Professional Documents

Culture Documents

ITC June 2022 MAF Discussion Question 1 OPM 10042022

Uploaded by

Takudzwa MashiriOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ITC June 2022 MAF Discussion Question 1 OPM 10042022

Uploaded by

Takudzwa MashiriCopyright:

Available Formats

DISCUSSION QUESTION #1 60 MARKS

OPM (Pty) Ltd (‘OPM’) is a private equity company that invests in established small to medium

unlisted companies that have growth potential, within the agricultural and industrial sectors.

Due to the higher risk associated with private equity investments, the director’s target a return from

OPM’s investments of an average of five percentage points above the return on the Johannesburg

Stock Exchange’s Top 40 index in the medium to longer term. OPM has just over R2 billion invested

at present, with individual investments ranging in size from R50 million to R150 million.

Investment in Crescent Chickens (Pty) Ltd

In June 2021 Mr. Henry Koopman, OPM’s back office manager, tasked back office staff with

performing the work necessary to value all of OPM’s investments at the end of OPM’s most recent

financial year on 31 May 2021. Mr Koopman reviews all valuations before submission to the

Investment Oversight Committee and his performance and remuneration are linked to the accuracy of

the valuations as assessed by the Investment Oversight Committee.

Details collected by a back office staff member relating to one of OPM’s investments, namely

Crescent Chickens (Pty) Ltd (‘CC’), are presented in appendices A and B. The valuation of CC has

not yet been completed as the staff member responsible for valuing the company has been booked off

sick for an extended period. However, the deadline for submission of all of OPM’s investment

valuations by the back office division to the Investment Oversight Committee is Monday, 30 June

2021.

Appendix A: Information relating to the valuation of CC

Company background

CC is a poultry producer operating within South Africa and was established in 1978. The company’s

operations are predominantly located in KwaZulu-Natal, and through various brands it provides

quality, affordable poultry products to customers throughout the country. The customer base of CC

mainly comprises major food retailers as well as companies operating in the food services industry

(such as fast food outlets). CC is regarded as a mid-tier poultry producer with approximately a 2%

market share in South Africa, delivering an estimated 350 000 chickens per week to its customers.

Acquisition by OPM

OPM acquired a controlling stake in CC on 1 June 2017. Prior to this date the majority shareholders of

CC were the management team members who had founded the company. The management team, all

of whom are close to retirement, sold the majority of their shares to OPM in order to diversify their

personal wealth prior to retirement. The terms of the acquisition required that the management team

remain in the employ of the company until the end of FY2021.

OPM paid R65 million for 60% of the equity shares of CC in issue – the purchase price was based on

a price-earnings multiple of 8,0 applied to net profit after taxation for the year ended 31 May 2017.

Subsequent to the acquisition, OPM streamlined and aggressively expanded CC’s operations by

means of debt finance, as CC has historically had a very low gearing ratio.

Industry and company update (as at 14 June 2021)

The poultry industry has experienced significant pressures in recent years, mainly as a result of rising

input costs and the inability to pass the cost increases on to customers. Selling prices have been

© Endunamoo ITC Board Course 2022 Class Discussion Question -

constrained as a result of a flood of cheap chicken imports, which resulted in local poultry producers

being price takers at the mercy of the large retail chains. In addition, the poultry industry remains

fragmented, with no single supplier or group of suppliers dominating the market. This has placed

additional downward pressure on operating margins.

In line with the industry, CC has struggled to remain profitable and reported losses in recent years.

However, it has managed to report a profit for its FY2021.

Extracts from the draft financial statements for FY2021 as well as a projection of expected results for

the next three financial years are presented in appendix B, together with selected supporting

information which may be pertinent for the purposes of valuing CC. The forecast has been prepared

by CC’s financial manager, who included the following comment when submitting the information to

OPM’s back office:

‘OPM has increased the financial leverage of CC to an exceptionally high level; hence my forecast

has included a constant dividend policy (dividend cover of four times earnings) with excess cash

being used to decrease debt levels in future years rather than reward shareholders. In addition to

reducing CC’s excessive gearing, the implementation of a constant dividend policy will provide

shareholders with greater certainty regarding future distributions.’

