Professional Documents

Culture Documents

Appeal in OC 1582 - 2021 - Compressed

Appeal in OC 1582 - 2021 - Compressed

Uploaded by

utkarshlegal960 ratings0% found this document useful (0 votes)

30 views310 pagesOriginal Title

Appeal in OC 1582_2021_compressed

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views310 pagesAppeal in OC 1582 - 2021 - Compressed

Appeal in OC 1582 - 2021 - Compressed

Uploaded by

utkarshlegal96Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 310

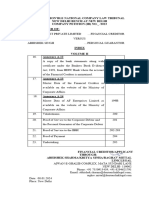

[BRPORE THE APPELLATE TRIBUNAL FOR PREVENTION OF MONEY-

{LAUNDERING ACT, LOK WAVAK EMAWAN, KHAM MARKET, NEW DELATL

is

APPEAL NO. 4353. OF 2022

(0 No.1882 07 2001

AO No, 05,2021 DATED 15.11.2021

8

cIR/02/Dzc8 2008

BUIWE MATTER OF;

Rejeah Kumar Gupta

Liguidater, Ma UV Byporte Private Limited

43 Dilahad Colony, Deihi-110005 Appellant

‘vores

Deputy Disecror

Directorate of Enforcement,

Governineat of toa,

Delhi Zone, TH Ba

using,

2% Floor, JLN Marg, New Delh-110002 Respondent

eae

2 liga er ear oo ae

|| Money-toundering Act, 2002 lone wih spor! 69 4,

es |

[SNORE BF Cenied Copy ate Tmpaied 1

| force aa i80n2002, peed by we [20-194 |

| [ptt tnt rae a |

; Sooo |

[So Rppation To eekng Stari way We ender | |

| passed by La. Adiicating Authors, PALA, New! 6) 05

| | bets dated 18.08.2022 in OC No. 1522/2921 slong |

| | th aidan |

[£7 Peteatreme rrr]

ee |ANNGRORE AGERE Dae Ne SST St

| Nainital Ben, Dished Coley Branch, Del

\ | 30.09.2022 for ta 10,000/-

Ti a aah

‘VOLNE NO.

‘ARNEXORE 2-3: Copy of the Original Complaint

‘No, 1882 of 2021 filed by the Respondent 45

RINEURE A Copy Fev ATS

omer h-98

‘RHNERURE AS Gopy_of the Omer anad)

19.09.2019 passed by the Houtle National |

Company Law Tribunal, New Delhi Bench, New

Delhi for inition of Corporate Insolvency’

Revolution Process of M/s UV Exports Privat|

Limite (Conporate Debtor

4-39

16

‘RINERURE A-6 Copy of the Public Announcement

Je 17102009ealing upon the cers of 3/0 WF

‘Exports Plvate Limited for submiosisn of claim ty |

creditors, I

8o-8o

i

ANWERURE RY Copy of named Comoe 1

creditors (COC} Report fed below the Hon'ble |

Nations! Company Law Tribunal, New Deihi Benen, | 81°85

New Delt.

rr

| ARRDRE A Gy oe BSF RE COE

ft/s Ov Expr Prat Lites [86-109

rc

‘ANNERURE “A-9” Copy of the Onder dated

11.03.2020 pasted By the Hon'ble National

Company Law Teibunsl New Delhi Bench, New

| Delhi to intate the Liquidation prossedings of M/s

UW Exports Private Limited end appointed the

Appellant as Liquidator of the M/s UV Exports

Private Limited,

fo3 109

‘ARNERORE ATO Copy of For B ie, Pubic

‘Announcement forthe attention ef the Stakeholders

of M/s UV Exports Private Limited fr ubalslon a

aims by creditors.

Mto-to

75.

‘NERORE HIT Copy fe see Saeindes |

“mn

committee members,

i.

MERE EC

Lacon reed on eam id)

|asoa: : Ign

fobliauid@emslicom ie. M/s Baba Poode Pave" M'S |

tinted, slr concern of M/s UY sapora Pat |

Limite appear on 28082000 |

ANNEXURE A-1S Copy of Vater died 20-00-2020 4-173

I Sompliones WH Die Asn he const]

ec received on easing dad 28.09.2020 |

TE | ARRERURE 4 Cop of sais 56.05 7000

foes tan Ben, IND MME Breach, Hew Debi)

to he Lgwiasto,

TE ARERR AS Copy of na dad STOOD

by Me Paka Kamar Aasiatant Dirctor (MLA 0 11419

the gto. {

FD. | ANNENURE AU6 Cop 0 her Gaal OST oO

repeating for reoostbn if eral one [Boba

BE TARWEXORE AAT Copy of the Tima Gata

| 17.11.2020, 27.11.2020 @ 02. 12.2020 by liquidator |

to Mr, Panka) Kumar, Assistant Dieter (PMLA as |S

Reminder fo consideration of requst unde eer

dat 09.11.2020

22) ANWERORE BAS” Cooy of how Geiss Woree

tinder section 8 of PMA, Act, 2022, dated (08-149,

07.01.2022 the Appel. |

B.| AWNERURE AD Copy oF vey ded TOOT

sent though email beore the 1A. Adiaiating 3-156

[ wstneity

‘ANNERURE A20 Copy of OO No TSSD/RORT

|Rejoinder reeived through Karun Enforcement| 15.6. 163)

Officer, Directorate of Enforcement, Deli Zone ~,

ew Det I

NEW DELEU- 110014.

Ph. No. 191 9871986830

‘Bmali- adumg29GemsiLcom

Place: New Dethi

Dated: 30.09.2022

BEFORE THE APPELLATE TRIBUNAL POR PREVENTION OF MONEY-

LAUNDERING ACT, LOK KAYAK BHAWAN, KHAN MARKET, NEW DELET

6

APPEALNO.YS93 P2022

1

(0cNo0.1582.0" 2021,

18

AO No, 05/2021 DATED 15.12.2021

W

crRy02/DzcB/2019

EE or:

Rejesh Kumar Gupta

Lguidates, 24/5 UV Expert Private Limited

43 Dilshad Colony, Delhi-1 20008 Appellant

Versus

Deputy Director

Directorate of Enforcement,

Gozernment of ii,

Det Zone -, MINL Busing,

‘29 Foor, JUN Marg, New Delhi-i10002 “Respondent

vounME

[aaa

Re. |

T._ [Memo of Partcs Foren

TS Ripe We OF oa OF Wee

|tauncaring Ae, 2002 a8 amended vie at 2 of 2015, |

(hereinafter referred as “the act") against order passed by) OK) ~ 14

the Ld. Adjudicnting Authority, PMLA, New Delhi in terms |

of Soc. 8 of the Act, on Complaint made ty the|

| Sees

| |e onl itchmentOrer No 5 of 200 dtd

[15.11.2021 made by the Complainant, confiraed vader |

vena Compact No 58D of 2001 cheing it |

[lores to Money tandeng vie oder dt |

| |sRon2o22 and wan ved 2 pant

21.08.2022, |

gormeracs

‘RECT ZS

RRR AT CRE Cony WT RST ORT]

dated 18:08,2022, passed by the Ld, Adjudicaing| *°~ NY

QO geepuant

(RAJESH KUMAR GUPTA)

Liquidator, M/s UV Exports Privnte Limited

Advocate)

No -D/4725/2022

COGNSSL FOR THE APPELLANT

6-22, LGF, JANGPURA EXTENSION

‘MEW DELET 110014,

Ph. Now 291 9871986630,

ma aduma9 gma com

Place: Hew Doth

Dated: 30.09.2022

©

BEFORE THE APPELLATE TRIBUNAL FOR PREVENTION OF MONEY-

{LAUNDERING ACT, LOK WAVAK BHAWAN, KHAN MARKET, NEW DELETE

1

APPEAL NOYES OF 2022

Ww

(0c No.1582 07 2001

PAO Wo. 05/2021 DATED 16.11.2001

ie

BeiRjo2/DzcF/ 2019,

CTHE MATTER OF:

Rajesh Kumse Gupea

Liquidator, ys UY txport Private Limited

Fa Dilabiad Colony, Delbi-110008 -Appellant

Deputy Director

Ditectorae of Bnforcesenty

‘Government of indi,

Delhi Zone I. MTL Building,

20! Foor, JUN Marg, New Delhi-110002 Respondent

‘MEMO .OF parties

Rajesh Kumar Cupea

iguidator, M/s UV Exports Private Limited

‘Sean ee tent

sO

aca

1B.

oe

rucno ct

Liquidator, M/s UV Exports Private Limited

MAMAN GUPTA

(Advocate)

o

BEFORE THE APPELLATE TRIBUNAL FOR PREVENTION OF MONEY.

‘VAUNDERING ACT, LOK NAVAK BHAWAN, KHAN MARKUT,AEW DRLET

We

APPEALNO.YE 53 or 2022

(0¢ No.1582.0¥ 2021

IN

PRO Ho. 08,2021 DATED 18.11.2021

i

ere/o2/D2c8/ 2019

HS MATTER.

Rajesh Kumar Gupta

Liquidator, M/ UY Exports Private Limited

1749 Dishad Colony, Debi-110005, ~~Appallant

Versus

Deputy Director

Directarate of Enforcement,

Government of indie,

Delhi Zone -, MTNL Bung

2s! Floor, JLN Marg, New Delhi] 10002

Respondent

STATUTORY APPEAL U/8. 26 OF THE PREVENTION oF monEY

LAUNDERING ACT, 2002 (HEREINAPTER REFERRED TO AS “PMLA) AS.

AMENDED VIDE ACT 2 OF 2013, (HEREINAFTER REFERRED TO AS “THE

ACT’) AGAINST ORDER PASSED BY THE LEARNED ADJUDICATING

AUTHORITY, PREVENTION OF MOMEY.LAUNDERING ACT, NEW DELI, IN

TERMS OF SECTION 8 OF THE ACT, ON COMPLAINT MADE BY THE

COMPLAINANT, ARRAYED HEREIN AS RESFONDENT CONFIRMING THE

PROVISIONAL ATTACHMENT ORDER NO, 05 OF 2021, DATED 18.06.2021

MADE BY THE COMPLAINANT, CONFIRMED UNDER ORIGINAL

COMPLAINT HO. 1582 OF 2021 OBSERVING IT TO EE INVOLVED IN

MONEY LAUNDERING, VIDE TTS ORDER DATED 16.08.2022 WAS

DBLIVERED TO APPELLANT ON 21.08.2022

1. That the present Statutory Appeal ie being fled by the AppoUant being

grieved by the Order passed by the Lmmed Adjudicating Authority

‘under PMIA. Certified copy of the Impugned Order dated 18.08.2022 is

fsnnened hereto #8 ARWEXURE A-1 which was delivered tothe eppelant

®

‘n 21.68.2022, Copy of the Original Complaint No, 1582 of 202% fled by

‘the Respondent is annexed herewith as ANNEXURE A.

‘That he Appellant i a lnwabiding citizen of India and has been appointed

18 the liquidator by the Hon'ble National Company Law Tsbusal, New

Delhi Bench, New Delhi vide ite order dated 11.08.2020,

‘That itis submitted that the Learned Adjstioating authority, PALA, Tew

Delhi without applying its judioiows mind “erroneously confirmed that the

Frovieonal Aitachinent Order No. O5 of 2021 dated 16.11.2021, while

holding that the sttachment of the propery, the subject matlcr of the

present Appeal, is out of proceeds of crine and is involved in money

laundering and unjustly confirmed the same, Whesees aa the Appellant

humbly erases indulgence of thie Hon'ble Appellate Trbun,iinpeacog

the directions & observations made by the Leatmed Adjudicating Autheiey,

PMLA, New Deli constcated in terme af the Act. Copy of the Provisional

Altchment Orders annesed herewith as AUNEXURE At

‘Thet shorn of detals, a bref brush of tects, necessary for the disposal of

the present Appeal may be gummed up as wer:

‘That the Hon'ble National Company Law Tibunsl, Rew Delhi Bench vide

it onder dated 19.09.2019 wes pleased to tgge the Corporets Insolvency,

Resolution Process (horeinafr sefered se (CIRP) of H/s UV Exporta

Private Limited (Corporate Debtor) by editing an Applcatice filed by

Ms Ambe Aavotoods Private Limited (Operaional Creditor, smnder Section,

9 ofthe Insolvency and Bankruptey Code, 2016. The Hoatble Tribunal was

further pleased to appoint the appellant i, Mr. Rajesh Kumar Gupte as

the Interim Resolotion Professional (IRE). Copy of the Onder is annexed,

herewith ANICESURE A.

‘That pursuant to the eppolntmest of the appslant, the eppellans 28 per

Section 19 & 15 of Ineolvency and Bankrastry Code, 2016 made & public

‘nnousicement on 17.10.2019 calling upon the eeditre ofthe corporate

er fe. Mis UV Beports Private Limited to subiit their claims before

the appellant on or before 31.10.2018, Copy of the Pubic announcement

Is annexed herewith oe ANMEXURE A-6

Subsequently, the appellant constituted the committee of exeitors of the

‘appellant and filed! the report certifi the constitution of the committee

of creditors Before the Hon'ble National Conpany Law Tribunal, Copy of

‘he said report is aanesed herewith es ANNEXURE A-7

sou

Ra Pasian

®

‘That CoC in the Second meeting decided to initiate the Liquidation

Proceeding against the Corporate Debtor. The CoC with » 78.42% voting

Percentage passed the regofution to initiate the Liquidation proceedings of

M/s UV Exports Private Limited. Subsequently the CoC in the third CoC

'eeting pested the solution to appoint the appelant as Liquidator. Coay

ofthe minutes of thict COC is annexed herewith es ANNEXURE 4-8.

‘That in view ofthe above, the appellant Sleé the appilestion under Section

38(2) of the Insolvency ant Bankruptcy Code, 2016 before the Hamble

National Company tay ‘ribunal. The Howe Nations) Company Law

‘Tribunal vide js onder dated 11.03.2029 was pleased te allow the

‘pplication and initiated the Liguidation ajainst Me UW Exports Private

Limited and appointed the appellant as Liquidator of the Corparsie

Debtor. Copy of the Ordar is annexed herewith as ANNEXURE 4-9,

‘That since then the sppellant has been taken charge of the functions of

the Liquidetor as per the provisions of the Insolrengy and Banleruptoy

Code, 2018,

‘That the appellant publiched Form - Bis, Public Annowacentent far the

sttenton ofthe stekehokiers of M/s UV Export Private Limited to submit

heir claims with proof on or before 10.04.2020, Copy of the aforesald

‘publication is annexed herewith as ANNEXURE A -10,

hereafter the Hquidator constituted the Stakeholders Committee as per

the provisions and regulstion of tnsltency and Bankruptcy Cade, 2016.

(Copy of the List ofstsleholders committee members ie annened hereth

2s ANNEXURE 8-11.

‘Thereafter the liquidator sold the plant and machinery of M/e'U V Exports

Private Limited 28 per provisions of the Insciveney and Bankruptcy Code,

2016.

‘That on 24.00.2020 sppelant received a summons ftom Mr. Pankaj

Xumar Asst, Director PMLA on mal id efpLquidgymail.cam, (7s maid

ertabss tothe lguidation process of BY Rekal Foods Private Limited, a

sister concer of M/s UV Exports Private Lined) aa well as through Speed

Post to sppear before him on 28.09.2020 and the liquidetor eppesred

before him on schedule time ard explained to him sbout the lnsolveney

land Bankruptcy Code, 2016 process and answered his queries, Copy of

‘the salt summons are annexed herewith as ANNEXURE A-12.

Later he took the statement of Liquidator and the next date was given to

him for submission of documents and the liquidator iz the same

accordingly,

‘eat on compliance withthe ércctons of te concerned office the details

‘wore provided a8 per Leer dated 29,092020 is annexed herewith ©

ANNEXURE A-13.

‘That Uquidator received an e-mail dated £0.09,2020 from indian Ban,

IND MSME Branch, New Delhi as under:-

Tn compliance of oral request of Mr. Pa Kumar, Assistant Director,

Enforcement Directorate, GOL MOF on cited matter we Nave put a hold on

‘account No, 6890408942 maintained in the name of offset fguidator Mr

Fajesk Kumar Gupta i the syle "UV Bxpors Pot, Lin liidation Rajesh

umer Qupea

We have requested Mr. Pankaj Kumar to send us a writin communication to

‘Thief for your infomation, Please make a nat of."

(Copy of seme is annexed herecith end rearked at ANNERURB A-14,

‘Teat on 29.10.2020 Mr. Pant) Kumar wené an exalt te Hguidator om

‘oil id: veel lauld@mmal.eom as under:

“Vehictes of Vinod Sirohi Usha Sirohi andl tir companies are the subject

matter of investigation under PMLA. You are requested to rot to enter ary

sale/ purchase with the said vehicies”” Copy of the ead summons are

annexed horevith at ANNEXURE 4-16,

1 isto be submit uber Rajesh Kamar Gupta is acting es the Liquidator

‘in oro companies ie, M/s UV Exports Prt Lid. and M/s Bshel Foods Pre,

ltd. of Usha Sirobi and Vinod Sirohi and lguidator was in physcial

possession ofthe vehicles and symbolic posession of ane veel of M/s

UV Exports Pvt. Lid and physclal postetsion of vehicle of M/s Eshal

Foods Pt. Ee.

4 is to be submitted chat one vehicle model Tain Neson is tying at 258,

‘Ceriappa Marg, Sainik Ferm, New Delhi and as per the information

sonilable o me the owner of the house redes outside Inia, Parte, it

vas inormed tothe Iigidator and the elie. by Pa Spang

ope

(Director of M/s, UV Exports Limited) hat the ey ofthe carts ying inside

the House. However, ater due efforts and struggles the liquidator and

valuers got the permission tom the gusrd present thereby and the

valuction ofthe said vehicle was done but they were not allowed to take

the possession as che keys were not alle,

1 ie o be submitted thet one vehicle mode! BMW isin the possession of

‘the Scoured Creditor Le. Kotak Mahindra Bank Limited, itis submitted

‘that one vehicle model LPT is i the possesion ofthe secared creditor Le

HRC Bank Limited ss per the provisions of nolvensy and Bankraptey

Coe, 2016,

‘Thet the appellant requested and communtated the positioning and facts

Sbou the Hquidation of M/s UV Exyorte Prete Limited to the

compininent/ respondent vide letter dated 03.11.2020 and has requested

revocation of orders. Copy of the said communication is marked as

ANNEXURE 4-16,

‘That the appslant again equestd fhm My. Panka Kumar Asst. Director

Enforcement Dirctorste to revoke the nowesiry instructions mentioned

stove. Cony of the said the e-mail dated 17.12.2020, 97.11.2020 &

(02.12.2020 marked as ANNEXURE &-17,

‘That the appelisat has fled an application before the Hone National

Company Lave Tribunal, New Delhi Bench I under Section 60(8) of the

Ingoivency and Bankruptcy Code, 2016 read with Rule 11 of the NCLT

ules seeking appropriate directions tothe complainants en to allow sale

‘of the Med Ascets of M/s U V Raper Pot id

That the above mention mater tiled “Rajesh Kumar Gupta Ve

[Enforcement Directorate" is stil sub juice with the Hon'ble Nations!

Company Law Tribunal, Nw Delhi Bench end the next date of beeing in

the sald matter is 10.11.2022

‘That, on 03.12.2021, she appellant through speed gost received the

Provisional attachment Order No. 05/2021 dated 16.11.2022 having

FCIR/02/DZGR/2019/421} pertaining to Nj UV Rxporte Private Limited

was being passed by the Deputy Director, Delhi Zone - il, Directorate of

‘Enforcement, ordering or Provisional attaciment ofthe fllowing assets of

M/s UV Exports Private Limite,

vt

=f PROFS

racial eure

A

Details ofthe Vebie "

[Siocs———[Regiscation Wo, Fansed By [Wear of]

Registration

TAT BEIKtITs —~fasre Bank |-—zors

‘WARUTI Giz HRIGZOSGS—| ROTAKTRANK | 2015

Tan WON [Buiacga77 ROTA BANK | —~~207s —]

‘RENAULT DUSTER | HRIoARwoo —[TcIcr BANK | 2018 —]

‘BNW 82607 [Beicvaase —"[ ROTA RANE | fois

aces in te.

