Professional Documents

Culture Documents

AT Quesaa

Uploaded by

A. MagnoOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AT Quesaa

Uploaded by

A. MagnoCopyright:

Available Formats

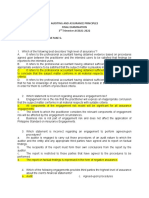

1.

Which of the following procedures would an accountant most likely perform in a compilation engagement

a. Test the accounting records c. Apply analytical

procedure

b. Collect, classify and summarized financial information d. Assess risk components

2. The procedures employed in doing compilation are

a. Less extensive than review procedures but more extensive than agreed upon procedures

b. Designed to enable the accountant to express a limited assurance

c. Not designed to enable the accountant to express any form of assurance

d. Designed to enable the accountant to express a negative assurance

3. Which of the following procedures is normally performed in connection with a compilation engagement

a. Collect, classify and summarize financial information

b. Inquire of management about subsequent events

c. Applying analytical review procedures

d. Making inquiries of management concerning actions taken at board meeting

4. The use of negative assurance in audit reports on financial statements is

a. Encourage by PICPA

b. Violation of the professional standards

c. Properly located in the opinion paragraph of the unqualified report

d. A help in clarifying the degree of responsibility being assumed by the auditor

5. Which of the following is not true about reports provided a CPA

a. In a compilation engagement, no assurance is expressed and the users of financial

information do not derive any benefit from the CPAs involvement

b. In the audit engagement, the auditor provides high level of assurance that the financial

information is free of material misstatement

c. In a review engagement, the CPAs moderate assurance is expressed in the form of negative

assurance

d. For agreed upon procedures, the CPA provides a report on factual; findings and no assurance

is expressed

6. A CPA who is not independent may issue

a. Review report b. Compilation report c. Special report d. Report expressing a

qualified opinion

7. Which of the following statements about assurance engagements is not correct

a. The Philippine Standards on Assurance Engagements issued by AASC describe the

objectives and elements of assurance engagements to provide either a high, moderate or low

level of assurance

b. Assurance engagements are intended to enhance the credibility of information about a subject

matter by evaluating whether the subject matter conforms in all material respects with suitable

criteria

c. Not all engagements performed by professional accountant are assurance engagements

d. The subject matter of an assurance engagement may take many forms such as data, systems

and processes

8. Which of the following services provides a moderate level of assurance about client financial statements

a. Compilation b. Review c. Compliance with contractual obligations d. Forecast and

projections

9. Which of the following is not one of the requirements before accepting an assurance engagements

a. The responsible party and the intended user of assurance report should be from different

organization

b. The practitioner should be competent and independent

c. The practitioner should accept the engagement only if the subject matter is identifiable and in

the form that can be subjected to evidence gathering procedures

d. The practitioner should accept the engagement only if the subject matter is the responsibility

of another party

10. Which of the following generalization is incorrect about the reliability of evidence gathered by practitioner

a. Evidence in the form of documents and written representation is more likely to be reliable

b. Evidence from external source is more reliable than the generated internally

c. Evidence generated internally is more reliable when subject to appropriate controls within the

entity

d. Evidence obtained indirectly by the practitioner is more likely reliable than that obtained

directly

11. When a CPA is associated with the preparation of forecast all of the following should be disclosed, except

a. Probability of achieving the forecast c. Character of work performed

b. Sources of information d. Major assumption used

12. Given one or more hypothetical assumption, a responsible party may prepare, to the best of its knowledge and

belief, an entity’s expected financial position, result of operations and cash flows. Such prospective financial

statements are known as

a. Proforma financial statements c. Partial presentation

b. Financial projections d. Financial forecast

13. An examination of financial forecast is a professional service that involves

a. Evaluating the preparation of the financial forecast and the support underlying management

assumption

b. Assembling financial forecast that is based on management assumption

c. Assuming responsibility on the financial forecast

d. Limiting the distribution of the accountant reports to management and board of directors

