Professional Documents

Culture Documents

Topics in Public Finance

Uploaded by

contactitsshun0 ratings0% found this document useful (0 votes)

2 views2 pagesOriginal Title

Topics-in-Public-Finance

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

2 views2 pagesTopics in Public Finance

Uploaded by

contactitsshunCopyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You are on page 1of 2

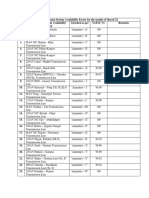

CAGAYAN STATE UNIVERSITY

COLLEGE OF BUSINESS ENTREPRENEURSHIP AND ACCOUNTANCY

BSBA-FINANCIAL MANAGEMENT

First Semester 2023-2024

PUBLIC FINANCE (FM Elec 5) – 3 units –

Prerequisite: FM1

BSBA-FM3

I. INTRODUCTION 1HR

II. THE ROLE OF PUBLIC FINANCE 8

A. What is public finance?

B. Why study public finance?

C. Private vs. Public finance

D. The changing role of the government in the economy

E. Public finance and the changing role of the government.

III. SOME THEORIES ON GOVERNMENT SPENDING 8

A. The concept of full employment

B. Types of unemployment

C. Basic premises in government spending

D. Compensatory spending in the long-run

E. Budget program for stability and full employment

F. Somer’s principles of government expenditure

IV. GOVERNMENT BUDGETING IN THE PHILIPPINES 8

A. Budgeting principles and theories

B. Constitutional provisions of budgeting

C. Organization of budget committee

D. Contents of the budget

E. Budgetary procedures or cycle

F. Issues and problems on government budgeting

MIDTERMS 2

V. PERFORMANCE BUDGETING IN THE PHILIPPINES 3

A. Concept of the Philippine budget system

B. Areas of reform

VI. GOVERNMENT EXPENDITURES BY FUNCTION 8

A. Patterns and trends of expenditures

B. The Philippine expenditure policies

C. Classification of Philippine public expenditures

D. Functional categories

E. Goals of government expenditure

VII. ANALYZING THE TAX SYSTEM 6

A. Tax principles and theories

B. Approaches to taxation

C. Tax efficiency Shifting and incidence

VIII. ORGANIZATION FOR TAX POLICY PLANNING AND TAX

ADMINISTRATION 4

A. Organization for tax policy planning

B. Organization for tax administration

C. Process involved in tax administration

D. Recent reforms

IX. ECONOMIC ASPECT OF THE PUBLIC DEBT 4

A. Public vs. private debt

B. Reason why government borrows

C. The burden of debt

D. Economic effects of borrowing

FINALS 27

TOTAL HOURS 54

References:

1. Seidman, Laurence.Public Finance.McGraw-Hill International Edition

2009

2. Arson, Richard. Public Finance, McGraw-Hill Inc: USA-2012

3. Briones, Leonor M. Philippine Public Fiscal Administration.2011

4. Celesto, A et al. Handbook of Local Fiscal Administration in the

Philippines. Kadena press foundation Inc:2000

5. Reference book on local government, 2nd edition, REX bookstore: Manila

2000

6. Rosen, Harvey. Public Finance 8th edition. McGraw-Hill Inc: USA-2011

7. DBM journals and circulars

Web references:

1. https://www.wallstreetmojo.com/public-finance/

2. https://www.slideshare.net/nithineconomics/public-finance-

128632819?f

You might also like

- Topics in Public FinanceDocument3 pagesTopics in Public FinanceGemini CapananNo ratings yet

- Hidden Spending: The Politics of Federal Credit ProgramsFrom EverandHidden Spending: The Politics of Federal Credit ProgramsNo ratings yet

- Bachelor of Science in Business Administration (BSBA) Major: Financial ManagementDocument3 pagesBachelor of Science in Business Administration (BSBA) Major: Financial Managementjhazel ganancialNo ratings yet

- Money Matters: Local Government Finance in the People's Republic of ChinaFrom EverandMoney Matters: Local Government Finance in the People's Republic of ChinaNo ratings yet

- Public-Fiscal-Admin Syllabus DrLMVicencio FinalDocument8 pagesPublic-Fiscal-Admin Syllabus DrLMVicencio FinaltullasjuriNo ratings yet

- Course PlanDocument11 pagesCourse PlanDrVinod KumarNo ratings yet

- Local Public Finance Management in the People's Republic of China: Challenges and OpportunitiesFrom EverandLocal Public Finance Management in the People's Republic of China: Challenges and OpportunitiesNo ratings yet

