Professional Documents

Culture Documents

Budgetary Control Assignment

Uploaded by

Yash AggarwalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgetary Control Assignment

Uploaded by

Yash AggarwalCopyright:

Available Formats

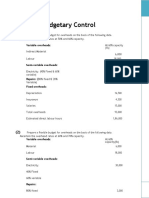

Assignment of Budgetary Control

`Prepare a flexible budget for overheads on the basis of the following data. Ascertain the overhead

rates at 50%, 60% and 70% capacity.

At 60%

Variable Overheads: capacity(RS)

Indirect Material 6,000

Indirect Labour 18,000

Semi Variable Overheads:

Electricity (40% fixed, 60% variables) 30,000

Repairs (80% fixed, 20 % variables) 3,000

Fixed Overheads:

Deprication 16,500

Insurance 4,500

Salaries 15,000

Total Overheads 93,000

Estimated Direct Labour Hours 1,86,000

Solution: Rs 0.55, Rs 0.50, Rs 0.46

1) Draw up flexible budget for the overhead expenses on the basis of the following data and

determine the overhead rate at 70%, 80% and 90% plant capacity.

At 70% At 80% At 90%

capacity(RS) capacity(RS) capacity(RS)

Variable Overheads:

Indirect Labour 12,000

Stores including spares 4,000

Semi Variable Overheads:

Power (30% Fixed) 20,000

(70% Variables)

Repairs (60% Fixed) 2,000

(40% Variables)

Fixed Overheads:

Deprication 11,000

Insurance 3,000

Salaries 10,000

Total Overheads 62,000

Estimated Direct Labour

Hours 1,24,000

Solution: Rs 0.536, Rs 0.50, Rs 0.472

Dr. Ramanpreet Singh Page 1

Assignment of Budgetary Control

2) The expenses for the budgeted production of 20,000 units in a factory are furnished below:

per unit

Particulars (Rs)

Materials 140

Labour 50

Variable Overhead 40

Fixed Overhead 20

Variable Expenses (Direct) 10

Selling Expenses (10% fixed) 26

Distribution Expenses (20%

fixed) 14

Administrative Expenses 10

Prepare a flexible budget for the production level of (a) 16,000 units (b) 12,000 units (c)

indicate cost per unit at both the levels. Assume that administrative expenses are fixed for

all the levels of production.

Ans: 310,318.85, 333.60

3) Murugan and Co is expected to have Rs. 25,000 in its bank account on 1.4.1996. Prepare a

cash budget for April, May, June 1996 from the following estimates.

Administrative Selling

Month Sales Purchase Salary Expenses Expenses

Februar

y 50,000 30,000 6,000 9,000 3,000

March 56,000 32,000 6,500 9,500 3,000

April 60,000 35,000 7,000 10,000 3,500

May 80,000 40,000 9,000 11,500 4,500

June 90,000 40,000 9,500 12,500 4,500

Other information

a) 20% sales on cash. Balance on credit and amount to be collected in the next month.

b) Suppliers are paid second month following the purchases.

c) Workers salary paid in the same month.

d) Administrative and selling expenses are paid in the next month.

e) Dividend of Rs 10,000 and Bonus to workers of Rs 15,000 are to be paid in May.

f) Income tax of Rs 25,000 to be paid in June.

Ans: June balance Rs. 13,300

Dr. Ramanpreet Singh Page 2

Assignment of Budgetary Control

4) Prepare a Cash Budget for the three months ending 30th June 2010 from the information

given below:

Month Sales Materials Wages Overheads

Februar

y 14,000 9,600 3,000 1,700

March 15,000 9,000 3,000 1,900

April 16,000 9,200 3,200 2,000

May 17,000 10,000 3,600 2,200

June 18,000 10,400 4,000 2,300

Credit terms are:

a) Sales and debtor- 10% of sales are on cash, 50% of the credit sales are collected next

month and balance in the following month.

b) Creditors – materials 2 months, wages ¼ month, Overheads ½ month

c) Cash and bank balance on 1st April, 2010 is expected to be Rs.6,000.

d) Plant and machinery will be installed in February 2010 at the cost of Rs 96,000. The

monthly instalment of Rs. 2,000 is payable from April onwards.

e) Dividend @ 5% on Preference Share capital of Rs.2,00,000 will be paid on 1 st June.

f) Dividend from investments amounting to Rs.1,000 are expected to be received in

June.

g) Income tax (advance) to be paid in June is Rs.2,000.

h) Advance to be received from sale of vehicle of Rs9000 in June.

Ans: closing balance of June is Rs.300.

5) A factory is currently working to 50% capacity and produces 10,000 units. Estimate the

profits of the company by preparing flexible budget, when it works at 60% and 80% capacity.

At 60% working, material cost increase by 2% and selling price falls by 2%. At 80% raw

material cost increases by 5% and selling price falls by 5%.

