Professional Documents

Culture Documents

Mid-Term Exam - Without Answer - FE63

Mid-Term Exam - Without Answer - FE63

Uploaded by

Phương BùiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mid-Term Exam - Without Answer - FE63

Mid-Term Exam - Without Answer - FE63

Uploaded by

Phương BùiCopyright:

Available Formats

NATIONAL ECONOMICS UNIVERSITY MID-TERM EXAM

PERSONAL FINANCIAL PLANNING

COURSE

Venue:

Duration: 90 minutes

Question 1: These statements are True or False? (30 marks, 2.5 score/each correct answer)

1.1. A financial plan is an informal report that analyzes past financial decisions.

1.2. Borrowers is less likely to be harmed by inflation.

1.3. A budget is a record of how a person or family has spent their money.

1.4. A cash flow statement uses this equation: Assets - Liabilities = Net worth.

1.5. Checking account balance is a liquid asset.

1.6. The information gathered from your loan application and the credit bureau establishes your credit

rating.

1.7. Consumer credit refers to the use of debit cards for personal needs.

1.8. Using the Rule of 72, with the value of land in an area is increasing 12.5 percent a year, it will

take 5.8 years for property values to double.

1.9. Using the Rule of 72, at an annual interest rate of 5.75 percent, it will take 15 years for savings to

double.

1.10. Purchasing a car is an example of a durable-product goal.

1.11. Opportunity costs refer to money already spent.

1.12. The problem of bankruptcy is associated with overuse and misuse of credit in the borrowing

component of financial planning.

Question 2: Assignments (30 marks)

2.1. (10 score) Describe some common money management mistakes that can cause long-term financial

concerns?

2.2. (20 scores) Create your own financial planning for next year, 5-year, 10-year, and when you

retire.

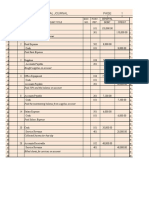

Question 3: Exercises (40 marks)

3.1. (20 scores)

Use the following items to determine the total assets, total liabilities, net worth, total cash

inflows, and total cash outflows. What is the problem with this person’s personal finance

situation?

Unit: US$

8 4,2

Rent for the month Monthly take-home salary

80 50

4 1,4

Spending for food Cash in checking account

90 00

2,5 3,5

Savings account balance Balance of educational loan

50 80

11,0 1

Current value of automobile Telephone bill paid for month

00 50

3,5 1

Credit card balance Loan payment

00 40

3 15,0

Auto insurance Household possessions

50 00

2,8 1

Video equipment Payment for electricity

00 00

2 1

Lunches/parking at work Donations

20 80

1,5 9

Personal computer Value of stock investment

00 50

2,4 2,5

Clothing purchase Restaurant spending

00 00

3.2. (20 scores)

Consider Minh’s budget worksheet for March, and then answer the questions:

Unit: US$

Income Spending

Date Source Amount Date Purpose Amount

7/3 Wages 850.5 3/3 New clothes 180.5

9/3 Birthday gift 55.7 12/3 Motobike insurance 125.7

21/3 Wages 660.5 15/3 Rent 380.9

23/3 Part-time job for 23/3 Credit card bill

120.5 380.5

Circle K

30/3 Savings interest 25.7 25/3 Telephone bill 25.5

26/3 Grocerries 280.7

29/3 Doctor’s visit 150

a. How much was Minh able to save in March?

b. Which sources of her income may not be the same from month to month?

c. Which types of spending might not be the same from month to month?

d. Why would a series of short-term budget worksheets be needed to develop a long-term

budget?

