Professional Documents

Culture Documents

Macroeconomía 4

Uploaded by

milvil1Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Macroeconomía 4

Uploaded by

milvil1Copyright:

Available Formats

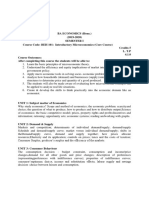

DYNAMIC MACROECONOMICS

January-February

Instructor: Fabio C. Bagliano

Contact information

Collegio Carlo Alberto +39 0116706084

Office n°: TBA fabio.bagliano@unito.it

Office Hours: TBA http://web.econ.unito.it/bagliano/

Course Description

The course presents basic dynamic macroeconomic models in several specific fields of

macroeconomics: consumption and investment theory, growth theory and labour economics. The

aim is to provide key methodological tools for the dynamic analysis of a broad range of

macroeconomic issues, mainly based on dynamic optimization techniques. Lacture note handouts

and problem sets will be provided throughout the course. All necessary material will be made

available on the web page of the course.

Exam

There will be a two-hour, closed-book, written exam at the end of the course.

Course outline and material

The course will cover the following topics:

1. Dynamic consumption theory

- Permanent income theory with rational expectations

- Empirical issues and puzzles

- The role of uncertainty: precautionary savings

- Intertemporal consumption and portfolio allocation

General references

Romer (2012) Advanced Macroeconomics, fourth edition, ch. 8

Bagliano F.C.-Bertola G. (2007) Models for dynamic macroeconomics, ch. 1

Specific references

Deaton A. (1992) Understanding consumption, especially ch. 3, 4

Attanasio O. (1999) "Consumption demand", in Handbook of Macroeconomics, vol. 1B, ch. 11

Campbell J. (1999) "Asset prices, consumption, and the business cycle", in Handbook of

Macroeconomics, vol. 1C, ch. 19

Carroll C. (2001) "A theory of the consumption function, with and without liquidity constraints",

Journal of Economic Perspectives ("graduate students version" NBER wp 8387)

Angeletos et al. (2001) "The hyperbolic consumption model: calibration, simulation and empirical

evaluation", Journal of Economic Perspectives

Meghir C. (2004) "A retrospective on Friedman's theory of permanent income", Economic Journal

Attanasio O. and G. Weber (2010) "Consumption and saving: models of intertemporal allocation

and their implications for public policy", Journal of Economic Literature

Jappelli T. and L. Pistaferri (2010) “The consumption response to income changes”, Annual

Reviews in Economics

2. Dynamic investment models

- Dynamic optimization in continuous time

- Adjustment costs and Tobin's forward-looking "q"

- Investment dynamics, interest rates, productivity and wages in partial equilibrium

General references

Romer (2012) Advanced Macroeconomics, fourth edition, ch. 9

Bagliano-Bertola (2007) Models for dynamic macroeconomics, ch. 2

On mathematical methods: Barro-Sala-i-Martin (1995) Economic Growth, Mathematical Appendix

Specific references

Yoshikawa H. (1980) "On the `q' theory of investment", American Economic Review, 70, 4, 739-

743

Hayashi F. (1982) "Tobin's marginal q and average q: a neoclassical interpretation", Econometrica,

50, 1, 213-224

Abel A. - Blanchard O.J. (1983) "An intertemporal model of saving and investment",

Econometrica, 51, 3, 675-692

Caballero R. (1999) "Aggregate Investment", Handbook of Macroeconomics, vol. 1B, ch 12

3. Economic growth in dynamic general equilibrium

- Balanced growth, steady state and optimal convergence

- Decentralization of production and investment decisions

- Endogenous growth and market imperfections.

General references

Romer (2012) Advanced Macroeconomics, fourth edition, ch. 1, 2 (Part A), 3

Bagliano-Bertola (2007) Models for dynamic macroeconomics, ch. 4

Specific references

Mankiw N.G., D. Romer, D. Weil (1992) "A contribution to the empirics of economic growth",

Quarterly Journal of Economics, May

Romer P. (1994) "The origins of endogenous growth", Journal of Economic Perspectives, 8, Winter

Barro-Sala-i-Martin (1995) Economic Growth, ch. 1, 2, 4

Aghion-Howitt (1998) Endogenous Growth Theory, ch. 1

4. Flow dynamics in the labour market

- Participation externalities in the labour market

- Features of search models of the labour market

- Job matching and unemployment dynamics

General references:

Romer (2012) Advanced Macroeconomics, fourth edition, ch. 10

Bagliano-Bertola (2007) Models for dynamic macroeconomics, ch. 5, sections 5.2-5.4

Specific references:

