Professional Documents

Culture Documents

GSTR3B 22aaoca5812f1zy 062022

GSTR3B 22aaoca5812f1zy 062022

Uploaded by

Jai BajajOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

GSTR3B 22aaoca5812f1zy 062022

GSTR3B 22aaoca5812f1zy 062022

Uploaded by

Jai BajajCopyright:

Available Formats

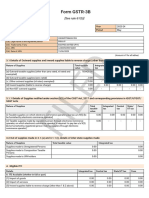

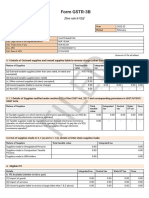

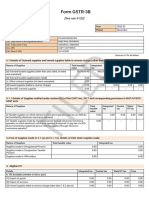

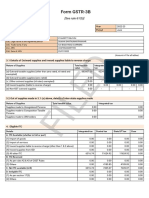

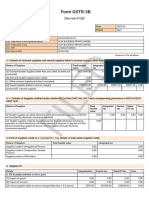

Form GSTR-3B

[See rule 61(5)]

Year 2022-23

Period June

1. GSTIN 22AAOCA5812F1ZY

2(a). Legal name of the registered person ALOK BUILDTECH PRIVATE LIMITED

2(b). Trade name, if any ALOK BUILDTECH PRIVATE LIMITED

2(c). ARN AA220622168317C

2(d). Date of ARN 20/07/2022

(Amount in ₹ for all tables)

3.1 Details of Outward supplies and inward supplies liable to reverse charge

Nature of Supplies Total taxable Integrated Central tax State/UT Cess

exempted)

(b) Outward taxable supplies (zero rated)

(c ) Other outward supplies (nil rated, exempted)

(d) Inward supplies (liable to reverse charge)

(e) Non-GST outward supplies

ED

(a) Outward taxable supplies (other than zero rated, nil rated and

value

102589173.00

571509.00

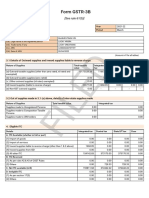

3.2 Out of supplies made in 3.1 (a) above, details of inter-state supplies made

0.00

0.00

0.00

tax

-

0.00

0.00

0.00

6155350.38

-

-

43457.00

-

tax

6155350.38

-

-

43457.00

-

0.00

0.00

0.00

-

-

FIL

Nature of Supplies Total taxable value Integrated tax

Supplies made to Unregistered Persons 0.00 0.00

Supplies made to Composition Taxable 0.00 0.00

Persons

Supplies made to UIN holders 0.00 0.00

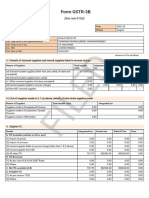

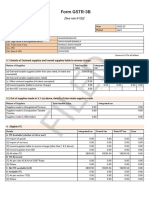

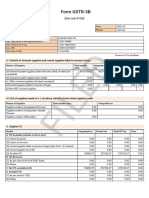

4. Eligible ITC

Details Integrated tax Central tax State/UT tax Cess

A. ITC Available (whether in full or part)

(1) Import of goods 0.00 0.00 0.00 0.00

(2) Import of services 0.00 0.00 0.00 0.00

(3) Inward supplies liable to reverse charge (other than 1 & 2 above) 0.00 43457.00 43457.00 0.00