- Public Finance An International PerspectDocument306 pagesPublic Finance An International PerspectHannah MelgarNo ratings yet

- Transforming Towards a High-Income People's Republic of China: Challenges and RecommendationsFrom EverandTransforming Towards a High-Income People's Republic of China: Challenges and RecommendationsNo ratings yet

- Econmics SyllabusDocument3 pagesEconmics SyllabusjimmyNo ratings yet

- Public Financial Management Systems—Fiji: Key Elements from a Financial Management PerspectiveFrom EverandPublic Financial Management Systems—Fiji: Key Elements from a Financial Management PerspectiveNo ratings yet

- Course Outline For Public FinanceDocument6 pagesCourse Outline For Public Financerami assefaNo ratings yet

- Public FinanceDocument2 pagesPublic FinanceNandhuNo ratings yet

- SS2 Economics Scheme of Work For 3RD Term 2021-2022Document4 pagesSS2 Economics Scheme of Work For 3RD Term 2021-2022lenee letambari100% (1)

- Syllabus Grad SCH Public Fiscal AdministrationDocument3 pagesSyllabus Grad SCH Public Fiscal AdministrationANGELITA U. ALONZO100% (6)

- Wk14 Summary Quizzer 1 - Set ADocument6 pagesWk14 Summary Quizzer 1 - Set Amariesteinsher0No ratings yet

- Public Finance - SEM IVDocument2 pagesPublic Finance - SEM IVfouad.mlwbdNo ratings yet

- Bayero University, Kano Bayero Business School: A. Course DescriptionDocument56 pagesBayero University, Kano Bayero Business School: A. Course DescriptionMoses AhmedNo ratings yet

- Public Finance PDFDocument55 pagesPublic Finance PDFaon waqas100% (2)

- PART 1: MULTIPLE CHOICE. Choose and Write The Letter of The Correct Answer in Your Answer Sheet. NO ERASURES ALLOWEDDocument3 pagesPART 1: MULTIPLE CHOICE. Choose and Write The Letter of The Correct Answer in Your Answer Sheet. NO ERASURES ALLOWEDtough mamaNo ratings yet

- Problem 1-1: True or False TrueDocument28 pagesProblem 1-1: True or False TrueLeila OuanoNo ratings yet

- Gov Acctg Solman MillanDocument68 pagesGov Acctg Solman MillanSymae Jung100% (1)

- PROEL 13 Public Finance March132023Document21 pagesPROEL 13 Public Finance March132023Mary Joy DayaoNo ratings yet

- Chapter 16 IMSMDocument49 pagesChapter 16 IMSMZachary Thomas CarneyNo ratings yet

- Chapter 16Document48 pagesChapter 16jthemansmith1No ratings yet

- Gov Acctg Solman MillanDocument69 pagesGov Acctg Solman MillanElvira Ariola100% (1)

- AC 518 Quizz 1 2018 BDocument2 pagesAC 518 Quizz 1 2018 BRichel ArmayanNo ratings yet

- Lecture 2Document19 pagesLecture 2Abdul SamadNo ratings yet

- Letter. No Erasures Allowed.: PART II. MULTIPLE CHOICE Write The Letter of The Correct Answer and Should Be in CAPITALDocument2 pagesLetter. No Erasures Allowed.: PART II. MULTIPLE CHOICE Write The Letter of The Correct Answer and Should Be in CAPITALtough mamaNo ratings yet

- Course Outline in Macroeconomics ECON 122 MWF 2.30 - 3.30 PDFDocument4 pagesCourse Outline in Macroeconomics ECON 122 MWF 2.30 - 3.30 PDFDaphne E DucayNo ratings yet

- Economics Paper IV Public Finance English VersionDocument123 pagesEconomics Paper IV Public Finance English VersionAbhiNo ratings yet

- ACC 805 Public Sector Accountig-Course Outline June 2021Document2 pagesACC 805 Public Sector Accountig-Course Outline June 2021Kehinde OjoNo ratings yet

- Pub - Finance Home ExamDocument3 pagesPub - Finance Home ExamEyuel SintayehuNo ratings yet

- Theory and Practice of Public AdministrationDocument2 pagesTheory and Practice of Public AdministrationOliva Mervz84% (25)