EAS ime Belanse

SDAA ije WW Bipirts Precis Lied [Re LS ORE

ee

1 is submited that no attachment order for M/s Eshal Rocds Private

inited have rseive,

“That the respendent/complainent lesued a Show Cause Neice dated

07.01.2022 to the Appellant. Copy of the sald Notice is marked as

[ANEXURE-18 for tho same appeiant haa fled the reply on 20.02.2022

(Copy ofthe said Reply is marked as ANNBURE-19.

‘That the respondent/complainant shared the OC No -1882/2021 ~

Rejoindar tothe reply filed by the Appellant cn dated 26.08.2022. Copy of

the said Rejoin le masked a ANNEXURE-20

‘That the Directorate of Enforcement has reonded the ECIR, on the basis

of the cate registered by the BOW, New Lelhi beating Prat Information

Report No, 196 dated 03.12.2014, under Section 409, 420, and 1208 of

the Indian Penal Code agninst M/s Bush Foods overseas Pre Lid, Vikram

Arvest, Rie Awasty, Namita Arora, Vino Sirf and Rab Raisurana,

‘The Respondent under aforessld ECIR hue provisionally attached the

roperty in question for allegedly the property aoquired by proceeds of

crime, without any evidence or documenta proof which established the

cate registered by the sespondent subsequantly the Learned Adjudeating

‘Authority, PMLA, New Delhi siso confirmed its Original Complaint fied by

the Respondent without considering the ‘actual matrix of the case in

‘respect to the properties of the M/s UV Esporte Private Limited and the

confirmed by the Learned Agjuticating Authority, PMLA, New

Delhi vie its order dated 18.08.2021, impxyyned herein.

‘That it fs submitted chat the Property attached {mentioned above)

pertaining o M/s UV Exports Private Limited wae purchased by M/s. UV

Exports Pevate Limited through the eourees raised by virtue of let and

thas nothing to do with the alleged proceeds of crime in the present case,

‘al the aaid vohices (herein referred to ae propery) ae Aypathecaed to

various banks, Further, the ald bane sccount bering -mumber

18860922198 pertains to the routine/ ondinay transaction ia the eourve of

business of M/s. UV Exports Private Limited

‘That as per, Para 5.4 of the Provisional tachment Onder No.05/202t

ated 18.11.2021 the alleged togus transactions happened during the

‘etiod from Ail 2014 to December 2015, Is to be specifically submitted

‘that most of the vebicles attached im thet ctder were purchased beswoea

the years from 2016 t 2018 and thet 100 on finance, thereby the eaid

vehicle should not be sakt to be purchased fem the proceed of erime.

‘That itis not dispute ty the present appellant in the case thet the

“Subject Property’ situated at Plot No, 505, 5M Floor, DLP South Cou,

New Dethi- 110017 and Plot No. 506, 5 Tir, DLF South Court, New

Dei 110017 are or not the concen of proseed of crime as they ere not

related in any manner to the concem of liquidation of M/e UY Exports

Private Lise

‘That the Impugned Provisional Attachment Order in eapect of the subject

Property isin violation of statutory mandate aa requized under Section

Sti) and 5(4)() of PHILA. Further, dere inno material placed an recor

whatsoever t oven remotely indicate that vehicles ancl bank accoust

Pertaining to M/s U Exports Private Limited waa lavelyed with Proceeds

(of Crime. AS @ matter of fact, even ifthe allegations of Complainant/

Respondent are presumed fo be true, even then itis crystal es thet the

Propesty in question was acquired by M/s UV Bxporta Private Limited

rough the loan facility trom various banks, Purder, the sid

finance loan transaction of the vehicles is clearly reflected in the suited

book af accounts of tho M/s UY Exports Pate Lisited. It is farther

submitted thet since the Learned Adjudieating Authority, PMLA, New Deli

bss observed and opined in He order dated 19,08,2022, based upon the

Provisional Attachment Order dated 15.11.2221, tht the, ubject property

has been purchased fom the funds of eleged proceeds

6 sity i

10.

ies

12,

®

came Adjusicating Authority, PLA, New Delhi ha fled to explain a

‘o how and under which circumstances i has passed the oter to attach

‘the property In question an has further failed to explain as to what

lege oes has been caused to the Compisinant/ Respondent.

‘That fis worthwhile to mention here that re Appelisnt, wit has not been

named dicectly in the initial Complaint, aot named in the case First

{Information Report, nor the material record based on which such yeasons

‘were formed itself merits dismissal ofthe Provisional Attachment Order

tnd confinmation order of the samme by Laumed Adjudicating Autheetty,

PIA, Nee Delhi Being ilies

‘That It s submitted that despite having no 2ower o jason to ettaca

‘the property in question asthe matter in being of iqudation covered under

‘the jurisdiction of NCLT, the Respondent/ Complainant has sought to make

observations or arrive at purported findings on the alleged scheduled

offense, Such findings are therelore non-eet. sty observations or purported

filings on the alleged scheduled offense in the PAO or the OC are a

pulley and eannot be looked into as the observations or purported findings

on the alleged scheduled offense, being whoie without jurisdiction, shoud

be expunged forthwith,

‘That f i submitted that as per Section 2¢ of the Peevention of Money

Laundering Act, 2002, the burden of proof to prove that the alleged

Proceeds are genereted fom the alleged Scheduled Offence remains

‘entirely on fo the investigation agency. There ia no legal presumotion in

Section 24 shat the subject property of Mj. UW Exports Private Limited's

Jn any manner connected with the ‘proceeds of crime’ Section 24 of

Prevention of Money Laundering Act, 2002

‘The Appellant Company declares that the sibjeet matter of the appeal is

‘within the jurisdictions of the Hoare Appelate Tesbimal within the scope

‘of ection 26 ofthe Prevention of Money Laundering Act, 2002,

uMTATIOn

Ht is submited that a8 per section 26 (0; af the Prevention of Money

“Laundering Act, 2002, the present appeal ie being Sled within 45 days of

revealing the passing ofthe Impugned Osder and there is no delay tn fling

the present ape

WES Kuna

rakes

V4. That being aggreved in the aforesaid facts and circumstances, the

Appellant has approiched this Hon'ble Tribunal under Section 26 of the

Prevention of Money Laundering Act, 2002, seeking the invecaticn offs

Powers for quashing and setting aside the onder dated 18.08.2022 in

Original Compisint No. 1982/2021, arising out of Provisional Attachment

ated 15.11.2021, alone with the proceedings ematsting there fom, om the

following among other grounds-

‘exounps

fH) BECAUSE the impugsed onier as passed by the leaned

Adjicating Authority, PMLA, New Dali in a total dstegand to the

‘ights of the Appellant in respect of property in the queation of M/s

‘UV Exports Private Limited (in Uquidacon| & by turning @ blind eye

ta the documents produced in due exuree, renders the impugned

cnder bain aw

(ii) BECAUSE she impugned order passed by the Learned Adjudicating

‘Authority, PMLA, New Delt is bad on ficts ea well as in law, as such

the same cannot be sustsined é thus Is lable to set eaide qua

property I question,

(ii, BECAUSE the impugned onler wee passed by the Leamed

‘Adjudicating Authority, PMLA, New Delhi in a mechanical manner,

without application ofjadicions mind en the facts bright before the

eared Adjudicsting Authority, PMLA, Rew Deli, alleging the

Property in question M/s UV Exparts Peate Limited fin Heudation)

‘being involved with the procoods of crime under investigation in

ferms of PMLA. As the sald assets (ichicies) sre Being purchased

‘through Ioane from varlous banks asd are hypothocated ehicles

‘hereby, cannot be termed es proceeds of erime, For instance, the

said bank account bearing number 6560922128 pertains to the

routine/ ondinacy transaction in the oyurse of business of M/s. UV

[Exports Pritate Limited,

lis) BECAUSE, the impugned onder wis passed by the Leamed

Adjudicating Authority, PMLA, New Delhi filed to appreciate the fact

@

i)

that M/S UV Export Pivete Limited is already ia Liquidation and he

‘moretorium has been already iesued and is in existence in

‘accordance to Section 35)

‘The relevant extract of Section fs mentloned herein:

Section “38 (5) Subject ro sactlon 52, when 4 liquidation onter has

‘nan passed no suit or other logal proweding shal be insted by

or against the comport debtor

Provided that suitor other legal proweding may be instiuted by

the fguidator, on Behalf of the operate debtor, with the prior

approval of the adjudicating thor,

BECAUSE, the impugned onler was passed by the Learned

‘Adjudicsting Authority, PMLA, New Deki filed to appreciate the fact

Yat Section 32A of. Inselvency and Bankruptcy Code,2018 grants

immunity to the property of the corgarate debtor hereby M/s, UV

Exports Private Limited

‘The relevant extract of Section is mentioned ierein:

‘No action shall be taben against the property of the somperate debtor

{ relation 1 an offense comited pri tothe caimmencoment ofthe

‘corporate insolvency resolution process ofthe corporate deter, whore

‘sich property ib comered wader a reeeution plan approved by the

Adfudiocting Authorty under Section 9, which results bythe change

fn oomzrel of the corprate debtor to a person, ar sale of Kidation

assets under the provisions of Chater II of put it of this Coe te a

Person, who was not ~

‘A promoter or the management or carta of the coparate debtor or

related party of such a person or

‘A person with regard ta whom the rlocent investigating authority has

‘onthe basis of the material in ts possession reason to eliove that he

had abetted or conspired for the conmesion ofthe offence, and has

Submited or fied a report or @ compbint%0 the relevant statitory

cexthory or court

‘hat itis submited in the case of JSW Stee! Limited Ve. Mahender

Bumar Khandetwat, the provisions, sbsequenty,

wt

for validity a, Une Case that has been theorined to be the eaison dete

lf the provision in the frst place. Perinently, against the ambiguity

sunvunding the operation of nonobstante clitses, scction 824

Provides immunity to the corporate debtor and its assets from any

prosecution, sttachinent, o similar proceeding upon the approval of

4 resolution plan, if the revolution pn results i charge in the

management or contol ofa corporate cebtor.