(4) Inward supplies from ISD 0.00 0.00 0.00 0.00

(5) All other ITC 2470886.76 7660215.24 7660215.24 0.00

B. ITC Reversed

(1) As per rules 42 & 43 of CGST Rules 0.00 0.00 0.00 0.00

(2) Others 19447.20 21109.38 21109.38 0.00

C. Net ITC available (A-B) 2451439.56 7682562.86 7682562.86 0.00

D. Ineligible ITC 0.00 0.00 0.00 0.00

(1) As per section 17(5) 0.00 0.00 0.00 0.00

(2) Others 0.00 0.00 0.00 0.00

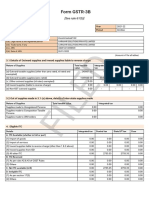

5 Values of exempt, nil-rated and non-GST inward supplies

Nature of Supplies Inter- State supplies Intra- State supplies

From a supplier under composition scheme, Exempt, Nil rated supply 0.00 0.00

Non GST supply 0.00 0.00

5.1 Interest and Late fee for previous tax period

Details Integrated tax Central tax State/UT tax Cess

System computed - - - -

Interest

Interest Paid 0.00 0.00 0.00 0.00

Late fee - 0.00 0.00 -

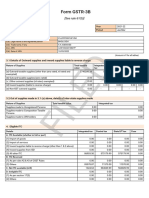

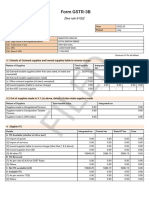

6.1 Payment of tax

Description Total tax Tax paid through ITC Tax paid in Interest paid in Late fee paid in

tax

Central tax

State/UT tax

Cess

payable

(A) Other than reverse charge

Integrated

(B) Reverse charge

Integrated

0.00

6155350.00

6155350.00

0.00

0.00

Integrated

tax

-

0.00

0.00

ED

Central tax

2451440.00 3703910.00

-

-

-

0.00

State/UT

tax

6155350.00

-

-

0.00

Cess

-

-

0.00

-

cash

0.00

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

0.00

0.00

cash

-

0.00

0.00

FIL

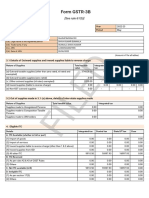

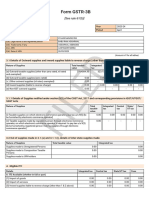

tax

Central tax 43457.00 - - - - 43457.00 - -

State/UT tax 43457.00 - - - - 43457.00 - -

Cess 0.00 - - - - 0.00 - -

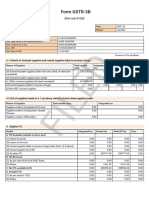

Breakup of tax liability declared (for interest computation)

Period Integrated tax Central tax State/UT tax Cess

June 2022 0.00 6198807.00 6198807.00 0.00

Verification:

I hereby solemnly affirm and declare that the information given herein above is true and correct to the best of my knowledge and belief and

nothing has been concealed there from.

Date: 20/07/2022 Name of Authorized Signatory

ALOK SHIVHARE

Designation /Status

DIRECTOR

You might also like

- Betty S Fashions Operates Retail Stores in Both Downtown and SuburbanDocument1 pageBetty S Fashions Operates Retail Stores in Both Downtown and SuburbanAmit PandeyNo ratings yet

- 11 Feb-22Document2 pages11 Feb-22yuvrajsinh jadejaNo ratings yet

- GSTR3B 22aaoca5812f1zy 062023Document3 pagesGSTR3B 22aaoca5812f1zy 062023Jai BajajNo ratings yet

- GSTR3B 33aaccv7032n1z5 112022Document3 pagesGSTR3B 33aaccv7032n1z5 112022PrathameshNo ratings yet

- GSTR3B 22aaoca5812f1zy 112022Document3 pagesGSTR3B 22aaoca5812f1zy 112022Jai BajajNo ratings yet

- GSTR3B 29aaafq0964b1zh 072021Document2 pagesGSTR3B 29aaafq0964b1zh 072021Goutham Kumar'sNo ratings yet

- GSTR3BDocument3 pagesGSTR3Bbuhroofarooq1No ratings yet

- Ess Pee GST May2023Document3 pagesEss Pee GST May2023Logesh Waran KmlNo ratings yet

- GSTR3B 36bmypp9150m1zx 062022Document2 pagesGSTR3B 36bmypp9150m1zx 062022RAJESH DNo ratings yet

- GSTR3B 06aadcg4814c1z3 092021Document2 pagesGSTR3B 06aadcg4814c1z3 092021akhil kwatraNo ratings yet

- GSTR3B 22aaoca5812f1zy 092022Document2 pagesGSTR3B 22aaoca5812f1zy 092022Jai BajajNo ratings yet

- GSTR3B 06aadcg4814c1z3 122021Document2 pagesGSTR3B 06aadcg4814c1z3 122021akhil kwatraNo ratings yet

- GSTR3B 29aavpv0973c1z3 082021Document2 pagesGSTR3B 29aavpv0973c1z3 082021Hemanth KumarNo ratings yet

