Professional Documents

Culture Documents

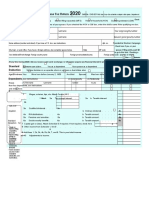

2021 Form 1040-NR

Uploaded by

valentynad74Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2021 Form 1040-NR

Uploaded by

valentynad74Copyright:

Available Formats

1040-NR U.S.

Nonresident Alien Income Tax Return 2021

Form Department of the Treasury—Internal Revenue Service (99)

IRS Use Only—Do not write

OMB No. 1545-0074 or staple in this space.

Filing Single Married filing separately (MFS) Qualifying widow(er) (QW)

Status

If you checked the QW box, enter the child’s name if the

Check only qualifying person is a child but not your dependent ▶

one box.

Your first name and middle initial Last name Your identifying number

(see instructions)

Home address (number and street or rural route). If you have a P.O. box, see instructions. Apt. no. Check if: Individual

Estate or Trust

City, town, or post office. If you have a foreign address, also complete spaces below. State ZIP code

Foreign country name Foreign province/state/county Foreign postal code

At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial interest in any virtual currency? Yes No

Dependents (4) ✔ if qualifies for (see inst.):

(2) Dependent’s (3) Dependent’s Credit for other

(see instructions): Child tax credit

(1) First name Last name identifying number relationship to you dependents

If more than four

dependents, see

instructions and

check here ▶

Income 1a Wages, salaries, tips, etc. Attach Form(s) W-2 . . . . . . . . . . . . . . . . 1a

Effectively b Scholarship and fellowship grants. Attach Form(s) 1042-S or required statement. See instructions . 1b

Connected c Total income exempt by a treaty from Schedule OI (Form 1040-NR), Item

With U.S. L, line 1(e) . . . . . . . . . . . . . . . . . . . 1c

Trade or 2a Tax-exempt interest . . . 2a b Taxable interest . . . . . . 2b

Business 3a Qualified dividends . . . 3a b Ordinary dividends . . . . . 3b

4a IRA distributions . . . . 4a b Taxable amount . . . . . . 4b

5a Pensions and annuities . . 5a b Taxable amount . . . . . . 5b

6 Reserved for future use . . . . . . . . . . . . . . . . . . . . . . . 6

7 Capital gain or (loss). Attach Schedule D (Form 1040) if required. If not required, check here . ▶ 7

8 Other income from Schedule 1 (Form 1040), line 10 . . . . . . . . . . . . . . . 8

9 Add lines 1a, 1b, 2b, 3b, 4b, 5b, 7, and 8. This is your total effectively connected income . . ▶ 9

10 Adjustments to income:

a From Schedule 1 (Form 1040), line 26 . . . . . . . . . . . 10a

b Reserved for future use . . . . . . . . . . . . . . . 10b

c Scholarship and fellowship grants excluded . . . . . . . . . 10c

d Add lines 10a and 10c. These are your total adjustments to income . . . . . . . . ▶ 10d

11 Subtract line 10d from line 9. This is your adjusted gross income . . . . . . . . . ▶ 11

12a Itemized deductions (from Schedule A (Form 1040-NR)) or, for certain

residents of India, standard deduction. See instructions . . . . . 12a

b Charitable contributions for certain residents of India. See instructions . 12b

c Add lines 12a and 12b . . . . . . . . . . . . . . . . . . . . . . . 12c

13a Qualified business income deduction from Form 8995 or Form 8995-A . 13a

b Exemptions for estates and trusts only. See instructions . . . . . 13b

c Add lines 13a and 13b . . . . . . . . . . . . . . . . . . . . . . . 13c

14 Add lines 12c and 13c . . . . . . . . . . . . . . . . . . . . . . . 14

15 Taxable income. Subtract line 14 from line 11. If zero or less, enter -0- . . . . . . . . . 15

For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, see separate instructions. Cat. No. 11364D Form 1040-NR (2021)

Form 1040-NR (2021) Page 2

16 Tax (see instructions). Check if any from Form(s): 1 8814 2 4972 3 16

17 Amount from Schedule 2 (Form 1040), line 3 . . . . . . . . . . . . . . . . . 17

18 Add lines 16 and 17 . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Nonrefundable child tax credit or credit for other dependents from Schedule 8812 (Form 1040) . . 19

