Professional Documents

Culture Documents

Ta Da Policy

Ta Da Policy

Uploaded by

SM Area0 ratings0% found this document useful (0 votes)

6 views6 pagesOriginal Title

TA DA POLICY

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views6 pagesTa Da Policy

Ta Da Policy

Uploaded by

SM AreaCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 6

Bajrang Wire & Infra Pvt.

Ltd. Jaipur

Domestic TA/DA Policy Tssue

Date:

arch’

4, Objective:

‘To define and lay down Company's rules on reimbursement of expenses incurred

on officially travel in India,

2 Scope: These rules shall cover all employees of the Company for journeys in India.

3. Definitions

‘a) Employees ‘Employee’ means persons employed by the Company including

temporary employees and those on probation but does not include part-time

or casual employees

b) Local Journey Local Journey shall mean a journey to a temporary duty point

from the permanent duty point but within 2 radius of forty kilometers thereof.

©) Local Conveyance Local conveyance shall mean conveyance used for

Local Journey.

) Day’ for the purpose of calculating daily allowance is to be taken as the period

of 24 hours fram the scheduled time of departure from the Headquarters in

respect of any particular tour.

©) Transfer’ means movement of an employee from the Headquarters to another

station where he/she is posted.

f) A‘tour’ is 2 journey undertaken for Company's work out of the Headquarters

where the employee is posted. A tour will be deemed to have commenced from

the scheduled time of departure of the mode of transport and shall end at the

actual time of arrival of transport at the Headquarters station,

City means prescribed in Classified of City

9)

4, Travelling Allowance:

‘An employee will be eligible for travelling allowance, if journeys are undertaken

for the following purposes:

1a) Official Work of company

5, Classification of City:

a)Tier City 1 ~ All Metro City (Delhi & NCR, Mumbai, Kolkata,

Chennai), Bangalore.

bb) Tier City 2- All State & union Territory capital Except Mention in Tier City-1.

oyTier City 3- All Other cities and location which is not in Tier-1 & Tier-2.

(Allover India including Metropolitan city Tariff will remain same)

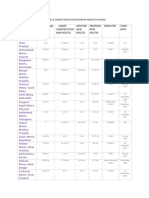

6. Classification of Employees:

For the purpose of Traveling Allowances, the Company Employees belonging to

all categories are grouped as per the following

Category Pos

GM/AVP/VP.

Senior Manager, RSM

Manager saa

Assistant Manager

“HOD

Manager

Manager|

Senior Executive

7. Accommodatio

Executive /Mgt. Trainee

Entitlements for Journey on Tour. Journey by Rail The Employees Group and

the travel entitlements for journeys by Rail on tour shall be 2s follows

Annexure-1 rates:

ANNEXURE-1

Category _

Mode of Travelling

GM/AVP/VP __

Senior Manager, RSM

Manager

Assistant Manager

Senior Executive

I Third AC Class

[Third AC Class

Second AC Class

Second AC Class

Third AC Class

Sleeper Class

8. Lodging Allowances:

When the employee either stays in a hotel or makes his own arrangement

during tour, the daily allowances shall be paid as per following Annexure-2

rates:

Daily allowances upto per Day for Night

Stay (Per Night Lodging & Boarding

‘allowance including taxes for Metro

GM/AVP/VP

Senior Manager, Regional

Manager (Sales)

Manager

Assistant Manager

Senior Executive

Executive/Mgt. Trainee

9. Fooding Allowances:

Food charges will be provided as per below annexure-3.

ANNEXURE-3

Category Daily allowances per Day (for Food

and beverages including taxes)

GM/AVP/VP ea :

Senior Manager, Regional 800 |

Manager (Sales) |

Manager

Executive/Mgt.

Trainee

10. Local Conveyance Charges:

Petrol Expenses will be based on the basis of Odo-meter Readings of the day

starting to end of the day. The total Kilometers run will be taken care of by

4,00 Rs/Km for Bike; 12,00 Rs/Km for Car including maintenance.

11, TA. Bill and Payment:

‘TA. Bill should be submitted in the Google sheet via Google form along with the

Tour Expenditure would be submitted along with Suppotting'stotheaccountsdepartment

within 48hoursafter joining.

Payment would be made as per company rules along with salary.