Taking into consideration future economic projections and the state of the poultry industry, CC’s

sustainable nominal growth rate beyond FY2024 is expected to be 6% per annum, largely due to its

smaller size. The South African long-term nominal economic growth rate is forecast to be 8% per

annum.

Surprise visits during the year

Two surprise visits were made to CC’s head office and operations by a team of back office staff

members during the past two years. The following pertinent information was noted:

22 September 2020 surprise visit

A new packaging process was installed during August 2020 which gives CC the edge over

competitors, as no other chicken producer has a similar packaging process. This process

guarantees what CC describes as a ‘fresher for longer’ product.

A new operations manager was appointed on 1 September 2020 after the unexpected resignation

of the previous operations manager, who had worked for the company for 23 years. In his

resignation letter the former operations manager stated that his resignation was due to stressful

working conditions and a breakdown in relations between the operations and finance divisions.

Overall employee morale appeared lower than on previous visits.

13 June 2021 surprise visit

No significant business process changes had occurred since the surprise visit in September 2020

– all production processes, including the new packaging process, appeared to be operating well.

The operations manager who had been appointed on 1 September 2020 tendered his letter of

resignation during May 2021 and will be leaving the employ of the company on 30 June 2021. CC

has not yet found a suitable replacement and has no suitably qualified internal staff members who

would be able to fill the position.

Employee morale remains on the low side but seems to have improved since the last surprise

visit.

© Endunamoo ITC Board Course 2022 Class Discussion Question -

Other information

The following market information has been gathered to assist with the valuation of CC:

The current yield on the R186 long-term government bond is 7,8% per annum, while short-

term government treasury bills are yielding 4,9% per annum.

The prime overdraft rate is presently 8,5% per annum.

The average historic market risk premium for the South African equity market is 5,5% per

annum.

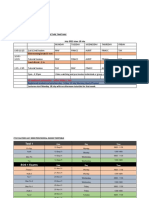

Current information applicable to listed poultry producers and the wider agricultural sector

is presented below:

Average value of all

Average agricultural

Variable listed poultry

sector value

producers

Levered beta 1,58 1,31

Unlevered beta 1,26 1,02

Debt-equity ratio 35% 40%

Earnings before interest, taxation,

depreciation and amortisation (EBITDA) 5,5 6,7

multiple

Mr Henry Koopman believes the most appropriate way to lever and unlever betas is to use the

following Hamada formula:

Bu = BL / [1 + (1 – T) (D/E)]

Where: Bu = Unlevered beta

BL = Levered beta

T = Taxation rate

D = Market value of debt

E = Market value of equity

© Endunamoo ITC Board Course 2022 Class Discussion Question -

Appendix B: Financial information relating to CC

CRESCENT CHICKENS (PTY) LTD

STATEMENTS OF COMPREHENSIVE INCOME FOR THE YEARS ENDING 31 MAY

Notes Actual Forecast Forecast Forecast

2021 2022 2023 2024

R'000 R'000 R'000 R'000

Revenue 503 160 513 220 523 480 539 180

Operating expenses 1 (450 810) (459 850) (469 040) (483 110)

Depreciation (25 340) (26 280) (26 940) (27 480)

Operating profit 27 010 27 090 27 500 28 590

Interest income 2 620 580 410 420

Interest expense 3 (7 350) (6 890) (5 130) (4 600)

Earnings before tax 20 280 20 780 22 780 24 410

Income tax (5 680) (5 820) (6 380) (6 830)

Net income 14 600 14 960 16 400 17 580

Retained income at beginning of year 159 360 170 310 181 530 193 830

Ordinary dividends declared (3 650) (3 740) (4 100) (4 400)