‘That it is submited thet in another cae tied as Mr. Ant! Goeh the

Hauldator of Varsana_tzpat_ Limited, ws. Deputy Director,

Pirsctorate of Enforcement, Delhl_the Hon'ble NCLT, Kolkata

Bench, Kollats held that ‘we are af she considered opinion thet a

liquidetor cen proceed with the eale of the assets even if it Is

liquidation under the provisions of the Code and upon completion f

the sole proceedings the buyer ean take appropriate steps to release

the attachment. It appears to us that the attachment and

confiscation become void under section 32-8 ofthe Code" This was

sho held in the mater of ir. Anil Goel the Liquidator of REL Agro

Limited, Ve, Deput Director, Directorate of Enforcement, Delht

That it te submitted thar in the case of The Directorate of

Enforcement Us. Sh Hanoi Kumar Agarwal, the XCLAT held that

{here is no eoafict between the Preven of Money Laundering Act,

2002 and Insolvency and Bankeuptsy Code, 2016 and sven if

[Popesty has beee attached in the PMA which is Belonging to the

Corporate Debtor, if CIRP is initiated, the property should become

valle to Mult objects oF BC cll n resoution takes place or se of

liguidation asset coeur i terms of Section 328,

[BECAUSE the Learned Adjudicating Authority, PALA, New Delhi hes

failed fo appreciaie the fet that as per Section 66 (5) of Insolvency

sand Bankruptey Code}2016 National Company Law Trbsnal isthe

Jurisdictional body in the matter pertaining to Liquidation for

Conporate debtor hereby M/e. UV tparts Paivate Liste.

‘The relevant extract of Section le meutloned herein:

(9) Notwithstanding anything to the contrary contained in ary

‘thar law for the tine being in fore, the Hational Company Law

Tribunal shail have jursaleion to entrain or dspace of—

(fa) ey application or proceeding ly or against the conporate

debtor or corporate persons;

(i

(hy ony claim made by or egainsttheconsomte debtor or comporate

Person. inctuding claims by or against any of i subsidiaries

stated in Ids ane

(9 any question of priorities or any question of lar or fact,

arising ont of or tn relation to tae insoinency resolution oF

liquidation proceedings ofthe corporate debtor or corporate person

under this Code

‘That, the Hon'ble High Court in the ease of Nth Jain, Lgwidetor,

St Limited. Vs. Enforcement Directorate (December 202) held that

‘when 2 liquidation order is delivered under the IRC, the ability 0

‘sri properties under the PMLA, 2602 no longer exists, The eaid

Jndgmient squarely applies tothe present case and since the metier

Ss sleady Subjudice to the NCLT, ns per Section 60(5} NCLT isthe

‘sole jurisdictional body and tt hae an overnding eect over PRILA,

So, the Adjudieating Authoriy under PMLA dors not have

Juwisdietion to aitach the propertke. of the Corporate Debior

‘undergoing the Corporate Insolvency Resolution Process.

In the matter of SREY Infiastrasture Ptnance Limited Ve,

‘Sterling International Enterprises Limited \ bare perusal ofthe

{acts iiustrates that on July 16, 2018, the CIRP was inaned ater

‘admission of the application under Section 7 of the 12C. Prior to

this, however, en May 29, 2018, a provisional aiachment order

(CPAOY divesting the extachment of tie assets purchased from the

proceeds of the crime was issued. Stortly thereafter, on November

20, 2018 (Le. post the initiation cf CIRE), the said ander was

confirmed by the adjudicating authoriy under he PMLA. Being

sugrieved by the PAO, the resoliton professions! moved an

pplication before the NCLT seeking ade-atzachment of assete,

BECAUSE the impugned onler ie passed by the Learned Achadicating

Authority, PMLA, New Delhi by overlooking & portraying ignorance of

material document produced before the Lesmed Adudiating

‘Authority, PMLA, New Deltl, thus, tre same wae passed by the

‘Learned! Adjudicating Authority, PMLA, New Deli to oe tine with the

‘complainant, in view of clamouring and duplicitous face of the

epactzment as the department is okey representing himself the

Wor'ble NCLT for the same subject mater, thereby the impugned

order is bad in la, thus i Hable ta Be at ede,

a

©

(wit) BECAUSE tne impugned order dose not disclose the besla of

observations made by the Learned Adjudiesting Authority, PMLA,

Now Dethi, a8 ta the nems between any proceeds af crime and the

fstiached properties, Tt io submitted that in the case of Aslam

Mohammed Merchant ¥/a. Competent Authority [2008 (14) SCC

126jthe Supreme Court inter aia held

Js, therefor, evident that the propery sohich ie acught to be

Jorfoted must be the one which tas m direct ness with the

Ireome, etc. derived by wey of contravention of any of the

Provisions ofthe Act or any propery sequined therein.”

fis] BECAUSE os allege! in the modus operandi of the cour the

respondent was not ale to establith any relevance to the fact that

the money wes transfered in lieu of any sort of laundering or an

leansfr for the proceeds of crime instead, they just followed the

entries in the bank account. Ia the Books of accounts of M/s. UY

Exports Limited the money Ie reflected us an ordinary tranaseson in

the business. The Respondent has aot atiown any nemus between

cash deposit inthe Banks and the pumose of fa tzanafec thereafter.

Since the respondent has innovated and contrived ‘proceeds of

crime" and in that process built up thestory on his owa assumptions

by penasing bank accounts without probing the transactions of M/s

‘UY rexports Private Limited, the ead appellant is admitiedly neither

involved in any offense, much less le sny scheduled offense, Pure

‘commercial runsactions are being branded

proceeds of crime”

(&) BECAUSE the assailed order severely disadvaningce the appellant

fand the stakeholders in the liquidation since it eversoly affects the

rights and calms. The lguidation fas stalled os a result of the

Jmpugned order, destroying the aiet ofthe insolvency law to proceed

ina time-bound manner.

In Innosentive Industries Limited Ye, ICICI Banke cho Supreme

(Court held that te objective ofthe IBC i t bring the insolvency law

nvder «single umbrta fo speed up the insoluency process. Fr this

reason, the IBC provides @ tme-bownd resohiton process that has to

steely adhere,

os

si

©

‘That the directions and orders of the Roforcement Direetnat, in this

case, are arbitrary, sajust, and patently legal in a8 rmuch as the

‘order has been passe in contravention ofthe Pale af Lew whic hs

ta Belton the Liquidation for more than two years. Further, due

to the halt rade by the directions of the Enfovcement Directorate,

She value of the assets of the corporste debtor has deprecated end

the stakeholders of liquidation have to bear the coet.

BECAUSE the impugned order was pasted, prefusicing the riehts

and interess of the appellant, thus It in vielatin of principles of

‘tural justice, which cannot be sustxined inlaw as well asin terms

of Section 5 of the Act.

“That i is submited that in the case of The Official Liquidator,

Hlah Court of Bombay v2. Arsarep Tourism Clud Resorts &

others, it was held by the Hoe'se High Court of Rombay thet “The

Possession of the properties of M/s City Lmeutines fui) Led anc

fe Cty Reaicom Lid fin Liquidation shall be handed over by the

Bxforcement Directorate and Bcononie Offence Wing tural or

‘whomscevsr is found im possession there to the Offi Liidator

along with the detaits of the hank account of thoee companies to the

Offa’ Liquidator and the cnaxnts ig i shoe accounés along with

Interest acerued if any, within two weeks fiom the date of

comomunication ofthis order”

[BECAUSE the Department/Respondest has failed jo make out a cose

to indicate that ‘proceeds of crime’ have been driven aut of echedule

offense’ which is a mandatory requirement U/a Sila) of the

Prevention of Maney Laundering At, 2302.

BECAUSE as provided under Section 5(}) of the PMLA, the

espondent hss not produced any cigent evidence to show even

‘remotely dat the Appellant isin possesion af any proceeds of crime

sand the same are Bkely to be conceal, transferred or dealt with in

‘any manner which may result ia frustrating any proceeding relating

tem to confiscation of such proceeds of crime under thie chapter,

‘The reagonable belief of the Respondent under section S{2) of the

PMLA is baseless, imaginary, and a fgment of imagination as they

‘have aossly filed vo show that any material on record even remotely

suggests possession of lloed proces ferme,

(iv) BECAUSE the proceedings under PMLA are Hey to be long time,

‘ening wich it shell be unjust by t3e Depastment/ Respondent to

‘subjugate the Appellant to unnecessary proceedings. The object of

Insolvency and Bankruptcy Ie to maxcmise the value ofthe assets of

the Corporate Debtor. In the instance cate the halt imposed due to

the actions of the Respondent/ Complainant’ sve zesulted in

{deprecation ofthe value ofthe attached assets.

fax) BECAUSE for the reasons mentioned hereinabove, the attachment

‘and consequent confiscation would emount to pretrial incarceration,

and inflicting of suck hardships onte the Appellant which cannot be

compensated In terme of money,

‘teil BECAUSE there is no matalal on =econt $9 show conspiracy

Yetween Appellant and accused in schedile offense and PMLA

fens and ne culpable knowledge ie attributed tothe Appell.

‘vif BECAUSE grave and irreparable loss und prejudice willbe cased to

the Appellant if the reliefs a8 prayed are not granted whereas no loss

or prejudice shall be caused to the Compininant/ Respondent if such

reliefs are granted

{evil BECAUSE the Learned Adfudioating Authority, PMLA, New Delhi

{eilod t appreciate the fact regarding the defiant bebaviour of the

Enforcement Directorate, us no persoral propety of Me. Usha Siro

{6 Mr. Vinod Sirohi were attached. However, the mesgre properties of

Mjs UV Biports Private Limited were being attached. Further, i is

pertinent to mention hereby thet to inordinate the amount of

attachient, te respondent /eumplbicant haa unreasonably attached

the assets of M/s UW Exports Private Limited (the Corporate Debtor

{In Liquidation).