20 Amount from Schedule 3 (Form 1040), line 8 . . . . . . . . . . . . . . . . . 20

21 Add lines 19 and 20 . . . . . . . . . . . . . . . . . . . . . . . . 21

22 Subtract line 21 from line 18. If zero or less, enter -0- . . . . . . . . . . . . . . 22

23a Tax on income not effectively connected with a U.S. trade or business

from Schedule NEC (Form 1040-NR), line 15 . . . . . . . . . 23a

b Other taxes, including self-employment tax, from Schedule 2 (Form 1040),

line 21 . . . . . . . . . . . . . . . . . . . . 23b

c Transportation tax (see instructions) . . . . . . . . . . . 23c

d Add lines 23a through 23c . . . . . . . . . . . . . . . . . . . . . . 23d

24 Add lines 22 and 23d. This is your total tax . . . . . . . . . . . . . . . . ▶ 24

25 Federal income tax withheld from:

a Form(s) W-2 . . . . . . . . . . . . . . . . . . 25a

b Form(s) 1099 . . . . . . . . . . . . . . . . . . 25b

c Other forms (see instructions) . . . . . . . . . . . . . 25c

d Add lines 25a through 25c . . . . . . . . . . . . . . . . . . . . . . 25d

e Form(s) 8805 . . . . . . . . . . . . . . . . . . . . . . . . . . 25e

f Form(s) 8288-A . . . . . . . . . . . . . . . . . . . . . . . . . 25f

g Form(s) 1042-S . . . . . . . . . . . . . . . . . . . . . . . . . 25g

26 2021 estimated tax payments and amount applied from 2020 return . . . . . . . . . . 26

27 Reserved for future use . . . . . . . . . . . . . . . 27

28 Refundable child tax credit or additional child tax credit from Schedule

8812 (Form 1040) . . . . . . . . . . . . . . . . 28

29 Credit for amount paid with Form 1040-C . . . . . . . . . 29

30 Reserved for future use . . . . . . . . . . . . . . . 30

31 Amount from Schedule 3 (Form 1040), line 15 . . . . . . . . 31

32 Add lines 28, 29, and 31. These are your total other payments and refundable credits . . . ▶ 32

33 Add lines 25d, 25e, 25f, 25g, 26, and 32. These are your total payments . . . . . . . ▶ 33

Refund 34 If line 33 is more than line 24, subtract line 24 from line 33. This is the amount you overpaid . . 34

35a Amount of line 34 you want refunded to you. If Form 8888 is attached, check here . . . ▶ 35a

Direct deposit? ▶b Routing number ▶ c Type: Checking Savings

See instructions. ▶

d Account number

▶ e If you want your refund check mailed to an address outside the United States not shown on page 1,

enter it here.

36 Amount of line 34 you want applied to your 2022 estimated tax . ▶ 36

Amount 37 Amount you owe. Subtract line 33 from line 24. For details on how to pay, see instructions . ▶ 37

You Owe 38 Estimated tax penalty (see instructions) . . . . . . . . . ▶ 38

Third Party Do you want to allow another person to discuss this return with the IRS?

See instructions . . . . . . . . . . . . . . . . . . . . ▶ Yes. Complete below. No

Designee

Designee’s Phone Personal identification

name ▶ no. ▶ number (PIN) ▶

Sign Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements, and to the best of my knowledge and

belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge.

Here Your signature Date Your occupation If the IRS sent you an Identity

▲

Protection PIN, enter it here

(see inst.) ▶

Phone no. Email address

Preparer’s name Preparer’s signature Date PTIN Check if:

Paid

Self-employed

Preparer

Firm’s name ▶ Phone no.

Use Only Firm’s address ▶ Firm’s EIN ▶

Go to www.irs.gov/Form1040NR for instructions and the latest information. Form 1040-NR (2021)

You might also like

- Pluralsight InvoiceDocument1 pagePluralsight Invoicesunny.anshulNo ratings yet

- Declaration No PE in India.175145431Document3 pagesDeclaration No PE in India.175145431Pallavi MaggonNo ratings yet

- Tax Return 2022 Mardik MardikianDocument23 pagesTax Return 2022 Mardik Mardikianyusuf Fajar100% (3)

- 2024 Bir Tax CalendarDocument39 pages2024 Bir Tax CalendarWilmz SalacsacanNo ratings yet

- Concentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt ContributionsDocument2 pagesConcentrix CVG Philippines, Inc.: Description Hrs Total Description Total Taxable Earnings Mandatory Govt Contributionszayn malikNo ratings yet

- U.S. Individual Income Tax Return: Filing Status XDocument8 pagesU.S. Individual Income Tax Return: Filing Status XTehone Teketelew100% (2)

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- 2019 TaxreturnDocument6 pages2019 TaxreturnMARC ANDREWS WOLFFNo ratings yet

- U.S. Individual Income Tax Return: Gregory 431-85-7104 Christopher BDocument5 pagesU.S. Individual Income Tax Return: Gregory 431-85-7104 Christopher BChris Gregory100% (2)

- 1120s PDFDocument5 pages1120s PDFBreann MorrisNo ratings yet

- U.S. Tax Return For Seniors Filing Status: Standard DeductionDocument2 pagesU.S. Tax Return For Seniors Filing Status: Standard DeductionPaula Speroni-yacht50% (4)