At 50% capacity working the product costs Rs. 180 per unit and is sold at Rs 200 per unit. The

unit cost of Rs 180 is made up as follows:

Material Rs. 100

Labour Rs. 30

Factory overhead Rs. 30(40% fixed)

Administration overhead Rs. 20(50% fixed)

6) Draw up a flexible budget for overhead expenses on the basis of the following data and

determine the overhead rates at 70%, 80% and 90% plant capacity.

Capacity level 70% 80% 90%

Variable overhead

Indirect labour 12,000

Indirect material 4,000

Semi variable overhead

Dr. Ramanpreet Singh Page 3

Assignment of Budgetary Control

Power (30% fixed) 20,000

Repairs and maintenance (60% fixed) 2,000

Fixed overhead

Depreciation 11,000

Insurance 3,000

Salaries 10,000

Total overhead 62,000

Estimated direct labours hour 1,24,000

7) The following information relates to the productive activities of G Ltd for three months

ended 31st December, 2007.

Fixed expenses Rs

Management Salaries 2,10,000

Rent and Taxes 1,40,000

Depreciation of machinery 1,75,000

Sundry office Expenses 2,22,500

7,47,500

Semi Variable Expenses at 50% Capacity

Plant maintenance 62,500

Indirect labour 2,47,500

Salesman’s Salaries 72,500

Sundry Expenses 65,000

4,47,500

Variable expenses at 50% Capacity

Materials 6,00,000

Labour 6,40,000

Salesman Commission 95,000

13,35,000

It is further noted that semi-variable expenses remain constant between 40% and 70%

capacity, increase by 10% of the figures between 70% and 85% capacity and increase by 15%

of the above figure between 85% and 100% capacity. Fixed expenses remain constant

whatever the level of activity may be sales at 60% capacity are Rs. 25, 50,000; at 80%

capacity Rs. 34,00,000 and 100% capacity Rs. 42,50,000. Assuming that items produce are

sold , prepare a flexible budget at 60%, 80% and 100% production capacity.

Dr. Ramanpreet Singh Page 4

You might also like

- Budgetary Control AssignmentDocument6 pagesBudgetary Control AssignmentBhavvyam BhatnagarNo ratings yet

- Budgetary Control: Variable OverheadsDocument11 pagesBudgetary Control: Variable OverheadsAmmy GuptaNo ratings yet

- Budgeting OnlineDocument4 pagesBudgeting OnlineSoumendra RoyNo ratings yet

- Business Budget Excercise ProblemsDocument5 pagesBusiness Budget Excercise ProblemsSHARATH JNo ratings yet

- Business Budget - Assignment ProblemsDocument3 pagesBusiness Budget - Assignment ProblemsSHARATH JNo ratings yet

- BUDGETINGDocument7 pagesBUDGETINGuma selvarajNo ratings yet

- Budgetary ControlDocument7 pagesBudgetary ControlKuldeep NNo ratings yet

- Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Document4 pagesAnswer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20) Answer ALL The Questions (10 2 20)Harish KapoorNo ratings yet

- AssignmentDocument11 pagesAssignmentKBA AMIRNo ratings yet

- Ama Set 37Document7 pagesAma Set 37uroojfatima21299No ratings yet

- In Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateDocument4 pagesIn Such A Way As To Assist The Management in The Creation of Policy and in The Day-To-Day Operations of An Undertaking." ElucidateKeran VarmaNo ratings yet

- Internals II - Managerial Accounting Question PaperDocument3 pagesInternals II - Managerial Accounting Question PaperasdeNo ratings yet

- 10 Capital Budgetting Techniques of Evolution PDFDocument57 pages10 Capital Budgetting Techniques of Evolution PDFVishesh GuptaNo ratings yet

- Masters of Business Administration MBADocument12 pagesMasters of Business Administration MBASachin KirolaNo ratings yet

- Budget Practice QuestionsDocument2 pagesBudget Practice QuestionsRuchaNo ratings yet

- Budgetory Control Flexible Budget With SolutionsDocument6 pagesBudgetory Control Flexible Budget With SolutionsJash SanghviNo ratings yet

- Apr 18 Management Acc 2Document4 pagesApr 18 Management Acc 2Harish KapoorNo ratings yet

- Flexible BudgetsDocument3 pagesFlexible Budgetsmansidalal45No ratings yet

- MbaDocument3 pagesMbaThiru VenkatNo ratings yet

- MCS Question BankDocument4 pagesMCS Question BankVrushali P.No ratings yet

- Adobe Scan 01 Jul 2023Document5 pagesAdobe Scan 01 Jul 2023Faisal NawazNo ratings yet

- Budgetary Control NumericalDocument8 pagesBudgetary Control NumericalPuja AgarwalNo ratings yet

