Professional Documents

Culture Documents

Judiciary Judgment Ito Vs M S Handgar Indexport P LTD CC On 1 February 2010

Judiciary Judgment Ito Vs M S Handgar Indexport P LTD CC On 1 February 2010

Uploaded by

Rubal SandhuOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Judiciary Judgment Ito Vs M S Handgar Indexport P LTD CC On 1 February 2010

Judiciary Judgment Ito Vs M S Handgar Indexport P LTD CC On 1 February 2010

Uploaded by

Rubal SandhuCopyright:

Available Formats

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ...

on 1 February, 2010

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc

... on 1 February, 2010

1

IN THE COURT OF SH. DIG VINAY SINGH, ADDITIONAL CHIEF METROPOLITAN

MAGISTRATE(SPL. ACTS):CENTRAL:TIS HAZARI COURTS, DELHI

In re:

ITO

VS.

M/S HANDGAR INDEXPORT (P) LTD

CASE NO. 82/4

U/S 276 C (1), 277 & 278 OF THE INCOME TAX ACT, 1961 AND SECTION 193/196 OF

THE INDIAN PENAL CODE

DATE OF RESERVATION OF JUDGMENT:

DATE OF PRONOUNCEMENT OF JUDGMENT:

JUDGEMENT

(a) The serial no. of the case : 02401R

(b) The date of commission of offence : 28.06.

(c) The name of complainant : Sh.

Commis

XV, Ne

(d) The name, parentage, residence of accused: (1)

(2)

(3)

(4)

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e H−459, New Rajinder Bagar, New Delhi (5) Smt. Jaswant Kaur, (deceased)

889/IT−10, Gali Raja Sawan Bazaar Mai Saiwan, Amritsar (6) Smt. Manorama Devi (deceased)

M/86, Greater Kailash−I, New Delhi (7) Parveen Kumar R/o−14−B/24, Dev Nagar, New Delhi (8)

Harish Chander S/o Sh. H.R. Kochhar, R/o B−1/249, Janakpuri, New Delhi

e) The offence complained of/ proved : U/s 276 C(1),277 & 278 of the Income Tax Act,1961 & section

193/196 of the Indian Penal Code

(f) The plea of accused : Acquitted

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 1

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

(g) The final order : 01.02.2010

(h) The date of such order : 01.02.2010 Brief statement of the reasons for the decision:− This is a

complaint case filed by the Income Tax Officer against the Eight accused named above. Before

proceeding further let it be mentioned that the accused No 2, 3 and 6 expired during the pendency

of proceedings and the proceedings against them were declared Judiciary/ judgment / ITO vs. M/s

Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e abated on different

dates, therefore, the present judgment is directed against the remaining five accused, that is,

accused No 1, 3, 4, 7 and the accused No 8 only.

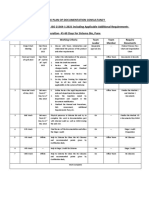

1. Briefly stated the facts are, that the present complaint was filed against the accused for offences

under section 276C (1), 277 and 278 of The Income Tax Act 1961, as also the offences under section

193 and 196 of the Indian penal code. The relevant assessment year is 1983−84 and, it is alleged that

the accused No 2 to 6 were directors of the accused No 1 company. During the accounting period

ending on 30th of June 1982, assessment year 1983−1984 the accused company was engaged in the

business of export of ready−made garments and handicrafts. The Return of the income of the

company for the relevant year was filed on 28 June 1983. In the Return filed, a loss of Rs 6,07,930

was reflected. The said Return of income comprised of a current loss of Rs 2,27,921 and unabsorbed

brought forward loss of Rs 2,95,346. The verification of the income tax Return was signed by the

accused No 2 who was one of the directors at the relevant time. The Return was also accompanied

by the profit and loss account of the company along with balance sheet. Those documents were

signed by the accused No 2 and accused No

3. In the Return filed a sum of Rs 26,41,184 was claimed to have been spent on fabrication and

processing charges and the said amount was debited to the profit of the company. The fabrication

and processing charges were mainly on account of tailoring, embroidery and dying charges.

Assessment proceedings were initiated by the income tax authorities and accordingly notices were

issued. A specific questionnaire was issued to the accused company to furnish certain

details/information. On examination of the trading details, supplied by the company along with

other details and information furnished on behalf of the company, the assessing officer felt that the

expenditure Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 /

February 1 , 2010/ Page of /e claimed by the company on fabrication and processing was excessive.