(8s) BECAUSE the Appellant isin need ofthe subject property latiached

sects since he has to full his statutory duty 26 liquidator and the

olay in possession willed to escalation of costa and te, Further,

1 Is pertinent to mention thatthe liquidator has so far paid fr al,

maintenance costs assoclted with the aforementioned attached

‘assets out of bis own pocket. The actioned by the Respondent/

(Complainant has hindered the spirit mad process of liquidation,

45.

v.

18.

1s,

4M fe submitted that grave and ireporable loss and prejudice

wil be cause t the Appellant if te reliefs as prayed are not

‘ented whereas no toss or prejudice shall be catieed to the

‘Ceanplainant if such reliefs are granted

‘That the Appellant craves leaves of thie Howble Appliate Thiteinal to

‘ane any other adtional/further grounels) as may te available during

‘the pendleney of the present appeal at the tine of final disposal of the

spatter,

The Appelians hss not approached any other foram for seeking such

flict aguinst the impugned Provisional ftachment Order and order of

the Learned Addicting Authority, PELA, New Delhi impugned herein,

However, the matter in regard to the freeing of Account and not to sale

‘or purchase of any asset of M/s UV Bugorts Private Liited is already

‘sub juice in Hor‘ble National Company Law Tribunal, New Delhi Ben,

Now Deli

‘The Requisite Court fe in form af af for Ra 10,000, sue by Meinl

Bank, Dilshad Colony Branch, Delhi under mumber 128192 dated

30.08.2022 in the name of the Rogisirsr of this Tsibunal ia annexed

hereto 2s Annexnr9 A.

‘The Present Appeal has bees fled in the interest of Justice and the

‘Appellant reserves his right toad any atonal grounds for challeneing

‘the “mpugned Order, The Appellant also reeervee ie right to add any

further grounds in suppor of his onse. The Appilate craves teave to this

Hon be Tritanal to claim any such relief aobsequently. Al the anncxres

annexed to the present Appeal are true copies of their respective

criginale

®

PRAYER

In ght of the foregoing submissions, the Appeliant most cespecthity

raya thet this Hone Tribunal may be pleased to

‘Allow and tae on record the present Appeal;

Pass an order thereby setting ase the enier dated 18.08.2022

fa OC No, 1882/2022 in reference to the assets of M/a. UV

‘Sxports Private Limited and sty the proceedings emanating

therefrom, 98 the senne is illegal, non-Rst, without jnisdieton,

incorrect tagether with heury ensta In favour of the Appellant

sand againet the Respondents

& Pass on order thereby Direction may be passed to the

[Respondent toot to proceed withthe attachment ofthe subject

property without confirmation cf the Impugned Order dated

18.08.2022.

Pass such further/other relies in favour ofthe Appellant which

Vhs Learned Tibunal may deem f and proper in fate and

Groumstances ofthe exe;

(RAJESH Kumar GUPTA)

Liquidator, M/s UV Exports Private Limited

‘THROUGH

IMANAN GUPTA

QT ates

siént No -D/4725/2022

COUNSEL FOR THE APPELLANT

0-22, LGF, JANGPURA EXTERSION

MEW DELBT 130014,

Ph. Ho. #91 9872946830

‘Email asvang9Qemail.com

Place: Hew Dethi

Dated: 30.09.2022

BEFORE THE APPELLATE TRIBUNAL FOR PREVENTION OF MONEY-

LAUNDERING ACT, LOK NAYAK BHAWAN, KHAN MARKET NEW DELHI

i

APPEAL NO. USS OF 2022

wn

oc No.15820F 2021

iN

PRO No. 05/2021 DATED 16 11,2021

WN

etRy/o2/D2c8/2013

TER

jes Kumar Gupta

Liquidator, Mf UV xports Private Limited

£-43 Dilshad Colony, Delhi 1 10095 -Appellant

Verma

Deputy Director

Directorate of Enforcement,

Goverment of Inia,

Delhi Zone 1, MTL Building,

‘204 Figo JLN Marg, New Deli-110002 Respondent

ArrDDAVIT

|, Rest Kumar Gupta [Liquidator of M/s UV sports Private Limited, aged 58

years, So Late Shri Satish Kumar Gupta R/o'F 32 Dilahad Colony Delht

110085 do hereey solemnly arm and deelare te ander:

1. That Tom the Liquidator jn the Appellant Company and as such 1 sa

fully conversant withthe facts and eircumutancea ofthe Appeal fled it

the captioned Appeal and hence, sm conpeteat vo swear this Aidan

2. That I have read and understood the costents of the accompanying,

Appes! which fax been dated under my metructions sod | ave read

the same, The facts stated therein are true ane correct tothe best of my

knowledge and legal submissions made therin ae based on legal edie,

Which I believe tne tre and correct

4. The contents ofthe accompanying Appeal ewe not being repeated Rerein

{or the sake of brevity and dhe same tay be read past and parcel of

this Affidait as if he same have been spectcaly been incorporated and

‘sworn by me herein

That the annetures ate trie cops of thei spective originals

iL

i vat

POS eKnee

Ver at ew Delhi on the 20% day of Septernter 2022, that the averments

sagen the hun afte ae rc an coe tn my wiedge and in

Sind nothing materia! hos born concealed teres, al

ATTESTED ene

Bron

30 SEP 2022

40) 7582/2024 Sh. Rajesh Kumar Gupta & Ors.) Dneniewes IC

ee ota & Or vont 18)

‘BEFORE THE ADIUDICATING AUTHORITY

(ONDER THE PREVENTION OF MONEY LAUNDERING ACT, 2009),

EW DELHI

BEFORE

|. VINODANAND JHA, CHAIRMAN

‘onucINAL coMmLANNT (0c) 1562/2021

In

PAO No. 05/2021 DATED 35.11.2028

Bate: 18.08.2022

Deputy Director

Directorate of Enforcement,

Government of Indie,

Dalhi Zone Central Region, MTNL Building

1 and Foo, J UN Marg, Now Do

Complsinant

Sh Raesh kumar Gui

Liquidator, M/s W Exports Pilate Lites,

F-43, Dilshad CulunysDeini-T10095, Defendant 1

2. Sh. Vined Sirohi, 1 2302,

{leo County, Seetor423, Noida - 20330 Defendant 2

3. Mrs, Usha Sirah, A 2202, Cleo County,

Sector-121, Noida- 201308, Defendant 3

4. VikaranAwasty, 6, Green street,

Mayfair, London, WaKRW,

United Kingdom,

Email: awastyveeru@icloud.com ig, “Defendant 4

age otat0

{0-1582/2021 Sh, Rajesh Kumar Gupta & Ors.)

5. Rika Avasty, 6, Green Street, Mayfair,

{ondon, WIKERW, United Kingdom,

6 The offal Uquidator

(i#/s Bush Foods Overseas Pvt. Lt),

{ok Nayak Bhawan, 8th floor,

an Market, New Defi-110003

7. HOFCBank, HOFC House, H

165-266, Backbay Reclamation,

(Churchgate, Mumbai - 400.020

8 otek Mahindra Gank27 BKC,

C27, Block, Bandra Kurla Compe,

Sandra (), Mumbal 400051,

‘Maharashtr, india

9. Indian Bank, P8 No: 5555,

254-260, Avvai Shanmugam Sala,

Rovepettah, Chennai 600024,

‘Tami-todu, India

20. IClct Bank cic Bank

Near Chak Gre ta Paine,

Vaossra 20007, curd

Anpearance

Counsel for Complainant

Counsel for Defendant No. 1

Counsel for Defendant No. 3

Counsel for Defendant No. 4&5

Counsel for Defendnt No. 7

Counsel for Defendant No. 8

Counsel for Defendant No. 9

Counsel for Defendant No, 10

Defendants

Defendant 6

Parekh Mare,

Defendant 7

Defendant 8

-~Defendont 9

Defendant 10

Mr. Rabin Majumder, Ld, Advocate

‘Me. Karun Bansal, €0

‘Mr. Rajesh Kumar Gupta Ld. Advocate

Mr. Mohit Chaudhary, Ms, Mahima

‘Ahuja, Ud. Advocates

Mr. Tushar Roy, Ld, Advocate

#Ms, Deepti Bhardwaj, Ld. Advocate

Mr. Yogesh kumar, Ld, Advocate

‘Ms, Seema Gupta, Ld. Advocate

Mr, Deepak Kaushik Ld Advocate

Page 20t330

ce

{0c-3582/2021 Sh. Rajesh Kumar Gupta & Ors.) &

Per Sh, Vinodanand Jha,

Shaleman

1. PROVISIONAL ATTACHMENT ORDER

‘The Provisional Attachment order (hereinafter alo referred to a5 PAO No.

95/2021 DATED 15.11.2021 came to be passed by the Deputy Director,

Enforcement Directorate, New Delhi, File No. ECIR/02/0ZCR/2019. The sad

PAO isin respect of immovable properties a detalled below Pursuant thereto

riginl Complaint (OC) u/s (5) of Prevention of Money Laundering Act, 2002

(tua) came tobe filed on 14.12.2021 before this Authority numbered 2s OC.

