Professional Documents

Culture Documents

03 Handout 2

Uploaded by

micah podadorOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

03 Handout 2

Uploaded by

micah podadorCopyright:

Available Formats

BMSH2203

RECORDING OF TRANSACTIONS OF A SERVICE BUSINESS

Business Transaction

The following transactions for the first month of the operation of Teddy’s Car Wash business were identified

through the business documents below:

Teddy’s Car Wash

Date Transactions

Nov. 1, Teddy invested cash amounting to P100,000 in Teddy's Car Wash business

2022

2 Paid P5,000 to Mr. Apollo for all the business licenses requirements

5 Purchased office supplies amounting to P2,500 from Athena's Bookstore

6 Paid rent for the month amounting to P10,000 to Mr. Zeus, plus two (2) months advance

rent deposit amounting to P20,000

7 Purchased car wash equipment worth P55,000 from Hera Inc. and paid a 25% down

payment with the balance to be paid in six (6) equal monthly installments subject to 5%

tax.

9 Purchased car wash supplies from Ares Enterprise amounting to P7,500

15 Rendered services to various clients, and per official receipts, the total amount received

amounted to P18,000

16 Paid the salary for the first half of the month amounting to P9,000

22 Rendered car wash services on account worth P12,000

24 Received cash for the services rendered for the week, P5,000

27 Collected P6,000 from a customer who availed of service on account

29 Teddy withdrew P3,000 cash from the business for personal use

30 Paid the salary for the last half of the month amounting to P9,000

30 Office supplies used was only P500, while car wash supplies used amounts to P3,500

30 Paid P4,000 for water and electricity consumption for the month

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 1 of 7

BMSH2203

General Journal Entries

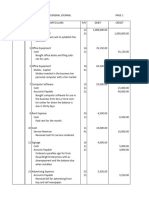

GENERAL JOURNAL PAGE 1

Teddy’s Car Wash

Date Description PR Debit Credit

Nov. 1, 2022 Cash 101 P100,000

Teddy's Capital 301 P100,000

To record Teddy's initial investment

2 Licenses Expense 551 5,000

Cash 101 5,000

To record payment of licenses

5 Office Supplies 121 2,500

Cash 101 2,500

To record purchased office supplies

6 Rent Expense 501 30,000

Cash 101 30,000

To record payment of rent and rent deposit

7 Car wash equipment 151 55,000

Cash (25% of P55,000) 101 13,750

Accounts payable 201 41,250

To record payment of rent and rent deposit

9 Car Wash Supplies 131 7,500

Cash 101 7,500

To record purchased supplies

15 Cash 101 18,000

Cash Wash Revenue 401 18,000

To record cash received from customers

16 Salary Expense 511 9,000

Cash 101 9,000

To record payment of salary

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 2 of 7

BMSH2203

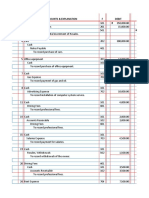

GENERAL JOURNAL PAGE 2

Teddy’s Car Wash

Date Description PR Debit Credit

Nov. 22, 2022 Accounts Receivable 111 12,000

Cash Wash Revenue 401 12,000

To record cash revenue on account

24 Cash 101 5,000

Cash Wash Revenue 401 5,000

To record cash received from customers

27 Cash 101 6,000

Accounts Receivable 111 6,000

To record collection of accounts receivable

29 Teddy, Drawing 311 3,000

Cash 101 3,000

To record cash withdrawal by the owner

30 Salary Expense 511 9,000

Cash 101 9,000

To record payment of salary

30 Office Supplies Expense 521 500

Car Wash Supplies Expense 531 3,500

Office Supplies 121 500

Car Wash Supplies 531 3,500

To record office and car wash supplies used

30 Utilities Expense 541 4,000

Cash 101 500

To record payment of water and electricity

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 3 of 7

BMSH2203

General Ledger Accounts

A. Cash

Account Cash Account No. 101

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 1 Balance GJ1 P100,000 P100,000