14. When an accountant examines financial forecast that fails to disclose several significant assumptions used to

prepare the forecast, the accountant should describe the assumption in the accountant’s report and issue an

a. Qualified opinion c. Unqualified with emphasis of a matter paragraph

b. Adverse opinion d. Disclaimer of opinion

15. Error includes

a. Engaging in complex transactions that are structured to misrepresent the financial position or

financial performance of the entity

b. Concealing or not disclosing facts that could affect the amounts recorded in the financial

statements

c. An incorrect accounting estimate arising from oversight or misinterpretation of facts

d. Intentional misapplication of accounting policies relating to amounts, classification, manner

of presentation and disclosure

16. Fraud involves one or more members of management or those charge with governance is referred to

a. Management fraud c. Fraudulent financial reporting

b. Employee fraud d. Misappropriation of assets

You might also like

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- QUIZ No. 1Document6 pagesQUIZ No. 1Kathleen FrondozoNo ratings yet

- Engagement ServicesDocument3 pagesEngagement Servicesjoseph90865No ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- AT QsDocument3 pagesAT QsA. MagnoNo ratings yet

- Financial Control Blueprint: Building a Path to Growth and SuccessFrom EverandFinancial Control Blueprint: Building a Path to Growth and SuccessNo ratings yet

- QUIZ No. 1Document6 pagesQUIZ No. 1KathleenNo ratings yet

- First Board Simulation. at With Answer KeyDocument10 pagesFirst Board Simulation. at With Answer KeyKatzkie Montemayor GodinezNo ratings yet

- Audtheo Questions Set A 150 CopiesDocument8 pagesAudtheo Questions Set A 150 CopiesSheila Mae Guerta LaceronaNo ratings yet

- Assurance EngagementsDocument7 pagesAssurance EngagementsXarina LudoviceNo ratings yet

- First PreboardDocument5 pagesFirst PreboardRodmae VersonNo ratings yet

- AT-01: Fundamentals OF Auditing AND Assurance: - T R S ADocument3 pagesAT-01: Fundamentals OF Auditing AND Assurance: - T R S Azj galapateNo ratings yet

- ACT1207 Review of Audit ProcessDocument8 pagesACT1207 Review of Audit ProcessAlyssa TordesillasNo ratings yet

- Framework On Philippine Standards On Auditing (PSA 120) : A Yes Yes Yes YesDocument5 pagesFramework On Philippine Standards On Auditing (PSA 120) : A Yes Yes Yes YesJohn Philip Abrigo CondeNo ratings yet

- Olytechnic Niversity of The Hilippines College of Accountancy andDocument7 pagesOlytechnic Niversity of The Hilippines College of Accountancy andPrancesNo ratings yet

- Auditing Theory CabreraDocument40 pagesAuditing Theory Cabreratyler1No ratings yet

- This Study Resource Was: Multiple Choice QuestionsDocument7 pagesThis Study Resource Was: Multiple Choice QuestionsCarol PagalNo ratings yet

- At Quizzer 1 Fundamentals of Auditing and Assurance Services S2AY2122Document12 pagesAt Quizzer 1 Fundamentals of Auditing and Assurance Services S2AY2122GabNo ratings yet

- Theories Cash - PpeDocument45 pagesTheories Cash - PpeClene DoconteNo ratings yet

- Handouts Set A1Document8 pagesHandouts Set A1Carina Mae Valdez ValenciaNo ratings yet

- PSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Document12 pagesPSBA AT Quizzer 1 - Fundamentals of Auditing and Assurance Services 2SAY2021Abdulmajed Unda MimbantasNo ratings yet

- AT Quizzer 1 - Overview of Auditing (2TAY1718)Document12 pagesAT Quizzer 1 - Overview of Auditing (2TAY1718)JimmyChaoNo ratings yet

- AT Preweek B93 - QuestionnaireDocument16 pagesAT Preweek B93 - QuestionnaireSilver LilyNo ratings yet

