Professional Documents

Culture Documents

Illustration 400

Illustration 400

Uploaded by

twat neckOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Illustration 400

Illustration 400

Uploaded by

twat neckCopyright:

Available Formats

Personal Illustration - Test Illustration

16 February 2024

Income

Days per week @ 400.00 5.0

Tax Code 1257L

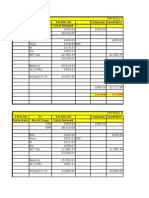

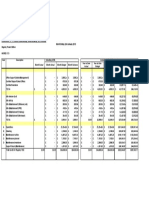

Umbrella Income to Gross Pay My Max Weekly My Max Monthly

Umbrella Income £2,000.00 £8,666.67

Employers Workplace Pension (£0.00) (£0.00)

Employers NI (£217.28) (£941.58)

Apprenticeship Levy (£8.75) (£37.91)

Expenses (£0.00) (£0.00)

Umbrella Margin (£24.50) (£106.17)

Gross Pay £1,749.48 £7,581.02

Gross Pay to Take Home Pay

Gross Pay £1,749.48 £7,581.02

Employees NI (£88.15) (£381.94)

PAYE Tax (£457.80) (£1,984.46)

Employees Workplace Pension (£0.00) (£0.00)

Expenses Reimbursed £0.00 £0.00

Take home pay £1,203.53 £5,214.62

Pensions

Total Workplace Pensions Contribution (inc. Tax Relief) £0.00 £0.00

Expected Take Home Pay + Pension Contributions £1,203.53 £5,214.62

Gross Pay Summary

Basic Pay £390.75 £1,693.25

Holiday Pay Paid £188.41 £816.42

Commission £1,170.32 £5,071.35

Gross Pay £1,749.48 £7,581.02

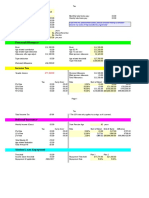

Key Assumptions

* We have not included earnings from any other sources this tax year.

* Calculations are estimates and based on a 1257L tax code, you working 52 weeks in a year and we have applied weekly tax allowances. If you do not believe the 1257L tax code will be

applicable to you based on your circumstance and would like an illustration based on a different tax code instead, then please contact us to request this.

* Our weekly margin has been deducted before any payments are made to you. The net cost to you could be as little as £12.49

* This is based on Rest of the UK tax allowances.

* Workplace pension contributions have not been included within this illustration.

* Salary Sacrifice pension contributions have not been included within this illustration.

* This illustration has been based on an advanced holiday pay model.

* If your annual taxable earnings exceed £100k, then the personal allowance may be restricted by £1 for every £2 on earnings between £100,000 and £125,140. Annual taxable earnings over

£125,140 may not have any tax allowance. If you believe this will apply to you and would like an illustration to show how your take home pay will be affected once your pay exceeds £100k,

then please contact us to request this.

You might also like

- DatabaseDocument161 pagesDatabaseFahidNo ratings yet

- File PDFDocument1 pageFile PDFScumpyk VioNo ratings yet

- Payslip Month Ending 30 November 2022Document1 pagePayslip Month Ending 30 November 2022zeppo1234No ratings yet

- Income From Capital GainsDocument18 pagesIncome From Capital GainsRhea Vishisht100% (2)

- Cloud Computing Security Risk AssessmentDocument33 pagesCloud Computing Security Risk Assessmentkingnachi100% (1)

- Trainee - Freshers Salary Breakup - HRDocument1 pageTrainee - Freshers Salary Breakup - HRAnuraagNo ratings yet

- Performance Boat TermsDocument6 pagesPerformance Boat TermsParamaet TamNo ratings yet

- Vlad-Antonio Istrate: Description Qty Unit Cost Amount TotalDocument1 pageVlad-Antonio Istrate: Description Qty Unit Cost Amount TotalIst Vladutu100% (1)

- Pay Statement: June 2019 Aspin Pharma Pvt. LTDDocument1 pagePay Statement: June 2019 Aspin Pharma Pvt. LTDAman AnsariNo ratings yet

- Using Solver TableDocument4 pagesUsing Solver TableErik Njølstad100% (1)

- Sagar Sapkota Full Application PDFDocument14 pagesSagar Sapkota Full Application PDFAnnie LamNo ratings yet

- Private and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duDocument1 pagePrivate and Confidential: Mrs Elaine Hicks 10 Dorset Avenue Barley Mow Birtley Dh3 2duElaine HicksNo ratings yet

- Miss V Becerra Bastidas 9 Hockett Close London Se8 3Px: Deductions PaymentsDocument1 pageMiss V Becerra Bastidas 9 Hockett Close London Se8 3Px: Deductions Paymentsvictoria BeceraNo ratings yet

- Sa302 2021Document1 pageSa302 2021Umt KayaNo ratings yet

- PayslipDocument2 pagesPaysliporrinlloyd750No ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Your Pay Summary: Payments DeductionsDocument1 pageYour Pay Summary: Payments DeductionscostingyNo ratings yet

