Professional Documents

Culture Documents

UBL Annual Report 2018-82

UBL Annual Report 2018-82

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-82

UBL Annual Report 2018-82

Uploaded by

IFRS LabCopyright:

Available Formats

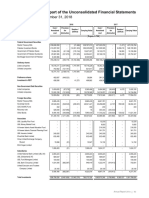

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

During the current year, IFRS 9, Financial Instruments: Classification and Measurement, became applicable for certain

overseas branches of the Bank. The impact of the adoption of IFRS 9 on the Bank's financial statements is disclosed in

note 5.1.2.

In addition, there are certain other new standards and interpretations of and amendments to existing accounting standards

that have become applicable to the Bank for accounting periods beginning on or after January 1, 2018. These are

considered either to not be relevant or to not have any significant impact on the Bank's financial statements.

4. BASIS OF MEASUREMENT

4.1 Accounting convention

These unconsolidated financial statements have been prepared under the historical cost convention except that certain

fixed assets / non-banking assets acquired in satisfaction of claims have been stated at revalued amounts, certain

investments and derivative financial instruments have been stated at fair value and net obligations in respect of defined

benefit schemes are carried at their present values.

4.2 Critical accounting estimates and judgments

The preparation of these unconsolidated financial statements in conformity with accounting and reporting standards

requires management to make judgments, estimates and assumptions that affect the reported amounts of assets and

liabilities and income and expenses. It also requires management to exercise judgment in the application of its accounting

policies. The estimates and assumptions are based on historical experience and various other factors that are believed to

be reasonable under the circumstances. These estimates and assumptions are reviewed on an ongoing basis. Revisions to

accounting estimates are recognized in the period in which the estimate is revised if the revision affects only that period, or

in the period of revision and future periods if the revision affects both current and future periods.

Significant accounting estimates and areas where judgments were made by management in the application of accounting

policies are as follows:

i) classification of investments (notes 5.4 and 9)

ii) provision against investments (notes 5.4 and 9.3), lendings to financial institutions (note 8.6) and advances (notes 5.5

and 10.4)

iii) income taxes (notes 5.9 and 35)

iv) staff retirement benefits (notes 5.11 and 40)

v) fair value of derivatives (note 5.16.2)

vi) fixed assets and intangible assets - revaluation, depreciation and amortization (notes 5.6, 11 and 12)

vii) impairment (note 5.8)

viii)valuation of non-banking assets acquired in satisfaction of claims (note 5.7)

5. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accounting policies adopted in the preparation of these unconsolidated financial statements are consistent with those

of the previous financial year, except for changes explained in note 5.1:

5.1 Change in accounting policies

5.1.1 The Companies Ordinance, 1984 was repealed through the enactment of the Companies Act, 2017. However, as directed

by the Securities and Exchange Commission of Pakistan vide Circular No. 23 dated October 4, 2017, the financial reporting

requirements of the Companies Act, 2017 were only made applicable for reporting periods starting from January 1, 2018.

Consequent to the enactment of the Companies Act, 2017 the Bank has changed its policy for accounting for a deficit

arising on revaluation of fixed assets. The Bank's previous accounting policy, in accordance with the repealed Companies

Ordinance, 1984, required that a deficit arising on revaluation of a particular property was to be adjusted against the total

balance in the surplus account or, if no surplus existed, was to be charged to the profit and loss account as an impairment

of the asset. The Companies Act, 2017 removed the specific provisions allowing the above treatment. A deficit arising on

revaluation of a particular property is now to be accounted for in accordance with IFRS, which requires that such deficit

cannot be adjusted against surplus in another property, but is to be taken to the profit and loss account as an impairment.