You might also like

- RMBSDocument23 pagesRMBSapi-3848669No ratings yet

- Introduction To Consumer CreditDocument29 pagesIntroduction To Consumer Creditmana gNo ratings yet

- Special Journals - Kathy Concepcion #4 Page287Document9 pagesSpecial Journals - Kathy Concepcion #4 Page287Joana Trinidad100% (3)

- EMI Calculator For Home LoanDocument5 pagesEMI Calculator For Home LoankeshavsainiNo ratings yet

- ParCor Chapter3 Part2 BuenaventuraDocument17 pagesParCor Chapter3 Part2 BuenaventuraAnonn100% (4)

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- General Mathematics: Second Quarter Module 1: Simple and Compound InterestDocument15 pagesGeneral Mathematics: Second Quarter Module 1: Simple and Compound InterestJelrose Sumalpong100% (2)

- Basic Documents and Transactions Related To Bank DepositsDocument18 pagesBasic Documents and Transactions Related To Bank DepositsSophia NicoleNo ratings yet

- Flex CubeDocument3 pagesFlex CubeashishbansaNo ratings yet

- Mid-Term Exam - Without Answer - Ba 64Document3 pagesMid-Term Exam - Without Answer - Ba 64Thu HaNo ratings yet

- Mid-Term Exam.2021.2022Document3 pagesMid-Term Exam.2021.2022Việt Phương NguyễnNo ratings yet

- Personal Loan EmiDocument7 pagesPersonal Loan EmiMILAN BEHERANo ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaCA JANAMDEEP SINGHNo ratings yet

- Education Ireland Vi Ual Fair: Featured Calculators & ArticlesDocument8 pagesEducation Ireland Vi Ual Fair: Featured Calculators & ArticlesAnkit UjjwalNo ratings yet

- EMI For Personal Loan in IndiaDocument2 pagesEMI For Personal Loan in IndiaAbhishek VishwakarmaNo ratings yet

- Loblaw Companies Limited 1 President's Choice Circle Brampton, ON L6Y 5S5 Allyssa Langford 1845 Cadillac Windsor, ON N8W 3X8 CanadaDocument1 pageLoblaw Companies Limited 1 President's Choice Circle Brampton, ON L6Y 5S5 Allyssa Langford 1845 Cadillac Windsor, ON N8W 3X8 CanadaAllyssa LangfordNo ratings yet

- 25.9 Working Capital Requirement: This Project Cost May Be Financed at A Debt Equity Ratio of 3:1 As FollowsDocument1 page25.9 Working Capital Requirement: This Project Cost May Be Financed at A Debt Equity Ratio of 3:1 As Followsk.g.thri moorthyNo ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument2 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in Indiakingarvind7777No ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in Indiadrvichram94No ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaASIK1144No ratings yet

- Personal Finance Course. Mock Exam 2023.without AnswerDocument3 pagesPersonal Finance Course. Mock Exam 2023.without Answernguyen tungNo ratings yet

- Featured Calculators & Articles: Home Loan Personal Loan Car LoanDocument2 pagesFeatured Calculators & Articles: Home Loan Personal Loan Car LoanSk RajNo ratings yet

- Consumer LoanDocument51 pagesConsumer Loan分享区No ratings yet

- Home Loan Personal Loan Car Loan: 0 2.5L 5L 7.5L 10L 12.5L 15LDocument11 pagesHome Loan Personal Loan Car Loan: 0 2.5L 5L 7.5L 10L 12.5L 15LsultanthakurNo ratings yet

- Revision Quizzes 2Document6 pagesRevision Quizzes 2Nghi AnNo ratings yet

- EMI Calculator For Personal Loan in IndiaDocument9 pagesEMI Calculator For Personal Loan in IndiaMurugan MNo ratings yet

- T2 Y10 Ccounting (Ii) 2022 2023Document5 pagesT2 Y10 Ccounting (Ii) 2022 2023Dimu GunawardanaNo ratings yet

- EMI Calculator For Personal LoanDocument4 pagesEMI Calculator For Personal LoanStarNo ratings yet

- Impartial Fulfillment in Principles of AccountingDocument177 pagesImpartial Fulfillment in Principles of AccountingIlarde, Charles Ezra S.No ratings yet

- Loan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Document2 pagesLoan Financial Summary As On 12/08/2020: Component Due (RS.) Receipt (RS.) Overdue (RS.)Alexander SNo ratings yet

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument2 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaAdarsh Patil100% (1)

- Gr08 Ems Term2 Pack01 Practice PaperDocument4 pagesGr08 Ems Term2 Pack01 Practice Paperkehindekevan223No ratings yet

