Professional Documents

Culture Documents

A Study On Computation of Salary With Respect To Financial Institution's Employees

Uploaded by

prajapatirohini360 ratings0% found this document useful (0 votes)

3 views3 pagesOriginal Title

a study on computation of salary with respect to financial institution's employees

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views3 pagesA Study On Computation of Salary With Respect To Financial Institution's Employees

Uploaded by

prajapatirohini36Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 3

INTRODUCTION

The computation of income technique is an assessment approach used to estimate an estate,

produced by dividing the capitalisation or amount by the net computation of income of the rental

amounts. However, investors use the computation of income to calculate the value of assets

depending on how profitable they are. This strategy focuses on the distribution of national income.

In other words, the money that people in a country pay or get when it is allotted to government

expenditure is called national income. Hence, using this strategy, national income is the sum of the

incomes of all citizens of a country. By contributing their time and resources, such as land

and cash, citizens benefit from the nation’s output.

A salary is a form of periodic payment from an employer to an employee, which may be specified in

an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid

separately, rather than on a periodic basis. Salary can also be considered as the cost of hiring and

keeping human resources for corporate operations, and is hence referred to as personnel expense or

salary expense. In accounting, salaries are recorded in payroll accounts.

A salary is a fixed amount of money or compensation paid to an employee by an employer in return

for work performed. Salary is commonly paid in fixed intervals, for example, monthly payments of

one-twelfth of the annual salary.

Salaries are typically determined by comparing market pay-rates for people performing similar work

in similar industries in the same region. Salary is also determined by leveling the pay rates and salary

ranges established by an individual employer. Salary is also affected by the number of people

available to perform the specific job in the employer's employment locale.

Meaning of salary computation

The formula for gross pay is as follows. Gross pay = Basic pay + HRA + DA + medical + conveyance

+ other allowances. However, if an individual knows the gross pay, then they can easily find the basic

salary with the given formula. Basic salary = Gross salary - DA - HRA - conveyance - medical - other

allowances.

Five Heads of Income for Computation of Income Tax

As per Section 14 of the Income Tax Act, all earnings are categorised under these heads of income for

calculating tax and the computation of total revenue.

Income from salaries

An income might be burdened under the head salaries of a business and representative association

between the payer and the payee. If this connection didn’t exist, the pay wouldn’t be decided. On the

off chance that there is no component of the business representative association, the payment will be

not assessable under this classification of pay.

Income from house property

The expense on the rental payments from the property is also the charge on that income. However, if

the property isn’t rented out, the cost will be calculated based on the assessed lease that would have

been acquired if the property had been leased.

The principal pay exposed to the load on a public premise appears to be from house property. This

charge includes income from residential rental homes and commercial and other property gains. This

pay class also allows for deductions with the standard deduction, the deduction for municipal taxes

paid, and the deduction for home loan interest.

Profits and gains from business or profession

Any income from the exchange/business/produce/calling will be burdened under this pay class after

deducting endorsed consumption.

Income from capital gains

Any benefits or gains emerging from the exchange of a capital resource affected in the financial year

will be chargeable to income tax under capital gains. They will be considered the pay of the year the

exchange occurred except if such capital increases.

Income from Other Sources

Any pay not chargeable to bun under the above determined four heads will be available under this

head of income. It turns out such revenue isn’t excluded from the calculation of total pay.

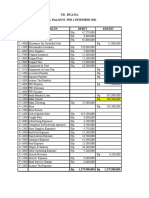

INDEX

You might also like

- Net Operating IncomeDocument5 pagesNet Operating IncomeNishant NagpurkarNo ratings yet

- Consulting Services Business PlanDocument30 pagesConsulting Services Business PlanPalo Alto Software100% (3)

- Understanding Salary Breakup, Salary Structure, and Salary ComponentsDocument11 pagesUnderstanding Salary Breakup, Salary Structure, and Salary ComponentsDoss MartinNo ratings yet

- A Accrual Accounting MethodDocument19 pagesA Accrual Accounting MethodVivian Montenegro GarciaNo ratings yet