- 1 EzgncDocument2 pages1 Ezgncliambenson271199No ratings yet

- 1ezgnc 2Document1 page1ezgnc 2liambenson271199No ratings yet

- Daniela Felippini Month Ending 31 Dec 2023: Payments Deductions Employee DetailsDocument1 pageDaniela Felippini Month Ending 31 Dec 2023: Payments Deductions Employee Detailsdanielafelippini.dfNo ratings yet

- Your Pay Summary: Payments DeductionsDocument2 pagesYour Pay Summary: Payments DeductionsQuincyhaslamNo ratings yet

- UKPayslipDocument2 pagesUKPayslipabdulhamid303No ratings yet

- Rose Limited Operates A Small Chain of Retail Shops That Sell High-Quality Teas and Coffees. Approximately Half of Sales Are On Credit. ADocument2 pagesRose Limited Operates A Small Chain of Retail Shops That Sell High-Quality Teas and Coffees. Approximately Half of Sales Are On Credit. AJenifer Klinton100% (2)

- Payslip - Phillipp Cope - 08-09-2022Document1 pagePayslip - Phillipp Cope - 08-09-2022Agent535No ratings yet

- Daniela Felippini Month 1: Payments Deductions Employee DetailsDocument1 pageDaniela Felippini Month 1: Payments Deductions Employee Detailsdanielafelippini.dfNo ratings yet

- Payslip 06.2022Document1 pagePayslip 06.2022danielafelippini.dfNo ratings yet

- WolflDocument14 pagesWolflapi-436164332No ratings yet

- UK Taxation: Personal AllowanceDocument4 pagesUK Taxation: Personal AllowanceAbhishek PandeyNo ratings yet

- Budget PDFDocument6 pagesBudget PDFapi-436164332No ratings yet

- Name Date Company: Total Deductions 10.47Document1 pageName Date Company: Total Deductions 10.47Paul PalaciosNo ratings yet

- Name Date Company: Total Deductions 523.41Document1 pageName Date Company: Total Deductions 523.41dahalsp73No ratings yet

- Payslip Month Ending 30 April 2021Document1 pagePayslip Month Ending 30 April 2021crystalbiegaNo ratings yet

- Payslips - Azmol KhanDocument2 pagesPayslips - Azmol Khanazmoluk0044No ratings yet

- Upwork TemplateDocument18 pagesUpwork TemplateSajid QureshiNo ratings yet

- Daniela Felippini Month Ending 30 Nov 2023: Payments Deductions Employee DetailsDocument1 pageDaniela Felippini Month Ending 30 Nov 2023: Payments Deductions Employee Detailsdanielafelippini.dfNo ratings yet

- Name Date Company: Total Deductions 0.00Document1 pageName Date Company: Total Deductions 0.00Cristian PîrnăuNo ratings yet

- FGD Section 1 2010Document1 pageFGD Section 1 2010James GreeneNo ratings yet

- Payslip - Andrei Ungureanu - 08-12-2023Document1 pagePayslip - Andrei Ungureanu - 08-12-2023tubalcain3macbenac3No ratings yet

- Daniela Felippini Month Ending 30 Apr 2023: Payments Deductions Employee DetailsDocument1 pageDaniela Felippini Month Ending 30 Apr 2023: Payments Deductions Employee Detailsdanielafelippini.dfNo ratings yet

- Your Own BudgetDocument1 pageYour Own BudgetElizabeth M StantonNo ratings yet

- PayslipDocument1 pagePayslipkvck6511No ratings yet

- Calculations UKDocument6 pagesCalculations UKrambbcNo ratings yet

- JanuaryDocument5 pagesJanuaryPVALUEWRITERS madNo ratings yet

- Driving Lessons/Test Holiday: ClothesDocument23 pagesDriving Lessons/Test Holiday: Clothesgreyfox2No ratings yet

- FGD Section 1 2010Document1 pageFGD Section 1 2010James GreeneNo ratings yet

- SC70328 747203 Payslip20170714Document1 pageSC70328 747203 Payslip20170714bogdantudorel1993No ratings yet

- Name Date Company: Total Deductions 189.07Document1 pageName Date Company: Total Deductions 189.07Mish ErinNo ratings yet

- PaySlips Monthly 20230630 1Document1 pagePaySlips Monthly 20230630 1Karl KonigNo ratings yet

- Trainee - Freshers Salary Breakup - OperationsDocument1 pageTrainee - Freshers Salary Breakup - OperationsAnuraagNo ratings yet

- 10 May 2022 12555230Document1 page10 May 2022 12555230rangu shruthiNo ratings yet

- In Come Statement Ga NotDocument1 pageIn Come Statement Ga NotCharmelyn EliseoNo ratings yet

- Payslip - Simba Tigere - Month Ending 31-05-2023Document1 pagePayslip - Simba Tigere - Month Ending 31-05-2023Simbarashe TigereNo ratings yet

- Manage Money TemplateDocument1 pageManage Money TemplateRahman ZafNo ratings yet

