Professional Documents

Culture Documents

2020 Marked Up - TraderLion Model Book TraderLion

Uploaded by

tawatchai limOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2020 Marked Up - TraderLion Model Book TraderLion

Uploaded by

tawatchai limCopyright:

Available Formats

Home TL UNIVERSITY Blog Services Tools Contact Login

2020 Marked Up!

A Fundamental & Technical Analysis

Model book traderlion 2020

AMZN

Amazon.com

Summary: Amazon.com, Inc. engages in the retail sale of consumer products and subscriptions in North America and internationally. The company operates

through three segments: North America, International, and Amazon Web Services (AWS). It sells merchandise and content purchased for resale from third-

party sellers through physical and online stores. The company also manufactures and sells electronic devices, including Kindle, Fire tablets, Fire TVs, Rings,

and Echo and other devices; provides Kindle Direct Publishing, an online service that allows independent authors and publishers to make their books available

in the Kindle Store; and develops and produces media content. In addition, it offers programs that enable sellers to sell their products on its Websites, as well

as its stores; and programs that allow authors, musicians, filmmakers, skill and app developers, and others to publish and sell content.

Sector Industry

Consumer Discretionary Internet & Direct Marketing Retail

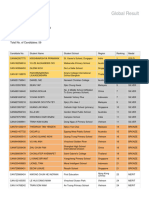

AMZN Chart – 2020 Model Book

AMZN was not the most powerful leader of 2020 by any means. However, its EPS, revenues and EPS estimates cannot be ignored, and its price volume action

was extremely healthy and constructive.

It clearly respected its 23-EMA throughout the length of its run and despite ultimately moving sideways the past 6 months, AMZN is still the leader of its

group.

AMZN’s quarter over quarter EPS has accelerated over the prior 3 quarters to a rate of 192% in their most recent quarter, backed by a solid stream of sales.

Their annual earnings grew by 51% in 2020 and the street is looking for 29% in 2021.

Also, AMZN’s ROE has accelerated from 18.5% to 25.5% over the prior 3 quarters and it continues to be well loved by 7 of MarketSmith’s flagship funds.

AMZN broke out through $1,933.02 on April 6th as the NASDAQ followed through and made an all-time high of $3,552.25 on September 2nd for a gain of

84% in 20 weeks.

AMZN has gone on to build a constructive base since, and with a little more time, it looks like AMZN could be off to the races again in 2021.

CRWD

CrowdStrike Holdings

Summary: CrowdStrike Holdings, Inc. provides cloud-delivered solutions for next-generation endpoint protection in the United States, Australia, Germany,

India, Romania, and the United Kingdom. It offers 11 cloud modules on its Falcon platform through software as a service subscription-based model that covers

various security markets, such as endpoint security, security and IT operations, and threat intelligence to deliver comprehensive breach protection even

against today’s most sophisticated attacks. The company primarily sells its platform and cloud modules through its direct sales team. CrowdStrike Holdings,

Inc. was founded in 2011 and is headquartered in Sunnyvale, California.

Sector Industry

Technology Application Software

CRWD Chart – 2020 Model Book

The computer security software group was on fire in 2020 and CRWD was a major leader in the space.

CRWD grew their quarter over quarter earnings at a triple digit pace over the prior 4 quarters and saw acceleration over the last three.

CRWD’s quarter over quarter revenue stream grew at a rate of 84 – 89% over the prior 4 quarters, which is not only large, but consistent.

CRWD has seen a tremendous pick-up in their annual earnings over the last 3 years and the street is looking for 45% growth in 2021.

Institutional sponsorship grew consecutively for the last five quarters and Fidelity’s Contrafund, which is a MarketSmith flagship fund, had a position as of the

end of 2020.

CRWD broke out through $59.50 on April 7th, one day after the NASDAQ followed through and hit an all-time high of $227.39 on December 24th for a move of

282% in 34 weeks.

DOCU

DocuSign, Inc.

Summary: DocuSign, Inc. provides cloud-based software in the United States and internationally. The company provides an e-signature solution that enables

businesses to digitally prepare, execute, and act on agreements. It also offers DocuSign CLM, which automates workflows across the entire agreement

process; Intelligent Insights that use artificial intelligence to search and analyze agreements by legal concepts and clauses; Gen for Salesforce, which allows

sales representatives to automatically generate agreements with a few clicks from within Salesforce; and Negotiate for Salesforce that supports for approvals,

document comparisons, and version control. The company was founded in 2003 and is headquartered in San Francisco, California.