- Salary Income LawDocument25 pagesSalary Income Lawvishal singhNo ratings yet

- Salary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsDocument6 pagesSalary, Net Salary, Gross Salary, Cost To Company Are They Same or Different. For Most People It IsAnonymous CwxsRiwNo ratings yet

- 2.1 Discuss The Different Components of SalaryDocument11 pages2.1 Discuss The Different Components of SalarymohithNo ratings yet

- Auditing Problem ReviewerDocument10 pagesAuditing Problem ReviewerTina Llorca83% (6)

- Accounting Cycle Exercises IDocument58 pagesAccounting Cycle Exercises IMd Mobasshir Iqubal100% (1)

- Company Financial Salaries Wages Deductions: Payroll Taxes in U.SDocument4 pagesCompany Financial Salaries Wages Deductions: Payroll Taxes in U.SSampath KumarNo ratings yet

- Operations & Financial PlanDocument41 pagesOperations & Financial Plansweetlunacy00100% (1)

- Epiroc CMDDocument97 pagesEpiroc CMDJustin CorbettNo ratings yet

- Concept of Salary Under Income Tax ActDocument29 pagesConcept of Salary Under Income Tax ActMaaz Alam100% (1)

- Income From Salary-FinalDocument42 pagesIncome From Salary-FinalPrathibha TiwariNo ratings yet

- Ethiopian Payroll System.: Payroll Accounting Is Important For The Following ReasonsDocument16 pagesEthiopian Payroll System.: Payroll Accounting Is Important For The Following ReasonsRashzi Peace PoyNo ratings yet

- Inventories Problems To DiscussDocument6 pagesInventories Problems To Discusskeisha santosNo ratings yet

- Deduction From Salary Under The Head SalaryDocument22 pagesDeduction From Salary Under The Head SalaryRishabhBhargav0% (1)

- SMEDA Ice Plant (15 Tons)Document19 pagesSMEDA Ice Plant (15 Tons)Hezekiah Reginalde RectaNo ratings yet

- Classification of Taxable Income Under Various Heads and Computation of Taxable IncomeDocument4 pagesClassification of Taxable Income Under Various Heads and Computation of Taxable IncomeAnkit Kr MishraNo ratings yet

- KSRTCDocument39 pagesKSRTCVidyaNo ratings yet

- What Is Gross Income - Definition, Formula, Calculation, and ExampleDocument7 pagesWhat Is Gross Income - Definition, Formula, Calculation, and ExampleKapil SharmaNo ratings yet

- Income Taxation NotesDocument3 pagesIncome Taxation NotesJea XeleneNo ratings yet

- Definition of Terms: GROSS INCOME: Classification of Taxpayers, Compensation Income, and Business IncomeDocument13 pagesDefinition of Terms: GROSS INCOME: Classification of Taxpayers, Compensation Income, and Business IncomeSKEETER BRITNEY COSTANo ratings yet

- 413sol3 04Document17 pages413sol3 04drtoeNo ratings yet

- Tax Law ProjectDocument24 pagesTax Law ProjectDeepesh SinghNo ratings yet

- Chapter 3Document14 pagesChapter 3Fethi ADUSSNo ratings yet

- Payroll Glosary InglesDocument7 pagesPayroll Glosary InglesAlejoTiradoNo ratings yet

- Taxation Law Question Bank BALLBDocument49 pagesTaxation Law Question Bank BALLBaazamrazamaqsoodiNo ratings yet

- Eco Wage 1Document5 pagesEco Wage 1rkNo ratings yet

- LC Acct LL CH4@2015Document12 pagesLC Acct LL CH4@2015newaybeyene5No ratings yet

- Direct TaxDocument26 pagesDirect Taxhermionegranger0703No ratings yet

- Heads of Income TaxDocument6 pagesHeads of Income Taxkanchan100% (1)

- Act06 - Lfau222n002 - Tobilla, Jose Mari ConstantinoDocument2 pagesAct06 - Lfau222n002 - Tobilla, Jose Mari ConstantinoAbi MariaNo ratings yet

