Professional Documents

Culture Documents

Income Tax Q&A Revision List As Per 13th Edition May 24 & Nov 24

Income Tax Q&A Revision List As Per 13th Edition May 24 & Nov 24

Uploaded by

focuson76540 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

Income Tax Q&A Revision List as Per 13th Edition May 24 & Nov 24

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesIncome Tax Q&A Revision List As Per 13th Edition May 24 & Nov 24

Income Tax Q&A Revision List As Per 13th Edition May 24 & Nov 24

Uploaded by

focuson7654Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

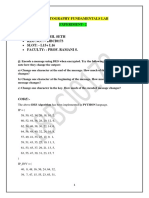

INCOME TAX – REVISION LIST (Q&A) By: CA Vijender Aggarwal

INCOME TAX – REVISION LIST (Q&A)

REVISION LIST FOR SUBJECTIVE Q&A (As Per 13th Edition):

Chapter 1 (Income Tax – Basic Concepts):

Examples Discussed In Class (+) Questions 10 & 11 From Book

Chapter 2 (Residential Status & Scope Of Total Income):

1, 7, 12, 13, 14, 17, 18, 19, 23, 24, 29, 36, 37, 40, 41, 44, 45, 46

Chapter 3 (Salary):

1, 3, 5, 8, 11, 13, 15, 17, 22, 23, 24, 25, 28, 29, 31, 32, 33, 36, 37, 39, 41, 42, 44, 45, 46, 48, 51, 52,

55, 59

Chapter 4 (House Property):

1, 2, 6, 15, 16, 17, 18, 27, 29, 33, 34, 35, 36, 42, 43, 44, 46, 50, 51

Chapter 5 (PGBP)

2, 3, 5, 6, 7, 9, 10, 14, 18, 19, 22, 23, 28, 29, 30, 33, 36, 37, 38, 40, 44, 45, 46, 51, 52, 57, 61, 65

Chapter 6 (Capital Gains):

1, 3, 5, 6, 7, 8, 9, 12, 13, 14, 15, 17, 21, 23, 24, 27, 28, 30, 31, 32, 34, 35, 36, 39, 40, 43, 44, 45, 46,

50, 52, 54, 55

Chapter 7 (Other Sources):

4, 9, 10, 12, 14, 16, 17, 21, 24, 26, 32, 36, 38, 39, 43

Chapter 8 (Agricultural Income):

5, 7, 11, 12, 13, 15, 20, 24, 25, 27, 28

Chapter 9 (Clubbing Of Income):

3, 4, 9, 10, 11, 15, 22, 23, 28, 29, 30

Chapter 10 (Set-Off & Carry-Forward Of Losses):

3, 6, 9, 12, 14, 15, 16, 17, 18

Chapter 11 (Deductions From GTI):

2, 5, 6, 10, 14, 15, 18, 22, 24, 25, 26, 30, 31, 33, 35, 37, 38, 43, 44,

Chapter 12 (TDS & TCS):

4, 5, 9, 11, 12, 14, 17, 20, 26, 29, 30, 33, 40, 41, 42, 43, 44, 45, 46, 47

Chapter 13 (Filing Of Return Of Income):

3, 5, 6, 7, 11, 13, 15, 16, 19, 21, 22, 23, 25, 26, 28, 31, 32

Chapter 14 (Advance Tax):

5, 6, 9, 10, 11, 14, 18

Chapter 15 (Income Tax Liability – Computation & Optimisation):

1, 2, 3, 4, 5, 7, 8, 9, 10, 14, 18, 19, 20, 22

Subscribe CA Vijender Aggarwal’s Telegram Channel (https://t.me/vijenderaggarwaltax) For Accessing Notes,

Summaries, Revisionary Videos, Amendment Notes & Videos, Latest Subjective Q&A, Latest MCQs, etc

INCOME TAX – REVISION LIST (Q&A) By: CA Vijender Aggarwal

REVISION LIST FOR MCQs (As Per 13th Edition):

Chapter 1 (Income Tax – Basic Concepts):

34, 35, 38, 42, 43, 46

Chapter 2 (Residential Status & Scope Of Total Income):

18, 19, 20, 21, 23, 24, 25, 26, 30, 32, 33

Chapter 3 (Salary):

Not Required (Just focus on subjective questions)

Chapter 4 (House Property):

2, 25, 26, 27, 28

Chapter 5 (PGBP)

9, 10, 11, 28, 29, 30, 31, 33, 35, 36, 37, 42, 43

Chapter 6 (Capital Gains):

29, 32, 33, 35, 36, 37, 38, 40, 41, 43, 44, 45

Chapter 7 (Other Sources):

21, 22, 31, 32, 33, 34, 35

Chapter 8 (Agricultural Income):

