeblood is taxation; without it, the government cannot

function. As citizens, we contribute to these efforts' success by paying income taxes, which

allows the government to work on new social schemes and programs.

Keywords: Economy, Government, Philippine Taxes, Redistribute Income, Tax Awareness

INTRODUCTION

Government has an essential role in every nation; without a strong government, society

will collapse. There are six significant roles of government in market economies as identified by

economists, which are the following: government (1) maintains legal and social framework, (2)

maintains competition, (3) provides goods and services, (4) manages externalities, (5) stabilizes

the economy, and (6) redistribute income (Aftrica et al., 2023).

Redistribution of income is the distribution of wealth and income from one member of

society to another (Hadji, 2019). In most cases, this was accomplished through government-

mandated taxation and monetary policy. The government seeks to provide for all of its citizens

through these programs. Taxation is the primary way through which governments redistribute

wealth and income. Through government assistance programs, the government redistributes all

tax revenue to members of society who are in need. Income, purchases of goods and services,

and property ownership can all be subject to these taxes. Businesses must also pay these

taxes.

The income distribution in the Philippines is highly unequal, with more excellent poverty

rates than in other ASEAN countries. Furthermore, while poverty has decreased over time, it

has decreased slower than in other countries, and income inequality has persisted. These

realities result from historically weak economic growth, partly due to inadequate policies and

previous failures to overcome structural hurdles to a more equitable income distribution. Despite

recent reforms, it will likely take some time to undo the effects of previous policies (IMF, 2016).

Furthermore, greater inequality may lead to a loss of trust in the government and its ability to

implement policies that benefit the many rather than the few. Government's capacity to level the

Electronic copy available at: https://ssrn.com/abstract=4433959

THE ROLE OF GOVERNMENT IN THE ECONOMY

playing field for everyone by ensuring equal opportunity and a basic standard of living is crucial

to preventing social unrest and encouraging well-being.

Collecting development financing through tax revenue presents a significant challenge.

This is one of the issues in Indonesia where there still needs to be a higher level of awareness

and tax compliance in Indonesian society. According to the OECD Tax Ratio data in the

Revenue Statistics in Asian Countries 2015: Trends in Indonesia, Malaysia, and the Philippines,

the tax ratio in Indonesia remains around 13%, while the Philippines is 16%, Malaysia is 17%,

and many countries have reached 34% (Said, L.2018).

Hence, the purpose of this literature review is two-fold, 1) to assess the awareness of

Filipino people in the role of taxation in economic growth, and 2) to inform individuals about the

importance of taxes in the nation.

The contribution of this review will draw the public's attention to how the government

redistributes revenue, as well as how taxes as a government method contribute to the

strengthening of our society.

METHODOLOGY

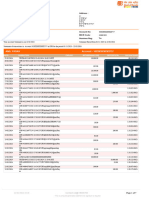

The Preferred Reporting Items for Systematic Reviews and Meta-Analyses, or PRISMA,

a flow diagram that describes the flow of information through the several phases of a systematic

review, was utilized in this analysis of related literature. Figure 1 shows the number of records

found, included, and excluded, as well as the reasons for exclusions. (PRISMA, 2020).

The researcher identified the review's objectives. Google Scholar was used to search for

and collect pertinent information through web searches. The information used in the research

was obtained from publications published by its contributors while doing their research.

The researcher gathered information on Filipino people's awareness of taxation's role in

economic growth through documentary analysis, published and readily available online.

Electronic copy available at: https://ssrn.com/abstract=4433959

THE ROLE OF GOVERNMENT IN THE ECONOMY

Figure1. Prisma flow diagram

RESULTS AND DISCUSSION

Assessing the awareness of the role of taxation in the economic growth

Economic growth is an increase in an economy's capacity to create goods and services

from one period to the next. Governments bear the task of providing specific basic infrastructure

for citizens. A government's critical responsibilities to its citizens include economic stabilization,

income redistribution, and the provision of financial services.

