Professional Documents

Culture Documents

Banking Regulation and Supervision

Uploaded by

Romina Bohorquez0 ratings0% found this document useful (0 votes)

3 views2 pagesGlobal Economics Environment

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentGlobal Economics Environment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

3 views2 pagesBanking Regulation and Supervision

Uploaded by

Romina BohorquezGlobal Economics Environment

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

1. What is the new role of the ECB since the crisis?

Supervising the largest banks in participating countries and sanctioning them if they do not

comply with the regulation standards. They ensure a more stable and sustainable financial

environment by recalibrating its monetary policy tools, the balancing of market rates, bond

portfolios and lending operations.

2. What is the Banking Union? Why and what for?

The Banking Union is a crucial component of the European Union’s Economic and Monetary

Union (EMU). The goal of the banking union is to make the financial industry more unified,

transparent, and secure. The 2008 financial crisis and the ensuing sovereign debt crisis

made a Banking Union necessary. It became evident that issues brought on by strong ties

between the banking industry and public sector finances might readily spread over national

borders and lead to financial hardship in other EU nations, particularly in a monetary union

like the euro area.

3. Are all the banks supervised?

Every bank's daily supervision is based on procedures and standards that are designed to

produce uniform and effective supervisory results.

On subjects like the Supervisory Review and Evaluation Process (SREP) and the notification

and application procedures for monitored banks, the European Central Bank (ECB) has the

authority to promulgate its own rules, guidelines, and directives.

4. In banking supervision, What kind of practices are required of banks?

Many practices are required by banks to ensure compliance with regulatory standards:

-Banks must have internal controls that evaluate risk management and governance

structures.

-Banks must have adequate capital to protect depositors and creditors in case of adverse

economic conditions.

-Banks must manage risks to manage long-term sustainability and resilience.

-Banks must manage their asset’s quality and non-performing loans to ensure they remain

resilient.

-Banks must protect themselves from cyber risk, IT infrastructure and data security

breaches.

-Banks are required to maintain high ethical and professional standards.

5. How are supervisory activities implemented?

Ongoing supervisory activities:

Daily supervision includes all interactions with banks as well as ongoing monitoring of their

operations. One of the key components supporting the Supervisory Review and Evaluation

Process (SREP), is based on a shared set of techniques and standards for the ongoing

examination of large banks':

- risks

- governance arrangements

- capital and liquidity positions

To guarantee that the strictest regulatory standards are maintained, the SREP is applied

equitably to institutions that are larger and smaller.

6. According to the European Commission, what is “resolution”?

According to the European Commission, a bank resolution occurs when authorities

determine that, contrary to normal insolvency proceedings, resolution out of court with the

assistance of an impartial dispute resolution body would better protect financial stability,

depositors and minimise the recourse to public funds (so called public interest assessment).

This process, known as Alternative Dispute Resolution (ADR).

7. What's the mission of the “Single Resolution Board”?

It is a key element of the Banking Union and its Single Resolution Mechanism. Its mission is

to ensure the orderly resolution of failing banks, preserving financial stability and protecting

the taxpayer, with as little impact as possible on the real economy and public finances of the

participating EU countries and others.

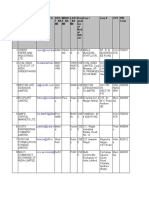

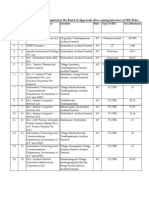

8. Elaborate a conceptual map of the Banking Union in the EU

You might also like

- Banking in Crisis: How strategic trends will change the banking business of the futureFrom EverandBanking in Crisis: How strategic trends will change the banking business of the futureNo ratings yet

- Banking 1ST PartDocument48 pagesBanking 1ST PartAlessandra ZannellaNo ratings yet

- Systemic Risk Tomography: Signals, Measurement and Transmission ChannelsFrom EverandSystemic Risk Tomography: Signals, Measurement and Transmission ChannelsNo ratings yet

