Professional Documents

Culture Documents

UBL Annual Report 2018-114

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-114

Uploaded by

IFRS LabCopyright:

Available Formats

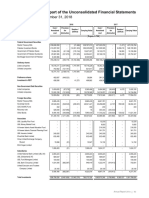

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

With regard to derivatives, the RMC is authorized to:

- Review the derivatives business with reference to market risk exposure and assign various limits in accordance with

the risk appetite of the Bank.

- Review the Derivatives Business Policy and recommend approval to the BRCC / BoD.

- Review and approve derivatives product programs.

- Authorize changes in procedures and processes regarding derivatives and structured products.

Overall responsibility for derivatives trading activity lies with the Treasury and Capital Markets Group. Measurement and

monitoring of market and credit risk exposure and limits and its reporting to senior management and the BoD is done by

Treasury Middle Office (TMO), which also coordinates with the business regarding approvals for derivatives risk limits.

Treasury Operations records derivatives activity in the Bank’s books, and handles its reporting to the SBP.

Derivatives risk management

There are a number of risks undertaken by the Bank, which need to be monitored and assessed.

Credit risk

Credit risk refers to the risk of non-performance or default by a party to a derivatives transaction, resulting in an adverse

impact on the Bank’s profitability. Credit risk associated with derivatives transactions is categorized into settlement risk

and pre-settlement risk. Credit proposals for derivatives transactions are approved by the Credit Committee. The credit

exposure of each counterparty is estimated and monitored against approved counterparty limits by TMO on a daily basis.

Market risk

The Bank, as a policy, hedges back-to-back all options transactions. In addition, the Bank does not carry any exchange

risk on its Cross Currency Swaps portfolio as it hedges the exposure in the interbank market. To manage the interest rate

risk of Interest Rate Derivatives, the Bank has implemented various limits which are monitored and reported by TMO on a

daily basis.

Liquidity risk

Derivatives transactions, usually being non-funded in nature, do not carry a specific funding liquidity risk.

The liquidity risk arises from the fact that in Pakistan, interest rate derivatives generally have a uni-directional demand,

and no perfect hedge is available. The Bank mitigates its risk by limiting the portfolio in terms of tenor, notional and

sensitivity limits, and can also hedge its risk by taking on and off balance sheet positions in the interbank market, where

available.

Operational risk

The staff involved in the trading, settlement and risk management of derivatives is carefully trained to deal with the

complexities involved in the process. Adequate systems and controls are in place to carry out derivatives transactions

smoothly. Each transaction is processed in accordance with the product program or a transaction memo, which contains

detailed guidance on the accounting and operational aspects of the transaction to further mitigate operational risk. In

addition, TMO and the Compliance and Control Department are assigned the responsibility of monitoring any deviation

from policies and procedures. The Bank’s Audit and Inspection Group also reviews this function, with a regular review of

systems, transactional processes, accounting practices and end-user roles and responsibilities.

The Bank uses FX and Derivatives module of Treasury System which provides an end-to-end valuation solution, supports

the routine transactional process and provides analytical tools to measure various risk exposures, carry out stress tests

and sensitivity analysis.

TMO produces various reports on a periodic basis which are reviewed by senior management. These reports provide

details of the derivatives business profile such as outstanding positions, profitability, risk exposures and the status of

compliance with limits.

112 United Bank Limited

You might also like

- Wells Fargo PowerpointDocument19 pagesWells Fargo Powerpointapi-316581998100% (1)

- A Risk Management Approach: Seventh EditionDocument23 pagesA Risk Management Approach: Seventh EditionOugoust DrakeNo ratings yet

- Your Statement: Smart AccessDocument23 pagesYour Statement: Smart Access11.15. Hoàng Nguyễn Thanh HươngNo ratings yet

- 3months Bank Statement Rgvrdy PDFDocument6 pages3months Bank Statement Rgvrdy PDFNikhilreddy SingireddyNo ratings yet

