Professional Documents

Culture Documents

Audit Report F.Y 2022-23

Audit Report F.Y 2022-23

Uploaded by

prateek gangwani0 ratings0% found this document useful (0 votes)

4 views5 pagesCopyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views5 pagesAudit Report F.Y 2022-23

Audit Report F.Y 2022-23

Uploaded by

prateek gangwaniCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 5

GUPTA MITTAL GOEL & ASSOCIATES

CHARTERED ACCOUNTANTS,

8-12. lind FLOOR, RDC, RAJ NAGAR, GHAZIABAD-201002

(Mob): #91-9560706327

e-mail: camukulmittal1987@yahoo.com

Independent Auditor's Report

TO THE MEMBERS OF SAG PIPES PRIVATE LIMITED

Report on the Financial Statements

We have audited the accompanying financial statements of SAG PIPES PRIVATE LIMITED (‘the Company’),

which comprise the balance sheet as at 31 March 2023, the statement of profit and loss for the year then ended,

and notes to the financial statements, including a summary of the significant accounting policies and other

explanatory information.

'n our opinion and to the best of our information and according to the explanations given to us, the aforesaid

financial statements give the information required by the Companies Act, 2013 in the manner so required and give

2 true and far view in conformity with the accounting principles generally accepted in India, of the state of affairs

‘of the Company as at 31 March, 2023, and its profit and the changes in equity for the year ended on that date,

Basis for Opinion

We conducted our audit in accordance with the standards on auditing specified under section 143 (10) of the

‘Companies Act, 2013. Our responsibilty under those standards, ae futher described in the aucitor's responsibilty

for the audit ofthe financial statements section of our report. We are independent ofthe company in accordance

withthe code of ethics issued by the Institute of Chartered Accountants of India together with ethical requirements

that are relevant to our aucit of the financial statements under the provisions of the Act and the rules there under,

‘and we have fulfilled our other ethical responsibilities in accordance with these requirements and the code of ethics.

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a basis for our opinion,

Key Audit Matters

Key audit matters are those matters that, in our professional judgement, were of most significance in our audit of

the financial statements of the current period. Those matters were addressed in the context of our audit of the

financial statements as a whole, and in forming our opinion thereon, and we do not provide a separate opinion on

these matters,

Reporting of key audit matters as per SA 701

Key audit matters are not applicable to the Company as itis an unlisted company.

Information other than the financial statements and auditor's report thereon

The Company's board of directors is responsible for the preparation ofthe other information. The other information

Comprises the information included in the Board's Report including Annexure to Board's Report, Business

responsibilty report but does not include the financial statements and our auditor's report thereon.

Our opinion on financial statements does not cover the other information do not express any form of

assurance conclusion thereon.

In connection with our audit ofthe financial statements, our responsibilty is to read the other information and, in

doing so, consider whether the other information is materially inconsistent with the financial statements or our

knowledge obtained during the course of our audit or otherwise appears to be materially misstated,

If, based on the work we had performed, we conclude that there is a material misstatement of tis other information

we are requied to report that fact. We have nothing to report in this regard,

incial Statements

Management's Responsibility for the Standalone

‘The Company's Board of Directors is responsible forthe matters stated in Section 134(5) of the Companies Act,

2013 with respect to the preparation of these financial statements that give a true and fair view of the financial

position, financial performance of the Company in aocordance with the accounting principles generally accepted

in India including the accounting standards specified under section 133 of the act.

This responsibilty also includes maintenance of adequate accounting records in accordance with the provisions

of the Act for safeguarding the assets of the Company and for preventing and detecting frauds and other

irtegulates; selection and application of appropriate accounting policies; making judgments and estimates that

are reasonable and prudent; and design, implementation and maintenance of adequate intemal fnancial controls,

that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to

the preparation and presentation ofthe financial statements that give atrue and fair view and are free from material

misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company's abilty to continue

8S a going concem, disclosing, as applicable, the matters related to going concer and using the going concern

basis of accounting unless management either intends to liquidate the Company to cease operations, or has no

realistic alternative but to do so,

‘The Board of Directors are also responsible for overseeing the Company's financial reporting process.