- Auditing TheoryDocument16 pagesAuditing TheoryJudeGuzmanNo ratings yet

- Preliminary Exam Reviewer1Document100 pagesPreliminary Exam Reviewer1Racel DelacruzNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug ofDocument100 pagesAt - Prelim Rev (875 MCQS) Red Sirug ofNicole Kyle AsisNo ratings yet

- Audit Theo FPB With Answer KeysDocument6 pagesAudit Theo FPB With Answer KeysPj Manez100% (1)

- Audit Process and Audit Planning With AnswerDocument12 pagesAudit Process and Audit Planning With AnswerR100% (1)

- AAAP Semi FinalsDocument6 pagesAAAP Semi FinalsJasmin Dela CruzNo ratings yet

- Auditing ReviewerDocument26 pagesAuditing ReviewerCynthia PenoliarNo ratings yet

- AT QsasDocument2 pagesAT QsasA. MagnoNo ratings yet

- At - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Document85 pagesAt - Prelim Rev (875 MCQS) Red Sirug Page 1 of 85Waleed MustafaNo ratings yet

- Bsac303 Final Examination - RoldanDocument16 pagesBsac303 Final Examination - RoldanJheraldinemae RoldanNo ratings yet

- At TestbankDocument5 pagesAt TestbankMartinez JomarNo ratings yet

- Department of Accountancy: Page - 1Document14 pagesDepartment of Accountancy: Page - 1NoroNo ratings yet

- May 2019 First PBDocument6 pagesMay 2019 First PBRandy PaderesNo ratings yet

- Chapter 13 Property Plant and EquiDocument43 pagesChapter 13 Property Plant and EquiMary MariaNo ratings yet

- Auditing Theory Test BankDocument24 pagesAuditing Theory Test BankJenica SaludesNo ratings yet

- Auditing Theory Test BankDocument31 pagesAuditing Theory Test BankLyza96% (53)

- C. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A Private CompanyDocument14 pagesC. A Review Engagement Focuses On Providing Limited Assurance On Financial Statement of A Private CompanyNoro100% (1)

- Auditing - First Preboard QuestionnaireDocument11 pagesAuditing - First Preboard QuestionnairewithyouidkNo ratings yet

- Auditing and AssuranceDocument21 pagesAuditing and AssuranceCathelyn SaliringNo ratings yet

- Auditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersDocument3 pagesAuditing & Assurance Principles (Module 2, 3, 6 & 7) - With AnswersJoana Lyn BuqueronNo ratings yet

- Aud TheoDocument23 pagesAud TheoKenneth Simon PidoNo ratings yet

- Multiple Choice Questions: Review of Financial StatementsDocument8 pagesMultiple Choice Questions: Review of Financial StatementsMarnelli CatalanNo ratings yet

- Auditing Theory Test BankDocument32 pagesAuditing Theory Test BankJane Estrada100% (2)

- All Subj Board Exam Picpa Ee PDF FreeDocument9 pagesAll Subj Board Exam Picpa Ee PDF FreeannyeongchinguNo ratings yet

- ATR Answers - 7Document29 pagesATR Answers - 7Christine Jane AbangNo ratings yet

- AT - PreWeek - May 2022Document24 pagesAT - PreWeek - May 2022Miguel ManagoNo ratings yet

- Auditing Theory Mcqs by Salosagcol With AnswersDocument31 pagesAuditing Theory Mcqs by Salosagcol With AnswersLeonard Cañamo100% (1)

- Auditing Theory: (Test Bank) Gerardo S. RoqueDocument82 pagesAuditing Theory: (Test Bank) Gerardo S. RoqueYukiNo ratings yet

- DocxDocument30 pagesDocxrandomlungs121223No ratings yet

- 5 Audit PlanningDocument53 pages5 Audit PlanningrogealynNo ratings yet

- Preliminary Exam Reviewer1Document77 pagesPreliminary Exam Reviewer1Adam Smith0% (1)

