Professional Documents

Culture Documents

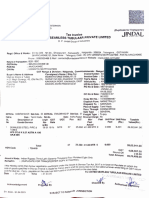

Cma2616 6000247712

Uploaded by

y8jkfz98m9Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cma2616 6000247712

Uploaded by

y8jkfz98m9Copyright:

Available Formats

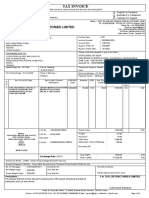

TAX INVOICE ORIGINAL

GSTIN: 23AAACH0351E1ZD ,CIN: L31900DL1983PLC016304 ,PAN (IT): AAACH0351E [Issued under Rule 46 of GST Rules (2017)] (FOR RECIPIENT)

Havells India Ltd.: 107/1/1/K, Lasudia Parmar, A. B. Road, Near Billed To: Shipped To: Invoice No.

Dakachiya, Indore Indore - 453771 , MADHYA PRADESH Manibhadra Electricals Private Limited - CMA2616 TCS IT PARK INDORE - XTCSINDSTE 6000247712

Regd. Office: 904, 9th Floor, Surya Kiran Building, K.G Marg, 4,, Shahviri Bldg,, 37/41,picket Road, IT PARK AT SCHEME NO.151 &169B, SUPER CORRIDOR,

Connaught Place, New Delhi - 110001. NEAR MR-10ROAD, Invoice Date

Corp. Office: QRG Tower 2-D,Sec-126,Expressway,Noida - MUMBAI-MH 400002 ,

MAHARASHTRA India INDORE A/C STERLING ELECTRO ENT 453112 30.03.2024

Bank details

201304, UP. (INDIA) PAN No: AADCM2739E Place of Supply-MAHARASHTRA MADHYA PRADESH India - 9769456655

for making

State Code: 27 GSTIN No. 27AADCM2739E1ZL State Code: 23 GSTIN No. 23AAACR4849R2ZS

payment

Tel:0120.3331000,FAX:0120-3332000,E-mail:marketing@havells.com,Web:www.havells.com

R.R./L.R. No.: 448651/Date.: 01.04.2024 Destination : INDROE ,MP Eway Bill No.: 681705872325 PO No / Date : 0000780051 / 28.03.2024

Transporter : Atishay Tradelink Contact No : 9769456655 No.of Boxes : 1 O.A. No / Date : 112394193 / 28.03.2024

Vehicle No.: MP09ZV9806 Mode of Transport : By Road Delivery No.142268855 / CS 6000247712

Rate / Total Discount(Rs.) Taxable Value CGST SGST/UTGST IGST Invoice

Item Code Description of Goods HSN Quantity Unit Unit(Rs.) Value(Rs.) Special* CD (Rs.) Rate% Amount(Rs.) Rate% Amount(Rs.) Rate% Amount(Rs.) Value(Rs.)

ACTXMIIX01 1/2 M Box 1mm CRB 85389000 45.000 Nos 31.05 1,397.25 1,397.25 18.00 251.51 1,648.76

SubTotal : 45.000 1,397.25 1,397.25 251.51 1,648.76

Total 45.000 1,397.25 1,397.25 251.51 1,648.76

EPOD : 5008980349 Total Invoice Value (In Words) Rounding off 0.24

Remark:

RUPEES ONE THOUSAND SIX HUNDRED 1,649.00

FORTY-NINE ONLY

Signature Not Verified

Signature & Stamp of Recipient

IRN No.: ac0cda20528310c6c3c56e0f69ba23dfb9b5d91c85414df7d72fd92954108c8a

Tax payable under Reverse Charge basis - (No)

IRN Date.: 01.04.2024

Authorised Signatory

The buyer has confirmed that the provisions of section 194Q of Income Tax Act, 1961 are applicable to him. The buyer is requested to deduct TDS @ 0.10% and deposit the same within time prescribed and file TDS returns accordingly. TCS u/s 206C(1H) will not be collected by M/s Havells India Limited (the company) on the basis of said declaration.

