Professional Documents

Culture Documents

GodrejIndustriesLtdQ4FY2022 23PerformanceUpdate

Uploaded by

Prity KumariOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GodrejIndustriesLtdQ4FY2022 23PerformanceUpdate

Uploaded by

Prity KumariCopyright:

Available Formats

Performance Update

Q4 & FY 2022-23

May,19, 2023

1 I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

DISCLAIMER

“Some of the statements in this communication may be ‘forward looking statements’

within the meaning of applicable laws and regulations. Actual results might differ

substantially or materially from those expressed or implied. Important developments

that could affect the Company’s operations include changes in industry structure,

significant changes in political and economic environment in India and overseas, tax

laws, import duties, litigation and labour relations.”

2 I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

PRESENTATION FLOW

• Results

• Financial Highlights – Consolidated

• Segment Performance

• Business Performance

• Performance highlights including Subsidiaries and Associates

• Other information

3 I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

FINANCIAL HIGHLIGHTS – CONSOLIDATED

4 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

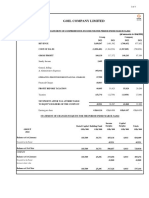

FINANCIAL HIGHLIGHTS - CONSOLIDATED

Q4 Q4

Particulars % FY FY %

FY FY

(₹crore) Growth 2022-23 2021-22 Growth

2022-23 2021-22

Total Income 5,085 4,727 8% 17,762 15,065 18%

PBDIT * 1,042 802 30% 2,928 2,179 34%

Depreciation 79 72 - 305 274 -

PBIT* 962 730 32% 2,623 1,906 38%

Interest 284 175 - 943 623 -

Net Profit *#

300 227 32% 975 654 49%

* Including share of profit in associates & exceptional.

# With share of profit in associate companies, post reduction of non-controlling interest.

5 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

CONSOLIDATED RESULTS – SEGMENT PERFORMANCE

6 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

SEGMENT-WISE CONTRIBUTION TO FINANCIALS:

Q4 FY 2022-23

Revenue * (₹ crore) PBIT * (₹ crore)

144 13

857 135

1,859 46

13

20

1,218

528

277

242 399

*excluding others segment.

7 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

SEGMENT-WISE CONTRIBUTION TO FINANCIALS:

FY 2022-23

Revenue * (₹ crore) PBIT * (₹ crore)

9

525

3,119 4,173

697

1,003

1,931

1,196 185

4,957

1,501 126

261

*excluding others segment.

8 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

BUSINESS PERFORMANCE: Performance Highlights

incl. subsidiaries, JVs and Associates

9 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

CONSUMER (GCPL)

Business and Financial Highlights for Q4 FY2022-23:

• Consolidated sales grew by 10% INR and 14% constant currency year-on-year.

• Consolidated EBITDA grew by 32% year-on-year.

• Consolidated net profit grew by 29% year-on-year (without exceptional items and one offs).

• Category Review

• Home Care: Home Care grew by 14%. Household Insecticides continued to improve its growth

trajectory, with growth in teens. Performance was broad based with both the mosquito and non-

mosquito portfolio growing in double digits. Air Fresheners continue to consistently deliver

strong double-digit growth.

• Personal Care: Personal Care grew by 17%, Personal Wash delivered double-digit growth led

by healthy volume growth. Magic Handwash grew double digits in volume terms. Hair Colour

continued to consistently deliver strong double-digit growth.

10 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

CHEMICALS

Financial Highlights Product Portfolio Q4 FY 2022-23

Q4 Q4 FY-23 FY-22

₹ crore FY-23 FY-22 Surfactant

17% Fatty Alcohols

Glycerin

33%

Revenue 857 802 4173 3057 4%

PBIT 135 83 697 334

• Revenues for Q4FY23 increased by 7% & FY23

increased by 37%

• PBIT for Q4FY23 increased by 63% & FY23 increased by

108% 46%

• Exports for FY23 stood at ₹1,383 crore

Fatty Acid

Godrej Industries Ltd (Chemicals) has received the

prestigious Export Excellence Award

11 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

REAL ESTATE

Godrej Properties Limited (GPL) - Consolidated Financial Highlights:

₹ crore Q4 Q4 FY23 FY22

FY23 FY22

Total Income 1,930 1,476 2,998 2,397

412 260 571 352

Net Profit after tax

Business & Sales Highlights for Q4 & FY 2022-23

• GPL’s best ever quarterly sales- booking value stood at ₹ 4,051 crore in Q4 FY23, up 25%

• GPL’s best ever annual sales- booking value stood at ₹ 12,232 crore in FY23, up 56%

• Added 5 new projects with a total estimated saleable area of nearly 9 million sq. ft. and total

estimated booking value of ~₹ 5,750 Crore in Q4 FY23.

