Professional Documents

Culture Documents

CHAPTER 3the Adjusting Process#1

Uploaded by

gameppass220 ratings0% found this document useful (0 votes)

2 views6 pagesThe Adjusting

Original Title

2. CHAPTER 3The Adjusting Process#1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe Adjusting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views6 pagesCHAPTER 3the Adjusting Process#1

Uploaded by

gameppass22The Adjusting

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 6

CHAPTER 3 The Adjusting Process

PROBLEMS

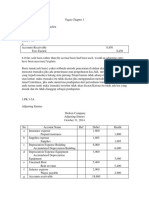

Prob. 3–1A Page 138

1. a. Supplies Expense 4,680

Supplies 4,680

Supplies used ($6,880 – $2,200).

b. Unearned Rent 2,300

Rent Revenue 2,300

Rent earned ($9,200 ÷ 4 months).

c. Wages Expense 1,850

Wages Payable 1,850

Accrued wages.

d. Accounts Receivable 11,700

Fees Earned 11,700

Accrued fees earned.

e. Depreciation Expense 3,500

Accumulated Depreciation—Office Equipment 3,500

Depreciation expense.

CHAPTER 3 The Adjusting Process

Prob. 3–2A

1. a. Accounts Receivable 9,150

Fees Earned 9,150

Accrued fees earned.

b. Supplies Expense 2,325

Supplies 2,325

Supplies used ($3,000 – $675).

c. Rent Expense 5,000

Prepaid Rent 5,000

Prepaid rent expired.

d. Depreciation Expense 3,300

Accumulated Depreciation—Equipment 3,300

Equipment depreciation.

e. Unearned Fees 7,500

Fees Earned 7,500

Fees earned ($10,500 – $3,000).

f. Wages Expense 3,100

Wages Payable 3,100

Accrued wages.

Prob. 3–3A

1. a. Accounts Receivable 12,700

Fees Earned 12,700

Accrued fees earned.

b. Supplies Expense 17,425

Supplies 17,425

Supplies used ($21,600 – $4,175).

c. Depreciation Expense 7,400

Accumulated Depreciation—Equipment 7,400

Equipment depreciation.

d. Unearned Fees 14,200

Fees Earned 14,200

Fees earned.

e. Wages Expense 1,100

Wages Payable 1,100

Accrued wages.

CHAPTER 3 The Adjusting Process

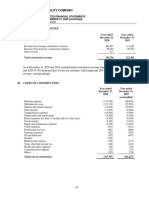

Prob. 3–5A

1. a. Insurance Expense 1,800

Prepaid Insurance 1,800

Insurance expired ($7,200 – $5,400).

b. Supplies Expense 1,605

Supplies 1,605

Supplies used ($1,980 – $375).

c. Depreciation Expense—Building 6,000

Accumulated Depreciation—Building 6,000

Building depreciation.

d. Depreciation Expense—Equipment 3,000

Accumulated Depreciation—Equipment 3,000

Equipment depreciation.

e. Unearned Rent 5,400

Rent Revenue 5,400

Rent revenue earned ($6,750 – $1,350).

f. Salaries and Wages Expense 2,900

Salaries and Wages Payable 2,900

Accrued salaries and wages.

g. Accounts Receivable 18,600

Fees Earned 18,600

Accrued fees earned.

CHAPTER 3 The Adjusting Process

Prob. 3–1B Page 142

Accounts Receivable 19,750

Fees Earned 19,750

Accrued fees earned.

Supplies Expense 8,150

Supplies 8,150

Supplies used ($12,300 – $4,150).

Wages Expense 2,700

Wages Payable 2,700

Accrued wages.

Unearned Rent 3,000

Rent Revenue 3,000

Rent earned ($9,000 ÷ 3 months).

Depreciation Expense 3,200

Accumulated Depreciation—Equipment 3,200

Depreciation expense.

