Professional Documents

Culture Documents

Exercise On Profit and Loss Appropriation Account

Uploaded by

Mujieh NkengOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise On Profit and Loss Appropriation Account

Uploaded by

Mujieh NkengCopyright:

Available Formats

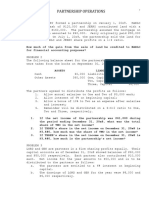

Exercise on profit and loss appropriation account

Ali, Carine and Vera set up a partnership firm on January 1, 2011. They contributed 50,000 frs,

40,000 frs and 30,000 frs respectively as their capitals and decided to share profits in the ratio of

3:2:1. The partnership deed provided that Ali is to be paid a salary of 1,000 per month and

Carine a commission of 5,000 frs. It also provided that interest on capital be allowed @ 6% p.a.

The drawings for the year were: Ali 6,000 frs, Carine 4,000 frs and Vera 2,000 frs. Interest on

drawings 270 frs on Ali's drawings, 180 frs on Carine's drawings and 90 frs on Vera's drawings.

The net amount of profit as per the profit and loss account for the year ended 2011 was 35,660

frs.

Required: You are required to prepare the profit and loss appropriation account and the partners'

capital accounts as at 30 December 2011.

You might also like

- J.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2019: For Preparing Your 2018 Tax ReturnNo ratings yet

- Advanced Financial Accounting and ReportingDocument5 pagesAdvanced Financial Accounting and Reportingaccounting prob100% (1)

- Special Transaction 1Document7 pagesSpecial Transaction 1Josua PagcaliwaganNo ratings yet

- Class 12 Accounts CA Parag GuptaDocument368 pagesClass 12 Accounts CA Parag GuptaJoel Varghese0% (1)

- Mock Aqe 1Document17 pagesMock Aqe 1Albert Ocno Almine100% (4)

- 9 Partnership Question 21Document11 pages9 Partnership Question 21kautiNo ratings yet

- Parcor CaseletsDocument13 pagesParcor CaseletsErika delos Santos100% (2)

- Chap 1 Part 4 - Installment Liquidation ProblemsDocument3 pagesChap 1 Part 4 - Installment Liquidation ProblemsLarpii Moname100% (1)

- Partnership Mock ExamDocument4 pagesPartnership Mock ExamCleo Meguel AbogadoNo ratings yet

- Summer Vacation Assignment - AccountancyDocument2 pagesSummer Vacation Assignment - Accountancykrishgupta723No ratings yet

- Important Questions OpDocument1 pageImportant Questions OplmaoNo ratings yet

- Home Work Set 1Document1 pageHome Work Set 1Zaid KhanNo ratings yet

- UntitledDocument8 pagesUntitledRae SlaughterNo ratings yet

- Advanced Accounting Chapter 16Document3 pagesAdvanced Accounting Chapter 16sutan fanandiNo ratings yet

- Acc QuesDocument2 pagesAcc QuesComedy Ka BaapNo ratings yet

- Basics of Partnership Unit 1Document1 pageBasics of Partnership Unit 1Kalpesh ShahNo ratings yet

- Without AnswerDocument4 pagesWithout AnswerRakesh AryaNo ratings yet

- Ch-1 Accountancy 2019Document3 pagesCh-1 Accountancy 2019animeshmoh1No ratings yet

- Partnerships Take Home Quiz PDFDocument2 pagesPartnerships Take Home Quiz PDFMelissa FelicianoNo ratings yet

- AccountsDocument22 pagesAccountsRakesh AryaNo ratings yet

- Introduction To Partnership Class WorkDocument1 pageIntroduction To Partnership Class WorkChaaru VarshiniNo ratings yet

- (2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRDocument4 pages(2022-23) 15-5-2022 Xii May Unit Test For Convent - Fundamental, Goodwill & Change in PSRnitya mahajanNo ratings yet

- Advanced Accounting 11th Edition Hoyle Test Bank Full Chapter PDFDocument67 pagesAdvanced Accounting 11th Edition Hoyle Test Bank Full Chapter PDFToniPerryyedo100% (12)

- Assignment#2Document10 pagesAssignment#2hae1234No ratings yet

- Indian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursDocument5 pagesIndian School Sohar UNIT TEST (2021-22) Accountancy Date: Max Marks:50 Class: XII Duration: 2 HoursRitaNo ratings yet

- Fundamental Test Mix Batch - 1Document1 pageFundamental Test Mix Batch - 1Harsh ShahNo ratings yet