• Received 17 awards in Q4 FY23 and a total of 91 awards in FY23

12 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

AGRI BUSINESS

Godrej Agrovet Limited (GAVL) - Consolidated Financial Highlights

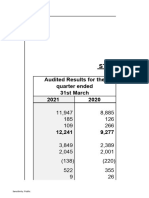

₹ crore Q4 FY23 Q4 FY22 FY23 FY22

Total Income 2,108 2,134 9,481 8,386

Net Profit after tax 31 122 302 403

▪ Animal Feed: Animal Feed segment revenue for the quarter grew by 10% however the margin for

the quarter was impacted by volatile commodity price movements and limited transmission due to

pricing pressure, mainly in poultry feed.

▪ Vegetable Oil: Strong volume growth in Q4 FY23; however, performance was impacted by lower

crude palm oil prices as compared to previous year.

▪ Crop Protection Business: In Q4FY23, Consolidated revenues stood at ₹242 crore as compared

to ₹353 crore in the corresponding quarter of the previous year.

▪ Dairy: In Q4FY23, revenues stood at ₹399 crore a growth of 19% as compared to the

corresponding quarter of the previous year.

13 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

OTHER INFORMATION

14 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

GODREJ INDUSTRIES LIMITED

CORPORATE STRUCTURE

Own Businesses:

Chemicals, Estate Management, Shareholding %

Finance & Investments

Godrej Consumer Godrej Capital

Godrej Properties Godrej Agrovet

Products 87.2% (Financial Others

47.3% 64.9%

23.7% Services)

• Other

investments

15 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

SIGNIFICANT APPRECIATION IN INVESTMENT VALUE

Investment at Market Value ^

Holding

Company Business cost of investment

(%) (₹ crore)

(₹ crore)

FMCG, Personal and

Godrej Consumer

Household Care 23.7% 1,366 23,513

Products (GCPL)

products

Godrej Properties Real Estate and

47.3% 1780 13,564

(GPL) Property Development

Animal Feed, Agri-

Godrej Agrovet inputs, Poultry, Dairy & 64.9% 1043 5,148

Oil Palm

Godrej Capital Ltd Financial Services 87.2% 1494

Godrej International International Trading 100% 15

Godrej International & International Trading &

100% 4

Trading Investments

Others -- 23

Total 5,725

16 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

^ as on Mar 31, 2023

SHAREHOLDING PATTERN AS ON MAR 31, 2023

Others, 6.16% Vanguard

United Insurance

DII, 2.89% AVI Global

Scottish Oriental

FII, 10.41%

First State

Godrej

Foundation,

13.37%

Habrock

Others

Promoter, LIC

67.17%

MSCI

Major Institutional Investors

17 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

THANKYOU

THANK YOUFOR

FORYOUR

YOURTIME

TIMEAND

ANDCONSIDERATION

CONSIDERATION

18 I I Godrej Industries Limited I Q4 & FY 2022-23 | Performance Update | May 19,2023

You might also like

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Godrej Industries Limited: Performance Update - Q4 & FY 2019-20Document19 pagesGodrej Industries Limited: Performance Update - Q4 & FY 2019-20pragadeesh jayaramanNo ratings yet

- JINDALSAW 16012024141843 FinancialHighlightDocument7 pagesJINDALSAW 16012024141843 FinancialHighlightPrithu RajNo ratings yet

- TASCODocument13 pagesTASCOsozodaaaNo ratings yet

- RADICO - Investor Presentation - 02-Nov-21 - TickertapeDocument22 pagesRADICO - Investor Presentation - 02-Nov-21 - TickertapeGyandeep KumarNo ratings yet

- Allcargo Investor PresentationDocument49 pagesAllcargo Investor Presentationme.lucha.badmashNo ratings yet

- S E Intimation Earnings Presentation 31.03.2023Document25 pagesS E Intimation Earnings Presentation 31.03.2023dinesh suresh KadamNo ratings yet