11, 18, 24, 25, 28, 29

Chapter 9 (Clubbing Of Income):

14, 15, 16, 24, 26, 28, 29, 30, 31, 32, 33

Chapter 10 (Set-Off & Carry-Forward Of Losses):

8, 19, 20, 22, 23, 24

Chapter 11 (Deductions From GTI):

5, 8, 9, 10, 14, 15, 16, 17, 18, 19, 20, 21

Chapter 12 (TDS & TCS):

25, 26, 27, 28, 30, 32, 33, 34, 36, 39, 40, 41

Chapter 13 (Filing Of Return Of Income):

7, 18, 19, 24, 27, 28, 29, 30, 31

Chapter 14 (Advance Tax):

27, 28, 29, 30, 31, 32, 33

Chapter 15 (Income Tax Liability – Computation & Optimisation):

Not Required (Just focus on subjective questions)

Subscribe CA Vijender Aggarwal’s Telegram Channel (https://t.me/vijenderaggarwaltax) For Accessing Notes,

Summaries, Revisionary Videos, Amendment Notes & Videos, Latest Subjective Q&A, Latest MCQs, etc

You might also like

- Clerk of Works and Site Inspector Handbook PDFDocument224 pagesClerk of Works and Site Inspector Handbook PDFKevin JamesNo ratings yet

- PGMP ExamDocument5 pagesPGMP ExamManojJain100% (5)

- H&M AssDocument5 pagesH&M AssDaleesha SanyaNo ratings yet

- GR 172101, AsiaPro PDFDocument6 pagesGR 172101, AsiaPro PDFLeopoldo, Jr. BlancoNo ratings yet

- ACCOUNTANCYDocument2 pagesACCOUNTANCYVansh ShahNo ratings yet

- Ratio Proportion Chapter SplitDocument2 pagesRatio Proportion Chapter SplitAnonymous H8AZMsNo ratings yet

- List of Important Questions Lyst6909Document2 pagesList of Important Questions Lyst6909Techno GamingNo ratings yet

- Solution To Campbell Lo Mackinlay PDFDocument71 pagesSolution To Campbell Lo Mackinlay PDFstaimouk0% (1)

- p2 cw2 Solving Quadratic FactoringDocument4 pagesp2 cw2 Solving Quadratic Factoringapi-268267969No ratings yet

- Solving Quadratic FactoringDocument4 pagesSolving Quadratic FactoringArianne Jayne G. GubaNo ratings yet

- Solving Quadratic FactoringDocument4 pagesSolving Quadratic Factoringapi-268267969No ratings yet

- Solving Quadratic FactoringDocument4 pagesSolving Quadratic Factoringapi-268267969No ratings yet

- Daves HWDocument1 pageDaves HWapi-294313503No ratings yet

- NYB - HR Assignments ProbleDocument1 pageNYB - HR Assignments ProbleRajeeNo ratings yet

- Target SSC CGL Pre: Sheet No. Question NoDocument4 pagesTarget SSC CGL Pre: Sheet No. Question NoNadeem NawazNo ratings yet

- SFM Important Questions - May & Nov 23 EditionDocument1 pageSFM Important Questions - May & Nov 23 EditionsimranNo ratings yet

- SFM Important Questions - May & Nov 23 EditionDocument1 pageSFM Important Questions - May & Nov 23 EditionprajwalaNo ratings yet

- SFM Important Questions - May & Nov 23 EditionDocument1 pageSFM Important Questions - May & Nov 23 Editionphilia.newNo ratings yet

- Solman PDFDocument71 pagesSolman PDFdav00034No ratings yet

- AR Hart Thermometer Chart Ine Chart Rea Charts Band Chart Aterfall Hart N Cell Charting Rept Function Onditional Formatting Icon Set FunctionDocument8 pagesAR Hart Thermometer Chart Ine Chart Rea Charts Band Chart Aterfall Hart N Cell Charting Rept Function Onditional Formatting Icon Set FunctionlmsmNo ratings yet

- Econ CurriculumDocument5 pagesEcon Curriculum서영최No ratings yet

- Chapters Socioeconomy PDFDocument19 pagesChapters Socioeconomy PDFfatkhur_rohman_1No ratings yet

- Practice QuestionsDocument3 pagesPractice QuestionsOsama bin adnanNo ratings yet

- NCERT + MME Book Selected Subj QsDocument3 pagesNCERT + MME Book Selected Subj Qsjyotisahni13No ratings yet

- Exercises For FINTECH 2021Document2 pagesExercises For FINTECH 2021haianh110603No ratings yet

- Chapter 2 Problems PlusDocument4 pagesChapter 2 Problems PlusBong Jit ChauNo ratings yet

