Professional Documents

Culture Documents

GST Handout - ITC Eligibility Secs 16-21

Uploaded by

deb0 ratings0% found this document useful (0 votes)

3 views1 pageAbout GST input tax credit complete tutorial- easy understanding

Original Title

GST Handout - ITC eligibility secs 16-21

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAbout GST input tax credit complete tutorial- easy understanding

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views1 pageGST Handout - ITC Eligibility Secs 16-21

Uploaded by

debAbout GST input tax credit complete tutorial- easy understanding

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Solutions Pvt. Ltd.

GST Handout updated 01/23

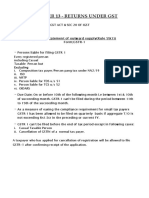

A few extra points - ITC

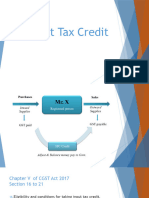

Section 16 – Eligibility & Conditions of claiming ITC

a) Eligibility : Registered person – furtherance of business – credited in e-credit ledger

b) Conditions : Possession of Tax invoice – Possession of Goods/Services – Tax paid to Govt. – Return filed –

from 1.4.21 GSTR2A

c) Extra points : Recipient must pay the supplier within 180 days (from invoice date) – lot/instalment last

– No depreciation under I.T Act allowed – To avail credit within November (or extended annual return)

Section 17 – Apportionment of Credit & Blocked Credits

a) Goods/Services used for – Party business – Partly other Available only for business part

b) Goods/Services used for – Party taxable – Partly exempt Attributable portion of taxable supply only

c) No ITC can be claimed on list of goods/services as provided in Section 17(5)

d) No ITC on tax paid u/Ss – 74, 129, 130 (evasion – retention – detention)

Section 18 – Availability of credit in special circumstances

i) Entitled to avail ITC – New Registrants/Voluntary Registrants – if effective date is obliged – available till 1

yr (invoice date)

ii) Entitled to avail ITC – when switching from Composite to Regular

iii) Entitled to avail ITC – When exempt items becomes taxable

iv) NOT Entitled (Reversal) – when switching from Regular to Composite

v) NOT Entitled (Reversal) – when taxable items becomes exempt

vi) NOT Entitled (Reversal) – Cancellation of registration

vii) Entitled but to different person – In case of Transfer, Sale, Merger, Death of sole prop. – ITC available to

parent organisation to be transferred to new organisation otherwise ITC will lapse automatically

Section 19 – Availability of credit Principal (Job work)

a) Entitled to Principal – ITC on Goods – if such goods are received back within 1 yr from the agent

b) Entitled to Principal – ITC on Assets – if such assets are received back within 3 yrs from the agent

Section 20 & 21 – Availability of credit to ISD

Entitled if GSTR 6 is filed and Rule 54 is obliged

87

You might also like

- 2020 Reme TPDocument24 pages2020 Reme TPManuel VillanuevaNo ratings yet

- Salary Slip - Feb. 2019Document1 pageSalary Slip - Feb. 2019Akibkhan PathanNo ratings yet

- Issues in Tax Audit ReportDocument70 pagesIssues in Tax Audit ReportPankaj ShahNo ratings yet

- Managing Birs Tax Assessment FreeebookDocument88 pagesManaging Birs Tax Assessment FreeebookJohn Patrick Guillen100% (1)

- 6.case Study On Input Tax Credit Under GSTDocument17 pages6.case Study On Input Tax Credit Under GSTSUNIL PUJARINo ratings yet

- GST Itc DetailDocument8 pagesGST Itc DetailAnonymous ikQZphNo ratings yet

- MCQ On Passive TaxesDocument7 pagesMCQ On Passive TaxesRandy ManzanoNo ratings yet

- Re-Fx Img ConfigDocument39 pagesRe-Fx Img ConfigshekarNo ratings yet

- Freelancers-Registration & Basics PDFDocument24 pagesFreelancers-Registration & Basics PDFMic BNo ratings yet

- Tax Remedies of The Taxpayer PDFDocument4 pagesTax Remedies of The Taxpayer PDFJester LimNo ratings yet

