Professional Documents

Culture Documents

Nidhi OPC Revised Version Jan 2023 Answer Accounting Equation

Uploaded by

Nitin MauryaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Nidhi OPC Revised Version Jan 2023 Answer Accounting Equation

Uploaded by

Nitin MauryaCopyright:

Available Formats

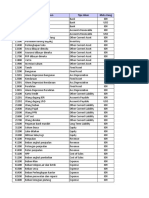

ASSETS

Nature of

Particulars or Transaction Cashflow

Reference if

applicable Deposit with Trade

# (F/I/O) Cash Furniture Laptop Consumables landlord Software receivables

Cash brought in by owner

1 (capital or share capital) ₹100,000

2 Loan taken ₹80,000

3 Bought furniture for cash -₹10,000 ₹10,000

4 Bough laptop for cash -₹40,000 ₹40,000

5 Purchased consumables -₹8,000 ₹8,000

6 Deposit made with landlord -₹10,000 ₹10,000

7 Bought software -₹21,000 ₹21,000

8 Advertisement expense -₹5,000

9 Provided services for cash ₹85,000

Collected cash for services to

10 be provided in future ₹20,000

11 Salaries paid - Oct & Nov -₹16,000

12 Rent paid - Oct-Dec -₹15,000

13 Travel expenses -₹12,000

14 Refreshements -₹7,000

15 Broadband and mobile -₹9,000

16 Electricity, etc. -₹6,000

17 Revenue on credit ₹25,000

18 Consummable expenses -₹5,000

Interest on loan due, but not

19 paid

Salaries due, but not paid for

20 December

Depreciation expense -

21 Furniture -₹625

Depreciation expense - Laptop

22 -₹1,500

23 Amortization of Software -₹1,750

24 Income tax expense -₹4,145

25 Dividend declared and paid -₹3,000

Total ₹118,855 ₹9,375 ₹38,500 ₹3,000 ₹10,000 ₹19,250 ₹25,000

Total Assets: ₹223,980

Total Equity and Liabilities ₹223,980

EQUITY AND LIABILITIES

Share Retained Loan Unearned Interest Salaries

capital Earnings payable Revenue payable payable

₹100,000 ₹80,000

-₹5,000

₹85,000

₹20,000

-₹16,000

-₹15,000

-₹12,000

-₹7,000

-₹9,000

-₹6,000

₹25,000

-₹5,000

-₹2,400 ₹2,400

-₹8,000 ₹8,000

-₹625

-₹1,500

-₹1,750

-₹4,145

-₹3,000

₹100,000 ₹13,580 ₹80,000 ₹20,000 ₹2,400 ₹8,000 ₹0

₹20,725

You might also like

- Tax Preparation ChecklistDocument3 pagesTax Preparation ChecklistElias TijerinaNo ratings yet

- E5-11 (Statement of Financial Position Preparation) Presented Below Is TheDocument7 pagesE5-11 (Statement of Financial Position Preparation) Presented Below Is Thedebora yosika100% (1)

- Stamp DutyDocument5 pagesStamp DutyBrij NandanNo ratings yet

- Tax Compliance RequirementsDocument8 pagesTax Compliance RequirementsJocelyn Verbo-AyubanNo ratings yet

- AirBnB April InvoiceDocument1 pageAirBnB April InvoiceMelanie SingletonNo ratings yet

- Accounting Worksheet Problem 4Document19 pagesAccounting Worksheet Problem 4RELLON, James, M.100% (1)

- Bir Regulations MonitoringDocument87 pagesBir Regulations MonitoringErica NicolasuraNo ratings yet

- Illustrative Problems Chap7-8Document3 pagesIllustrative Problems Chap7-8Nikki GarciaNo ratings yet

- Acc 1Document7 pagesAcc 1Taskeen AliNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set CDocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set CleshamunsayNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- Jawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Document22 pagesJawaban Mojakoe-UTS Akuntansi Keuangan 1 Ganjil 2020-2021Vincenttio le CloudNo ratings yet

- Module 2 - Caragan, Adriane Ronn B. (CORRESPONDENCE)Document6 pagesModule 2 - Caragan, Adriane Ronn B. (CORRESPONDENCE)WonnNo ratings yet