- Public Finance Teaching - MaterialDocument232 pagesPublic Finance Teaching - MaterialShime HI RayaNo ratings yet

- CPD 02Document35 pagesCPD 02ARCHANA KUMARI100% (1)

- Long-Quiz P1Document3 pagesLong-Quiz P1demo.nacario.cocNo ratings yet

- AEC 34 - ACB Assignment: Module 1: Problem 1-1.TRUE OR FALSEDocument5 pagesAEC 34 - ACB Assignment: Module 1: Problem 1-1.TRUE OR FALSEDrew BanlutaNo ratings yet

- Public SectorDocument17 pagesPublic SectorTRYANANo ratings yet

- MCQ Far 1Document7 pagesMCQ Far 1syaaNo ratings yet

- Assignment Module 1Document5 pagesAssignment Module 1Drew BanlutaNo ratings yet

- Financial Management For Public Health and Not For Profit Organizations Fifth Edition Ebook PDF VersionDocument62 pagesFinancial Management For Public Health and Not For Profit Organizations Fifth Edition Ebook PDF Versionlester.conti89095% (44)

- Financial GovernmentDocument3 pagesFinancial Governmentronaldsatorre.15No ratings yet

- Bsba 2a Midterm QuestionsDocument12 pagesBsba 2a Midterm QuestionsrowepascuaNo ratings yet

- Analysis Public+policies 2023 PDFDocument5 pagesAnalysis Public+policies 2023 PDFiamyeoneNo ratings yet

- Solution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L BlackDocument5 pagesSolution Manual For International Accounting and Multinational Enterprises 6th Edition by Lee H Radebaugh Sidney J Gray Ervin L Blackplainingfriesishd1hNo ratings yet

- ch02 TB RankinDocument7 pagesch02 TB RankinSyed Bilal AliNo ratings yet

- Ch02 TB RankinDocument8 pagesCh02 TB RankinAnton VitaliNo ratings yet

- Gov Acctg Solman MillanDocument69 pagesGov Acctg Solman MillanMichael Brian Torres100% (2)

- BAF3202 Public Finance NOTES KAMOYODocument123 pagesBAF3202 Public Finance NOTES KAMOYOabdalla mwakutalaNo ratings yet

- Course Outline PFMDocument7 pagesCourse Outline PFMmohamedNo ratings yet

- AA4102 ExamDocument5 pagesAA4102 ExamAlyssa AnnNo ratings yet

- Aspire April 2022 Psaf Intervention Final 26 03 22-FinalDocument40 pagesAspire April 2022 Psaf Intervention Final 26 03 22-FinalDesmond Grasie ZumankyereNo ratings yet

- TOA Long Quiz 1 (Answer Key) PDFDocument7 pagesTOA Long Quiz 1 (Answer Key) PDFabby100% (1)

- Accounting For Public Sector and Civil Model Exit Exam1Document4 pagesAccounting For Public Sector and Civil Model Exit Exam1tame kibruNo ratings yet

- Course Outline Public FiscalDocument2 pagesCourse Outline Public FiscalRhea Rico100% (1)

- Worksheet - Govt BudgetDocument3 pagesWorksheet - Govt BudgetAlans TechnicalNo ratings yet

- Presentation For Public Fiscal Administration For Batch 1Document16 pagesPresentation For Public Fiscal Administration For Batch 1Jeffrey LimsicNo ratings yet

- General Power of Attorney - MadriagaDocument2 pagesGeneral Power of Attorney - Madriagajoonee09No ratings yet

- 1-9-24 Regular Meeting MinutesDocument2 pages1-9-24 Regular Meeting Minutesapi-38761527No ratings yet

- Psa CorrectionDocument3 pagesPsa CorrectionHarley Joy BuctolanNo ratings yet

- Offeror'S Letter To Undp Confirming Interest and Availability For The Individual Contractor (Ic) AssignmentDocument4 pagesOfferor'S Letter To Undp Confirming Interest and Availability For The Individual Contractor (Ic) Assignmentnahid islamNo ratings yet

- Blank - 2020 January 24 - Bergamo Hotel, Lingayen, Pangasinan PDFDocument1 pageBlank - 2020 January 24 - Bergamo Hotel, Lingayen, Pangasinan PDFLGU BinmaleyNo ratings yet

- Alia'o Vs Heirs of LorenzoDocument2 pagesAlia'o Vs Heirs of Lorenzok santosNo ratings yet

