Professional Documents

Culture Documents

Precision Trading Concepts Series

Precision Trading Concepts Series

Uploaded by

Steven HensworthCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Precision Trading Concepts Series

Precision Trading Concepts Series

Uploaded by

Steven HensworthCopyright:

Available Formats

📈

Precision Trading Concepts -

Free Tutorial

VOLUME 1 - WEEKLY ORDER BLOCKS &

ORDER FLOW

What Is Covered In This Series

Low Risk - High Probability Setups Are Derived From Higher Timeframe

Perspectives.

The Large Institutions & Banks Are Basing The Majority Of Their Trades

From These Charts.

Trends & Order Flow Tends To Remain For Long Periods And Require More

To Change Them.

Framing Retail Trading Ideas On The Basis Of The Macro Perspective Is

Conducive For Profits.

The Exponential Moving Averages On Weekly Timeframes Will Assist In

Higher Odds Order Flow & Order Blocks.

Trading In Line With This View Will Greatly Increase The Likelihood Of

Consistency & Precision.

Precision Trading Concepts - Free Tutorial 1

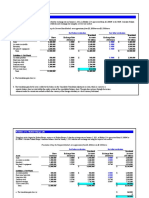

💡 THE 9 & 18 EXPONENTIAL MOVING AVERAGES ASSIST IN WEEKLY

TIMEFRAME DIRECTIONAL BIAS. WHEN THE 9 EMA CROSSES

OVER THE 18 EMA & THE AVERAGES BEGIN TO STACK (OPEN UP),

THAT IS INDICATIVE OF HEALTH IN THAT PARTICULAR

DIRECTIONAL BIAS. WE ARE NOT SHAKEN BY SHORTER TERM

RETRACEMENTS AS THESE BREED OPPORTUNITIES FOR ENTRIES

IN LINE WITH THE MACRO LONG TERM MOVES. ONCE THE EMA'S

CROSS, THEN THE EMA'S CROSS. THAT IS THE ONLY TIME WHEN

WE BEGIN TO LOOK FOR A SHIFT IN MACRO MARKET DIRECTION.

EUR/USD

WEEKLY

Precision Trading Concepts - Free Tutorial 2

💡 THE SHADED AREA HIGHLIGHTS A PERIOD OF TIME WHEN THE

HIGHER TIMEFRAME WEEKLY BIAS WAS BULLISH WITH THE

CONFLUENCE OF THE 9 & 18 MOVING AVERAGES. MICHAEL

SPENDS MUCH OF THIS VIDEO HIGHLIGHTING THE BENEFICIAL

INFLUENCE OF TRADING IN LINE WITH THE WEEKLY BIAS AS THE

BULLISH ORDER BLOCKS ON LOWER TIMEFRAMES PRODUCE

MORE ACCELERATED & HIGH MAGNITUDE MOVES IN LINE WITH

INSTITUIONAL SPONSORSHIP.

1 HOUR

VOLUME 2 - ORDER BLOCKS ON A

WEEKLY BASIS

Weekly Order Block Framework

Precision Trading Concepts - Free Tutorial 3

💡 MICHAEL HINTS TO THE FACT THAT HE FRAMES HIS OPTIMAL

TRADE ENTRY PATTERNS WITH ORDER BLOCK CONFLUENCES.

A Bullish Order Block Is The Last Bearish Candle Prior To An Expansion

Higher.

A Bearish Order Block Is The Last Bullish Candle Prior To An Expansion

Lower.

When The Higher Timeframe Weekly Chart Retraces Into An Order Block, The

Lower Timeframes & Time & Price Theory Are Capitalized On For Lower Risk

Entries & High Probability Rewards.

Framing Trades On This Higher Timeframe Perspective Breeds The

Opportunity For Gaining Monstrous Profits.

EUR/USD

WEEKLY

VOLUME 3 - RANGE TRADING

Precision Trading Concepts - Free Tutorial 4

💡 MARKETS HAVE A 70% LIKELIHOOD OF STAYING INSIDE

PREDETERMINED TRADING RANGES.

When Trading From One End Of A Range Towards The Other, We May Look

For The Order Blocks That Are Found In The Furthest Quarter Of The Price

Swing That We Are "Retracing" In As Reasonable Target Objectives For Range

Trading.

One approach to Range Trading & Trade Management is to enter a trade Within A

Range & Take A Large Portion Of The Trade Off Once The Range Breaks Out In

Your Favor. That way you leave something on for potentially more profit whilst

Reducing The Risk of having the 70% chance of price remaining in a range taking

you out with nothing.