The importance of taxation in an economy cannot be overstated. However, this can only

be accomplished if the country develops and implements a tax policy to mitigate the stated

Electronic copy available at: https://ssrn.com/abstract=4433959

THE ROLE OF GOVERNMENT IN THE ECONOMY

problems with its tax system. If taxation is to contribute to economic progress, it must be

efficient and effective, and accountable to revenue agencies and the government. In general,

taxes should be few, broad-based, and revenue-generating. They should also be adaptable

enough to allow for changes in economic circumstances to be easily absorbed into the tax

system (Nwafor, 2020).

Variables such as gender, age, position, and number of years in the establishment all

impacted the knowledge about the subject under research. In contrast, the study anticipated

that participants' educational attainment would influence their tax awareness. Furthermore,

research revealed that educational attainment, penalties, and tax awareness are statistically

significant predictors of tax compliance (Paco, 2022).

Building tax awareness is a challenging and fast job. Tax awareness should be instilled

from an early age through education and occur on an ongoing basis from time to time. Tax

awareness should be the character of the nation's generation as part of the love of the country

and defend the country. Tax awareness should be a culture of citizens in the future to realize a

prosperous and independent Indonesian nation. She suggested in her study the inclusion of Tax

awareness in Higher Education (Said, L.2018).

Based on the statistics that the Statistical Research Department issued on August 10,

2022, an estimated 26. 8 Million Filipino people are classified as individual taxpayers

(statistica.com, 2021). This is a large discrepancy in the total adult population of the

government; thus, there may be a need for more awareness of where these taxes go.

Information Dissemination on the Importance of Taxation

The government's ability to meet these tasks is primarily determined by the amount of

revenue it generates through the many (internal and external) sources available to it. Taxation is

one example. One of the oldest methods of paying government spending is taxation. It is also

one of the tools for increasing the potential of public sector performance and repaying public

debt. Taxation is critical to any nation's aim of self-sufficiency and achieving its economic

regulation demands. Taxation is critical to any nation's aim of self-sufficiency and achieving its

economic regulation demands.

Taxation can be used to affect or guide citizens' consumption patterns. It can be used to

stimulate or discourage investment in specific industries. The government can drastically lower

the amount of 'damaging' and 'antisocial' economic activities, not criminal ones. It can also

protect local and small firms while repositioning them to compete with larger, overseas

competitors.

Most importantly, taxation is a significant source of government revenue (Prichard W. et

al., 2018). The government uses tax proceeds to perform traditional functions such as road

maintenance, law, and order enforcement, defense against external aggression, and trade and

business regulation to ensure social and economic stability. The provision of these social

services and infrastructure contributes significantly to the overall cost of running a firm. This

means that firms can expand rather than attempt to supply these services and infrastructures. It

means businesses can expand their operations rather than strive to provide these services and

infrastructures.

Taxation's aim and influence can be separated into four categories: raising and

generating resources, equity and growth, behavior, and social contract. The primary goal of

Electronic copy available at: https://ssrn.com/abstract=4433959

THE ROLE OF GOVERNMENT IN THE ECONOMY

taxation is to raise funds for governments to provide necessary public services (Burgess &

Stern, 1993). Taxation pays for many of the things that are essential to the operation of

societies all around the world, such as health care, education, and social services. According to

studies, a country's bare minimum tax revenue should be at least 15% of its gross domestic

product to provide essential services to its population. Taxation is also one of the primary lenses

for gauging a society's state capacity, state creation, and power relations (Di-John, 2006).

Taxation encourages or discourages specific behavior forms, remedies market flaws, and alters

income or wealth distribution. However, at a fundamental level, the main reason for a tax

system to exist is to allocate the cost of government in a fair manner (Bird and Zolt, 2005).

