Professional Documents

Culture Documents

UBL Annual Report 2018-81

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-81

Uploaded by

IFRS LabCopyright:

Available Formats

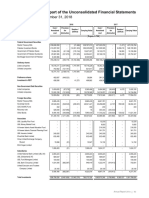

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

3.3 The SECP vide its notification SRO 633 (I)/2014 dated 10 July 2014, adopted IFRS 10 effective from the periods starting

from June 30, 2014. However, vide its notification SRO 56 (I)/2016 dated January 28, 2016, it has been notified that the

requirements of IFRS 10 and section 228 of the Companies Act, 2017 will not be applicable with respect to the investment

in mutual funds established under trust structure.

3.4 These unconsolidated financial statements represent the separate financial statements of the Bank. The consolidated

financial statements of the Bank and its subsidiaries are presented separately.

3.5 Standards, interpretations and amendments to accounting and reporting standards that are not yet effective

The following new standards and interpretations of and amendments to existing accounting standards will be effective from

the dates mentioned below against the respective standard, interpretation or amendment:

Effective date (annual periods

Standard, Interpretation or Amendment beginning on or after)

- IFRS 15 - Revenue from contracts with customers July 1, 2018

- IFRS 11 - Joint Venture - (Amendments) January 1, 2019

- IFRS 16 - Leases January 1, 2019

- IAS 19 - Employee Benefits - (Amendments) January 1, 2019

- IAS 28 - Investments in Associates and Joint Ventures - (Amendments) January 1, 2019

- IFRIC 23 - Uncertainty over Income Tax Treatments January 1, 2019

- IFRS 3 - Business Combinations - (Amendments) January 1, 2020

Effective date (periods

ending on or after)

- IFRS 9 - Financial Instruments: Classification and Measurement June 30, 2019

IFRS 16 replaces existing guidance on accounting for leases, including IAS 17 'Leases', IFRIC 4 'Determining whether an

arrangement contains a Lease', SIC-15 'Operating Leases - Incentive' and SIC-27 'Evaluating the Substance of

Transactions Involving the Legal Form of a Lease'. IFRS 16 introduces a single, on balance sheet lease accounting model

for lessees. A lessee recognizes a right-of-use asset representing its right to use the underlying asset and a lease liability

representing its obligations to make lease payments. There are recognition exemptions for short-term leases and leases of

low-value items. Lessor accounting remains similar to the current standard i.e. lessors continue to classify leases as

finance or operating leases.

On adoption of IFRS 16, the Bank shall recognize a 'right of use asset' with a corresponding liability for lease payments.

The Bank is in the process of assessing the full impact of this standard.

IFRS 9: 'Financial Instruments' addresses recognition, classification, measurement and derecognition of financial assets

and financial liabilities. The standard has also introduced a new impairment model for financial assets which requires

recognition of impairment charge based on an 'Expected Credit Losses' (ECL) approach rather than the 'incurred credit

losses' approach as currently followed. The ECL has impact on all assets of the Bank which are exposed to credit risk. As

detailed in note 5.1.2, the Bank has already adopted IFRS 9 in respect of certain overseas branches.

The Bank is in the process of assessing the full impact of this standard.

The Bank expects that adoption of the remaining interpretations and amendments will not affect its financial statements in

the period of initial application.

3.6 Standards, interpretations and amendments to accounting and reporting standards that are effective in the current

year

The State Bank of Pakistan (SBP) through its BPRD Circular No. 02 of 2018 dated January 25, 2018 has amended the

format of annual financial statements of banks. All banks are directed to prepare their annual financial statements on the

revised format effective from the accounting year ending December 31, 2018. Accordingly, the Bank has prepared these

financial statements on the new format prescribed by the State Bank of Pakistan. The adoption of new format required

certain recognition requirements, reclassification of comparative information and also introduced additional disclosure

requirements. Accordingly a third statement of financial position has been presented at the beginning of the preceding

period (i.e. December 31, 2016) in accordance with the requirement of International Accounting Standard 1 – Presentation

of Financial Statements.