- MAT 540 Statistical Concepts For ResearchDocument42 pagesMAT 540 Statistical Concepts For Researchnequwan79No ratings yet

- Jntu Kak 2 2 Eee STLD Set 1 2Document18 pagesJntu Kak 2 2 Eee STLD Set 1 2Harold WilsonNo ratings yet

- Important Questions For EXAMS From Income Tax Question BankDocument3 pagesImportant Questions For EXAMS From Income Tax Question Bankvaibhavayush994No ratings yet

- MAT250 Common Exercise ProblemsDocument2 pagesMAT250 Common Exercise ProblemsMahmud Islam 2211527642No ratings yet

- IBPS QuantitativeDocument44 pagesIBPS QuantitativeRam ChandranNo ratings yet

- Assignment 1 MC2008Document11 pagesAssignment 1 MC2008bubunranaNo ratings yet

- TS Grewal Important Question 2023-24Document5 pagesTS Grewal Important Question 2023-24intelligenceartificial998No ratings yet

- 4.2 Penyajian DataDocument17 pages4.2 Penyajian DataBagus SusantoNo ratings yet

- DT Master Plan: Do Everything & FinallyDocument5 pagesDT Master Plan: Do Everything & FinallyGurvinder Mann Singh PradhanNo ratings yet

- IBPS Clerk Pre 2016 MathsDocument3 pagesIBPS Clerk Pre 2016 MathsMahendraKumarNo ratings yet

- FIRST Year, First Semester FIRST Year, Second SemesterDocument2 pagesFIRST Year, First Semester FIRST Year, Second SemesterKevin RacelisNo ratings yet

- PracticeProblems 4315 SolutionsDocument9 pagesPracticeProblems 4315 SolutionsKashifRizwanNo ratings yet

- Data Preprocessing ML LabDocument6 pagesData Preprocessing ML Labmohan kukrejaNo ratings yet

- Digital Electronics Assignments Nirjari Desai 8q3VqbDocument8 pagesDigital Electronics Assignments Nirjari Desai 8q3VqbMuhammad BasitNo ratings yet

- Ca Inter (Income Tax) Ca Vijender AggarwalDocument2 pagesCa Inter (Income Tax) Ca Vijender AggarwalMehul GuptaNo ratings yet

- Earth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RDocument4 pagesEarth: Current Previous Close 2013 TP Exp Return Support Resistance CGR 2012 N/RCamarada RojoNo ratings yet

- Chapter 5&6Document9 pagesChapter 5&6Bhebz Erin MaeNo ratings yet

- Chapter 2 AnswersDocument4 pagesChapter 2 Answersslurppy3No ratings yet

- Exp-IMPLEMENT A3 A8 AlgorithmsDocument13 pagesExp-IMPLEMENT A3 A8 Algorithmsnihan sezinNo ratings yet

- Expert Math 2 PDFDocument29 pagesExpert Math 2 PDFCharanraj ParichendiNo ratings yet

- Canara Bank Result UpdatedDocument11 pagesCanara Bank Result UpdatedAngel BrokingNo ratings yet

- Step 6: Profiling Segments: 8.1 Identifying Key Characteristics of Market SegmentsDocument15 pagesStep 6: Profiling Segments: 8.1 Identifying Key Characteristics of Market SegmentsFadhili DungaNo ratings yet

- OM Assignment Roll No 88Document14 pagesOM Assignment Roll No 88ankurmakhija50% (4)

- Financial Results For December 31, 2015 (Result)Document2 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderNo ratings yet

- AP Micro SyllabusDocument7 pagesAP Micro Syllabus이재욱No ratings yet

- 1 Number SeriesDocument17 pages1 Number SerieschandraNo ratings yet

- Opening ReporttarraschDocument20 pagesOpening ReporttarraschLuciano LellNo ratings yet

- Anatomy and Physiology p1Document3 pagesAnatomy and Physiology p1Kelly NtangueNo ratings yet

- Set Up An Appropriate Control Chart To Monitor This Process. What Is Your Suggestion About TheDocument1 pageSet Up An Appropriate Control Chart To Monitor This Process. What Is Your Suggestion About TheAdnan HossainNo ratings yet

- Tutorial Math 3171Document159 pagesTutorial Math 3171badarNo ratings yet

- Advanced Algebra 2 Assignment Sheet - Chapter 8: Turn Over For Answers Not in The Book!Document1 pageAdvanced Algebra 2 Assignment Sheet - Chapter 8: Turn Over For Answers Not in The Book!cfortescueNo ratings yet

- Number Series 264Document22 pagesNumber Series 264Abhishek Soni100% (3)

- Solution Manual Elements of Modern Algebra 8Th Edition by Gilbert Isbn 1285463234 9781285463230 Full Chapter PDFDocument36 pagesSolution Manual Elements of Modern Algebra 8Th Edition by Gilbert Isbn 1285463234 9781285463230 Full Chapter PDFmichelle.lowe753100% (17)