80 United Bank Limited

You might also like

- PAS 1 With Notes - Pres of FS PDFDocument75 pagesPAS 1 With Notes - Pres of FS PDFFatima Ann GuevarraNo ratings yet

- Financial StatementsDocument4 pagesFinancial StatementsBobby VisitacionNo ratings yet

- Cash CallsDocument7 pagesCash CallseddiemedNo ratings yet

- Profession Tax Challan - MaharashtraDocument1 pageProfession Tax Challan - MaharashtraPaymaster Services80% (5)

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsMaruf HossainNo ratings yet

- Ias 8 EnglezaDocument9 pagesIas 8 EnglezaTatiana LupuNo ratings yet

- Notes To AccountsDocument57 pagesNotes To AccountsgandabachaaNo ratings yet

- 11 Ias 8Document5 pages11 Ias 8Irtiza AbbasNo ratings yet

- ACS ProjectDocument31 pagesACS Projectshanker_kNo ratings yet

- Ifrs VS PsakDocument58 pagesIfrs VS PsakAnisyaCahyaningrumNo ratings yet

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Document33 pagesReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB CloydNo ratings yet

- Exp Posure D Draft: A Accounti Ing Stan Ndard (A AS) 5 (Re Evised)Document15 pagesExp Posure D Draft: A Accounti Ing Stan Ndard (A AS) 5 (Re Evised)ratiNo ratings yet

- 21.0 NAS 8 - SetPasswordDocument9 pages21.0 NAS 8 - SetPasswordDhruba AdhikariNo ratings yet

- Accounting InformationDocument9 pagesAccounting InformationAtaulNo ratings yet

- Padma Oil CompanDocument4 pagesPadma Oil CompanAnonymous uRR8NyteNo ratings yet

- IAS1 Presentation of FSDocument6 pagesIAS1 Presentation of FSIrishLove Alonzo BalladaresNo ratings yet

- IFRS Illustrative Financial StatementsDocument306 pagesIFRS Illustrative Financial Statementsjohnthorrr100% (2)

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument7 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and Errorsmusic niNo ratings yet

- Pas 8 SuperfinalDocument16 pagesPas 8 SuperfinalmattNo ratings yet

- Explanation Financial StatementsDocument3 pagesExplanation Financial StatementsitsmekuskusumaNo ratings yet

- ABA - Annual Report 2018Document146 pagesABA - Annual Report 2018Ivan ChiuNo ratings yet

- Accounting Standard DiscosuresDocument24 pagesAccounting Standard DiscosuresplmahalakshmiNo ratings yet

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationDocument21 pagesACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadNo ratings yet

- 08 Handout 1 (CFAS)Document12 pages08 Handout 1 (CFAS)laurencedechosa907No ratings yet

- Toa Pas 1 Financial StatementsDocument14 pagesToa Pas 1 Financial StatementsreinaNo ratings yet

- IAS Standards IAS 1 Presentation of Financial StatementsDocument23 pagesIAS Standards IAS 1 Presentation of Financial StatementsmulualemNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument14 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsSuresh Reddy SannapureddyNo ratings yet

- Philippine Accounting Standard No. 1: Presentation of Financial StatementsDocument58 pagesPhilippine Accounting Standard No. 1: Presentation of Financial StatementsDark PrincessNo ratings yet

- Ias 8Document47 pagesIas 8অরূপ মিস্ত্রী বলেছেনNo ratings yet

- Presentation of Financial StatementsDocument11 pagesPresentation of Financial StatementsHasnain MahmoodNo ratings yet

- IFRS Illustrative Financial Statements (Dec 2019) FINALDocument290 pagesIFRS Illustrative Financial Statements (Dec 2019) FINALPaddireddySatyamNo ratings yet

- Ias 8Document9 pagesIas 8Muhammad SaeedNo ratings yet

- Indian Accounting Standard (Ind AS) 8 - Taxguru - inDocument11 pagesIndian Accounting Standard (Ind AS) 8 - Taxguru - inaaosarlbNo ratings yet

- IAS8-Summary Notes PDFDocument8 pagesIAS8-Summary Notes PDFWaqas Younas BandukdaNo ratings yet