Certified that the particulars given above are true and correct. The amounts indicated represents the price actually charged and there is no flow of additional consideration directly or indirectly from the Buyer/ Recipient. The normal terms governing the above supply are printed overleaf. E&OE

Page 1 of 1

You might also like

- Fidelity Bond Application Form FBAFDocument2 pagesFidelity Bond Application Form FBAFMark Idaloy0% (1)

- Track HelpersDocument1 pageTrack Helpersbtech.banalaNo ratings yet

- Invoice Cat 2 AmazonDocument1 pageInvoice Cat 2 AmazonyogeshNo ratings yet

- Books and Udemy InvoiceDocument6 pagesBooks and Udemy InvoiceRajvardhan JhaNo ratings yet

- Survey No.528/1, Perambakkam Road, Mannur Village, Sriperambudur Taluk, Chennai-602 105, TamilnaduDocument4 pagesSurvey No.528/1, Perambakkam Road, Mannur Village, Sriperambudur Taluk, Chennai-602 105, TamilnaduShakti MahaveerNo ratings yet

- RF Zigzag 801Document1 pageRF Zigzag 801siddharthtexsuratNo ratings yet

- InvoiceDocument2 pagesInvoiceAdira ThakurNo ratings yet

- Channel - Shipping Invoice 509754805Document1 pageChannel - Shipping Invoice 509754805kailashbisht6666No ratings yet

- InvoiceDocument1 pageInvoiceSwamy RamulaNo ratings yet

- HSRPDocument1 pageHSRPAbhinandan SahaniNo ratings yet

- Invoice No. 3532Document2 pagesInvoice No. 3532AMIT TIWARINo ratings yet

- MS Pipes (250mm)Document1 pageMS Pipes (250mm)dada shaikNo ratings yet

- 1312 Dalmia Godown Inv RjyDocument3 pages1312 Dalmia Godown Inv RjyDALMIARJY DEPONo ratings yet

- Montage Enterprises PVT LTD.: Tax InvoiceDocument1 pageMontage Enterprises PVT LTD.: Tax Invoicewasu sheebuNo ratings yet

- 4177 BVCPSDocument1 page4177 BVCPSpawansinghpk9993No ratings yet

- Invoice Washing MachineDocument1 pageInvoice Washing MachineAnkit TripathiNo ratings yet

- InvoiceDocument1 pageInvoicealim zaidiNo ratings yet

- Credit 243112012575 12 2023Document2 pagesCredit 243112012575 12 2023bhawesh joshiNo ratings yet

- Foam Test CertificateDocument6 pagesFoam Test CertificatesadfdsNo ratings yet

- 2092 Key Stone Developers PVT LTDDocument2 pages2092 Key Stone Developers PVT LTDRishu YadavNo ratings yet

- MU03L2piWTlhdW1yUFFQcFhHT0gxdz09 Seller Tax InvoiceDocument1 pageMU03L2piWTlhdW1yUFFQcFhHT0gxdz09 Seller Tax InvoiceVarun GoswamiNo ratings yet

- 4ccounting VoucherDocument3 pages4ccounting VoucherSuhas TopkarNo ratings yet

- Parts Invoice - 2022-12-01T114656.716Document1 pageParts Invoice - 2022-12-01T114656.716C RamakrishnaNo ratings yet

- Amazon 5Document2 pagesAmazon 5Vishakha SNo ratings yet

- 86d5d10 2149smartDocument1 page86d5d10 2149smartShailesh JainNo ratings yet

- Vega Nail ClipperDocument1 pageVega Nail ClipperSundeep ChebroluNo ratings yet

- SK Infrastructure 15.10.2022Document1 pageSK Infrastructure 15.10.2022Poonam RaiNo ratings yet

- 2208237918Document1 page2208237918NEW GENERATIONSNo ratings yet

- Union Bank of India (Tarnaka) : Signature Not VerifiedDocument6 pagesUnion Bank of India (Tarnaka) : Signature Not VerifiedAnil AsangiNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)yogeshNo ratings yet