Prob. 3–2B

1. a. Supplies Expense 2,620

Supplies 2,620

Supplies used ($3,170 – $550).

b. Depreciation Expense 1,675

Accumulated Depreciation—Equipment 1,675

Depreciation for year.

c. Rent Expense 8,500

Prepaid Rent 8,500

Rent expired.

d. Wages Expense 2,000

Wages Payable 2,000

Accrued wages.

e. Unearned Fees 6,000

Fees Earned 6,000

Fees earned ($10,000 – $4,000).

f. Accounts Receivable 5,380

Fees Earned 5,380

Accrued fees.

You might also like

- Boom en CrushDocument51 pagesBoom en CrushLungile Innocent Mswela100% (6)

- Problem 3-5B: InstructionsDocument4 pagesProblem 3-5B: InstructionsAlba LunaNo ratings yet

- Solutions To Chapter 7 Chapter 8Document10 pagesSolutions To Chapter 7 Chapter 8Saurabh SinghNo ratings yet

- Chapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesDocument8 pagesChapter 4 - Complete The Accounting Cycle Practice Set A: Exercise 4.1A - Prepare Correcting EntriesBảo GiangNo ratings yet

- Go-Figure WorksheetDocument2 pagesGo-Figure WorksheetChris Marasigan0% (1)

- 1.operations ResearchDocument36 pages1.operations ResearchPiuShan Prasanga Perera100% (1)

- Akun 2 BenerDocument2 pagesAkun 2 BenerLatifah KhalisyahNo ratings yet

- Module 2Document81 pagesModule 2Arra StypayhorliksonNo ratings yet

- Module 2 Ver 3.1Document81 pagesModule 2 Ver 3.1Akira Marantal Valdez100% (1)

- Problem 3-5B: InstructionsDocument3 pagesProblem 3-5B: Instructionsselse060No ratings yet

- Chap 4Document13 pagesChap 4Hoàng NhiNo ratings yet

- Financial Accounting: Master of Accounting and Auditing Course: Dr. Naser Abdel Kareem Student Name: Abdallah NamroutiDocument3 pagesFinancial Accounting: Master of Accounting and Auditing Course: Dr. Naser Abdel Kareem Student Name: Abdallah NamroutiHasan NajiNo ratings yet

- Acc HWDocument5 pagesAcc HWHasan NajiNo ratings yet

- Chapter 3 Practice QuestionsDocument3 pagesChapter 3 Practice QuestionsFamily PicturesNo ratings yet

- Dwidhitia Arnensy MustikaDocument3 pagesDwidhitia Arnensy MustikadNo ratings yet

- Topic 4 Class Discussion Question SolutionDocument3 pagesTopic 4 Class Discussion Question Solutionsyedimranmasood100No ratings yet

- Module 2 Solution Manual-2 PDFDocument41 pagesModule 2 Solution Manual-2 PDFMarvin MarianoNo ratings yet

- Date Description PR Debit Credit Dec - 31 1. Prepaid InsuranceDocument4 pagesDate Description PR Debit Credit Dec - 31 1. Prepaid InsuranceJackie EasterNo ratings yet

- Dnda Putri Nurhaliza - Tugas Chapter 3Document2 pagesDnda Putri Nurhaliza - Tugas Chapter 3dindawatanabe54No ratings yet

- Alternative Methods of Recording DeferralsDocument1 pageAlternative Methods of Recording DeferralsAngela Maxien De GuzmanNo ratings yet

- Test Soal AdjustingDocument2 pagesTest Soal AdjustingNicolas ErnestoNo ratings yet

- Kidusan Amha Mbao-6074-15A FMA Assignment-11111Document13 pagesKidusan Amha Mbao-6074-15A FMA Assignment-11111Kidusan AmhaNo ratings yet

- Problem 3-5A: InstructionsDocument2 pagesProblem 3-5A: InstructionsJEERAPA KHANPHETNo ratings yet

- Financial Accounting - Assignment #1#Document5 pagesFinancial Accounting - Assignment #1#Hasan NajiNo ratings yet

- Take Home Quiz 3Document3 pagesTake Home Quiz 3Sergio NicolasNo ratings yet

- Examples Ch3 SolutionDocument7 pagesExamples Ch3 SolutionNajwa Al-khateebNo ratings yet

- Financial StatementDocument20 pagesFinancial StatementMarielle CambaNo ratings yet

