Professional Documents

Culture Documents

Job Order Costing Material

Job Order Costing Material

Uploaded by

cheesesiz yum0 ratings0% found this document useful (0 votes)

1 views1 pageOriginal Title

Job-order-costing-material

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views1 pageJob Order Costing Material

Job Order Costing Material

Uploaded by

cheesesiz yumCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 1

ABC Company manufactures custom-built conveyor systems for factory and commercial operations.

The cost accountant for ABC Company is in the process of educating

a new employee, Mark Garcia, about the job-order costing system that ABC Company uses. The cost accountant of the company told Mark that the direct labor cost per

hour is P20 and the overhead is applied based on direct labor cost.

To explain the missing job number, the cost accountant informed Mark that Job #668 had been completed and sold in June.

At the end of July, Job #671 and #673 had not been completed; and all other jobs were complete.

The company sold Job # 667 and # 669.

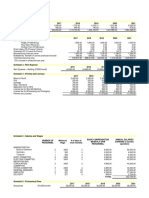

Following job-order cost records are available for July:

Beginning Work-in-process Inventory

Job No. Direct Materials Direct Labor Applied OH Total Cost

667 5,540.00 2,100.00 1,260.00 8,900.00

669 18,000.00 8,000.00 4,800.00 30,800.00

670 9,450.00 4,000.00 2,400.00 15,850.00

Manufacturing cost/hrs incurred during the period

Job No. Direct Materials Direct Labor hours

667 - 20

669 2,000.00 45

670 6,000.00 60

671 20,000.00 380

672 5,250.00 90

673 7,450.00 180

674 12,000.00 295

The cost accountant asked Mark several questions to determine whether he understood the job-order costing system.

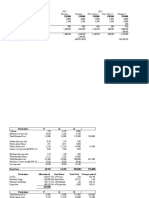

A. Answer the following:

1. What is the predetermined overhead rate?

2. What is the total prime cost?

3. What is the total cost of goods manufactured?

4. What is the total ending finished goods inventory?

5. Assuming the actual overhead is P12,000, what is the over/under-applied overhead?

B. Prepare the following:

1. T-account for work-in-process inventory (general ledger), finished goods inventory and all the subsidiary ledger.

2. Prepare the adjusting entry to close the overhead control account assuming the over/under applied overhead:

2.1 immaterial

2.2 material

JOB-ORDER COSTING MATERIALS

You might also like

- Star Engineering CompanyDocument5 pagesStar Engineering CompanyChleo Espera100% (1)

- Referencias SFPDocument646 pagesReferencias SFPAlexandre Antunes100% (1)

- Cost Segregation IllustrationDocument4 pagesCost Segregation IllustrationJessica Aningat50% (4)

- Browning Manufacturing CaseDocument6 pagesBrowning Manufacturing CaseChleo EsperaNo ratings yet

- Notes in Contemporary World PDFDocument12 pagesNotes in Contemporary World PDFVeneice Amor Alonzo84% (37)

- SALES MCQ QuestionsDocument43 pagesSALES MCQ QuestionsKess Montallana100% (1)

- Projected IncomeDocument17 pagesProjected IncomecarlomaderazoNo ratings yet

- Class Case 3 - Star Engineering CompanyDocument3 pagesClass Case 3 - Star Engineering Company9ry5gsghybNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument39 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialAniket100% (1)

- SCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Document7 pagesSCHEDULE 1 - Revenue 2017 2018 2019 2020 2021Nathalie PadillaNo ratings yet

- Paper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialDocument38 pagesPaper - 3: Cost Accounting and Financial Management Part I: Cost Accounting Questions MaterialMinni BegumNo ratings yet

- Lesson 1 Comprehensive Problem P3Document1 pageLesson 1 Comprehensive Problem P3Jay AnunciacionNo ratings yet

- COSTACCDocument9 pagesCOSTACCVillaluna Janne ChristineNo ratings yet

- Ab Ipc9Document1 pageAb Ipc9hagos aregawiNo ratings yet

- 10.40L Masala MakingDocument10 pages10.40L Masala MakingVedant AssociatesNo ratings yet