- NOTES 12 InterimDocument6 pagesNOTES 12 InterimWinny PoeNo ratings yet

- NFRS IiiDocument105 pagesNFRS Iiikaran shahiNo ratings yet

- AfmDocument15 pagesAfmabcd dcbaNo ratings yet

- Ias 8 Accounting Policies, Changes in Accounting Estimates and ErrorsDocument10 pagesIas 8 Accounting Policies, Changes in Accounting Estimates and ErrorsBagudu Bilal GamboNo ratings yet

- SABS - Impending IFRS Convergence - Vinayak PaiDocument7 pagesSABS - Impending IFRS Convergence - Vinayak PaiBasappaSarkarNo ratings yet

- Financial ProceduresDocument29 pagesFinancial ProceduresGopti EmmanuelNo ratings yet

- Objective of IAS 1Document8 pagesObjective of IAS 1mahekshahNo ratings yet

- UBL Annual Report 2018-72Document1 pageUBL Annual Report 2018-72IFRS LabNo ratings yet

- Pas 1Document52 pagesPas 1Justine VeralloNo ratings yet

- Indian Accounting Standards (Abbreviated As Ind-AS) in India Accounting StandardsDocument6 pagesIndian Accounting Standards (Abbreviated As Ind-AS) in India Accounting Standardsmba departmentNo ratings yet

- Module 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and ErrorsDocument9 pagesModule 014 Week005-Statement of Changes in Equity, Accounting Policies, Changes in Accounting Estimates and Errorsman ibeNo ratings yet

- NFS 2019Document24 pagesNFS 2019Maria MelissaNo ratings yet

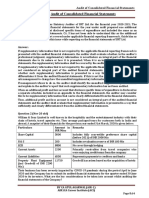

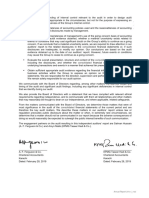

- Audit of Consolidated Financial StatementsDocument7 pagesAudit of Consolidated Financial StatementsDheeraj VermaNo ratings yet

- Summary of Significant Accounting PoliciesDocument6 pagesSummary of Significant Accounting PoliciesCaptain ObviousNo ratings yet

- CFAS SummaryDocument5 pagesCFAS SummaryMichael Jack SalvadorNo ratings yet

- Applying IFRS 15 - P&DDocument73 pagesApplying IFRS 15 - P&DMuhammad Zaid Sahak100% (1)

- Ifrs Updates August 2019Document9 pagesIfrs Updates August 2019obedNo ratings yet

- Financial Review: World's First Corporate Bonds To Tackle Plastic WasteDocument30 pagesFinancial Review: World's First Corporate Bonds To Tackle Plastic WasteWang Hon YuenNo ratings yet

- TOAMOD2 Financial Statement PresentationDocument20 pagesTOAMOD2 Financial Statement PresentationCukeeNo ratings yet

- Financial Statement Presentation. Theory of Accounts GuideDocument20 pagesFinancial Statement Presentation. Theory of Accounts GuideCykee Hanna Quizo LumongsodNo ratings yet

- Accounting Policies, Changes in Accounting Estimates and ErrorsDocument15 pagesAccounting Policies, Changes in Accounting Estimates and ErrorsPriya JandialNo ratings yet

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsFrom EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsNo ratings yet

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- ACC101 Practice Problem - Complete Accounting CycleDocument2 pagesACC101 Practice Problem - Complete Accounting CycleJeluMVNo ratings yet

- Collapse of The UssrDocument17 pagesCollapse of The Ussrapi-278664076No ratings yet

- English 8 Q3 Episode 4 SLMDocument6 pagesEnglish 8 Q3 Episode 4 SLMmarian buenafeNo ratings yet

- Unit 2 Economic ActivitiesDocument3 pagesUnit 2 Economic Activitiesnotkingit68No ratings yet