- AUD Review 10234Document4 pagesAUD Review 10234PachiNo ratings yet

- Auditing Theory-2018Document26 pagesAuditing Theory-2018Suzette VillalinoNo ratings yet

- Audit Assurance and Principles Quiz No. 2Document9 pagesAudit Assurance and Principles Quiz No. 2Xel Joe BahianNo ratings yet

- Enviii Sci SaDocument6 pagesEnviii Sci SaA. MagnoNo ratings yet

- Approach To A Potential ClientDocument3 pagesApproach To A Potential ClientA. MagnoNo ratings yet

- Auditing QuesDocument4 pagesAuditing QuesA. MagnoNo ratings yet

- Cellular Respiration 1 1Document2 pagesCellular Respiration 1 1A. MagnoNo ratings yet

- AuditingDocument3 pagesAuditingA. MagnoNo ratings yet

- Engl ReviewerDocument22 pagesEngl ReviewerA. MagnoNo ratings yet

- The Nervous SystemDocument3 pagesThe Nervous SystemA. MagnoNo ratings yet

- Art 15Document3 pagesArt 15A. MagnoNo ratings yet

- EA Flora 1Document3 pagesEA Flora 1A. MagnoNo ratings yet

- FLUOROCARBONDocument3 pagesFLUOROCARBONA. MagnoNo ratings yet

- Module 13Document1 pageModule 13A. MagnoNo ratings yet

- Reviewquiz4 Lit PDFDocument3 pagesReviewquiz4 Lit PDFA. MagnoNo ratings yet

- Sci FiniteDocument5 pagesSci FiniteA. MagnoNo ratings yet

- What Happened Till The First Supply 1Document10 pagesWhat Happened Till The First Supply 1A. MagnoNo ratings yet

- Module 2 - Overview and Intro 2 Env SciDocument15 pagesModule 2 - Overview and Intro 2 Env SciA. MagnoNo ratings yet

- Student Take Quiz Assignmentstart38387006Document5 pagesStudent Take Quiz Assignmentstart38387006A. MagnoNo ratings yet

- End of Quiz: G-Litt001 Bsa33 Classic Literatures of The World 2Nd Sem (2022-2023) Review Quiz 6Document3 pagesEnd of Quiz: G-Litt001 Bsa33 Classic Literatures of The World 2Nd Sem (2022-2023) Review Quiz 6A. MagnoNo ratings yet

- John Smith 1612Document19 pagesJohn Smith 1612A. MagnoNo ratings yet

- Mod 2 LittDocument9 pagesMod 2 LittA. MagnoNo ratings yet

- Mod 2 Litt 3Document2 pagesMod 2 Litt 3A. MagnoNo ratings yet

- Mod 2 Litt 2Document2 pagesMod 2 Litt 2A. MagnoNo ratings yet

- What Is EthicsDocument1 pageWhat Is EthicsA. MagnoNo ratings yet

- Lesson 1 Ecology and EthicsDocument25 pagesLesson 1 Ecology and EthicsA. MagnoNo ratings yet

- 6573 18176 1 PBDocument12 pages6573 18176 1 PBA. MagnoNo ratings yet

- PROBLEMS - Partnership DissolutionDocument4 pagesPROBLEMS - Partnership DissolutionA. MagnoNo ratings yet

- ED621826Document56 pagesED621826A. MagnoNo ratings yet

- EJ1158714Document10 pagesEJ1158714A. MagnoNo ratings yet

- End of Quiz: S-MATH311LA BSA31 1st Sem (2022-2023) Enabling Assessment 9Document15 pagesEnd of Quiz: S-MATH311LA BSA31 1st Sem (2022-2023) Enabling Assessment 9A. MagnoNo ratings yet

- Yellow Final Ans Thanks// Palagay San Nakita For Ex: NASA FILE OR LINK - Final Answer - No Answer Yet/not SureDocument7 pagesYellow Final Ans Thanks// Palagay San Nakita For Ex: NASA FILE OR LINK - Final Answer - No Answer Yet/not SureA. MagnoNo ratings yet