USD/CHF

DAILY

Precision Trading Concepts - Free Tutorial 5

💡 THE LETTER "L" AND THE NUMBER "7" ARE USED BY MICHAEL TO

SIMPLIFY THE PREMISE OF RANGE BOUND TRADING.

ICT PRECISION TRADING CONCEPTS

SERIES COMPLETE. THANK YOU FOR

THIS VALUABLE INSIGHT.

Precision Trading Concepts - Free Tutorial 6

You might also like

- Silver Bullet HourDocument7 pagesSilver Bullet HourDT92% (12)

- .ICT Mastery - 1614680538000Document36 pages.ICT Mastery - 1614680538000Laston Kingston94% (17)

- Trade Entries Starter GuideDocument18 pagesTrade Entries Starter Guidehamza.editz100% (2)

- ICT HandbookDocument40 pagesICT HandbookAKASH PAL100% (1)

- Void's ICT HandbookDocument40 pagesVoid's ICT Handbookrao muhammad umar farooqNo ratings yet

- The Socionomic Theory of FinanceDocument93 pagesThe Socionomic Theory of FinanceTHE TRADING SECTNo ratings yet

- Boo K JuDocument20 pagesBoo K JuJonathan Bohorquez60% (5)

- Trading Smart Way With The - NorthgodDocument17 pagesTrading Smart Way With The - NorthgodAndile100% (10)

- ICT SummaryDocument35 pagesICT Summaryrerer100% (3)

- Intra - Day Trading Techniques and Trading Day PreparationDocument100 pagesIntra - Day Trading Techniques and Trading Day Preparationvishal gandhi100% (13)

- Chap 13Document3 pagesChap 13atierazainolNo ratings yet

- Larry Williams - Trading Patterns For Stocks and CommoditiesDocument8 pagesLarry Williams - Trading Patterns For Stocks and CommoditiesAlex Grey83% (6)

- Forexmas 2012 SeriesDocument18 pagesForexmas 2012 SeriesSteven HensworthNo ratings yet

- WENT SeriesDocument33 pagesWENT SeriesSteven HensworthNo ratings yet

- Fair Value Gap Trading Strategy - Inner Circle TradingDocument9 pagesFair Value Gap Trading Strategy - Inner Circle TradingAMINENo ratings yet

- Smart Money Concept. Section-1 Theory E4c FXDocument9 pagesSmart Money Concept. Section-1 Theory E4c FXkefafxNo ratings yet

- BullionDocument28 pagesBullionGift JiyaneNo ratings yet

- The (Almost) Complete Guide To Trading: by Anne ChapmanDocument60 pagesThe (Almost) Complete Guide To Trading: by Anne ChapmanTheodoros Maragakis100% (1)

- Trade Entries StarterDocument15 pagesTrade Entries Starterrichard patrickNo ratings yet

- How To Make Money With Stocks Online 3 Books in 1 The Complete Beginners Guide For Learning How To Trade Options, Swing... (Jordan, Simon) (Z-Library)Document199 pagesHow To Make Money With Stocks Online 3 Books in 1 The Complete Beginners Guide For Learning How To Trade Options, Swing... (Jordan, Simon) (Z-Library)SamNo ratings yet

- Phoenix Commodities Webinar Synopsis & Trading SetupDocument15 pagesPhoenix Commodities Webinar Synopsis & Trading Setupvinayak sontakkeNo ratings yet

- Scout Sniper Basic Field Guide SeriesDocument56 pagesScout Sniper Basic Field Guide SeriesSteven HensworthNo ratings yet

- coUNTER TREND TRADINGDocument11 pagescoUNTER TREND TRADINGjjaypowerNo ratings yet

- FX FTMM Systems 20Document34 pagesFX FTMM Systems 20emilis galindo80% (5)

- Smart Money Trading GuideDocument9 pagesSmart Money Trading GuidesgksanalNo ratings yet

- BRV ''No Brainer'' S+R TradingDocument37 pagesBRV ''No Brainer'' S+R Tradingvladv100% (1)

- Saitta A Range Breakout TradingDocument5 pagesSaitta A Range Breakout TradingArp PitNo ratings yet

- Forex Volatility PatternsDocument9 pagesForex Volatility PatternsLeanne heywoodNo ratings yet

- Opening Bell: L B R O S T T SDocument8 pagesOpening Bell: L B R O S T T SErezwaNo ratings yet