According to K. Amirthalingam (2013), taxes are a crucial tool for achieving a good

pattern of resource allocation, income distribution, and economic stability to disperse economic

development's advantages evenly. However, many developing countries need help to raise tax

revenue to the levels required to promote economic growth. In actuality, tax income as a

percentage of GDP is meager in many developing nations compared to wealthy countries due to

poor economic performance, weak economic structure and administration, political instability,

and a lack of a clear-cut political rationale on taxes.

Taxation is an effective weapon for boosting a country's development and being a

source of funds. Corbacho et al. (2013) argue for fiscal and tax reform to create progressive

systems that encourage economic growth, mobility, and social equality. "Taxation is more than

just a source of revenue; it is a tool for development." All governments require revenue, but the

issue lies in carefully selecting the level of tax rates and the tax base. Participants at the

Platform for Collaboration on Tax (PCT) global conference expressed concern that the trend

toward reduced capital taxes (to encourage growth) is making it more challenging to combat

rising income and wealth disparity. These growing income and wealth gaps can undermine

social cohesion and economic growth. It should be a priority to ensure an equitable allocation of

the tax burden among taxpayers through a system that helps poorer households preserve their

income.

Many countries have historically used taxes to encourage healthy behaviors while

discouraging unhealthy ones. Two examples are tobacco taxation to reduce tobacco

consumption and green taxes to aid the environment (Bader P., 2011). Taxation has a

significant impact on the outcome of human growth. Another illustration is the possible impact of

taxation on advancing gender equality. This subject is receiving increased attention in the policy

debate on public finance and the government's responsibility toward its citizens. Taxation has

been shown to influence people's behavior and choices, with consequences for health

outcomes, gender equity, and environmental sustainability. A government's decisions can make

or break a society. Taxes have been shown to influence people's behavior and choices, with

consequences for health outcomes, gender justice, and environmental sustainability. A

government's decisions either make or break a society (Vlaev I. et al., 2019).

Finally, effective tax administration can influence citizens' interactions with the

government. Taxation is a fundamental component of the social compact between citizens and

the government since it pays for public goods and services. "How taxes are raised and spent

can determine the legitimacy of a government." Citizens are more likely to obey tax rules if they

believe the tax system is fair and value the public benefits they receive. Trust in government is

vital for developing tax morale: the degree to which people recognize a moral need to pay taxes

as part of their societal contribution. As a result, governments must continue to earn public trust

by improving the design and administration of their tax systems (Quak, E. 2019)

Electronic copy available at: https://ssrn.com/abstract=4433959

THE ROLE OF GOVERNMENT IN THE ECONOMY

CONCLUSION

Several inferences have been drawn from the literature. In general, it is argued that

collecting taxes and fees is an essential means for governments to produce public revenues

that allow them to finance expenditures in human resources, infrastructure, and services to

citizens and enterprises.

First, approximately 26 million Filipinos pay taxes out of a total population of 100 million.

This may be due to other Filipinos' need to understand where their taxes go. The tax system

must be fair and equal. The government needs to balance achieving goals like enhanced

revenue mobilization, sustainable growth, lower compliance costs, and ensuring that the tax

system is fair and equitable. The relative taxation of the poor and the rich; corporate and

individual taxpayers; cities and rural areas; formal and informal sectors, labor and investment

income; and the older and younger generations are all fairness considerations.

Second, an education campaign is needed to educate people about the need for

taxation. The importance of taxes should be highlighted because they strengthen the nation.

Taxation is the lifeblood of every nation; without it, the government cannot function. We, the

citizens, contribute to achieving these initiatives by paying income tax, allowing the government

to work on more social schemes and programs. Instead of seeing income tax as a burden, strive

to understand its significance, and people will recognize the various roles their money plays in

the country's success. People should be responsible citizens by paying their income taxes on

time because it is only via tax payments that the country can stay up with other developed

countries and grow further.

