Professional Documents

Culture Documents

Find New or Old What Regime

Find New or Old What Regime

Uploaded by

akshayg0792Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Find New or Old What Regime

Find New or Old What Regime

Uploaded by

akshayg0792Copyright:

Available Formats

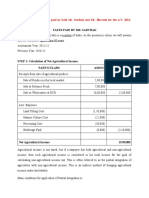

Which Tax Regime is beneficial for Salaried Individual (below

60 years) for FY 2024-25-

New Tax or Old Tax?

The decision to opt for the old tax regime will depend on the amount of exemptions and deductions available

For example, if an individual has no deductions available to him under

to the assessee.

the old tax regime, it would be beneficial for him to opt for the New tax regime.

On the other hand, if an individual is availing of deductions under Section 80C, Section 80D, and the interest on

a housing loan under Section 24, and others, it would always be beneficial for him to opt for the old tax regime.

It's important to carefully consider the exemptions and deductions available to the assessee

when deciding whether or not to opt for the old tax regime. The breakeven points for

different situations, as outlined in the below table, can help a person determine

which option is more beneficial.

BY N.KRISHNAKUMAR (Retired IOBian)

NEW TAX REGIME OR OLD TAX REGIME – WHICH IS BENEFICAL FOR SALARIED

INDIVIDUAL (BELOW 60 YEARS) FOR THE FINANCIAL YEAR 2024-25

Gross Standard Tax as Tax as

Income Deduction per per

without Rs. Old Tax New Tax Break even Investments / Payments

reducing Regime Regime

Standard in Rs. in Rs. /Incomes for Salaried individual (Below 60

Deduction Years)

Rs.

7,50,000 50,000 54,600 NIL Up to Rs.7,50,000/- GROSS INCOME, ONLY NEW TAX REGIME IS

BENEFICIAL

7,75,000 50,000 59,800 26,000

Old Tax Regime if deductions other than Standard Deduction

8,00,000 50,000 65,000 31,200 >1,62,500

8,25,000 50,000 70,200 33,800 Old Tax Regime if deductions other than Standard Deduction

>1,75,000

8,50,000 50,000 75,400 36,400 Old Tax Regime if deductions other than Standard Deduction

>1,87,500

8,75,000 50,000 80,600 39,000 Old Tax Regime if deductions other than Standard Deduction

>2,00,000

9,00,000 50,000 85,800 41,600 Old Tax Regime if deductions other than Standard Deduction

>2,12,500

BY N.KRISHNAKUMAR (Retired IOBian)

9,25,000 50,000 91,000 44,200 Old Tax Regime if deductions other than Standard Deduction

>2,25,000

9,50,000 50,000 96,200 46,800 Old Tax Regime if deductions other than Standard Deduction

>2,37,500

9,75,000 50,000 1,01,400 50,700 Old Tax Regime if deductions other than Standard Deduction

>2,43,750

10,00,000 50,000 1,06,600 54,600 Old Tax Regime if deductions other than Standard Deduction

>2,50,000

10,25,000 50,000 1,11,800 58,500 Old Tax Regime if deductions other than Standard Deduction

>2,56,250

10,50,000 50,000 1,17,000 62,400 Old Tax Regime if deductions other than Standard Deduction

>2,62,500

10,75,000 50,000 1,24,800 66,300 Old Tax Regime if deductions other than Standard Deduction

>2,68,750

11,00,000 50,000 1,32,600 70,200 Old Tax Regime if deductions other than Standard Deduction

>2,75,000

11,25,000 50,000 1,40,400 74,100 Old Tax Regime if deductions other than Standard Deduction

>2,81,250

11,50,000 50,000 1,48,200 78,000 Old Tax Regime if deductions other than Standard Deduction

>2,87,500

11,75,000 50,000 1,56,000 81,900 Old Tax Regime if deductions other than Standard Deduction

