Professional Documents

Culture Documents

UBL Annual Report 2018-124

Uploaded by

IFRS LabCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

UBL Annual Report 2018-124

Uploaded by

IFRS LabCopyright:

Available Formats

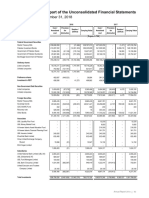

Notes to and forming part of the Unconsolidated Financial Statements

For the year ended December 31, 2018

39.12 Maturity profile 2018

Post retire-

Pension Gratuity Benevolent ment

fund fund fund medical

benefit

The weighted average duration of the obligation (in years) 7.67 6.84 4.07 10.56

39.13 Funding Policy

The Bank endeavours to ensure that liabilities under the various employee benefit schemes are covered by the Fund on

any valuation date having regards to the various actuarial assumptions such as projected future salary increase, expected

future contributions to the fund, projected increase in liability associated with future service and the projected investment

income of the Fund.

Asset Volatility

Only three Schemes out of the all the Schemes are funded: Pension; Gratuity; and Benevolent Fund. The combined

investment of the three funds is Rs 9.4 billion. Almost 65% is invested in Government Bonds with a maturity that is less

than the maturity of the corresponding liability.

The asset class is volatile with reference to the yield on this class. This risk should be viewed together with change in the

bond yield risk.

There is an insignificant equity exposure of around 1%. While 32% is invested in corporate bonds giving rise to settlement

risk, the bonds are, though, high quality.

Changes in Bond Yields

There are two dimensions to the changes in Bond yields: first, as described above; second, the valuation of the Gratuity

Liability is discounted with reference to the government bond yields. So, any increase in Bond yields will lower the

Retirement Benefits Liability and vice versa, but, it will also lower the Asset values.

Inflation Risk

The salary inflation (especially the final salary risk) is the major risk that the Gratuity and compensated absences liability

carries. In pension fund the increased been determined by the Supreme Court does not carry this risk as the benefit is

practically no longer related to future salary increases. Some of the post-retirement medical benefits are capped to a

proportion of Pension, thus carrying no salary inflation risk. However, the hospitalization benefit is susceptible to medical

inflation risk.

In a general economic sense and in a longer view, there is a case that if bond yields increase, the ensuing change in salary

inflation generally offsets the gains from the decrease in discounted gratuity. But viewed with the fact that, for gratuity,

asset values will also decrease; the salary inflation does, as an overall effect, increases the net liability of the Bank.

Life Expectancy / Withdrawal Rate

The Gratuity and Compensated Absences are paid off at the maximum of age 60. The life expectancy is in almost minimal

range and is quite predictable in the ages when the employee is in the accredited employment of the Bank for the purpose

of the Gratuity and Compensated Absences. Thus, the risk of life expectancy is almost negligible. However, post-retirement

benefit given by the Bank like monthly pension, post-retirement medical gives rise to a significant risk which is quite difficult

to value even by using advance mortality improvement models. Thus, this risk carries valuation risk as well.

The withdrawal risk is dependent upon the: benefit structure; age and retention profile of the staff; the valuation

methodology; and long-term valuation assumptions. In this case, it is not a significant downside risk as higher withdrawal,

although troublesome for the Bank, will give rise to a release in the liability as retirement benefits for unvested due to

earlier withdrawal.