- Partnership FundamentalsDocument3 pagesPartnership FundamentalsDeepanshu kaushikNo ratings yet

- Partnership MidtermDocument10 pagesPartnership MidtermJoanna Caballero100% (1)

- Long Answer Type QuestionDocument75 pagesLong Answer Type Questionincome taxNo ratings yet

- WS 2 FUNDAMENTALS OF PARTNERSHIP - DocxDocument5 pagesWS 2 FUNDAMENTALS OF PARTNERSHIP - DocxGeorge Chalissery RajuNo ratings yet

- Acctng 7 Partnership Review ProblemsDocument5 pagesAcctng 7 Partnership Review ProblemssarahbeeNo ratings yet

- FUNDAMENTAL OF PARTNERSHIP Class 12Document1 pageFUNDAMENTAL OF PARTNERSHIP Class 12Varun HurriaNo ratings yet

- Class XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Document3 pagesClass XII Assignment - 2 Accounting For Partnership Firms-Fundamentals 1Lester Williams100% (1)

- Midterm Exam - 2BSA1Document3 pagesMidterm Exam - 2BSA1joevitt delfinadoNo ratings yet

- Partnership TestDocument3 pagesPartnership Teststudy.aman902No ratings yet

- Change in Profit Sharing Ratio Amongst TDocument2 pagesChange in Profit Sharing Ratio Amongst TSukhjinder SinghNo ratings yet

- 12 Accountancy 2023-24Document37 pages12 Accountancy 2023-24chiragdahiya0602No ratings yet

- Accountancy Previous QuestionsDocument4 pagesAccountancy Previous QuestionsmurthyNo ratings yet

- Quiz 1 AFAR ReviewDocument7 pagesQuiz 1 AFAR ReviewPrankyJellyNo ratings yet

- OperationDocument4 pagesOperationRyan SanchezNo ratings yet

- 2 OperationsDocument7 pages2 Operationsmartinfaith958No ratings yet

- Class Xii: Accountancy Practice Assignment: Partnership FundamentalsDocument4 pagesClass Xii: Accountancy Practice Assignment: Partnership FundamentalsManinder Singh ArnejaNo ratings yet

- Soal 2 Akl 1Document5 pagesSoal 2 Akl 1Hamzah Shalahuddin0% (1)

- Past AdjustmentsDocument6 pagesPast Adjustmentsgaurav.jahnavimishraNo ratings yet

- A 2 OperationsDocument6 pagesA 2 OperationsAngela DucusinNo ratings yet

- Pretest Operation and DissolutionDocument1 pagePretest Operation and DissolutionMondays AndNo ratings yet

- Fixed and Flucuating Capital AccountDocument3 pagesFixed and Flucuating Capital AccountArun AroraNo ratings yet

- Accountancy SQP PDFDocument8 pagesAccountancy SQP PDFInder Singh NegiNo ratings yet

- 2020 12 SP AccountancyDocument21 pages2020 12 SP AccountancySaroj ViswariNo ratings yet

- Assessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Document2 pagesAssessement Test 5 - Partnership Accounts & Goodwill - Docx - 1660529707799Shreya PushkarnaNo ratings yet

- Fundamental Test PDFDocument2 pagesFundamental Test PDFHarshit AgarwalNo ratings yet

- Forecasting ProblemsDocument3 pagesForecasting ProblemsJimmyChaoNo ratings yet

- Financial Accounting Reporting Partnership OperationDocument3 pagesFinancial Accounting Reporting Partnership OperationApril QuiboteNo ratings yet

- Ho P2 01Document6 pagesHo P2 01Kriza Sevilla MatroNo ratings yet

- CAPE U1 Partnership Revaluation QuestionsDocument6 pagesCAPE U1 Partnership Revaluation QuestionsNadine DavidsonNo ratings yet

- CH 1 Past Adjustment 1Document2 pagesCH 1 Past Adjustment 1Ohm ShahNo ratings yet

- St. Scholasticas College: Leon Guinto, ManilaDocument13 pagesSt. Scholasticas College: Leon Guinto, Manilamaria evangelistaNo ratings yet

- Quiz 1Document5 pagesQuiz 1cpacpacpa100% (2)

- Stop the Investing Rip-off: How to Avoid Being a Victim and Make More MoneyFrom EverandStop the Investing Rip-off: How to Avoid Being a Victim and Make More MoneyNo ratings yet