1582/2023. The said PAO and the OC are the subject pater ofthe present

adjusteatin,

ST.OF MOVABLE AND MOVABLE snore ONAL ATAcuED

[Bata of the [etonasee ST Rropariy

propery tee | Vee Baan

k- i ft lee fins)

i TN, 55, 5 oa i Wah Foods su 1S 087

DEF South cov. brtceas Poe

| aks et

| soot? sd peceeon

(re lee

z | Naf'SaBi8™ floor, | 7s Bush Foods | 13240087 | 12.03 2010

| DUPSoleh cour, | Overseas Pe fon

| Stet new dete [ta teuance of

| soi? osesion

L ) _ letter)

We No-[ Uv fapors RA Sagas a1

| sssosz2i38 | i

| maintained in

| indian Bonk,

saxty ch

Branch, Karol

Lo detttew oem | Lo

Paes efa39

€

PSCISEI2N2A Sh. Rajesh Kumar Gupta & Ors.) ®

|< TATA teaig [OV ons Be [28355 Toon

Registration No | i

| DuLx0279 |

~ [sem Gaz | WV Expons Bt |a7iase fara]

bearing ed

| Registration No

Se

TATA “Nexon | UV Exports Bvt. | 455000

bearing tg,

Registration No.

Suazca2s79_ _ _—__|

Renault Duster] WV Sport Pt [as Tana

Dearing a

Regstraon No

| neaoseese2

z BMW bearing [UV

Restrain No. |itd.pee

ETE TE

Gs

2 souepute Gfitites

OW, New Deh eegtered FR No 136 dated 03.12.2014 for commision of

offences punishable unde sections 42, 20 and 1209 of Reagan win

foods Overseas Prt Ld, Vitaranavasy tha Away, Nant eon aoe

Sh, od Rahul Rana. ter vestgtonEOW, New Di es cones

sheet on 08.08.2016 before the Competent outage te osc ne

accused forthe offences punishable under 409420,468,474,778 @ tek

1: Since sectons 620, 471 and 1208 of PC were pat of steed ott

Under PMLA, the mater wat. taken up for invetinnes ne

cyoyozce/201s dated 26022018,

Pagesctsso

OC 4582/2021 Sh. Rajesh Kumar Gupta & Ors} &

3. ENFORCEMENT CASE INFORMATION ReponT.

Sine sections 42,471 and 1208 of I were part of schduled offence under

PMLA, the matter as taken up for investigation and Een/on/osnhyoens

dated 26 02 2019 was recorded accordingly in the ofce of Deli zone earn t

eon, Drectorate of Enforcement, New Delhi gas VitaanAwery oe

Stroh, M/s Bush Foods Overseas Pit Ud. and its erator, KPMG nada non

tc and others unknown personsentties for commission of often us oy

MLA, 2002 punishable u/s 4 of PMLA, 2002 (as amend),

4 _ INVESTIGATION UNDER PMLA (as submited by he Compleat

nn RCUMSTANGES OF THE cE LEADING 2AB Fue OF Ts

compar: RY

1. That the EOW, New Deli reptered Mil! 136 dated 03.12.2018

(annexes herewith as Annexure - 1) fo cbmmtson of offences punshebis

carci 0 1208 oe ese a

Lid, Viraranawasty, Rika Auasy'f Arora, Vinod Shot, and Reker

Faisurana. After InvesigationafOWWW/Hew Delhi fled charge sheet ne

98.08.2016 (annexed herewifpslpnhexure- I) before the Competent Court

sasinst the folowing fergedused for the offences punishable under

409 206sa7s.77 geo

(i) Sak Chanraepadt fo Sh ¢Janardnan

(i) Vinod Stohs/ Sh, Ramesh Singh Son

(™)Viarandwaty, S/o, Vay Avasty

(1) ita Awasty, W/o VitronAwaty

(1) is bush Foods Overseas PL trough its rectors VitrenAwasy,

Rika Avast and Vinod sro

2. Supplementary chargesheets were aso fled by the Economic Offences

Wing on 29.06.2017 and in tly 2018 in this case. (ennexed herewith e¢

‘Annexure IV and Annexure -V respectively)

Page sornt9

1OC1882/2021 Sh, Rajesh Kumar Gupta & Ors) Qs

3. Sine sections 420, 471 and 1208 of PC were part of scheduled offence

under PMLA, the matter was taken up for investigation and

fcIR/02/02CR/2039 dated 26.02.2019 (annexed herewith s Annexure - Vi)

was recorded sccordingly in the office of Delhi Zone Central Reson

Directorate of Enforcement, New Delhi against VekaranAwasty, Vinod Stok,

[M/s Bush Foods Overseas Pvt id. and is directors, KPMG india Pa ta, ana

“thers unknown persont/entities for commision of offence u/s 3 of Pia

2002 punishable w/s 4 of PMLA, 2002 (as amended),

{Investigation by EOW

1. Investigation of Economie Offences Wing, New Delhi in FIR No. 136

dted 03.12.2014 was insted on the basis of a Ropplant of Hssed

Naterands BY. having ts regtered ffce a pho! Boulevard 231,

‘31884 Amsterdam, Netharlands against M/s Bushs Oversees Poa

and ts Directors. %

2. lt was alleged that M/s Hassed.Metheninds BV was induced by Me.

Vittaranawasty and Mrs. Rika Avast Bart with its funde amounting Uss

220 lion (approx Rs. 789. conta) by mistepresanting the Teel ct

Hocisnventory.On the basi sph misepresentatons, Veranameay ate

Atha awasty ako need uZdlasndNetheands 8 V to provide comornc

suarantee for the ousthdn amount of Rs 718 crores ocr econ,

availed from conspriunf of banks, Cred facies were avaled by M/s Bach

Foods Overseas onthe bss of om enon sooo

3. Mirkaranawasty and Rha Awasty were the original shareholders and

Glkectors of the compan, Since incorporation of the company, Viraranawasty

‘as the Monaging Director of M/s Bush Foods Overseas Pvt. Ltd and wee i

charge ofthe affairs ofthe company and was responsible forthe conduct of ite

business along with the other members of the Boatd of Directors of the

company,

4. Virkaran Awasty, Rita Awasty and Vinod Sicohi, In a pre-planned

‘manner, created bogus stocks by inflating the Inventory and at the same time

fabricated the financial statement of the company. The bulk transactions of

‘ales and purchases were generated in order-that M/s. Bush Foods could

‘{OC1S52/2021 Sh. Rajesh Kurnar Gupta & Ors.)

‘Scrd inerese turnover, profit margins and ational stock by generating

potonatty equal vlue of sles and pucheses in a year. An aie! pros

and arta increase Inthe book value of eventory was recorded inthe book

OF Mis Bush Foods Overseas Pvt. Ltd by recording these bulk sles within the

accounting ledger ofthe company as domestic sales. These bulk transactions

were sported by actual cesh movements through bank accounts and by the

use of cheques

5.__Tese bogus transaction were cated out to ave credit facts fom

{he consortium of bons and to crete inventory The bopu trancaton vee

done vith some ponietrsti ms in Naya Baar, Deh who worked on he

basi of commision of 2% por quit. These partes only teued recent

sale and purchase and charged 2% per quintal as geptHSion but in actual

were ot crying out any busines of re. TheteMipanies wore wn

companies and were used only forthe purpos Yolation of money andthe

mount received n the bark account of thd cofnponies was returned tothe

‘rheology i nese

&. 201 StanardChaeyed Rvke Ext acquied 29% shareholding in

l/s bah Foods Ovrseus re ttdhtrough Standard Chartered Prone

(Maus) ean tnd are rate Eoaty Moonah ne

7. to and aroundiSetember 2012, KPMG lndia Private td, on behalf of

Mis Bush Foods Qyetseas Pt Lid. and VrkaranAwasty, approached Hassod

Food Company, the parent ‘company of the Hassad Netherlands 8 V, inviting it

to invest ito the company 28a satge partner. KPMG indo Pv Lad. aa

repored an infomation Memorandum and Databook annexed os Avrora

= Ml eoncening the alles of M/s Bush Foods Overseas Pv iad ne

September anda copy ofthe same was provided to Hessad Food Comeery,

Vavious presentations were made to Hasta Food Company around the cea

November 2013 in which Standard Chartered Privote Egy nominee deers

Me. Rahul Rasrane ad Mr, Nam Arora were also present The deals the

Standard Chartered Privat Equity woud sell ts ene shareholding (2) a5

M/s Hasnd Netherlands 8.V, and ex the company,

Page 7otst0

Om

£#00-1882/2021 Sh. Rajesh Kumar Gupta & Ors.) Ka

5 _ls Hassad Netherlands B V agreed to it and acquired 69.59 ofthe

‘hare capital and Mr, VrkeranAwasty and Mes. ita Awasty held 30586of he

"sued share capital of M/s Bush Foods Overseas Pvt. Ld

Ss oihs, Bot the, deal, Us. Hassad Netherland BV transferred Re

653.20,75,315/- and provided a ded of guarantee dated 16.05.2013, tn avon

of the Consortom of banks and guaranteed the repayment of oustanding

amounts due under certain credit faites avalled by M/s Bush Foods Overs

>t td from the consortium bank othe extent of 70% ofthe caim amount

10. The details of Rs. 653,20,75,318/-is a under.

Owe he ene py at

s [eeitctvan Jno ot fear RAS” ~ansat We

| ne

No. Shares 0

Ton us sy

1. | virkaranaasty 459.50,239 | 249,38,80256

2 itika Awasty ob7,680 17,87,529 |9,70,15,455

ee eer

4. [SCPE Mi ” 14234593 | 4,42,67,156 |240,25,33,491

[Secon stres| asa Jazaanao0" fosaeaio

from Brore

oar jaamaer | saoasa7ea esoan ome

L

(1 As per RB Conversion Rote s on 26.03.2013 - 1 USS» Rs, 54.2735)

MOCIS2/2021 Sh. Rajesh Kumar Gupta & Ors)

11. t's seen from the chargesheet of OW, that reports of the auditors

{eeaed by Ms Hassd Netherlands 8. andthe statements of theca

of ifs Bush Foods Overseas Pt. td, confirmed thatthe socks wens earn

and the nancial statements were fabricated. Further, bulk eke) ae noe

Purchases were generated trough some popritersip fms in Nee enn

Dal to create fake stock and to aval eet acy fem the conse den

bani. Statements of the proprietors of these fem recorded by roan

Contd the sme M/s Bush Foods Overieas Pt Lt hed sasted the

to employees to prepare the bls of alas and purchases even ah

etl buses was cared out, Fr thi purpose, by ae purthased athe

werdosin aya Bazar. ancaprch was prepare nthe paral eos stoseg

Malia Nagor, New Deli and stpled with the ‘ole. purchasing

Xaetpachi was reared a pa istrucion of Vga RB. Rochon ed

Witoranuaty. Job work contac, ling cong agreement of ne

sete found tobe forged, Signatures onthe G@abems Were fond te be

fora nhs manne, stock fo the tuna gesimate Re 50-200 cores,

found tobe togue,

{paca ened u/baite a

judg company, after the ait fo a 300% physical vrtcaton, When

Delotte started the audit: dubai

12 tad terns ov af

162013, vray and Voda

mado ita dfcut task fohad/s Deloitte, so that proper veiieaion could not be

fora an wit opt wi mas ae

tame een

Relevant part of the report of Deloitte is reproduced below,

cP

‘Auditor's Responsibility

Our responsibilty i to express an opinion on these financial statements bosed

on our audit in accordance with the Stondards on Auditing isued by the

Institute of Chertered Accountants of Indi

However, becouse of the moters described in the ‘Basis for Diselimer of

pinion’ paragraph below, we were notable to obtain sufficlent appropriate

ual evidence o provide o bast fran aud opinion.

