Professional Documents

Culture Documents

Financial Statement Exercises

Uploaded by

Mai Nguyễn Thanh0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

Financial statement exercises

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesFinancial Statement Exercises

Uploaded by

Mai Nguyễn ThanhCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

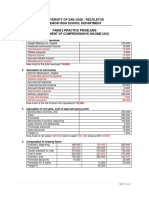

Exercise 1:

Franklin Kite Co. Inc.

Income statement

For a specific period of time

Revenues

Service revenue 900,000

Cost of goods sold 400,000

Gross profit 500,000

Expenses

Interest expenses 40,000

Selling and administrative expense 60,000

Depreciation expense 20,000

Taxes 50,000

Total expenses 170,000

Net income 330,000

Basic earning per share (EPS) (330,000 - 80,000) ÷ 50,000 = 5

Exercise 2:

Virginia Slim Wear

Income statement

For a specific of time

Revenues

Sales 1,360,000

Cost of goods sold 700,000

Gross profit 660,000

Expenses

34,000

Interest expense 49,000

Selling and administrative expense 23,000

Depreciation expense 100,000

Taxes

Total expenses 206,000

Net income 454,000

Basic earning per share (EPS) (454,000 - 86,000) ÷ 104,000 = 3,538

You might also like

- Chapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Document20 pagesChapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Asi Cas Jav100% (2)

- Schaum's Outline of Principles of Accounting I, Fifth EditionFrom EverandSchaum's Outline of Principles of Accounting I, Fifth EditionRating: 5 out of 5 stars5/5 (3)

- FI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeyDocument10 pagesFI 3300 - Corporation Finance Spring 2015: THPS-1 Solution KeySer Ronell0% (1)

- 72 - Pertemuan 4 DocumentDocument7 pages72 - Pertemuan 4 DocumentWahyu JanokoNo ratings yet

- TAÑOTE Daisy AEC7 MEPIIDocument9 pagesTAÑOTE Daisy AEC7 MEPIIDaisy TañoteNo ratings yet

- Solution Comp Acc Soalan 1Document4 pagesSolution Comp Acc Soalan 1maiNo ratings yet

- Jawaban Soal Latihan AKL2 Pertemuan 4Document5 pagesJawaban Soal Latihan AKL2 Pertemuan 4fathan qoriibaNo ratings yet

- Prefinal Exam - SolutionDocument7 pagesPrefinal Exam - SolutionKarlo PalerNo ratings yet

- 4 2 Endless Company PDFDocument3 pages4 2 Endless Company PDFJulius Mark Carinhay TolitolNo ratings yet

- CH 4 Brief Exercises 16th PDFDocument18 pagesCH 4 Brief Exercises 16th PDFNiken PurwantyNo ratings yet

- Comprehensive IncomeDocument2 pagesComprehensive IncomeLeomar CabandayNo ratings yet

- Chapter 9 - Presentation of Fs (Statement of Comprehensive Income)Document2 pagesChapter 9 - Presentation of Fs (Statement of Comprehensive Income)Mark IlanoNo ratings yet

- 05 Activity 1 BALADocument3 pages05 Activity 1 BALAPola PolzNo ratings yet

- BT Tổng Hợp Topic 7 8 2Document12 pagesBT Tổng Hợp Topic 7 8 2Man Tran Y NhiNo ratings yet

- Group 5Document16 pagesGroup 5Amelia AndrianiNo ratings yet

- REG.A - Laras Sukma N.T - 0320101001 - Tugas Pertemuan Ke 4Document9 pagesREG.A - Laras Sukma N.T - 0320101001 - Tugas Pertemuan Ke 4Laras sukma nurani tirtawidjajaNo ratings yet

- Assignment1 - Profit and Loss Exercise E FinanceDocument8 pagesAssignment1 - Profit and Loss Exercise E Financees.eldeebNo ratings yet

- Income Statement PreparationDocument11 pagesIncome Statement PreparationIbi Ifti100% (1)

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubNo ratings yet

- Income StatementDocument6 pagesIncome StatementMohamed Yusuf KarieNo ratings yet

- Income StatementDocument1 pageIncome StatementAllen KateNo ratings yet

- Income StatementDocument1 pageIncome StatementAllen KateNo ratings yet

- Semi-Finals Solutions MartinezDocument10 pagesSemi-Finals Solutions MartinezGeraldine Martinez DonaireNo ratings yet

- Tutorial 1 27 April 2022Document6 pagesTutorial 1 27 April 2022Swee Yi LeeNo ratings yet