- IRS Form 1040Document2 pagesIRS Form 1040fox43wpmt50% (2)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09fortha loveof100% (5)

- TAX87 16 Local Preferential With Answers PDFDocument5 pagesTAX87 16 Local Preferential With Answers PDFJohn Carlo CruzNo ratings yet

- U.S. Nonresident Alien Income Tax Return: Filing StatusDocument2 pagesU.S. Nonresident Alien Income Tax Return: Filing StatusFandyNo ratings yet

- U.S. Nonresident Alien Income Tax Return: Filing StatusDocument2 pagesU.S. Nonresident Alien Income Tax Return: Filing Statuscamilacorredor1998No ratings yet

- HTTPSWWW Irs Govpubirs-Pdff1040sa PDFDocument1 pageHTTPSWWW Irs Govpubirs-Pdff1040sa PDFAppaNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument3 pagesU.S. Individual Income Tax Return: Filing StatuspyatetskyNo ratings yet

- U.S. Tax Return For Seniors: Filing StatusDocument2 pagesU.S. Tax Return For Seniors: Filing StatusRemyan RNo ratings yet

- 1120S Case StudyDocument5 pages1120S Case StudyHimani SachdevNo ratings yet

- 2022 Draft Schedule ADocument2 pages2022 Draft Schedule ARiley CareNo ratings yet

- F1040nre 2012 PDFDocument2 pagesF1040nre 2012 PDFJohanna AriasNo ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2022 or Tax Year Beginning, 2022, Ending, 20Benny BerniceNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusBrianNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax ReturnJohnNo ratings yet

- Additional Income and Adjustments To Income: Schedule 1Document1 pageAdditional Income and Adjustments To Income: Schedule 1Betty Ann LegerNo ratings yet

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2018 or Fiscal Year Beginning, 2018, and Ending, 20Document2 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2018 or Fiscal Year Beginning, 2018, and Ending, 20Lauren100% (2)

- Profit or Loss From Business: Schedule C (Form 1040)Document4 pagesProfit or Loss From Business: Schedule C (Form 1040)adam burd100% (1)

- f1120s AccessibleDocument5 pagesf1120s AccessiblebhanuprakashbadriNo ratings yet

- Form 1040 Ethan Calandra Tax ProjectDocument4 pagesForm 1040 Ethan Calandra Tax Projectapi-548953348No ratings yet

- 2019 Tax Return Documents (VERAS MELQUISEDED)Document7 pages2019 Tax Return Documents (VERAS MELQUISEDED)Edison Estrada100% (2)

- U.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20Document3 pagesU.S. Income Tax Return For Estates and Trusts: For Calendar Year 2022 or Fiscal Year Beginning, 2022, and Ending, 20dizzi dagerNo ratings yet

- Ralston Medina W2Document2 pagesRalston Medina W2bussinesl las100% (1)

- Hong Thien PhuocBui2018Document6 pagesHong Thien PhuocBui2018Thien BaoNo ratings yet

- 2020 Tax Return Documents (DERICK BROOKS A)Document2 pages2020 Tax Return Documents (DERICK BROOKS A)Patricia100% (2)

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Navek SmithsNo ratings yet

- Finalized Schedule EDocument2 pagesFinalized Schedule EMira HuNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument5 pagesU.S. Individual Income Tax Return: Filing Statuskristen kindleNo ratings yet

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental ExpensesnuseNo ratings yet

- U.S. Income Tax Return For An S Corporation: For Calendar Year 2023 or Tax Year Beginning, 2023, Ending, 20Document5 pagesU.S. Income Tax Return For An S Corporation: For Calendar Year 2023 or Tax Year Beginning, 2023, Ending, 20h0oud4No ratings yet

- Untitled PDFDocument2 pagesUntitled PDFjenny abbottNo ratings yet

- Exempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )Document2 pagesExempt Organization Business Income Tax Return: (And Proxy Tax Under Section 6033 (E) )lp101goldNo ratings yet

- f1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONDocument2 pagesf1040 - Schedule - C - 2019-00-00-ED SNIDER YOUTH HOCKEY FOUNDATIONKeller Brown Jnr50% (2)

- U.S. Tax Return For Seniors Filing StatusDocument16 pagesU.S. Tax Return For Seniors Filing StatusJonathan Mahe100% (1)

- f1040s8 2021Document3 pagesf1040s8 2021さくら樱花No ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeIshfaq Ali KhanNo ratings yet

- Additional Income and Adjustments To IncomeDocument1 pageAdditional Income and Adjustments To IncomeIshfaq Ali KhanNo ratings yet

- Amended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any ChangesDocument2 pagesAmended U.S. Individual Income Tax Return: Use Part III On The Back To Explain Any Changesgolcha_edu532No ratings yet

