Professional Documents

Culture Documents

Franchise Accounting

Franchise Accounting

Uploaded by

misonim.e0 ratings0% found this document useful (0 votes)

13 views2 pagesOriginal Title

FRANCHISE ACCOUNTING

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

13 views2 pagesFranchise Accounting

Franchise Accounting

Uploaded by

misonim.eCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 2

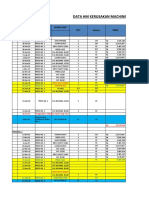

AFAR 06-04 FRANCHISE ACCOUNTING

Accounting for Franchise Fees (FRANCHISOR) – PFRS 15

Initial Franchise Fee

Apply the 5 1. Contract – Franchise Agreement

step model 2. Performance Obligations

(COTA-Rev) • Not distinct from one another – combined into 1 performance obligation (SIPO)

• Distinct – separate performance obligations (SEPO) (if silent, SEPO)

3. Transaction Price

• Consider if there is significant financing component

Sale/revenue + loan

Get the PV by considering the ER vs SR

4. Allocate

5. Recognize revenue

• Special Rule:

▪ License/Tradename

a) Right to Use – franchisor/seller gives control – usually no more ongoing

activities needed (i.e., tradename is not modified anymore)

Recognized @ Point in Time upon transfer of control

b) Right to Access – franchisor “pinapahiram” – ongoing activities (marketing

activities, R&D, etc.)

Recognized Over Time, usually on a Straight Line Basis

Accounting for Franchise Fees (FRANCHISOR) – PFRS 15

Special rule for Continuing Franchise Fee (CFF) or sales-based royalties

Recognized as revenue when both conditions are met:

1. Related performance obligations are already satisfied

2. When or as sales occur (important factor)

IFF – Initial Franchise Fee Direct Cost Matching principle

CFF – Continuing Franchise Indirect Cost Expense Immediately

Revenue (Total)

Fee

Interest

Accounting for Franchise Fees (FRANCHISOR) – PRE-PFRS 15

Revenue if both requirements are met:

1. Substantial performance (PFRS 15: Satisfaction of PO)

2. Down payments or any payments made are non-refundable (PFRS 15: Part of Variable Consideration)

Revenue

• If collection is reasonably assured – ACCRUAL

• If collection is NOT reasonably assured – INSTALLMENT

• Only collections are recognized as revenue (of Principal)

Under PFRS 15, NOT A CONTRACT = NO REVENUE

You might also like

- Far CpaDocument44 pagesFar CpaSrinivas Rao100% (6)

- CFA Level I - Financial Reporting and Analysis - SMG PDFDocument38 pagesCFA Level I - Financial Reporting and Analysis - SMG PDFFinTree Education Pvt Ltd94% (17)

- Emirates Return TicketDocument1 pageEmirates Return TicketShaheen Rahman50% (4)

- FinTree - FRA Sixty Minute GuideDocument38 pagesFinTree - FRA Sixty Minute GuideUtkarsh Jain100% (3)

- Impact of Globalization On HealthcareDocument42 pagesImpact of Globalization On Healthcarezsaddique91% (11)

- 4 Franchise Ifrs 15 2020Document15 pages4 Franchise Ifrs 15 2020natalie clyde matesNo ratings yet

- Financial Instruments Ifrs 9Document29 pagesFinancial Instruments Ifrs 9chalojunior16No ratings yet

- IFRS 9 Part II Classification Measurement CPD November 2015Document55 pagesIFRS 9 Part II Classification Measurement CPD November 2015Justine991No ratings yet

- Sources of GAAP: Statements of Financial Accounting Concepts (SFAC) - Establish The Objectives andDocument37 pagesSources of GAAP: Statements of Financial Accounting Concepts (SFAC) - Establish The Objectives andElwatnNo ratings yet

- Key Differences Between US GAAP and IFRSDocument46 pagesKey Differences Between US GAAP and IFRSmohamedNo ratings yet

- Franchise IFRS 15 2020Document13 pagesFranchise IFRS 15 2020Divine Victoria100% (1)

- IFRS Vs GAAP DifferencesDocument5 pagesIFRS Vs GAAP DifferencesMahmoud SalahNo ratings yet

- 9 - Accounting For Franchise Operations - FranchisorDocument7 pages9 - Accounting For Franchise Operations - FranchisorDarlene Faye Cabral RosalesNo ratings yet

- FinTree - FRA Sixty Minute Guide PDFDocument38 pagesFinTree - FRA Sixty Minute Guide PDFkamleshNo ratings yet

- Business Combinations - ASPEDocument3 pagesBusiness Combinations - ASPEShariful HoqueNo ratings yet

- Lesson 08. Franchising - Sample ProblemsDocument7 pagesLesson 08. Franchising - Sample ProblemsHayes HareNo ratings yet

