Professional Documents

Culture Documents

Capital Budgeting-2 1.0 Solutions

Uploaded by

Yashveer Singh0 ratings0% found this document useful (0 votes)

6 views14 pagesCopyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views14 pagesCapital Budgeting-2 1.0 Solutions

Uploaded by

Yashveer SinghCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 14

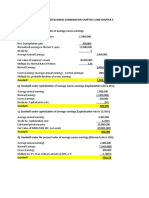

Axis Corp is considering investment in the best of two mutually exclusive projects.

Project Kelvin involves an overhaul

of the existing systems; it will cost $45000 and generate cash inflows of $20,000 per year for the next 3 years. Project

Thompson involves replacement of the existing system; it will cost $275,000, and generate cash inflows of $60,000 per

year for 6 years. Using an 8% cost of capital, calculate each project's NPV, IRR, DPBP and PI, and make a recommendation base

findings.

Year Kelvin CF Thompson CF

0 -45,000 -275000

1 20,000 60,000

2 20,000 60,000

3 20,000 60,000

4 60,000

5 60,000

6 60,000

vin involves an overhaul

he next 3 years. Project

sh inflows of $60,000 per

nd make a recommendation based on your

NPV IRR DPBP PI

Kelvin

Thompson

Axis Corp is considering investment in the best of two mutually exclusive projects. Project Kelvin involves an overhaul

of the existing systems; it will cost $45000 and generate cash inflows of $20,000 per year for the next 3 years. Project

Thompson involves replacement of the existing system; it will cost $275,000, and generate cash inflows of $60,000 per

year for 6 years. Using an 8% cost of capital, calculate each project's NPV, IRR, DPBP and PI, and make a recommendation base

findings.

Year Kelvin CF Thompson CF Discount factor Kelvin DCF Thompson DCF

0 -45,000 -275000 1 -45000 -275000

1 20,000 60,000 0.92592592592593 18518.51851852 55555.5555556

2 20,000 60,000 0.85733882030178 17146.77640604 51440.3292181

3 20,000 60,000 0.79383224102017 15876.6448204 47629.9344612

4 60,000 0.73502985279645 0 44101.7911678

5 60,000 0.68058319703375 0 40834.991822

6 60,000 0.6301696268831 0 37810.177613

vin involves an overhaul

he next 3 years. Project

sh inflows of $60,000 per

nd make a recommendation based on your

Kelvin Cum DCF Thompson Cum DCF NPV IRR DPBP PI

-45000 -275000 Kelvin 6541.9397 16% 2.587952 1.1453764

-26481.481481481 -219444.444444444 Thompson 2372.7798 8.284% 5.93724494 1.0086283

-9334.7050754458 -168004.115226337

6541.93974495757 -120374.180765127

-76272.3895973401

-35437.3977753149

2372.77983767137

Hook industries is considering the replacement of one of its old drill presses. Three alternative replacement presses

are under consideration. The relevant cash flows associated with each are shown in the following table. The firm's

cost of capital is 15%.

Press A Press B Press C

Initial Investment -85000 -60000 -130000

1 18000 12000 50000

2 18000 14000 30000

3 18000 16000 20000

4 18000 18000 20000

5 18000 20000 20000

6 18000 25000 30000

7 18000 40000

8 18000 50000

replacement presses

ing table. The firm's

NPV IRR DPBP PI

Press A

Press B

Press C

Hook industries is considering the replacement of one of its old drill presses. Three alternative replacement presses

are under consideration. The relevant cash flows associated with each are shown in the following table. The firm's

cost of capital is 15%.

Press A Press B Press C DF Press A Press B Press C

Initial Investment -85000 -60000 -130000 15% -85000 -60000 -130000

1 18000 12000 50000 0.86956522 15652.174 10434.783 43478.261

2 18000 14000 30000 0.75614367 13610.586 10586.011 22684.31

3 18000 16000 20000 0.65751623 11835.292 10520.26 13150.325

4 18000 18000 20000 0.57175325 10291.558 10291.558 11435.065

5 18000 20000 20000 0.49717674 8949.1812 9943.5347 9943.5347

6 18000 25000 30000 0.4323276 7781.8967 10808.19 12969.828

7 18000 40000 0.37593704 6766.8667 0 15037.482

8 18000 50000 0.32690177 5884.2319 0 16345.089

replacement presses

ing table. The firm's

Press A Press B Press C

-85000 -60000 -130000 NPV IRR DPBP PI

-69347.83 -49565.22 -86521.74 Press A 165771.79 13% 8+ 0.9502563

-55737.24 -38979.21 -63837.43 Press B 122584.34 16% 5.7608909 1.0430723

-43901.95 -28458.95 -50687.1 Press C 275043.89 19% 7.0796077 1.1157223

-33610.39 -18167.39 -39252.04

-24661.21 -8223.853 -29308.5

-16879.31 2584.3367 -16338.68

-10112.44 2584.3367 -1301.195

-4228.213 2584.3367 15043.893

Pound industries is attempting to select the best of three mutually exclusive projects. The initial investment and after tax cash

associated with these projects are shown in the following table. The cost of capital is 15%:

Cash flows Year Project A Project B

Initial Investment 0 -60000 -100000

Cash inflows (t=1 to 5) 1 20000 31500

Cash inflows (t=1 to 5) 2 20000 31500

Cash inflows (t=1 to 5) 3 20000 31500

Cash inflows (t=1 to 5) 4 20000 31500

Cash inflows (t=1 to 5) 5 20000 31500

nitial investment and after tax cash-inflows

Project C DF DCF A DCF B DCF C

-110000 1 -60000 -100000 -110000 Press A

32500 0.8695652 17391.3043 27391.304 28260.87 Press B

32500 0.7561437 15122.8733 23818.526 24574.669 Press C

32500 0.6575162 13150.3246 20711.761 21369.278

32500 0.5717532 11435.0649 18010.227 18581.98

32500 0.4971767 9943.53471 15661.067 16158.244

NPV 7043.10196 5592.8856 -1054.959

IRR 20% 17% 15%

PI 1.11738503 1.0559289 0.9904095

NPV IRR PI

7043.102 20% 1.117385

5592.8856 17% 1.0559289

-1054.959 15% 0.9904095

Projects A and B, of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost of

capital is 13%. The cash flows for each project are shown in the following table. Choose between the projects using

all capital budgeting techniques

Project A Project B Year

Initial Investment -80000 -50000 0

15000 15000 1

20000 15000 2

25000 15000 3

30000 15000 4

35000 15000 5

NPV 3659.68359796616 2758.4689

IRR 15% 15%

PI 1.04574604497458 1.0551694

firm's cost of

ween the projects using

Nicholson Roofing materials Inc is considering two mutually exclusive projects, each with an

initial investment of $150,000. The company’s board of directors has set a maximum 4 year payback

requirement and has set its cost of capital at 9%. Use NPV, DPBP, IRR and PI to decide.

Year Project A Project B

-150000 -150000

1 45000 75000

2 45000 60000

3 45000 30000

4 45000 30000

5 45000 30000

6 45000 30000

NPV 51866.3365603919 51112.361

IRR 20% 23%

PI 1.34577557706928 1.3407491

You might also like

- MortgageKillerEX 2Document48 pagesMortgageKillerEX 2AndyJackson100% (9)

- Capital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Document10 pagesCapital Budgeting Techniques: Sum of Present Value of Cash Inflows Rs.119,043Aditya Anshuman DashNo ratings yet

- PC Ch. 11 Techniques of Capital BudgetingDocument22 pagesPC Ch. 11 Techniques of Capital BudgetingVinod Mathews100% (2)

- Allied Bank ReportDocument70 pagesAllied Bank ReportRaja YasirNo ratings yet

- Group4 SectionA SampavideoDocument5 pagesGroup4 SectionA Sampavideokarthikmaddula007_66No ratings yet

- Q1Document31 pagesQ1Bhaskkar SinhaNo ratings yet

- Assignment - Group 6 - Case Analysis (Investment Analysis and Lockheed Tristar)Document6 pagesAssignment - Group 6 - Case Analysis (Investment Analysis and Lockheed Tristar)Rajat Gupta100% (4)

- Analysis of Project Cash FlowsDocument16 pagesAnalysis of Project Cash FlowsTanmaye KapurNo ratings yet

- NCD Proof MaroroDocument2 pagesNCD Proof MaroroAndrei CNo ratings yet

- B071GTXBS3Document119 pagesB071GTXBS3Anonymous 94TBTBRks100% (2)

- 6959 - PAS 1 - Presentation of Financial StatementsDocument7 pages6959 - PAS 1 - Presentation of Financial Statementsjohn paulNo ratings yet

- Answers and Solutions For Business Combination Chapter 3 and Chapter 4Document4 pagesAnswers and Solutions For Business Combination Chapter 3 and Chapter 4Kyree Vlade0% (1)

- Dairy ProjectDocument8 pagesDairy ProjectPraveen SinghNo ratings yet

- Comprehensive Problem On Intercompany TransactionsDocument9 pagesComprehensive Problem On Intercompany TransactionsasdasdaNo ratings yet