- EMI Calculator For SaidaDocument2 pagesEMI Calculator For SaidaSuresh varma AkulaNo ratings yet

- Neo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleDocument17 pagesNeo Techno Designs Purchases Journal Debit Delivery Supplies Other Accounts Account TitleGina Calling Danao100% (1)

- 19 Abucay Piddig Nilo Z. Tomas Ilocos Norte 10% SK Fund 2023-001Document16 pages19 Abucay Piddig Nilo Z. Tomas Ilocos Norte 10% SK Fund 2023-001Eugene GuillermoNo ratings yet

- Accounting GR 11 Paper 1Document11 pagesAccounting GR 11 Paper 1Muneebah HajatNo ratings yet

- STMNT SV 2558-Statement-02-29-2024Document2 pagesSTMNT SV 2558-Statement-02-29-2024api-370964632No ratings yet

- ACCE 112 DL Assessment 4 QPDocument4 pagesACCE 112 DL Assessment 4 QPnazmirakaderNo ratings yet

- January 2020 ShsDocument4 pagesJanuary 2020 Shsrayban ariñoNo ratings yet

- IBA2Document44 pagesIBA2Astha KothariNo ratings yet

- ACCOx 131 EcDocument10 pagesACCOx 131 EcSinazo XhosaNo ratings yet

- Estatement20200915 000084862 PDFDocument3 pagesEstatement20200915 000084862 PDFReal NurulNo ratings yet

- Assignment Accounting VillinoDocument10 pagesAssignment Accounting Villinomuslineh haidin100% (2)

- Assignment Accounting VillinoDocument10 pagesAssignment Accounting Villinomuslineh haidinNo ratings yet

- Appendix 43 Cash Disbursement RegisterDocument6 pagesAppendix 43 Cash Disbursement RegisterYULAINE CARILLONo ratings yet

- Centralaized ReportDocument2 pagesCentralaized ReportMelvin AppaduraiNo ratings yet

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel TolentinoNo ratings yet

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel Tolentino100% (1)

- Activity 3 - TolentinoDocument7 pagesActivity 3 - TolentinoDJazel TolentinoNo ratings yet

- Scrib Upload - ACC 201 Final Project WorkbookDocument40 pagesScrib Upload - ACC 201 Final Project WorkbookTJEM50% (30)

- EMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaDocument7 pagesEMI Calculator For Home Loan, Car Loan & Personal Loan in IndiaNikhil Jain100% (1)

- S's PDFDocument7 pagesS's PDFKaushal PrasadNo ratings yet

- Debt Reduction Calculator: Balance Date: 10/1/2019Document12 pagesDebt Reduction Calculator: Balance Date: 10/1/2019Dr. Bharat SutharNo ratings yet

- Basavaraju S CDocument32 pagesBasavaraju S Cproject mailNo ratings yet

- ACC 201 Final Project WorkbookDocument40 pagesACC 201 Final Project WorkbookSwapan Kumar SahaNo ratings yet

- Monthly WFPDocument22 pagesMonthly WFPCelz GraciadasNo ratings yet

- Mobile Services: This Month'S ChargesDocument4 pagesMobile Services: This Month'S Chargessomya sharmaNo ratings yet

- MR Zolani W Tyelaphantsi Welcome 20187 Jerusalem Park Thabong 9463Document1 pageMR Zolani W Tyelaphantsi Welcome 20187 Jerusalem Park Thabong 9463Zolani Welcome TyelaphantsiNo ratings yet

- Applied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDocument7 pagesApplied Financial Accounting AFAC02-6: Formative Assessment - AssignmentDesire PiRah GriffinsNo ratings yet

- Document 1768 1298Document59 pagesDocument 1768 1298JonathanMasseyqemiNo ratings yet

- Amity International Business School: Industrial Relations Project WorkDocument12 pagesAmity International Business School: Industrial Relations Project WorkTirthangkar TalukdarNo ratings yet

- Assessment 10th Feb 2021Document7 pagesAssessment 10th Feb 2021Zeeshan SiddiquiNo ratings yet

- Accounting AssignmentDocument8 pagesAccounting AssignmentSimran LakhwaniNo ratings yet