Auditor's Responsibility for the audit ofthe financial statements

ur objectives are to obtain reasonable assurance about whether the financial statements as a whole are free from

material misstatement, whether due to fraud or error, and to issue an auditor's report that includes our opinion,

Reasonable assurance is a high level of assurance, but is not a guarantee that an audit conducted in accordance

with SAs will always detect a material misstatement when it exists. Misstatements can arise from fraud or error

and are considered material if, individually or in the aggregate, they could reasonably be expected to influence the

economic decisions of users taken on the basis of these financial statements

‘As part of an audit in accordance with SAs, we exercise professional judgment and maintain professional

skepticism throughout the audit. We alsor

Identify and assess the risks of material misstatement of the financial statements, whether due to fraud or error,

You might also like

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- DR Data GhaziabadDocument36 pagesDR Data Ghaziabadprateek gangwaniNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5808)

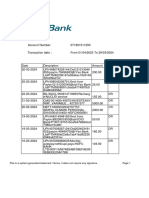

- Icici Bank Statement Simpal Kumari 01 04 2023 - 29 03 2024Document24 pagesIcici Bank Statement Simpal Kumari 01 04 2023 - 29 03 2024prateek gangwaniNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (346)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (843)

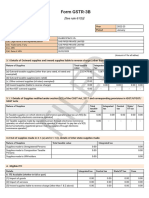

- GSTR3B_21AYWPA7472L1ZZ_072023Document2 pagesGSTR3B_21AYWPA7472L1ZZ_072023prateek gangwaniNo ratings yet

- GSTR3B_21AYWPA7472L1ZZ_012023Document2 pagesGSTR3B_21AYWPA7472L1ZZ_012023prateek gangwaniNo ratings yet

- GSTR3B_21AYWPA7472L1ZZ_052022Document2 pagesGSTR3B_21AYWPA7472L1ZZ_052022prateek gangwaniNo ratings yet

- MGR pptDocument16 pagesMGR pptprateek gangwaniNo ratings yet

- Coi Ay 2021-22 Kanta SinghalDocument2 pagesCoi Ay 2021-22 Kanta Singhalprateek gangwaniNo ratings yet

- GSTR3B_21AYWPA7472L1ZZ_062022Document2 pagesGSTR3B_21AYWPA7472L1ZZ_062022prateek gangwaniNo ratings yet

- Itr Ay 2022-23 Naveen KumarDocument1 pageItr Ay 2022-23 Naveen Kumarprateek gangwaniNo ratings yet

- Details sheet for loginDocument4 pagesDetails sheet for loginprateek gangwaniNo ratings yet

- Shyamveer 432 Kisan (S.sir)Document14 pagesShyamveer 432 Kisan (S.sir)prateek gangwaniNo ratings yet

- Coi Ay 2021-22 Nupur SinghalDocument2 pagesCoi Ay 2021-22 Nupur Singhalprateek gangwaniNo ratings yet

- GSTR1 09abdcs7847l1zl 102023Document4 pagesGSTR1 09abdcs7847l1zl 102023prateek gangwaniNo ratings yet

- P OD CC DetailsDocument1 pageP OD CC Detailsprateek gangwaniNo ratings yet

- Itr Simpal Kumari 23 24Document1 pageItr Simpal Kumari 23 24prateek gangwaniNo ratings yet

- Simpal Itr 2022 23Document1 pageSimpal Itr 2022 23prateek gangwaniNo ratings yet

- Himanshu Aggarwal Itr 22 23Document1 pageHimanshu Aggarwal Itr 22 23prateek gangwaniNo ratings yet

- Parul Pan Card NewDocument1 pageParul Pan Card Newprateek gangwaniNo ratings yet

- ACK492760830160723Document1 pageACK492760830160723prateek gangwaniNo ratings yet

- GSTR1 09abdcs7847l1zl 112023Document4 pagesGSTR1 09abdcs7847l1zl 112023prateek gangwaniNo ratings yet

- GSTR3B - 22 - 23 MarchDocument3 pagesGSTR3B - 22 - 23 Marchprateek gangwaniNo ratings yet

- GSTR3B - 22-23 JanDocument3 pagesGSTR3B - 22-23 Janprateek gangwaniNo ratings yet

- Sag Pipes Comp 2020 2021Document2 pagesSag Pipes Comp 2020 2021prateek gangwaniNo ratings yet

- Form PDF 126581270091221Document37 pagesForm PDF 126581270091221prateek gangwaniNo ratings yet

- Coi 2023 Sag PipesDocument3 pagesCoi 2023 Sag Pipesprateek gangwaniNo ratings yet

- Itr 2Document1 pageItr 2prateek gangwaniNo ratings yet

- Educational CertificateDocument6 pagesEducational Certificateprateek gangwaniNo ratings yet