BY N.KRISHNAKUMAR (Retired IOBian)

>2,93,750

12,00,000 50,000 1,63,800 85,800 Old Tax Regime if deductions other than Standard Deduction

>3,00,000

12,25,000 50,000 1,71,600 89,700 Old Tax Regime if deductions other than Standard Deduction

>3,06,250

12,50,000 50,000 1,79,400 93,600 Old Tax Regime if deductions other than Standard Deduction

>3,12,500

12,75,000 50,000 1,87,200 98,800 Old Tax Regime if deductions other than Standard Deduction

>3,12,500

13,00,000 50,000 1,95,000 1,04,000 Old Tax Regime if deductions other than Standard Deduction

>3,12,500

13,25,000 50,000 2,02,800 1,09,200 Old Tax Regime if deductions other than Standard Deduction

>3,12,500

13,50,000 50,000 2,10,600 1,14,400 Old Tax Regime if deductions other than Standard Deduction

>3,12,500

13,75,000 50,000 2,18,400 1,19,600 Old Tax Regime if deductions other than Standard Deduction

>3,16,666

14,00,000 50,000 2,26,200 1,24,800 Old Tax Regime if deductions other than Standard Deduction

>3,25,000

BY N.KRISHNAKUMAR (Retired IOBian)

14,25,000 50,000 2,34,000 1,30,000 Old Tax Regime if deductions other than Standard Deduction

>3,33,333

14,50,000 50,000 2,41,800 1,35,200 Old Tax Regime if deductions other than Standard Deduction

>3,41,666

14,75,000 50,000 2,49,600 1,40,400 Old Tax Regime if deductions other than Standard Deduction

>3,50,000

15,00,000 50,000 2,57,400 1,45,600 Old Tax Regime if deductions other than Standard Deduction

>3,58,333

15,25,000 50,000 2,65,200 1,50,800 Old Tax Regime if deductions other than Standard Deduction

>3,66,666

15,50,000 50,000 2,73,000 1,56,000

For Gross Income of Rs.15,50,000 and above

15,75,000 50,000 2,80,800 1,63,800

Old Tax Regime if deductions other than Standard Deduction

>3,75,000

16,00,000 50,000 2,88,600 1,71,600

BY N.KRISHNAKUMAR (Retired IOBian)

TAX RATES

OLD TAX REGIME NEW TAX REGIME (Section 115BAC)

Net income range Rate Total Income Rate

Up to Rs. 2,50,000 NIL Upto Rs.3,00,000 NIL

Rs. 2,50,001- Rs.5,00,000 5% of the amount by From 3,00,001 to 6,00,000 5% of the amount by

which the taxable which the taxable

income exceeds income exceeds

Rs.2,50,000/- Rs.3,00,000/-

Rs. 5,00,001- Rs. 10,00,000 Rs.12,500/- + 20% of the From 6,00,001 to 9,00,000 Rs.15,000/- + 10% of the

amount by which the amount by which the

taxable income taxable income

exceeds Rs.5,00,000/- exceeds Rs.6,00,000/-

Above Rs. 10,00,000 Rs.1,12,500/- + 30% of From 9,00,001 to 12,00,000 Rs.45,000/- + 15% of the

the amount by which amount by which the

the taxable income taxable income

exceeds Rs.10,00,000/- exceeds Rs.9,00,000/-

From 12,00,001 to 15,00,000 Rs.90,000/- + 20% of the

amount by which the

taxable income

exceeds Rs.12,00,000/-

Above 15,00,000 Rs.1,50,000/- + 30% of

the amount by which

the taxable income

exceeds Rs.15,00,000/-

Rebate under Section 87A

For the old tax regime - In the case of a resident individual, a rebate of up to Rs. 12,500 is allowed under Section

87A from the amount of tax if the total income of such individual does not exceed Rs. 5,00,000.