- ACCT101SOLUTIONS Ch03Document33 pagesACCT101SOLUTIONS Ch03Reese TanNo ratings yet

- Problem 8, 9, 14Document5 pagesProblem 8, 9, 14Margarette Novem T. PaulinNo ratings yet

- 4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceDocument3 pages4.3.2.3 Elaborate - Preparing Adjusting Entries From Unadjusted and Adjusted Trial BalanceMa Fe Tabasa100% (2)

- 8625adjusting Entries PracticeDocument4 pages8625adjusting Entries PracticeNajia SalmanNo ratings yet

- Class ExerciseDocument14 pagesClass ExerciseAbdul Basit MalikNo ratings yet

- Adjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingDocument9 pagesAdjusting Entries: Q1: Pass The Necessary Adjusting Entries For The FollowingHassan AliNo ratings yet

- SolutionsDocument10 pagesSolutionsRenee WongNo ratings yet

- Assignments Chapter 4Document5 pagesAssignments Chapter 4Mohammed NaderNo ratings yet

- CH 2 Answers PDFDocument5 pagesCH 2 Answers PDFLian Blakely CousinNo ratings yet

- AdjustingDocument16 pagesAdjustingShayne Nicolai C. VeronaNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Pauline Kisha CastroNo ratings yet

- Group Assignment Account SEM1Document7 pagesGroup Assignment Account SEM1NUR LIEYANA BINTI MOHD SHUKOR MoeNo ratings yet

- Adjusting Entries ConstantinoDocument5 pagesAdjusting Entries ConstantinoKyla Lyn OclaritNo ratings yet

- CH 3 Solutions ENDocument17 pagesCH 3 Solutions ENHayat AliNo ratings yet

- Arab Final 90% Fall2021 (YS)Document8 pagesArab Final 90% Fall2021 (YS)ahmed abuzedNo ratings yet

- Activity #6Document20 pagesActivity #6JEWELL ANN PENARANDANo ratings yet

- Whatever - Ciclo ContableDocument6 pagesWhatever - Ciclo ContablemillionextupNo ratings yet

- Tibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRDocument33 pagesTibans Shoe Repair Shop Unadjusted Trial Balance For The Month Ended March 31, 2020 Acct. No. Accoun Title DR CRjoshuaNo ratings yet

- Nguyen My Khanh - 25 - Mc1802Document6 pagesNguyen My Khanh - 25 - Mc1802Biên KimNo ratings yet

- Tum CompanyDocument4 pagesTum CompanyNguyen My Khanh (K18 HCM)No ratings yet

- Unit 2 Tutorial Worksheet AnswersDocument15 pagesUnit 2 Tutorial Worksheet AnswersHhvvgg BbbbNo ratings yet

- Class Exercise Session 5 and 6Document8 pagesClass Exercise Session 5 and 6Sumeet KumarNo ratings yet

- 54605bos43769 p3Document25 pages54605bos43769 p3Mukesh jivrajikaNo ratings yet

- Chapter 4: Adjusting The Accounts and Preparing The Financial StatementsDocument5 pagesChapter 4: Adjusting The Accounts and Preparing The Financial Statementschi_nguyen_100No ratings yet

- Class Exercise Session 5, 6 and 7Document20 pagesClass Exercise Session 5, 6 and 7Sumeet Kumar100% (1)

- ABM 1 Worksheet PreparationDocument2 pagesABM 1 Worksheet PreparationChelsie ColifloresNo ratings yet

- Test 10-11Document2 pagesTest 10-11TIÊN NGUYỄN LÊ MỸNo ratings yet

- Trial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRDocument3 pagesTrial Balance Adjustments Adjusted Trial Balance Income Statement Balance Sheet Account Titles Dr. Cr. Dr. Cr. Dr. Cr. Dr. Cr. Dr. CRMaharani SinuratNo ratings yet

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesPhạm Hồng Trang Alice -No ratings yet

- 592198Document11 pages592198mohitgaba19No ratings yet

- Sale and LeasebackDocument10 pagesSale and LeasebackShinny Jewel VingnoNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)HohohoNo ratings yet