Sector Industry

Information Technology Application Software

DOCU Chart – 2020 Model Book

Other than a rough quarter in July 2019, DOCU’s fundamental snapshot is top notch.

DOCU was a major leader in the computer enterprise software group, which exhibited tremendous strength throughout 2020, and was a clear driver behind

the powerful trend in the general market.

Despite not seeing quarter over quarter acceleration, DOCU grew quarter over quarter earnings at a swift pace.

Fortunately, DOCU’s quarterly earnings growth was backed by solid double digit revenue growth, which accelerated consecutively over the last 4 quarters.

DOCU’s annual earnings growth over the last 5 years was textbook. Their earnings picked up every year consecutively from a loss of $0.79/share in 2016, to a

gain of $0.31/share in 2020.

It certainly doesn’t hurt that DOCU’s estimates for fiscal ’21 and ’22 are enormous at 139% and 50% respectively.

Additionally, DOCU’s ROE has increased every quarter for the last 4 quarters from 10.2% to 24.8% in the most recent quarter.

DOCU broke out through $88.27 on March 30th about a week before the NASDAQ followed though and ran up to an all-time high of $290.23 on September

2nd for a gain of 229%.

ETSY

ETSY, Inc.

Summary: Etsy, Inc. operates online market places for buyers and sellers primarily in the United States, the United Kingdom, Canada, Australia, France, and

Germany. Its online market places include Etsy.com and Reverb.com. The company offers approximately 66 million items in its various retail categories to

buyers. It also provides various seller services, including Etsy Payments, a payment processing service; Etsy Ads, an advertising platform; and Etsy Shipping

Labels, which allows sellers in the United States, Canada, the United Kingdom, and Australia to purchase discounted shipping labels. Etsy, Inc. was founded in

2005 and is headquartered in Brooklyn, New York.

Sector Industry

Consumer Discretionary Internet & Direct Marketing Retail

ETSY Chart – 2020 Model Book

ETSY’s fundamental snapshot was outstanding by the end of 2020 and has been for a few years now.

Even though ETSY experienced a notable slowdown in their quarter over quarter earnings growth during the second half of ‘19 and the first quarter of ‘20,

they experienced triple digit earnings growth and acceleration of 113% to 367% over the 3 quarters prior, from the quarter ended December ‘18 to quarter-

end, June ‘19.

ETSY’s quarter over quarter revenue growth also experienced a slowdown during the second half of ‘19 and the first quarter of ‘20, but not nearly to the same

degree. Their revenue growth only experienced a slight deceleration comparatively, and then accelerated in a big way over its most recent 3 quarters, which

carried over to their earnings over the same period.

Not surprisingly, ETSY’s quarter over quarter growth in ROE also exploded from 18.6% to 48.5% over its most recent 3 quarters.

ETSY’s annual earnings growth has been accelerating at a swift pace over the last 5 years, from a loss of $0.49/share in 2015 to what’s shaping up to be a

huge year once their final quarter of 2020 is reported.

The retail internet group has been among the top ranks of leading industry groups for a few years now and ETSY has been a big RS winner since the beginning

of 2016.

Finally, institutional sponsorship in ETSY has picked up in a big way over the prior 5 quarters and as of the most recent quarter, 4 of MarketSmith’s flagship

funds hold positions.

ETSY broke out through $44.40 on April 6th as the NASDAQ followed through and ran up to an all-time high of $198.50 on December 22nd for a move of

346% in 30 weeks.

FVRR

Fiverr.com

Summary: Fiverr International Ltd. operates an online marketplace worldwide. Its platform enables sellers to sell their services and buyers to buy them. The

company’s platform includes approximately 300 categories in eight verticals, including graphic and design, digital marketing, writing and translation, video

and animation, music and audio, programming and technology, business, and lifestyle. The company was founded in 2010 and is headquartered in Tel Aviv,

Israel.