REFERENCES

Africa, C., Benitez, M. G., Pesigan, K., Vigonte, F., & Abante, M. V. (2023, February 11). Role of

the Government in the Economy. Papers.ssrn.com.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4354390

Bader, P., Boisclair, D., & Ferrence, R. (2011). Effects of Tobacco Taxation and Pricing on

Smoking Behavior in High-Risk Populations: A Knowledge Synthesis. International

Journal of Environmental Research and Public Health, 8(11), 4118–4139.

https://doi.org/10.3390/ijerph8114118

Bird, R. M., and Zolt, E M. (2005). The Limited Role of the Personal Income Tax

in Developing Countries. Journal of Asian Economics, 16, 928–946

Burgess, R., & N. Stern. (1993). Taxation and Development. Journal of

Economic Literature XXXI, 762−830

Corbacho, Ana; Fretes Cibils, Vicente; Lora, Eduardo (2013). Taxation as a

Development Tool. https://publications.iadb.org/en/publication/more-revenue-taxation-

development-tool

Di- John, J. ( 2006). The Political Economy of Taxation and Tax Reform in

Developing Countries, Research Paper No. 2006/74, United Nations

University:1-27.

Hadji Latif, S. (2019). Halal Conception and Other Factors Affecting Income Distribution in

Islam. International Journal of Islamic Economics and Finance Studies.

https://doi.org/10.25272/ijisef.542534

Electronic copy available at: https://ssrn.com/abstract=4433959

THE ROLE OF GOVERNMENT IN THE ECONOMY

Home. (n.d.). Government at a Glance 2019 Www.oecd-Ilibrary.org.

https://www.oecdilibrary.org/sites/79321fa3en/index.html?itemId=/content/component/79

321fa3-en

Inequality, the Distribution of Wealth & Government Policies. (n.d.). Study.com.

https://study.com/academy/lesson/inequality-the-distribution-of-wealth-government-

policies.html

K. Amirthalingam (2013). Importance and Issues of Taxation in Sri Lanka,

Colombo Business Journal, 04 (01): 43-52

Mehrotra, A. K. (2017, December 21). Fiscal Forearms: Taxation as the Lifeblood of the Modern

Liberal State. Papers.ssrn.com.

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3091796

Meltzer, A. H., & Richard, S. F. (1981). A Rational Theory of the Size of Government.

Journal of Political Economy, 89(5), 914–927. https://doi.org/10.1086/261013

Nwafor, Chinaza. “THE ROLE of TAXATION in the ECONOMIC GROWTH of NATIONS.”

Www.linkedin.com, May 17, 2020, www.linkedin.com/pulse/role-taxation-economic-

growth-nations-for-BSc-aat.

Paco, Donna Lerma Janica A., Quezon, Marissa S. (2020). Tax Awareness and

Compliance of Micro and Small Enterprises JPSP-2022-434%20.pdf

Poverty, Income Distribution, and Economic Policy in the Philippines. (n.d.). IMF.

https://www.imf.org/en/Publications/WP/Issues/2016/12/30/Poverty-Income-Distribution-

and-Economic-Policy-in-the-Philippines-2515

Prichard, W., Salardi, P., & Segal, P. (2018). Taxation, non-tax revenue, and democracy: New

evidence using new cross-country data. World Development, 109, 295–312.

https://doi.org/10.1016/j.worlddev.2018.05.014

PRISMA. (2020). PRISMA Flow Diagram. Prisma-Statement.org. http://prisma-

statement.org/PRISMAStatement/FlowDiagram.aspx

Quak, E. (2019). Taxation and Accountability: How to Improve the State-Citizen Social Contract

Through Taxation. Opendocs.ids.ac.uk.

https://opendocs.ids.ac.uk/opendocs/handle/20.500.12413/14752

Said Lina. (2018). Inclusion of Tax Awareness in Higher Education

https://seajbel.com/wp-content/uploads/2018/08/ACC-10.pdf

Vlaev, I., King, D., Darzi, A., & Dolan, P. (2019). Changing health behaviors using

financial incentives: a review from behavioral economics. BMC Public Health, 19(1),