- Balkrishna Industries Investor PresentationDocument34 pagesBalkrishna Industries Investor PresentationAnand SNo ratings yet

- Redginton Q4 FY22Document26 pagesRedginton Q4 FY22nitin2khNo ratings yet

- Annual Report of Fy 2021 22Document156 pagesAnnual Report of Fy 2021 22DUBEY ADARSHNo ratings yet

- GH SCB Ghana Full Year Financial Statement For Year 2021Document1 pageGH SCB Ghana Full Year Financial Statement For Year 2021Fuaad DodooNo ratings yet

- BKT InvestorPresentation March2020Document34 pagesBKT InvestorPresentation March2020Rina JageNo ratings yet

- Bse 2Document18 pagesBse 2Aashish JainNo ratings yet

- 1QFY23Document14 pages1QFY23Rajendra AvinashNo ratings yet

- Reliance Press Release-JuneDocument9 pagesReliance Press Release-Junenakarani39No ratings yet

- Investor Presentation Mar21Document34 pagesInvestor Presentation Mar21Sanjay RainaNo ratings yet

- Investor Presentation Q4 FY23Document40 pagesInvestor Presentation Q4 FY23Ronak Pradeep SoniNo ratings yet

- NAZARA 20102022184857 IntimationofInvestorPresentation Q2Document27 pagesNAZARA 20102022184857 IntimationofInvestorPresentation Q2apoorvsharanNo ratings yet

- FFL Business review-CBS 2024Document19 pagesFFL Business review-CBS 2024Ali RanaNo ratings yet

- Phiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedDocument6 pagesPhiroze Jeejeebhoy Towers Dalal Street Mumbai - 400 001.: BSE Limited National Stock Exchange of India LimitedJITHIN KRISHNAN MNo ratings yet

- Kaushal Kumar Agarwal: The Manager The ManagerDocument33 pagesKaushal Kumar Agarwal: The Manager The ManagerGurjeevNo ratings yet

- Accountancy ProjectDocument27 pagesAccountancy ProjectLINCY ELDHONo ratings yet

- Jamna Auto 2017-18Document184 pagesJamna Auto 2017-18Karun DevNo ratings yet

- AFFLE - Investor Presentation - 05-Feb-22 - TickertapeDocument26 pagesAFFLE - Investor Presentation - 05-Feb-22 - TickertapebhanupalavarapuNo ratings yet

- LPPF Laporan InformasiDocument13 pagesLPPF Laporan InformasiDaniel PradityaNo ratings yet

- Amber Enterprises India LTD: Investor Release: 23 May 2021, New DelhiDocument3 pagesAmber Enterprises India LTD: Investor Release: 23 May 2021, New DelhiVasim MerchantNo ratings yet

- Media Release RIL Q1 FY2023 24Document40 pagesMedia Release RIL Q1 FY2023 24Amit KumarNo ratings yet

- Note On The Restated Financial and Operating Information:: Basis of PreparationDocument59 pagesNote On The Restated Financial and Operating Information:: Basis of PreparationGrace StylesNo ratings yet

- MM Forgings MM Forgings: Auto AutoDocument22 pagesMM Forgings MM Forgings: Auto Autorchawdhry123No ratings yet

- Investor Presentation Q1 FY23Document25 pagesInvestor Presentation Q1 FY23Anirban BhattacharyaNo ratings yet

- Acharya Electronics Bhakundebesi 07, Namobuddha Kavre Nepal Project Feasibility ReportDocument9 pagesAcharya Electronics Bhakundebesi 07, Namobuddha Kavre Nepal Project Feasibility ReportRamHari AdhikariNo ratings yet

- GoodluckDocument34 pagesGoodluckSarma P.J.No ratings yet

- Investor Presentation FY 2023: Aegis Logistics LTDDocument42 pagesInvestor Presentation FY 2023: Aegis Logistics LTDGurjeevNo ratings yet

- 0176 KRONO QR 2022-07-31 KronologiGroupNotestoresultQ22023 1898469086Document9 pages0176 KRONO QR 2022-07-31 KronologiGroupNotestoresultQ22023 1898469086FK MNo ratings yet

- Harish Anchan: Re:-Annual Report For The Financial Year Ended 31 March 2023Document209 pagesHarish Anchan: Re:-Annual Report For The Financial Year Ended 31 March 2023abhi1234kumar402389No ratings yet