- Individual Paper - Ahmad Ihsan Rizkinda - 1806212766Document8 pagesIndividual Paper - Ahmad Ihsan Rizkinda - 1806212766Ahmad Ihsan RizkindaNo ratings yet

- Banking 1 MCQDocument200 pagesBanking 1 MCQLakshmi Narasaiah100% (1)

- Integrated Treasury Management in BanksDocument17 pagesIntegrated Treasury Management in Banksmasapu100% (1)

- Citi Bank 2021 StatementsDocument2 pagesCiti Bank 2021 StatementsJohn call67% (3)

- Risk Management in Banking CompaniesDocument2 pagesRisk Management in Banking CompaniesPrashanth NaraenNo ratings yet

- Chapter 1 - Introduction To Treasury ManagementDocument17 pagesChapter 1 - Introduction To Treasury ManagementCarlos Reid89% (9)

- Asset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsDocument12 pagesAsset - Liability Management System in Banks - Guidelines: 4. ALM Information SystemsKevin VazNo ratings yet

- Risk PDFDocument44 pagesRisk PDFTathi GuerreroNo ratings yet

- Songy PresentationDocument10 pagesSongy PresentationRommel CruzNo ratings yet

- Credit Risk PolicyDocument32 pagesCredit Risk PolicyRajib Ranjan Samal100% (1)

- Accounting - Answer Key Quiz - Receivable FinancingDocument2 pagesAccounting - Answer Key Quiz - Receivable FinancingNavsNo ratings yet

- OCC Interest Rate RiskDocument74 pagesOCC Interest Rate RiskSara HumayunNo ratings yet

- ALMDocument15 pagesALMGaurav PandeyNo ratings yet

- Statement of Account 159544642288: Name Email Address Mobile NumberDocument9 pagesStatement of Account 159544642288: Name Email Address Mobile NumberRaveendran Sukumaran PareshnathNo ratings yet

- Stress Testing ProjectDocument28 pagesStress Testing Projectjeetu998800No ratings yet

- Index: Acknowledgement Executive Summary Chapter-1Document85 pagesIndex: Acknowledgement Executive Summary Chapter-1Kiran KatyalNo ratings yet

- Interest Risk Management and GuidelinesDocument8 pagesInterest Risk Management and GuidelinessurajjosepNo ratings yet

- What Does Treasury Department Do in A Bank?Document12 pagesWhat Does Treasury Department Do in A Bank?Dolores RosarioNo ratings yet

- Comprehensive Risk Management SystemDocument2 pagesComprehensive Risk Management SystemrakhalbanglaNo ratings yet

- Treasury ManagementDocument14 pagesTreasury ManagementOmkar RohekarNo ratings yet

- ALM - SBI - PPT FinalDocument54 pagesALM - SBI - PPT FinalaanchaliyaNo ratings yet

- Core Risks in BankingDocument9 pagesCore Risks in BankingVenkatsubramanian R IyerNo ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument20 pagesRisk Management Systems in Banks Genesis, Significance and Implementationrajajee43No ratings yet

- Risk Management Framework For MCX (Stock Exchange)Document4 pagesRisk Management Framework For MCX (Stock Exchange)Anuj GoyalNo ratings yet

- Risk Management in BanksDocument26 pagesRisk Management in BanksDivya Keswani0% (1)

- Supervisory Guidance For Managing Settlement Risk in Foreign Exchange TransactionsDocument26 pagesSupervisory Guidance For Managing Settlement Risk in Foreign Exchange Transactionsshishir_nair_1No ratings yet

- Risk Management Systems in Banks Genesis, Significance and ImplementationDocument32 pagesRisk Management Systems in Banks Genesis, Significance and Implementationmahajan87No ratings yet

- 1a. MeaningDocument33 pages1a. MeaningalpeshNo ratings yet

- TKB AML CTF Risk Management PolicyDocument12 pagesTKB AML CTF Risk Management PolicyVishi SinghNo ratings yet

- MFS - Risk Management in Banks MuskanDocument54 pagesMFS - Risk Management in Banks Muskansangambhardwaj64No ratings yet