- Share SMATH311LC - SummativeAssessment2Document14 pagesShare SMATH311LC - SummativeAssessment2A. MagnoNo ratings yet

- AvulsionDocument5 pagesAvulsionLCRizonNo ratings yet

- Pure, Conditional, and With A PeriodDocument5 pagesPure, Conditional, and With A PeriodIrona LynNo ratings yet

- Snowsgiving Hypesquad Fables RulesDocument3 pagesSnowsgiving Hypesquad Fables RulesAzTT TaNo ratings yet

- Rolco Construction & Development CorporationDocument4 pagesRolco Construction & Development CorporationMichael Jorge BernalesNo ratings yet

- Exercise 18Document2 pagesExercise 18jr centenoNo ratings yet

- Assignment Criminal Law IIDocument4 pagesAssignment Criminal Law IIusman soomroNo ratings yet

- Incoterms 2020: Key Words: Incoterms, Sales Contract, Delivery, Trade Practices, Import, Export, DocuDocument20 pagesIncoterms 2020: Key Words: Incoterms, Sales Contract, Delivery, Trade Practices, Import, Export, DocuAnouar SebaibiNo ratings yet

- STMicroelectronics UA741CN Datasheet PDFDocument11 pagesSTMicroelectronics UA741CN Datasheet PDFAlina ȘtefănesiNo ratings yet

- Tax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inDocument8 pagesTax Saving Schemes: in Partial Fulfilment of The Requirements For The Award of The Degree inMOHAMMED KHAYYUMNo ratings yet

- Opo111536 AlDocument23 pagesOpo111536 Alayush jainNo ratings yet

- RPH Group 3Document28 pagesRPH Group 3Deseree ValienteNo ratings yet

- PDS Deped - 3Document5 pagesPDS Deped - 3annatheresaNo ratings yet

- Chester Uyco vs. Vicente Lo: G.R. No. 202423 January 28, 2013Document2 pagesChester Uyco vs. Vicente Lo: G.R. No. 202423 January 28, 2013brigetteNo ratings yet

- MidtermsDocument8 pagesMidtermsRhea BadanaNo ratings yet

- Technical License Application Form - 21082017020357Document2 pagesTechnical License Application Form - 21082017020357charlieNo ratings yet

- Membership Application Form-NewDocument3 pagesMembership Application Form-NewMolla Saidul IslamNo ratings yet

- Corporate Criminal LiabilityDocument61 pagesCorporate Criminal Liabilitygantuvshin ganbaatarNo ratings yet

- اردو کی گہرائی. Urdu book. Year 7 (PDFDrive)Document65 pagesاردو کی گہرائی. Urdu book. Year 7 (PDFDrive)VikasNo ratings yet

- Certificate of Annual Electrical InspectionDocument1 pageCertificate of Annual Electrical InspectionJohn Rodolfo BultronNo ratings yet

- Insurance Case SummariesDocument31 pagesInsurance Case SummariesRaymund CallejaNo ratings yet

- Proclaimation and Declaration of Independence To President Donald John Trump (4) (Signed)Document2 pagesProclaimation and Declaration of Independence To President Donald John Trump (4) (Signed)USWGO Brian D. Hill60% (5)

- RFI-201 Stack Pile Investigation For Sub-Base Material at Janjira End Approach (NB) Site (3!2!2021)Document1 pageRFI-201 Stack Pile Investigation For Sub-Base Material at Janjira End Approach (NB) Site (3!2!2021)rownakNo ratings yet

- Sample of Preliminary Investigation ReportDocument4 pagesSample of Preliminary Investigation ReportMikhail Andrei Larios100% (2)

- Human Law and Computer Law Comparative Perspectives (PDFDrive)Document200 pagesHuman Law and Computer Law Comparative Perspectives (PDFDrive)JUAN FRANCISCO CABEZAS MARTINEZ100% (2)