Pradeep Parihar Sanjeev Jhunjhunwala

(HR & Admin) (GM — Commercial)

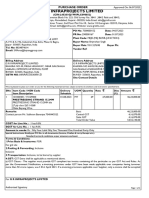

‘ANNEXURE-4

BAJRANG WIRE & INFRA PVT LTD

A & DLA. CLAIM FORM

PART -1

(Tobe filed by the Claimant)

Name: bn

Designation Category:

Department/Address:

|] Place & Purpose of Journey:

|] Tour approved by:

Details of Journey: ‘A, (Onward & Return Journey)

r Fro To —Km~|—Mode of} Actual Fare) Amt. |

Mi ee Transpo | Paid(Rs.) Admissible

Date | Place | Date | Place Sea a

Time | Time Class |

TOTAL(A)

B. {Details of Lodging Charges} {Original Bill be attac

Date Date of | No. of Name of the Charges Paid

of Departure | Days: Place &

Arrival Hotel/Gues

tHouse

TOTAL (B)

. {Details of Food Charges}

{of Staying | Food Charges Claimed ‘Amt.

C To No-of Days, Rate (Rs.) | Total(R.) | Admissible

©

D. {Local Conveyance}

To | Km. | Modeof | Actual

Transport) Fare

Paid (Rs.)

Statement of Claim

~~ Particulars

{Fare for Onward & Return Journey

|B. Expenses on of Lodging

Fc. Expenses on Food

1D. Expenses Local Conveyance

List of Tier-1, Tier-2 and Tier-3 class Cities are given in classification of cties point no 5.

Lodging charges shall be paid at the rate of actual expenditure supported by original Bill / Cash

Memos etc. along with the T.A. Bill subject to the maximum rate admissible as per above

Table.

However, food charges shall be paid at the prescribed rate without production of Bil/Cash

Memo.

Intimation of tour should be forwarded to HR Department in advance with approval of HOD,

Authority In prescribed formats.

Pradeep Parihar Sanjeev Jhunjhunwala

(HR & Admin) (GM- Commercial)

You might also like

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5813)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (844)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Nhai PiuDocument10 pagesNhai PiuSM AreaNo ratings yet

- List of Contrators AA (Website 15.7.19)Document3 pagesList of Contrators AA (Website 15.7.19)SM AreaNo ratings yet

- Axis BankDocument2 pagesAxis BankSM AreaNo ratings yet

- Awarded Year 22 23 0Document50 pagesAwarded Year 22 23 0SM AreaNo ratings yet

- RCP PricesDocument5 pagesRCP PricesSM AreaNo ratings yet

- NK PPSDocument70 pagesNK PPSSM AreaNo ratings yet

- Just Dial PT Wonders ListDocument18 pagesJust Dial PT Wonders ListSM AreaNo ratings yet

- PWD BSR 11-07-2019 - NewDocument88 pagesPWD BSR 11-07-2019 - NewSM AreaNo ratings yet

- Relaxation Test 15.2-1860-P GR INFRA 16 JAN 2024 BWI 300Document2 pagesRelaxation Test 15.2-1860-P GR INFRA 16 JAN 2024 BWI 300SM AreaNo ratings yet

- Sales BrochureDocument8 pagesSales BrochureSM AreaNo ratings yet

- Hotel BillDocument2 pagesHotel BillSM AreaNo ratings yet

- Ultra TMT BrochureDocument8 pagesUltra TMT BrochureSM AreaNo ratings yet

- Plant and Machinery (1) - 3Document1 pagePlant and Machinery (1) - 3SM AreaNo ratings yet

- Bajrang Wire & Infra Credentials 2024Document257 pagesBajrang Wire & Infra Credentials 2024SM AreaNo ratings yet

- BS - LRPC Brochure - Vol-3Document12 pagesBS - LRPC Brochure - Vol-3SM AreaNo ratings yet

- Bis License of PC WireDocument1 pageBis License of PC WireSM AreaNo ratings yet

- Company Profile (1) - MergedDocument31 pagesCompany Profile (1) - MergedSM AreaNo ratings yet

- Plant and Machinery (1) - 1Document1 pagePlant and Machinery (1) - 1SM AreaNo ratings yet

- GR BundiDocument1 pageGR BundiSM AreaNo ratings yet

- PO 7300000152 Bajrang WireDocument6 pagesPO 7300000152 Bajrang WireSM AreaNo ratings yet

- PO 7300000420 Bajrang WireDocument6 pagesPO 7300000420 Bajrang WireSM AreaNo ratings yet

- Awarded Not Appointed 0 16dec 2023Document48 pagesAwarded Not Appointed 0 16dec 2023SM AreaNo ratings yet

- PO 7300000312 Bajrange WireDocument6 pagesPO 7300000312 Bajrange WireSM AreaNo ratings yet

- LRPC Credentials - 1 PDFDocument102 pagesLRPC Credentials - 1 PDFSM AreaNo ratings yet