Paper

{0c 4582/2021 Sh. Rajesh Kumar Gupte & Ors)

Boss

iscloimer of Opinion

0) With regard toe material ventory as & March 3, 2013 comprising row

(ee amounting to Rs. 76,562.58 lacs and paddy amounting to Re 23.216 46

lacs

(0) stated in Note 4 (0),

2 Te Company id ot cary out phys veiiaton of is ow motra

lovey oso Mach 31,2013 end reled yar en it of proce

the yearend nor were updted veto cans eae sof tha eo

seein yor end book bones the eons were wptited beanies

Inch ater det) Conse query, we were unable tata te bot tees

lye wr non per itof rceli oofe

nd procedures clos te year en, eo

% The company finally cari outa py

3 However tn respect of 5 torial ventory leter ton fig

sock which could not be pied verified os indicated ebove), during the

Plyskal verification extyie) the manogement exaressed he. Inabtty to

saronge adequate retour for validating welght and contents of bags ner

‘eoaly aces e stocks

© ae nsequenty, quantiles of such row moterol Inventory could not be

accurtely determined die to improper stacking and nonsegregation thereof

variety wie

5 _The weight of raw rice inventory bags for inventory valuation has been

onsiered bythe compory ata stondord weight of 75 kg per bay As explained

{0 us by the management, for the purposes of storage, most ofthe row rie

{ventory boas (purchased largely i quanthy varying fom SOka/ bag to 6Stg/

hog) were repacked into 75 kg weight per bag. However, our text check ot the

{ime of physico verification reveled thatthe weight of bags ciffered from the

‘andord weight claimed by the management in most of the cases, de to

which the actual weight of the raw rice inventory cudnt be established,

{ne

(OEOSSAEORY Sh. Rajesh Kumar Gupta & Ors) &e

itt, in the absence of variety wie imentoy records being

‘maintained bythe company and varety wise physica! verification thereof the

Groroprateness of classiiction of such tventory varity wise dove on the

‘esl of the management judgment for valucton purposes coulé not be

veidoted.

(0) "Attention is also drawn to Note 40 () regarding yeor end raw material

inventory of padtycogregating Rs. 23,216 lcs (71,194 MT) npostenson of

third partes for which independent crularation of balance confirmation woe

‘not permitted bythe management forthe reasons stated inthe sold Nate,

(Sine epdted book of eccouns pert te prod sutequnt to

or end up othe dete of approval ofthese francchgetemert nec ne

valet, we were unble to cary out subsegehprven woreanna

Concave, the Impact of subsquem vere

stxent couldnt beaseraned” Sh

hy

Tere the sid epore was daeflin Board of Minutes ofthe sth

AGI of members of Bush Food OneGbPUE Ut 2.102019 & 9.102013 9

a

» Nasi Chairman & Representative of Hassad]

Mohammed tg AL | Netherland 8. Shareholder)

2" MeVifsibnawesty | Managing Director & Shareholder

[fine hated}

Abelrahman Rag

4 | hr Fadi Erseouni | Dkeetor

pectnt 8 CrO pemeececaaeneae|

| Company Secretary

7.” Wir Simon Henderson [Senior tegal Counsel, Hasiad” Food

‘Company. ASC as observer

{[0<-1882/2021 Sh. Rajoch Kumar Gupta & Ors)

B._ Inthe sid meeting the sue of at audit report and declines report

was dscussed by Mr. Jaideep Bhargava highlighting. that “one of are

warehouses Deloitte were taken to by Mr. Awasty to do the stock count

{appears not to have been company assets Deloitte received a call rom the

warehouse owner stating that none of the inventory In that warehoure

belonged te Bush Foods. The actual GPS location andthe coordinates pen to

Delite were also ferent. He further stated that Delete were not shen

Permission to nor assisted to remove more than 1 or 2 layers of bags to sen

‘ow many bes were in each stack Deloitte could not verity number of bape”

24 Inthe survey report ofthe Or, Amin Controllers Put. i, the following was

‘ound mentioned - (annexed herewith as Annexure =)

“Puanr suo eS

There were four Silos found in the plant Compoynditpver only 1 silo could be

‘Opened and the other 3 were sealed. The st, Opened was found to be

rote empty. “oy

umriawammoue A) Mi

Ink melas ofr SA oe we fd ob

oxi wi cs ne Hg soe a

ere 16 and 10 ft hb betel. A 0 ough and wave caine nee

wer approx. 115 Uf bog! whch were trd fom walt ll eu oe

‘stack plan. Bags yitrendving approx. 60 kg packing, though this could not be

The fats ofthe report" Delonte as well a Or. Amin Controllers Pu. tt

twearing the stck( Bt Jodantory of paddytice were corroborated by the

documentary evggie"ts well as statements ofthe employes of M/s usa

Food Overseas Pvt"Yid,

435, | VekaranAwastyreceived Rs. 249,23,40,969/- from M/s assed

Netherlands BV in lieu of share transfer and the same are proceeds of erime

‘and a substantial amount was transferred by VirkaranAwasty to the A/e No

052800712002 of his concern V & R Overseas, maintained at HSBC Bank

Barakhamba Road, New Deli

® Vinod Siohi colluded and conspired with VirkaranAwesty to cheat Hes

sad Netherlands BL. of substantial sums of money and wae well

‘ewardedby VrkaranAwasty for his comply in the offence.

rae ter0

Hocas#2/2021 Sh, Rajesh Kumar Gupta & Ors.) &)

2. Vilaronawasty, trough his frm M/s VER Oversst, rangfered Re. 8

Crore to M/s Usha Exports, © proprietorship concern of Usha Stroh, we of

Vinod Sroh, against bogus purchase bl

€ is Usha Exports i 2 proprietorship concern of Ms. Usho Soi. M/s

tishe Exports received Rs. 8 crores from M/s VAR Overseas during the poriad

from 02.08.2013 to 20.04.2013

‘nweitigation under Prevention of Money Laundering Act

1. _Minod Sirohi was director as well as CFO of M/s Bush Foods Overseas

Pat td, He was the one tho was managing oll th afar ofthe company

along withirkaranawasty. Vinod Sirohi was pald Rs. 8 rores as ileal Bevery

from he company of Vitaranwasty fs comity treporing the forged

ecamats Tho amount asec inlet’ fil fl Ua pos

2. tod Sih along wth Vitaranawasty Sh ka Awasy manipulated

the books of accounts of M/s Bush ‘oat Cosas Pvt. Ltd, to avail higher

credit limits from financial institutions Gt IiBuced M/s Hassad Netherlands B

finest in M/s Bush Food OvieehP by shown oho frocea

fzrtonal earn vga owt pcs te we

fudged and used wo gh als to 8, kash sed Sorc an

jos slvburchase to be around in he

hooks of aucune voter to nr the tower He dooney

‘manipulated andy tsied stock/inventories of Bush Foods Overseas Pvt. Ltd.

3. Vinod Sirohi was associated with M/s Bush Foods Overseas Pvt.Ltd,

since 1998,

4 On examination of the bank statement of account no. 052-237880-006

in the name of virkaranawasty and Rtka Awasty maintained with HSBC Bank,

"twas revealed that on 28.03.2013, INR 2,9,23 40,963.36 we received from

(M/s Hassad Netherlands BV agunst the sale of shares of M/s Bush Foods

Overseas Put td

Pre 50110

USRPAARL Sh. Rajesh Kumar Gupta & Ors.) 8)

wr sett ofthese funds, fn 2s shown nthe tale blow were rnsered

wn aount Ae, 052-800783-005 inthe name of M/s VER Overseas maintomea

with HSBC Bank (annexed herewith as Annexure -)

[S.No. [Date —Tamount Gn i) ]

30.68.2013 170,00,00,000

(02.04.2013 |2,00,00,000 |

00,00,000,

6 Lit ofthe funds rectablh M/s VER Overseas, funds were transfered

te atcout no 0356213L20}684in the name of isthe Fone es

‘wim Onental Banko Coferce. (annexed herewith ae Annerare sa)

{

Pe aa aT]