122 United Bank Limited

You might also like

- 6 Sources of Retirement Income: How To Create Your Retirement PaycheckDocument27 pages6 Sources of Retirement Income: How To Create Your Retirement PaycheckGerman Briceño0% (1)

- 0403 Glossary of Life Insurance TermsDocument6 pages0403 Glossary of Life Insurance TermsttongNo ratings yet

- Overview of Premium Financed Life InsuranceDocument17 pagesOverview of Premium Financed Life InsuranceProvada Insurance Services100% (1)

- Wage, Salary and Reward AdministrationDocument34 pagesWage, Salary and Reward AdministrationSuparna2No ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipShubhamNo ratings yet

- Understanding Actuarial Practice - KlugmanDocument54 pagesUnderstanding Actuarial Practice - Klugmanjoe malor0% (1)

- Foundations of Financial Markets and Institutions 4th Edition Fabozzi Solutions ManualDocument8 pagesFoundations of Financial Markets and Institutions 4th Edition Fabozzi Solutions Manualfinificcodille6d3h100% (23)

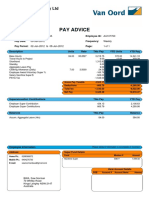

- 0451 Pay Advice AU107760 WK 201228 PDFDocument1 page0451 Pay Advice AU107760 WK 201228 PDFNorman BwaNo ratings yet

- Blackrock Essentials Guide To LdiDocument52 pagesBlackrock Essentials Guide To LdiL Prakash JenaNo ratings yet

- Payslip April 2021 State Bank of India: AIOPP6062HDocument1 pagePayslip April 2021 State Bank of India: AIOPP6062HsayanNo ratings yet

- Premium Paid Certificate For The Year 2022-2023Document1 pagePremium Paid Certificate For The Year 2022-2023yogesh bafnaNo ratings yet

- Project Report Sem IV - Tax Planning in IndiaDocument62 pagesProject Report Sem IV - Tax Planning in IndiaRahul SinghNo ratings yet

- (Use The Below Problem To Answers The Succeeding Four (4) Questions.)Document3 pages(Use The Below Problem To Answers The Succeeding Four (4) Questions.)admiral spongebobNo ratings yet

- Mercado R Mlprime 28072023152829Document19 pagesMercado R Mlprime 28072023152829Jem AmansecNo ratings yet

- Sun Smarter Life ClassicDocument7 pagesSun Smarter Life Classicpaul jan sarachoNo ratings yet

- B Pension Risk TransferDocument7 pagesB Pension Risk TransferMikhail FrancisNo ratings yet

- Aquino AP Ml100 With-Complete-RidersDocument16 pagesAquino AP Ml100 With-Complete-RidersAldrin Paul AquinoNo ratings yet

- EO-Short Qns & Ans onEPF ActDocument13 pagesEO-Short Qns & Ans onEPF ActRatnesh RajanyaNo ratings yet

- Insurance Commission Traditional Life ReviewerDocument42 pagesInsurance Commission Traditional Life Reviewerkristine de jesus100% (2)

- National Pension System (Blackbook)Document86 pagesNational Pension System (Blackbook)chirag karara100% (2)

- Asset Management-Pension FundsDocument9 pagesAsset Management-Pension FundsKen BiiNo ratings yet

- Chapter 15 - Pensions and Other Postretirement BenefitsDocument35 pagesChapter 15 - Pensions and Other Postretirement Benefitselizabeth karinaNo ratings yet

- Accounting For Pensions and Postretirement BenefitsDocument3 pagesAccounting For Pensions and Postretirement BenefitsDhivena JeonNo ratings yet

- Pension Topic One and TwoDocument7 pagesPension Topic One and Twonogarap767No ratings yet

- Chapter 14Document23 pagesChapter 14YolandaNo ratings yet

- Pension Terminology FinalDocument8 pagesPension Terminology FinalEugeneNo ratings yet

- LDI Explained - 2017 FinalDocument44 pagesLDI Explained - 2017 Finaladonettos4008No ratings yet

- Actuarial Glossary PDFDocument18 pagesActuarial Glossary PDFmiguelNo ratings yet

- Term Paper of BankingDocument22 pagesTerm Paper of BankingnidhijunejaNo ratings yet

- Project For Pension PlanDocument9 pagesProject For Pension PlanLakshmi DlaksNo ratings yet

- 03 Conventional With ProfitDocument8 pages03 Conventional With ProfitKimondo KingNo ratings yet