- Raghunath Internet: Name - Address SL - No DateDocument1 pageRaghunath Internet: Name - Address SL - No DateAlok NayakNo ratings yet

- Garcia v. American Eagle Outfitters Inc.Document41 pagesGarcia v. American Eagle Outfitters Inc.WPXI StaffNo ratings yet

- Intermodal Transportation System in An Evolving Economy: Research PaperDocument7 pagesIntermodal Transportation System in An Evolving Economy: Research PaperUsiwo FranklinNo ratings yet

- 8 PDFDocument84 pages8 PDFAshok SutharNo ratings yet

- Former Twitter Execs Vs TwitterDocument148 pagesFormer Twitter Execs Vs TwitterSimon AlvarezNo ratings yet

- File No. HQ-PPII010/1/2022-PP - II-Part (3) Comp-3723 Staff Selection Commission Important NoticeDocument1 pageFile No. HQ-PPII010/1/2022-PP - II-Part (3) Comp-3723 Staff Selection Commission Important NoticeLokeshNo ratings yet

- 1 Evolution and Scope of Admin LawDocument8 pages1 Evolution and Scope of Admin Lawsarthak chughNo ratings yet

- Flow-Chart of Actions Required To Take ControlDocument2 pagesFlow-Chart of Actions Required To Take Controlagray43100% (2)

- Payroll Dec With 13th MonthDocument8 pagesPayroll Dec With 13th MonthchippaiUSANo ratings yet

- Site C Dam Project Assurances Board FOI The Narwhal Part 3Document500 pagesSite C Dam Project Assurances Board FOI The Narwhal Part 3The NarwhalNo ratings yet

- EE1213ra CebuDecember 2013 Electronics Engineer Board Exam Result Room Assignment - CebuDocument45 pagesEE1213ra CebuDecember 2013 Electronics Engineer Board Exam Result Room Assignment - CebuJunneil AbapoNo ratings yet

- Sohel & Brothers: A Decade of Excellence in Manpower RecruitmentDocument18 pagesSohel & Brothers: A Decade of Excellence in Manpower RecruitmentBWEB SOLUTIONSNo ratings yet

- Cold Drink ReceiptDocument1 pageCold Drink ReceiptAnish Kumar Giri0% (1)

- Government Financial Reporting and Public Sector ProjectDocument33 pagesGovernment Financial Reporting and Public Sector ProjectSmith JosephNo ratings yet

- Avs Orchard Cost SheetDocument3 pagesAvs Orchard Cost SheetRishabh Naresh JainNo ratings yet

- Permen PU No. 10 Th. 2014 Construction Rep Offoce (English Version) -ipbujka 관련규정Document44 pagesPermen PU No. 10 Th. 2014 Construction Rep Offoce (English Version) -ipbujka 관련규정임한별No ratings yet

- Revised Corporation CodeDocument13 pagesRevised Corporation CodeDencel CundanganNo ratings yet

- Subhash Dey's Indian Economic Development 2020 Edition (Shree Radhey Publications)Document72 pagesSubhash Dey's Indian Economic Development 2020 Edition (Shree Radhey Publications)KsNo ratings yet

- H17obcoursetextar PDFDocument583 pagesH17obcoursetextar PDFidrisNo ratings yet

- NTN: 4098876-7 NTN: 4098876-7 NTN: 4098876-7Document1 pageNTN: 4098876-7 NTN: 4098876-7 NTN: 4098876-7Noman Jutt GNo ratings yet

- Msme Technology Centre Bengaluru Application Form: Paste Here Your Recent Passport Size Photograph and Sign It AcrossDocument2 pagesMsme Technology Centre Bengaluru Application Form: Paste Here Your Recent Passport Size Photograph and Sign It AcrossMalavika SivagurunathanNo ratings yet

- TAFM Index VCDocument2 pagesTAFM Index VCrahulggn4_588180004No ratings yet

- Tampico, Eldene L. JD 2-3 (AsynchAct3)Document4 pagesTampico, Eldene L. JD 2-3 (AsynchAct3)eldene tampicoNo ratings yet

- THE PHILIPPINE TOURISM INDUSTRY AND THE PUBLIC SECTOR lllIIIDocument39 pagesTHE PHILIPPINE TOURISM INDUSTRY AND THE PUBLIC SECTOR lllIIIArgesil SaysonNo ratings yet

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassFrom EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassNo ratings yet