1059. https://doi.org/10.1186/s12889-019-7407-8

Electronic copy available at: https://ssrn.com/abstract=4433959

You might also like

- Narrative Report On Revenue and Tax Structure by Albert Jerome CasihanDocument11 pagesNarrative Report On Revenue and Tax Structure by Albert Jerome CasihanHealth Planning Unit CHD-MMNo ratings yet

- MANGONON Assignment3 Group Work6 Module3Document3 pagesMANGONON Assignment3 Group Work6 Module3Iamjasp JohnNo ratings yet

- Section: Readings in Philippine HistoryDocument10 pagesSection: Readings in Philippine HistoryJomar CatacutanNo ratings yet

- Philippine Tax Reform Law's Effects on the EconomyDocument8 pagesPhilippine Tax Reform Law's Effects on the EconomyMA. CRISSANDRA BUSTAMANTENo ratings yet

- What Is Tax?Document3 pagesWhat Is Tax?Aque LangtoeNo ratings yet

- Literature Review of Taxation in PakistanDocument7 pagesLiterature Review of Taxation in Pakistannydohavihup2100% (1)

- Tax Perception and Compliance Behavior in Nekemte TownDocument9 pagesTax Perception and Compliance Behavior in Nekemte TownarcherselevatorsNo ratings yet

- RESEARCHDocument5 pagesRESEARCHmanuelitofuentescruzNo ratings yet

- Jasmin Star Ornillo Eapp First Draft The Proposed Tax Policy Reform in The PhilippinesDocument5 pagesJasmin Star Ornillo Eapp First Draft The Proposed Tax Policy Reform in The PhilippinesJasmin Star OrnilloNo ratings yet

- Tax 4 5Document43 pagesTax 4 5MubeenNo ratings yet

- Tax 4 5Document43 pagesTax 4 5MubeenNo ratings yet

- Issues in Philippine Fiscal AdministrationDocument8 pagesIssues in Philippine Fiscal AdministrationMIS Informal Settler FamiliesNo ratings yet

- TAX+AUTHORITY+EFFORT+IN+THE+PREVENTION+AND+DETECTION+OF+TAX+FRAUD+IN+NIGERIADocument9 pagesTAX+AUTHORITY+EFFORT+IN+THE+PREVENTION+AND+DETECTION+OF+TAX+FRAUD+IN+NIGERIAOgunmodede OlamideNo ratings yet

- Tax Revenue Capital ExpenditureDocument56 pagesTax Revenue Capital Expenditurechidubemnjoku111No ratings yet

- INCOMETTTTTTTTTDocument25 pagesINCOMETTTTTTTTTJayvee JoseNo ratings yet

- Thesis On Taxation in EthiopiaDocument6 pagesThesis On Taxation in Ethiopialaurajohnsonphoenix100% (2)

- Best Practices To Control Underground Economy in The World: JapanDocument8 pagesBest Practices To Control Underground Economy in The World: JapanAsif RahoojoNo ratings yet

- Reaction Paper About TaxationDocument1 pageReaction Paper About TaxationQueenie PiñedaNo ratings yet

- Direct Taxation Essay PDFDocument9 pagesDirect Taxation Essay PDFHina chaudhryNo ratings yet

- Tax Avoidance and Evasion Impact on Nigeria's Economic GrowthDocument13 pagesTax Avoidance and Evasion Impact on Nigeria's Economic GrowthChe DivineNo ratings yet

- Relevance of Taxation1Document10 pagesRelevance of Taxation1einol padalNo ratings yet

- Basic Principles of A Sound Tax SystemDocument6 pagesBasic Principles of A Sound Tax SystemhppddlNo ratings yet

- International PublicationDocument8 pagesInternational PublicationArsil AryanNo ratings yet