- Cash Balance PlansDocument11 pagesCash Balance Plansmphillips36111No ratings yet

- RISK Chapter 5Document19 pagesRISK Chapter 5Taresa AdugnaNo ratings yet

- Liability-Driven Investing For Defined Benefit Pensions PlansDocument25 pagesLiability-Driven Investing For Defined Benefit Pensions PlansasdasdNo ratings yet

- Organisation For Economic Co-Operation and Development: Hosted by The Government of BrazilDocument11 pagesOrganisation For Economic Co-Operation and Development: Hosted by The Government of Brazildata4csasNo ratings yet

- Effect of Pension Funds Characteristics On Financial Performance of Pension Administrators Chapter OneDocument39 pagesEffect of Pension Funds Characteristics On Financial Performance of Pension Administrators Chapter OneUmar FarouqNo ratings yet

- Chapter 20Document21 pagesChapter 20Diana SantosNo ratings yet

- Chapter 2 Lecture Notes.2021Document15 pagesChapter 2 Lecture Notes.2021Hoyin SinNo ratings yet

- Max New York Life, Axis Bank Sign Bancassurance RelationshipDocument22 pagesMax New York Life, Axis Bank Sign Bancassurance RelationshipAnurag PateriaNo ratings yet

- IAS Group1Document7 pagesIAS Group1Carol PhaswanaNo ratings yet

- Tier-I Account: Fund ManagersDocument5 pagesTier-I Account: Fund ManagersKarthikeyanNo ratings yet

- Life InsuranceDocument22 pagesLife Insuranceckchetankhatri967No ratings yet

- Pension Plans in India NEWWDocument22 pagesPension Plans in India NEWWKomal BhatiaNo ratings yet

- FP Group WorkDocument12 pagesFP Group WorkStellina JoeshibaNo ratings yet

- 1st Case CORTEZ - ML - MLPRIME - 21052022173703Document16 pages1st Case CORTEZ - ML - MLPRIME - 21052022173703Jeanina delos ReyesNo ratings yet

- A New Defined Benefit Pension Risk Measurement Methodology2015Insurance Mathematics and EconomicsDocument12 pagesA New Defined Benefit Pension Risk Measurement Methodology2015Insurance Mathematics and EconomicsMartínCamarenaNo ratings yet

- Defined Benefit Pension PlanDocument8 pagesDefined Benefit Pension Planhenok AbebeNo ratings yet

- Categories of InsuranceDocument6 pagesCategories of InsurancewilliamyesNo ratings yet

- Jagendra Kumar RenewedDocument7 pagesJagendra Kumar RenewedbcibaneNo ratings yet

- Performance Measurement For Pension Funds: Auke Plantinga March 2005Document15 pagesPerformance Measurement For Pension Funds: Auke Plantinga March 2005Dasulea V.No ratings yet

- Institute OF Commerce, Nirma University (Honors) Programme (2017-2020)Document15 pagesInstitute OF Commerce, Nirma University (Honors) Programme (2017-2020)Paras MasariaNo ratings yet

- All You Wanted To Know About Pension Plans!: Share ThisDocument10 pagesAll You Wanted To Know About Pension Plans!: Share ThisAbhi SharmaNo ratings yet

- Briones N Mlprime 18072023193014Document19 pagesBriones N Mlprime 18072023193014Jem AmansecNo ratings yet

- Wealthsurance Growth Insurance Plan SP - Brochure - 1 PDFDocument23 pagesWealthsurance Growth Insurance Plan SP - Brochure - 1 PDFKARAN SINGH-MBA0% (1)

- E.Types of Retirement Plans-1Document13 pagesE.Types of Retirement Plans-1Madhu dollyNo ratings yet

- Johnson & JohnsonDocument2 pagesJohnson & JohnsonpthavNo ratings yet

- Updated Pensions Training - Slides 05.03.18Document101 pagesUpdated Pensions Training - Slides 05.03.18archanaanuNo ratings yet