- Accts Imp QnsDocument4 pagesAccts Imp QnsnishabilochiNo ratings yet

- Copies Express Inc - by Cherryl ValmoresDocument7 pagesCopies Express Inc - by Cherryl ValmoresCHERRYL VALMORESNo ratings yet

- V. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesDocument3 pagesV. Financial Plan Mas-Issneun Samgyeopsal Income Statement For The Period Ended December 2022 SalesYuri Anne MasangkayNo ratings yet

- FABM 2 Peer TutorialDocument3 pagesFABM 2 Peer TutorialIrish LudoviceNo ratings yet

- Jordan RiverDocument5 pagesJordan RiverLouise Anne MelanoNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set BDocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set BleshamunsayNo ratings yet

- Q3 TrialDocument17 pagesQ3 TrialArthur DiselNo ratings yet

- FDNACCT - Quiz #1 - Solutions To PS - Set ADocument2 pagesFDNACCT - Quiz #1 - Solutions To PS - Set AleshamunsayNo ratings yet

- Book 2Document2 pagesBook 2Joyce NoblezaNo ratings yet

- CH 2 - HomeworkDocument5 pagesCH 2 - HomeworkAxel OngNo ratings yet

- Assignment 3 Accounting and Finance (Mba 601)Document5 pagesAssignment 3 Accounting and Finance (Mba 601)Itti SinghNo ratings yet

- Account No. Account Name Account TypeDocument2 pagesAccount No. Account Name Account Typesc9296No ratings yet

- Def Corporation Statemenrt of Financial Position December 31, 2014Document2 pagesDef Corporation Statemenrt of Financial Position December 31, 2014Aizen IchigoNo ratings yet

- Managerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Document5 pagesManagerial: July 16 Aug 16 Sept 16 Oct 16 Nov 16 Dec 16Miral AqelNo ratings yet

- Jankyle EdiongDocument10 pagesJankyle EdiongPasa YanNo ratings yet

- Daftar Akun PT Prima ElektorikDocument4 pagesDaftar Akun PT Prima ElektorikSalma AfriyaniNo ratings yet

- Rizamie SueloDocument11 pagesRizamie SueloPasa YanNo ratings yet

- HW 1 Preparing Income Statement Balance SheetDocument5 pagesHW 1 Preparing Income Statement Balance SheetDeepak KapoorNo ratings yet

- Journal, T Accounts, Worksheet and Posting and Trial BalanceDocument31 pagesJournal, T Accounts, Worksheet and Posting and Trial Balancekenneth coronel100% (1)

- Accounting Interview TestDocument86 pagesAccounting Interview TestgorettysilalahiNo ratings yet

- Balance Sheet1Document1 pageBalance Sheet1Abdirahman AbdilaahiNo ratings yet

- Hazel Do1 11am1Document11 pagesHazel Do1 11am1hazelNo ratings yet

- Total Asset LiabilitiesDocument13 pagesTotal Asset LiabilitiesIrah CabanlitNo ratings yet

- Total Asset LiabilitiesDocument13 pagesTotal Asset LiabilitiesIrah CabanlitNo ratings yet

- Persamaan Akuntansi Modul 1 Hal 13 Dan 14-1Document19 pagesPersamaan Akuntansi Modul 1 Hal 13 Dan 14-1MetarianNo ratings yet

- Practice Problems - Karysse JalaoDocument34 pagesPractice Problems - Karysse JalaoKarysse ArielleNo ratings yet

- Cash Flows From OperatingDocument1 pageCash Flows From OperatingAnonymous poFC3Q7uejNo ratings yet

- Assets Note Current Assets: Less: Accumulated Depreciation - Building Less: Accumulated Depreciation - EquipmentDocument8 pagesAssets Note Current Assets: Less: Accumulated Depreciation - Building Less: Accumulated Depreciation - EquipmentAshley Keith D. BernardinoNo ratings yet

- Unit 4 - Cash Flow Statement AnalysisDocument12 pagesUnit 4 - Cash Flow Statement Analysissikute kamongwaNo ratings yet