BY N.KRISHNAKUMAR (Retired IOBian)

For the new tax regime - A resident individual paying tax as per the new tax regime under Section 115BAC shall

be allowed a higher amount of rebate under Section 87A if the total income is up to Rs. 7,00,000. Further, if the

total income of the resident individual marginally exceeds Rs. 7,00,000, he will be eligible for the marginal

rebate.

Health and Education Cess

Every person is liable to pay health and education cess at the rate of 4% on the amount of income tax plus

surcharge.

Default Tax Regime

From FY 2023-24 (AY 2024-25) onwards, the new tax regime will be the default tax regime for all taxpayers. This

means that when you will file your income tax return next year, the new tax regime will be selected

automatically. If you want to continue for the old tax regime, then you will have to specifically opt for it.

Switch between Tax Regimes

An individual can switch between the new tax regime and the old tax regime in every financial year. However,

the facility to switch between the new and old tax regimes is available only for those individuals having salaried

income and does not have business income

Can you opt for different income tax regime while filing ITR vis-à-vis employer?

The income tax laws allow an individual to choose any income tax regime irrespective of what was

communicated to the employer. As a result, if you choose the new tax regime with your employer, you can

also choose the old tax regime while completing your ITR. Ensure that your ITR is filed on or before July 31.

If you are planning to switch from new tax regime to old tax regime at the time of filing income tax return, you

must complete your tax-savings investments and expenditures by March 31, 2025.

BY N.KRISHNAKUMAR (Retired IOBian)

Comparison of exemption/deductions available under the old tax regime and new tax regime

of Section 115BAC

Particulars Old tax regime New tax regime

Standard Deduction of Rs.50,000 Available Available

[Section 16(ia)]

Leave Travel concession [Section Available Not Available

10(5)]

House Rent Allowance [Section Available Not Available

10(13A)]

Official and personal allowances Available Not Available

(other than those as may be

prescribed) [Section 10(14)]

Entertainment Allowance [Section Available Not Available

16((ii)]

Professional Tax [Section 16(iii)] Available Not Available

Section 24(b) – Deduction from Available Not Available for Self Occupied

Income from House Property on Property and

interest paid on housing loan & available for let out property

housing improvement loan. In

case of self- occupied property,

the upper limit for deduction of

interest paid on housing loan is

Rs. 2 lakh.

For Self Occupied Property, if the

loan was taken on or after

01.04.1999, for construction or

purchase of house property –

Maximum Limit is Rs.2,00,000/-

and for Repairs of House property

BY N.KRISHNAKUMAR (Retired IOBian)

– Maximum Limit is Rs.30,000/-

if the loan was taken before

01.04.1999, for construction or

purchase of house property –

Maximum Limit is Rs.30,000/- and

for Repairs of House property also

– Maximum Limit is Rs.30,000/-

For let out property, For

Construction or purchase of house

property - Actual value without

any limit.

Deduction under Sections 80C like Available Not Available

Contribution to PF/PPF/NPS, LIC

premium, Payment towards annuity

Plan, NSC+interest, ULIP, ELSS of

mutual funds, Housing Loan

Principal, Tuition fees for children,

Tax Saver Deposits, Sukanya

Samruddhi Scheme – Maximum

Rs.1,50,000/-

Additional Contribution towards NPS Available Not Available

–Sec 80 CCD(1B) – Max Rs.50,000/-

Deduction towards payments Available Not Available

made to Health Insurance Premium

& Preventive Health Check Up

For Self / Spouse or Dependent

Children Rs.25,000/- (Rs.5,000/- for

preventive health check up,

included in above Limit)

For Parents Rs.25,000/- (Rs.50,000/-

if any person is a Senior Citizen)

BY N.KRISHNAKUMAR (Retired IOBian)

(Rs.5,000/- for preventive health

check up, included in above Limit)

Deduction towards Medical

Expenditure incurred on a Senior

Citizen, if no premium is paid on

health insurance coverge.