- Variable Reviewer12346Document17 pagesVariable Reviewer12346jeffNo ratings yet

- Types of Bank AccountsDocument20 pagesTypes of Bank AccountsNisarg Khamar73% (11)

- Capital Budgeting DCFDocument38 pagesCapital Budgeting DCFNadya Rizkita100% (4)

- PracticeDocument5 pagesPracticearif khanNo ratings yet

- Practise Question Chap 11Document20 pagesPractise Question Chap 11SaadNo ratings yet

- CB Numericals 1Document13 pagesCB Numericals 1Vedashree MaliNo ratings yet

- FM Crash Course Material 111Document65 pagesFM Crash Course Material 111Safwan Abdul GafoorNo ratings yet

- Financial Management Assignment: Sharanyan Sampath, John Deere India Private Limited Ex-PgdbmDocument6 pagesFinancial Management Assignment: Sharanyan Sampath, John Deere India Private Limited Ex-PgdbmSharanyan IyengarNo ratings yet

- Submitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoDocument8 pagesSubmitted By:: Qaisar Shahzad Submitted To: Dr. Haroon Hussain Sb. Roll NoFaaiz YousafNo ratings yet

- Capital BudgetingDocument14 pagesCapital BudgetingbhaskkarNo ratings yet

- Paper 2Document5 pagesPaper 2dua95960No ratings yet

- Chapter 9 - Home WorkDocument8 pagesChapter 9 - Home WorkFaisel MohamedNo ratings yet

- Chapter 9 - Home WorkDocument8 pagesChapter 9 - Home WorkFaisel MohamedNo ratings yet

- Capital Selection Techniques-IllustrationsDocument9 pagesCapital Selection Techniques-Illustrationsmuzaire solomonNo ratings yet

- Payback PeriodDocument32 pagesPayback Periodarif SazaliNo ratings yet

- Year Project1 Project2 Project3 Project4Document12 pagesYear Project1 Project2 Project3 Project4rajma2006No ratings yet

- Final CaseDocument25 pagesFinal CaseSakshi SharmaNo ratings yet

- Case01 02Document24 pagesCase01 02Sakshi SharmaNo ratings yet

- SamigroupDocument9 pagesSamigroupsamidan tubeNo ratings yet

- Capital Budgeting SumsDocument14 pagesCapital Budgeting Sumssunny patwaNo ratings yet

- Mulcher Cash Flow EstimationDocument8 pagesMulcher Cash Flow EstimationvarunjajooNo ratings yet

- Capital BudgetingDocument18 pagesCapital Budgetingteen agerNo ratings yet

- Capital Budgeting Practical Questions 1Document139 pagesCapital Budgeting Practical Questions 1Amita Bissa100% (1)

- DM21A24 - Hitakshi ThakkarDocument8 pagesDM21A24 - Hitakshi ThakkarRAHUL DUTTANo ratings yet

- Tarea 9.1 Problemas Evaluación Proyectos 1 Loera CoronadoDocument12 pagesTarea 9.1 Problemas Evaluación Proyectos 1 Loera CoronadoBrandon LoeraNo ratings yet

- Finance&Accounts T3 SolutionDocument4 pagesFinance&Accounts T3 Solutionkanika thakurNo ratings yet

- Cell Name Original Value Final ValueDocument13 pagesCell Name Original Value Final ValueAyman AlamNo ratings yet

- Solution Capital Budgeting AssignmentDocument8 pagesSolution Capital Budgeting AssignmentAryamanNo ratings yet

- Final Assignment ValuationDocument5 pagesFinal Assignment ValuationSamin ChowdhuryNo ratings yet

- Capital Budgeting Numericals and CasesDocument5 pagesCapital Budgeting Numericals and CasesAnkur ShuklaNo ratings yet

- Chapter 12Document14 pagesChapter 12Naimmul FahimNo ratings yet

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- FM2 Assignment 4 - Group 5Document7 pagesFM2 Assignment 4 - Group 5TestNo ratings yet

- FCF ClaculationDocument6 pagesFCF Claculationsarvesh goyalNo ratings yet

- 074 Philip UfuomaDocument18 pages074 Philip UfuomaAdeleye OluseyeNo ratings yet

- FINANCIAL MANAGEMENT Assignment 2Document14 pagesFINANCIAL MANAGEMENT Assignment 2dangerous saifNo ratings yet

- Financial Plan of Chemical Industry: Amardeep PigmentDocument17 pagesFinancial Plan of Chemical Industry: Amardeep Pigmentsant1306No ratings yet