Sector Industry

Consumer Discretionary Internet & Direct Marketing Retail

FVRR Chart – 2020 Model Book

FVRR was an extremely powerful leader in the retail internet group in 2020. The retail internet group exhibited solid relative strength throughout the year, with

many other high quality, high relative strength stocks in the group confirming its move.

2020 will be FVRR’s first year of positive earnings, assuming their final report for the year is near what the street is currently expecting. In ‘19 FVRR lost

$0.50/share. However, analysts are currently looking for them to earn about $0.27/share by the end of fiscal 2020.

FVRR’s spectacular earnings acceleration story doesn’t end here. The street is looking for a staggering 159% growth over fiscal ‘21.

FVRR’s quarter over quarter earnings showed a similar turnaround from negative to positive and have accelerated big time over the last 2 quarters.

The acceleration in FVRR’s institutional sponsorship has been explosive over the prior 7 quarters. Not to mention, 4 of MarketSmith’s flagship funds held

positions in the stock as of their most recent quarter.

FVRR broke out through $26.98 on April 8th and ran up to an all-time high of $228.49 on December 22nd for a gain of 747% in 34 weeks.

NIO

NIO Limited Designs

Summary: NIO Limited designs, manufactures, and sells electric vehicles in the People’s Republic of China, Hong Kong, the United States, the United

Kingdom, and Germany. The company offers five, six, and seven-seater electric SUVs. It is also involved in the provision of energy and service packages to its

users; marketing, design, and technology development activities; manufacture of e-powertrains, battery packs, and components; and sales and after-sales

management activities. NIO Limited was founded in 2014 and is headquartered in Shanghai, China.

Sector Industry

Consumer Discretionary Automobile Manufacturers

NIO Chart – 2020 Model Book

NIO is clearly not included in this model book for its phenomenal earnings track record. They haven’t earned a dime since 2016 and the street is looking for a

loss of $0.33/share for fiscal 2021. However, this should be a big improvement over their EPS loss for 2020 once they report their final quarter.

Conversely, NIO’s quarter over quarter revenue stream is worth noting. By no means have their revenues been accelerating in a smooth, consistent manner.

However, they have exhibited the ability to generate some extremely powerful quarters, especially their most recent 2, at 140% and 159% respectively.

The major reason NIO was included in this model book was because it has been part of one of the most powerful themes, sectors/industry groups in the

market for the last few years and it appears as if this should continue well into the future.

Remember, nearly 50% of a leading stock’s price performance is directly correlated to its sector and industry group, and NIO has been a super RS leader in

the space.

NIO started off the year trading below $5.00, a relatively ignorable penny stock. However, by August 25, 2020 it broke out of a cup and handle base through

$15.45 on huge volume, offering CANSLIM style investors a clear buying opportunity.

For those traders/investors open to a bit more risk, NIO could have been purchased even earlier, at lower prices, due to its extreme liquidity. Nevertheless,

even if you didn’t get started until $15.45 at the end of August, NIO reached an all-time high of $66.99 on January 11, 2021, which is a gain of 334% in about

10 weeks.

PINS

You might also like

- 12months To 1 MillionDocument2 pages12months To 1 Milliontawatchai lim80% (5)

- Lister D Engine ManualDocument29 pagesLister D Engine Manualetr420100% (1)

- 3 TIMELESS Setups That Have Made Me TENS OF MILLIONS! - QullamaggieDocument1 page3 TIMELESS Setups That Have Made Me TENS OF MILLIONS! - Qullamaggietawatchai lim100% (1)

- Sample Business ProposalDocument16 pagesSample Business Proposalanon-8913799% (273)

- Ramp SectionDocument1 pageRamp SectionBhavya PatelNo ratings yet

- Investment Thesis Converge Technology SolutionsDocument10 pagesInvestment Thesis Converge Technology SolutionsArturoNo ratings yet

- TraderLion2020 2018ModelBookDocument62 pagesTraderLion2020 2018ModelBookFu Hao100% (1)

- The 60 Minute Startup PDFDocument3 pagesThe 60 Minute Startup PDFtawatchai limNo ratings yet

- Outbound Hiring: How Innovative Companies are Winning the Global War for TalentFrom EverandOutbound Hiring: How Innovative Companies are Winning the Global War for TalentNo ratings yet