- Schedule 1 For 2019 Form 1040Document1 pageSchedule 1 For 2019 Form 1040CNBC.comNo ratings yet

- f1040s1 PDFDocument1 pagef1040s1 PDFCarlosNo ratings yet

- Planilla Fed 2021Document4 pagesPlanilla Fed 2021zsanta1317No ratings yet

- Massachusettsschedule CDocument2 pagesMassachusettsschedule Cmatthewbraunschweig65100% (1)

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusRobert M Hamil.No ratings yet

- Supplemental Income and Loss: Schedule E (Form 1040) 13Document2 pagesSupplemental Income and Loss: Schedule E (Form 1040) 13Ahmad GaberNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040 or 1040-SR) 09Thomas LawrenceNo ratings yet

- Adriano Alessandro Averzano 2019 Tax ReturnDocument21 pagesAdriano Alessandro Averzano 2019 Tax ReturnMucho FacerapeNo ratings yet

- 2010 Blank IRS Form 1065Document5 pages2010 Blank IRS Form 1065Nick PechaNo ratings yet

- Amended U.S. Individual Income Tax ReturnDocument2 pagesAmended U.S. Individual Income Tax Returnmarxvera158No ratings yet

- Alternative Minimum Tax-IndividualsDocument2 pagesAlternative Minimum Tax-IndividualsBenjamín Varela UmbralNo ratings yet

- 2020 Irs Form Rafael VargasDocument5 pages2020 Irs Form Rafael VargasChristy Helen100% (1)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Law of Business Assignment 3Document2 pagesLaw of Business Assignment 3Maria QadirNo ratings yet

- BIR Form 1702-RTDocument1 pageBIR Form 1702-RTGil DelenaNo ratings yet

- Form 9465-PDF Reader ProDocument2 pagesForm 9465-PDF Reader ProEdward FederisoNo ratings yet

- Collection. Recovery and RefundDocument25 pagesCollection. Recovery and RefundDharshini AravamudhanNo ratings yet

- REPORTDocument33 pagesREPORTavani pandeyNo ratings yet

- 2551QDocument2 pages2551QCris David Moreno79% (14)

- Answer Key - Income Tax Peer Tutoring Quiz (Chapter 4)Document4 pagesAnswer Key - Income Tax Peer Tutoring Quiz (Chapter 4)Jahz Aira GamboaNo ratings yet

- FDNACCT Review Exam-AnsKey-SetADocument7 pagesFDNACCT Review Exam-AnsKey-SetAChyle Sagun100% (1)

- Tax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018Document1 pageTax Invoice: Against Loa: BCPL/C&P/LE17W111SD/5600000682 DATED 15.05.2018RNo ratings yet

- Income Taxation Notes For FinalsDocument15 pagesIncome Taxation Notes For FinalsMa VyNo ratings yet

- What Is Community Tax?: Speaker: Valerie A. OngDocument25 pagesWhat Is Community Tax?: Speaker: Valerie A. Ongmarz busaNo ratings yet

- Special Itemized Deductions, NOLCO & OSDDocument13 pagesSpecial Itemized Deductions, NOLCO & OSDdianne caballero100% (1)

- PubCorp PFDA Vs Central Board of AssementDocument1 pagePubCorp PFDA Vs Central Board of AssementCristine Joy KwongNo ratings yet

- Auto Tax Calculator Version 15.0 (Blank) FY 2020-21Document18 pagesAuto Tax Calculator Version 15.0 (Blank) FY 2020-21Deepak DasNo ratings yet

- Document 18Document6 pagesDocument 18Bernadette Asuncion100% (1)

- 166215019774Document331 pages166215019774warehouseNo ratings yet

- Chapter 7 Introduction To Regular Income TaxDocument18 pagesChapter 7 Introduction To Regular Income TaxDANICKA JANE ENERONo ratings yet

- Order 119 MiscComm 31 1 24Document6 pagesOrder 119 MiscComm 31 1 24Mmkpss Sriram Sista MmkpssNo ratings yet

- Solman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8Document43 pagesSolman Tax2 Transfer Bus Tax 2018 Edition Chapters 1 To 8sammie helsonNo ratings yet

- Final Income TaxationDocument15 pagesFinal Income TaxationElizalen MacarilayNo ratings yet

- Christ Hospital Form 990Document36 pagesChrist Hospital Form 990xoneill7715No ratings yet

- Lecture 5 - Donor - S TaxDocument4 pagesLecture 5 - Donor - S TaxBhosx KimNo ratings yet

- Minimum Wage EarnerDocument2 pagesMinimum Wage EarnerdailydoseoflawNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)sachinsaboo3No ratings yet

- DCS - Status of Account ModuleDocument6 pagesDCS - Status of Account ModuleTejas ThakorNo ratings yet