- DT - One Page Summary - Accreted Tax (Exit Tax)Document1 pageDT - One Page Summary - Accreted Tax (Exit Tax)Aruna RajappaNo ratings yet

- Itc FaqDocument4 pagesItc Faqbhushanbraj811307No ratings yet

- Day 6 & 7Document23 pagesDay 6 & 7PrasanthNo ratings yet

- InputTaxCredit JPSCDocument42 pagesInputTaxCredit JPSCVinayak DeshpandeNo ratings yet

- Unit 3 Notes GSTDocument8 pagesUnit 3 Notes GSTayusha dasNo ratings yet

- Input Tax Credit (GST)Document16 pagesInput Tax Credit (GST)ravi.pansuriya07No ratings yet

- @GSTMCQ Chapter 5 Input Tax CreditDocument15 pages@GSTMCQ Chapter 5 Input Tax CreditIndhuja MNo ratings yet

- Concept of Input Tax Credit: © Indirect Taxes Committee, ICAIDocument35 pagesConcept of Input Tax Credit: © Indirect Taxes Committee, ICAIyennamNo ratings yet

- CA Ashish Chaudhary 1Document30 pagesCA Ashish Chaudhary 1sonapakhi nandyNo ratings yet

- GST Amdts Part 2Document5 pagesGST Amdts Part 2amankhurana0910No ratings yet

- IDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesDocument27 pagesIDT Saar CA Final CH 8 Input Tax Credit by CA Mahesh Gour Handwritten NotesRonita DuttaNo ratings yet

- Input Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)Document3 pagesInput Tax Credit System (Chapter-V) (Sections: 16, 17, 18, 19, 20, 21. (Other Related Sections Linked 39, 41, and 49)dinesh kasnNo ratings yet

- 7 Input Tax CreditDocument16 pages7 Input Tax CreditinstainstantuserNo ratings yet

- Overview of GST Session II and III Final - RTCDocument25 pagesOverview of GST Session II and III Final - RTCSuresh Kumar YathirajuNo ratings yet

- ProjectDocument37 pagesProjectcontactnilkanth123No ratings yet

- GST Remark Related FileDocument14 pagesGST Remark Related FileAnonymous ikQZphNo ratings yet

- Session 3 & 4 - Input Tax Credit and Cross Utilisation of Taxes FinalDocument42 pagesSession 3 & 4 - Input Tax Credit and Cross Utilisation of Taxes FinalaskNo ratings yet

- Page 1 of 4Document4 pagesPage 1 of 4Sunil ShahNo ratings yet

- Itc FormsDocument5 pagesItc FormssaranistudyNo ratings yet

- GST - ITC - What Care We Need To Take Now - CA Vaishali KhardeDocument19 pagesGST - ITC - What Care We Need To Take Now - CA Vaishali KhardeVaishali KhardeNo ratings yet

- GST Proposals Gabhawalla & Co.: Finance Bill, 2022Document40 pagesGST Proposals Gabhawalla & Co.: Finance Bill, 2022sbgcoNo ratings yet

- Input Tax Credit (Itc) SystemDocument17 pagesInput Tax Credit (Itc) SystemJasmin BidNo ratings yet

- Goods and Services Tax (GST) in India: Input Tax Credit (ITC)Document24 pagesGoods and Services Tax (GST) in India: Input Tax Credit (ITC)Noman AreebNo ratings yet

- TAX UPDATES POWERPOINT PRESENTATION - (Version 4)Document60 pagesTAX UPDATES POWERPOINT PRESENTATION - (Version 4)JennNo ratings yet

- CIR Vs San Roque Taganito and Philex MiningDocument3 pagesCIR Vs San Roque Taganito and Philex MiningBeryl Joyce BarbaNo ratings yet

- Chapter 13 - Returns Under GSTDocument11 pagesChapter 13 - Returns Under GSTJay PawarNo ratings yet