- Review of The Accounting Process Problems 2-1. (Tiger Company)Document5 pagesReview of The Accounting Process Problems 2-1. (Tiger Company)Joana MagtuboNo ratings yet

- Chapter 3 AssignmentDocument9 pagesChapter 3 AssignmentAnas Omar MuffarrejNo ratings yet

- A Project Report On Artificial Intelligence in HRDocument109 pagesA Project Report On Artificial Intelligence in HRmd khaja100% (1)

- Review Test QuestionsDocument24 pagesReview Test QuestionsKent Mathew BacusNo ratings yet

- Working Capital Management Test 2014Document1 pageWorking Capital Management Test 2014daveferalNo ratings yet

- SOLUTION MAF603 - JAN 2018 Without TickDocument8 pagesSOLUTION MAF603 - JAN 2018 Without Tickanis izzatiNo ratings yet

- 2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationDocument26 pages2014 IRS Form 990 Sumter Electric Cooperative Return of Tax Exempt OrganizationNeil GillespieNo ratings yet

- Financial Accounting Midterm ExamDocument4 pagesFinancial Accounting Midterm ExamMary Joy SumapidNo ratings yet

- Issues, Challenges and Thier Solution in An Execution of Real Estate Project at Selected Site in Addis Ababa.Document91 pagesIssues, Challenges and Thier Solution in An Execution of Real Estate Project at Selected Site in Addis Ababa.Eyob Light Worku100% (1)

- Math Shortcut Math by MaHBuB or RashidDocument100 pagesMath Shortcut Math by MaHBuB or RashidIjaj AhmedNo ratings yet

- "Azvirt" Limited Liability Company: 25. Construction RevenueDocument1 page"Azvirt" Limited Liability Company: 25. Construction RevenueŞeyxəli ŞəliyevNo ratings yet

- Tulungan Application Form Rev. 7Document1 pageTulungan Application Form Rev. 7joyce DtNo ratings yet

- Unethical Practices in AdvertisingDocument34 pagesUnethical Practices in AdvertisingAyushi Aggarwal100% (1)

- Algorithm To Determine If An Applicant Is Approved For An Allocation in A Named Housing CommunityDocument7 pagesAlgorithm To Determine If An Applicant Is Approved For An Allocation in A Named Housing CommunityJEREMIAHNo ratings yet

- Fall 2022 - MTH302 - 1Document2 pagesFall 2022 - MTH302 - 1Kinza LaiqatNo ratings yet

- Money Insurance Proposal FormDocument4 pagesMoney Insurance Proposal FormPrasanth KumarNo ratings yet

- RAP Demofest 2022 Letter of InvitationDocument2 pagesRAP Demofest 2022 Letter of InvitationRomss SyNo ratings yet

- Account CurrentDocument13 pagesAccount Currentfathima.comafug23No ratings yet

- The Impact of The CovidDocument17 pagesThe Impact of The Covidkeshyam59No ratings yet

- Engineering Design Ch8Document8 pagesEngineering Design Ch8ansudasinghaNo ratings yet

- 3 Ways To Calculate Your TrainingDocument3 pages3 Ways To Calculate Your TrainingSonal ChaturvediNo ratings yet

- Geo ToursDocument22 pagesGeo ToursOtlaadisa TauNo ratings yet

- The Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresDocument36 pagesThe Expenditure Cycle Part II: Payroll Processing and Fixed Asset ProceduresdavidmargantiNo ratings yet

- Activity Sheet In: Business FinanceDocument8 pagesActivity Sheet In: Business FinanceCatherine Larce100% (1)

- 2020 CFA Program: Level III ErrataDocument14 pages2020 CFA Program: Level III ErrataJacek KowalskiNo ratings yet

- PriyaDocument24 pagesPriyaAnil RajputNo ratings yet

- 12 Ida Dme Ibc Conf 2002Document29 pages12 Ida Dme Ibc Conf 2002danaosajoNo ratings yet

- Lecture Notes On Intellectual Property LawDocument55 pagesLecture Notes On Intellectual Property LawArieza MontañoNo ratings yet

- Overview of Co-Operative BankingDocument14 pagesOverview of Co-Operative BankingDr. Meghna DangiNo ratings yet