Thereafter the accused company was directed to file a complete list of the fabricators, including their

names and addresses, along with the quantum of payments claimed to have been made to them. A

list of 27 such parties, to whom payment in excess of Rs 10,000 was made by the company, was

supplied to the income tax authorities. The total amount claimed to have been paid to them was

approximately Rs 25,44,059. The copies of accounts of those 27 parties, indicating the mode of

payments to them and as recorded in the books of account of the accused company, were also

furnished on behalf of the accused company. The income tax authorities issued summons to those

27 parties under section 131 of The Income Tax Act through registered post. Out of those 27 parties,

16 parties could not be served and their notices were received back, with remarks 'left without

address', 'refused', 'no such person exist' etc. Thereafter the accused company was directed to

produce those 27 parties but none of them could be produced by the accused company. Ultimately

the accused company expressed its inability to produce the parties. It is claimed in the complaint

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 2

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

that one of the parties M/s Design Centre to whom certain processing charges to the extent of Rs

44,640 were claimed to have been paid did not exist at that given address. Out of the remaining 11

parties, from total 27 parties, 7 parties furnished copy of account of accused company in their books

of accounts and out of them five parties were examined on test check basis by the income tax

authorities. The proprietor of one such party appeared and made a statement that the accused

company used to charge him cash amount equal to Rs 1 per piece of garment tailored by him. From

the said statement it transpired that the payments made by the accused company to the fabricators,

in respect of fabrication and processing charges, as appearing Judiciary/ judgment / ITO vs. M/s

Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e in its books of accounts

were not the same as paid to the fabricators, because a part of the said payment was siphoned back

to the accused company on the basis of oral arrangement with the fabricators. The matter was

further investigated and attempts were made to summon those parties which could not be served

earlier. The proprietor of one more firm appeared, whose statement was recorded by the income tax

authorities and who stated that the accused company used to get over−billing done and the

difference in the bill amount and the actual tailoring charges used to be recovered back on behalf of

the accused company by way of cash from him after the payment was made to him by cheque. It was

also stated that sometimes the accused company used to accept Bearer cheques from him which

were got encashed by it through its employees. Certain discrete inquiries were made by the income

tax authorities which revealed that accused No 7 encashed certain cheques issued by the said

proprietor. The accused No 7 was an employee of the accused company. It is also claimed that at

times the accused company used to issue the cheques in respect of fabrication charges in favour of

the fabricators and those cheques were encashed by the company through accused No 7. The income

tax authorities came to know about two such cheques in the books of account of the accused

company which were in the name of M/s Hindustan traders and M/s U.K. enterprises. The income

tax authorities also recorded the statement of the accused No 7 who admitted his signatures on the

reverse of the cheques and also admitted that he used to encash cheques for the company. The

accused No 7 is claimed to have encashed five such cheques in such manner. Against accused No 7 it

is also claimed that he encashed one cheque of Rs 11,500 which was purportedly issued by M/S

Rainbow Garments but the proprietor of the said firm stated that he does not know the accused No

7. So far as the Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 /

February 1 , 2010/ Page of /e accused No 8 is concerned, it is the case of the complainant, that

during the assessment proceedings the affidavit of this accused No 8 was filed before the assessing

officer. To verify the authenticity of the affidavit, the accused No 8 was called, and in his statement

the accused No 8 stated that he did not go through the contents of the affidavit before signing it and

that he never appeared before the Oath commissioner and, signed the affidavit on the asking of son

of accused No 4. He claimed that the cheque bearing No 4948354 for Rs 5000 was never received or

encashed by him. The assessing officer also recorded statements of other persons to prove that the

expenditure claimed by the accused company was untrue.

2. On these allegations the present complaint was filed for the offences under section 276C (1), 277

and section 278 of The Income Tax Act 1961 and also section 193 and 196 of the Indian penal code.

3. My learned predecessor court summoned the accused vide order dated 15th of January 1987 for

the above−mentioned offences. Thereafter pre−charge evidence was recorded against the accused

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 3

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

persons and charges were framed against the accused No 1, 3, 4, 6, 7 and 8. The charges were

framed on 11th of April 2001. It would be pertinent to mention here that my learned predecessor

court vide its order dated 12 of March 2001 ordered that charges against the accused be framed only

for the offences under section 276 C (1), 277 and section 278 of The Income Tax Act and no charges

were ordered to be framed under section 193 and 196 of Indian penal code. The said order was never

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e challenged and it has attained finality. Needless to say that the present judgment

confines to the charges framed against the accused.

4. The material parts of Sections 276C and 277 of the Act read as follows:

"276C. Willful attempt to evade tax etc. − (1) If a person willfully attempts in any

manner whatsoever to evade any tax, penalty or interest chargeable or imposable

under this Act, he shall, without prejudice to any penalty that may be imposable on

him under any other provision of this Act, be punishable, ........................."

" (2) If a person willfully attempts in any manner whatsoever to evade the payment of

any tax, penalty or interest under this Act, he shall, without prejudice to any penalty

that may be imposable on him under any other provision of, this Act, be punishable

with ......

...............".

"Explanation ......................."

5. "277. False statement in verification etc. − If a person makes a statement in any verification under

this Act or under any rule made there under or delivers an account or statement which is false and

which he either knows or believes to be false, or does not believe to be true, he shall be

punishable,..................."

6. In support of its case the prosecution examined total five witnesses namely PW 1 Sunil Chopra,

PW 2 Smt. Vanita Chopra , PW 3 Ramesh Kakkar , PW−4 S.P.Aggarwal and PW−5 Vinay Kapoor.