- BOLI Overview - Meyer ChatfieldDocument4 pagesBOLI Overview - Meyer ChatfieldjrboulwareNo ratings yet

- Bethlehem Case WriteupDocument3 pagesBethlehem Case WriteupAdityaMakhija100% (2)

- Group Insurance ProductsDocument8 pagesGroup Insurance Productshamza omarNo ratings yet

- File 4Document4 pagesFile 4Sk AslamNo ratings yet

- Chapter-25 - Pension Fund OperationsDocument17 pagesChapter-25 - Pension Fund OperationsZareen TasfiahNo ratings yet

- Semana JK Mlprime 30082023134907Document16 pagesSemana JK Mlprime 30082023134907Rogelio EscobarNo ratings yet

- EFU Retirement PlanDocument14 pagesEFU Retirement PlanGhafoor khanNo ratings yet

- POI MaterialDocument11 pagesPOI MaterialMukesh ChoudharyNo ratings yet

- Ac Standard - AS15Document9 pagesAc Standard - AS15api-3705877No ratings yet

- Heading DescriptionDocument4 pagesHeading DescriptionSri Ram SahooNo ratings yet

- Joint Trade Union Response From The Staff Side of The Pensions Working GroupDocument7 pagesJoint Trade Union Response From The Staff Side of The Pensions Working GroupRMT London CallingNo ratings yet

- The Economic Impact of Protracted Low Interest RatDocument21 pagesThe Economic Impact of Protracted Low Interest RatAna López RoucoNo ratings yet

- UBL Annual Report 2018-182Document1 pageUBL Annual Report 2018-182IFRS LabNo ratings yet

- UBL Annual Report 2018-180Document1 pageUBL Annual Report 2018-180IFRS LabNo ratings yet

- UBL Annual Report 2018-179Document1 pageUBL Annual Report 2018-179IFRS LabNo ratings yet

- UBL Annual Report 2018-172Document1 pageUBL Annual Report 2018-172IFRS LabNo ratings yet

- UBL Annual Report 2018-159Document1 pageUBL Annual Report 2018-159IFRS LabNo ratings yet

- UBL Annual Report 2018-160Document1 pageUBL Annual Report 2018-160IFRS LabNo ratings yet

- UBL Annual Report 2018-126Document1 pageUBL Annual Report 2018-126IFRS LabNo ratings yet

- UBL Annual Report 2018-166Document1 pageUBL Annual Report 2018-166IFRS LabNo ratings yet

- UBL Annual Report 2018-157Document1 pageUBL Annual Report 2018-157IFRS LabNo ratings yet

- UBL Annual Report 2018-145Document1 pageUBL Annual Report 2018-145IFRS LabNo ratings yet

- UBL Annual Report 2018-165Document1 pageUBL Annual Report 2018-165IFRS LabNo ratings yet

- UBL Annual Report 2018-131Document1 pageUBL Annual Report 2018-131IFRS LabNo ratings yet

- UBL Annual Report 2018-125Document1 pageUBL Annual Report 2018-125IFRS LabNo ratings yet

- UBL Annual Report 2018-132Document1 pageUBL Annual Report 2018-132IFRS LabNo ratings yet

- UBL Annual Report 2018-109Document1 pageUBL Annual Report 2018-109IFRS LabNo ratings yet

- UBL Annual Report 2018-98Document1 pageUBL Annual Report 2018-98IFRS LabNo ratings yet

- UBL Annual Report 2018-118Document1 pageUBL Annual Report 2018-118IFRS LabNo ratings yet

- UBL Annual Report 2018-120Document1 pageUBL Annual Report 2018-120IFRS LabNo ratings yet

- UBL Annual Report 2018-137Document1 pageUBL Annual Report 2018-137IFRS LabNo ratings yet