- Exercise 2Document6 pagesExercise 2Drey JanNo ratings yet

- Chapter - 1Document23 pagesChapter - 1Kumar AmitNo ratings yet

- Untitled SpreadsheetDocument7 pagesUntitled SpreadsheetJames Gliponio CamanteNo ratings yet

- Adjusting Entry Page 180Document9 pagesAdjusting Entry Page 180rainellagmendozaNo ratings yet

- NO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Document6 pagesNO Accounts Name Debt Credit: Ud Surya Prabu Adjusment Journal Entries 31 Desember 2019Rizki Fajar RhamadanNo ratings yet

- GROUP8Document25 pagesGROUP8dinesh dNo ratings yet

- Journal, T Accounts, WorksheetDocument10 pagesJournal, T Accounts, Worksheetkenneth coronelNo ratings yet

- Tugas05 AKM1M 21013010130 Shavira Aisyah MaharaniDocument7 pagesTugas05 AKM1M 21013010130 Shavira Aisyah MaharanicaNo ratings yet

- Comparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Document2 pagesComparative Financial Statements: Heritage Antiquing Services Comparative Balance Sheet (Dollars in Thousands)Rose BaynaNo ratings yet

- Startup Costs CalculatorDocument1 pageStartup Costs CalculatorAnish BabuNo ratings yet

- BITAVARRA c2 p2-1Document4 pagesBITAVARRA c2 p2-1Lady Margarette BitavarraNo ratings yet

- Daftar Akun PT Galaxy ElektronikDocument4 pagesDaftar Akun PT Galaxy ElektronikAshilla ZahraNo ratings yet

- Assignment:: Do It in Group With A Member of 5Document3 pagesAssignment:: Do It in Group With A Member of 5yaregalNo ratings yet

- Balance SheetDocument2 pagesBalance SheetWambo MonsterrNo ratings yet

- Income Statement: Dec-16 Dec-17Document14 pagesIncome Statement: Dec-16 Dec-17HetviNo ratings yet

- FAR Assignment - 2Document7 pagesFAR Assignment - 2Melvin ShajiNo ratings yet

- Midterm-Exam Accounting Magno Test4-1Document21 pagesMidterm-Exam Accounting Magno Test4-1Castor, Cyril Nova T.No ratings yet

- Coa PT Mukti SentosaDocument2 pagesCoa PT Mukti SentosaPutri Rahmawati20No ratings yet

- Crochet Love Financial PlanDocument2 pagesCrochet Love Financial PlanJaztine CaoileNo ratings yet

- Financial Study Table 5.1 Pre-Operation Statement of Financial PositionDocument10 pagesFinancial Study Table 5.1 Pre-Operation Statement of Financial PositionRonna Mae MendozaNo ratings yet

- Eyedropper Clinic: Accounting Equation: Current Assets Non Current AssetsDocument5 pagesEyedropper Clinic: Accounting Equation: Current Assets Non Current AssetsSofía MargaritaNo ratings yet

- Evaluating Operating and Financial PerformanceDocument33 pagesEvaluating Operating and Financial PerformanceAbhi PatelNo ratings yet

- Statement of Change in Working Capital & Inflows/Outflows of Working CapitalDocument5 pagesStatement of Change in Working Capital & Inflows/Outflows of Working CapitalChandani DesaiNo ratings yet

- Emailed Radiation Part 1 2024Document15 pagesEmailed Radiation Part 1 2024Nitin MauryaNo ratings yet

- Physics Investigatory Project On Logic GDocument19 pagesPhysics Investigatory Project On Logic GNitin MauryaNo ratings yet

- RDocument1 pageRNitin MauryaNo ratings yet

- Indian Institute of Technology KharagpurDocument14 pagesIndian Institute of Technology KharagpurNitin MauryaNo ratings yet

- SharpCookie OfflineSemBookDocument346 pagesSharpCookie OfflineSemBookNitin MauryaNo ratings yet

- C-8-Resonance (1-39)Document39 pagesC-8-Resonance (1-39)Nitin MauryaNo ratings yet