Retained income at end of year 170 310 181 530 193 830 207 010

© Endunamoo ITC Board Course 2022 Class Discussion Question -

CRESCENT CHICKENS (PTY) LTD

STATEMENTS OF FINANCIAL POSITION AS AT 31 MAYTEMENTS OF FINANCIAL POSITION

AS AT 31 MAY

Notes Actual Forecast Forecast Forecast

2021 2022 2023 2024

R'000 R'000 R'000 R'000

ASSETS

Non-current assets 175 680 179 630 183 220 188 710

Property, plant and equipment 5 175 180 179 630 183 220 188 710

Deferred taxation 4 500 – – –

Current assets 103870 100080 104690 106 760

Inventories 14 280 12 830 15 700 16 180

Biological assets 6 35 770 35 930 36 640 37 740

Trade and other receivables 7 39 300 41 060 41 880 43 130

Cash and cash equivalents 2 14 520 10 260 10 470 9 710

Total assets 279 550 279 710 287 910 295 470

EQUITY AND LIABILITIES

Ordinary share capital 8 12 000 12 000 12 000 12 000

Retained earnings 170 310 181 530 193 830 207 010

Non-current liabilities 52 500 38 590 35 000 29 980

Interest-bearing borrowings 3 52 500 35 000 31 340 26 210

Deferred taxation 4 – 3 590 3 660 3 770

Current liabilities 44 740 47 590 47 080 46 480

Current portion of interest-

bearing borrowings 3 10 170 11 670 10 440 8 740

Trade and other payables 29 940 30 790 31 410 32 350

Provisions 4 630 5 130 5 230 5 390

Total equity and liabilities 279 550 279 710 287 910 295 470

Notes:

1. The operating expenses for FY2021 include remuneration paid to the management team

that founded CC and who were required to remain in the employ of the company until the end

of FY2021. Their remuneration was approximately R2 500 000 less in aggregate during 2021

than the amount a similar management team would have been paid at market rates. This has

been taken into account in the forecast figures.

2. Interest income comprises interest on CC’s cash balances. Cash and cash equivalents reflect

operating cash requirements.

3. Interest on long-term borrowings is payable at a variable rate linked to the prime

overdraft rate. The interest rate payable is set at 250 basis points (2.5%) above the prime

overdraft rate. OPM’s target long-term debt-equity ratio for CC is 25% and is based on

market values, although the forecast which was prepared by the financial manager did not

incorporate this.

© Endunamoo ITC Board Course 2022 Class Discussion Question -

4 CC had an unutilised assessed tax loss of R12 580 000 on 31 May 2021. This has correctly

been accounted for and the benefit thereof was fully recognised in accordance with IAS 12,

Income Taxes, resulting in a net deferred tax asset balance in the 2021 statement of financial

position.

5 CC accounts for all property, plant and equipment in accordance with the cost model of IAS

16, Property, Plant and Equipment. Property, plant and equipment are reflected at a book value

close to the assets’ market value, except for the items specified below:

Land and buildings acquired on 1 June 1990 at a cost of R3 800 000 now have a market

value of R30 million. The property is used for operations and had a book and tax value of

R2 million on 31 May 2021. The fair value of the property was R12 500 000 on 1 October

2001.

Equipment with a book value of R15 600 000 has an estimated market value of

approximately R4 million.

6 Biological assets comprise chicken breeding stock and broilers (chickens specifically bred for

meat production). These assets are measured at their market value.

7 When the financial manager submitted the financial information to OPM’s back office he

indicated that a major customer had filed for bankruptcy on 12 June 2021. The customer

comprised 4% of the outstanding trade and other receivables balance at 31 May 2021,

after 50% had been provided for in the form of an inclusion in CC’s allowance for doubtful

debts at year end due to a poor settlement history and long overdue invoices. Initial

indications are that CC will receive no compensation in respect of the amount owed.

8 Ordinary share capital comprises 1 500 000 shares in issue. The shares are held as follows:

Number of shares Percentage

Shareholder

held shareholding

OPM 900 000 60%

Management team (founders) 450 000 30%

Employees 105 000 7%

Ms Lauren Heynes (wife of Mr Brian Heynes –

45 000 3%

the Finance Director of OPM)

The transferability of CC’s ordinary shares is restricted in terms of a ‘right of first refusal’

clause in the shareholders’ agreement in terms of which shareholders are required to offer any

shares they intend to sell to other shareholders before such shares may be offered to third

parties.

© Endunamoo ITC Board Course 2022 Class Discussion Question -

REQUIRED

Marks

(a) ….. 12

Perform valuations of OPM’s equity interest in CC at 31 May 2021, using the

following valuation techniques:

Free cash flow method,

(b) Earnings based method; and

Net asset value method.