- CAL BankDocument2 pagesCAL BankFuaad DodooNo ratings yet

- Icra 200306FMCGDocument12 pagesIcra 200306FMCGSylvia GraceNo ratings yet

- Financial Statement Q2-2018Document13 pagesFinancial Statement Q2-2018Bharath Simha ReddyNo ratings yet

- KPI Q1 FY24 June2023Document12 pagesKPI Q1 FY24 June2023tapas.patel1No ratings yet

- 2cjvoeqflu7sw8 Yid1o4pb 6cvddrcbdeqj Kz6clyDocument24 pages2cjvoeqflu7sw8 Yid1o4pb 6cvddrcbdeqj Kz6clySuzlonNo ratings yet

- Nippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportDocument36 pagesNippon Paint Group Medium-Term Plan (FY2021-2023) Update ReportRahiNo ratings yet

- KOEL Investor Presentation March 2015Document17 pagesKOEL Investor Presentation March 2015Yash PatelNo ratings yet

- Unaudited Financial Statements For The Period Ended 31 March, 2022Document2 pagesUnaudited Financial Statements For The Period Ended 31 March, 2022Fuaad DodooNo ratings yet

- Goil Company Limited: Group Unaudited Statement of Comprehensive Income For The Period Ended March 31,2022Document4 pagesGoil Company Limited: Group Unaudited Statement of Comprehensive Income For The Period Ended March 31,2022Fuaad DodooNo ratings yet

- Website Public Disclosure Mar-2022 BupaDocument101 pagesWebsite Public Disclosure Mar-2022 BupaYash DoshiNo ratings yet

- Cia2Document10 pagesCia2srikanthor2003No ratings yet

- 2022 10 14 SMGRDocument2 pages2022 10 14 SMGRfirmanNo ratings yet

- Media Release RIL Q3 FY23 20012023Document38 pagesMedia Release RIL Q3 FY23 20012023Riya ThakurNo ratings yet

- Maxs Sec 17-q Report q3 2022 11nov2022Document61 pagesMaxs Sec 17-q Report q3 2022 11nov2022Rachel VillanoNo ratings yet

- Earnings Presentation For December 31, 2016 (Company Update)Document26 pagesEarnings Presentation For December 31, 2016 (Company Update)Shyam SunderNo ratings yet

- BackgroundDocument2 pagesBackgroundAlkesh SadhwaniNo ratings yet

- Annual Accounts Press Conference.: 18 MARCH 2020Document54 pagesAnnual Accounts Press Conference.: 18 MARCH 2020Katarina DasicNo ratings yet

- IPO Market Nov-2023Document4 pagesIPO Market Nov-2023Deepan KapadiaNo ratings yet

- Majeed Traders Projections 2024 To 2025Document12 pagesMajeed Traders Projections 2024 To 2025vayave5454No ratings yet

- BAL Hly Report 2021 Web IndiDesignDocument4 pagesBAL Hly Report 2021 Web IndiDesignAarav MehtaNo ratings yet

- Capital Plastic 2021Document78 pagesCapital Plastic 2021JanosNo ratings yet

- Consolidated Statement of Profit and LossDocument1 pageConsolidated Statement of Profit and LossSukhmanNo ratings yet

- EYFR - Budget Briefing - 2022Document75 pagesEYFR - Budget Briefing - 2022Tariq HussainNo ratings yet

- Board's Report: Financial ResultsDocument22 pagesBoard's Report: Financial ResultsRNo ratings yet

- BizBuilder BlitzDocument1 pageBizBuilder BlitzPrity KumariNo ratings yet

- FSA&R Module 5Document9 pagesFSA&R Module 5Prity KumariNo ratings yet

- Godrej Consumer Products Result Update - Q1FY23Document4 pagesGodrej Consumer Products Result Update - Q1FY23Prity KumariNo ratings yet

- MQ'21 Results in ExcelDocument100 pagesMQ'21 Results in ExcelPrity KumariNo ratings yet

- History of DiamondsDocument21 pagesHistory of Diamondssilvernitrate1953No ratings yet

- Sensors & Transducers: (Code: EI 401)Document4 pagesSensors & Transducers: (Code: EI 401)Mayukh BiswasNo ratings yet

- Genesis of KupferschieferDocument15 pagesGenesis of KupferschieferMaricela GarciaNo ratings yet