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e

7. PW 1 Sunil Chopra was the concerned inspecting assistant Commissioner of Income Tax at the

relevant time and the accused company was one of his assessee. When he took over from the

previous inspecting assessing officer he found that the proposal had already been made by earlier

assessing officer to the Commissioner of Income Tax, seeking authorization to launch prosecution

against the accused company. The assessment of the accused company was already completed by the

previous assessing officer vide order dated 27th March 1986. The previous assessing officer had

already initiated penalty proceedings against the accused company under section 271 (1) C of the

Income Tax Act. This witness made a request to the C. F. S. L. seeking opinion on the signatures of

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 4

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

accused No 7 appearing on the backside of cheques, which were allegedly encashed by him. This

witness proved his request letters Exhibit PW 1/1, Ex 1/2 , and Exhibit PW 1/3. He also proved the

letter from the C. F. S. L. through which he received the report of the F. S. L. as Exhibit PW 1/4. The

report has not been proved in this case in accordance with law and the F. S. L. report was only

marked as Mark A in the testimony of this witness. The witness also proved the authorization to

launch prosecution against the accused as Exhibit PW 1/5 and his complaint Exhibit PW 1/6. The

witness is, therefore, more or less a formal witness and in the cross−examination this witness

admitted that the Income Tax Appellate Tribunal, vide its order dated 1st Jun 1992, relating to the

assessment year in question regarding the accused company, dismissed the appeal against the order

of remand back of the assessment proceedings, by the Commissioner of Income Tax. The witness

admitted that the Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 /

February 1 , 2010/ Page of /e original affidavit against accused No 8 was not filed on the record of

the present case and it was kept in the records of the income tax authorities only.

8. PW 2 Smt. Vanita Chopra, is the concerned assessing officer who assessed the accused company

at the relevant time. She proved the Return filed by the accused company as Exhibit PW 2/1 along

with the documents bearing signatures of the accused No 2. She also proved the notice issued by her

to the accused company under section 143(2) of The Income Tax Act as Exhibit PW 2/2, the

questionnaire sent to the accused company Exhibit PW 2/3. This witness also deposed that the

accused company was doing business of fabrication and sale including export of ready−made

garments and that she conducted inquiries against the claim of fabrication charges from the parties

to whom the payment for fabrication expenses were allegedly made by the company, on the basis of

the list of fabricators provided by the accused company. She deposed that the inquiries revealed that

the assessee company was claiming fictitious expenses and was inflating expenses claimed as

fabrication charges. It is deposed that it was found by her on the basis of statements recorded by

her, of some of the fabricators who stated that the directors of the accused company were taking

some money back by way of cash from the fabricators after making payment to them through

cheque. The witness also deposed that the modus operandi of the accused company, for taking back

some of the payments, was that some cheques were issued by the accused company to the

fabricators which were bearer cheques and which were encashed by the employee of the accused

company i.e. accused No 7, who encashed the cheques by signing behind the cheques while

presenting the cheques to the bank for encashment. One such cheque is Exhibit PW 1. The witness

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e also deposed that after conducting inquiries she made the assessment order

Exhibit PW 2 against the accused company and that, the proprietors of few firms admitted before

her that the accused company was indulging in over−billing for fabrication charges and the excess

amount of fabrication charges used to be recovered from the fabricators by the accused company by

way of cash. The witness also deposed that vide letter dated 5th of March 1991 the assessing officer

submitted a report Exhibit PW 3. The witness was subjected to cross−examination by the accused in

which the witness admitted that the payments were not made directly to any of the accused directors

of the company and as per the statement of fabricators, accused No 2 and 3 used to ask the

fabricators to do the over−billing.

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 5

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

9. This part of the testimony of this witness is barred by the principles of hearsay as none of those

fabricators who allegedly made any such statement has been examined by the complainant in its

favour. The witness also deposed that the cheques which were bearer cheques were taken by the

accused No 7 to the fabricators who used to withdraw the money himself from the bank. The witness

specifically admitted that the Commissioner of Income Tax set aside the assessment order and the

matter was remanded back for the assessment. The witness in the next breath stated that the

assessment order was not set aside but in fact remand report was sought which was submitted to the

Commissioner of Income Tax. The witness also specifically admitted that after submission of the

remand report, no final order of Commissioner of Income Tax (Appeals), is on the file. The witness

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e also admitted that the fabricators who were allegedly examined by her during

assessment proceedings were named as witnesses in the complaint.

10. It would be pertinent to mention here that this witness did not prove any of the statement of any

of the fabricators recorded during the assessment proceedings, which even otherwise would have

been not admissible, in absence of examination of fabricators. Therefore, the deposition of this

witness as to what was stated by the fabricators before her is barred by the principles of hearsay, in

absence of examination of those persons who made such a statement against the directors of the

accused company or the accused company.