2 Payment for license GJ1 P5,000 95,000

5 Office supplies fee GJ1 2,500 92,500

6 Rent payment GJ1 30,000 62,500

7 Purchase of equipment GJ1 13,750 48,750

9 Car wash supplies fee GJ1 7,500 41,250

15 Service revenue GJ1 18,000 59,250

16 Salary payment GJ1 9,000 50,250

24 Service revenue GJ2 5,000 55,250

27 Collection from customer GJ2 6,000 61,250

29 Withdrawal GJ2 3,000 58,250

30 Salary payment GJ2 9,000 49,250

30 Payment for utilities GJ2 4,000 P45,250

B. Account Receivable

Account Accounts Receivable Account No. 111

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 22 Balance GJ2 P12,000 P12,000

27 Collection from customer GJ2 P6,000 P6,000

C. Office Supplies

Office Supplies Account No. 121

Account

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 5 Balance GJ1 P2,500 P2,500

30 Office supplies used GJ2 P500 P2,000

D. Car Wash Supplies

Account Car Wash Supplies Account No. 131

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 9 Balance GJ1 P7,500 P7,500

30 Car wash supplies used GJ2 P3,500 P4,000

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 4 of 7

BMSH2203

E. Car Wash Equipment

Account Car Wash Equipment Account No. 151

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 7 Balance GJ1 P55,000 P55,000

F. Accounts Payable

Account Accounts Payable Account No. 201

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 7 Balance GJ1 P41,250 P41,250

G. Owner’s Capital

Account Teddy's Capital Account No. 301

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 1 Balance GJ1 P100,000 P100,000

H. Owner’s Withdrawal

Account Teddy's Withdrawal Account No. 311

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 29 Balance GJ2 P3,000 P3,000

I. Car Wash Revenue

Account Car Wash Revenue Account No. 401

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 15 Balance GJ1 P18,000 P18,000

22 Service revenue on account GJ2 12,000 30,000

24 Service revenue on account GJ2 5,000 P35,000

J. Rent Expense

Account Rent Expense Account No. 501

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 6 Balance GJ1 P30,000 P30,000

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 5 of 7

BMSH2203

K. Salary Expense

Account Salary Expense Account No. 511

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 16 Balance GJ1 P9,000 P9,000

30 Payment for salary GJ2 P9,000 P18,000

L. Office Supplies Expense

Account Office Supplies Expense Account No. 521

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 30 Balance GJ2 P500 P500

M. Car Wash Supplies Expense

Account Car Wash Supplies Expense Account No. 531

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 30 Balance GJ2 P3,500 P3,500

N. Utilities Expense

Account Utilities Expense Account No. 541

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 30 Balance GJ2 P4,000 P4,000

O. License Expense

Account License Expense Account No. 551

Balance

Date Item PR Debit Credit

Debit Credit

2022 √

November 30 Balance GJ2 P5,000 P5,000

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 6 of 7

BMSH2203

Trial Balance

Teddy’s Car Wash

Trial Balance

For the month of November 2022

Acct.

No. Account Name Debit Credit

101 Cash P45,250

111 Accounts Receivable 6,000

121 Office Supplies 2,000

131 Car Wash Supplies 4,000

151 Car Wash Equipment 55,000

201 Accounts Payable P41,250

301 Teddy's Capital 100,000

311 Teddy's Withdrawal 3,000

401 Car Wash Revenue 35,000

501 Rent Expense 30,000

511 Salary Expense 18,000

521 Office Supplies Expense 500

531 Car Wash Supplies Expense 3,500

541 Utilities Expense 4,000

551 Licenses Expense 5,000

Total P176,250 P176,250

References

De Guzman, A. (2018) Fundamentals of Accountancy, Business, and Management: A Textbook in Basic Accounting 1.