- Problems On Marginal CostingDocument7 pagesProblems On Marginal Costingrathanreddy2002No ratings yet

- Sri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - V (UNIT-V)Document9 pagesSri Balaji University Pune (Sbup) Bitm SEMESTER-I-BATCH - 2020-22 Management Accounting - Assignment - V (UNIT-V)Jaya BharneNo ratings yet

- END Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Document2 pagesEND Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Lavi LakhotiaNo ratings yet

- Ca 1Document4 pagesCa 1VaibhavrvNo ratings yet

- Model Question For Account409792809472943360Document8 pagesModel Question For Account409792809472943360yugeshNo ratings yet

- Acm 701 2017-18-1-1-2Document13 pagesAcm 701 2017-18-1-1-2Utkarsh Kumar SrivastavNo ratings yet

- May 4519201 May 2019Document4 pagesMay 4519201 May 2019PILLO PATELNo ratings yet

- Flexible Budgeting Lecture: Fixed/Static BudgetsDocument4 pagesFlexible Budgeting Lecture: Fixed/Static BudgetsSeana GeddesNo ratings yet

- Costing Methods and TechniquesDocument3 pagesCosting Methods and TechniquesAishwarya SundararajNo ratings yet

- Problem of Pricing MethodDocument4 pagesProblem of Pricing MethodKhelin ShahNo ratings yet

- Mba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDocument4 pagesMba 1 Sem Management Accounting 4519201 S 2019 Summer 2019 PDFDeepakNo ratings yet

- Costing 07102020Document24 pagesCosting 07102020Faizan JavedNo ratings yet

- Budgeting and Budgetary ControlDocument2 pagesBudgeting and Budgetary ControlpalkeeNo ratings yet

- SMU MBA104 FINANCIAL AND MANAGEMENT ACCOUNTING Free Solved AssignmentDocument10 pagesSMU MBA104 FINANCIAL AND MANAGEMENT ACCOUNTING Free Solved Assignmentrahulverma251233% (3)

- Strategic Cost Management Assignment 3 Exercise 1 (Schedule of Expected Cash Collection)Document9 pagesStrategic Cost Management Assignment 3 Exercise 1 (Schedule of Expected Cash Collection)Rhea OraaNo ratings yet

- Loyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceDocument4 pagesLoyola College (Autonomous), Chennai - 600 034: Degree Examination - CommerceHarish KapoorNo ratings yet

- Overheads - CW - Sums - Part 1Document6 pagesOverheads - CW - Sums - Part 1kushgarg627No ratings yet

- Project Report EDocument6 pagesProject Report EMecheri Dmk MohaNo ratings yet

- Costing (New) MTP Question Paper Mar2021Document8 pagesCosting (New) MTP Question Paper Mar2021ADITYA JAINNo ratings yet

- 13 17227rtp Ipcc Nov09 Paper3aDocument24 pages13 17227rtp Ipcc Nov09 Paper3aemmanuel JohnyNo ratings yet

- WORKSHEET - 5 On CFSDocument6 pagesWORKSHEET - 5 On CFSNavya KhemkaNo ratings yet

- 1 Cost Sheet TexbookDocument6 pages1 Cost Sheet TexbookVishal Kumar 5504No ratings yet

- Ama Set 40Document6 pagesAma Set 40uroojfatima21299No ratings yet

- II Internal Test - Accounting For Management - Important QuestionsDocument3 pagesII Internal Test - Accounting For Management - Important QuestionsSTARBOYNo ratings yet

- Incomplete RecordsDocument32 pagesIncomplete RecordsSunil KumarNo ratings yet

- Financial ManagementDocument9 pagesFinancial ManagementAtif SiddiquiNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsNikhilNo ratings yet

- Question Bank Paper: Cost Accounting McqsDocument8 pagesQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayNo ratings yet

- BudgetDocument9 pagesBudgetDrBharti KeswaniNo ratings yet

- Perunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiDocument4 pagesPerunthalaivar Kamarajar Arts College Department of Commerce Practice Set - 1 Management Accounting - IiAlbert JulieNo ratings yet

- AccontsDocument7 pagesAccontsAmith MNo ratings yet

- Budgetary ControlDocument5 pagesBudgetary ControlJasdeep Singh DeepuNo ratings yet

- MBAC1003Document7 pagesMBAC1003SwaathiNo ratings yet

- Cost Accounting (CC) (Code: 52414404) : AssignmentDocument4 pagesCost Accounting (CC) (Code: 52414404) : AssignmentAnkushNo ratings yet

- Unit 10 Approaches To Budgeting: StructureDocument17 pagesUnit 10 Approaches To Budgeting: StructurerehanNo ratings yet

- 64 Costing Methods Fresh CBCS 2016 17 and Onwards PDFDocument4 pages64 Costing Methods Fresh CBCS 2016 17 and Onwards PDFmilanNo ratings yet