- SRM Q&A 10 JulyDocument13 pagesSRM Q&A 10 JulyKara BellNo ratings yet

- SSRN Id2610594Document18 pagesSSRN Id2610594rhassan.a6969No ratings yet

- PWC Eu Bank Recovery and Resolution Directive Triumph or TragedyDocument8 pagesPWC Eu Bank Recovery and Resolution Directive Triumph or TragedykunalwarwickNo ratings yet

- Monetary Policy InstrumentsDocument16 pagesMonetary Policy InstrumentsMariana PopaNo ratings yet

- The European Banking UnionDocument4 pagesThe European Banking UnionCarlaNo ratings yet

- Group 1Document12 pagesGroup 1eranyigiNo ratings yet

- PC 2014 14 PDFDocument11 pagesPC 2014 14 PDFBruegelNo ratings yet

- Internal Control System For Banking OrganizationDocument34 pagesInternal Control System For Banking OrganizationLovelyn AtienzaNo ratings yet

- European Central Bank Master ThesisDocument6 pagesEuropean Central Bank Master Thesisvxjtklxff100% (1)

- Summary Comprehensive Response enDocument5 pagesSummary Comprehensive Response endj_han85No ratings yet

- Paper Presentation EcbDocument3 pagesPaper Presentation EcberikaNo ratings yet

- Memo 14 244 - enDocument10 pagesMemo 14 244 - enopreanioan01No ratings yet

- Bank-Objectives, Functions & Organisation StructureDocument19 pagesBank-Objectives, Functions & Organisation StructureAman Kaur LubanaNo ratings yet

- Lecture Note On BankingDocument68 pagesLecture Note On Bankinggeta beleteNo ratings yet

- Towards A Banking Union: Uropean OmmissionDocument6 pagesTowards A Banking Union: Uropean OmmissionMolnár LeventeNo ratings yet

- Peculiarities of Compliance in The BankDocument18 pagesPeculiarities of Compliance in The BankGhazi PatangNo ratings yet

- Banking UnionDocument10 pagesBanking UnionIvan MedićNo ratings yet

- International Banking Regulation ManjunathDocument40 pagesInternational Banking Regulation ManjunathvelaniepereiraNo ratings yet

- Term Paper of FM&INSDocument13 pagesTerm Paper of FM&INSKetema AsfawNo ratings yet

- FINANCIAL LAW AND LEGAL REASONING NotesDocument17 pagesFINANCIAL LAW AND LEGAL REASONING Notesfiona tefikuNo ratings yet

- Chapter 9 Central BanksDocument21 pagesChapter 9 Central BanksJay Ann DomeNo ratings yet

- PC 2012 12 BankingDocument20 pagesPC 2012 12 BankingBruegelNo ratings yet

- Scholz Position Paper Banking UnionDocument8 pagesScholz Position Paper Banking UnionMario SeminerioNo ratings yet

- Monetary Policy in ItalyDocument4 pagesMonetary Policy in Italygshah_20No ratings yet

- 2 ENG Submitter Approver Course September 2021Document75 pages2 ENG Submitter Approver Course September 2021A GNo ratings yet

- Main Functions: The Maintenance of Price StabilityDocument16 pagesMain Functions: The Maintenance of Price StabilityMariana PopaNo ratings yet

- Central BanksDocument9 pagesCentral BanksTrifan_DumitruNo ratings yet

- Financial Regulation DefinitionsDocument2 pagesFinancial Regulation DefinitionsSantiago Rodríguez PazosNo ratings yet

- Neoma How Is Climate Change Impacting The Financial System Oct 2022Document30 pagesNeoma How Is Climate Change Impacting The Financial System Oct 2022XX YYNo ratings yet

- Financial Risk Management of Eurosystem Monetary Policy Operations 201507.enDocument52 pagesFinancial Risk Management of Eurosystem Monetary Policy Operations 201507.enZerohedgeNo ratings yet

- Chapter Two: Banking SystemDocument45 pagesChapter Two: Banking Systemዝምታ ተሻለNo ratings yet