Annual Report 2018 79

You might also like

- Series 6 ReviewDocument202 pagesSeries 6 ReviewAnthony McnicholsNo ratings yet

- Financial Reporting and Analysis Using Financial Accounting Information 13th Edition Ebook PDFDocument41 pagesFinancial Reporting and Analysis Using Financial Accounting Information 13th Edition Ebook PDFdon.anderson433100% (38)

- Ch25 Tool KitDocument35 pagesCh25 Tool KitJITIN ARORANo ratings yet

- Revenue Recognition TelecomDocument32 pagesRevenue Recognition TelecomUrooj KhanNo ratings yet

- 15 IfrsDocument13 pages15 Ifrssuruth242100% (1)

- SEA Startup Ecosystem 2.0Document45 pagesSEA Startup Ecosystem 2.0Rocky SinghNo ratings yet

- 3 - Capital BudgetingDocument60 pages3 - Capital BudgetingValerie WNo ratings yet

- IFRS 9 - Financial InstrumentsDocument14 pagesIFRS 9 - Financial InstrumentsJayvie Dizon Salvador0% (1)

- Effected For Accounting Period Beginning On or After: IFRS 16 LeasesDocument2 pagesEffected For Accounting Period Beginning On or After: IFRS 16 LeasesSaad OlathNo ratings yet

- Oman Chromite Company SAOG Notes To The Financial Statements For The Year Ended 31 December 2019 (Expressed in Omani Rial)Document28 pagesOman Chromite Company SAOG Notes To The Financial Statements For The Year Ended 31 December 2019 (Expressed in Omani Rial)Sumant AggNo ratings yet

- PFRS Updates For The Year 2018Document7 pagesPFRS Updates For The Year 2018nenette cruzNo ratings yet

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- WPP Annual Report 2019Document55 pagesWPP Annual Report 2019voodoomediaservicesNo ratings yet

- Coa Circular No. 2024 - 007 - 0001Document21 pagesCoa Circular No. 2024 - 007 - 0001nieves.averheaNo ratings yet

- IFRS 9 Financial InstrumentsDocument2 pagesIFRS 9 Financial InstrumentsJEP WalwalNo ratings yet

- IFRS Update: Topics Discussed in Monthly MeetingDocument2 pagesIFRS Update: Topics Discussed in Monthly MeetingAbdullah Hish ShafiNo ratings yet

- Adamay International Co., Inc.: Note 1 - General InformationDocument36 pagesAdamay International Co., Inc.: Note 1 - General Informationgrecelyn bianesNo ratings yet

- IFRS Document WordDocument21 pagesIFRS Document WordHabte DebeleNo ratings yet

- Sun and Earth Corporation: Notes To The Financial Statements-AmendedDocument57 pagesSun and Earth Corporation: Notes To The Financial Statements-AmendedBeatrice ReynanciaNo ratings yet

- IAS Currently UsingDocument7 pagesIAS Currently UsingWasim Arif HashmiNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2021)Document292 pagesIFRS Illustrative Financial Statements (Dec 2021)bacha436No ratings yet

- IFRS 16 - Leases: Date Development CommentsDocument8 pagesIFRS 16 - Leases: Date Development CommentsAleya MonteverdeNo ratings yet

- 01.introductory Materia... 03-07-2020 7.32 PMDocument20 pages01.introductory Materia... 03-07-2020 7.32 PMوليد محمد فكري عبيدNo ratings yet

- Summary of Significant Accounting PoliciesDocument6 pagesSummary of Significant Accounting PoliciesCaptain ObviousNo ratings yet

- Petron PDFDocument71 pagesPetron PDFEliza MapaNo ratings yet

- Notes To and Forming Part of The Financial Statements: For The Year Ended June 30, 2015Document36 pagesNotes To and Forming Part of The Financial Statements: For The Year Ended June 30, 2015Hasnain KharNo ratings yet

- Applying Rev RHC Mar 2015Document33 pagesApplying Rev RHC Mar 2015Danik AstutikNo ratings yet

- Transportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectDocument6 pagesTransportation & Logistics Transportation & Logistics: Impacts of The Annual Improvements ProjectSo LokNo ratings yet

- List of International Financial Reporting Standards in 2022 Updated - 62f2074aDocument18 pagesList of International Financial Reporting Standards in 2022 Updated - 62f2074aCA Naveen Kumar BalanNo ratings yet

- Reduction in Time Period of Financial StatementsDocument2 pagesReduction in Time Period of Financial StatementsanjithNo ratings yet

- MFRS 16 Disclosure Guide 110919Document45 pagesMFRS 16 Disclosure Guide 110919Yuki 巧仪No ratings yet