- Tax Policy and the Economy, Volume 35From EverandTax Policy and the Economy, Volume 35Robert A. MoffittNo ratings yet

- Term Paper. Business TaxDocument10 pagesTerm Paper. Business TaxMica Joy GallardoNo ratings yet

- Inpact of Taxation in Nigeria EconomyDocument34 pagesInpact of Taxation in Nigeria EconomyAjayi Oluwatobiloba TessyNo ratings yet

- The Impact of Tax Revenue On Economic Growth in Nigeria From 1988 - 2018Document9 pagesThe Impact of Tax Revenue On Economic Growth in Nigeria From 1988 - 2018The CheekahNo ratings yet

- Economy Topic 2Document20 pagesEconomy Topic 2Ikra MalikNo ratings yet

- Backcock Chapter OneDocument6 pagesBackcock Chapter OneDon-ibeh PrinceNo ratings yet

- PUBLIC FISCAL ADMINISTRATION - docxSUMDocument20 pagesPUBLIC FISCAL ADMINISTRATION - docxSUMRenalyn FortezaNo ratings yet

- Role of Taxation in Equal Distribution of The Economic Resources in A CountryDocument5 pagesRole of Taxation in Equal Distribution of The Economic Resources in A CountryAlextro MaxonNo ratings yet

- Tax Rates and Economic GrowthDocument6 pagesTax Rates and Economic GrowthHamza NasirNo ratings yet

- Impact of TRAIN Law on Minimum Wage EarnersDocument14 pagesImpact of TRAIN Law on Minimum Wage EarnersAnn GGNo ratings yet

- Taxation As A Major Source of Govt. FundingDocument47 pagesTaxation As A Major Source of Govt. FundingPriyali Rai50% (2)

- Student-Work-5-Term Paper - Ok PDFDocument28 pagesStudent-Work-5-Term Paper - Ok PDFPaul Laurence DocejoNo ratings yet

- Assessing Tax Evasion's Impact on Nigeria's Financial CrimeDocument38 pagesAssessing Tax Evasion's Impact on Nigeria's Financial CrimeKAYODE OLADIPUPO100% (4)

- Reflection 3 - Campos, Grace R.Document4 pagesReflection 3 - Campos, Grace R.Grace Revilla CamposNo ratings yet

- Effects of Tax Avoidance To The Economic Development in Taraba StateDocument75 pagesEffects of Tax Avoidance To The Economic Development in Taraba StateJoshua Bature SamboNo ratings yet

- 18. TAXATION AND NIGERIAN ECONOMYDocument9 pages18. TAXATION AND NIGERIAN ECONOMYPeace AdamsNo ratings yet

- The Essence of Taxation Fueling Society's ProgressDocument2 pagesThe Essence of Taxation Fueling Society's ProgressKaren Faith MallariNo ratings yet

- Determinants of tax compliance attitude in EthiopiaDocument13 pagesDeterminants of tax compliance attitude in EthiopiaAubrrryNo ratings yet

- PESTE Analysis Reveals Opportunities and Threats for Amazona Chocolate in PeruDocument2 pagesPESTE Analysis Reveals Opportunities and Threats for Amazona Chocolate in PeruMarcio SilvaNo ratings yet

- The Problem With Our Tax System and How It Affects UsDocument65 pagesThe Problem With Our Tax System and How It Affects Ussan pedro jailNo ratings yet

- SCRIPT FISCAL REPORT: CORPORATE TAX EVASIONDocument8 pagesSCRIPT FISCAL REPORT: CORPORATE TAX EVASIONMIS Informal Settler FamiliesNo ratings yet

- The Effects of Tax Evasion and Avoidance On Nigeria JoeDocument50 pagesThe Effects of Tax Evasion and Avoidance On Nigeria Joemoscotech247No ratings yet