- European Commission: Green Paper Shadow BankingDocument14 pagesEuropean Commission: Green Paper Shadow BankingbookyyyNo ratings yet

- Future of The Banking UnionDocument38 pagesFuture of The Banking UnionboxineNo ratings yet

- Chapter 2 Treasury Management Environment Updated Version 6Document39 pagesChapter 2 Treasury Management Environment Updated Version 6Nawaff ShaiefNo ratings yet

- Contemporary Issues of Financial IntermediariesDocument1 pageContemporary Issues of Financial IntermediariesGETAHUN ASSEFA ALEMU100% (2)

- CH 5 Central BankDocument5 pagesCH 5 Central Bankሔርሞን ይድነቃቸውNo ratings yet

- MSC Financial Markets, Financial Institutions and Banking - Lecture 2Document34 pagesMSC Financial Markets, Financial Institutions and Banking - Lecture 2Lumumba KuyelaNo ratings yet

- Central Banking PDFDocument112 pagesCentral Banking PDFSK Mishra100% (2)

- Chapter 6 BDocument25 pagesChapter 6 Bbirook27No ratings yet

- Basel Committee On Banking Supervision: Customer Due Diligence For BanksDocument23 pagesBasel Committee On Banking Supervision: Customer Due Diligence For BanksavinashavalaNo ratings yet

- CH-2 Ethiopian Banking SectorDocument20 pagesCH-2 Ethiopian Banking Sectoraddisu bezaNo ratings yet

- Role of Centrel Bank and Monetary Policy - ClassDocument52 pagesRole of Centrel Bank and Monetary Policy - ClassalioNo ratings yet

- European Central BankDocument2 pagesEuropean Central BanknairpranavNo ratings yet

- 2018 10 08 - AE Initial Statement at ECONDocument4 pages2018 10 08 - AE Initial Statement at ECONLuca ErzegovesiNo ratings yet

- Term Paper Demise DawoDocument11 pagesTerm Paper Demise DawoKetema AsfawNo ratings yet

- Preguntas Teóricas ClaveDocument38 pagesPreguntas Teóricas Claveirene.aguirrezabalNo ratings yet

- AssignmentDocument2 pagesAssignmentHaziel Ladanan100% (1)

- 3 Chapter 3 Financial Institutions and Their Operations Lecture NotesDocument133 pages3 Chapter 3 Financial Institutions and Their Operations Lecture NotesAnimaw Yayeh100% (4)

- R M G D: ISK Anagement Uidelines For Erivatives (July 1994)Document17 pagesR M G D: ISK Anagement Uidelines For Erivatives (July 1994)loghanand_muthuramuNo ratings yet

- Macroprudential Institutions in Europe - What Are The Blind Spots?Document28 pagesMacroprudential Institutions in Europe - What Are The Blind Spots?tiyasarthaNo ratings yet

- Key Regional and International Bodies and Fora For The Financial MarketsDocument9 pagesKey Regional and International Bodies and Fora For The Financial MarketsdanoantaNo ratings yet

- Task 2 Monetary Policy in The EUDocument3 pagesTask 2 Monetary Policy in The EUekateryna249No ratings yet

- UNIT TWO Central BanksDocument6 pagesUNIT TWO Central BankswubeNo ratings yet

- CiballDocument171 pagesCiballdffinanceethiopiaNo ratings yet

- 2: European Central Bank and Monetary System (Monetary Policy Objectives and Targets)Document3 pages2: European Central Bank and Monetary System (Monetary Policy Objectives and Targets)Akshat KediaNo ratings yet

- Post-Crisis: The New NormalDocument16 pagesPost-Crisis: The New NormalRohit DeshmukhNo ratings yet

- Coverbondsintheeufinancialsystem200812en enDocument34 pagesCoverbondsintheeufinancialsystem200812en entenzin2No ratings yet

- Kantar - Study On New Digital Payment MethodsDocument128 pagesKantar - Study On New Digital Payment MethodsTrader CatNo ratings yet