Show all workings and set out the key assumptions you have used in each method. 40

Based on the results of your valuation workings in part (b) above, make a

recommendation, with reasons, to the Investment Oversight Committee regarding

the appropriate valuation method and value of the investment in CC as at 31 May

(c)

2021. 7

Communication skills – logical argument 1

TOTAL 60

© Endunamoo ITC Board Course 2022 Class Discussion Question -

DISCUSSION SOLUTION #1

Part (b) Marks

Free cash flow valuation

Risk free rate 7,8% 1

Market risk premium 5,5% 1

Unlevered industry beta 1,26 1

Levered beta = 1, 26 x [1+ (1-28%) (25%)] 1,4868 2c

1 mark - inverting formula, 1 mark - correct

application of formula

Therefore, cost of equity 15,98% 1c

Long-term debt equity ratio (market values) 20% 80%

Cost of equity x 80% [15,98% x 80%] 12,78% 1

Cost of debt x 20% [(8,5% + 2,5%) x 72% x 20%] 1,58% 1½

½ mark adding the spread, ½ mark tax and ½ mark

weighting

WACC therefore 14.37% 14.37% 1c

(Adjustment to the WACC for additional risks, not

1

listed, size, control, right refusal etc.)

Free cash flows 2022 2023 2024

Dividends 3 740 4 100 4 400 3

Repayment of interest-bearing borrowings 16 000 4 890 6 830 3

Reverse interest tax shield (interest) (1 929) (1 436) (1 288) 3

Interest expense 6 890 5 130 4 600 3

24 701 12 684 14 542 ½

Alternative solution

Operating profit 27 090 27 500 28 590

Depreciation 26 280 26 940 27 480 1

Movement in provisions 500 100 160 ½

Interest income 580 410 420 1

Taxes paid (Or tax and deferred tax) (Tax+def tax

movement) (1 730) (6 310) (6 720)

(Tax (5 820) (6 380) (6 830) 1

+def tax movement) 4 090 70 110 1

Reverse interest tax shield (interest) (1 929) (1 436) (1 288) 1

Inventories 1 450 (2 870) (480) ½

Biological assets (160) (710) (1 100) ½

Trade receivables (1 760) (820) (1 250) ½

Cash movement 4 260 (210) 760 ½

Trade payables 850 620 940 ½

Capital expenditure (Movement assets +

depreciation) (30 730) (30 530) (32 970)

(Movement assets (4 450) (3 590) (5 490) 1

+ depreciation) (26 280) (26 940) (27 480) 1

Free cash flows 24 701 12 684 14 542 1c

CV / TV (14 542 x 1,06)/(14.37% - 6%) or 8% (246

2

552) 184 164

24 701 12 684 198 706 ½C

© Endunamoo ITC Board Course 2022 Class Discussion Question -

Part (b) Marks

Enterprise value 164 118 1P

Less: Interest-bearing debt (Current + Long term) (62 670) 1C

Equity value 101 448

Value of OPM's stake (60%) 60 869 ½c

Available marks FCF method 23

Earnings-based method Marks

FY2021 EBITDA (27 010 + 25 340) 52 350 1

Adjustment for executives’ salaries (2 500) 1

Interest income 620 1

Sustainable EBITDA (Or 20280 + 7350 + 25340 - 2500) 50 470

EBITDA multiples of listed poultry businesses 5,5 1

Adjustments for:

Unlisted status (illiquidity) - 25% (1.375) 100%

Company is a private, marketability of shares -1 1

Smaller size than listed counterparts - 5% (0.275) 1

Reliance on key management - 5% (0.275) 1

Control premium (valuing OPM’s 60% stake + 1,00 1

EBITDA multiple for OPM 3.575 Max 4

Adjusted enterprise value (3,575 x R50 470) 180 430 1P

Less: Interest-bearing debt (62 670) 1

Equity value 117 760

Value of OPM's stake (60%) 70 656 1c

Available marks EBITDA method 11

NAV method Marks

Shareholders’ equity at end of FY2021 182 310 1

Land and buildings 23 576

Revaluation to market value 28 000 1

Tax recoupment [(3 800 – 2 000) x 28%] (504) 1

CGT arising on disposal [(30 000 – 12 500) x 80% x 28%] (3 920) 1

Equipment (8 352)

Revaluation to market value (11 600) 1

Scrapping allowance

1

[(15 600 – 4 000) x 28%] Assume book value = tax value 3 248

Bankruptcy of a major customer (1 132)

Decrease trade receivables by [39,3 m x 4%] (1 572) 1

Related tax shield [1 572 x 28%] 440 1

Adjusted NAV 196 402

Value of OPM's stake (60%) 117 841 1P

Available 46½

Maximum 41

Total 41

© Endunamoo ITC Board Course 2022 Class Discussion Question -

Part (c) Marks

The FCF method is the most technically sound method to use as it focusses on

cash flows, and provides a more comprehensive calculation using a robust WACC 1

calculation.