Deduction towards payments Available Not Available

made towards maintenance or

medical treatment of a Disabled

Dependent or Paid / Deposited

any amount under relevant

approved scheme (u/s 80DD)

Flat deduction of Rs. 75,000

available for a person with

Disability, irrespective of expense

incurred. The deduction is

Rs. 1,25,000 if the person has Severe

Disability (80% or more)

Please note: If Taxpayer is

claiming deduction u/s 80DD then

its recommended to file form 10-IA

also before filing of return. F

Actual payment towards medical Available Not Available

treatment of self or dependent for

specified diseases (u/s 80DDB)

Deduction limit of

Rs. 40,000 (Rs. 1,00,000 if Senior

Citizen)

Deduction towards interest Available Not Available

payments made on loan for higher

education of self or relative

BY N.KRISHNAKUMAR (Retired IOBian)

(u/s 80E) – Total amount paid

towards interest on loan taken

Deduction towards interest Available Not Available

payments made on loan taken for

acquisition of residential house

property where the loan is

sanctioned between 1st April 2016

to 31st March 2017 (Section 80 EE) –

Deduction limit of Rs.50,000/- on the

interest paid on loan taken

Deduction available only to Available Not Available

individuals towards interest

payments made on loan taken

for acquisition of residential

house property for the first time

where the loan is sanctioned

between 1st April 2019 to 31st

March 2022 & deduction

should not have been claimed

u/s 80EE (Section 80 EEA) -

Deduction limit of

Rs.1,50,000/- on the interest

paid on loan taken

Deduction towards interest Available Not Available

payments made on loan for

purchase of Electric Vehicle where

the loan is sanctioned between 1st

April 2019 to 31st March 2023

(Section 80 EEB) - Deduction limit of

Rs.1,50,000 on the interest paid on

loan taken

BY N.KRISHNAKUMAR (Retired IOBian)

Donations to Charitable Institutions Available Not Available

or Funds (Sec 80 G)

Deduction towards rent paid for Available Not Available

house & applicable to only those

who are self-employed or for

whom HRA is not part of Salary

(Sec 80 GG)

Least of the following shall be

allowed as deduction

I) Rent paid reduced by 10%

of Total Income before this

deduction

II) Rs 5,000 per month

III) 25% of Total Income

(excluding long term

capital gains, short term

capital gains under

section 111A or income

under section 115A or

115D)

Note: Form 10BA to be filled for

claiming this deduction.

Deduction on interest received on Available Not Available

saving bank accounts by Non-

Senior Citizens (u/s 80TTA) –

Maximum of Rs.10,000/-

Deductions for a Available Not Available

resident individual taxpayer with

BY N.KRISHNAKUMAR (Retired IOBian)

Disability (u/s 80U)

-Flat Rs. 75,000 deduction for a

person with Disability, irrespective

of expense incurred

Flat Rs. 1,25,000 deduction for a

person with Severe Disability (80%

or more), irrespective of expense

incurred

Please note: If Taxpayer is

claiming deduction 80U then it is

recommended to file form 10-IA

also before filing of return.

BY N.KRISHNAKUMAR (Retired IOBian)

You might also like

- Taxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Document15 pagesTaxation: Gudani/Naranjo/Siapian First Pre-Board Examination August 6, 2022Harold Dan AcebedoNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- 24353-2002-Amending Ordinance No. 93-95 or TheDocument27 pages24353-2002-Amending Ordinance No. 93-95 or TheLUNA JEZERNo ratings yet

- PRTC TAX-1stPB 0522 220221 091723Document16 pagesPRTC TAX-1stPB 0522 220221 091723MOTC INTERNAL AUDIT SECTIONNo ratings yet

- Advance Account II MCQ FinalbsisjshDocument33 pagesAdvance Account II MCQ FinalbsisjshPranit Pandit100% (1)