- Example 4.3: Surestep Aggregate Planning Model With Backlogging, Page 161 Input DataDocument3 pagesExample 4.3: Surestep Aggregate Planning Model With Backlogging, Page 161 Input Dataライ ハンNo ratings yet

- The Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Document19 pagesThe Accounting Cycle PHASE 1 - RECORDING AND CLASSIFYING PROCESS (During The Accounting Period)Allondra DapengNo ratings yet

- Pelantikan Perunding Bukit Rimau (SOF)Document9 pagesPelantikan Perunding Bukit Rimau (SOF)Projek JK3No ratings yet

- Rencana Kegiatan Dan Anggaran Sekolah (Rkas) SMK Negeri 1 Tampaksiring TAHUN 2019Document27 pagesRencana Kegiatan Dan Anggaran Sekolah (Rkas) SMK Negeri 1 Tampaksiring TAHUN 2019DESA PUTERANo ratings yet

- Financial PlanDocument7 pagesFinancial PlanFesto MshumaNo ratings yet

- Project Report Beauty ParlourDocument12 pagesProject Report Beauty ParlourfundzerodhaNo ratings yet

- Chapter 5Document19 pagesChapter 5JessicaNo ratings yet

- Financial Slide For ReportDocument6 pagesFinancial Slide For ReportTuan Noridham Tuan LahNo ratings yet

- ProjectDocument17 pagesProjectshubham shauravNo ratings yet

- Chapter 5 - Solutions To Cost Accounting Book (Raiborn and Kinney, 2 Phil Edition)Document22 pagesChapter 5 - Solutions To Cost Accounting Book (Raiborn and Kinney, 2 Phil Edition)Mark Johnrei GandiaNo ratings yet

- PT Bangkit Jaya Sakti Cost of Proction Report For Year Ended December 31, 2009Document8 pagesPT Bangkit Jaya Sakti Cost of Proction Report For Year Ended December 31, 2009um ummrhNo ratings yet

- Chapter 9 Accounting For Labor Illustraive Problems - Compress PDFDocument7 pagesChapter 9 Accounting For Labor Illustraive Problems - Compress PDFAbantas, Abdul HakimNo ratings yet

- Total Project CostDocument17 pagesTotal Project Costfrescy mosterNo ratings yet

- Examples FMA - 6Document9 pagesExamples FMA - 6DaddyNo ratings yet

- Red Tomato Case StudyDocument19 pagesRed Tomato Case StudyAmmar Ali AbroNo ratings yet

- FAMA '22 SolutionDocument4 pagesFAMA '22 SolutionRushil JoshiNo ratings yet

- Lotac Daily Bread 12 Months Projected Cash Flow and P&L AccountDocument16 pagesLotac Daily Bread 12 Months Projected Cash Flow and P&L AccountAaron Chidi JudeNo ratings yet

- Target Market Every Month 3,600.00 Average Sales Per Customer 25.00Document4 pagesTarget Market Every Month 3,600.00 Average Sales Per Customer 25.00Mark Harold RaspadoNo ratings yet

- Pasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Document6 pagesPasia Singapore Plans Discussion Document: 18 Feb 2019 Rev 3Aljon DagalaNo ratings yet

- PR 117 Part 2Document9 pagesPR 117 Part 2viswadevassociates.tvmNo ratings yet

- Chapter 13 - Solutions: Demand 34000 UnitsDocument7 pagesChapter 13 - Solutions: Demand 34000 UnitsJimena OchoaNo ratings yet

- Financial Feasibility - 1Document20 pagesFinancial Feasibility - 1Josie Casquijo BobisNo ratings yet

- Lapran Keuangan Kso Per November 2021Document13 pagesLapran Keuangan Kso Per November 2021BekNo ratings yet

- Project FIle - Balaji NAikDocument5 pagesProject FIle - Balaji NAikBALAJI NAIK MudavatuNo ratings yet