- CONFRA2Document5 pagesCONFRA2Pia ChanNo ratings yet

- Sample Functional Form of Statement of Comprehensive IncomeDocument2 pagesSample Functional Form of Statement of Comprehensive IncomeHazel Joy DemaganteNo ratings yet

- Fa2 TutorialDocument59 pagesFa2 TutorialNam PhươngNo ratings yet

- Fa2 Module234Document20 pagesFa2 Module234Yanna100% (1)

- Fabm2 Statement of Comprehensive Income Practice Problems Answer KeyDocument3 pagesFabm2 Statement of Comprehensive Income Practice Problems Answer KeyMounicha Ambayec0% (1)

- Fabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyDocument3 pagesFabm2 - Statement of Comprehensive Income (Practice Problems) - Answer KeyMounicha Ambayec100% (4)

- DAIBB MA Math Solutions 290315Document11 pagesDAIBB MA Math Solutions 290315joyNo ratings yet

- IA3 Engaging Activity, PT1 PT2 PT3 & QUIZDocument8 pagesIA3 Engaging Activity, PT1 PT2 PT3 & QUIZKaye Ann Abejuela RamosNo ratings yet

- Pr. 4-146-Income StatementDocument13 pagesPr. 4-146-Income StatementElene SamnidzeNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Chapter 2Document40 pagesChapter 2ellyzamae quiraoNo ratings yet

- Financial Accounting 3A Assignment 2tendai MakosaDocument5 pagesFinancial Accounting 3A Assignment 2tendai MakosaTendai MakosaNo ratings yet

- Account AssignmentDocument4 pagesAccount AssignmentNavjeet SandhuNo ratings yet

- Solution Income Statment Part 1 Revision PDFDocument2 pagesSolution Income Statment Part 1 Revision PDFAA BB MMNo ratings yet

- Confra Financial StatementsDocument3 pagesConfra Financial StatementsPia ChanNo ratings yet

- 2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)Document20 pages2E Intermediate (Sat - 16-3-2024) - Final Ch.2 (A)ahmedNo ratings yet

- Profit & Loss (Standard) : PT Fifa - Resa HarismaDocument1 pageProfit & Loss (Standard) : PT Fifa - Resa HarismaBikin OrtubanggaNo ratings yet

- Equity MethodDocument2 pagesEquity MethodJeane Mae BooNo ratings yet

- Statement of Comprehensive IncomeDocument28 pagesStatement of Comprehensive IncomePrincess GuimbalNo ratings yet

- Asdos Pert 2Document2 pagesAsdos Pert 2mutiaoooNo ratings yet

- Group Quiz InstructionsDocument9 pagesGroup Quiz InstructionsRaidenhile mae VicenteNo ratings yet

- Cases Chapter 4 - Syndicate 8Document4 pagesCases Chapter 4 - Syndicate 8Ahike HukatenNo ratings yet

- Chapter 3. Solution Exercises Income StatementDocument13 pagesChapter 3. Solution Exercises Income StatementHECTOR ORTEGANo ratings yet

- Preparation of Financial StatementsDocument13 pagesPreparation of Financial StatementsSharina Mhyca SamonteNo ratings yet

- Sample Problems Cash Flow AnalysisDocument2 pagesSample Problems Cash Flow AnalysisTeresa AlbertoNo ratings yet

- Latihan P7-4Document6 pagesLatihan P7-4ryuNo ratings yet

- Answer No. 1: A. MaterialDocument4 pagesAnswer No. 1: A. MaterialFaroo wazirNo ratings yet

- IA3 AssignmentDocument7 pagesIA3 AssignmentJaeNo ratings yet

- This Study Resource Was: Solutions To Assigned Problems & ExercisesDocument3 pagesThis Study Resource Was: Solutions To Assigned Problems & ExercisesMikaela Amigan EvangelistaNo ratings yet

- QUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEDocument6 pagesQUIZ - CHAPTER 2 - Printing STATEMENT OF COMPREHENSIVE INCOMEAllen Kate Malazarte0% (1)

- Solutions To ProblemsDocument22 pagesSolutions To ProblemsSyeed AhmedNo ratings yet

- Fundamentals of Corporate Finance 6th Edition Christensen Solutions ManualDocument6 pagesFundamentals of Corporate Finance 6th Edition Christensen Solutions ManualJamesOrtegapfcs100% (62)

- Advanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FDocument7 pagesAdvanced Accounting 2 - Chapter 4 James B. Cantorne Problem 1. T/FJames CantorneNo ratings yet

- (Chap 26) MaDocument16 pages(Chap 26) MaDuong TrinhNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet