Professional Documents

Culture Documents

Qateel

Qateel

Uploaded by

maham rasheedCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Qateel

Qateel

Uploaded by

maham rasheedCopyright:

Available Formats

Accounting entry for finance lease Tax treatment for lease

Machinery DR Lease rentals expense Dr 100,000

Lease liability Cr Bank/cash Cr 100,000

Lease rentals paid

during a tax year are

allowed as tax

Lease rentals/installment deduction

100,000 every year Tax does not accept accounting treatment for leasing.

interest exp

liability repayment

Accounting treatment : finance lease

Treats leased asset as

asset therefore

records depreciation

reatment for leasing.

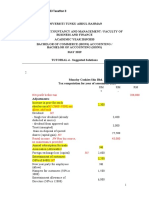

Mr. Qateel

Total income - Tax year 2024

Income from business:

Accounting profit 2,809,297

Add: finance charges on leased asset 35,703

Fine for breach of contract - No treatment

Add: Accounting dep 1,900,000

Add:Manufacturing licence 450,000 Intangible asset as per Tax

Less: amortization of licence - 30,000

Vehicle tax - deduction allowed

Security deposit to KE 200,000 not a deduction allowed

advance tax 300,000 not a deduction allowed

add: donations 2,064,600 not a deduction allowed

penality for late return filung 25,000 not a deduction allowed

Entertainment exp - No treatment

Less: dividend income - 580,000 Not business income

less: capital gain - 1,200,000 Not business income

less: lease rentals - 270,000 Full lease rentals paid are allowed as tax expense

less: tax depreciation - 1,679,000

Income from business 4,025,600

Income from other sources 800,000 Gross earning. Dividend is FTR income

Capital gain 1,200,000

Total income 6,025,600

less: FTR and deparate block of income 5,225,600

less: zakat - 100,000

Taxable income under NTR 5,125,600

Tax liability:

on NTR income - 5,125,000 1,158,960 Tax credit working:

Less: tax credit - 347,688 A tax liability C: lower of

Tax liability - NTR 811,272 B taxable income 1,537,680

Tax on dividend 120,000

Total tax liability 931,272

Less: tax already paid

advaance tax collected through electricity b- 300,000

advance income tax paid - 480,000

tax on dividend - 120,000

Tax payable with return 31,272

Tax depreciation working

other than iv and v 1,560,000

leased asset 15,000 Asset to be treated as an acquisition in tax year 24 and Residual va

warehouse 104,000 Depreciation rate is 10% on building.

Total depreciation 1,679,000

Tax treatment for lease:

as tax expense

2million

on in tax year 24 and Residual value is treated as cost. Depreciation rate is 15%

You might also like

- Accounting Practice SetDocument8 pagesAccounting Practice SetAlliah Mae Castil89% (9)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- Vershire Company - Case - SolutionDocument7 pagesVershire Company - Case - SolutionFor SolutionNo ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Managerial Accounting-Solutions To Ch06Document7 pagesManagerial Accounting-Solutions To Ch06Mohammed HassanNo ratings yet

- Quiz 1Document2 pagesQuiz 1Richelle ManocayNo ratings yet

- AFAR Quizzer 2 SolutionsDocument8 pagesAFAR Quizzer 2 SolutionsRic John Naquila Cabilan100% (1)

- Solution Manual For Managerial Economics 7th Edition AllenDocument33 pagesSolution Manual For Managerial Economics 7th Edition AllenPrashant GautamNo ratings yet

- Tutorial 8-CIT3-2024 - AnswerDocument15 pagesTutorial 8-CIT3-2024 - Answercaduong0109No ratings yet

- Assignment E & L Env 4 BusiDocument9 pagesAssignment E & L Env 4 BusiSyed Hamza RasheedNo ratings yet

- Examiner Comments-Summer 2017Document12 pagesExaminer Comments-Summer 2017Mahendar BhojwaniNo ratings yet

- Cash Flow StatementDocument18 pagesCash Flow Statementriya SharmaNo ratings yet

- Question On Income From Business and Profession 2Document9 pagesQuestion On Income From Business and Profession 2Ayush BholeNo ratings yet

- Determination of Income Tax Due and Payable If There Is A Given Creditable Withholding TaxDocument12 pagesDetermination of Income Tax Due and Payable If There Is A Given Creditable Withholding Taxgellie mare flores100% (1)

- TAX ANSWER-R4Tanyag KeyDocument5 pagesTAX ANSWER-R4Tanyag KeyCheska JaplosNo ratings yet

- Eyatid 06activity1Document2 pagesEyatid 06activity1Allan vincent EyatidNo ratings yet

- 11.25.2017 Accounting For Income TaxDocument5 pages11.25.2017 Accounting For Income TaxPatOcampo0% (1)

- Salary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Document5 pagesSalary and Wages 940,000 Gross Profit 2,600,000 Rent Expense 200,000 Gain On Sale of Building (Note-1) 100,000Samia AkterNo ratings yet

- Bba F&a Notes & ProbDocument5 pagesBba F&a Notes & ProbMouly ChopraNo ratings yet

- IAS12 - Examples - SolutionDocument9 pagesIAS12 - Examples - SolutionTrần Nguyễn Tuệ MinhNo ratings yet

- December 2010 TC10BADocument12 pagesDecember 2010 TC10BAkalowekamoNo ratings yet

- CHAPTER 14 - ExercisesDocument6 pagesCHAPTER 14 - ExercisesDeviane CalabriaNo ratings yet

- Chapter 5Document7 pagesChapter 5yebegashetNo ratings yet

- Illustration 1Document9 pagesIllustration 1Thanos The titanNo ratings yet

- Excercise ProblemsDocument7 pagesExcercise ProblemsKatherine EderosasNo ratings yet

- Tax Accounting AssignmentDocument10 pagesTax Accounting Assignmentsamuel debebeNo ratings yet

- CamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Document9 pagesCamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Soeung SereyvanttanaNo ratings yet

- Mr. Zulfiqar Computation of Taxable Income For Tax Year 2009 RupeesDocument5 pagesMr. Zulfiqar Computation of Taxable Income For Tax Year 2009 Rupeesmeelas123No ratings yet

- Tax Dep F Dec 2007Document9 pagesTax Dep F Dec 2007Saleem TahirNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxRyll BedasNo ratings yet

- Taxation Review Dec2016Document6 pagesTaxation Review Dec2016Shaiful Alam FCANo ratings yet

- Financial StatementDocument18 pagesFinancial StatementhamdanNo ratings yet

- UNIT-4 - Income-From-BusinessDocument114 pagesUNIT-4 - Income-From-BusinessGuinevereNo ratings yet

- Screenshot 2023-03-28 at 9.42.11 AMDocument38 pagesScreenshot 2023-03-28 at 9.42.11 AMKinza NawazNo ratings yet

- Week 8 PreparationDocument2 pagesWeek 8 PreparationSteve NgôNo ratings yet

- Cash Flow Statement For The Period: EntityDocument3 pagesCash Flow Statement For The Period: EntityJanmejay MinaNo ratings yet

- ACCY 200 - Tutorial 2Document5 pagesACCY 200 - Tutorial 2KaiWenNgNo ratings yet

- Solutions For Cash Flow Sums OnlyDocument11 pagesSolutions For Cash Flow Sums OnlyS. GOWRINo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- O CPA Review: Taxation PreweekDocument19 pagesO CPA Review: Taxation PreweekVanessa Anne Acuña DavisNo ratings yet

- Statement of Comprehensive IncomeDocument4 pagesStatement of Comprehensive Incomebobo tangaNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhNo ratings yet

- He Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeDocument15 pagesHe Is Not Subject To Basic Income Tax. However, His 13th Month Pay Exceeds 90,000. ThereforeEarl Daniel RemorozaNo ratings yet

- Case StudyDocument2 pagesCase Studyの変化 ナザレNo ratings yet

- 4 A TUTORIAL 4 AnswerDocument6 pages4 A TUTORIAL 4 AnswerLee HansNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- It 2Document44 pagesIt 2Business RecoveryNo ratings yet

- Income TaxesDocument37 pagesIncome TaxesAngelaMariePeñarandaNo ratings yet

- QuestionsDocument12 pagesQuestionsDolliejane MercadoNo ratings yet

- Interim 7 Consolidation AFAR1Document7 pagesInterim 7 Consolidation AFAR1Bea Tepace PototNo ratings yet

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Session 5Document19 pagesSession 5youssef.oubenaliNo ratings yet

- Taxation Mid 2 Solution NUBDocument4 pagesTaxation Mid 2 Solution NUBNiizamUddinBhuiyanNo ratings yet

- Txmwi 2019 Jun ADocument9 pagesTxmwi 2019 Jun AangaNo ratings yet

- Suggested Answers Certificate in Accounting and Finance - Spring 2019Document7 pagesSuggested Answers Certificate in Accounting and Finance - Spring 2019Abdullah QureshiNo ratings yet