- 06 Sep-22Document3 pages06 Sep-22yuvrajsinh jadejaNo ratings yet

- GSTR3B 01acppd9374f1zm 032022Document2 pagesGSTR3B 01acppd9374f1zm 032022pathaniagudia1996No ratings yet

- GSTR3B May - 2022Document2 pagesGSTR3B May - 2022HEMANTH kumarNo ratings yet

- GSTR3B 22aadcn1296k1zf 032023Document3 pagesGSTR3B 22aadcn1296k1zf 032023Jai BajajNo ratings yet

- GSTR3B 09aanfg8262b1z9 092022Document3 pagesGSTR3B 09aanfg8262b1z9 092022AdityaNo ratings yet

- GSTR3B 09abdcs7847l1zl 122023Document3 pagesGSTR3B 09abdcs7847l1zl 122023prateek gangwaniNo ratings yet

- GSTR3B 27ctapk1633g1zz 092022Document3 pagesGSTR3B 27ctapk1633g1zz 092022Lokesh SoniNo ratings yet

- GSTR3B 06aadcg4814c1z3 032022Document2 pagesGSTR3B 06aadcg4814c1z3 032022akhil kwatraNo ratings yet

- GSTR3B 27ajypp7786p1zj 032022Document2 pagesGSTR3B 27ajypp7786p1zj 032022pratik parmarNo ratings yet

- MARCH 23 GST 3B.pdf 1Document3 pagesMARCH 23 GST 3B.pdf 1Arun MotorsNo ratings yet

- Afsar EnterprisesDocument2 pagesAfsar EnterprisesMohitNo ratings yet

- GSTR3B 18auupb9802f1ze 122023Document3 pagesGSTR3B 18auupb9802f1ze 122023bdebajit240No ratings yet

- GSTR3B 06aadcg4814c1z3 062021Document2 pagesGSTR3B 06aadcg4814c1z3 062021akhil kwatraNo ratings yet

- GSTR3B 18actpi6464p1zk 022023Document3 pagesGSTR3B 18actpi6464p1zk 022023IMRADUL HUSSAINNo ratings yet

- GSTR3B 06aehpa7043l1zk 022022Document2 pagesGSTR3B 06aehpa7043l1zk 022022NITISH JAINNo ratings yet

- GSTR3B 24agppp8172k1zp 032021Document2 pagesGSTR3B 24agppp8172k1zp 032021Nanu PatelNo ratings yet

- GSTR3B 36aoupg4539a1zx 042022Document2 pagesGSTR3B 36aoupg4539a1zx 042022abhi ramNo ratings yet

- GSTR3B 33axxpa3486g1z8 122022Document3 pagesGSTR3B 33axxpa3486g1z8 122022solaciNo ratings yet

- GSTR3B 32aaffn1158h1zk 122023Document3 pagesGSTR3B 32aaffn1158h1zk 122023AneeshNo ratings yet

- GSTR3B 36bbtpc4918a1zt 052023Document3 pagesGSTR3B 36bbtpc4918a1zt 052023uslprocess1No ratings yet

- GSTR3B 09aaopj3054f1zo 052022Document3 pagesGSTR3B 09aaopj3054f1zo 052022Suhail KhanNo ratings yet

- GSTR3B 07biypk7555f1zl 092022Document3 pagesGSTR3B 07biypk7555f1zl 092022Shubham JindalNo ratings yet

- Ess Pee Sep2022Document3 pagesEss Pee Sep2022Logesh Waran KmlNo ratings yet

- GSTR3B 09CXNPD7074F1Z6 082022Document3 pagesGSTR3B 09CXNPD7074F1Z6 082022Ishan SrivastavaNo ratings yet

- GSTR3B 01aelpk0229g1z1 092022Document3 pagesGSTR3B 01aelpk0229g1z1 092022Kaka KushalNo ratings yet

- Apr June 3Document2 pagesApr June 3ROHAN AGGARWALNo ratings yet

- GSTR3B 07aadpa4245q1zm 112022Document3 pagesGSTR3B 07aadpa4245q1zm 112022meenakshi08071983No ratings yet

- GSTR3B 06aakfh0743f1zn 032023Document3 pagesGSTR3B 06aakfh0743f1zn 032023hecllp.ggnNo ratings yet