- AAU February 2015Document28 pagesAAU February 2015RakeshkargwalNo ratings yet

- Interim Financial Reporting and Applicable Disclosure Provisions of The Paragraph 9.22 of TheDocument8 pagesInterim Financial Reporting and Applicable Disclosure Provisions of The Paragraph 9.22 of TheChee Meng TeowNo ratings yet

- IFRS: Changes On The Way: by Steve CollingsDocument7 pagesIFRS: Changes On The Way: by Steve CollingsFahim yusufNo ratings yet

- IFRS 9 - Financial InstrumentsDocument63 pagesIFRS 9 - Financial InstrumentsMonirul Islam MoniirrNo ratings yet

- BV2018 - MFRS 1Document41 pagesBV2018 - MFRS 1imieNo ratings yet

- Amendments On Financial Reporting Standards Part 1Document5 pagesAmendments On Financial Reporting Standards Part 1Mon RamNo ratings yet

- IFRS Update 2019Document5 pagesIFRS Update 2019Naveed Akhtar ButtNo ratings yet

- Amendments To PAS 19, Plan Amendment, Curtailment or SettlementDocument4 pagesAmendments To PAS 19, Plan Amendment, Curtailment or SettlementRizza Mae AbanielNo ratings yet

- CY GSIS2021 Notes To FSDocument93 pagesCY GSIS2021 Notes To FSEthan RosarioNo ratings yet

- Ifrs 15Document4 pagesIfrs 15cholestudyNo ratings yet

- Adv RTP 19Document34 pagesAdv RTP 19Pawan AgrawalNo ratings yet

- Notes To The Consolidated Financial Statements: For The Year Ended December 31, 2008Document50 pagesNotes To The Consolidated Financial Statements: For The Year Ended December 31, 2008Rabail PkNo ratings yet

- Illustrative MFRS FinancialStatement 2013Document249 pagesIllustrative MFRS FinancialStatement 2013Ahmad Zamri OsmanNo ratings yet

- Ey Applying Ifrs Leases Transitions Disclsosures November2018Document43 pagesEy Applying Ifrs Leases Transitions Disclsosures November2018BT EveraNo ratings yet

- OBA Advisors LTDDocument7 pagesOBA Advisors LTDWALTA ETHIOPIA S. C.No ratings yet

- 25 Notes of Financial StatementsDocument35 pages25 Notes of Financial StatementsDustin ThompsonNo ratings yet

- BBA III Semester - BBA3B04 - Corporate AccountingDocument136 pagesBBA III Semester - BBA3B04 - Corporate AccountingMohammed MubeenNo ratings yet

- IND ASyear-end-consideration-tl - EYDocument56 pagesIND ASyear-end-consideration-tl - EYDilip ChoudharyNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2023)Document286 pagesIFRS Illustrative Financial Statements (Dec 2023)Vamsi Krishna GaragaNo ratings yet

- KPMG IFRS Notes IndAS PDFDocument13 pagesKPMG IFRS Notes IndAS PDFJagadish ChaudharyNo ratings yet

- Indus Dyeing & Manufacturing Co. Limited: Notes To The Consolidated Financial Statements For The Year Ended June 30, 2012Document41 pagesIndus Dyeing & Manufacturing Co. Limited: Notes To The Consolidated Financial Statements For The Year Ended June 30, 2012bestthaneverNo ratings yet

- Commission On Audit: Republic of The PhilippinesDocument5 pagesCommission On Audit: Republic of The PhilippinesEvan TriolNo ratings yet

- Comparison of Ind As With IFRSDocument30 pagesComparison of Ind As With IFRSRakeshkargwalNo ratings yet

- Ind As ImplementationDocument5 pagesInd As ImplementationrohitNo ratings yet

- Financial Instruments Accounting For Asset Management PDFDocument39 pagesFinancial Instruments Accounting For Asset Management PDFNikitaNo ratings yet

- Ey Ctools Interim Ifrs Disclosure Checklist May 2020Document31 pagesEy Ctools Interim Ifrs Disclosure Checklist May 2020sona abrahamyanNo ratings yet

- IFRS Blue Book 2016 Changes in This EditionDocument5 pagesIFRS Blue Book 2016 Changes in This Editionstudentul1986No ratings yet

- Convergence With Accounting Standards: Compiled by CA Saurabh PatniDocument11 pagesConvergence With Accounting Standards: Compiled by CA Saurabh PatniCA Raj KanwalNo ratings yet

- Summary of Changes in Accounting StandardsDocument2 pagesSummary of Changes in Accounting StandardsAnna annANo ratings yet