- 8531 1uniDocument18 pages8531 1uniMs AimaNo ratings yet

- Salary StructureDocument4 pagesSalary Structure19UBCA020 HARIHARAN KNo ratings yet

- Taxation - Part4.2 SyllabusDocument17 pagesTaxation - Part4.2 SyllabusJoAiza DiazNo ratings yet

- Chapter 6 - Income TaxDocument12 pagesChapter 6 - Income TaxlovelyrichNo ratings yet

- Accounting Assignment 1Document12 pagesAccounting Assignment 1TongNo ratings yet

- IncomeTaxation VirreyDocument14 pagesIncomeTaxation VirreyAdilyn Grace VirreyNo ratings yet

- Assignment of M.com Sem 1 2Document38 pagesAssignment of M.com Sem 1 2PriyaNo ratings yet

- Total Income 1Document31 pagesTotal Income 1swatiNo ratings yet

- Minimum Wage: It Is That Wage That Must Be Paid Whether The Company Earns Any Profit or Not. ThisDocument8 pagesMinimum Wage: It Is That Wage That Must Be Paid Whether The Company Earns Any Profit or Not. Thissurabhi mandalNo ratings yet

- 15 - All Five Heads of Income and Their Deductions in Detail.Document4 pages15 - All Five Heads of Income and Their Deductions in Detail.ArvindNo ratings yet

- Perso Nal Plannin G: Saket Kumar Singh (91046) Hunedali Chasmawala (91136) Ankush Jha (91167) Ketan Chanana (91170)Document52 pagesPerso Nal Plannin G: Saket Kumar Singh (91046) Hunedali Chasmawala (91136) Ankush Jha (91167) Ketan Chanana (91170)Shujat AliNo ratings yet

- Income From SalariesDocument30 pagesIncome From SalariesDeepak Gupta50% (2)

- Unit 3Document7 pagesUnit 3piyush.birru25No ratings yet

- Taxation Law CIA 1 (B) Salary AnalysisDocument3 pagesTaxation Law CIA 1 (B) Salary Analysisawinash reddyNo ratings yet

- Business Income SummaryDocument3 pagesBusiness Income SummaryShivani JatakiyaNo ratings yet

- Personal Tax PlanningDocument9 pagesPersonal Tax PlanningGayathri SudheerNo ratings yet

- The Law Reviews - The Executive Remuneration ReviewDocument20 pagesThe Law Reviews - The Executive Remuneration ReviewranjanjhallbNo ratings yet

- Group-3 Forro Written ReportDocument3 pagesGroup-3 Forro Written ReportShaira BaltazarNo ratings yet

- B9-057 - VanshPatel - Assignment 4Document6 pagesB9-057 - VanshPatel - Assignment 4Vansh PatelNo ratings yet

- A Primer On Financial StatementsDocument11 pagesA Primer On Financial StatementsPranay NarayaniNo ratings yet

- Tax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLDocument7 pagesTax Planning / Tax Saving Tips For Financial Year 2018-19: Taxguru - In/income-Tax/tax-Planning-Save-Tax - HTMLmansiNo ratings yet

- Tata SteelDocument3 pagesTata SteelBinodini SenNo ratings yet

- Taxation of Fringe BenefitsDocument5 pagesTaxation of Fringe BenefitsTawanda Tatenda HerbertNo ratings yet

- Deferred Charge: DEFINITION of 'Regulatory Asset'Document6 pagesDeferred Charge: DEFINITION of 'Regulatory Asset'Joie CruzNo ratings yet

- Accounting RelationshipDocument2 pagesAccounting RelationshipJoem'z Burlasa-Amoto Esler-DionaldoNo ratings yet

- Final Project of TaxDocument26 pagesFinal Project of TaxakshataNo ratings yet

- Law of Taxation: Concept of Salary Under Income Tax Act, 1961Document28 pagesLaw of Taxation: Concept of Salary Under Income Tax Act, 1961Sapna RajmaniNo ratings yet