- CH 02Document32 pagesCH 02Rushabh VoraNo ratings yet

- Name: - Anshil Seth REG NO.: - 18BCI0173 SLOT: - L15+ L16 Faculty: - Prof. Ramani SDocument11 pagesName: - Anshil Seth REG NO.: - 18BCI0173 SLOT: - L15+ L16 Faculty: - Prof. Ramani SShaunak bagadeNo ratings yet

- QA NextDocument10 pagesQA NextvijithacvijayanNo ratings yet

- Economic and Financial Modelling with EViews: A Guide for Students and ProfessionalsFrom EverandEconomic and Financial Modelling with EViews: A Guide for Students and ProfessionalsNo ratings yet

- Rapid Assessment and Recovery of Troubled Projects PDFDocument20 pagesRapid Assessment and Recovery of Troubled Projects PDFHolly MurrayNo ratings yet

- Chapter 1-7Document48 pagesChapter 1-7Grace Lofranco100% (2)

- Owl Creek Q2 2010 LetterDocument9 pagesOwl Creek Q2 2010 Letterjackefeller100% (1)

- Consumer Preference of Tvs MotorcycleDocument82 pagesConsumer Preference of Tvs MotorcycleSUKUMAR97% (30)

- What Is SIL?: SIL Means Risk Reduction To A Tolerable LevelDocument6 pagesWhat Is SIL?: SIL Means Risk Reduction To A Tolerable Leveljamil voraNo ratings yet

- SR Manager Financial Reporting TaxationDocument1 pageSR Manager Financial Reporting TaxationNiamul HasanNo ratings yet

- Logistic ManagementDocument3 pagesLogistic ManagementThiviah Sanasee100% (1)

- Online TradingDocument64 pagesOnline Tradingferoz5105No ratings yet

- Samuel Lafontaine: Career ObjectiveDocument1 pageSamuel Lafontaine: Career ObjectiveSam LafontaineNo ratings yet

- KeyDocument3 pagesKeyHường Đinh ThịNo ratings yet

- REGISTERED PV SERVICE PROVIDER v4.1Document8 pagesREGISTERED PV SERVICE PROVIDER v4.1ragunatharaoNo ratings yet

- As GR 1 Ipcc Compiler 2015-18Document24 pagesAs GR 1 Ipcc Compiler 2015-18KRISHNA MANDLOINo ratings yet

- Global Movement Types and Accounting DocumentsDocument13 pagesGlobal Movement Types and Accounting DocumentsJoy Kristine BuenaventuraNo ratings yet

- Paper 11 PDFDocument6 pagesPaper 11 PDFKaysline Oscar CollinesNo ratings yet

- Citizen'S Charter: Metals Industry Research & Development CenterDocument73 pagesCitizen'S Charter: Metals Industry Research & Development CenterJohn Mark Almonte MatuguinaNo ratings yet

- Non Disc Hold HarmDocument4 pagesNon Disc Hold HarmSylvester MooreNo ratings yet

- Model PAPER-Analysis of Financial Statement - MBA-BBADocument5 pagesModel PAPER-Analysis of Financial Statement - MBA-BBAvelas4100% (1)

- Data Lakes in A Modern Data ArchitectureDocument23 pagesData Lakes in A Modern Data Architecturei360.pk100% (4)

- Management Question BankDocument3 pagesManagement Question Bankconnect.goldlabsNo ratings yet

- Finance UbiDocument36 pagesFinance UbiRanjeet RajputNo ratings yet

- Jose Fernandez vs. Francisco Dela RosaDocument2 pagesJose Fernandez vs. Francisco Dela RosaValora France Miral AranasNo ratings yet

- Chapter 5 Capacity Management Handout MBA427Document3 pagesChapter 5 Capacity Management Handout MBA427OPS PMLCNo ratings yet

- Experience CertificateDocument5 pagesExperience Certificatedevendrasingh_j9150No ratings yet

- Sherluck Jun C. Villegas: People of The Philippines Vs Dolores Ocdem G.R. No. 173198 (June 1, 2011) FactsDocument4 pagesSherluck Jun C. Villegas: People of The Philippines Vs Dolores Ocdem G.R. No. 173198 (June 1, 2011) FactsAnonymous XFtQQ0hNo ratings yet

- The Baton Rouge Area Sports Foundation Social Media Plan BookDocument15 pagesThe Baton Rouge Area Sports Foundation Social Media Plan Bookapi-218506392No ratings yet

- Chapter 4 The Business Research ProcessDocument30 pagesChapter 4 The Business Research ProcessAmanda SamarasNo ratings yet