- User Instructions For WRC1021DDocument15 pagesUser Instructions For WRC1021DjfcNo ratings yet

- IPC-S-816 SMT Process Guideline ChecklistDocument4 pagesIPC-S-816 SMT Process Guideline Checklistmigant23uNo ratings yet

- (Rect-15) Experimental Study On Partial Replacement of Cement With Coconut Shell Ash in ConcreteDocument3 pages(Rect-15) Experimental Study On Partial Replacement of Cement With Coconut Shell Ash in Concretefrancis dimakilingNo ratings yet

- Https - Threejs - Org - Examples - Webgl - Fire - HTMLDocument9 pagesHttps - Threejs - Org - Examples - Webgl - Fire - HTMLMara NdirNo ratings yet

- 520l0553 PDFDocument52 pages520l0553 PDFVasil TsvetanovNo ratings yet

- Reason: God Had Made The Mistake of Sending Only 70 PesosDocument2 pagesReason: God Had Made The Mistake of Sending Only 70 PesosS Vaibhav81% (21)

- Toolbox Talks Working at Elevations English 1Document1 pageToolbox Talks Working at Elevations English 1AshpakNo ratings yet

- The Relaxation Solution Quick Start GuideDocument17 pagesThe Relaxation Solution Quick Start GuideSteve DiamondNo ratings yet

- Exact Solution Tank DrainageDocument8 pagesExact Solution Tank DrainageFelipe CastNo ratings yet

- Ryan's DilemmaDocument11 pagesRyan's DilemmaAkhi RajNo ratings yet

- Omyacarb 1t TNDocument1 pageOmyacarb 1t TNGİZEM DEMİRNo ratings yet

- Bams 1st Rachna Sharir Joints and Their Classification 16-05-2020Document15 pagesBams 1st Rachna Sharir Joints and Their Classification 16-05-2020Sanjana SajjanarNo ratings yet

- Chapter 4 TurbineDocument56 pagesChapter 4 TurbineHabtamu Tkubet EbuyNo ratings yet

- Edrolo ch3Document42 pagesEdrolo ch3YvonneNo ratings yet

- MicrosoftDynamicsNAVAdd OnsDocument620 pagesMicrosoftDynamicsNAVAdd OnsSadiq QudduseNo ratings yet

- Volume 2 Part 1 - Civil & Arch SpecificationsDocument173 pagesVolume 2 Part 1 - Civil & Arch Specificationsanish100% (1)

- TL K1 2 1 04 VSD35 Varyset DE enDocument25 pagesTL K1 2 1 04 VSD35 Varyset DE enAkilaJosephNo ratings yet

- Barilla SpaDocument11 pagesBarilla Spavariapratik100% (1)

- Electrical BOQ 07.12.2021 New Boq R4 05-01-2022 Final 16.02.2022Document92 pagesElectrical BOQ 07.12.2021 New Boq R4 05-01-2022 Final 16.02.2022Upendra ChariNo ratings yet

- Fermat Contest: Canadian Mathematics CompetitionDocument4 pagesFermat Contest: Canadian Mathematics Competitionสฮาบูดีน สาและNo ratings yet

- Catalyst Worksheet - SHHSDocument3 pagesCatalyst Worksheet - SHHSNerd 101No ratings yet

- Phase-Locked Loop Independent Second-Order Generalized Integrator For Single-Phase Grid SynchronizationDocument9 pagesPhase-Locked Loop Independent Second-Order Generalized Integrator For Single-Phase Grid SynchronizationGracella AudreyNo ratings yet

- Linear Predictor: Nature of Linear PredictionDocument9 pagesLinear Predictor: Nature of Linear PredictionkvNo ratings yet

- Design and Management of Mettur Dam by Predicting Seepage Losses Using Remote SensingDocument10 pagesDesign and Management of Mettur Dam by Predicting Seepage Losses Using Remote SensingInternational Journal of Application or Innovation in Engineering & ManagementNo ratings yet

- DattadasDocument4 pagesDattadasJéssica NatáliaNo ratings yet

- Module 5: Safety and Health at Work: Participant's HandbookDocument24 pagesModule 5: Safety and Health at Work: Participant's HandbookChristian Surio RamosNo ratings yet

- Surface & Subsurface Geotechnical InvestigationDocument5 pagesSurface & Subsurface Geotechnical InvestigationAshok Kumar SahaNo ratings yet