- Basic Engineering Mechanics GUIDELINESDocument3 pagesBasic Engineering Mechanics GUIDELINESNitin MauryaNo ratings yet

- Income Tax Calculator FY 2019-20 (AY 2020-21)Document1 pageIncome Tax Calculator FY 2019-20 (AY 2020-21)J DassNo ratings yet

- Partnership Tax SyllabusDocument7 pagesPartnership Tax SyllabussmyantNo ratings yet

- Taxes and Levies (Approved List For Collection) ACT 1998 NO. 2, 1998Document4 pagesTaxes and Levies (Approved List For Collection) ACT 1998 NO. 2, 1998Shuaibu AhmadNo ratings yet

- Acc f125 Bir Computation 2019Document33 pagesAcc f125 Bir Computation 2019AlliyahLynneUlepCorcueraNo ratings yet

- Budget 2021 Summary Mrunal Competitive ExamsDocument24 pagesBudget 2021 Summary Mrunal Competitive ExamsVarun MatlaniNo ratings yet

- DT - Aula 08 - BIRD, Richard M., OLDMAN, Oliver. Tax Research and Tax Reform in Latin America-A Survey and CommentaryDocument20 pagesDT - Aula 08 - BIRD, Richard M., OLDMAN, Oliver. Tax Research and Tax Reform in Latin America-A Survey and CommentaryRenan GomesNo ratings yet

- Section 28 & 29: Income From Business or ProfessionDocument5 pagesSection 28 & 29: Income From Business or ProfessionMd.Shadid Ur RahmanNo ratings yet

- 33aabfi9859c1zd GSTR2B 06072021Document60 pages33aabfi9859c1zd GSTR2B 06072021aaruna muruganNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Bhauma Lila DasNo ratings yet

- Payslip India April - 2023-1-2Document1 pagePayslip India April - 2023-1-2aamirashfaque20No ratings yet

- SPIT Cases - Day 5 - EndDocument624 pagesSPIT Cases - Day 5 - EndPeter Lloyd CarpioNo ratings yet

- UNIT-1 INCIDENCE OF TAX & Exempted IncomeDocument16 pagesUNIT-1 INCIDENCE OF TAX & Exempted IncomeAnjali SinghNo ratings yet

- MVAT ProjectDocument17 pagesMVAT ProjectRashid Nisar Daroge0% (1)

- Document 2 Epi Tax Form 2017Document10 pagesDocument 2 Epi Tax Form 2017ABC Action NewsNo ratings yet

- LIPSEY - FIGS19Visit Us at Management - Umakant.infoDocument10 pagesLIPSEY - FIGS19Visit Us at Management - Umakant.infowelcome2jungleNo ratings yet

- Real Estate Seminar 21 07 2012 CA Naresh Seth PDFDocument43 pagesReal Estate Seminar 21 07 2012 CA Naresh Seth PDFRipujoy BoseNo ratings yet

- SEC. 2. DEFINITION OF TERMS. - For Purposes of These Regulations, The FollowingDocument2 pagesSEC. 2. DEFINITION OF TERMS. - For Purposes of These Regulations, The Followingkat de castroNo ratings yet

- Tax517 Test June 2022Document5 pagesTax517 Test June 2022Marlina RashidNo ratings yet

- Govacc Quiz 3 and 4Document19 pagesGovacc Quiz 3 and 4Toni Francesca MarquezNo ratings yet

- Ward No. 03, Sial Colony, Fatehpur Road, Chowk Azam, Layyah Layyah Participatory Welfare Services (PWS)Document1 pageWard No. 03, Sial Colony, Fatehpur Road, Chowk Azam, Layyah Layyah Participatory Welfare Services (PWS)Shadnan Bin RashidNo ratings yet

- Train LawDocument3 pagesTrain LawJereme BalbinNo ratings yet

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961YashodhaNo ratings yet

- V6 After Budget 2023 New Tax Regime Vs Old Tax RegimeDocument20 pagesV6 After Budget 2023 New Tax Regime Vs Old Tax RegimegunagaliNo ratings yet

- 2012 Bar QuestionsDocument11 pages2012 Bar QuestionsGelo MVNo ratings yet