Pissarides (2000) Equilibrium Unemployment Theory, 2nd ed., ch. 1-3

Petrongolo-Pissarides (2001) "Looking into the black box: a survey of the matching function",

Journal of Economic Literature

Nickell S., Nunziata L., Ochel W., Quintini G. (2002) "The Beveridge curve, unemployment and

wages in the OECD from the 1960s to the 1990s", Centre for Economic Performance, LSE

Hornstein A., Krusell P., G.L. Violante (2005) "Unemployment and Vacancy fluctuations in the

matching model: inspecting the mechanism", Federal Reserve Bank of Richmond Economic

Quarterly

Shimer R. (2005) "The cyclical behavior of equilibrium unemployment and vacancies", American

Economic Review, March

Hall R. (2005) "Employment fluctuations with equilibrium wage stickiness", American Economic

Review, March

Pissarides C. (2011) “Equilibrium in the labor market with search frictions”, American Economic

Review

Diamond P. (2011) “Unemployment, vacancies, wages”, American Economic Review

You might also like

- Eng Outline Macro II FEN 2015Document13 pagesEng Outline Macro II FEN 2015LukeO'BrienNo ratings yet

- EC 585 - Special Topics in Dynamic Macroeconomic Modeling Spring 2011Document5 pagesEC 585 - Special Topics in Dynamic Macroeconomic Modeling Spring 2011su11674No ratings yet

- Curriculum Vitae: Nicola PavoniDocument6 pagesCurriculum Vitae: Nicola PavoniDeni djbNo ratings yet

- Bec 111 Course OutlineDocument3 pagesBec 111 Course OutlineFeddy CruzNo ratings yet

- Syllabus Eurpubchopubeco 20152016 Cesi 2016 02 17 16 27 15Document6 pagesSyllabus Eurpubchopubeco 20152016 Cesi 2016 02 17 16 27 15Estella ManeaNo ratings yet

- ECO 509 Economics For ManagersDocument3 pagesECO 509 Economics For ManagersMaryam NoorNo ratings yet

- Eco No MetricsDocument6 pagesEco No MetricsSirElwoodNo ratings yet

- M.A. Part I Semester I: Four Courses in Each of The Two Semesters For M.A in EconomicsDocument11 pagesM.A. Part I Semester I: Four Courses in Each of The Two Semesters For M.A in EconomicsHolly JohnsonNo ratings yet

- Public Finance: Daeyong@phbs - Pku.edu - CNDocument6 pagesPublic Finance: Daeyong@phbs - Pku.edu - CNSprasadNo ratings yet

- Eco 121Document6 pagesEco 121Sahil VermaNo ratings yet

- Jai Hind College Basantsing Institute of Science & J.T.Lalvani College of Commerce (Autonomous)Document6 pagesJai Hind College Basantsing Institute of Science & J.T.Lalvani College of Commerce (Autonomous)S1626No ratings yet

- (Handbook of Macroeconomics 1, Part C) John B. Taylor and Michael Woodford (Eds.) - North Holland (1999)Document566 pages(Handbook of Macroeconomics 1, Part C) John B. Taylor and Michael Woodford (Eds.) - North Holland (1999)Raphael BacchiNo ratings yet

- Full Reading List 18112010Document4 pagesFull Reading List 18112010Omen ProtectorNo ratings yet

- Course Outline EconomicsDocument2 pagesCourse Outline EconomicsRamadan NureeNo ratings yet

- (Ciclo 6) PA513 - Economía PetroleraDocument3 pages(Ciclo 6) PA513 - Economía PetroleraChristian AcostaNo ratings yet

- DSGEDocument10 pagesDSGEsimbiroNo ratings yet

- Ec325 Syllabus 2013 - v4Document12 pagesEc325 Syllabus 2013 - v4dashapuskarjovaNo ratings yet

- Fundamental of Micro Economics: Department of Economics Master of Business Economics Semester-I Paper-IDocument41 pagesFundamental of Micro Economics: Department of Economics Master of Business Economics Semester-I Paper-IDev KumarNo ratings yet

- Syllabus EconomicsDocument13 pagesSyllabus EconomicsBirendra BishtNo ratings yet

- Francesco Caselli: PersonalDocument4 pagesFrancesco Caselli: PersonalSaiganesh RameshNo ratings yet

- Course Outline For MacroeconomicsDocument3 pagesCourse Outline For MacroeconomicsERICK LOUIS ADOKONo ratings yet

- Macroeconomía I 2017Document3 pagesMacroeconomía I 2017mauro monterosNo ratings yet

- Draft Proposal, Research Method, SS15Document5 pagesDraft Proposal, Research Method, SS15anon_834032661No ratings yet