- 2 TM C Finance-Task-CalcDocument3 pages2 TM C Finance-Task-Calcvlad vladNo ratings yet

- Exercise On Capital Budgeting-BSLDocument19 pagesExercise On Capital Budgeting-BSLShafiul AzamNo ratings yet

- Delta Project and Repco AnalysisDocument9 pagesDelta Project and Repco AnalysisvarunjajooNo ratings yet

- LAB 4 Capital Budgeting 2024Document3 pagesLAB 4 Capital Budgeting 2024asthapatel.akpNo ratings yet

- Srinath SirDocument19 pagesSrinath Sirmy Vinay100% (1)

- FM09 CH 10 Im PandeyDocument19 pagesFM09 CH 10 Im PandeyJack mazeNo ratings yet

- Assignement No 4Document5 pagesAssignement No 4Elina aliNo ratings yet

- Assignement No 4Document5 pagesAssignement No 4Elina aliNo ratings yet

- Cup Pa Mania ProjectDocument4 pagesCup Pa Mania ProjectDurgaprasad VelamalaNo ratings yet

- Class 5 Project Selection ExerciseDocument18 pagesClass 5 Project Selection ExerciseVinodshankar BhatNo ratings yet

- Assignment 1 20 F-0023Document7 pagesAssignment 1 20 F-0023maheen iqbalNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- Free Cash FlowDocument11 pagesFree Cash FlowAbdul Hameed LoundNo ratings yet

- Module 2 Capital Budgeting Handout For LMS 2020Document11 pagesModule 2 Capital Budgeting Handout For LMS 2020sandeshNo ratings yet

- C2 PsychoCeramic SciencesDocument2 pagesC2 PsychoCeramic Sciencesmuhammad haziq abdul ghaniNo ratings yet

- Engneering Economics and Accountenchy-1Document32 pagesEngneering Economics and Accountenchy-1vigneshk7697No ratings yet

- Excercise 1 AnswersDocument3 pagesExcercise 1 AnswersfaisalNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Asian Paints Ltd. (India) : SourceDocument6 pagesAsian Paints Ltd. (India) : SourceDivyagarapatiNo ratings yet

- VJ2Document4 pagesVJ2Thư TrầnNo ratings yet

- Review AudDocument13 pagesReview AudMichelle AlvarezNo ratings yet

- 1234 Statement of Cash FlowDocument9 pages1234 Statement of Cash Flowahmie banez100% (1)

- Banking Law Short QuestionsDocument4 pagesBanking Law Short QuestionsDEEPAKNo ratings yet

- Tutorial 4 QAsDocument6 pagesTutorial 4 QAsJin HueyNo ratings yet

- AccountStatement 1Document1 pageAccountStatement 1hraza5263No ratings yet

- Gold Loan CompanyDocument23 pagesGold Loan CompanyPratiksha Misal100% (1)

- Quiz I - Set A - SolutionDocument3 pagesQuiz I - Set A - SolutionSarthak JainNo ratings yet

- RATIO ANALYSIS MCQsDocument9 pagesRATIO ANALYSIS MCQsAS GamingNo ratings yet

- Ruth Assignment On Financial and Managerial Accounting (Hallmark College)Document7 pagesRuth Assignment On Financial and Managerial Accounting (Hallmark College)kal4evr19No ratings yet

- ALLPAGO Argentina Online PaymentsDocument5 pagesALLPAGO Argentina Online PaymentsMarco CamachoNo ratings yet

- Quiz 1 ProblemsDocument6 pagesQuiz 1 ProblemsRuthchell CiriacoNo ratings yet

- Fabm ReviewerDocument25 pagesFabm Reviewerdnicolecarreon11No ratings yet

- 1 - Basics of AccountingDocument48 pages1 - Basics of AccountingakshaykhaireNo ratings yet

- InstructionsDocument1 pageInstructionsvadivel.km1527No ratings yet

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodDocument6 pagesUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)No ratings yet

- Federal Urdu University of Arts, Science and Technology, IslamabadDocument5 pagesFederal Urdu University of Arts, Science and Technology, IslamabadQasim Jahangir WaraichNo ratings yet

- Answers and SolutionsDocument31 pagesAnswers and SolutionsKatherine Cabading InocandoNo ratings yet

- Jawaban KK Pengantar Akuntansi 2 After MidtermDocument8 pagesJawaban KK Pengantar Akuntansi 2 After Midtermdinda ardiyaniNo ratings yet

- BD5 SM30Document2 pagesBD5 SM30ksgNo ratings yet