The FCF method result is significantly higher than the EBITDA method, which may

be due to -

o high growth rate assumed into perpetuity; and 1

o EBITDA multiples of listed poultry producers being suppressed due to current

1

difficulties in industry.

The NAV method yields a much higher result than other methods:

o It is unusual as it is generally lower, due to it representing a liquidation value; 1

o It excludes liquidation costs and retrenchment costs; and 1

o Other methods may be understating values due to current industry

1

conditions.

o NAV method is not appropriate, as the value of individual assets is

1

considered, rather than collective ability to generate returns.

o May be due to the high market value of the land and buildings acquired in

1990 which is accounted for using the depreciated cost model. This significant

1

market value adjustment appears to overestimate the value of operations on a

NAV basis in light of the present challenging economic environment.

o As the NAV is the highest it may be beneficial to close CC’s operations and

1

sell off the assets.

CC incurred losses until 2021 and it may be prudent to adopt a conservative stance

1

until the turnaround proves to be sustainable.

Accordingly, the result of the lower of the two methods, namely the EBITDA method

result of R70, 6m, should be used. (OR any other reasonable conclusion based on 1

calculations/discussion presented)

Available 11

Maximum 7

Communication skills - logical argument 1

© Endunamoo ITC Board Course 2022 Class Discussion Question -

You might also like

- 10 Interview Questions and Answers - DAILY JOBS Dubai UAE - New Job OpeningsDocument27 pages10 Interview Questions and Answers - DAILY JOBS Dubai UAE - New Job OpeningsRaza ButtNo ratings yet

- Indian IT Services - Sector Report 6mar09Document73 pagesIndian IT Services - Sector Report 6mar09BALAJI RAVISHANKARNo ratings yet

- Flutter Entertainment PLCDocument73 pagesFlutter Entertainment PLCprajwal sedhaiNo ratings yet

- Contract of LeaseDocument4 pagesContract of LeaseIelBarnachea100% (5)

- Prog Copywriting Exercise 10Document3 pagesProg Copywriting Exercise 10azertyNo ratings yet

- ZIMCODEDocument130 pagesZIMCODETakudzwa Mashiri100% (1)

- Cisco Start CatalogDocument4 pagesCisco Start CatalogqntttNo ratings yet

- 2020-08-31 Ar20Document68 pages2020-08-31 Ar20Daniel ManNo ratings yet

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document9 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalNo ratings yet

- KPITTECH 03082020160338 KPITInvestorUpdateSEuploadDocument28 pagesKPITTECH 03082020160338 KPITInvestorUpdateSEuploadSreenivasulu Reddy SanamNo ratings yet

- Results For Announcement To The MarketDocument63 pagesResults For Announcement To The MarketTimBarrowsNo ratings yet

- RAK Ceramics PJSC CFS Q2 2020 EnglishDocument34 pagesRAK Ceramics PJSC CFS Q2 2020 Englishahme farNo ratings yet

- BritanniaDocument269 pagesBritanniaAnushkaa GuptaNo ratings yet

- Financial Reporting Paper 2.1 Dec 2023Document28 pagesFinancial Reporting Paper 2.1 Dec 2023Oni SegunNo ratings yet

- B1 Free Solving Nov 2019) - Set 3Document5 pagesB1 Free Solving Nov 2019) - Set 3paul sagudaNo ratings yet

- Tax Memorandum 2012 FinalDocument58 pagesTax Memorandum 2012 FinalAzka KhalidNo ratings yet

- IFII Research Report Vincent TjoeDocument4 pagesIFII Research Report Vincent TjoeVincent TjoeNo ratings yet

- RIL 2Q FY21 Analyst Presentation 30oct20Document60 pagesRIL 2Q FY21 Analyst Presentation 30oct20ABHISHEK GUPTANo ratings yet