- Net Income NI Definition Uses and How To Calculate ItDocument4 pagesNet Income NI Definition Uses and How To Calculate IthieutlbkreportNo ratings yet

- Intermediate Accounting IIIDocument12 pagesIntermediate Accounting IIIAlma FigueroaNo ratings yet

- Revenue & ExpenseDocument5 pagesRevenue & ExpenseJohn MilnerNo ratings yet

- The Profit and Loss StatementDocument5 pagesThe Profit and Loss Statementnenaddejanovic100% (1)

- Interest: L PinDocument8 pagesInterest: L Pineka putri sri andrianiNo ratings yet

- 1) How Income Tax Works in India?: GST Is One of The Biggest Indirect Tax Reforms in The CountryDocument21 pages1) How Income Tax Works in India?: GST Is One of The Biggest Indirect Tax Reforms in The Countryaher unnatiNo ratings yet

- Maximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryFrom EverandMaximizing Your Wealth: A Comprehensive Guide to Understanding Gross and Net SalaryNo ratings yet

- Infosys Annual Report 2004Document156 pagesInfosys Annual Report 2004Niranjan PrasadNo ratings yet

- Final Yr Finance ProjectDocument86 pagesFinal Yr Finance ProjectRajesh Khanna0% (1)

- Financial Management MDocument3 pagesFinancial Management MYaj CruzadaNo ratings yet

- Book - Keeping and AccountingDocument5 pagesBook - Keeping and AccountingAshish DhakalNo ratings yet

- TOA Midterm Exam 2010Document22 pagesTOA Midterm Exam 2010Patrick WaltersNo ratings yet

- Test Bank For Environmental Geology 9th Edition by MontgomeryDocument32 pagesTest Bank For Environmental Geology 9th Edition by MontgomeryDanny SullivanNo ratings yet

- Ukk 2023 P2-Kunci Jawaban RevDocument47 pagesUkk 2023 P2-Kunci Jawaban RevSaepul RohmanNo ratings yet

- BLMGNF Thousand Currents Asset Transfer AgreementDocument58 pagesBLMGNF Thousand Currents Asset Transfer AgreementWashington ExaminerNo ratings yet

- UntitledDocument46 pagesUntitledBaby PinkNo ratings yet

- Libby7ce PPT Ch09Document47 pagesLibby7ce PPT Ch09Moussa ElsayedNo ratings yet

- Accounting Errors and Their CorrectionDocument32 pagesAccounting Errors and Their CorrectionmillzmartoNo ratings yet

- Financial Analysis of Wipro LTD PDFDocument101 pagesFinancial Analysis of Wipro LTD PDFAnonymous f7wV1lQKRNo ratings yet

- Danville-Pittsylvania Regional Industrial Facility AuthorityDocument26 pagesDanville-Pittsylvania Regional Industrial Facility AuthoritySouthsideCentralNo ratings yet

- Kishore Pay SlipDocument1 pageKishore Pay Slipsuperhit123No ratings yet

- ExercisesDocument11 pagesExercisesGayathri PrasathNo ratings yet

- Example of WorksheetDocument5 pagesExample of WorksheetAizen IchigoNo ratings yet

- The Lakeside Company Case 9 Terjemahan InggrisDocument6 pagesThe Lakeside Company Case 9 Terjemahan InggrisMaria Putri Panjaitan0% (1)

- T25 Final Revision 1Document112 pagesT25 Final Revision 1Andrew Wong100% (2)

- Advance Chapter 4Document17 pagesAdvance Chapter 4abel habtamuNo ratings yet

- Name: Date: Score:: Property of STIDocument3 pagesName: Date: Score:: Property of STICharise OlivaNo ratings yet

- Insurance Need AnalysisDocument8 pagesInsurance Need AnalysisRajesh Chowdary ChintamaneniNo ratings yet

- Nishi Sirs Accounts NotesDocument34 pagesNishi Sirs Accounts NotesKshitij RedijNo ratings yet

- UntitledDocument5 pagesUntitledCristel TannaganNo ratings yet