11. The complainant also examined, PW 3 Ramesh Kakkar who deposed, that during the assessment

proceedings, the accused No 7 agreed that the signatures on the backside of certain cheques were his

signatures and he further agreed that he used to encash cheques and gave the money to the

company. The witness also deposed that during the course of assessment proceedings it was found

that fabrication charges claimed by the accused company were bogus and excessive. He deposed that

the modus operandi of the party was that it used to issue bearer cheques to its fabricators and get

them encashed through one of its own employee that is accused No 7.

12. This witness nowhere deposed as to on what basis he makes such a deposition and whether in his

presence any of the fabricators made such a statement or whether the accused No 7 in his personal

presence made such a confession. Even Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P)

Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e otherwise had any such statement made in

presence of this witness by the fabricators, the same would have been barred by the principles of

hearsay in absence of examination of those fabricators. Similarly the admission/confession of

accused No 7 before the authorities becomes inadmissible under the Indian Evidence Act. This

witness also did not prove any of the statements made by any of the fabricators during the

assessment proceedings nor he proved any of the cheques which as per this witness bear signatures

of the accused No 7.

13. Complainant also examined, PW 4 who was a chartered accountant of the accused company and

who did not support the case of the complainant at all and deposed that he does not know whether

any case under The Income Tax Act was made out against the company, or not. Despite the witness

turning hostile to the case of the complainant, the complainant did not thought it proper to cross−

examine this witness to elicit any further facts in favour of the complainant.

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 6

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

14. Lastly, the complainant also examined PW 5 Vinay Kapoor, Manager from Canara bank who

deposed that the cheques Exhibit PW 5/A1 to Exhibit PW 5/A9 were issued by Canara bank

Parliament Street New Delhi. But this witness stated that he does not know anything about this case.

Accordingly, even this witness turned hostile to the case of prosecution but despite this witness

turning hostile to the case of complainant, the complainant did not thought it proper to cross−

examine this witness to elicit any facts in favour of the complainant. Judiciary/ judgment / ITO vs.

M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e

15. After conclusion of the evidence of the complainant, the incriminating evidence was put to the

accused In their examination under section 313 read with section 281 of the Criminal Procedure

Code. It would be also pertinent to mention here that the statement of accused No 3, 4 and accused

No 7 was recorded on 10th of March 2005 but the statement of accused No 8 was not recorded. It is

recorded in the ordersheet dated 21.07.2005 that there is no incriminating evidence against this

accused and his statement was dispensed with. The statement of AR of the accused No 1 company

was also recorded on 21.01.2010 through accused no. 4 Jatinder Singh.

16. The accused No 3 in his statement admitted that he was a director of the accused company at the

relevant time but he claimed that he was not in charge of or responsible for the day−to−day affairs of

the company. He admitted that the accused company was doing the business of ready−made

garments which included fabrication and export of ready−made garments but he stated that the

assessment proceedings conducted by the income tax department was incomplete and based on

incomplete facts. The accused No 3 also stated that the fabricators were not examined in the court

and that if any cheque was encashed by the accused No 7 , it was encashed by him for the fabricators

and not for the accused company or any of its directors. The accused also claimed, that had the

fabricators been examined in the court they would not have supported the claim of the complainant.

He also claimed that the Commissioner of Income Tax appeal remanded the matter back for fresh

report which was never done. It is also claimed that as on date no penalty has been imposed on the

accused company and even the case was not fit for imposition of any penalty.

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e

17. Similarly the accused No 4 and AR of accused company denied the incriminating evidence

against him on the same grounds.

18. Similarly the accused No 7 denied the incriminating evidence against him and claimed that he

was an employee of the company and sometimes the fabricators used to give him the cheques and

after encashing the same he used to hand over the money to the fabricators and no money was paid

to the company or its directors. He stated that the allegations appearing that the money was being

paid to the company or its directors are absolutely false.

19. None of the accused led any defence evidence in their favour.

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 7

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

20. I have heard learned counsels for the accused as well as Learned Counsel for the complainant,

and have perused the record.

21. As is clear from the above facts the whole case of the complainant was based upon the fact that

some of the fabricators to whom, allegedly, certain payments were made were non−existent. In this

connection, the least which was expected from the complainant was, to have proved those notices or

those registered envelopes which were received back undelivered from the addresses of fabricators

allegedly supplied by the accused company to the income tax authorities. But unfortunately not even

a single notice or single registered envelop, which has been received back undelivered, with the

report that the addressee does not exist at the address, has been proved on record. There is not even

a single report by any of the income tax employee, on the notices, to reveal that as to which income

tax employee visited the address and Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd

/ CC No.82/4/09 / February 1 , 2010/ Page of /e found that the fabricators did not exist at the given

address. Admittedly PW 1, 2 or 3 did not personally visit any of the addresses of the fabricators nor

they have deposed any such fact that they personally went to any of the addresses to find out that the

fabricators did not exist. The person who visited any such address and gave the report is not

examined.