- Annual Report Berger Paints IndiaDocument4 pagesAnnual Report Berger Paints IndiaRamanathan GopalakrishnanNo ratings yet

- Major 1 Finance Project - 20461Document12 pagesMajor 1 Finance Project - 20461Augum DuaNo ratings yet

- c3 Mergers and Acquisitions Review QuestionsDocument7 pagesc3 Mergers and Acquisitions Review Questionscharlesmicky82No ratings yet

- Swire Pacific Reports An Underlying Loss of HK$5,485 Million in The First Half of 2020Document86 pagesSwire Pacific Reports An Underlying Loss of HK$5,485 Million in The First Half of 2020ChiaNo ratings yet

- Valuation Report: JD SportsDocument10 pagesValuation Report: JD SportsJunaid IqbalNo ratings yet

- PI Industries DolatCap 141111Document6 pagesPI Industries DolatCap 141111equityanalystinvestorNo ratings yet

- FIN435 Imrul Farhan Pritom 1620326030 Sec5 PartC PDFDocument10 pagesFIN435 Imrul Farhan Pritom 1620326030 Sec5 PartC PDFঅদেখা ভুবনNo ratings yet

- IDFC-AMC 2021 Annual-ReportDocument63 pagesIDFC-AMC 2021 Annual-ReportvinitNo ratings yet

- Bec524 and Bec524e Test 2 October 2022Document5 pagesBec524 and Bec524e Test 2 October 2022Walter tawanda MusosaNo ratings yet

- Balkrishna Industries Investor PresentationDocument34 pagesBalkrishna Industries Investor PresentationAnand SNo ratings yet

- 105 DepaDocument12 pages105 DepaLA M AENo ratings yet

- Bse 2Document18 pagesBse 2Aashish JainNo ratings yet

- Indiabulls Housing Finance: CMP: INR514Document12 pagesIndiabulls Housing Finance: CMP: INR514Tanya SinghNo ratings yet

- Appendix 4E and Annual Report FY20Document79 pagesAppendix 4E and Annual Report FY20Gursheen KaurNo ratings yet

- Frieslandcampina Engro Pakistan Limited Financial Results - Quarter 1, 2020Document3 pagesFrieslandcampina Engro Pakistan Limited Financial Results - Quarter 1, 2020Hassan KhanNo ratings yet

- B1 Free Solving Nov 2019) - Set 4Document11 pagesB1 Free Solving Nov 2019) - Set 4paul sagudaNo ratings yet

- DownloadDocument33 pagesDownloadrdhNo ratings yet

- CIA 1 Shalini Mam CIA 1Document9 pagesCIA 1 Shalini Mam CIA 1agnelfrancyNo ratings yet

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocument7 pagesSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirNo ratings yet

- PFI VizslaDocument2 pagesPFI VizslaNur AmirahNo ratings yet

- Kotak - LTI Q1FY21 ReviewDocument15 pagesKotak - LTI Q1FY21 ReviewshahavNo ratings yet

- Financial Analysis of Bega Cheese, AustraliaDocument26 pagesFinancial Analysis of Bega Cheese, AustraliaTanmoy NaskarNo ratings yet

- CBCS 3.3.3 Corporate Valuation and Restructuring 2020Document4 pagesCBCS 3.3.3 Corporate Valuation and Restructuring 2020Bharath MNo ratings yet

- Indiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Document12 pagesIndiabulls Housing Finance: CMP: INR949 TP: INR1,150 (+21%)Veronika AkheevaNo ratings yet

- CECDocument4 pagesCECJyoti Berwal0% (3)

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- q4 Fy20 EarningsDocument20 pagesq4 Fy20 EarningsKJ HiramotoNo ratings yet

- Press Release and Inv. PresentationDocument16 pagesPress Release and Inv. Presentationankur parekhNo ratings yet

- 10 - 14 - 2022 - SEC Form 17-C - Quarterly Report On The Use of Proceeds From Preferred Shares Offering (3rd Quarter 2022)Document7 pages10 - 14 - 2022 - SEC Form 17-C - Quarterly Report On The Use of Proceeds From Preferred Shares Offering (3rd Quarter 2022)Mik SerranoNo ratings yet