Manila: Lori Mar Publishing

03 Handout 2 *Property of STI

student.feedback@sti.edu Page 7 of 7

You might also like

- Senate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!Document666 pagesSenate Finds Massive Fraud Washington Mutual: Special Delivery For Wamu Victims!DinSFLA100% (9)

- Wicktator Trade MaterialDocument11 pagesWicktator Trade MaterialrontechtipsNo ratings yet

- Cambridge Software Corporation - Q1Document2 pagesCambridge Software Corporation - Q1kkayathwalNo ratings yet

- Date Account & Explanation F Debit CreditDocument7 pagesDate Account & Explanation F Debit CreditCindy Claire Pilapil88% (8)

- Accounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionFrom EverandAccounting Principles and Practice: The Commonwealth and International Library: Commerce, Economics and Administration DivisionRating: 2.5 out of 5 stars2.5/5 (2)

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- Day Trading - 15 Secrets To SuccessDocument8 pagesDay Trading - 15 Secrets To SuccessSunny100% (1)

- To Trade or Not To Trade Informed Trading With Short Term Signals For Long Term InvestorsDocument15 pagesTo Trade or Not To Trade Informed Trading With Short Term Signals For Long Term Investorsrobert mcskimmingNo ratings yet

- Transaction Codes For SAP FICODocument28 pagesTransaction Codes For SAP FICOAjinkya MohadkarNo ratings yet

- Larry Jones Laundry Shop New FormatDocument18 pagesLarry Jones Laundry Shop New FormatVincent Madrid100% (1)

- 1 4 Certificate of Non ResponseDocument1 page1 4 Certificate of Non ResponseJason HenryNo ratings yet

- Laurent e Answer KeyDocument4 pagesLaurent e Answer KeyZee Santisas86% (7)

- Happy Tours and Travel Agency Chart of Accounts To Balance SheetDocument11 pagesHappy Tours and Travel Agency Chart of Accounts To Balance SheetChristine Tiprado100% (3)

- Chan Accounting FirmDocument37 pagesChan Accounting FirmRishaan Dominic100% (3)

- Whole Cycle - Accounting Act.Document26 pagesWhole Cycle - Accounting Act.IL MareNo ratings yet

- DBR 73218 - Asset Revaluation - AR29NDocument9 pagesDBR 73218 - Asset Revaluation - AR29Nsanjay100% (1)

- Demystifying The Ichimoku CloudDocument10 pagesDemystifying The Ichimoku CloudShahzad Dalal100% (1)

- The Fuller Method Learn To Grow Your Money Exponentially - V4.0 14 PDFDocument35 pagesThe Fuller Method Learn To Grow Your Money Exponentially - V4.0 14 PDFartlet100% (1)

- Service - Journal-TB - Dr. Who ClinicDocument11 pagesService - Journal-TB - Dr. Who ClinicJasmine Acta67% (3)

- Problem 1Document8 pagesProblem 1HazeNo ratings yet

- ACCOUNTING CYCLE Leonor CreationsDocument6 pagesACCOUNTING CYCLE Leonor CreationsNadzma Pawaki HashimNo ratings yet

- Fabm 21Document6 pagesFabm 21kristelNo ratings yet

- Bernabe Accounting-FirmDocument33 pagesBernabe Accounting-FirmElla Ramos100% (1)

- General Journal ExcelDocument10 pagesGeneral Journal ExcelJoy Mikaela GozonNo ratings yet

- Ulidsonlen5Document11 pagesUlidsonlen5devora aveNo ratings yet

- Chapter 2 Problems and Solutions EnglishDocument8 pagesChapter 2 Problems and Solutions EnglishyandaveNo ratings yet

- Mangapot Problem Set No. 3Document10 pagesMangapot Problem Set No. 3Lucky MeNo ratings yet

- Question April-2010Document51 pagesQuestion April-2010zia4000100% (1)

- Format Jurnal Perusahaan JasaDocument20 pagesFormat Jurnal Perusahaan JasasainahNo ratings yet

- CHP 2 Exam Preparation ProblemsDocument3 pagesCHP 2 Exam Preparation ProblemsShawn JohnstonNo ratings yet

- LatihanDocument7 pagesLatihanDeny WilyartaNo ratings yet

- Chapter Four AssignmentDocument8 pagesChapter Four AssignmentUrBaN-xGaMeRx TriicKShOtZNo ratings yet