22. Despite the fact that the fabricators were named in the list of witnesses, none of them has been

examined by the complainant in support of its case to prove the fact that the claim made by the

accused company in the income tax was false in any manner. Although the complainant claims that

those fabricators were examined by the assessing officer during assessment proceedings but none of

them were examined in the court. The examination of those fabricators before the assessing officer

and, whatever those fabricators stated before the assessing officers, is not admissible ipso facto,

being barred by the principles of hearsay evidence, in the absence of examination of those

fabricators in the courts.

23. Learned Counsel for the complainant claimed that statements of those fabricators were recorded

by the assessing officer during assessment proceedings. But this fact by itself is insufficient since the

statements given by the fabricators to the assessing officer during assessment proceedings are not

per se admissible in evidence. At the most those statements could have been used for contradicting

or confronting the witnesses had they been examined in the court. The complainant ought to have

examined those fabricators in the court in order to prove their statements. In Judiciary/ judgment /

ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e absence of

examination of those fabricators in the courts, absolutely no reliance can be placed upon the fact

that those fabricators made any such statement against the accused company before the assessing

officer during assessment proceedings.

24. Learned counsel for the complainant claimed that the proceedings before the income tax

authorities are judicial proceedings under section 136 of the Income Tax Act, therefore, the

statements of fabricators can be used.

25. Section 136 of The Income Tax Act, provides, that any proceedings under the Act before an

income tax authority shall be deemed to be a judicial proceeding within the meaning of section 193

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 8

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

and section 228 and for the purposes of section 196 of the Indian penal code and every income tax

authority shall be deemed to be a civil court for the purposes of section 195 but not for the purposes

of chapter XXVI of the criminal procedure code.

26. This section does not, per−se, makes admissible the proceedings or the statements of individuals

recorded during the assessment proceedings. The purpose of this section to make it judicial

proceedings is only limited to the point that in case during such proceedings any false statement or

evidence is given such person can be proceeded against under section 193/196 of Indian penal code

or section 228 of the Indian penal code, as the case may be. This section nowhere provides that the

statements recorded by an assessing officer during assessment proceedings are per se admissible in

evidence, without examination of the person making the statement. Therefore this contention of

learned counsel for the complainant is of no help. Judiciary/ judgment / ITO vs. M/s Handgar

Indexport (P) Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e

27. Turning to the cheques which are claimed to have been encashed by the accused No 7, again,

even if this fact is taken to be proved that the accused No 7 encashed certain cheques which were in

the name of fabricators, that fact by itself does not prove the guilt of either the accused No 7 or the

accused No 1 to 6 to the effect that he encashed the cheques and gave the money to the accused No 1

to accused No 6. At the most this fact proves that the cheques were encashed by the accused No 7.

But then he has specifically stated in his examination that he used to encash those cheques for the

fabricators. In absence of examination of fabricators, to deny this fact, the said fact has to be read in

favour of the accused and none else. Although the claim of accused No 7, that he used to encash the

cheques for the fabricators and not for the accused company or its directors, may not appeal to

common sense and may not appear inspiring, but, unfortunately due to non examination of the

fabricators the benefit of this has to be given to the accused.

28. In such circumstances the complainant has miserably failed to prove the charges against the

accused company and its directors that they made claim of rebate in the name of non−existent

fabricators or that they used to inflate the fabrication bills or that fictitious fabrication rebates were

claimed.

29. So far is accused No 8 is concerned, against him the prosecution case was that he gave an

affidavit before the assessing officer during assessment proceedings which was not true.

Unfortunately the complainant has not even proved that affidavit on Judiciary/ judgment / ITO vs.

M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 , 2010/ Page of /e record, what to

talk of the falsity of the claim made by the accused No 8 in the affidavit.

30. For the foregoing reasons there is only one conclusion which comes out of this discussion, that

is, that the complainant has failed to prove its case against any of the eight accused and all the eight

accused are entitled to benefit of doubt and thus they are acquitted of the charges.

ANNOUNCED IN OPEN COURT ON (DIG VINAY SI

FEBRUARY 1st, 2010 ADDITIONAL CHIEF METROPOLITAN MAGISTRATE

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 9

Judiciary/ Judgment / Ito vs . M/S Handgar Indexport (P) Ltd / Cc ... on 1 February, 2010

SPECIAL ACTS, CENTRAL, TIS HAZARI COURTS

DELHI

Judiciary/ judgment / ITO vs. M/s Handgar Indexport (P) Ltd / CC No.82/4/09 / February 1 ,

2010/ Page of /e

Indian Kanoon - http://indiankanoon.org/doc/66039274/ 10

You might also like

- 9kla21-24 April A M Rao ActivitiesDocument78 pages9kla21-24 April A M Rao ActivitiesA M Rao100% (2)

- Builder Cannot Deduct TDS On Payment of Interest As Compensation To Flat Purchasers HC 2021Document14 pagesBuilder Cannot Deduct TDS On Payment of Interest As Compensation To Flat Purchasers HC 2021Moneylife Foundation100% (2)