- SPJ Fungsional Des 2020Document1 pageSPJ Fungsional Des 2020Imilda Utami DewiNo ratings yet

- 2018 4083 3rd Evaluation ExamDocument7 pages2018 4083 3rd Evaluation ExamPatrick Arazo0% (1)

- Afar 2612 Job Order CostingDocument25 pagesAfar 2612 Job Order Costingcorpnet globalNo ratings yet

- Quick Lunch & Browning ManufacturingDocument9 pagesQuick Lunch & Browning ManufacturingMariaAngelicaMargenApeNo ratings yet

- Iggys Talipapa Payroll Aug 11 - August 26, 2023Document40 pagesIggys Talipapa Payroll Aug 11 - August 26, 2023finance.tangingyamanfoundationNo ratings yet

- Economic Cost and Profit of BeximcoDocument15 pagesEconomic Cost and Profit of BeximcoMamun RashidNo ratings yet

- Budgeting: Cost Accounting 14th Edition. By: CarterDocument37 pagesBudgeting: Cost Accounting 14th Edition. By: CartertinkerbellNo ratings yet

- 66088bos53351inter p3Document34 pages66088bos53351inter p3Asfarin ShaikhNo ratings yet

- Grand MLB Basic Commodities Corporation 2023'Document8 pagesGrand MLB Basic Commodities Corporation 2023'Bambie Porras Jaca100% (1)

- LEVEL 2 Online Quiz - Answers SET ADocument10 pagesLEVEL 2 Online Quiz - Answers SET AVincent Larrie MoldezNo ratings yet

- SolutionDocument2 pagesSolutionLuffy MonkeyNo ratings yet

- Case AnalysisDocument5 pagesCase AnalysisChetan Dasgupta0% (1)

- Completing The Accounting CycleDocument11 pagesCompleting The Accounting CycleRaymond RocoNo ratings yet

- Chapter 9.1 Process CostingDocument9 pagesChapter 9.1 Process CostingdoomageddonsplinterlandNo ratings yet

- Payroll FresnozaDocument3 pagesPayroll FresnozaAna Marie FresnozaNo ratings yet

- Project Management ToolkitDocument19 pagesProject Management ToolkitVenu RaviNo ratings yet

- Process Costing Standard CostingDocument4 pagesProcess Costing Standard CostingNikki GarciaNo ratings yet

- Fare Forecast - Sheet1Document2 pagesFare Forecast - Sheet1Tahsin Al MuntaquimNo ratings yet

- Chapter 8 - 9 - ExamplesDocument7 pagesChapter 8 - 9 - Examplesaaha10No ratings yet

- Chapter 8 - 9 - TTT ExamplesDocument7 pagesChapter 8 - 9 - TTT Examplesaaha10No ratings yet

- Financial FeasibilityDocument28 pagesFinancial FeasibilityJosie Casquijo BobisNo ratings yet

- Mahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Document20 pagesMahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Mahmoud MegahedNo ratings yet

- Codification of Statements on Auditing Standards: Numbers 122 to 133, January 2018From EverandCodification of Statements on Auditing Standards: Numbers 122 to 133, January 2018No ratings yet

- Ais 1.0Document15 pagesAis 1.0cheesesiz yumNo ratings yet

- Unit III Lesson 1 The LGBTQ Question 1Document37 pagesUnit III Lesson 1 The LGBTQ Question 1cheesesiz yumNo ratings yet

- ChapterDocument8 pagesChaptercheesesiz yumNo ratings yet

- BookDocument9 pagesBookcheesesiz yumNo ratings yet

- Group6 EssayDocument1 pageGroup6 Essaycheesesiz yumNo ratings yet

- UTSDocument1 pageUTScheesesiz yumNo ratings yet

- Group 10Document1 pageGroup 10cheesesiz yumNo ratings yet

- Activity 1Document1 pageActivity 1cheesesiz yumNo ratings yet

- Activiy 2Document1 pageActiviy 2cheesesiz yumNo ratings yet

- War Crimes - The Nuremberg Trial and The Tribunal For The FormerDocument19 pagesWar Crimes - The Nuremberg Trial and The Tribunal For The Formeryani_hamhampandaNo ratings yet