- GST Unit 1 BDocument23 pagesGST Unit 1 BMukul BhatnagarNo ratings yet

- 28.01.2020, 1. v.D.N.sravanthi Madam, Asst. Commissioner (ST), Persons Liable To Registration, Compulsory Registration, ProcedureDocument52 pages28.01.2020, 1. v.D.N.sravanthi Madam, Asst. Commissioner (ST), Persons Liable To Registration, Compulsory Registration, ProcedureArchana LNo ratings yet

- GST-603 Unit-3Document23 pagesGST-603 Unit-3GauharNo ratings yet

- Judicial Rulings BY ABHAY DESAIDocument27 pagesJudicial Rulings BY ABHAY DESAIPiyush PatelNo ratings yet

- Notes PGBPDocument3 pagesNotes PGBPVandana VaidyaNo ratings yet

- GST Overview Rachana 1Document31 pagesGST Overview Rachana 1Path A Way AheadNo ratings yet

- Shri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDDocument46 pagesShri Paresh Parekh, Chartered Accountants, Partner, Ernst & Young Pvt. LTDSridharRaoNo ratings yet

- 33-Transition Provision in GSTDocument3 pages33-Transition Provision in GSTJinx GNo ratings yet

- Chapter 8 - Input Tax CreditDocument21 pagesChapter 8 - Input Tax Creditmadaanakansha91No ratings yet

- Input Tax CreditDocument28 pagesInput Tax CreditKhushbuNo ratings yet

- (H) VISem BCH6.2 GST Week3 AnkitaTomarDocument23 pages(H) VISem BCH6.2 GST Week3 AnkitaTomarRAJBIR SINGH TADANo ratings yet

- Input Tax Credit: Speaker: Sudhir V SDocument31 pagesInput Tax Credit: Speaker: Sudhir V Smahi_kunkuNo ratings yet

- Quick Notes - Tax AdministrationDocument3 pagesQuick Notes - Tax AdministrationAyda S.No ratings yet

- Returns GSTDocument25 pagesReturns GSTRahul RockzzNo ratings yet

- H4 - GST at GVC: Spark For The Day "Document6 pagesH4 - GST at GVC: Spark For The Day "Kenny PhilipsNo ratings yet

- Tax Remedies NotesDocument8 pagesTax Remedies NotesLaurene Ashley Sore-YokeNo ratings yet

- DT PROVISIONS ENACTED FINANCE ACT 2022 PankajDocument21 pagesDT PROVISIONS ENACTED FINANCE ACT 2022 Pankajnilanjan_kar_2No ratings yet

- Itc (Incl. Transitional Provisions), Isd, Cross Utilization of Igst & Fund TransferDocument51 pagesItc (Incl. Transitional Provisions), Isd, Cross Utilization of Igst & Fund Transfershivam beniwalNo ratings yet

- Section: A MCQ 20X1 20 Marks: A. B. C. DDocument12 pagesSection: A MCQ 20X1 20 Marks: A. B. C. DSarath KumarNo ratings yet

- Standardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiaDocument11 pagesStandardised PPT On GST: Indirect Taxes Committee The Institute of Chartered Accountants of IndiamonikaNo ratings yet

- GST LatestAmendments Issues 01072023Document85 pagesGST LatestAmendments Issues 01072023Selvakumar MuthurajNo ratings yet

- Chapter 2Document9 pagesChapter 2Adethri AdethriNo ratings yet

- 6input Tax Credit1867ihhgghDocument35 pages6input Tax Credit1867ihhgghvinit tandelNo ratings yet

- Basic Concepts of Transition & Invoice I20177804Document28 pagesBasic Concepts of Transition & Invoice I20177804vishalNo ratings yet

- S. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)Document3 pagesS. 16: Eligibility & Conditions: Receipt of Document Forward Charge Cases (FCM)MANU SHANKARNo ratings yet

- Companies Act, 2013: An Insight Into Latest AmendmentsDocument10 pagesCompanies Act, 2013: An Insight Into Latest Amendmentsvipul tutejaNo ratings yet