- Unit IV 7.: B. Arch. EXAMINATION, May 2019Document2 pagesUnit IV 7.: B. Arch. EXAMINATION, May 2019Apoorva JainNo ratings yet

- STERRAD Consumables DatasheetDocument1 pageSTERRAD Consumables Datasheetjosue david pino gonzalezNo ratings yet

- Multiple Choice QuestionsDocument13 pagesMultiple Choice QuestionsCyber VirginNo ratings yet

- Bishop Elizondo and Bishop Vann's Letter To The U.S. GovernmentDocument3 pagesBishop Elizondo and Bishop Vann's Letter To The U.S. GovernmentNational Catholic ReporterNo ratings yet

- 59 Racho vs. TanakaDocument17 pages59 Racho vs. TanakaSimeon TutaanNo ratings yet

- Subject - General Knowledge Code - 7.46 - 111 Sr. No. - ... Roll No. - ...Document5 pagesSubject - General Knowledge Code - 7.46 - 111 Sr. No. - ... Roll No. - ...murthy gNo ratings yet

- The Financial Numbers Game: Detecting Creative Accounting PracticesFrom EverandThe Financial Numbers Game: Detecting Creative Accounting PracticesNo ratings yet

- Mastering Internal Audit Fundamentals A Step-by-Step ApproachFrom EverandMastering Internal Audit Fundamentals A Step-by-Step ApproachRating: 4 out of 5 stars4/5 (1)

- Business Process Mapping: Improving Customer SatisfactionFrom EverandBusiness Process Mapping: Improving Customer SatisfactionRating: 5 out of 5 stars5/5 (1)

- The Layman's Guide GDPR Compliance for Small Medium BusinessFrom EverandThe Layman's Guide GDPR Compliance for Small Medium BusinessRating: 5 out of 5 stars5/5 (1)

- (ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideFrom Everand(ISC)2 CISSP Certified Information Systems Security Professional Official Study GuideRating: 2.5 out of 5 stars2.5/5 (2)

- A Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersFrom EverandA Step By Step Guide: How to Perform Risk Based Internal Auditing for Internal Audit BeginnersRating: 4.5 out of 5 stars4.5/5 (11)

- Amazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobFrom EverandAmazon Interview Secrets: A Complete Guide to Help You to Learn the Secrets to Ace the Amazon Interview Questions and Land Your Dream JobRating: 4.5 out of 5 stars4.5/5 (3)

- Internal Audit Quality: Developing a Quality Assurance and Improvement ProgramFrom EverandInternal Audit Quality: Developing a Quality Assurance and Improvement ProgramNo ratings yet

- Money Laundering Prevention: Deterring, Detecting, and Resolving Financial FraudFrom EverandMoney Laundering Prevention: Deterring, Detecting, and Resolving Financial FraudNo ratings yet

- Executive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceFrom EverandExecutive Roadmap to Fraud Prevention and Internal Control: Creating a Culture of ComplianceRating: 4 out of 5 stars4/5 (1)

- Financial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsFrom EverandFinancial Shenanigans, Fourth Edition: How to Detect Accounting Gimmicks & Fraud in Financial ReportsRating: 4 out of 5 stars4/5 (26)

- Scrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsFrom EverandScrum Certification: All In One, The Ultimate Guide To Prepare For Scrum Exams And Get Certified. Real Practice Test With Detailed Screenshots, Answers And ExplanationsNo ratings yet

- Internal Controls: Guidance for Private, Government, and Nonprofit EntitiesFrom EverandInternal Controls: Guidance for Private, Government, and Nonprofit EntitiesNo ratings yet

- A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowFrom EverandA Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should KnowNo ratings yet

- GDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekFrom EverandGDPR-standard data protection staff training: What employees & associates need to know by Dr Paweł MielniczekNo ratings yet

- Bribery and Corruption Casebook: The View from Under the TableFrom EverandBribery and Corruption Casebook: The View from Under the TableNo ratings yet