- GSTR3B 10BCSPC5671G1ZQ 062022Document2 pagesGSTR3B 10BCSPC5671G1ZQ 062022Kishan JaiswalNo ratings yet

- GSTR3B 06aehpa7043l1zk 032022Document2 pagesGSTR3B 06aehpa7043l1zk 032022NITISH JAINNo ratings yet

- GSTR3B 29aaacq3842r1zr 032023Document3 pagesGSTR3B 29aaacq3842r1zr 032023vasanth.sNo ratings yet

- GSTR3B 29aaoca4244p1zz 122021Document2 pagesGSTR3B 29aaoca4244p1zz 122021HEMANTH kumarNo ratings yet

- GSTR3B 36aoupg4539a1zx 052022Document2 pagesGSTR3B 36aoupg4539a1zx 052022abhi ramNo ratings yet

- GSTR3B 06aajfk2610f1zr 082023Document3 pagesGSTR3B 06aajfk2610f1zr 082023tingu gangNo ratings yet

- GSTR3B 37adcfs8516j1zp 032021Document2 pagesGSTR3B 37adcfs8516j1zp 032021ravi kiranNo ratings yet

- GSTR3B 33auapv1142j1zs 102023Document3 pagesGSTR3B 33auapv1142j1zs 102023crmfinance.tnNo ratings yet

- GSTR3B 09aaeci2181f2zn 062022Document2 pagesGSTR3B 09aaeci2181f2zn 062022Pushan SrivastavaNo ratings yet

- GSTR3B 21abypr0839h1zb 092022Document2 pagesGSTR3B 21abypr0839h1zb 092022Chinmaya MohantyNo ratings yet

- GSTR3B 27auspp7198j1zh 062022Document2 pagesGSTR3B 27auspp7198j1zh 062022Aman PanwarNo ratings yet

- Ess Pee GST April 2023Document3 pagesEss Pee GST April 2023Logesh Waran KmlNo ratings yet

- GSTR3B 06aehpa7043l1zk 012022Document2 pagesGSTR3B 06aehpa7043l1zk 012022NITISH JAINNo ratings yet

- GSTR3B 27azgpt9919a1z1 122022Document3 pagesGSTR3B 27azgpt9919a1z1 122022Ishwarchandra KolheNo ratings yet

- GSTR3B 33acdpg9324j1zp 012022Document2 pagesGSTR3B 33acdpg9324j1zp 012022Sankar GaneshNo ratings yet

- GSTR3B 36bbtpc4918a1zt 062023Document3 pagesGSTR3B 36bbtpc4918a1zt 062023uslprocess1No ratings yet

- GSTR3B 36bmypp9150m1zx 072022Document2 pagesGSTR3B 36bmypp9150m1zx 072022RAJESH DNo ratings yet

- GSTR3B 37bcbpp5786l2zu 032022Document2 pagesGSTR3B 37bcbpp5786l2zu 032022sivapolesNo ratings yet

- GSTR3B 07aadpa4245q1zm 042023Document3 pagesGSTR3B 07aadpa4245q1zm 042023meenakshi08071983No ratings yet

- Vikash Mittal Itr-Ay 21-22Document1 pageVikash Mittal Itr-Ay 21-22Jai BajajNo ratings yet

- GSTR3B 22aaoca5812f1zy 082022Document2 pagesGSTR3B 22aaoca5812f1zy 082022Jai BajajNo ratings yet

- GSTR3B 22aaoca5812f1zy 072022Document2 pagesGSTR3B 22aaoca5812f1zy 072022Jai BajajNo ratings yet

- GSTR3B 22aaoca5812f1zy 092022Document2 pagesGSTR3B 22aaoca5812f1zy 092022Jai BajajNo ratings yet

- GSTR1 22aaefg6054e1zu 072023Document4 pagesGSTR1 22aaefg6054e1zu 072023Jai BajajNo ratings yet

- GSTR3B 22aaoca5812f1zy 042023Document3 pagesGSTR3B 22aaoca5812f1zy 042023Jai BajajNo ratings yet

- Electricity Bill Sep2021Document1 pageElectricity Bill Sep2021Jai BajajNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Jai BajajNo ratings yet