- Ajooni BiotechDocument21 pagesAjooni BiotechSunny RaoNo ratings yet

- PJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Document15 pagesPJT Partners Inc., Q3 2022 Earnings Call, Oct 25, 2022Neel DoshiNo ratings yet

- Press Release Arman Q3FY21Document5 pagesPress Release Arman Q3FY21Forall PainNo ratings yet

- AFR 2 End of Semester Examination 2022-2023Document10 pagesAFR 2 End of Semester Examination 2022-2023Sebastian MlingwaNo ratings yet

- Financial Accounting and Reporting-IIDocument7 pagesFinancial Accounting and Reporting-IIRochak ShresthaNo ratings yet

- Tax Planning and Compliance - JA-2022 - QuestionDocument6 pagesTax Planning and Compliance - JA-2022 - QuestionsajedulNo ratings yet

- FY10 Earnings & Strategy Update Gy P To Shareholders: August 6, 2010 August 6, 2010Document31 pagesFY10 Earnings & Strategy Update Gy P To Shareholders: August 6, 2010 August 6, 2010Shankar KosuruNo ratings yet

- Financial Management Paper 2.4 July 2023Document18 pagesFinancial Management Paper 2.4 July 2023johny SahaNo ratings yet

- Research of Healthcare Facility in USADocument4 pagesResearch of Healthcare Facility in USATanmoy NaskarNo ratings yet

- C6 - Investment IncentivesDocument26 pagesC6 - Investment Incentivesnabilah natashaNo ratings yet

- 2cjvoeqflu7sw8 Yid1o4pb 6cvddrcbdeqj Kz6clyDocument24 pages2cjvoeqflu7sw8 Yid1o4pb 6cvddrcbdeqj Kz6clySuzlonNo ratings yet

- Divya Pandey - Mba - Finance - 2019 - 0306 - 0001 - 0010Document20 pagesDivya Pandey - Mba - Finance - 2019 - 0306 - 0001 - 0010Avinash Tiwari0% (2)

- ITC Limited: Ratings Reaffirmed: Summary of Rating ActionDocument6 pagesITC Limited: Ratings Reaffirmed: Summary of Rating ActionSatish RajNo ratings yet

- Epicenter Technologies Private - R - 11082020Document7 pagesEpicenter Technologies Private - R - 11082020Shawn BlazeNo ratings yet

- Today.: Technology For The Next DecadeDocument26 pagesToday.: Technology For The Next DecadeBschool caseNo ratings yet

- Ge Webcast Pressrelease 10262021Document12 pagesGe Webcast Pressrelease 10262021Santhosh Lvs AnuNo ratings yet

- AR201920Document185 pagesAR201920utkarsh tripathiNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Hre 2024Document5 pagesHre 2024Takudzwa MashiriNo ratings yet

- Dividend Policy Tutorial QuestionDocument9 pagesDividend Policy Tutorial QuestionTakudzwa MashiriNo ratings yet

- International Finance Study UnitDocument21 pagesInternational Finance Study UnitTakudzwa MashiriNo ratings yet

- Cta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDDocument9 pagesCta 2&Ft Applied Financial Accounting Reporting 2022 Test 1 - Scenario - TDTakudzwa MashiriNo ratings yet

- UntitledDocument11 pagesUntitledTakudzwa MashiriNo ratings yet

- Cta 2ft End of Semester Financial Accounting Reporting 2022 - ScenarioDocument9 pagesCta 2ft End of Semester Financial Accounting Reporting 2022 - ScenarioTakudzwa MashiriNo ratings yet

- Cta Fulltime July 2022 Provisional TimetableDocument2 pagesCta Fulltime July 2022 Provisional TimetableTakudzwa MashiriNo ratings yet

- Cta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TDDocument1 pageCta 2&FT Applied Financial Accounting Reporting 2022 Test 1 - Required - TDTakudzwa MashiriNo ratings yet

- Cta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalDocument2 pagesCta 2021 Level 2 Applied Auditing and Governance Eos - Required - FinalTakudzwa MashiriNo ratings yet

- Money, Happiness and InvestingDocument65 pagesMoney, Happiness and InvestingTakudzwa MashiriNo ratings yet

- Tax ActsDocument625 pagesTax ActsTakudzwa MashiriNo ratings yet

- Michigan Clinic 2008 NotesDocument10 pagesMichigan Clinic 2008 NotesCoach Brown100% (3)