- Notebook 2. Recording Transactions - Posting To The General LedgerDocument4 pagesNotebook 2. Recording Transactions - Posting To The General LedgerCherry RodriguezNo ratings yet

- General Journal: Date Particulars PR Debit CreditDocument5 pagesGeneral Journal: Date Particulars PR Debit CreditRicky Cordova SierraNo ratings yet

- 21S1 AC1103 Lesson 06 Discussion QuestionsDocument14 pages21S1 AC1103 Lesson 06 Discussion Questionsxiu yingNo ratings yet

- Practical Exr 2Document2 pagesPractical Exr 2GUDATA ABARANo ratings yet

- Accounting Cycle SampleDocument7 pagesAccounting Cycle Samplejosedvega178No ratings yet

- AccDocument13 pagesAccFrancis V MaestradoNo ratings yet

- Budget Driving Institute Prob 2&3Document94 pagesBudget Driving Institute Prob 2&3Ma Sophia Mikaela EreceNo ratings yet

- 11 ABM Sean Jairus Lauta FABM PT #1 (AutoRecovered)Document20 pages11 ABM Sean Jairus Lauta FABM PT #1 (AutoRecovered)Sean LautaNo ratings yet

- PA5 Group-5 P1Document6 pagesPA5 Group-5 P1Phuong Nguyen MinhNo ratings yet

- Ledger Posting With OE GL UTB SamplesDocument46 pagesLedger Posting With OE GL UTB SamplesZamantha OliverosNo ratings yet

- TLE Group 1 St. PhilipDocument9 pagesTLE Group 1 St. Philipdaphnie ashley alcazarinNo ratings yet

- 06 BTLE 30043 Santos Repair Shop Complete Cycle StudentDocument29 pages06 BTLE 30043 Santos Repair Shop Complete Cycle StudentnicoleshiNo ratings yet

- Financial Accounting Major Assignment1Document7 pagesFinancial Accounting Major Assignment1Elham JabarkhailNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- Homework Chapter 2: ExerciseDocument6 pagesHomework Chapter 2: ExerciseDiệu QuỳnhNo ratings yet

- Businesses in PoblacionDocument29 pagesBusinesses in PoblacionnicoleshiNo ratings yet

- Module 1 Key To CorrectionsDocument7 pagesModule 1 Key To CorrectionsPlame GaseroNo ratings yet

- CASE 1: PM Company: Total Current Asset 1,750,000Document3 pagesCASE 1: PM Company: Total Current Asset 1,750,000JanineD.MeranioNo ratings yet

- Review Accounting 1Document9 pagesReview Accounting 1jhouvanNo ratings yet

- Chan Accounting FirmDocument45 pagesChan Accounting FirmNina Gaboy100% (1)

- A) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A BusinessDocument12 pagesA) Chart of Accounts: 1. On March 1, 2020, Tahir Muktar, A Famous Businessman in Addis, Opened A Businessrediet solomonNo ratings yet

- Bookkeeping Cycle, Leonor Creations and Wash&clean LaundryDocument18 pagesBookkeeping Cycle, Leonor Creations and Wash&clean LaundryNadzma Pawaki Hashim100% (1)

- Guimbungan, Core Competency Module 1 - Part 3 PDFDocument11 pagesGuimbungan, Core Competency Module 1 - Part 3 PDFSharlyne K. GuimbunganNo ratings yet

- Journal EntryDocument5 pagesJournal EntryABM-AKRISTINE DELA CRUZNo ratings yet

- Basicacctng (Journal, Taccounts, Tbalance)Document2 pagesBasicacctng (Journal, Taccounts, Tbalance)Pearl Jade YecyecNo ratings yet

- Finals Graded Exercises 002 Final Special Journals For Dist. FinalDocument4 pagesFinals Graded Exercises 002 Final Special Journals For Dist. FinalGarpt Kudasai100% (1)