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- Case Study Estate TaxDocument5 pagesCase Study Estate TaxRalph JaysonNo ratings yet

- Business Taxation SolutionDocument3 pagesBusiness Taxation SolutionBillie MatchocaNo ratings yet

- Revised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6Document3 pagesRevised Withholding Tax Table Effective January 1, 2018: Semi-Monthly 1 2 3 4 5 6GwenNo ratings yet

- Anju M Final ProjectDocument118 pagesAnju M Final ProjectmanjuNo ratings yet

- TRAIN Part 1 - Income TaxDocument53 pagesTRAIN Part 1 - Income TaxGianna CantoriaNo ratings yet

- REO CPA Review: Rit: Compensation IncomeDocument6 pagesREO CPA Review: Rit: Compensation IncomeReynalyn BarbosaNo ratings yet

- Old Vs NewDocument7 pagesOld Vs NewAkhil KapoorNo ratings yet

- Latest Income Tax Slabs - Fundfolio by Sharique SamsudheenDocument1 pageLatest Income Tax Slabs - Fundfolio by Sharique SamsudheensalmanNo ratings yet

- Train by SGV ColorDocument32 pagesTrain by SGV ColorFlorenz AmbasNo ratings yet

- Train Law PhilippinesDocument64 pagesTrain Law PhilippinesThe BeatlessNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax GurujiSunitKumarChauhanNo ratings yet

- CS Executive Tax Laws Amendments by Vipul ShahDocument41 pagesCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNo ratings yet

- Investment Declaration (2023-24)Document14 pagesInvestment Declaration (2023-24)DEBDEEP789No ratings yet

- Quikchex 2020 Tax Comparison CalculatorDocument1 pageQuikchex 2020 Tax Comparison CalculatorSankar rajNo ratings yet

- Tax Calculator by Tax GurujiDocument4 pagesTax Calculator by Tax Gurujicdem3782No ratings yet

- Enter Data in Yellow Fields Workings: 1,200,000 Slab Amount (Old)Document2 pagesEnter Data in Yellow Fields Workings: 1,200,000 Slab Amount (Old)Utkarsh KamalNo ratings yet

- BC NormalDocument3 pagesBC Normalma1toNo ratings yet

- Only Fill Yellow Cells: WorkingsDocument2 pagesOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNo ratings yet

- Tax Final Exam Practice Material - CompressDocument10 pagesTax Final Exam Practice Material - CompressNovemae CollamatNo ratings yet

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDocument15 pagesHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNo ratings yet

- Compensation and Reward ManagementDocument3 pagesCompensation and Reward ManagementMeghana LohumiNo ratings yet

- MCTax GuideDocument1 pageMCTax Guidekhageshcode89No ratings yet

- Q1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."Document11 pagesQ1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."kumar kartikeyaNo ratings yet

- Tax Sace 1Document13 pagesTax Sace 1kumar kartikeyaNo ratings yet

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateDocument14 pagesLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudNo ratings yet

- Comp. Jan23Document6 pagesComp. Jan23bprsowanutamaNo ratings yet

- Trial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing BalanceDocument4 pagesTrial Balance: Primary Dimension Set Period MA Name Opening Balance Debit Credit Net Difference Closing Balancesushilo_2No ratings yet

- Salary Tax - Sonali SecuritiesDocument19 pagesSalary Tax - Sonali Securitieslimon islamNo ratings yet

- Choose Your Tax RegimeDocument3 pagesChoose Your Tax Regimejanesh singhNo ratings yet

- How To Save Tax For Salary Above 20 LakhsDocument12 pagesHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNo ratings yet

- Illustration of Benefits: Pioneer Life IncDocument2 pagesIllustration of Benefits: Pioneer Life IncRon CatalanNo ratings yet

- Tax SolutionDocument4 pagesTax Solutiongen eyesNo ratings yet

- Principles of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsDocument15 pagesPrinciples of Taxation M. Khalid Petiwala: Income Tax Rates, Rebates & DeductionsosamaNo ratings yet