- TMForum-Telco Revenue Growth BenchmarkDocument86 pagesTMForum-Telco Revenue Growth BenchmarkHasan Mukti100% (1)

- Collection of Windows 10 Hidden Secret Registry TweaksDocument9 pagesCollection of Windows 10 Hidden Secret Registry TweaksLiyoNo ratings yet

- LinkedIn ValuationDocument13 pagesLinkedIn ValuationSunil Acharya100% (1)

- ARTS10 - q2 - Mod1 - Elements and Distinct Characteristics of Technologybased Arts Version3.2Document26 pagesARTS10 - q2 - Mod1 - Elements and Distinct Characteristics of Technologybased Arts Version3.2junnel masaluon100% (4)

- Overview of Low-CodeDocument15 pagesOverview of Low-CodeKyanon Digital100% (2)

- White Star Capital 2020 Future of Work Industry ReportDocument41 pagesWhite Star Capital 2020 Future of Work Industry ReportWhite Star CapitalNo ratings yet

- HR Digital Transformation: The Practical GuideDocument50 pagesHR Digital Transformation: The Practical Guidepaulus chandraNo ratings yet

- 05GENREPX0015 Rev0Document38 pages05GENREPX0015 Rev0anub0025100% (1)

- Benchmark Report Telco GrowthDocument78 pagesBenchmark Report Telco Growthdaba1987No ratings yet

- Framework7 TutorialDocument67 pagesFramework7 TutorialMaylen RivasNo ratings yet

- Digital Hesitation: Why B2B Companies Aren't Reaching their Full Digital Transformation PotentialFrom EverandDigital Hesitation: Why B2B Companies Aren't Reaching their Full Digital Transformation PotentialRating: 5 out of 5 stars5/5 (1)

- The DAP Strategy: A New Way of Working to De-Risk & Accelerate Your Digital TransformationFrom EverandThe DAP Strategy: A New Way of Working to De-Risk & Accelerate Your Digital TransformationNo ratings yet

- Scope and Impact of Industry On Indian EconomyDocument66 pagesScope and Impact of Industry On Indian Economysomiya kausualNo ratings yet

- FairmountDocument6 pagesFairmountKevin ParkerNo ratings yet

- How Do Tech Companies Earn and InvestDocument4 pagesHow Do Tech Companies Earn and InvestpalakNo ratings yet

- Microsoft Swot AnalysisDocument12 pagesMicrosoft Swot AnalysisGie Pescasio UmandalNo ratings yet

- Wipro: Business Area of The CompanyDocument5 pagesWipro: Business Area of The CompanyMansi ThakoreNo ratings yet

- Industry 4.0: Volume Lii July 2020Document8 pagesIndustry 4.0: Volume Lii July 2020Andy HuffNo ratings yet

- Annual Report 2012 PDFDocument80 pagesAnnual Report 2012 PDFMani SelvanNo ratings yet

- E CommerceDocument21 pagesE Commercehafizmuhammad1122squareNo ratings yet

- Street Rating MicrosoftDocument5 pagesStreet Rating MicrosoftEric LeNo ratings yet

- Redington Final MSDocument15 pagesRedington Final MSkarthik sNo ratings yet

- 2012 JulyDocument8 pages2012 Julyjen8948No ratings yet

- Computer SoftwareDocument2 pagesComputer SoftwarePulkit JainNo ratings yet

- Business Plan: Rakibul HassanDocument21 pagesBusiness Plan: Rakibul HassanRakibz HassanNo ratings yet

- Swot Analysis of IbmDocument6 pagesSwot Analysis of IbmSahil ShahNo ratings yet

- Nanon Ives HDocument7 pagesNanon Ives Hprince1900No ratings yet

- Market and Consumer AnalysisDocument25 pagesMarket and Consumer AnalysisLakota FischerNo ratings yet

- AssignmentDocument5 pagesAssignmentMai ChiNo ratings yet

- Final ProjectDocument12 pagesFinal ProjectelizabthomasNo ratings yet

- Management Discussion and AnalysisDocument14 pagesManagement Discussion and Analysis02 - CM Ankita AdamNo ratings yet

- LinkedIn Report Copy 3Document63 pagesLinkedIn Report Copy 3dayotot841No ratings yet