- Written StatementDocument50 pagesWritten StatementSakshi Singh86% (7)

- Judgment Ito Vs Jawahar Singh CC No 141 3 Dated On 8 February 2010Document16 pagesJudgment Ito Vs Jawahar Singh CC No 141 3 Dated On 8 February 2010Rubal SandhuNo ratings yet

- ..1 .. C.C.No.121/SW/2014. JudgmentDocument12 pages..1 .. C.C.No.121/SW/2014. JudgmentSkk IrisNo ratings yet

- Pinak Bharat and Company vs Anil Ramrao Naik and Ors (Section 87 NI)Document8 pagesPinak Bharat and Company vs Anil Ramrao Naik and Ors (Section 87 NI)Khushi ParmarNo ratings yet

- 2014 (2) Apex Court J 0356Document11 pages2014 (2) Apex Court J 0356rakesh sharmaNo ratings yet

- Pooja Ravinder Devidasani Vs State of Maharashtra SC20141812141700211COM837620Document10 pagesPooja Ravinder Devidasani Vs State of Maharashtra SC20141812141700211COM837620soni sattiNo ratings yet

- Swiss Timing Ltd. V/s Organising Comittee, Commonwealth Games 2010Document36 pagesSwiss Timing Ltd. V/s Organising Comittee, Commonwealth Games 2010nayanj89No ratings yet

- Pankaj Gautam Vs Kunal Tradin Company Commercial Suit PDFDocument27 pagesPankaj Gautam Vs Kunal Tradin Company Commercial Suit PDFSoniNo ratings yet

- Man 06092011 S 9082002Document9 pagesMan 06092011 S 9082002Mayank DwivediNo ratings yet

- Ashutosh Ashok Parasrampuriya and Ors Vs Gharrkul SC202112102110211211COM948650 PDFDocument9 pagesAshutosh Ashok Parasrampuriya and Ors Vs Gharrkul SC202112102110211211COM948650 PDFSHERLOCKNo ratings yet

- ALM MootDocument12 pagesALM MootGENERAL SECRETARYNo ratings yet

- IndexDocument10 pagesIndextanmaystarNo ratings yet

- 138 Must Read Case Many Case Studies For Money Lending AcquitalDocument26 pages138 Must Read Case Many Case Studies For Money Lending AcquitalPranay ChauguleNo ratings yet

- P Mohanraj V Shah Brothers IspatDocument120 pagesP Mohanraj V Shah Brothers IspatSatyam MishraNo ratings yet

- Indus - Biotech - Private - Limited - Vs - Kotak - India - Venture Fund and OthersDocument15 pagesIndus - Biotech - Private - Limited - Vs - Kotak - India - Venture Fund and OthersUrviNo ratings yet

- Common Judgment Ito Vs D D Kochar CC Nos 33 34 3 January 4Th On 4 January 2010Document24 pagesCommon Judgment Ito Vs D D Kochar CC Nos 33 34 3 January 4Th On 4 January 2010Rubal SandhuNo ratings yet

- Innoventive Industries LTD Vs ICICI Bank and Ors 1NL201722051716452796COM869427Document23 pagesInnoventive Industries LTD Vs ICICI Bank and Ors 1NL201722051716452796COM869427veer vikramNo ratings yet

- Judgment On Section 17A of PC ActDocument82 pagesJudgment On Section 17A of PC ActVijay BhardwajNo ratings yet

- Awarding Higher Rate of Interest - Against Public Policy - SAIL Case 2020 Delhi HCDocument33 pagesAwarding Higher Rate of Interest - Against Public Policy - SAIL Case 2020 Delhi HCMuthu OrganicsNo ratings yet

- Navneet Dutta Vs ITO Revision of ClaimDocument4 pagesNavneet Dutta Vs ITO Revision of ClaimAnkur ShahNo ratings yet

- Affidavit DraftDocument6 pagesAffidavit DraftMohit ChugNo ratings yet

- Sholay Media, Generation - BomHC Order Dtd. 9.3.2020Document19 pagesSholay Media, Generation - BomHC Order Dtd. 9.3.2020pankaj dalmiaNo ratings yet

- RERA Complain Form-VI - HeavenDocument4 pagesRERA Complain Form-VI - HeavenDDO SEEC SAMBALPURNo ratings yet

- Multiple FIRDocument2 pagesMultiple FIRRakshit GuptaNo ratings yet

- Geo Miller & Co. Pvt. Ltd. vs. Chairman, Rajasthan Vidyut Utpadan Nigam Ltd.Document10 pagesGeo Miller & Co. Pvt. Ltd. vs. Chairman, Rajasthan Vidyut Utpadan Nigam Ltd.Flab ThugsNo ratings yet

- DisputeDocument15 pagesDisputeSandeep KhuranaNo ratings yet

- Babumanoharan Jai Kumar Christhurajan v. Indian Bank (NCLAT - Chennai)Document29 pagesBabumanoharan Jai Kumar Christhurajan v. Indian Bank (NCLAT - Chennai)karanNo ratings yet

