Professional Documents

Culture Documents

Accounting 100

Accounting 100

Uploaded by

Lebohang Ngubane0 ratings0% found this document useful (0 votes)

8 views10 pagesAccounting 100 assessment

Original Title

Accounting 100 (1)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAccounting 100 assessment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

8 views10 pagesAccounting 100

Accounting 100

Uploaded by

Lebohang NgubaneAccounting 100 assessment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 10

A Leader in Accounting Education

Accountancy@UJ =e

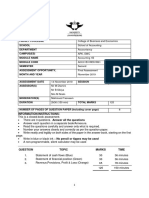

ACCOUNTING 100

FINAL ASSESSMENT OPPORTUNITY

10 November 2014 Marks: 150 Time: 180 Minutes

Examiners

Me Daniella Goncalves

Mr Tendani Mutshutshu

Mr Jelvin Grifficen

Moderators

Ms Marelize Malan

Professor Nerine Stegmann

Instructions:

Please confirm thal your question paper consis of 10 pages (including cover page)

= Read questions carefully and manage your time properly.

+ Do not write in pencil and do not use tp-ex as this will not be marked,

= Hand back unused answer sheets) together with your completed answer sheet(s)

Answer questions on the following colour answer booklets:

t= Blue Q2=Green B= Red (Q4= Yellow

2014 Act Strata potiy ‘vetens

Questions (ao marks)

This question consists of three independent pats

PART A (12 marke)

Honeymoon Limited operates a resort and ena inthe Magaliesberg Mountains. The company’s

fiearearepoting pried ends on 30 September 2014, The franca drector has asked fo your

‘assistance wth ascosing the folowing mats:

On 5 July 2014 a newlywed couple drowned in the resorts swimming pool after they

ilegaly entered the locked swimeing pol during the night when ro Hfeguards were an

duty, Tre family of the couple has insutedlogal acton against the company, claiming

2 lion in damages due to negligence on the company’ sie. Honeymoon Liiled has

appointed lawyers to oppose the clsim. An independent legal expert has stated that the

chance of the clam suczeeding i less than 50% but stated that fe company was found

uly, wnich is possible, tne damages awarded by the court could amount to R2 millon

=n 28 July 2014 the nancial manager fred a staff memiber who came late for werk, The

staff member subsequently sued the company for unfair dismissal, The case was head in

the Rustenburg regional court on 25 September 2014 and the cout ruled in favour of the

fomor staff member, but resetved udgment on the amount of compersation unl

‘3 December 2014. Tho company has agreed to pay damages but will await the outcome of

‘the vertict on 3 December 2014 to than maka the necessary payment, The company

consulted various legal exper for an opinion onthe posibie amount payable, but the legal

experts coud not reach consensus on the amount payable and therefore the amount of he

labty could not be determined as at 30 Saptember 2014

Honeyinoon Linited sells various beauty trestment products that are manufactured atthe

resor, The products are sol vith a money back guaranise wnereby customers are alowed

to relun the products to Honeymoon Limited for a ful relune within ane month of the

transaction taking place. The company's experonce that 10% of total sales are returmed

fora reund and therefore makes a provision atthe end of each reporting period reflecting

that rguee,

Total sales of beauty treatment products permont

‘September 073

Seplember 2014

al

in October 2013 the pay-out related to September 2013 sales amounted to R28 500,

Required

Based on the information provided above, dlscose the folowing notes in the financial

statements of Honeymoon Limited forthe epocing perios ended 30 September 2014

Contingent abies

Provisions «2

Ignore var

= Comparative Ngures are not requires

04 sng Frater pry sions

PARTE (14 MARKS)

‘A meeting is scheduled forthe fut board of erecors of Siyabonga Limited for 39 Api 2014 to

‘prove the nancial statements cf the company forthe reporting period ended 21 March 20%4,

‘The company reques your assistance th te folowing events that occured in Api 2014

Event 1

Jozi Limited, a debtor who owes Syabonge Limited RS 000 #5 at 31 March 2014, was

Geclared bankupt on 5 Apri 2014. Siyabonga Limited had not made any wrte-os or

‘lowances fr the debt. Tha nancial rector of Jozni Limited caled Siaybonge Lite on

6 April 2014 informing the company tat they had experienced fhancal eeu for ang tne

‘and would notte able te pay any ofthe custanding debt.

Event2

‘Some inventory that was on hand on 31 March 2014 ard was incuded inthe inveniony figure at

‘cos, as sold for R100 000 below the cost price in Apri 2014

event3

(0n 20 January 2014 Siyabonga Limted was sued for medical expanses by a customer who

sipped and fellin tha shop. The rectors were ofthe opinion that the case would not succaed

‘and made na provision forthe claim on 31 Match 2014, The court however ruled In favour of

the customer on 20 Api 2014 and ordered Siyabonga Limited to pay R58 000 in damages.

Event 4

(On 10 April 2014 an earthquake caused damages of thousands of Rands to Siyabonga

Limited's store ‘oom. Upon futher imesigaton twas discovered that Siyabonga Limited was

not insured fortis damage and it would have a severely negative Impact cn the company's

‘operations for the next wo years,

Required:

1) With reference to the concept ‘events ater the reporting date, provide a short deinion

of aqusing events and non-agusting events @

b) _Inrespect ot each of he abovementioned events:

1) Indate wnether its an adjusting event or @ non-sdjsting event; and “

§)_Brelly (one sentence) motivate your answer “

©) Explain and motivate what the accounting vestment ander disclosure requirements a

for event fo the reporting period ended 34 March 2014 @

Parte (amarns)