Boer SDR

[2 06.04.2013 '2,00,00,000

Smee oy 000 B00

|i fsa —— zaomom9 —|

ee

Poe 16 F110

10C-1582/2021 Sh. Rajesh Kumar Gupta & Ors.} Bo

&. Mis Usha Exports isa proprietorship itm of Usha Siok, wife of Vinod

Sitch, Vinod Sioh, in his statement recorded u/s 50 of PMLA, stated that he

looked after the day to day work of M/s Usha Exports and thatthe amount ot

Bs. 8 crores was rocsived by MY/s Usha Exports against the sale of rice o the

company M/s VBR Overseas. However, investigation has established thet the

account of Ms Usha Exports was opened on 28.03.2013 which is just a few

days before the funds started coming from M/s V & R Overseas, During

investigation it was revealed that no actual business was carted out In the

fem. Vinod Sirohi was paid this amount for his comply in preparing the

{forged documents

&. 14 ako paint to mention hte that pol of bank secant

Statement of M/s Usha Exports ao reveals thatthe, ipa shown sale of

sc fom 02042013 t0 20.04.2018 tthe tune offbgrres toe VaR

Gere, wheres the paca sees 8 Op RY oe ee a

vpto08102019 Risso ste engine ee ae at

‘by M/s Usha Exports to the tune of Rs.i@\Crbges, Thus, it is established that

srr es en co tr aa

the mone eed fo cope tarntunay the eo

strengtered rom the fat hip the tune of NR 494 coves i ston a

be purchased fom Mis alee rsae wach cabo one ck rn

supper free ofs ueas rene et

10°" sam th peor upterofi/Ue Egons were xan by

EOW viz. Ashok ilitnge-dnd Vijey Kumar who are the Proprietors of the firms

Is Aa Ae ed nd Ms el am Vay Kans ees

hereto Aare “Kon Ameuredtenccn)

contest there waren aul bss Waneon wee le

Epon twas shin but aconnatston ens Fat ne

there avers ts nthe Naa Boro meron oot eee

ot 2p qt These arte onvana eco ole nde ak

‘ctaty werent carne ot ony bets tee hse eee aa

sham campus nd wae ued tr he puone statcael ey

f.Onberg aad shut te wet ene fom VBR Oretans vad

Stone atthe amours vere caved sso ee oe

he fae open rete decmens mnt ein see,

‘that M/s V&R Overseas had entered into any sale/purchase with M/s Usha

Pp ita

‘106-1582/2021 Sh, Rajesh Kumar Gupta & Ors.)

Emports. Vinoc Sirohi admitted that he was looking after day to day work of

Mls VR Overseas He further stated tha though his wife Usha Stel wos oe

Proprietor of Mis Usha Exports al the doy to dy aos of Mie Uo tapore

were looked after by him. Hs wife & a housewife and she was mene 6

Fropsetor for name sake, Statement of Mis. Usha Skah! was recorded oe

06.05.2020 wherein, she stated tht Vinod Soh looked after the day to doy

work of Mls Uta Exports She could not expan the purpose of recip ot

funds from Mj VaR Overseas inthe account of Ms Usha Export Staterens

of Vinod So an Usha Soh recorde us 50 of PMLA are annexed tern

2 Anmexure- Xl and Annenue- respecte,

1. Vind Soi farther stated that he used to dea wth Yogender Kumar

who used to provide him bogus sae/purchae bill. Yoder Kumar ised to

Sorted eer ge ae gr rd

a Kel! rm Vy Kumar fom whom he has caidadehasing of ce, were

not actualy doing ay rice business and provid Sons sale/purcace bls

‘without actual movement of gods and ward ehrbing commision on each

Vinod Soh was shown statement ofbipth Misra and Bisdev Kashyap

tod reiterate when

they have stated that Vind Spy yalsed to gve them monty figures for

bogus ils, Vinod Sch aiid Lhsme and stated that he usa to convey

the igre of bots bl jdbegblined on the ection of VikaranAwesty,

| Role of Vinod, Sihjtn oreparing nes sale/purchate bile is also

estalshed by the titefpent of sh. Santosh Mishra, exemplayce of is Bush

tots wre hi Seema of suo sb eat

PMLA on 20062078 his statement, he, te ai, stated that he jedi

Bush Foods Overseas Pt Lid. in the year 2009 as Accountant He was

"eportg to Bev Kashyap, CA and Vinod Shi, CFO. Me admitted thts

Bush Foods Overseas Pvt. Le, according tothe requirement, Used tote of

rocure bogus bis without sting or purchasing the iems mentioned in the

Bog ils He was given charge fr procuring bogus bil fom the markt He

as deced by Vinod Sirol and Bisdev Kashyap about the amount of equied

“bata, They used to ge trets of around Rs 20 to 30 eroes pee month

hich was the amount for which th bile were to be procured. M/t Bush

Foods Oversas Put id sued fake sl bl, For this purpose fs ware taten

on rent n Malye Nagar, th for 23 months ich company employes

40 Pesto

rey

‘rand Balab,BasudevSisual Vipin Chander, Manvendr Shukla ee vad to

St and prepare fae/bogs bls in the name of fens. The bogen bee nace

slvana commission found 10 pase per Re 100,

J. © Oashyap was Dy. CFO In M/s Bush Foods Overseas Pt Ld He

Chartered Accountant. statement of D Kashyap was recorded on rob sons

He stated tat he was heading a team of 1520 sesnuntants st he meres

of us us Foods Overseas vt. da 506506 Du South cou Soin en

He ued to take cae of al data entry of ses/purchases bank oenctanns

Se He wed ttn the blance sheet of he compary slong anes

and Vined toh. He used to report to Viaranhvasty ane Vine sro

\itaransty and Vinod Stroh wad to pve him monty gues of ls ong

ad bul purchases. The i fr bl purchaser wa proce om one

Yooener ef Ne ad Rj sion of ys apn Wise bles were

‘charging a certain percentage of brokerage on bot apron bills

_Onbeing asked what Buk sales and ba ichase he stated that il

for sles ad purchases were obsined ffl broker and Nays Boe

broker on monthly basis to Increase thal of sale and purchase. This was

done at the instruction of Vinod pfu Viekaranawasty, who used to give

imonthiy figures of bulk sales/ppeqsbtn figures say Rs. 20 crores/50 crores,

Trot bulk sls/purchases Bf. chalng ona monthly bat depandng oven

the stock postion a the on dnd committed by Vikaranawasty and Vinod

Sirohi to the banks. Gener hly bulk cales/purchases varied from Rs. a0 crores to

‘bout the procedure of preparing fake (bulk bls, he

Stated that these fake sales/purchasebils were arranged on monthly bass at

‘the Instruction of VirkaranAwasty and Vinod Sirohi from Naya Bazar and

‘Narellaon monthly basis. After getting bil rom brokers, the bity and weight

‘measurement slip (kantaparchl) were prepared and attached with these bills at

‘the head office at 505-506, South Court, Saket. He further stated that one site

office was ako taken at Maliya Nagar todo this work and they used to keep

changing such offices after 2-3 months. The same work was also done at

Bakali, Dell ofice, Santosh Mishra used to make the excel sheet of sales and

Purchase bls Le, detail heving party name, quantity, amount and bill No. After

setting these excel sheets, 24 accountants sitting at Head Office and Malvva

Nagar offic, completed the set of bls after attaching kantaparchi and truck

4. a Pages of 110

ed

f0C582/2021 Sh. Rajesh Kumar Gupta & Ors] »)

ty Tea aap ity wr to arpa perth xa ane

ets gen by not an ty Sa a een St

bare ots tlre tthe sone aan ea a and

Snounou a eee Se

Iurtocome boca hi ayant sooner a ae

sls od prcase sre rege se ee eas

the amour es ig tc ots bee eh

Sh tn or tae wonton, er em ta i

tha por an cr ne a ees ea

ssf army an od Seo ee ee onmon

pate on puch and 29 pean Te ees rae 30

were brngeyYopetr arr teense

im_ Statement of vopender fury,» oro gee Wi oes aa

Men, os cae on isan nee ae ea a

of tis sept rang wih sin rating EPL and he conn

that he used to arange bogus sle/puchas lor ts Bush ocd ne oe

ta Ns VR Ocnee epee spocioe

Foods Overseas Pvt. Ltd. tll 2011-42 bubed to ‘get fake bills from the firms in

Harder sonetins fonts ce me

omission on providing fake Bush Foods Overseas Pvt Ln, ne etn

Dour lefty che mace actors a

fd Santosh Mishra (Se it of Yoomtor tomar eden noe ae

are smnened here atoense- oy

mr Samer US Scena o eas ered 5 of aa

thro he sated et ens ands Can PMA

tom te yr 308 fo 201 fe tr Ped ee

Sron a tansy seg hn sae ns OE ood

bom sprue bors Rees a ane

Toots reas PU need ey aes Renee tn

fam Wir toma io pod em ps beaker nr

tame of Sen redo 01 PA oe ee

eee

o."Sonet Aranda, exes oY uh Fond nn

Prey ted at Ved Stoerd Deaton ea oan

SSrot Mia nd co he acne Se pe

a : 3 Page 20010

48)

(0c1582/2021 Sh. Rajesh Kumar Gupta & Ors} Xs)

frtties of fae sle/purchase bil in ERP system, These bogus bite were

senerated at diferent ented locations other than the main afi of bees

Foods Overseas Pt Ltd (statement of Anand Balabh recorded u/s $0 of Pach

sre annexed herewith as Annexure XV)

P. Directorate of Enforcement has fled Prosecution Complint dated

12.11.2020 (annexed herewith a5 Anmenure - XV) in the presen case tet

ommission of offences under Sections 3 and 70, punishable under section 4 of

the Prevention of Money Laundering Act, 2002 before the Honble Special

our (PMLA, District and Sessions Cour, Saket, New Delhi nthe Posecaan

Complaint, Si Chandrassthar, VikaranAwasy, Rta Awasty and M/s. Sua

Fos Overseas Private Umited have Been arained as acre of he offence

Of meney Inder The Hobe Spec Cour (PMLA ew Deli bs ten

ceric theconplton anata

4 ine prevent ese, Povo! Atachmene BH No. 05/2019 dated

17.06 2019 (annexed herewith as Annexure SQV Was isued whereln the

Properties of Si Chandraselher, Vikarangvagy Sd ita Anasy Imola

money laundering to the extent off. 7.16,72,746.50 was. provisionally

SSO Sievers Atanebcer as cntnad ye tote

Adjudeatng Autry vide ts ply Ate 14122018 (anmonednerewth og

aneware. 0m cee

‘sites onerandla.nbivement of propery inthe offence of money

inden (Sh!

1. _ M/s UV Exports Put, Ld. was incorporated on 12.02.2016. As per Vinod