- InternDocument9 pagesInternPalak HemnaniNo ratings yet

- Salesforce E-Commerce AnalysisDocument8 pagesSalesforce E-Commerce Analysisvincent njeruNo ratings yet

- Business PracticeDocument11 pagesBusiness Practicetp0603069No ratings yet

- Benchmarking Digital: A Digital Experience Index Is BornDocument8 pagesBenchmarking Digital: A Digital Experience Index Is BornCognizantNo ratings yet

- Adobe (Magento) Named A Leader in 2020 Gartner Magic Quadrant For Digital CommerceDocument2 pagesAdobe (Magento) Named A Leader in 2020 Gartner Magic Quadrant For Digital CommerceCarlos Stuars Echeandia CastilloNo ratings yet

- Unit VIII Final Essay - Nguyen Duy SonDocument20 pagesUnit VIII Final Essay - Nguyen Duy SonsonndNo ratings yet

- UntitledDocument61 pagesUntitledMani KandanNo ratings yet

- PHONE VENTURES Intro and OverviewDocument4 pagesPHONE VENTURES Intro and Overviewaditya polNo ratings yet

- Student Number: 0708964 Word Count: 2796Document17 pagesStudent Number: 0708964 Word Count: 2796James KnightNo ratings yet

- Manufacturing Partner Product Design & Development MarketingDocument5 pagesManufacturing Partner Product Design & Development MarketingAnant BhandariNo ratings yet

- Cloud Mustang Executive SummaryDocument7 pagesCloud Mustang Executive SummarygowrishhhhNo ratings yet

- Social Life Network Presentation Deck 2021Document13 pagesSocial Life Network Presentation Deck 2021natasha-elisabeth-8530No ratings yet

- 1 BackgroundDocument3 pages1 BackgroundkidiNo ratings yet

- Cono ScanDocument116 pagesCono ScanMarie Taylaran100% (2)

- Ispixb2B) : India Software Products Industry Index - B2BDocument18 pagesIspixb2B) : India Software Products Industry Index - B2BAbhishek TuliNo ratings yet

- TCS FaDocument28 pagesTCS FasunnyNo ratings yet

- Document 1Document41 pagesDocument 1Ella Jade CadizNo ratings yet

- TcsDocument13 pagesTcsnafis20No ratings yet

- Baron Opportunity Fund 12.31.22Document5 pagesBaron Opportunity Fund 12.31.22Vinci ChanNo ratings yet

- Adobe Digital Trends 2020 APACDocument19 pagesAdobe Digital Trends 2020 APACkinnar32No ratings yet

- Application Software Industry Project 1Document51 pagesApplication Software Industry Project 1api-269304124No ratings yet

- Software Sector Analysis ReportDocument8 pagesSoftware Sector Analysis ReportpintuNo ratings yet

- Consad Bsit704 ITSM 05 Assignment 1Document3 pagesConsad Bsit704 ITSM 05 Assignment 1Jc ConsadNo ratings yet

- Business To Business Marketing: Avnet Technology SolutionsDocument16 pagesBusiness To Business Marketing: Avnet Technology SolutionsGaurav KumarNo ratings yet

- Description of The Business Executive SummaryDocument20 pagesDescription of The Business Executive Summarychiwuzor nankwoNo ratings yet

- How to Negotiate with Microsoft: Proven Strategies to help you Maximise Value and Minimise CostsFrom EverandHow to Negotiate with Microsoft: Proven Strategies to help you Maximise Value and Minimise CostsNo ratings yet

- Evaluating The Business To Business Ecommerce Systems Of Dell & CiscoFrom EverandEvaluating The Business To Business Ecommerce Systems Of Dell & CiscoNo ratings yet

- Kell, Oliver - Victory in Stock Trading (2021) PDF Moving Average Day TradingDocument1 pageKell, Oliver - Victory in Stock Trading (2021) PDF Moving Average Day Tradingtawatchai limNo ratings yet

- The Skiptimes - Satit Kaset IPDocument1 pageThe Skiptimes - Satit Kaset IPtawatchai limNo ratings yet

- SEAMO X 2023 Global Champions Division Grade 1Document3 pagesSEAMO X 2023 Global Champions Division Grade 1tawatchai limNo ratings yet