- Qau Memo 2019-03. Pfrs 16 Leases Annex A EntriesDocument2 pagesQau Memo 2019-03. Pfrs 16 Leases Annex A EntriesMikx LeeNo ratings yet

- Income-Taxation CompressDocument27 pagesIncome-Taxation CompressRochel Ada-olNo ratings yet

- AFEDocument7 pagesAFEsarah josephNo ratings yet

- Lt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Document5 pagesLt234. Tvp. (Il-II) Solution Cma May-2023 Exam.Arif HossainNo ratings yet

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessDocument17 pagesShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuNo ratings yet

- Income TaxDocument31 pagesIncome TaxUday KumarNo ratings yet

- 06 Actvity 1 1Document4 pages06 Actvity 1 14mpspxd5msNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- MAPI - Annual Report 2019 PDFDocument373 pagesMAPI - Annual Report 2019 PDFAshfina HardianaNo ratings yet

- APLN - Annual Report - 2018 PDFDocument381 pagesAPLN - Annual Report - 2018 PDFIrna WatiNo ratings yet

- PT Garudafood Putra Putri Jaya TBK - Q3 - 30.09.2019Document96 pagesPT Garudafood Putra Putri Jaya TBK - Q3 - 30.09.2019We Luph NNo ratings yet

- FABM 2 Module 4 Exercises Statement of Cash FlowDocument3 pagesFABM 2 Module 4 Exercises Statement of Cash FlowJennifer NayveNo ratings yet

- Unit III Utility Analysis - EconomicsDocument15 pagesUnit III Utility Analysis - Economicsqyani90% (30)

- Prelim Exam - LUNADocument17 pagesPrelim Exam - LUNAJoyce LunaNo ratings yet

- Elliot Residencies-Application FormDocument3 pagesElliot Residencies-Application FormVindula RanawakaNo ratings yet

- Stock Market Research Paper 5Document13 pagesStock Market Research Paper 5api-549214190No ratings yet

- Term Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryDocument3 pagesTerm Test 1 (QP) IAS 16 + 36 + 23 + 40 + 20 + Single EntryAli OptimisticNo ratings yet

- Running Head: Woolworths Financial AnalysisDocument13 pagesRunning Head: Woolworths Financial AnalysisPrinciNo ratings yet

- Kuldeep Kaur Pbi Mist.-Incometax Caculator 2019-20Document7 pagesKuldeep Kaur Pbi Mist.-Incometax Caculator 2019-20ssNo ratings yet

- Afar Quizzer On Consolidation (Ifrs 10)Document9 pagesAfar Quizzer On Consolidation (Ifrs 10)john paul100% (1)

- Practice Accounts Prime PDFDocument56 pagesPractice Accounts Prime PDFShraddha NepalNo ratings yet

- Verification of Assets and Liabilities: Basic ConceptsDocument59 pagesVerification of Assets and Liabilities: Basic ConceptsHarikrishnaNo ratings yet

- V. Traditional Finance Vs Behavioral FinanceDocument14 pagesV. Traditional Finance Vs Behavioral FinanceIsmayil ElizadeNo ratings yet

- Econ c3Document51 pagesEcon c3larra100% (1)

- Pages 436 To 478Document43 pagesPages 436 To 478sakthiNo ratings yet

- Format For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +Document2 pagesFormat For Preparing Cash Flow Statement - Start With PBT: (4) Reclassify Interest Paid Under Financing Activities +shidupk5 pkNo ratings yet

- Unit 2 (NATIONAL INCOME)Document41 pagesUnit 2 (NATIONAL INCOME)Sophiya PrabinNo ratings yet

- Top-Down Valuation (EIC Analysis) : EconomyDocument5 pagesTop-Down Valuation (EIC Analysis) : EconomyManas MohapatraNo ratings yet

- Financial Accounting 2A Sick Test MemoDocument10 pagesFinancial Accounting 2A Sick Test MemoMapsipiexNo ratings yet

- Section B - ALL THREE Questions Are Compulsory and MUST Be AttemptedDocument6 pagesSection B - ALL THREE Questions Are Compulsory and MUST Be AttemptedProf. OBESENo ratings yet

- Business PlanDocument22 pagesBusiness PlanLitzy DelgadoNo ratings yet

- Financial & Corporate Reporting: RequirementDocument6 pagesFinancial & Corporate Reporting: RequirementTawsif HasanNo ratings yet

- Investors Policy Statement For Mr. Avinash TopnoDocument2 pagesInvestors Policy Statement For Mr. Avinash TopnoRanjith KumarNo ratings yet