- The "System Approach": Trading SystemsDocument12 pagesThe "System Approach": Trading SystemsThato MotlhabaneNo ratings yet

- Successful Day TradingDocument12 pagesSuccessful Day TradingChristopher Michael Quigley100% (1)

- SecretDocument1 pageSecretElamine AmamiNo ratings yet

- Profitable Trading Strategies EbookDocument42 pagesProfitable Trading Strategies Ebookplc2k588% (8)

- Trading StratergiesDocument13 pagesTrading Stratergiesanantuprav100% (1)

- Trade BreakoutsDocument7 pagesTrade Breakoutspetefader100% (1)

- OA Mentorship YTDocument38 pagesOA Mentorship YTflaviensa1284No ratings yet

- Scalping Future Strategy TemplateDocument4 pagesScalping Future Strategy TemplateSURAJ KUMARNo ratings yet

- UntitledDocument18 pagesUntitledSantiago Ramos100% (8)

- 2022 ICT Mentorship Ep 11-13 - Market Structure For Precician TradersDocument119 pages2022 ICT Mentorship Ep 11-13 - Market Structure For Precician TradersBarbara MartinsNo ratings yet

- StocksDocument68 pagesStockscrownstudiopr100% (1)

- 6 Secret Tips For Supply and Demand TradingDocument6 pages6 Secret Tips For Supply and Demand TradingMichael MarioNo ratings yet

- BRV S+R Trading: IndexDocument33 pagesBRV S+R Trading: IndexrodrigoNo ratings yet

- How To Study Candlestick in TradingDocument6 pagesHow To Study Candlestick in Tradingsiulam1973gmNo ratings yet

- M&T IndicatorsDocument12 pagesM&T Indicatorskaaviraj2020No ratings yet

- (EN) Advance Smart Money Concept-Market StructureDocument66 pages(EN) Advance Smart Money Concept-Market Structureekawat100% (2)

- Day Trading Strategies You Need To KnowDocument20 pagesDay Trading Strategies You Need To Knowjeevandran0% (1)

- Snowflake1 @FOREXSyllabusDocument31 pagesSnowflake1 @FOREXSyllabusHamzah Ahmed100% (6)

- Pub Swing Trading SimplifiedDocument115 pagesPub Swing Trading Simplifiedsuresh kumar100% (1)

- Swing Trading Simplified Larry D Spears PDFDocument115 pagesSwing Trading Simplified Larry D Spears PDFAmine Elghazi100% (4)

- Mastering Stock Market LeadMagnet PDFDocument11 pagesMastering Stock Market LeadMagnet PDFSushant DumbreNo ratings yet

- Trading AddictsDocument9 pagesTrading AddictsKiran Krishna100% (1)

- AlphaFX Price Action Practical Guide v2Document82 pagesAlphaFX Price Action Practical Guide v2absar ahmed67% (3)

- 9 Advanced and Profitable Trading StrategiesDocument44 pages9 Advanced and Profitable Trading StrategiesKrish RajNo ratings yet

- 3 Areas of Value Drawing Levels Multiple Time Analysis EnteringDocument14 pages3 Areas of Value Drawing Levels Multiple Time Analysis EnteringMus'ab Abdullahi Bulale100% (1)

- Trade Breakouts For Bigger Profit PotentialDocument7 pagesTrade Breakouts For Bigger Profit PotentialLoose100% (1)

- Mean Reversion Day Trading Strategies: Profitable Trading StrategiesFrom EverandMean Reversion Day Trading Strategies: Profitable Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformFrom EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformNo ratings yet

- Bitcoin Day Trading Strategies For Beginners: Day Trading StrategiesFrom EverandBitcoin Day Trading Strategies For Beginners: Day Trading StrategiesRating: 5 out of 5 stars5/5 (1)

- SWING TRADING STRATEGIES: Proven Techniques for Capturing Market Swings (2024 Guide for Beginners)From EverandSWING TRADING STRATEGIES: Proven Techniques for Capturing Market Swings (2024 Guide for Beginners)No ratings yet

- Crypto Scalping Strategies: Day Trading Made Easy, #3From EverandCrypto Scalping Strategies: Day Trading Made Easy, #3Rating: 3 out of 5 stars3/5 (2)

- Forexmas 2012 SeriesDocument18 pagesForexmas 2012 SeriesSteven HensworthNo ratings yet