- CA FInal DT SampleDocument8 pagesCA FInal DT SampleprasannaNo ratings yet

- Taxation (Singapore) : March/June 2016 - Sample QuestionsDocument10 pagesTaxation (Singapore) : March/June 2016 - Sample QuestionsJobsdudeNo ratings yet

- XXXXXDocument2 pagesXXXXXvivek tiwariNo ratings yet

- 0 Dick Mobby Tracy NCR 555123444 0 Milky Liber TEA NCRDocument17 pages0 Dick Mobby Tracy NCR 555123444 0 Milky Liber TEA NCRJayrick BuencaminoNo ratings yet

- F6SGP Dec2015q PDFDocument15 pagesF6SGP Dec2015q PDFDrift SirNo ratings yet

- Advanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsDocument13 pagesAdvanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsLee WendyNo ratings yet

- PRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressDocument16 pagesPRTC Tax 1st PB 0522 This Is PRTC Tax Problem Quizzes Assignement Drills Answer Key - CompressNovemae CollamatNo ratings yet

- Presentation 1Document16 pagesPresentation 1RenzNo ratings yet

- Union Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualDocument2 pagesUnion Budget-2020-21 New Tax Rates Vs Existing Tax Rates For IndividualCA Upendra Singh ThakurNo ratings yet

- Advanced Taxation - Singapore (Atx - SGP) : Strategic Professional - OptionsDocument12 pagesAdvanced Taxation - Singapore (Atx - SGP) : Strategic Professional - Optionsnivethababu7No ratings yet

- Manila PDFDocument17 pagesManila PDFJela OasinNo ratings yet

- Chapter 1Document18 pagesChapter 1Kenny WongNo ratings yet

- f6sgp 2017 Sep Dec Q PDFDocument10 pagesf6sgp 2017 Sep Dec Q PDFJobsdudeNo ratings yet

- Balance de Prueba (De 1/ABR/2017 A 30/JUN/2017) : Innovaciones Empresariales E Inmobiliarias S.A.S (Nit: 900.423.362-1)Document3 pagesBalance de Prueba (De 1/ABR/2017 A 30/JUN/2017) : Innovaciones Empresariales E Inmobiliarias S.A.S (Nit: 900.423.362-1)Yury Nayduth MUNOZ GOMEZNo ratings yet

- Taxation - Singapore (TX - SGP) : Applied SkillsDocument19 pagesTaxation - Singapore (TX - SGP) : Applied SkillsLee WendyNo ratings yet

- Assignment - Chapter 2 (Due 09.20.20)Document5 pagesAssignment - Chapter 2 (Due 09.20.20)Tenaj KramNo ratings yet

- TOPIC 1-Tax LesgislationDocument23 pagesTOPIC 1-Tax LesgislationNURUL NUHA BINTI AZIZ HILMI / UPMNo ratings yet

- Salary Mock Solution - March-24Document2 pagesSalary Mock Solution - March-24syedameerhamza762No ratings yet

- Old RegimeDocument4 pagesOld RegimePRITHIKA DASGUPTA 19212441No ratings yet

- Es - Group 8Document4 pagesEs - Group 8Papa NketsiahNo ratings yet

- Jurnal Umum TN Budiman Servis KomputerDocument3 pagesJurnal Umum TN Budiman Servis Komputerrendibmsc002No ratings yet

- UntitledDocument30 pagesUntitledRavi BanothNo ratings yet

- Wiley GAAP 2015: Interpretation and Application of Generally Accepted Accounting PrinciplesFrom EverandWiley GAAP 2015: Interpretation and Application of Generally Accepted Accounting PrinciplesNo ratings yet

- Bank Recon and Petty CashDocument3 pagesBank Recon and Petty CashCyrus MulopeNo ratings yet