- 3 - FIG09104 Fin. Mark.& InsDocument49 pages3 - FIG09104 Fin. Mark.& InsMoud KhalfaniNo ratings yet

- HLBANK-Page 45 To ProxyForm (1.5MB) PDFDocument246 pagesHLBANK-Page 45 To ProxyForm (1.5MB) PDFNickyYongChiaChiNo ratings yet

- Risks in Foreign Exchange ManagemnentDocument4 pagesRisks in Foreign Exchange ManagemnentNazmul H. PalashNo ratings yet

- Asset Liability Management in Banks (Alm) : Follow AllbankingsolutionsDocument6 pagesAsset Liability Management in Banks (Alm) : Follow AllbankingsolutionsSanjeet MohantyNo ratings yet

- Risk Management in Banks Under Basel NormsDocument53 pagesRisk Management in Banks Under Basel NormsSahni SahniNo ratings yet

- Asset-Liability-Management FOR NBFCDocument7 pagesAsset-Liability-Management FOR NBFCDr. Prafulla RanjanNo ratings yet

- Risk Factors and Risk ManagementDocument12 pagesRisk Factors and Risk ManagementRamela Jean SabanNo ratings yet

- Dissertation Project Report On Risk Management in BanksDocument38 pagesDissertation Project Report On Risk Management in BanksKelly HamiltonNo ratings yet

- Article On Risk Management in BankDocument7 pagesArticle On Risk Management in Bankraihan175No ratings yet

- Final Exam - International FinanceDocument59 pagesFinal Exam - International FinanceSusan ArafatNo ratings yet

- Foreign Exchange Risk ManagementDocument12 pagesForeign Exchange Risk ManagementDinesh KumarNo ratings yet

- 1 Give The Meaning of Treasury Management. Explain The Need For Specialized Handling of Treasury and Benefits of Treasury. AnsDocument4 pages1 Give The Meaning of Treasury Management. Explain The Need For Specialized Handling of Treasury and Benefits of Treasury. AnsNIKHILPATNINo ratings yet

- Asset Liability Management At-FinalDocument22 pagesAsset Liability Management At-FinalDarshana PratapNo ratings yet

- A025 - Aakriti Jain - FRM - AssignmentDocument8 pagesA025 - Aakriti Jain - FRM - AssignmentAakriti JainNo ratings yet

- Guidance Note On Market Risk ManagementDocument63 pagesGuidance Note On Market Risk ManagementSonu AgrawalNo ratings yet

- Risk Management, Swaps & VARDocument55 pagesRisk Management, Swaps & VARsashaathrgNo ratings yet

- Alm Guidelines by RBIDocument10 pagesAlm Guidelines by RBIPranav ViraNo ratings yet

- RiskDocument10 pagesRiskSanath FernandoNo ratings yet

- Paying Creditors:: 1.0 Risk ManagementDocument4 pagesPaying Creditors:: 1.0 Risk Managementdeepak_computerenggNo ratings yet

- This Report Is On Assets and Liability Management of Different BanksDocument22 pagesThis Report Is On Assets and Liability Management of Different BanksPratik_Gupta_3369No ratings yet

- The Measurement and Management of Risks in BanksDocument21 pagesThe Measurement and Management of Risks in BanksGaurav GehlotNo ratings yet

- Assets Liability ManagementDocument28 pagesAssets Liability Managementpriyanka choudharyNo ratings yet

- ALM and Fund ManagementDocument60 pagesALM and Fund Managementmanoj rijalNo ratings yet

- Assignment Treasury Management in Banking (Vaani Khurana)Document21 pagesAssignment Treasury Management in Banking (Vaani Khurana)dhawalbaria7No ratings yet

- CAIIBDocument11 pagesCAIIBsubhasis123bbsrNo ratings yet

- Risk Management ProjectDocument16 pagesRisk Management ProjectAnkush SoniNo ratings yet

- R M G D: ISK Anagement Uidelines For Erivatives (July 1994)Document17 pagesR M G D: ISK Anagement Uidelines For Erivatives (July 1994)loghanand_muthuramuNo ratings yet