- Bombay HC 450122Document21 pagesBombay HC 450122advocatewalkersNo ratings yet

- Case 4Document7 pagesCase 4Anusha RamanathanNo ratings yet

- Prathiba M. Singh, J.: Equiv Alent Citation: 262 (2019) DLT455Document13 pagesPrathiba M. Singh, J.: Equiv Alent Citation: 262 (2019) DLT455Siddharth BhandariNo ratings yet

- DPC - Written Statement - Singh and AssoDocument42 pagesDPC - Written Statement - Singh and AssoJagatjeet SinghNo ratings yet

- IA No. 29010-12 of 2020Document120 pagesIA No. 29010-12 of 2020Karan ShahuNo ratings yet

- SC Judgment-Forgery-civil Suit PendingDocument4 pagesSC Judgment-Forgery-civil Suit PendingNarapa Reddy YannamNo ratings yet

- Written Statement#18Document8 pagesWritten Statement#18Jitendra Prajapati100% (1)

- Reportable: Page - 1Document28 pagesReportable: Page - 1Prerna Batra DhaliwalNo ratings yet

- Madhumilan Syntex Ltd. & Ors Vs Union of India & Anr On 23 March, 2007Document11 pagesMadhumilan Syntex Ltd. & Ors Vs Union of India & Anr On 23 March, 2007Abhishek Yadav100% (1)

- Tipu Sultan Vs State and Ors 02122015 BDHCBDHC2015230916170154153COMb575691Document6 pagesTipu Sultan Vs State and Ors 02122015 BDHCBDHC2015230916170154153COMb575691A.B.M. Imdadul Haque KhanNo ratings yet

- Mira Gehani and Ors Vs Axis Bank Limited and Ors 2MH2019150319162925227COM598480Document68 pagesMira Gehani and Ors Vs Axis Bank Limited and Ors 2MH2019150319162925227COM598480Saharssh K SNo ratings yet

- Real Link PlaintDocument4 pagesReal Link Plaintsreekhanth malathielangovanNo ratings yet

- Defence WitnessesDocument39 pagesDefence WitnessesArvind PatilNo ratings yet

- In The Supreme Court of IndiaDocument41 pagesIn The Supreme Court of Indiavenugopal murthyNo ratings yet

- Mko31012022crlmm24452021 193037 408772 1Document10 pagesMko31012022crlmm24452021 193037 408772 1Anu VermaNo ratings yet

- Hemant C. ShivDocument43 pagesHemant C. ShivBHAVYANSHI DARIYANo ratings yet

- RT 11021 47 2014 MVL DT 10 06 2021-MergedDocument52 pagesRT 11021 47 2014 MVL DT 10 06 2021-MergedNikunj LathiyaNo ratings yet

- In The High Court of Delhi at New DelhiDocument18 pagesIn The High Court of Delhi at New DelhiSambasivam GanesanNo ratings yet

- Hs Chemical 7'11 and Leave To DefendDocument32 pagesHs Chemical 7'11 and Leave To Defenddushyant bhargava100% (1)

- Suo Motu Case No. 02 of 2020Document57 pagesSuo Motu Case No. 02 of 2020Chrisgayle GayleNo ratings yet

- PRESSDocument4 pagesPRESSRavi BhatejaNo ratings yet

- P.R. Shah, Shares and Stock Broker (P) Ltd. v. B.H.H. Securities (P) Ltd. and OthersDocument7 pagesP.R. Shah, Shares and Stock Broker (P) Ltd. v. B.H.H. Securities (P) Ltd. and OthersUrviNo ratings yet

- Mukisa Biscuit Manufacturing Ltd's CaseDocument11 pagesMukisa Biscuit Manufacturing Ltd's CaseMarco kusyamaNo ratings yet

- Rajiv Sahai Endlaw, JDocument5 pagesRajiv Sahai Endlaw, JSiddharth BhandariNo ratings yet

- CIC Decision Dated 06.12.2019 On The Complaint Filed by Neeraj Sharma v. CPIO National Payments Corporation of India New Delhi Full Bench DecisionDocument16 pagesCIC Decision Dated 06.12.2019 On The Complaint Filed by Neeraj Sharma v. CPIO National Payments Corporation of India New Delhi Full Bench DecisionMitali KshatriyaNo ratings yet

- C B I Vs Maninder Singh On 28 August 2015Document5 pagesC B I Vs Maninder Singh On 28 August 2015CA VED PRAKASH PALIWALNo ratings yet

- 2Document15 pages2vikram nagpalNo ratings yet

- Page 1 of 15Document15 pagesPage 1 of 15Ritwick MajumderNo ratings yet

- Compounding of Offence 138 of Negotiable Instruments Act, 1881 Not Permissible Except With The Consent of The Complainant.Document10 pagesCompounding of Offence 138 of Negotiable Instruments Act, 1881 Not Permissible Except With The Consent of The Complainant.Anuj GoyalNo ratings yet