- Economics Module Book Edition Version 2013Document159 pagesEconomics Module Book Edition Version 2013Terence Lo100% (2)

- Ma Economics PDFDocument59 pagesMa Economics PDFHarish ItkarNo ratings yet

- Macroeconomic Policy AlemayehuDocument11 pagesMacroeconomic Policy AlemayehuAyanaw MussieNo ratings yet

- Economics SyllabusDocument16 pagesEconomics SyllabusRajiv VyasNo ratings yet

- Annexure-172. B.COM. PROGRAMME GE COURSESDocument5 pagesAnnexure-172. B.COM. PROGRAMME GE COURSES8717878740No ratings yet

- SyllabusDocument4 pagesSyllabusjiosjaNo ratings yet

- Topics in Modern Public Economics 2009Document8 pagesTopics in Modern Public Economics 2009Nguyen QuyetNo ratings yet

- Global Economic Environment: Gerardo JacobsDocument8 pagesGlobal Economic Environment: Gerardo JacobsGuzmán Noya NardoNo ratings yet

- ECON 2102 Principles of MacroeconomicsDocument3 pagesECON 2102 Principles of MacroeconomicsSyeda Eman FatimaNo ratings yet

- Eco Sem 1Document5 pagesEco Sem 1Tutul BiswasNo ratings yet

- Econ F211 1023 PDFDocument2 pagesEcon F211 1023 PDFPranjal SrivastavaNo ratings yet

- Analytical Political EconomyFrom EverandAnalytical Political EconomyRoberto VenezianiNo ratings yet

- Monetary+Thoery+and+Policy PHDDocument2 pagesMonetary+Thoery+and+Policy PHDhm512771No ratings yet

- Ba (H) EconomicsDocument89 pagesBa (H) EconomicsHimanshi BhatiaNo ratings yet

- CursosExtensionUniversitaria 2010Document16 pagesCursosExtensionUniversitaria 2010josepa_mNo ratings yet

- Financial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Document4 pagesFinancial Econometrics and Empirical Finance II: Professor Massimo Guidolin (With Prof. Carlo Favero)Diamante GomezNo ratings yet

- Macro Syllabus Fall12Document5 pagesMacro Syllabus Fall12bofwNo ratings yet

- CMAP Public Sector Economics Course Outline (Revised July 2020)Document23 pagesCMAP Public Sector Economics Course Outline (Revised July 2020)bngimor_158047917No ratings yet

- Syllabus M.SC - Economics New Code 13-14Document24 pagesSyllabus M.SC - Economics New Code 13-14Kajal ChaudharyNo ratings yet

- Institute of Business Management (Iobm)Document3 pagesInstitute of Business Management (Iobm)Syed Jodat Askari ZaydiNo ratings yet

- EconomicsDocument44 pagesEconomicskhrysttalexa31460% (1)

- Macro Economics MonikaDocument3 pagesMacro Economics MonikaDejo MathewNo ratings yet

- Chap.01.Science of Macroeconomics - GMDocument26 pagesChap.01.Science of Macroeconomics - GMSallyan DonnyNo ratings yet

- M.A. Economics (Dept.)Document36 pagesM.A. Economics (Dept.)dher1234No ratings yet

- John B. Taylor, Michael Woodford - Handbook of Macroeconomics, Volume 1C-North Holland (1999)Document566 pagesJohn B. Taylor, Michael Woodford - Handbook of Macroeconomics, Volume 1C-North Holland (1999)Fredy A. CastañedaNo ratings yet

- Economic AnalysisDocument8 pagesEconomic AnalysisJoan GardoceNo ratings yet

- Math108c SyllabusDocument2 pagesMath108c SyllabusMariusBuensucesoNo ratings yet

- CB2 Booklet 3Document102 pagesCB2 Booklet 3Somya AgrawalNo ratings yet

- Chap1 EconometricsDocument36 pagesChap1 EconometricsLidiya wodajenehNo ratings yet

- Debates in Economic Theory (MA 15PECH033) 2023-2024 Syllabus-1Document7 pagesDebates in Economic Theory (MA 15PECH033) 2023-2024 Syllabus-1huseyin.acarbrothersNo ratings yet

- Competences and Skills That Will Be Acquired and Learning ResultsDocument2 pagesCompetences and Skills That Will Be Acquired and Learning ResultsNguyễn LongNo ratings yet

- EC 111 OutlineDocument2 pagesEC 111 OutlineFred MukondaNo ratings yet

- Mankiwscarth6e Lectureslides ch01Document26 pagesMankiwscarth6e Lectureslides ch01Rehan HabibNo ratings yet