- Balance PDFDocument2 pagesBalance PDFapi-436164332No ratings yet

- May 2021Document1 pageMay 2021Andrea MoleroNo ratings yet

- B EfhlbfslgyDocument4 pagesB Efhlbfslgyapi-436164332No ratings yet

- NL Ec LS 400 6Document1 pageNL Ec LS 400 6Gladys CasarrubiasNo ratings yet

- Ukpaye-2017-2018 - 18500Document2 pagesUkpaye-2017-2018 - 18500Anonymous jEmTt5o6No ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Project Name: 5 The Pavement, Clapham Common, London SW4 0HZDocument2 pagesProject Name: 5 The Pavement, Clapham Common, London SW4 0HZjordenNo ratings yet

- Monthly Income 15th 30th Source of Income Amounts (Estimated) TotalDocument3 pagesMonthly Income 15th 30th Source of Income Amounts (Estimated) TotalMyles Ninon LazoNo ratings yet

- Tax Due - Business MathDocument2 pagesTax Due - Business MathMishka AlascaNo ratings yet

- Tax Due Business MathDocument2 pagesTax Due Business MathJaren Pauline D. HidalgoNo ratings yet

- Loonkosttabel1 En-Gb Rev PDFDocument1 pageLoonkosttabel1 En-Gb Rev PDFStephanie CasetNo ratings yet

- Loonkosttabel1 En-Gb RevDocument1 pageLoonkosttabel1 En-Gb RevStephanie CasetNo ratings yet

- ITIPT02 - Lesson 1 Concepts of Mobile ApplicationsDocument23 pagesITIPT02 - Lesson 1 Concepts of Mobile ApplicationsGian Jerome RubioNo ratings yet

- Quiz 2 TableDocument5 pagesQuiz 2 TableSathish BNo ratings yet

- General Information 1.1. About Gather Care: Program GuidelineDocument31 pagesGeneral Information 1.1. About Gather Care: Program GuidelineAhmad Saiful Ridzwan JaharuddinNo ratings yet

- Dlp-For-observation Science 5 Week 6 q3Document4 pagesDlp-For-observation Science 5 Week 6 q3MarlynAudencialNo ratings yet

- BetterDocument5 pagesBetterIfan AzizNo ratings yet

- English File: 11 Quick TestDocument2 pagesEnglish File: 11 Quick TestYanby fghj ffNo ratings yet

- Freight Forwarders Licensea 2023Document9 pagesFreight Forwarders Licensea 2023CivicNo ratings yet

- Generation Z: Forbes MagazineDocument2 pagesGeneration Z: Forbes MagazineVladut Irina-elenaNo ratings yet

- Automatic Tank Dewatering 1Document4 pagesAutomatic Tank Dewatering 1JADNo ratings yet

- STLED316S: Serial-Interfaced 6-Digit LED Controller With KeyscanDocument33 pagesSTLED316S: Serial-Interfaced 6-Digit LED Controller With KeyscanDhivya NNo ratings yet

- Martillo - Manual de Operacion PIleco D100Document110 pagesMartillo - Manual de Operacion PIleco D100Jhousep steven Mesia gonzalesNo ratings yet

- 01 Project Shakti HULDocument3 pages01 Project Shakti HULAjaySharmaNo ratings yet

- 3 Cigüeñal y Arbol de LevasDocument32 pages3 Cigüeñal y Arbol de LevasGuillermo Gerardo Sanchez PonceNo ratings yet

- TR04 - Retrieve Data PDFDocument15 pagesTR04 - Retrieve Data PDFRajNo ratings yet

- The Chhattisgarh Land Revenue Code 1959 Complete Act - Citation 134590 - Bare AcDocument175 pagesThe Chhattisgarh Land Revenue Code 1959 Complete Act - Citation 134590 - Bare AcKshitij NawarangNo ratings yet

- Mo7amed Reda Abd El-Rahman: Financial Consultant Applications Environment Accountant Under Financial R12 InstructorDocument45 pagesMo7amed Reda Abd El-Rahman: Financial Consultant Applications Environment Accountant Under Financial R12 InstructorMohammedMustafaNo ratings yet

- A129 Pro Duo Dash Camera ManualDocument14 pagesA129 Pro Duo Dash Camera Manualdie0another0dayNo ratings yet

- RecipesDocument47 pagesRecipesRobert da SilvaNo ratings yet

- 800 Series: Articulating Boom LiftsDocument2 pages800 Series: Articulating Boom LiftsRAFA SNo ratings yet

- Esterification of Acetic Acid With Ethanol Catalysed by An AcidicDocument9 pagesEsterification of Acetic Acid With Ethanol Catalysed by An AcidicLord ZukoNo ratings yet

- Course Syllabus of Digital Image Processing (EE6131)Document1 pageCourse Syllabus of Digital Image Processing (EE6131)Ritunjay GuptaNo ratings yet

- KPMG CII Ease of Doing Business in IndiaDocument64 pagesKPMG CII Ease of Doing Business in IndiaKritika SwaminathanNo ratings yet

- Eng Spec For Fire Fighting System DesignDocument27 pagesEng Spec For Fire Fighting System DesignIndunil WarnasooriyaNo ratings yet

- Pilgram BankDocument9 pagesPilgram BankJasmine ZhuNo ratings yet

- Setting The Rules Dean BakerDocument11 pagesSetting The Rules Dean BakerOccupyEconomicsNo ratings yet