- Almost 1-3 - ThesisDocument92 pagesAlmost 1-3 - ThesisJohn Paul Edward BennettNo ratings yet

- Almost 1-4 ThesisDocument94 pagesAlmost 1-4 ThesisJohn Paul Edward BennettNo ratings yet

- Implications of Tax Evasion On The Economic Development of Third World CountriesDocument11 pagesImplications of Tax Evasion On The Economic Development of Third World CountriesTrisha GarciaNo ratings yet

- Section 2: Influence of Access To Finance, Infrastructure, Market, Government Policy, Entrepreneurial Influence and Technology On The Growth of SmesDocument7 pagesSection 2: Influence of Access To Finance, Infrastructure, Market, Government Policy, Entrepreneurial Influence and Technology On The Growth of SmesaleneNo ratings yet

- DocumentDocument5 pagesDocumentSamira PatrickNo ratings yet

- An Investigation On The Impact of Taxpayer Education On Tax Compliance Among Small and Medium EnterprisesDocument22 pagesAn Investigation On The Impact of Taxpayer Education On Tax Compliance Among Small and Medium Enterprisesblaston kapsata100% (2)

- Facrors Affecting Tax Revenue in Ethiyopia (1990-2008) - Tahir Desta, Mekdelawit Reta, Bizuneh GirmaDocument23 pagesFacrors Affecting Tax Revenue in Ethiyopia (1990-2008) - Tahir Desta, Mekdelawit Reta, Bizuneh Girmapriyanthikadilrukshi05No ratings yet

- Chapter One 1.1 Background To The StudyDocument26 pagesChapter One 1.1 Background To The StudyThe CheekahNo ratings yet

- Chapter One 1.1 Background of The StudyDocument55 pagesChapter One 1.1 Background of The StudyOlasunmade Rukayat olamide100% (1)

- Philippine Fiscal Policy and PrioritiesDocument9 pagesPhilippine Fiscal Policy and PrioritiesMelissa Favila PanagaNo ratings yet

- Examining Taxpayer's Cognition and Volition As Determinants of Tax Compliance in Surabaya: A Tax Avoidance Moderated AnalysisDocument23 pagesExamining Taxpayer's Cognition and Volition As Determinants of Tax Compliance in Surabaya: A Tax Avoidance Moderated Analysisindex PubNo ratings yet

- 7th Annual International Academic Conference-2Document14 pages7th Annual International Academic Conference-2Mustapha AbdullahiNo ratings yet

- ATR 2 1 18 3 EkweDocument15 pagesATR 2 1 18 3 EkweTariku KolchaNo ratings yet

- Gale Researcher Guide for: The Role of Institutions and InfrastructureFrom EverandGale Researcher Guide for: The Role of Institutions and InfrastructureNo ratings yet

- Tax Knowledge, Tax Complexity and Tax Compliance: Taxpayers' ViewDocument7 pagesTax Knowledge, Tax Complexity and Tax Compliance: Taxpayers' Viewabbey89No ratings yet

- Dialnet-TheImpactOfJobSatisfactionOnJobPerformanceOfTaxOff-9178563Document32 pagesDialnet-TheImpactOfJobSatisfactionOnJobPerformanceOfTaxOff-9178563June AlvarezNo ratings yet

- Master CAPEX Items ListingDocument4 pagesMaster CAPEX Items ListingJune AlvarezNo ratings yet

- Ga Journal Entry FormDocument2 pagesGa Journal Entry FormJune AlvarezNo ratings yet

- MoU - 2023 - 24 - LBAS - MADocument5 pagesMoU - 2023 - 24 - LBAS - MAMetilda AcademyNo ratings yet

- Profile of The Aerospace Industry in Greater MontrealDocument48 pagesProfile of The Aerospace Industry in Greater Montrealvigneshkumar rajanNo ratings yet

- Marketing CommunicationDocument8 pagesMarketing CommunicationAruna EkanayakaNo ratings yet