- Louie Anne R. Lim - 03 Activity 1Document3 pagesLouie Anne R. Lim - 03 Activity 1Louie Anne LimNo ratings yet

- Answer 1Document7 pagesAnswer 1Mylene HeragaNo ratings yet

- FM 211 Preparation of Journal EntriesDocument9 pagesFM 211 Preparation of Journal EntriesJuvy Jane DuarteNo ratings yet

- COVID19 KDV 2022 8EMS T3 CASE STUDY 8p3dykDocument6 pagesCOVID19 KDV 2022 8EMS T3 CASE STUDY 8p3dykmarelie eksteenNo ratings yet

- FINMANDocument16 pagesFINMANRonan NabloNo ratings yet

- Far-1 2Document6 pagesFar-1 2tygurNo ratings yet

- Financial Accounting. (Sem-1) 2017-20Document39 pagesFinancial Accounting. (Sem-1) 2017-20Rahul DasNo ratings yet

- May Daya Consultancy ServicesDocument7 pagesMay Daya Consultancy ServicesMary GregorioNo ratings yet

- Comp 2 Activity 5Document13 pagesComp 2 Activity 5Jhon Lester MagarsoNo ratings yet

- Washy Wash Inc. Acctg For Already Existing BusinessDocument20 pagesWashy Wash Inc. Acctg For Already Existing BusinessmapapashishsasarapNo ratings yet

- Svu Bcom CA Syllabus III and IVDocument19 pagesSvu Bcom CA Syllabus III and IVram_somala67% (9)

- GOI Department and MinistriesDocument7 pagesGOI Department and MinistriesgaderameshNo ratings yet

- PhonePe Statement Nov2023 Jan2024Document33 pagesPhonePe Statement Nov2023 Jan2024Arvind KumarNo ratings yet

- Application Form Self Help Groups For PrintoutDocument5 pagesApplication Form Self Help Groups For Printoutnilya7081No ratings yet

- April 2016 - PaySlipDocument1 pageApril 2016 - PaySlipMedi Srikanth NethaNo ratings yet

- Amazon Analysis QuestionsDocument3 pagesAmazon Analysis Questionsapi-260880991No ratings yet

- Capital Market PDFDocument14 pagesCapital Market PDFRenju KokkattNo ratings yet

- Act1 Business Acc. HubiernaDocument3 pagesAct1 Business Acc. Hubiernanew genshinNo ratings yet

- Chapter 2 The Sale of Goods Act 1930Document59 pagesChapter 2 The Sale of Goods Act 1930taufeequeNo ratings yet

- WAPDA Book of Financial Powers (May 2016)Document113 pagesWAPDA Book of Financial Powers (May 2016)waqar67% (3)

- PrepmateDocument69 pagesPrepmatevishal pathaniaNo ratings yet

- 09dinvestmentinequitysecuritiescostequitymethodpdfpdf PDF FreeDocument14 pages09dinvestmentinequitysecuritiescostequitymethodpdfpdf PDF FreeLouierose Joy CopreNo ratings yet

- Report JSWDocument29 pagesReport JSWS nithin100% (1)

- Zonal ZamboangaDocument173 pagesZonal ZamboangaJoelebie Gantonoc Barroca50% (2)

- Company Basic Concept MCQ'sDocument3 pagesCompany Basic Concept MCQ'sFaizan ChNo ratings yet

- Rural Entrepreneurship: Scope & ChallengesDocument26 pagesRural Entrepreneurship: Scope & ChallengesSandeep KumarNo ratings yet

- Susan Lee Weissinger v. James C. White, 733 F.2d 802, 11th Cir. (1984)Document7 pagesSusan Lee Weissinger v. James C. White, 733 F.2d 802, 11th Cir. (1984)Scribd Government DocsNo ratings yet

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaNo ratings yet

- Binghatti Gardenia Sales OfferDocument5 pagesBinghatti Gardenia Sales OfferrasarivalaNo ratings yet

- Annual Report 2019 PDFDocument188 pagesAnnual Report 2019 PDFowen.rijantoNo ratings yet