- Banking and FinanceDocument74 pagesBanking and FinancekimmheanNo ratings yet

- Privileging The Machines: American Engineers, Indentured Chinese and White Workers in South Africa's Deep-Level Gold Mines, 1902-1907Document34 pagesPrivileging The Machines: American Engineers, Indentured Chinese and White Workers in South Africa's Deep-Level Gold Mines, 1902-1907Yasmin DinNo ratings yet

- Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesDate Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiddhant A. KhankalNo ratings yet

- Project ProposalDocument7 pagesProject Proposalrehmaniaaa100% (3)

- Eu Government Expenditure by Function 2018Document7 pagesEu Government Expenditure by Function 2018Ces PortaNo ratings yet

- Answer: CDocument4 pagesAnswer: CwendychenNo ratings yet

- MacEcon Mod 3 PretestDocument3 pagesMacEcon Mod 3 PretestAleihsmeiNo ratings yet

- Income Tax Department: Computerized Payment Receipt (CPR - It)Document2 pagesIncome Tax Department: Computerized Payment Receipt (CPR - It)Mian EnterprisesNo ratings yet

- Dharavi'S Recycling IndustryDocument16 pagesDharavi'S Recycling IndustryGanesh AlagirisamyNo ratings yet

- Nature and Scope of Business Economics Hand Written Notes Sampurna Dec 2023Document12 pagesNature and Scope of Business Economics Hand Written Notes Sampurna Dec 2023aamna3082No ratings yet

- The Importance of Government RegulationDocument2 pagesThe Importance of Government RegulationAxel HagosojosNo ratings yet

- General Parts of Business PlanDocument6 pagesGeneral Parts of Business PlanGabriel MartinNo ratings yet

- Ola UberDocument4 pagesOla UberAnil SinghNo ratings yet

- Case 3 - Group 5, Section 2Document8 pagesCase 3 - Group 5, Section 2sd_tataNo ratings yet

- List of Countries Forecast 2025 - DeagelDocument3 pagesList of Countries Forecast 2025 - DeagelAbanoub100% (4)

- Nodalofficers 26102020Document40 pagesNodalofficers 26102020aman3327No ratings yet

- Nicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Document3 pagesNicolas Marié What Is The Relevance, Policy and Measurement Challenges Associated With Middle Classes (And Polarization) ?Nicolas MariéNo ratings yet

- LIC Premium Receipt StatementDocument2 pagesLIC Premium Receipt StatementRMNo ratings yet

- List of Formal Approval SEZDocument34 pagesList of Formal Approval SEZsampuran.das@gmail.comNo ratings yet

- SSLC Social EM PP 2022 - 23Document10 pagesSSLC Social EM PP 2022 - 23abdulkhadar22072005No ratings yet

- MercantilismDocument2 pagesMercantilismBapu FinuNo ratings yet

- RV Capital Letter 2019-06Document10 pagesRV Capital Letter 2019-06Rocco HuangNo ratings yet

- LindbeckDocument48 pagesLindbeckMartin JacquesNo ratings yet

- Basic Economic Problems and The Philippine Socioeconomic Development in The 21st CenturyDocument3 pagesBasic Economic Problems and The Philippine Socioeconomic Development in The 21st CenturyRobert BalinoNo ratings yet

- Film Budget Template StudioBinderDocument41 pagesFilm Budget Template StudioBinderDavid AzoulayNo ratings yet

- Burton (2015) Organizational Design BDocument22 pagesBurton (2015) Organizational Design BCarol Viviana Zanetti DuranNo ratings yet

- WK2 - Business ExpansionDocument28 pagesWK2 - Business ExpansionIsmailNo ratings yet

- Chapter Four The Theory of Production and CostDocument15 pagesChapter Four The Theory of Production and CostTadesse Ayalew100% (1)

- Solved Using The Following Information For Gold Star National Bank CalculateDocument1 pageSolved Using The Following Information For Gold Star National Bank CalculateM Bilal SaleemNo ratings yet