- Amit Enterprises: Billed To: Shipped ToDocument2 pagesAmit Enterprises: Billed To: Shipped ToAmit DuttaNo ratings yet

- 46340032358019132Document4 pages463400323580191324-you 4 everNo ratings yet

- PI - Indigenous Spares & RepairsDocument1 pagePI - Indigenous Spares & RepairsPurchase Pethe IndustriesNo ratings yet

- Book Invoice 24 Jan 2024Document1 pageBook Invoice 24 Jan 2024krishsaxena20No ratings yet

- (Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountDocument1 page(Triplicate For Supplier) : Sl. No Description Unit Price Qty Net Amount Tax Rate Tax Type Tax Amount Total AmountArnav JoshiNo ratings yet

- InvoiceDocument1 pageInvoiceVikki KumarNo ratings yet

- XERONDocument1 pageXERONfekim31651No ratings yet

- InvoiceDocument1 pageInvoiceArvind KumarNo ratings yet

- Havells MSBI 18092017 PSSL 17-18 00037Document1 pageHavells MSBI 18092017 PSSL 17-18 00037ashish10mca9394No ratings yet

- InvoiceDocument1 pageInvoiceSaaksshi TyagiNo ratings yet

- Print 2Document2 pagesPrint 2SwagBeast SKJJNo ratings yet

- RKSV Securities India Pvt. LTD.: Nse-EqDocument2 pagesRKSV Securities India Pvt. LTD.: Nse-EqSachin MalviNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)ANANT MISHRANo ratings yet

- AmazonFile 0Document2 pagesAmazonFile 0chawllarohitNo ratings yet

- 642 GST AR Invoice Items Export - IEL - Nov18Document1 page642 GST AR Invoice Items Export - IEL - Nov18SoyabSuriyaNo ratings yet

- Sales Invoice 2221351033 Dated 09.09.2022Document2 pagesSales Invoice 2221351033 Dated 09.09.2022Jyoti PrakashNo ratings yet

- InvoiceDocument1 pageInvoicemadhuryadav018No ratings yet

- Esenpro Power Transmission Pvt. LTD: Jobwork Purchase OrderDocument1 pageEsenpro Power Transmission Pvt. LTD: Jobwork Purchase OrderSANDESHNo ratings yet

- MSIL - InvoiceDocument1 pageMSIL - Invoicevineet.tpsNo ratings yet

- InvoiceDocument1 pageInvoiceNanditaNo ratings yet

- InvoiceDocument2 pagesInvoiceनारायण सिंह निर्दोषNo ratings yet

- Quotation For Approval & Registration of OrderDocument2 pagesQuotation For Approval & Registration of Orderkhare.tusharNo ratings yet

- Water Purifier Cleaning GuideDocument2 pagesWater Purifier Cleaning GuideAkshayJainNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Ankit DwivediNo ratings yet

- It World: DuplicateDocument1 pageIt World: Duplicatezeerahman624No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document2 pagesTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dilip MishraNo ratings yet

- Tax Invoice: KONE Elevator India Private LimitedDocument1 pageTax Invoice: KONE Elevator India Private LimitedSameer PatilNo ratings yet

- Inv Parida 2488512649Document5 pagesInv Parida 2488512649Ashish ParidaNo ratings yet

- Indu-Nandlal Mangumal-10147Document2 pagesIndu-Nandlal Mangumal-10147vsp1412No ratings yet

- MSF R.K.P Sec-13 - Aug'23Document2 pagesMSF R.K.P Sec-13 - Aug'23vineet.tpsNo ratings yet

- Review and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportFrom EverandReview and Assessment of the Indonesia–Malaysia–Thailand Growth Triangle Economic Corridors: Thailand Country ReportNo ratings yet

- Onlyias-Indian EconomyDocument444 pagesOnlyias-Indian EconomyAnkurNo ratings yet

- Cash Budget Fin420 - Ba250 Group 4Document9 pagesCash Budget Fin420 - Ba250 Group 4nuraz3169No ratings yet