- UBL Annual Report 2018-130Document1 pageUBL Annual Report 2018-130IFRS LabNo ratings yet

- UBL Annual Report 2018-97Document1 pageUBL Annual Report 2018-97IFRS LabNo ratings yet

- UBL Annual Report 2018-110Document1 pageUBL Annual Report 2018-110IFRS LabNo ratings yet

- UBL Annual Report 2018-103Document1 pageUBL Annual Report 2018-103IFRS LabNo ratings yet

- UBL Annual Report 2018-92Document1 pageUBL Annual Report 2018-92IFRS LabNo ratings yet

- UBL Annual Report 2018-95Document1 pageUBL Annual Report 2018-95IFRS LabNo ratings yet

- UBL Annual Report 2018-107Document1 pageUBL Annual Report 2018-107IFRS LabNo ratings yet

- UBL Annual Report 2018-106Document1 pageUBL Annual Report 2018-106IFRS LabNo ratings yet

- UBL Annual Report 2018-88Document1 pageUBL Annual Report 2018-88IFRS LabNo ratings yet

- UBL Annual Report 2018-90Document1 pageUBL Annual Report 2018-90IFRS LabNo ratings yet

- UBL Annual Report 2018-93Document1 pageUBL Annual Report 2018-93IFRS LabNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireMr. Khan100% (1)

- Unit 5Document2 pagesUnit 5HuysymNo ratings yet

- 1223.9 F Benefit Payment Application ISS6 - 1021 - HRDocument4 pages1223.9 F Benefit Payment Application ISS6 - 1021 - HRCam Kemshal-BellNo ratings yet

- Occupation GuidelinesDocument160 pagesOccupation Guidelinesjo lamosNo ratings yet

- ISR3702 Assignment 2 Second SemesterDocument2 pagesISR3702 Assignment 2 Second SemesteridreesNo ratings yet

- SAPayslipDocument1 pageSAPayslipmomen rababahNo ratings yet

- International Pay Systems (Chap 8)Document35 pagesInternational Pay Systems (Chap 8)Incia HaiderNo ratings yet

- Central Govt Scheme HandbookDocument51 pagesCentral Govt Scheme HandbookaatishsutardasNo ratings yet

- Pension Calculation Sheet Sindh 2019 20 21Document6 pagesPension Calculation Sheet Sindh 2019 20 21Inder KishanNo ratings yet

- 14 - PFM - Chapter 13 - Retirement and Estate PlanningDocument2 pages14 - PFM - Chapter 13 - Retirement and Estate PlanningLee K.No ratings yet

- IT-Checklist - Gratuity TrustDocument6 pagesIT-Checklist - Gratuity TrustD S VivekNo ratings yet

- Mint 18.10.2023?Document18 pagesMint 18.10.2023?manikantanjeNo ratings yet

- QC 16159Document18 pagesQC 16159Reza KühnNo ratings yet

- Armed Forces Pension Scheme 1975 Your Pension Scheme ExplainedDocument32 pagesArmed Forces Pension Scheme 1975 Your Pension Scheme ExplainedbobNo ratings yet

- Problems On Income From Salaries: Tax SupplementDocument20 pagesProblems On Income From Salaries: Tax SupplementJkNo ratings yet

- 2020 Annual ReportDocument128 pages2020 Annual ReportSaul PimientaNo ratings yet

- The Barefoot InvestorDocument8 pagesThe Barefoot Investortagoeedmund62No ratings yet

- PNHIS Enrollment Annx IVDocument2 pagesPNHIS Enrollment Annx IVRaghuNo ratings yet

- LIC Form - Intimation of Death Retirement Leaving ServiceDocument1 pageLIC Form - Intimation of Death Retirement Leaving ServicekaustubhNo ratings yet

- Project Investment in Tax Saving Product - An OverviewDocument12 pagesProject Investment in Tax Saving Product - An OverviewAkshay DakhaleNo ratings yet