Professional Documents

Culture Documents

Jackson County Executive S Office Memo 9.25.23

Uploaded by

The Kansas City Star0 ratings0% found this document useful (0 votes)

43 views3 pagesCaleb Clifford memo to Bryan Covinsky

Original Title

7. Jackson County Executive s Office Memo 9.25.23 (4)

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCaleb Clifford memo to Bryan Covinsky

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

43 views3 pagesJackson County Executive S Office Memo 9.25.23

Uploaded by

The Kansas City StarCaleb Clifford memo to Bryan Covinsky

Copyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 3

JACKSON COUNTY COURTHOUSE

415 EAST 12TH STREET

KANSAS CITY, MISSOUAI 64108

MEMORANDUM

To: Bryan Covinsky, County Counselor

Fror

\: Caleb Clifford, Chief of Staff

Subject: Jackson County's Position for Negotiations with Kansas City Royals

Date: September 25, 2023

|. TERM OF AGREEMENT

Jackson County proposes a 20-year exter

year period.

n to the sales tax as opposed to the Royals’ suggested 40-

I. LOCATION,

Despite the Royals' preference for an “East Village” site, Jackson County believes that alternative sites,

particularly those east of Troost, could offer better economic and social benefits. While open to

discussions, we alm to highlight the potential benefits of other sites.

Ill, SALES TAX & COUNTY CONTRIBUTIONS

‘* Assuming other terms are met, the County will place the extension of a 3/8 cent sales tax on the

ballot at the earliest election date.

‘The County will agree to bond for a maximum of $250 million, Excess revenue will go to the

County.

‘Discontinuation of the park levy's addition to the waterfall, leading to an annual saving of $3.5

million,

‘* The Royals will handle the insurance of the facility at its replacement value, stadium

deconstruction, its site conversion for more parking, and cover all repairs and improvements.

‘They can use their part of the $250 million for these expenses.

IV, RENT AND REVENUE

‘The Royals' yearly rent will begin at $5,000,000, adjusted annually based on the CPI.

© OPTION: Rent can be directed to RMIMO Fund OR to Jackson County.

Harry S. Truman, Presiding Judge, 1927-1954

®@

(616) set-sas3

OFFICE OF THE COUNTY EXECUTIVE Fax: (816) 881-3133

+ Revenue Sharing: A 50/50 split for revenues from stadium naming rights, concerts, parking, and

‘other non-baseball events,

* Economie Activity Taxes (EATS)

‘© OPTION: RMIMO OR to Jackson County.

\V. ECONOMIC IMPACT & COMMITMENTS

‘The Royals must provide a detailed account of thelr private Investment.

Contractual language should ensure timely investments with penalties for unfulfilled obligations.

Vi, AUTHORITY OVER INCENTIVES & ZONES

© OPTION:

(© Jackson County Legislature must approve any incentives or abatements in the "East

Village" curing the agreement, OR

© Taxing Jurisdictions must approve the redirection of thelr anticipated tax revenue

{taxing Jurisdiction preference)

‘+ The team must work with the county to modify state laws, making sure the entire project and its

surrounding area qualify for benefits like the Port Authority Aim Zone and Port improvement

District.

Vil. MAINTENANCE & COMMUNITY BENEFITS

‘+ The Royals should maintain "first-class" stadium standards,

‘© St, Louls contract: “Section 10.5 ~ Performance of Ballpark Capital Repairs and

Improvements “[TJhe Cardinals shall be responsible for making and performing all

Ballpark Capital Repairs and {mprovements.”” ~pg. 47A

‘+ Acomprehenslve Community Benefit Agreement Is anticipated, including:

© Living wage proviston for stadium and nearby employees.

© Ban on unlon-busting actions.

© A$50-100 million investment by the Royals in vulnerable Jackson County areas,

* Health Disparities (Our Healthy Jackson County}

Affordable Housing

Vill. VISIBILITY AND RECOGNITION

Prominent advertising and signage placements for Jackson County within the stadium.

Elected officials to welcome/thank Jackson County taxpayers during events (Le. video screen message)

Equal or superior billing for county officals during significant events,

1X, PRIORITY SEATING & RESIDENTIAL INCENTIVES

Priority for Jackson County residents to purchase tickets with a proposed 10% discount,

1X. INFRASTRUCTURAL COMMITMENTS

‘The Royals must construct the pedestrian bridge shown in thelr plans, regardless of Federal fund

avallablity.