- Annual Gender and Development (Gad) Accomplishment ReportDocument2 pagesAnnual Gender and Development (Gad) Accomplishment ReportJessa BaloroNo ratings yet

- PCT101E23Document1 pagePCT101E23Jefzibá AguileraNo ratings yet

- Ornamental Fish Exporter - RO Mumbai: SL - No. Firm Name & AddessDocument38 pagesOrnamental Fish Exporter - RO Mumbai: SL - No. Firm Name & AddessJibran SakharkarNo ratings yet

- Skills Development Training Tender RFP EOI NSKFDC Skill Reporter 04042020 PDFDocument15 pagesSkills Development Training Tender RFP EOI NSKFDC Skill Reporter 04042020 PDFManishDwivediNo ratings yet

- Land Acquisition Act MCQDocument2 pagesLand Acquisition Act MCQshobha dighe100% (11)

- State Board (NTSE STAGE-1) (CLASS - X) : Sat/marDocument44 pagesState Board (NTSE STAGE-1) (CLASS - X) : Sat/marBhanu PurushothamaNo ratings yet

- True English Translation of A Business Permission Letter Which The Original Is in BengaliDocument3 pagesTrue English Translation of A Business Permission Letter Which The Original Is in Bengalifahim527433No ratings yet

- KaHEP Tariff PetitionFinalDocument24 pagesKaHEP Tariff PetitionFinalranendra sarmaNo ratings yet

- RES - Removal of County Board ChairDocument3 pagesRES - Removal of County Board ChairAJ WoodsonNo ratings yet

- New Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orDocument24 pagesNew Delhi,: (I) The Total Income of Such Fund or Institution or Trust or University or Other Educational Institution orCA.Shreehari KutsaNo ratings yet

- Joan M. Schumacher: Supervisor With Extensive Background in Customer Service and Call Center ManagementDocument2 pagesJoan M. Schumacher: Supervisor With Extensive Background in Customer Service and Call Center Managementapi-509263434No ratings yet

- MP1 Part 2&3 - Design of A City HallDocument10 pagesMP1 Part 2&3 - Design of A City HallGerardo, Liano Ezekiel N.No ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- Presentation Au Recs Un 210122018Document7 pagesPresentation Au Recs Un 210122018Léon OhandzaNo ratings yet

- Office of Bids and Awards Committee: Republic of The PhilippinesDocument2 pagesOffice of Bids and Awards Committee: Republic of The PhilippinesSt. JohnNo ratings yet

- Sworn Declaration: Annex DDocument3 pagesSworn Declaration: Annex DellamanzonNo ratings yet

- BLR CCU: TICKET - ConfirmedDocument2 pagesBLR CCU: TICKET - ConfirmedShubhrajit MaitraNo ratings yet

- First Appeal To SRADocument3 pagesFirst Appeal To SRANILESH PARABNo ratings yet

- m1 PDFDocument2 pagesm1 PDFSivanandNo ratings yet

- 2307 New Template Ni PauDocument37 pages2307 New Template Ni Pau175pauNo ratings yet

- Trans1 2020 05Document166 pagesTrans1 2020 05AmbujNo ratings yet

- Country Profile Burkina Faso 2019 - PRDocument23 pagesCountry Profile Burkina Faso 2019 - PROusmaneNo ratings yet

- Receipt Booking United StateDocument1 pageReceipt Booking United StateMoch. Arif Bayu Setia BudiNo ratings yet

- PTCL ReportDocument199 pagesPTCL ReportSalman SaeedNo ratings yet

- Model Bye Laws of Coop Housing Society New Flatowner Type (2!9!14)Document91 pagesModel Bye Laws of Coop Housing Society New Flatowner Type (2!9!14)dezoramaNo ratings yet

- EnrollmentDocument38 pagesEnrollmentSachin SharmaNo ratings yet

- Binod Bihari Mahto Koyalanchal University, Dhanbad (Jharkhand)Document1 pageBinod Bihari Mahto Koyalanchal University, Dhanbad (Jharkhand)sindri008No ratings yet