- Type of Risk LessonDocument29 pagesType of Risk LessonpremseoulNo ratings yet

- Final FX Risk & Exposure ManagementDocument33 pagesFinal FX Risk & Exposure ManagementkarunaksNo ratings yet

- Market Risk MNGMNT in FedDocument2 pagesMarket Risk MNGMNT in FedsmrataNo ratings yet

- Treasury of A Commercial BankDocument4 pagesTreasury of A Commercial BankBerkshire Hathway coldNo ratings yet

- Subject Code & Name Mf0016 Treasury Management: AssignmentDocument7 pagesSubject Code & Name Mf0016 Treasury Management: AssignmentNIKHILPATNINo ratings yet

- Risk Management RMDDocument8 pagesRisk Management RMDDewan Joheb ZamanNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- Cash, BNK Recon and AR Answer KeyDocument6 pagesCash, BNK Recon and AR Answer KeyNanya BisnestNo ratings yet

- Assignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionDocument6 pagesAssignment Subject Code BM 0001 (4 Credits) 60 Marks Set I Subject: Financial Accounting - An IntroductionAbdul Lateef KhanNo ratings yet

- Session 1 - Grameen BankDocument5 pagesSession 1 - Grameen BankagyeyaNo ratings yet

- Midterm Activity BFIDocument16 pagesMidterm Activity BFIgrapeslibanNo ratings yet

- Bank Transfer StatementDocument2 pagesBank Transfer StatementhanhNo ratings yet

- Gmail - 'USAMA EHSAN SIDDIQUI' Your Bill For '051-2221344' - December, 2021Document3 pagesGmail - 'USAMA EHSAN SIDDIQUI' Your Bill For '051-2221344' - December, 2021usama ehsanNo ratings yet

- Letter of ContinuityDocument1 pageLetter of ContinuityAPARNANo ratings yet

- UNIT 1.the Organization of The Financial IndustryDocument7 pagesUNIT 1.the Organization of The Financial IndustryNU MaseNo ratings yet

- Practie Homework CH 9 (25ed) Updated NovDocument3 pagesPractie Homework CH 9 (25ed) Updated NovThomas TermoteNo ratings yet

- An Internship Report On Online Banking Activities of Rupali Bank.Document33 pagesAn Internship Report On Online Banking Activities of Rupali Bank.ফারজান স্মৃতিNo ratings yet

- Nominal & Effective Interest RatesDocument18 pagesNominal & Effective Interest RatesMUHAMMAD QASIMNo ratings yet

- Module 4 Banking and Financial InstitutionDocument19 pagesModule 4 Banking and Financial Institutionkimjoshuadiaz12No ratings yet

- Tugas Kelompok TM 3 Pengantar AkuntansiDocument4 pagesTugas Kelompok TM 3 Pengantar AkuntansiYuni ArtaNo ratings yet

- Acct Statement - XX0081 - 21062022Document4 pagesAcct Statement - XX0081 - 21062022vaibhav9839328462No ratings yet

- Asset Reconstruction Company - Section Z - FinalDocument71 pagesAsset Reconstruction Company - Section Z - FinalHarshdeep GargNo ratings yet

- World Exchange Rates - Questions PDFDocument2 pagesWorld Exchange Rates - Questions PDFveda20No ratings yet

- WSAFE396 - Organisation Profile and Job DescriptionDocument3 pagesWSAFE396 - Organisation Profile and Job DescriptionjasmyneNo ratings yet

- CRM - Icici BankDocument45 pagesCRM - Icici BankRadhika ChadhaNo ratings yet

- Onecard Statement (14 Feb 2023 - 13 Mar 2023) : Pss KiranDocument3 pagesOnecard Statement (14 Feb 2023 - 13 Mar 2023) : Pss KiranPss KiranNo ratings yet

- Evolution of MoneyDocument10 pagesEvolution of MoneyRohit SinghNo ratings yet

- 201216216 (5)Document4 pages201216216 (5)Kasi Viral TVNo ratings yet