- Itc GSTDocument22 pagesItc GST311812922nishanthininkNo ratings yet

- Unit - 2 Chap - 3 Input Tax CreditDocument17 pagesUnit - 2 Chap - 3 Input Tax CreditRakshit DattaniNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- ºéæié Mééb÷Méä Éé Éé + É®Úé Éiéò Ê Été (Éò'Ö: Ééêhév É Ê Été ÉéjééDocument14 pagesºéæié Mééb÷Méä Éé Éé + É®Úé Éiéò Ê Été (Éò'Ö: Ééêhév É Ê Été ÉéjééMahadev GhatoleNo ratings yet

- Reviewer Counsumer EducationDocument13 pagesReviewer Counsumer EducationAjay CanoNo ratings yet

- YourekaDocument18 pagesYourekaKanwaljeet SinghNo ratings yet

- Compensation Is The Amount of Remuneration Paid To AnDocument53 pagesCompensation Is The Amount of Remuneration Paid To AnGitanzali KhuranaNo ratings yet

- Chapter 19 HomeworkDocument3 pagesChapter 19 HomeworkTracy LeeNo ratings yet

- Aplikasi International IssuesDocument16 pagesAplikasi International IssuesGray JavierNo ratings yet

- Law of Taxation: Concept of Salary Under Income Tax Act, 1961Document28 pagesLaw of Taxation: Concept of Salary Under Income Tax Act, 1961Sapna RajmaniNo ratings yet

- Susquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6Document6 pagesSusquehanna Medical Center Computation of Break-Even Point in Patient-Days: Pediatrics For The Year Ended June 30, 20X6EdTan RagadioNo ratings yet

- Cipla Standalone Balance Sheet - in Rs. Cr. - 1.equity & Liabilities A) Shareholder's FundDocument6 pagesCipla Standalone Balance Sheet - in Rs. Cr. - 1.equity & Liabilities A) Shareholder's Fundmanwanimuki12No ratings yet

- India and The Contemprorary World1Document160 pagesIndia and The Contemprorary World1சுப.தமிழினியன்75% (4)

- Erp - HCM Eg LocalizationDocument38 pagesErp - HCM Eg LocalizationMohamed ShanabNo ratings yet

- ANSWER Fundamental Concepts of Donor S Taxation PDFDocument30 pagesANSWER Fundamental Concepts of Donor S Taxation PDFKimNo ratings yet

- Letter To The Mayor (Sunshine City) FinalDocument2 pagesLetter To The Mayor (Sunshine City) Finalapi-288606068No ratings yet

- Mccia Ar Final CompressedDocument78 pagesMccia Ar Final Compressedgoten25No ratings yet

- 2nd AssignmentDocument3 pages2nd AssignmentFriekis Tan-ganNo ratings yet

- Tax Q and A 1Document2 pagesTax Q and A 1Marivie UyNo ratings yet

- BCG Back To MesopotamiaDocument15 pagesBCG Back To MesopotamiaZerohedgeNo ratings yet

- Tax Lecture Gross IncomeDocument6 pagesTax Lecture Gross IncomeAngelojason De LunaNo ratings yet

- Effects of Multiple Taxation On The Survival of Businesses in Grand Cape Mount County, Republic of LiberiaDocument6 pagesEffects of Multiple Taxation On The Survival of Businesses in Grand Cape Mount County, Republic of LiberiaYusef MohamedNo ratings yet

- QUIZ 1 Deferred Taxes SolutionDocument3 pagesQUIZ 1 Deferred Taxes SolutionMohd NuuranNo ratings yet

- 19th Century Philippines As Rizal's ContextDocument20 pages19th Century Philippines As Rizal's ContextJames Ivan DuraNo ratings yet

- AFAR Part 1 Page 1-20Document2 pagesAFAR Part 1 Page 1-20Tracy Ann AcedilloNo ratings yet

- Moore Afghanistan OnlineDocument20 pagesMoore Afghanistan Onlinejawadwafa795No ratings yet

- The German Hyperinflation of 1923Document13 pagesThe German Hyperinflation of 1923VictorNo ratings yet

- KTM Duke 250 Abs 2017 GST 0Document1 pageKTM Duke 250 Abs 2017 GST 0zaim nur hakimNo ratings yet