- 7.1.1. Revenue Recognition Licenses Royalties Franchises and Non Refundable Upfront FeesDocument49 pages7.1.1. Revenue Recognition Licenses Royalties Franchises and Non Refundable Upfront FeesAnne Jasmine FloresNo ratings yet

- Sources of GAAP: FAR - Notes Chapter 1Document5 pagesSources of GAAP: FAR - Notes Chapter 1kmkim9No ratings yet

- Ind-AS: Overview: by CA Jatin FuriaDocument18 pagesInd-AS: Overview: by CA Jatin FuriamansiNo ratings yet

- IFRS 9 - Financial Instrument (Final) V2Document23 pagesIFRS 9 - Financial Instrument (Final) V2mfaisal3No ratings yet

- Accounting:: Recording, Analysing and SummarisingDocument37 pagesAccounting:: Recording, Analysing and SummarisingNguyen Ngoc MaiNo ratings yet

- Notes Chapter 1 FARDocument5 pagesNotes Chapter 1 FARcpacfa90% (50)

- Acca Ias & Ifrs List 2014Document12 pagesAcca Ias & Ifrs List 2014computeraidNo ratings yet

- Reporting Interview GuideDocument7 pagesReporting Interview Guideidrees bajjarNo ratings yet

- IFRS 9-Part 1-Intro-CPD-November 2015Document28 pagesIFRS 9-Part 1-Intro-CPD-November 2015Ivane KutibashviliNo ratings yet

- IFRS 9-Part 1-Intro-CPD-November 2015Document28 pagesIFRS 9-Part 1-Intro-CPD-November 2015Ivane KutibashviliNo ratings yet

- 1 IFRS 9 - Financial InstrumentsDocument31 pages1 IFRS 9 - Financial InstrumentsSharmaineMirandaNo ratings yet

- Franchising (PFRS 15)Document9 pagesFranchising (PFRS 15)Bernardino PacificAceNo ratings yet

- Seminar On Direct Tax Code: Corporate Tax: Vishal ShahDocument23 pagesSeminar On Direct Tax Code: Corporate Tax: Vishal ShahKoushik BalajiNo ratings yet

- Document IFRS-9.1Document6 pagesDocument IFRS-9.1Jime MadrigalNo ratings yet

- Revenue Module Overview and GuidelineDocument11 pagesRevenue Module Overview and GuidelinethamsanqamanciNo ratings yet

- Ifrs 9Document80 pagesIfrs 9Veer Pratab SinghNo ratings yet

- 15.515 Financial Accounting Preliminary Final ReviewDocument21 pages15.515 Financial Accounting Preliminary Final ReviewAnant AgarwalNo ratings yet

- International Financial Reporting Standards: Part IIDocument38 pagesInternational Financial Reporting Standards: Part IIJuliaMaiLeNo ratings yet

- IFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: Welcome! July 31, 2019Andualem ZenebeNo ratings yet

- Investment in Debt SecuritiesDocument7 pagesInvestment in Debt SecuritiesRoma Suliguin0% (1)

- Summary of Key Provisions of IAS & IFRS Which May Be Relevant To ACCA Financial Reporting and Audit Papers For 2013 ExaminationsDocument11 pagesSummary of Key Provisions of IAS & IFRS Which May Be Relevant To ACCA Financial Reporting and Audit Papers For 2013 ExaminationskrissbosNo ratings yet

- Chapter 3 Ias 1 Presentation of Financial StatementsDocument5 pagesChapter 3 Ias 1 Presentation of Financial StatementsKent YpilNo ratings yet

- Difference Between International Financial Reporting Standard's (IFRS's) AND Generally Accepted Accounting Principles (GAAP'S)Document3 pagesDifference Between International Financial Reporting Standard's (IFRS's) AND Generally Accepted Accounting Principles (GAAP'S)jaydeep5008No ratings yet

- Afar 2 Module CH 6 PDFDocument15 pagesAfar 2 Module CH 6 PDFRazmen Ramirez PintoNo ratings yet

- SU12 - Revenue From Contracts With Customers - 2018 - Part 3Document24 pagesSU12 - Revenue From Contracts With Customers - 2018 - Part 3Valerie Verity MarondedzeNo ratings yet

- Accounting Standard Summary Notes Group IDocument15 pagesAccounting Standard Summary Notes Group ISrinivasprasadNo ratings yet

- Technical Interview Questions Prepared by Fahad Irfan - PDF Version 1Document4 pagesTechnical Interview Questions Prepared by Fahad Irfan - PDF Version 1Muhammad Khizzar KhanNo ratings yet

- Statement of Financial Position-SmesDocument5 pagesStatement of Financial Position-SmesAngieNo ratings yet

- Ifrs 22 Aug 09 - VC - 4Document32 pagesIfrs 22 Aug 09 - VC - 4Darshan ToreNo ratings yet