X1. ADDITIONAL CONSIDERATIONS

Explore a split TIF mechanism to let PILOTs from the East Village financially benefit areas like 18th and

Vine.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5806)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (842)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (589)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Patrick Mahomes Coloring PageDocument1 pagePatrick Mahomes Coloring PageThe Kansas City Star50% (2)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Travis Kelce Coloring PageDocument1 pageTravis Kelce Coloring PageThe Kansas City StarNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Letter of Intent From Kansas City Royals and ChiefsDocument22 pagesLetter of Intent From Kansas City Royals and ChiefsThe Kansas City StarNo ratings yet

- Proposed Kansas City Ordinance 231019Document19 pagesProposed Kansas City Ordinance 231019The Kansas City Star100% (1)

- 24-3s-001 Greater Kansas City Sports Commission - 2024 Chiefs Post Season Champoinship Celebration CDocument25 pages24-3s-001 Greater Kansas City Sports Commission - 2024 Chiefs Post Season Champoinship Celebration CThe Kansas City StarNo ratings yet

- KC Star Naloxone Harm Reduction Zine (180 Flipped)Document4 pagesKC Star Naloxone Harm Reduction Zine (180 Flipped)The Kansas City StarNo ratings yet

- 94-026 Vehicle Pursuits 03-16-2021 11291 28226 v2.00Document18 pages94-026 Vehicle Pursuits 03-16-2021 11291 28226 v2.00The Kansas City StarNo ratings yet

- Opinion SC99931Document60 pagesOpinion SC99931The Kansas City StarNo ratings yet

- 2024.05.17 - Ltr to AG Bailey Re Harassment of EmployeesDocument2 pages2024.05.17 - Ltr to AG Bailey Re Harassment of EmployeesGreg DaileyNo ratings yet

- 15.5 Dec 15 Royals-Jackson County LTR Email Attachment 12.15.23Document11 pages15.5 Dec 15 Royals-Jackson County LTR Email Attachment 12.15.23The Kansas City StarNo ratings yet

- Summary of Lease and Development Agreement TermsDocument5 pagesSummary of Lease and Development Agreement TermsThe Kansas City StarNo ratings yet

- 3.5 KCR-Stadium Term Sheet Email Attachment - 6.28.23Document9 pages3.5 KCR-Stadium Term Sheet Email Attachment - 6.28.23The Kansas City StarNo ratings yet

- Kansas Secretary of State's Office LetterDocument4 pagesKansas Secretary of State's Office LetterThe Kansas City StarNo ratings yet

- County Executive Frank White's Letter To Royals Owner John Sherman 'Urging Clarity'Document1 pageCounty Executive Frank White's Letter To Royals Owner John Sherman 'Urging Clarity'The Kansas City StarNo ratings yet

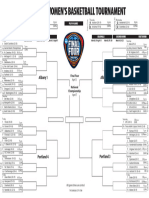

- 2024 NCAA Men's BracketDocument1 page2024 NCAA Men's BracketThe Kansas City Star0% (3)

- Trent Letter To KobachDocument3 pagesTrent Letter To KobachThe Kansas City StarNo ratings yet

- Letter To Mr. Hunt and Mr. Sherman - 3.14.2024Document2 pagesLetter To Mr. Hunt and Mr. Sherman - 3.14.2024The Kansas City Star100% (1)

- 2024 NCAA Women's Blank BracketDocument1 page2024 NCAA Women's Blank BracketThe Kansas City StarNo ratings yet

- 2024 NCAA Women's BracketDocument1 page2024 NCAA Women's BracketThe Kansas City StarNo ratings yet

- Clay Platte Joint StatementDocument1 pageClay Platte Joint StatementThe Kansas City StarNo ratings yet

- KCATA KCMO Contract 2023 2024 ATA Signed June 28 2023 With Attachments-SignedDocument32 pagesKCATA KCMO Contract 2023 2024 ATA Signed June 28 2023 With Attachments-SignedThe Kansas City StarNo ratings yet

- Dominic Miller Chiefs Rally Shooting Charging DocumentsDocument7 pagesDominic Miller Chiefs Rally Shooting Charging DocumentsThe Kansas City StarNo ratings yet

- Kansas City Police Department Policy On Vehicle PursuitsDocument20 pagesKansas City Police Department Policy On Vehicle PursuitsThe Kansas City StarNo ratings yet

- Kansas City Police Department Policy On Vehicle PursuitsDocument20 pagesKansas City Police Department Policy On Vehicle PursuitsThe Kansas City StarNo ratings yet

- KC Star Naloxone Harm Reduction Zine (Not Flipped)Document4 pagesKC Star Naloxone Harm Reduction Zine (Not Flipped)The Kansas City Star100% (1)

- KCATA Zero Fare Study ProposalDocument29 pagesKCATA Zero Fare Study ProposalThe Kansas City StarNo ratings yet

- Kansas City Fire Department MemoDocument10 pagesKansas City Fire Department MemoIan CummingsNo ratings yet

- St. Louis Source of Income Discrimination Report 1 2019 FinalDocument6 pagesSt. Louis Source of Income Discrimination Report 1 2019 FinalThe Kansas City StarNo ratings yet

- Letter To Mayor Quinton Lucas From County Executive Frank White Jr.Document1 pageLetter To Mayor Quinton Lucas From County Executive Frank White Jr.The Kansas City StarNo ratings yet

- Economic Impact Assessment Presentation Independence MODocument13 pagesEconomic Impact Assessment Presentation Independence MOThe Kansas City StarNo ratings yet