- How to Save Money: 100 Ways to Live a Frugal LifeFrom EverandHow to Save Money: 100 Ways to Live a Frugal LifeRating: 5 out of 5 stars5/5 (1)

- You Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantFrom EverandYou Need a Budget: The Proven System for Breaking the Paycheck-to-Paycheck Cycle, Getting Out of Debt, and Living the Life You WantRating: 4 out of 5 stars4/5 (104)

- Budget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.From EverandBudget Management for Beginners: Proven Strategies to Revamp Business & Personal Finance Habits. Stop Living Paycheck to Paycheck, Get Out of Debt, and Save Money for Financial Freedom.Rating: 5 out of 5 stars5/5 (91)

- Money Made Easy: How to Budget, Pay Off Debt, and Save MoneyFrom EverandMoney Made Easy: How to Budget, Pay Off Debt, and Save MoneyRating: 5 out of 5 stars5/5 (1)

- Radically Simple Accounting: A Way Out of the Dark and Into the ProfitFrom EverandRadically Simple Accounting: A Way Out of the Dark and Into the ProfitRating: 4.5 out of 5 stars4.5/5 (9)

- Heart and Hustle: Use your passion. Build your brand. Achieve your dreams.From EverandHeart and Hustle: Use your passion. Build your brand. Achieve your dreams.Rating: 4.5 out of 5 stars4.5/5 (48)

- The Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsFrom EverandThe Black Girl's Guide to Financial Freedom: Build Wealth, Retire Early, and Live the Life of Your DreamsNo ratings yet

- Swot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessFrom EverandSwot analysis in 4 steps: How to use the SWOT matrix to make a difference in career and businessRating: 4.5 out of 5 stars4.5/5 (4)

- Basic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonFrom EverandBasic Python in Finance: How to Implement Financial Trading Strategies and Analysis using PythonRating: 5 out of 5 stars5/5 (9)

- CAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitFrom EverandCAPITAL: Vol. 1-3: Complete Edition - Including The Communist Manifesto, Wage-Labour and Capital, & Wages, Price and ProfitRating: 4 out of 5 stars4/5 (6)

- Minding Your Own Business: A Common Sense Guide to Home Management and IndustryFrom EverandMinding Your Own Business: A Common Sense Guide to Home Management and IndustryRating: 5 out of 5 stars5/5 (1)

- CDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsFrom EverandCDL Study Guide 2022-2023: Everything You Need to Pass Your Exam with Flying Colors on the First Try. Theory, Q&A, Explanations + 13 Interactive TestsRating: 4 out of 5 stars4/5 (4)

- How To Budget And Manage Your Money In 7 Simple StepsFrom EverandHow To Budget And Manage Your Money In 7 Simple StepsRating: 5 out of 5 stars5/5 (4)

- The 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)From EverandThe 30-Day Money Cleanse: Take Control of Your Finances, Manage Your Spending, and De-Stress Your Money for Good (Personal Finance and Budgeting Self-Help Book)Rating: 3.5 out of 5 stars3.5/5 (9)

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (18)

- The Best Team Wins: The New Science of High PerformanceFrom EverandThe Best Team Wins: The New Science of High PerformanceRating: 4.5 out of 5 stars4.5/5 (31)

- The Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)From EverandThe Complete Strategy Guide to Day Trading for a Living in 2019: Revealing the Best Up-to-Date Forex, Options, Stock and Swing Trading Strategies of 2019 (Beginners Guide)Rating: 4 out of 5 stars4/5 (34)

- The Minimalist Budget: Mindset of the Successful:Save More Money and Spend Less with the #1 Minimalism Guide to Personal Finance, Money Management Skills, and Simple Living StrategiesFrom EverandThe Minimalist Budget: Mindset of the Successful:Save More Money and Spend Less with the #1 Minimalism Guide to Personal Finance, Money Management Skills, and Simple Living StrategiesRating: 3 out of 5 stars3/5 (1)

- Financial Rescue: The Total Money Makeover: Money ManifestationFrom EverandFinancial Rescue: The Total Money Makeover: Money ManifestationRating: 5 out of 5 stars5/5 (1)

- An easy approach to common investment funds: The introductory guide to mutual funds and the most effective investment strategies in the field of asset managementFrom EverandAn easy approach to common investment funds: The introductory guide to mutual funds and the most effective investment strategies in the field of asset managementNo ratings yet