- Profit OR Loss PRE AND Post Incorporation: After Studying This Unit, You Will Be Able ToDocument29 pagesProfit OR Loss PRE AND Post Incorporation: After Studying This Unit, You Will Be Able ToNitesh MattaNo ratings yet

- F7.1 Chap 11 - Financial Instruments 2Document35 pagesF7.1 Chap 11 - Financial Instruments 2NapolnzoNo ratings yet

- Revenue IFRS 15Document36 pagesRevenue IFRS 15kawsursharifNo ratings yet

- IFRS 7,9, & 32 Financial Instruments: February 19, 2019Document55 pagesIFRS 7,9, & 32 Financial Instruments: February 19, 2019Andualem ZenebeNo ratings yet

- RAR Overview OriginalDocument32 pagesRAR Overview OriginalnagalakshmiNo ratings yet

- Lecture 7 - IfRS 5 Assets Held For Sale and Discontinued OperationsDocument8 pagesLecture 7 - IfRS 5 Assets Held For Sale and Discontinued OperationsJeff GanyoNo ratings yet

- AFARevenue RecognitionDocument34 pagesAFARevenue RecognitionRameen ShehzadNo ratings yet

- IFRS 9 Recognition, Classification & MeasurementDocument2 pagesIFRS 9 Recognition, Classification & MeasurementphumuNo ratings yet

- Accounting 404BDocument2 pagesAccounting 404BMelicah Chantel SantosNo ratings yet

- AFAR-06 (Revenue From Contracts With Customers - Other Topics)Document26 pagesAFAR-06 (Revenue From Contracts With Customers - Other Topics)MABI ESPENIDONo ratings yet

- Financial Shenanigans CashflowsDocument19 pagesFinancial Shenanigans CashflowsAdarsh ChhajedNo ratings yet

- Pfrs For Smes - 31aug20118Document6 pagesPfrs For Smes - 31aug20118Joseph II MendozaNo ratings yet

- PFRS of SME and SE - Concept MapDocument1 pagePFRS of SME and SE - Concept MapRey OñateNo ratings yet

- IFRS 9 Part II Classification & Measurement CPD November 2015Document55 pagesIFRS 9 Part II Classification & Measurement CPD November 2015Nicolaus CopernicusNo ratings yet

- IAChap 004 PPTDocument41 pagesIAChap 004 PPTلين صبحNo ratings yet

- Technical Interview Questions Prepared by Fahad IrfanDocument8 pagesTechnical Interview Questions Prepared by Fahad Irfanzohaibaf337No ratings yet

- MASDocument119 pagesMASmisonim.eNo ratings yet

- Taxation On IndividualsDocument20 pagesTaxation On Individualsmisonim.eNo ratings yet

- Far AudDocument191 pagesFar Audmisonim.eNo ratings yet

- RFBTDocument206 pagesRFBTmisonim.eNo ratings yet

- Sample Working Papers-1Document11 pagesSample Working Papers-1misonim.eNo ratings yet

- Tax RemediesDocument11 pagesTax Remediesmisonim.eNo ratings yet

- FOREX Lecture-MergedDocument31 pagesFOREX Lecture-Mergedmisonim.eNo ratings yet

- TAXDocument128 pagesTAXmisonim.eNo ratings yet

- FOREX Part3Document2 pagesFOREX Part3misonim.eNo ratings yet

- Taxation Notes by Angelo MonforteDocument32 pagesTaxation Notes by Angelo Monfortemisonim.eNo ratings yet

- Translation of Foreign Financial Statements (IAS 21)Document6 pagesTranslation of Foreign Financial Statements (IAS 21)misonim.eNo ratings yet

- AFARDocument107 pagesAFARmisonim.eNo ratings yet

- FOREX Part2Document9 pagesFOREX Part2misonim.eNo ratings yet

- COA - C2018 003 MergedDocument52 pagesCOA - C2018 003 Mergedmisonim.eNo ratings yet

- New Chat-MergedDocument10 pagesNew Chat-Mergedmisonim.eNo ratings yet

- (Solved) INVENTORY MODEL - ECONOMIC ORDER QUANTITY 1. Shirley Company... - Course HeroDocument5 pages(Solved) INVENTORY MODEL - ECONOMIC ORDER QUANTITY 1. Shirley Company... - Course Heromisonim.eNo ratings yet

- Chapter 6 - Consolidated Financial Statements (Part 3)Document75 pagesChapter 6 - Consolidated Financial Statements (Part 3)misonim.eNo ratings yet

- (Solved) Clap Off Manufacturing Uses 1,150 Switch Assemblies Per Week And... - Course HeroDocument3 pages(Solved) Clap Off Manufacturing Uses 1,150 Switch Assemblies Per Week And... - Course Heromisonim.eNo ratings yet