- Case 4 Matapang's Repair BusinessDocument13 pagesCase 4 Matapang's Repair BusinessCobie VillenaNo ratings yet

- Report of Disbursement (ROD)Document2 pagesReport of Disbursement (ROD)amender22No ratings yet

- Questions of CommerceDocument9 pagesQuestions of CommerceSushan MaharjanNo ratings yet

- Receipt For Rhomar Dimayuga Malicse: FailedDocument1 pageReceipt For Rhomar Dimayuga Malicse: FailedVelaNo ratings yet

- Chapter 19 Managerial AccountingDocument36 pagesChapter 19 Managerial AccountingTien TienNo ratings yet

- The Money Supply ProcessDocument48 pagesThe Money Supply ProcessAlejandroArnoldoFritzRuenesNo ratings yet

- FINANCIAL RATIOS Isb535Document3 pagesFINANCIAL RATIOS Isb535NAJWA SUHA BINTI SELAMAT NAJWA SUHA BINTI SELAMATNo ratings yet

- Business Model of Bajaj CapitalDocument1 pageBusiness Model of Bajaj Capitalhemant kandpalNo ratings yet

- 5.2 - Cash Flow Forecasting and Working CapitalDocument4 pages5.2 - Cash Flow Forecasting and Working CapitalannabellNo ratings yet

- ISA 510 MindMapDocument1 pageISA 510 MindMapA R AdILNo ratings yet

- Ratios, VLOOKUP, Goal SeekDocument15 pagesRatios, VLOOKUP, Goal SeekVIIKHAS VIIKHASNo ratings yet

- 2.audit Standards FreeDocument47 pages2.audit Standards FreeVrinda KNo ratings yet

- F8-15 Audit EvidenceDocument26 pagesF8-15 Audit EvidenceReever RiverNo ratings yet

- Accounting Cycle of A Service Business: Mr. Jan CupangDocument30 pagesAccounting Cycle of A Service Business: Mr. Jan Cupangbanigx0xNo ratings yet

- Financial Performance of Non Banking Finance Companies in India Amita S. KantawalaDocument7 pagesFinancial Performance of Non Banking Finance Companies in India Amita S. KantawalajayasundariNo ratings yet

- Financial Accounting and Reporting III LiabilityDocument3 pagesFinancial Accounting and Reporting III LiabilityAhmad Azim HazimiNo ratings yet

- Question 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Document3 pagesQuestion 1: Ias 8 Policies, Estimates & Errors: Page 1 of 3Bagudu Bilal GamboNo ratings yet

- Profit. Planning and ControlDocument16 pagesProfit. Planning and ControlNischal LawojuNo ratings yet

- BOIMF NFO Cobranded One Pager - CompressedDocument2 pagesBOIMF NFO Cobranded One Pager - CompressedBig DickNo ratings yet

- Merger and Acquisition in Banking IndustryDocument6 pagesMerger and Acquisition in Banking IndustryGauravsNo ratings yet

- Smart Multi Critical Care FlyerDocument2 pagesSmart Multi Critical Care Flyerchliang 80No ratings yet

- Consolidated Interim Condensed Financial Statements PJSC "PhosAgro"Document25 pagesConsolidated Interim Condensed Financial Statements PJSC "PhosAgro"Ardhani SetyoajiNo ratings yet

- Vipin Resume Oct-22Document3 pagesVipin Resume Oct-22Macline IndiaNo ratings yet

- Fact Sheet Affin Hwang World Series - China Allocation Opportunity FundDocument1 pageFact Sheet Affin Hwang World Series - China Allocation Opportunity FundHenry So E DiarkoNo ratings yet

- Muthoot Finance Limited: General OverviewDocument5 pagesMuthoot Finance Limited: General OverviewVaibhav BhatiaNo ratings yet

- Https Server - Mspmandal.in MSPMT Success ExamDocument1 pageHttps Server - Mspmandal.in MSPMT Success ExamAarti DalviNo ratings yet

- Commercial PropertyDocument14 pagesCommercial PropertyMITHILESHBHARATINo ratings yet