- Mastering High Probability Scalping Series - Free TutorialDocument13 pagesMastering High Probability Scalping Series - Free TutorialSteven HensworthNo ratings yet

- Workshop - Develop Your Business IdeaDocument2 pagesWorkshop - Develop Your Business IdeaSteven HensworthNo ratings yet

- If I Had To Restart Again As A Trader at 20 Years Old Series - Free TutorialDocument3 pagesIf I Had To Restart Again As A Trader at 20 Years Old Series - Free TutorialSteven HensworthNo ratings yet

- Workshop - Social Media Marketing Short CourseDocument25 pagesWorkshop - Social Media Marketing Short CourseSteven HensworthNo ratings yet

- Entrepreneurship NotesDocument33 pagesEntrepreneurship NotesSteven HensworthNo ratings yet

- PDF Financial Accounting For Management An Analytical Perspective 5Th Edition Ambrish Gupta Ebook Full ChapterDocument53 pagesPDF Financial Accounting For Management An Analytical Perspective 5Th Edition Ambrish Gupta Ebook Full Chapterjessie.ham964100% (1)

- Case StudyDocument7 pagesCase StudyAli RazaNo ratings yet

- FR EssayDocument3 pagesFR EssayDavid YamNo ratings yet

- Verge Ifrs 15Document2 pagesVerge Ifrs 15Wafa ObaidNo ratings yet

- Far410 (Jan 2018)Document8 pagesFar410 (Jan 2018)nurathirahNo ratings yet

- Accountancy Assignment Allotment - I PUCDocument8 pagesAccountancy Assignment Allotment - I PUCPREMA.G.N NAGARAJNo ratings yet

- Net Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityDocument21 pagesNet Income ($M) 8382 EBIT ($M) 13224 Income Tax Expense ($M) 5016 Return On EquityRahil VermaNo ratings yet

- Notes1 & 2Document17 pagesNotes1 & 2wingkuen107No ratings yet

- 03 Magic Breakout Strategy PDFDocument14 pages03 Magic Breakout Strategy PDFAlex Gomes100% (2)

- Consultation Paper: Esma'S Guidelines On Etfs and Other Ucits IssuesDocument77 pagesConsultation Paper: Esma'S Guidelines On Etfs and Other Ucits IssuesMarketsWikiNo ratings yet

- CHAPTER 2 Capital Structure DecisionsDocument42 pagesCHAPTER 2 Capital Structure Decisionsyebegashet100% (1)

- CIC ReportDocument8 pagesCIC ReportSODHI SINGHNo ratings yet

- Accounting/Finance M.C.Qs PreparationDocument11 pagesAccounting/Finance M.C.Qs Preparationkarim mawazNo ratings yet

- Chapter 5Document5 pagesChapter 5Kaleab TessemaNo ratings yet

- Valuation of Goodwill SharesDocument12 pagesValuation of Goodwill Sharesrani26octNo ratings yet

- Week 8 - Equity ValuationDocument57 pagesWeek 8 - Equity ValuationshanikaNo ratings yet

- Investment AlternativesDocument14 pagesInvestment AlternativesAnjaliPrasadNo ratings yet

- PFD - Arun Kumar V R - STARDocument2 pagesPFD - Arun Kumar V R - STARArun Kumar V RNo ratings yet

- Chapter Five DSFDocument15 pagesChapter Five DSFtame kibruNo ratings yet

- Quiz 2 Lecturer - Answer - Accounting and FinanceDocument5 pagesQuiz 2 Lecturer - Answer - Accounting and FinancehenryNo ratings yet

- 12471depreciation 2Document2 pages12471depreciation 2Simra SalmanNo ratings yet

- 02 Bear Stearns Case StudyDocument13 pages02 Bear Stearns Case Studydinieus100% (1)

- E L F T: Xchange Isted Unds RustDocument25 pagesE L F T: Xchange Isted Unds RustFooyNo ratings yet

- SFMDocument18 pagesSFMPiyush PatelNo ratings yet

- Polarityte (Pte) Update: The Product (Skinte Is) Three To Five Years Away From Full Fda Approval" (B) "Document11 pagesPolarityte (Pte) Update: The Product (Skinte Is) Three To Five Years Away From Full Fda Approval" (B) "Lee PedersonNo ratings yet

- Capital Structure (WordDocument32 pagesCapital Structure (Wordrashi00100% (1)

- Case Study 2 Excel Jackson AutomobileDocument15 pagesCase Study 2 Excel Jackson AutomobileSayantani NandyNo ratings yet