- Scanned With CamscannerDocument59 pagesScanned With Camscannermisonim.eNo ratings yet

- Scanned With CamscannerDocument103 pagesScanned With Camscannermisonim.eNo ratings yet

- (Solved) in Fiscal Year 2017 2017, Wal-Mart Stores (WMT) Had... - Course HeroDocument3 pages(Solved) in Fiscal Year 2017 2017, Wal-Mart Stores (WMT) Had... - Course Heromisonim.eNo ratings yet

- (Solved) INVENTORY MODEL - ECONOMIC ORDER QUANTITY 1. Shirley Company... - Course HeroDocument5 pages(Solved) INVENTORY MODEL - ECONOMIC ORDER QUANTITY 1. Shirley Company... - Course Heromisonim.eNo ratings yet

- Executive Order 14067-Joe BidenDocument10 pagesExecutive Order 14067-Joe BidenJoe Smartt100% (3)

- Tle-Ia-Carpentry: Observe Good Formworks RequirementsDocument10 pagesTle-Ia-Carpentry: Observe Good Formworks RequirementsTitser RamcaNo ratings yet

- 14 - Chapter 5Document32 pages14 - Chapter 5Sukanya DuttaNo ratings yet

- Market Failure - John O. Ledyard (1987)Document9 pagesMarket Failure - John O. Ledyard (1987)Farhan 10No ratings yet

- Forwards and FuturesDocument49 pagesForwards and FuturesPragya JainNo ratings yet

- MTF Folio Template 2022Document24 pagesMTF Folio Template 2022Jenny SerranoNo ratings yet

- Eco Indifference CurveDocument3 pagesEco Indifference CurveRONSHA ROYS ANNANo ratings yet

- Weekly Commodity Market Report For TradersDocument6 pagesWeekly Commodity Market Report For TradersRahul SolankiNo ratings yet

- MN2102 Mid Sem 19-20Document1 pageMN2102 Mid Sem 19-20Smruti RanjanNo ratings yet

- My First Bitcoin - Student Workbook (V2023) - Spreads - Final - OptimizerDocument104 pagesMy First Bitcoin - Student Workbook (V2023) - Spreads - Final - OptimizerChristopher William LeeNo ratings yet

- MONEY & CREDIT - Class Notes - Foundation Mind-MapDocument49 pagesMONEY & CREDIT - Class Notes - Foundation Mind-Mapnimit jaiswalNo ratings yet

- Chapter 5.SVDocument73 pagesChapter 5.SVHương ViệtNo ratings yet

- British Rule in IndiaDocument3 pagesBritish Rule in IndiaAliyan HaiderNo ratings yet

- Recording Warranty Expenses and Liabilities What Is A Warranty?Document5 pagesRecording Warranty Expenses and Liabilities What Is A Warranty?Mac FerdsNo ratings yet

- JAVEDDocument1 pageJAVEDMuhammad Ilhamsyah PutraNo ratings yet

- RTCDocument49 pagesRTCobenlawNo ratings yet

- Development of The Vietnam Derivative Stock Market: Nguyen Tuan AnhDocument7 pagesDevelopment of The Vietnam Derivative Stock Market: Nguyen Tuan AnhHồng ÁnhNo ratings yet

- PAM2006 With Quantities WORDSDocument73 pagesPAM2006 With Quantities WORDSAlice TayNo ratings yet

- S3-Low Saving-Investment Trap - PakistanDocument4 pagesS3-Low Saving-Investment Trap - PakistanParmesh KumarNo ratings yet

- Audit RTP NOV 23Document45 pagesAudit RTP NOV 23Kartikeya BansalNo ratings yet

- Katalog Geotube PanelDocument16 pagesKatalog Geotube PanelGry ArdiansyahNo ratings yet

- Introduction of Corporate Governance: Unit-1Document20 pagesIntroduction of Corporate Governance: Unit-1Kusum LataNo ratings yet

- Nathan Rosenberg - Technology and American Economic Growth (1972, Harper & Row) - Libgen - Li-1Document228 pagesNathan Rosenberg - Technology and American Economic Growth (1972, Harper & Row) - Libgen - Li-1GuilhermeNo ratings yet

- Hystory Card Press 2021 Update Maret 2021Document14 pagesHystory Card Press 2021 Update Maret 2021slamet supriyadiNo ratings yet

- 3D-Vjezba IIIDocument4 pages3D-Vjezba IIIhajrudinNo ratings yet

- 11A. HDFC Feb 2021 EstatementDocument10 pages11A. HDFC Feb 2021 EstatementNanu PatelNo ratings yet

- Cash Base VS Accrual BaseDocument8 pagesCash Base VS Accrual BaseCheryl FuentesNo ratings yet

- Invoice TransworldDocument2 pagesInvoice TransworldMitra GlobalindoNo ratings yet