- FPL Player Predicted Points and Value FPL Form 2Document1 pageFPL Player Predicted Points and Value FPL Form 2tawatchai limNo ratings yet

- Give and Care RS ScoreDocument84 pagesGive and Care RS Scoretawatchai limNo ratings yet

- CDIO Syllabus Information Management 1 LecDocument18 pagesCDIO Syllabus Information Management 1 LecChoir choirNo ratings yet

- Arieyanti Dwi Astuti Badan Perencanaan Pembangunan Daerah Kabupaten Pati Jl. Raya Pati-Kudus Km. 4 Pati. 59163. Jawa TengahDocument15 pagesArieyanti Dwi Astuti Badan Perencanaan Pembangunan Daerah Kabupaten Pati Jl. Raya Pati-Kudus Km. 4 Pati. 59163. Jawa TengahFitriani 1310No ratings yet

- PPSC Lecturer Math (2017) Available QuestionsDocument5 pagesPPSC Lecturer Math (2017) Available QuestionsMujahid KhanNo ratings yet

- Task 2-Answer Requirements TemplateDocument8 pagesTask 2-Answer Requirements TemplateleyNo ratings yet

- October 2016 Question Paper 3 - tcm143 370635Document12 pagesOctober 2016 Question Paper 3 - tcm143 370635Mihaela Cristina LazarNo ratings yet

- Cat Forklift Et3500 Schematic Service Operation Maintenance ManualDocument27 pagesCat Forklift Et3500 Schematic Service Operation Maintenance Manualiancarrillo210188ris100% (49)

- Auto Calculate Are ADocument4 pagesAuto Calculate Are ADr Purushottam DNNo ratings yet

- RMC No. 122 2022 S1905 RUS 1kikay PDFDocument1 pageRMC No. 122 2022 S1905 RUS 1kikay PDFGloria Kikay KuderaNo ratings yet

- Product Highlights: Wireless N150 Router With 3G/CDMA/LTE Support and USB PortDocument5 pagesProduct Highlights: Wireless N150 Router With 3G/CDMA/LTE Support and USB PortJonasNo ratings yet

- GS33J62F20 01enDocument8 pagesGS33J62F20 01enBobby SetiawanNo ratings yet

- Ciphertext Policy Attribute Based Encryption: KeywordsDocument4 pagesCiphertext Policy Attribute Based Encryption: Keywordssucheta pandaNo ratings yet

- Lecture Note Networking StarDocument15 pagesLecture Note Networking StarHAILE KEBEDENo ratings yet

- Instructions For Taylor & Francis Author Template Microsoft Word Mac 2008Document3 pagesInstructions For Taylor & Francis Author Template Microsoft Word Mac 2008samuel mechNo ratings yet

- Hawke Cable Gland 2014077-KWx PriceDocument10 pagesHawke Cable Gland 2014077-KWx PriceFauzan Fakhrul ArifinNo ratings yet

- Siddu SeminarDocument19 pagesSiddu SeminarVenkat SaiNo ratings yet

- Adv No. 25-2023Document2 pagesAdv No. 25-2023mu234355No ratings yet

- Atlas Copco PL & Code 14-10-97Document308 pagesAtlas Copco PL & Code 14-10-97aliNo ratings yet

- Liba Weekend PGDM Brochure v3 220802 - CompressedDocument8 pagesLiba Weekend PGDM Brochure v3 220802 - Compressedans2684No ratings yet

- Custom Notification Actions: Supported REST HTTP MethodsDocument1 pageCustom Notification Actions: Supported REST HTTP MethodsAlejo1895No ratings yet

- NetWorker 9.0.x Server Disaster Recovery and Availability Best Practices GuideDocument166 pagesNetWorker 9.0.x Server Disaster Recovery and Availability Best Practices GuideKarol NNo ratings yet

- Fitting A MK2.5 Spoiler PDFDocument7 pagesFitting A MK2.5 Spoiler PDFAlexandru-Mihai NitaNo ratings yet

- Workbook in Integral CalculusDocument85 pagesWorkbook in Integral Calculusma.cristina balictarNo ratings yet

- PERT7 ACT1 MarcellinoDanis 13119534Document12 pagesPERT7 ACT1 MarcellinoDanis 13119534zekri fitra ramadhanNo ratings yet