- The Rook Volume XXIIIDocument40 pagesThe Rook Volume XXIIIThe RookNo ratings yet

- 3.6-6kva Battery Cabinet: 1600Xp/1600Xpi SeriesDocument22 pages3.6-6kva Battery Cabinet: 1600Xp/1600Xpi SeriesIsraelNo ratings yet

- General Rules ICT Lab Rules PE & Gym RulesDocument1 pageGeneral Rules ICT Lab Rules PE & Gym Rulestyler_froome554No ratings yet

- 13 Datasheet Chint Power Cps Sca5ktl-Psm1-EuDocument1 page13 Datasheet Chint Power Cps Sca5ktl-Psm1-EuMARCOS DANILO DE ALMEIDA LEITENo ratings yet

- Askehave and Nielsen - Digital Genres PDFDocument22 pagesAskehave and Nielsen - Digital Genres PDFChristopher SmithNo ratings yet

- Junior 3 Future-Passive VoiceDocument1 pageJunior 3 Future-Passive VoiceJonathan QNo ratings yet

- Gian Jyoti Institute of Management and Technology, Mohali Assignment No-1 Academic Session January-May 202Document4 pagesGian Jyoti Institute of Management and Technology, Mohali Assignment No-1 Academic Session January-May 202Isha aggarwalNo ratings yet

- Chapter 1 and 2Document75 pagesChapter 1 and 2Balamurali SureshNo ratings yet

- Charmed - 3x13 - Bride and Gloom - enDocument50 pagesCharmed - 3x13 - Bride and Gloom - enGa ConNo ratings yet

- New Microsoft Word DocumentDocument2 pagesNew Microsoft Word Documenthakimfriends3No ratings yet

- Technical Support Questions and Answers: How Do I Access Commseciress?Document3 pagesTechnical Support Questions and Answers: How Do I Access Commseciress?goviperumal_33237245No ratings yet

- Nine Competencies For HR Excellence Cheat Sheet: by ViaDocument1 pageNine Competencies For HR Excellence Cheat Sheet: by ViaRavi KumarNo ratings yet

- Culture and CraftDocument27 pagesCulture and CraftFreya UmelNo ratings yet

- Quantitative Reasearch KINDS OF RESEARCHDocument1 pageQuantitative Reasearch KINDS OF RESEARCHEivie SonioNo ratings yet

- Clam Antivirus 0.100.0 User ManualDocument34 pagesClam Antivirus 0.100.0 User ManualJacobus SulastriNo ratings yet

- Biodata Arnel For Yahweh GloryDocument2 pagesBiodata Arnel For Yahweh GloryClergyArnel A CruzNo ratings yet

- Use of Digital Games in Teaching Vocabulary To Young LearnersDocument6 pagesUse of Digital Games in Teaching Vocabulary To Young LearnersRosely BastosNo ratings yet

- Land Laws LAW 446: AssignmentDocument21 pagesLand Laws LAW 446: AssignmentpriyaNo ratings yet

- Walt Disney BiographyDocument8 pagesWalt Disney BiographyIsaacRodríguezNo ratings yet

- Faculty of Education: Dr. Ghanshyam Singh P.G. College, Soyepur, Lalpur, VaranasiDocument4 pagesFaculty of Education: Dr. Ghanshyam Singh P.G. College, Soyepur, Lalpur, VaranasiRajeshKumarJainNo ratings yet

- Keeper of The Lost Cities - CGDocument4 pagesKeeper of The Lost Cities - CGat ur disposalNo ratings yet

- 850 SQ MM AAC Conductor PDFDocument1 page850 SQ MM AAC Conductor PDFSamyak DeoraNo ratings yet

- Yangon Technological University Department of Civil Engineering Construction ManagementDocument18 pagesYangon Technological University Department of Civil Engineering Construction Managementthan zawNo ratings yet

- Fundamentals of Software Engineering Course OutlineDocument4 pagesFundamentals of Software Engineering Course Outlinebetelhem yegzawNo ratings yet

- From St. Francis To Dante-Translations From The Chronicle of The Franciscan Salimbene, 1221-1288Document489 pagesFrom St. Francis To Dante-Translations From The Chronicle of The Franciscan Salimbene, 1221-1288Jake SalNo ratings yet