Manacor Lid resent purchased a bulng for R2 miflon. The company wit use the building for

is ovm administrative purposes. The managing arector of Manacor Ltd decided thatthe new

bulging should be classified es Investment propery because, acorting fo his understancing,

epreciaton weuld then not be writen off onthe asset

Required

\Wrte a memo the managing director of ManacerLiited in which you explsin wit reasons

“iether the building can be classed ab Investment property in tors of JAS 40,

3

‘nesroing wore saan epoiy ten

QuEsTON2 (20 NARKS)

‘Alona Transport Entity provides transportation services to guests ona poplar game reserve, The

nity’ current roporting period ends on 20 June 2044. Alana and a te uppers aro registered

VAT vendors. The VAT rates 4%,

Vehicles

‘Azlana guns 5 game dive vehicles purchased on 1 January 2012 ata cost of R200 030 each

{UAT excluded) to transport the customers around the lodge and game farm. Game deve vehicles

are not classed as passenger vehicles according to the VAT Act. The vehicles are depreciated at

20% per year on the diminishing balance method and havea resicual value of R&S 000 por vehicle

{excluding VAT),

(On 31 March 2014 one of the vehicles was bumped by an elephant, Luckly no passongers wore

hurtin this incident but the vehicle was damaged beyond repair. On 10 Aps! 2014 the insurance

compary paid @ compensation amount of R171 000 fr tis inedent,

‘ew vehicle was purchased on 1 May 2014 to replace the damaged vehicle, The invoice rica ot

‘the nen vehicle amounted to R342 000, which consisted of he fofowing amounts

Coaipis

| Registration and aad wontinass

|S Yeurmanienares pon

Pro oxciding VAT

[YAT at 145 (Rezordng io the VAT aga VAT Inpat c

[Pre including VAT at 1436

C

Helicopter

‘Aziana aso owns a helcepter which was purchased on + January 20%2 ata pice of R800 OOD

(WAT excluded) The helicopter is deprecated according tothe number of fight hour al the

hlcoptar is able to make over ifs use ie, which Is 1 090 000 foal fight hours and has no

residual vale,

“Total fight hours flown thus tar

i Four

Hs @2 [25000

ay 201 25.000

‘July 2013 30 tune 2014

214 eng fo Ftnemaert py umten2

zirplane

‘Aziana owns a smal aiplane which is used for game viewing. The aipane was purchased on

4 duly 2012 ata price of Ri 400 000 (VAT excleded. The aiplane consists of two components

ramaly the body (at a cost of Rt 200 000) and the engine (at a cost of R200 000), The body ofthe

plane ls depreciated over 10 years on the straight-line basis (wih no residual value) wist the

engine is depreciated over 5 yeare according to the straight‘ method (wth a residual value of

40 000 VAT exchded). On 30 June 2014 I was estimated thatthe engine ofthe apne would

Fave a remaining useful Me of 7 years wih an unchanged residval valve and woul sth be

Cepresiled according tothe sraightine mebiod. Tho remaining usetul feof the body remained

nenanges.

Required:

2) Provide all the journal entries to account forthe damaged vehicle ag well a the insurance claim

pay-out forthe reporting period ened 30 June 2014 (19)

1» Provide the Property, plant and equipment note tothe fhancial statements of Azlana Trensport

Entity forthe reporting period ended 20 June 2014 (oa column nol required), (20)

Note

= Accounting pote nots are not requied

(Comparative gures are not required

= Caleuations must be shown clea.

\Where appicable, rund calculated amounts tothe nearest Rand.

zo Acie 09Fr Anema unten

Question s (30 MARKS)

Grupo Desperado Entity is @ wholesaler of al Kinds of soccer equipment and agparel. Grupo

Desperado as well as all of Is suppliers are registered VAT vendors in accordance withthe

VAT Act Grupo Desperado's curent reporting dato is 31 December 2013 ana the ovmet wil

probably approve the 2013 financial statements cn 20 February 2014,

Grupo Desperado recenty appointed @ new bookkeeper whois competent but nat yt famiar

with Grupo Desperado’s business and thus has had same dificly in competing Grupo

Desperado's financial statements Grupo Desperaco uses the perpetual nventey sys to

account for its Inventory transactions.

The folowing transactions and events stil have to he accounted for in Grupo Desporado's

receras and, wnere appcabe,Inelude VAT at 14%

1. Grupo Desperado's VAT period isa calendar monty, The VAT return for November 2013,

Feflocs the folowing amounts:

R

VAT outout 231 500

VAT input 487 000

Amount due to SARS “44-500

‘The amount due in respect ofthe November 2013 VAT rotum was paid fo the SARS on

24 December 2013 by means of an EFT.

2, Afer completing the December 2013 payables reconciliation inresfect of Syplier Unie,

(Grupo Dosporado's bookkooperidenvid the follwing ference:

‘A creat amount exists in Supplier Union's account In Grupo Desperado’ records, in

respect of Inventories purchased by Grupo Desperado on 28 December 2013, wich

amounts fo R13 680. The corresponding debt amount that appears on Supplier Union's

Statement Is however only R12 996, This afarenca arose because Grupo Dexperade's

bookkeeper was unaware that Grupo Desperaco always makes uso ofthe #% setement

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Assessment 5 2022 - Suggested Solution (1) Acc100Document7 pagesAssessment 5 2022 - Suggested Solution (1) Acc100Lebohang NgubaneNo ratings yet

- Acc01b1 Rek1b01 Main PDFDocument10 pagesAcc01b1 Rek1b01 Main PDFLebohang NgubaneNo ratings yet

- Acc100 Main PDFDocument9 pagesAcc100 Main PDFLebohang NgubaneNo ratings yet

- Assessment 3 - Question June ExamDocument6 pagesAssessment 3 - Question June ExamLebohang NgubaneNo ratings yet

- Assessment 5 Q3Document4 pagesAssessment 5 Q3Lebohang NgubaneNo ratings yet