- 1.3 M1 - Dividends Question SetDocument3 pages1.3 M1 - Dividends Question Setshyla negiNo ratings yet

- FM CH 2Document18 pagesFM CH 2sosina eseyewNo ratings yet

- MCQ CH 14 - TDS and TCS - Nov 23Document18 pagesMCQ CH 14 - TDS and TCS - Nov 23NikiNo ratings yet

- Worksheet Preparation ExercisesDocument2 pagesWorksheet Preparation ExercisesDalemma FranciscoNo ratings yet

- Chapter 4 - Financial Statements of CompaniesDocument198 pagesChapter 4 - Financial Statements of CompaniesVaidehee MishraNo ratings yet

- Transaction: What Is A Transaction?Document4 pagesTransaction: What Is A Transaction?Ashok NagpalNo ratings yet

- Big Increase in Trade ReceivableseDocument4 pagesBig Increase in Trade ReceivableseShesharam ChouhanNo ratings yet

- CDM TemplateDocument9 pagesCDM TemplateRajshri SaranNo ratings yet

- 2 - FSA1 Handout (Topic 3) - Standard&incomeDocument73 pages2 - FSA1 Handout (Topic 3) - Standard&incomeGuyu PanNo ratings yet

- Payslip June Upgrad (Talentedge)Document1 pagePayslip June Upgrad (Talentedge)kartik.chahal.ug21No ratings yet

- Module 13 - (Assignment) Finance and Managing CostsDocument3 pagesModule 13 - (Assignment) Finance and Managing Costsnfarah618No ratings yet

- The Taxing Power: Tax Law, Body of Rules Under Which A Public Authority Has A Claim On Taxpayers, Requiring Them ToDocument8 pagesThe Taxing Power: Tax Law, Body of Rules Under Which A Public Authority Has A Claim On Taxpayers, Requiring Them ToTouhid SarrowarNo ratings yet

- Case Study 1 - Fundamental Financial ReportingDocument7 pagesCase Study 1 - Fundamental Financial Reporting1231402960No ratings yet

- ACE PP11MSTP1 ExamDocument18 pagesACE PP11MSTP1 Examgrayce limNo ratings yet

- NAME: - SECTION: - Classwork: Financial Planning, Tools, and Concept (Budgeting) Business Finance I. True or FalseDocument3 pagesNAME: - SECTION: - Classwork: Financial Planning, Tools, and Concept (Budgeting) Business Finance I. True or FalseSOFIA YASMIN VENTURANo ratings yet

- Tata Steel Annual Report 2022-23-413Document1 pageTata Steel Annual Report 2022-23-413mudikpatwariNo ratings yet

- Practice Cases For Chapter 12 Case 1Document3 pagesPractice Cases For Chapter 12 Case 1Lê Minh TríNo ratings yet

- Abc-Consolidation With Intercompany TransactionsDocument3 pagesAbc-Consolidation With Intercompany TransactionsLeonardo MercaderNo ratings yet

- Hart CoDocument4 pagesHart CoSITI SARAH JAUHARINo ratings yet

- The Payment of Bonus Act - 1965: Compensation ManagementDocument13 pagesThe Payment of Bonus Act - 1965: Compensation ManagementdeeshasimejiaNo ratings yet

- Partnerships Lecture Notes Partnership Formation and OperationDocument3 pagesPartnerships Lecture Notes Partnership Formation and OperationJessalyn CilotNo ratings yet

- Housing Project Case StudyDocument4 pagesHousing Project Case StudyKJNo ratings yet

- Newaygo May ElectionsDocument2 pagesNewaygo May ElectionsWXMINo ratings yet

- Accounting For Income Tax-1Document4 pagesAccounting For Income Tax-1CAINo ratings yet

- 10 Element of FRDocument12 pages10 Element of FRIloNo ratings yet

- Quiz 1Document8 pagesQuiz 1Kurt dela TorreNo ratings yet