- PG PL Governor: ApplicationsDocument4 pagesPG PL Governor: ApplicationsHusnain AliNo ratings yet

- Fda GLP PDFDocument2 pagesFda GLP PDFSharonNo ratings yet

- REH984b 05a PDFDocument17 pagesREH984b 05a PDFcritestachNo ratings yet

- Tehran Times, 18.11.2023Document8 pagesTehran Times, 18.11.2023nika242No ratings yet

- Caltex Phil Inc. VS CaDocument1 pageCaltex Phil Inc. VS CaRengie GaloNo ratings yet

- Notes Chapter 2 FARDocument5 pagesNotes Chapter 2 FARcpacfa100% (16)

- The Indolence of The FilipinosDocument2 pagesThe Indolence of The FilipinosJulio SuinanNo ratings yet

- Bond Raise Pre - Evaluation Form (Fina..l)Document1 pageBond Raise Pre - Evaluation Form (Fina..l)falconkudakwasheNo ratings yet

- President Uhuru Kenyatta's Speech During The National Youth Service Recruits at National Youth Service College, GilgilDocument3 pagesPresident Uhuru Kenyatta's Speech During The National Youth Service Recruits at National Youth Service College, GilgilState House KenyaNo ratings yet

- Decree or Final Support - Lisa Renae Scutio V Eric W. MusgraveDocument44 pagesDecree or Final Support - Lisa Renae Scutio V Eric W. MusgravethesacnewsNo ratings yet

- Roy v. Herbosa 2017Document1 pageRoy v. Herbosa 2017kimoymoy7No ratings yet

- Terry Vs Ohio DigestDocument3 pagesTerry Vs Ohio DigesthappymabeeNo ratings yet

- Uncertainty and Incomplete Agreements: Learning OutcomesDocument18 pagesUncertainty and Incomplete Agreements: Learning OutcomesamandaNo ratings yet

- Zahraa Specific Performance 2Document23 pagesZahraa Specific Performance 2Marinela SeremetNo ratings yet

- Hospitals - ASCICO InsuranceDocument40 pagesHospitals - ASCICO InsuranceAshiq MaanNo ratings yet

- Unit 5 Grounds For ReviewDocument13 pagesUnit 5 Grounds For ReviewkipkarNo ratings yet

- CSPL INTERNAL DOC-AUDIT 20.jan - 21jan 21Document6 pagesCSPL INTERNAL DOC-AUDIT 20.jan - 21jan 21sukhNo ratings yet

- Quotation From Liebherr EhingenDocument3 pagesQuotation From Liebherr Ehingenم.فرج العماميNo ratings yet

- Connections and Settings: Communication Unit 560CMR01Document4 pagesConnections and Settings: Communication Unit 560CMR01Mohammed MostefaiNo ratings yet

- Survey of Accounting 8th Edition Warren Solutions Manual 1Document39 pagesSurvey of Accounting 8th Edition Warren Solutions Manual 1michael100% (46)

- The Case For ChristDocument2 pagesThe Case For ChristJessica NublaNo ratings yet

- 7918final Adv Acc Nov06Document20 pages7918final Adv Acc Nov06ஆக்ஞா கிருஷ்ணா ஷர்மாNo ratings yet

- NCR T-261-ND 122322Document32 pagesNCR T-261-ND 122322Kwen Codizal MendozaNo ratings yet

- Reading 32 Working Capital - LiquidityDocument13 pagesReading 32 Working Capital - LiquidityNeerajNo ratings yet

- North Jersey Jewish Standard, Oct. 10, 2014Document52 pagesNorth Jersey Jewish Standard, Oct. 10, 2014New Jersey Jewish StandardNo ratings yet

- 13 CIR VS MARUBENI (2001) G.R. No. 137377Document12 pages13 CIR VS MARUBENI (2001) G.R. No. 137377JanMarkMontedeRamosWongNo ratings yet