- Work Sheet 3 & 4 Business FinanceDocument3 pagesWork Sheet 3 & 4 Business FinancePrateek YadavNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Compound Interest Practice QuesDocument12 pagesCompound Interest Practice QuesKothapalli VinayNo ratings yet

- Chap 11 - Decision Making and Relevant Information (1) PrintDocument28 pagesChap 11 - Decision Making and Relevant Information (1) PrintranjithaNo ratings yet

- Transactions For 50100036654971 From 2022-08-01 To 2023-02-06Document39 pagesTransactions For 50100036654971 From 2022-08-01 To 2023-02-06Vadivel Kumar TNo ratings yet

- Medical Summary HospitalisationDocument1 pageMedical Summary Hospitalisation1941012817.l.prernababberNo ratings yet

- Limited PartnersDocument2 pagesLimited PartnersDavid TollNo ratings yet

- CIR V Air India GR 72443 Jan 29, 1988Document2 pagesCIR V Air India GR 72443 Jan 29, 1988Felicia Allen100% (2)

- Corporate Financial Accounting 12th Edition Warren Solutions ManualDocument25 pagesCorporate Financial Accounting 12th Edition Warren Solutions ManualDavidHicksarzb100% (63)

- Tax Amnesty - Said. Redeem. RelievedDocument22 pagesTax Amnesty - Said. Redeem. RelievedANGELINA ANGELINANo ratings yet

- Rich Vs PalomaDocument2 pagesRich Vs PalomaEderic ApaoNo ratings yet

- CS Professional Programme Tax NotesDocument47 pagesCS Professional Programme Tax NotesRajey Jain100% (2)

- Helsb University of Zambia 2021-2022Document1 pageHelsb University of Zambia 2021-2022Blessed M.u.kNo ratings yet

- Anti Money Laundering (Document5 pagesAnti Money Laundering (krishmasethi100% (2)

- Online Lecutre 1Document21 pagesOnline Lecutre 1Dinar HassanNo ratings yet

- Chapter 4 - Closing Entries - Classified Financial StatementsDocument17 pagesChapter 4 - Closing Entries - Classified Financial StatementsNaeemullah baigNo ratings yet

- PhilPaSS PrimerDocument22 pagesPhilPaSS PrimerCoolbuster.NetNo ratings yet

- Lecture 11 Higher Financing AgenciesDocument10 pagesLecture 11 Higher Financing AgenciesNEERAJA UNNINo ratings yet

- Data Extract From World Development IndicatorsDocument19 pagesData Extract From World Development IndicatorsTham NguyenNo ratings yet

- Shariah Issues in IslamicDocument14 pagesShariah Issues in IslamicEwan PeaceNo ratings yet

- Garcia V Villar: Mortgage: Real Estate MortgageDocument4 pagesGarcia V Villar: Mortgage: Real Estate MortgageLesly BriesNo ratings yet

- Text Summary Topic: Direct and Indirect TaxesDocument2 pagesText Summary Topic: Direct and Indirect TaxessilvacuinicaNo ratings yet

- 11th Lecture Modified-PCFM-Project Cost and Financial ManagementDocument18 pages11th Lecture Modified-PCFM-Project Cost and Financial ManagementMuhammad ArshiyaanNo ratings yet

- BEC Vantage With KeyDocument12 pagesBEC Vantage With KeyNelu Si Elena FurnicaNo ratings yet

- Agreement This Agreement Is Made This Day of June 13, 2007 BetweenDocument3 pagesAgreement This Agreement Is Made This Day of June 13, 2007 BetweenCA Arpit YadavNo ratings yet

- Based On Internship Report Submitted To SBI in Completion of The Requirement of Summer Internship atDocument5 pagesBased On Internship Report Submitted To SBI in Completion of The Requirement of Summer Internship atDevesh MishraNo ratings yet

- Notes VarianceDocument37 pagesNotes Variancezms240No ratings yet

- Council Minutes 20080512Document4 pagesCouncil Minutes 20080512Ewing Township, NJNo ratings yet

- Adjustment Entries I Accounting Workbooks Zaheer SwatiDocument6 pagesAdjustment Entries I Accounting Workbooks Zaheer SwatiZaheer Swati100% (1)

- Gap Analysis of Services Offered in Retail BankingDocument90 pagesGap Analysis of Services Offered in Retail BankingSrija KeerthiNo ratings yet

- Do Audit Tenure and Firm Size Contribute To Audit Quality Empirical Evidence From Jordan PDFDocument18 pagesDo Audit Tenure and Firm Size Contribute To Audit Quality Empirical Evidence From Jordan PDFMuhammad AkbarNo ratings yet

- 14 Bank of Commerce V San PabloDocument2 pages14 Bank of Commerce V San PabloAleezah Gertrude RaymundoNo ratings yet