- Fully Developed Residential Plots & DuplexDocument7 pagesFully Developed Residential Plots & DuplexJai BajajNo ratings yet

- Mindray Pricelist - Dec 11-Sales TeamDocument1 pageMindray Pricelist - Dec 11-Sales TeamNayan PatelNo ratings yet

- How To Make Salary Sheet in Excel With FormulaDocument6 pagesHow To Make Salary Sheet in Excel With FormulaFrances JuntillaNo ratings yet

- List of Additional Withholding Agents - Non-Individual 6-22-2023Document16 pagesList of Additional Withholding Agents - Non-Individual 6-22-2023Franz Xavier GarciaNo ratings yet

- Us VS LudeyDocument2 pagesUs VS LudeyA Paula Cruz FranciscoNo ratings yet

- ICPAK Training Introduction Income Indirect Taxes CPA Jared MarangaDocument16 pagesICPAK Training Introduction Income Indirect Taxes CPA Jared MarangaREJAY89No ratings yet

- Henderson V CollectorDocument3 pagesHenderson V CollectorViolet ParkerNo ratings yet

- 5652 20190806194323 Chart It 19Document1 page5652 20190806194323 Chart It 19arti chowdhryNo ratings yet

- Ops Converted - R - 2021Document323 pagesOps Converted - R - 2021knowledge musendekwaNo ratings yet

- GST Trade Notice No.002.2017 Dt.20.06.2016Document78 pagesGST Trade Notice No.002.2017 Dt.20.06.2016sathyaNo ratings yet

- PPRC 22-01-2023Document1 pagePPRC 22-01-2023Popular PipesNo ratings yet

- Anti Deferral and Anti Tax Avoidance June 2008Document11 pagesAnti Deferral and Anti Tax Avoidance June 2008Chelsea BorbonNo ratings yet

- Analysis and Reaction To Train LawDocument4 pagesAnalysis and Reaction To Train LawandengNo ratings yet

- InvoiceDocument1 pageInvoiceAman MadhukarNo ratings yet

- 07 Laboratory Exercise 1Document3 pages07 Laboratory Exercise 1Praisen JoyNo ratings yet

- Cagayan Electric Company v. CIRDocument2 pagesCagayan Electric Company v. CIRCocoyPangilinanNo ratings yet

- Proof of Travel Not Required For Claiming LTADocument3 pagesProof of Travel Not Required For Claiming LTAyagayNo ratings yet

- Profit & Loss - Bimetal Bearings LTDDocument2 pagesProfit & Loss - Bimetal Bearings LTDMurali DharanNo ratings yet

- 4.4.1 Introduction - Internal Revenue ServiceDocument62 pages4.4.1 Introduction - Internal Revenue ServiceBillie Russell SchofieldNo ratings yet

- Tax Types PDFDocument11 pagesTax Types PDFyebegashetNo ratings yet

- Resham Kaur Form - PDF - 713453130311221Document6 pagesResham Kaur Form - PDF - 713453130311221navdeep kaurNo ratings yet

- E-WAY BILL DetailsDocument1 pageE-WAY BILL DetailsrohanNo ratings yet

- US Internal Revenue Service: I1040se - 1997Document5 pagesUS Internal Revenue Service: I1040se - 1997IRSNo ratings yet

- Miami CH: Leder To CommissionDocument3 pagesMiami CH: Leder To CommissionMitch ScottNo ratings yet

- CS GARMENT, INC. vs. CIRDocument14 pagesCS GARMENT, INC. vs. CIRBernice joyce OliverosNo ratings yet

- SAUDI Expat GuideDocument3 pagesSAUDI Expat GuideKTSivakumarNo ratings yet

- Upselling PolicyDocument2 pagesUpselling PolicyylouihiNo ratings yet

- 1604-CFDocument8 pages1604-CFmamasita25No ratings yet

- Pre-Final Exam in Income Taxation: PointsDocument17 pagesPre-Final Exam in Income Taxation: PointsJAML Create CornerNo ratings yet

- Syllabus For The 2023 Bar Examinations - Commercial LawDocument19 pagesSyllabus For The 2023 Bar Examinations - Commercial LawCharlie ChickenNo ratings yet