- 2020 Hrto 22Document4 pages2020 Hrto 22iandmydisciplesNo ratings yet

- Exhibit in The Bombay City Civil Court at Bombay Summary Suit No. 3614 of 2010 (High Court Summary Suit No.1151 of 2010)Document14 pagesExhibit in The Bombay City Civil Court at Bombay Summary Suit No. 3614 of 2010 (High Court Summary Suit No.1151 of 2010)Gulam ImamNo ratings yet

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Sedex Audit Report 03.08.2019Document14 pagesSedex Audit Report 03.08.2019Shopee Lazada100% (1)

- 7TH Chapter - Strategy Review Control and EvaluationDocument39 pages7TH Chapter - Strategy Review Control and EvaluationSM2022No ratings yet

- This Study Resource Was: BBMA4303Document7 pagesThis Study Resource Was: BBMA4303NURUL AMALINA BINTI ROSLI STUDENTNo ratings yet

- Ayush GuptaDocument2 pagesAyush GuptaThe Cultural CommitteeNo ratings yet

- Sample EHS Audit Check SheetDocument8 pagesSample EHS Audit Check SheetgovindNo ratings yet

- White Paper On Fixed Assets Valuation and Fair ValueDocument9 pagesWhite Paper On Fixed Assets Valuation and Fair ValueAmeni WannésNo ratings yet

- Provisions For Filing of Return of IncomeDocument17 pagesProvisions For Filing of Return of IncomeJoseph SalidoNo ratings yet

- Niat ReviewerDocument2 pagesNiat ReviewerMae leeNo ratings yet

- B - Performance EvaluationDocument15 pagesB - Performance Evaluationian dizonNo ratings yet

- Waseem Shahzad: F O M O S /E S H / A ADocument2 pagesWaseem Shahzad: F O M O S /E S H / A AWaqaar Ali VirkNo ratings yet

- Kibru DessuDocument63 pagesKibru Dessubereket nigussieNo ratings yet

- BA 141 Chapter 1: Introduction To Corporate Finance Corporate FinanceDocument5 pagesBA 141 Chapter 1: Introduction To Corporate Finance Corporate FinanceJoy PeleteNo ratings yet

- Final Exam: Assoumou Kouame Jose Auditing DR BoguiDocument2 pagesFinal Exam: Assoumou Kouame Jose Auditing DR BoguiEudes Salvy AssoumouNo ratings yet

- Reviewer For Final Exam Strategic Management Chpater 6 10Document37 pagesReviewer For Final Exam Strategic Management Chpater 6 10Kate NuevaNo ratings yet

- ACC 408 Accounting Theory: Questions Comments Suggestions Information SharingDocument24 pagesACC 408 Accounting Theory: Questions Comments Suggestions Information SharingKesa MetsiNo ratings yet

- Work Plan of Sistema BioDocument1 pageWork Plan of Sistema BioDeependraAgarwalNo ratings yet

- Manage Petty Cash and Expenses: ElearningDocument44 pagesManage Petty Cash and Expenses: ElearningfghyurNo ratings yet

- 2020 Proxy Statement - CognizantDocument72 pages2020 Proxy Statement - CognizantRahul Agarwal0% (1)

- Documentation MatrixDocument9 pagesDocumentation MatrixRavi javaliNo ratings yet

- F2 Accounting For MaterialsDocument15 pagesF2 Accounting For MaterialsMunyaradzi Onismas ChinyukwiNo ratings yet

- Itc ProjectDocument103 pagesItc ProjectSrinivasulu Reddy PNo ratings yet

- Part 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewDocument12 pagesPart 2 Examination - Paper 2.6 (INT) Audit and Internal ReviewkhengmaiNo ratings yet

- Republic of The Philippines Regional Trial CourtDocument11 pagesRepublic of The Philippines Regional Trial Courtmisyeldv0% (1)

- Streamlining The Financial Close With The SAP Financial Closing CockpitDocument4 pagesStreamlining The Financial Close With The SAP Financial Closing Cockpitpravnb4u634No ratings yet

- Quiz BowlDocument6 pagesQuiz BowlKim Nicole ReyesNo ratings yet

- Audit I I OverviewDocument9 pagesAudit I I OverviewLGNo ratings yet

- Accounting and Financial Close - Group Ledger IFRS (1GA - US) : Test Script SAP S/4HANA - 02-09-19Document4 pagesAccounting and Financial Close - Group Ledger IFRS (1GA - US) : Test Script SAP S/4HANA - 02-09-19tungthu83No ratings yet

- Annex 9 - Accreditation ACs FormsDocument19 pagesAnnex 9 - Accreditation ACs FormsMark MarasiganNo ratings yet

- Investment Analysis of Jamuna Bank Ltd.Document53 pagesInvestment Analysis of Jamuna Bank Ltd.SharifMahmud50% (6)