- IFRS 14 & 15: International Financial Reporting StandardDocument19 pagesIFRS 14 & 15: International Financial Reporting StandardAromalNo ratings yet

- BV2021CR - MFRS1 First-Time Adoption of Malaysian Financial Reporting StandardsDocument43 pagesBV2021CR - MFRS1 First-Time Adoption of Malaysian Financial Reporting StandardsChee Juan PhangNo ratings yet

- MBC Audited FS 2017 PARENTDocument57 pagesMBC Audited FS 2017 PARENTMikx LeeNo ratings yet

- IFRS Update PDFDocument13 pagesIFRS Update PDFFrodouard ManirakizaNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- FM ECO MarathonDocument98 pagesFM ECO MarathonShreyas PatelNo ratings yet

- FA - MCQ'sDocument8 pagesFA - MCQ'sAshika JayaweeraNo ratings yet

- ULOb - Lets AnalyzeDocument2 pagesULOb - Lets Analyzealmira garciaNo ratings yet

- HKABE 2014-15 Paper2A QuestionDocument11 pagesHKABE 2014-15 Paper2A QuestionChan Wai KuenNo ratings yet

- Fin621 Midterm Short Notes by Maha ShahDocument10 pagesFin621 Midterm Short Notes by Maha ShahRamzan100% (1)

- 2020 China Glaze Bangladesh Limited - AFSDocument46 pages2020 China Glaze Bangladesh Limited - AFSMD. Rezwanul HaqueNo ratings yet

- 664936327345_e-StatementBRImo_067501007570530_Mar2024_20240327_140431Document2 pages664936327345_e-StatementBRImo_067501007570530_Mar2024_20240327_140431dedeikpiana51No ratings yet

- Capital Adequacy Ratio IntroductionDocument9 pagesCapital Adequacy Ratio IntroductionShubham PhophaliaNo ratings yet

- 41st - AGM 300718 For WEBSITEDocument13 pages41st - AGM 300718 For WEBSITEAghora Kali Peetham DeccanNo ratings yet

- Final RevisionDocument9 pagesFinal RevisionVo Phuc An (K17 HCM)No ratings yet

- Advanced Accounting - Interactive Online Quiz Ch01Document4 pagesAdvanced Accounting - Interactive Online Quiz Ch01gilli1tr100% (1)

- Acc 4100Document13 pagesAcc 4100Guen ParkNo ratings yet

- BSRM Steels LimitedDocument6 pagesBSRM Steels LimitedFossil FuelNo ratings yet

- Financial Management Thesis TopicsDocument8 pagesFinancial Management Thesis Topicslizgrahammanchester100% (1)

- Chapter 13 Exercise Demonstration PowerPoint PresentationDocument68 pagesChapter 13 Exercise Demonstration PowerPoint PresentationCinema RecappedNo ratings yet

- 12 Accountancy Lyp 2017 Outside Delhi Set3Document42 pages12 Accountancy Lyp 2017 Outside Delhi Set3Ramprasad Sarkar100% (1)

- Supplemental Agreement On Admission Cum Retirement ofDocument3 pagesSupplemental Agreement On Admission Cum Retirement ofGITIKA ARORANo ratings yet

- 4201 (Previous Year Questions)Document13 pages4201 (Previous Year Questions)Tanjid MahadyNo ratings yet

- JP Morgan Financial StatementsDocument8 pagesJP Morgan Financial StatementsTamar PirtskhalaishviliNo ratings yet

- Problem Sets Security AnalysisDocument24 pagesProblem Sets Security AnalysisK59 Tran Nguyen HanhNo ratings yet

- Swedish Match Case StudyDocument2 pagesSwedish Match Case StudySaurabh AgarwalNo ratings yet

- Division of ProfitsDocument55 pagesDivision of ProfitsMichole chin MallariNo ratings yet

- Temu 8 (Proved Property Cost Disposition-Successful Eforts)Document13 pagesTemu 8 (Proved Property Cost Disposition-Successful Eforts)Toto SugiyartoNo ratings yet

- Chapter 9 Cash Flow Analysis To Make Investment DecisionsDocument6 pagesChapter 9 Cash Flow Analysis To Make Investment DecisionstyNo ratings yet

- Arini Alfahani - Tugas AKM IDocument2 pagesArini Alfahani - Tugas AKM Iarini alfahaniNo ratings yet