- C1 OverviewDocument32 pagesC1 OverviewAnh Ôn KimNo ratings yet

- ECO 309-OutlineDocument3 pagesECO 309-OutlineKenza RdwNo ratings yet

- The Microeconomics of Complex Economies: Evolutionary, Institutional, Neoclassical, and Complexity PerspectivesFrom EverandThe Microeconomics of Complex Economies: Evolutionary, Institutional, Neoclassical, and Complexity PerspectivesNo ratings yet

- Over and Under PopulationDocument2 pagesOver and Under PopulationminhaxxNo ratings yet

- Women and Recession Revisited: Jill RuberyDocument19 pagesWomen and Recession Revisited: Jill RuberyRubén AnaníasNo ratings yet

- Datamonitor Starbucks SWOT Analysis 2011Document13 pagesDatamonitor Starbucks SWOT Analysis 2011Koulis KoulidisNo ratings yet

- BMBS Chapter 2 Short NotesDocument8 pagesBMBS Chapter 2 Short NotesMasood AliNo ratings yet

- Positive and Normative EconomicsDocument3 pagesPositive and Normative EconomicsEmy BahariNo ratings yet

- Etdp Seta Annual Report 2009-2010Document85 pagesEtdp Seta Annual Report 2009-2010Aisha FarhanNo ratings yet

- Unemployment in PakistanDocument8 pagesUnemployment in Pakistanopenid_HsE7LD5bNo ratings yet

- PresidentDocument4 pagesPresidentJed KucharczkNo ratings yet

- Employability of Bsed English Graduates (For Hard Bound Cutie)Document57 pagesEmployability of Bsed English Graduates (For Hard Bound Cutie)Jenipe Rondina CodiumNo ratings yet

- GLEC Assignment-Country Report (Spain)Document15 pagesGLEC Assignment-Country Report (Spain)Sohil AggarwalNo ratings yet

- Some Problems of Development Planning: Part - ViDocument29 pagesSome Problems of Development Planning: Part - ViKamal SinghNo ratings yet

- Cork Historic Centre Action Plan (April 1994)Document128 pagesCork Historic Centre Action Plan (April 1994)Cork CIty CentreNo ratings yet

- Lessons For Undercover BossesDocument2 pagesLessons For Undercover BossesUmair AhmedNo ratings yet

- Final Report On CYP National Consultation DhakaDocument37 pagesFinal Report On CYP National Consultation DhakasabetaliNo ratings yet

- Neha Gupta - Research Project ReportDocument80 pagesNeha Gupta - Research Project Reportudit dubeyNo ratings yet

- Republic Act No. 11494 Bayanihan To Recover As One ActDocument10 pagesRepublic Act No. 11494 Bayanihan To Recover As One ActChristiaan CastilloNo ratings yet

- Macro Theories & FactorsDocument18 pagesMacro Theories & FactorsAnonymous 1997No ratings yet

- 12.sickness in Small Scale Industries Causes RemediesDocument9 pages12.sickness in Small Scale Industries Causes RemediesKruttika MohapatraNo ratings yet

- ECN204 Mid 2013WDocument11 pagesECN204 Mid 2013WexamkillerNo ratings yet

- Effect of Covid-19 On Unemployment in IndiaDocument16 pagesEffect of Covid-19 On Unemployment in IndiaAlina khanNo ratings yet

- Okun's Law and The Phillips CurveDocument3 pagesOkun's Law and The Phillips CurveSipanNo ratings yet

- Country RoadDocument22 pagesCountry RoadAhsan Ul Hoque RohanNo ratings yet

- Session 1 Introduction To MacroeconomicsDocument7 pagesSession 1 Introduction To MacroeconomicsdboterNo ratings yet

- Economic Planning - MA Economics Karachi UniversityDocument12 pagesEconomic Planning - MA Economics Karachi UniversitySharina ObogNo ratings yet

- Procrastination's Impact in The WorkplaceDocument12 pagesProcrastination's Impact in The WorkplacefitriflNo ratings yet

- TeamLeaseServicesLimitedAnnualReport2017 18Document194 pagesTeamLeaseServicesLimitedAnnualReport2017 18Anonymous NJDmHvj100% (1)

- Social Problems 3 PDFDocument24 pagesSocial Problems 3 PDFjacor1987No ratings yet

- Types of UnemploymentDocument4 pagesTypes of UnemploymentGhanshyam BhambhaniNo ratings yet

- Ke BD 18 001 en N PDFDocument280 pagesKe BD 18 001 en N PDFmohamed jagwarNo ratings yet

- DOMINIC COLE - PhrasesDocument19 pagesDOMINIC COLE - Phrasesjoanna manabatNo ratings yet