- Criminal Jurisdiction in EthiopiaDocument47 pagesCriminal Jurisdiction in EthiopiaBooruuNo ratings yet

- 12 - Computer and Computerised Accounting System (168 KB) PDFDocument14 pages12 - Computer and Computerised Accounting System (168 KB) PDFramneekdadwalNo ratings yet

- Case Number Grade Level Student Name Age Gender Height (M)Document4 pagesCase Number Grade Level Student Name Age Gender Height (M)Rizal LeonardoNo ratings yet

- Ace Navigation v. FGU Insurance PDFDocument13 pagesAce Navigation v. FGU Insurance PDFKris Antonnete DaleonNo ratings yet

- Microcrystalline cellulose production from sugarcane bagasseDocument12 pagesMicrocrystalline cellulose production from sugarcane bagasseAnkit MaharshiNo ratings yet

- Soundplate™: Owner'S ManualDocument20 pagesSoundplate™: Owner'S ManualdanielNo ratings yet

- 1 - Steve Lockwood - Leanhealthcarep2i PPTX PDFDocument33 pages1 - Steve Lockwood - Leanhealthcarep2i PPTX PDFEmerson Rodrigo YuraNo ratings yet

- Family Planning and Contrceptives For Midwifery StudentsDocument190 pagesFamily Planning and Contrceptives For Midwifery StudentsAbdusamed100% (1)

- Introduction To Unix: Fundamental CommandsDocument48 pagesIntroduction To Unix: Fundamental Commandsputtu1No ratings yet

- Oplan TokhangDocument4 pagesOplan TokhangJohnson LimNo ratings yet

- Subject: P.PRACT 513: Topic: Specialized Architectural Services (SPP Document 203) 1.6.9. Acoustic DesignDocument34 pagesSubject: P.PRACT 513: Topic: Specialized Architectural Services (SPP Document 203) 1.6.9. Acoustic DesignEarn Mark Hanzelle Catangal100% (3)

- News Release: Aisi Publishes 2013 Edition of Cold-Formed Steel Design ManualDocument3 pagesNews Release: Aisi Publishes 2013 Edition of Cold-Formed Steel Design ManualBONDHON-2 APARTMENT0% (1)

- Daihatsu Terios II J200, J210, J211 2006-2014 Body ExteriorDocument54 pagesDaihatsu Terios II J200, J210, J211 2006-2014 Body ExteriorBadis Ait HammouNo ratings yet

- Feed Manufacturer Plant Site/Contact Address Brand and Product Lines Classification2Document9 pagesFeed Manufacturer Plant Site/Contact Address Brand and Product Lines Classification2Frances VistaNo ratings yet

- Cambridge International AS & A Level: CHEMISTRY 9701/52Document12 pagesCambridge International AS & A Level: CHEMISTRY 9701/52Abdul AlimNo ratings yet

- Journal Pre-Proof: Finance Research LettersDocument18 pagesJournal Pre-Proof: Finance Research LettersAshraf KhanNo ratings yet

- Destoner MachineDocument6 pagesDestoner MachinekunalkakkadNo ratings yet

- ParenteralarticleDocument14 pagesParenteralarticleevaNo ratings yet

- Marketing BudgetDocument13 pagesMarketing Budgetshahbazahmad0057No ratings yet

- Compound Shortened WordsDocument5 pagesCompound Shortened WordsAltinay ZhumashovaNo ratings yet

- The Elements 2.0 StyleDocument10 pagesThe Elements 2.0 StyledambundosNo ratings yet

- Character of AerialDocument2 pagesCharacter of AerialArya singhaNo ratings yet

- Grade 8 Division Lesson PlanDocument5 pagesGrade 8 Division Lesson Planapi-532928947No ratings yet

- Iwrbs Q2 M12Document15 pagesIwrbs Q2 M12Rhae Diaz DarisanNo ratings yet