- Introduction of Planning System and Urban Regeneration in TaiwanDocument70 pagesIntroduction of Planning System and Urban Regeneration in TaiwanRCE August ResidencesNo ratings yet

- THESISDocument62 pagesTHESISBetelhem EjigsemahuNo ratings yet

- Case Study RajeevDocument1 pageCase Study Rajeevyatin rajput100% (1)

- Prevention Appraisal Internal Failure External Failure: Iona CompanyDocument5 pagesPrevention Appraisal Internal Failure External Failure: Iona CompanyFrans KristianNo ratings yet

- Module 6 - Project Closure and TerminationDocument29 pagesModule 6 - Project Closure and TerminationAnthonyNo ratings yet

- Marketing Vocabulary: Term MeaningDocument3 pagesMarketing Vocabulary: Term MeaningSudarmika KomangNo ratings yet

- Option 1 Billing: SustainabilityDocument4 pagesOption 1 Billing: SustainabilityArnie Tron NoblezaNo ratings yet

- OpTransactionHistoryUX522 02 2024Document7 pagesOpTransactionHistoryUX522 02 2024Praveen SainiNo ratings yet

- LSF PresentationDocument18 pagesLSF PresentationkgaaNo ratings yet

- PDF To WordDocument17 pagesPDF To WordMehulsonariaNo ratings yet

- Nuss Company ProfileDocument3 pagesNuss Company ProfiletelecomstuffsNo ratings yet

- IFRS 1 Technical SummaryDocument2 pagesIFRS 1 Technical SummaryShashank GuptaNo ratings yet

- BCG - ACC3 - 28 June 2021 - S1Document5 pagesBCG - ACC3 - 28 June 2021 - S1Ntokozo Siphiwo Collin DlaminiNo ratings yet

- Ch4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Document45 pagesCh4 - Designing Distribution Networks and Applications To Omni-Channel Retailing (Student)Wenhui TuNo ratings yet

- Sivagnanam PDFDocument213 pagesSivagnanam PDFjohn100% (1)

- COSACC Assignment 2Document3 pagesCOSACC Assignment 2Kenneth Jim HipolitoNo ratings yet

- Llegado-Chapter 1Document13 pagesLlegado-Chapter 1Mary LlegadoNo ratings yet

- ProdmixDocument10 pagesProdmixLuisAlfonsoFernándezMorenoNo ratings yet

- Jan 2005 Formasi Trading Inc Income StatementDocument1 pageJan 2005 Formasi Trading Inc Income StatementRictu SempakNo ratings yet

- IDENTIFIKASI PAD KABUPATEN KEPU LA UAN SANGIHEDocument8 pagesIDENTIFIKASI PAD KABUPATEN KEPU LA UAN SANGIHESentahanakeng Malahasa perkasaNo ratings yet

- Medical Devices Industry in Malaysia PDFDocument28 pagesMedical Devices Industry in Malaysia PDFmangesh224100% (2)

- Advanced Financial MGMT Notes 1 To 30Document87 pagesAdvanced Financial MGMT Notes 1 To 30Sangeetha K SNo ratings yet

- Business Chapter 2 BUSINESS STRUCTUREDocument7 pagesBusiness Chapter 2 BUSINESS STRUCTUREJosue MushagalusaNo ratings yet

- Trading The Ichimoku WayDocument4 pagesTrading The Ichimoku Waysaa6383No ratings yet

- Factors Affecting Employee Relations in Banking: A SCB Case StudyDocument51 pagesFactors Affecting Employee Relations in Banking: A SCB Case StudyMBAMBO JAMESNo ratings yet

- "Study of Different Loans Provided by SBI Bank": Project Report ONDocument55 pages"Study of Different Loans Provided by SBI Bank": Project Report ONAnonymous g7uPednINo ratings yet

- So PaidDocument7 pagesSo Paidjames pearsonNo ratings yet