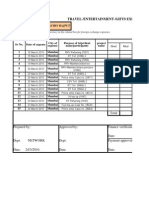

Staff Number (6Digits) Date (ddmmyy) Suffix (eg A,B)

For Foreign Currency claims please

BBC STAFF and PAYE FREELANCER Expenses Claim (UK and Foreign) use CLAIM SUMMARY FORM if

required by your division

CLAIM REF: M 546097L 16/03/2023

WBS Code, Cost Centre, Sales Order etc.

COMPANY CODE SURNAME ALIYU INITIALS S. CURRENCY Naira CHARGE CODE Sheet of

Reason for not making claim on ACCOM & TRAVEL BUSINESS HOSPITALITY HOSPITALITY IRREGULAR VAT - UK Expenses TOTAL AMOUNT TAX-

e-Expenses MEALS PHONE INTERNAL EXTERNAL EXPENSES Only ABLE

TRIP DETAILS DUTY TRIP TO KATSINA FOR BBC DEBATE EXP

BUSINESS FUEL RECEIPT

MILES TYPE No.

DATE DESCRIPTION OF EXPENSE / IRREGULAR ITEM (Indicate GL code for Irregular) 62200 62204 80315 62209 62210 70730 "X"

Totals brought forward from previous sheet = P/D/L

20/01/2023 Feeding allowance for duty trip to Katsina for BBC Debate 5,500.00 2,000.00 7,500.00

21/01/2023 Feeding allowance for duty trip to Katsina for BBC Debate 5,500.00 2,000.00 7,500.00

22/01/2023 Feeding allowance for duty trip to Katsina for BBC Debate 5,500.00 2,000.00 7,500.00

23/01/2023 Feeding allowance for duty trip to Katsina for BBC Debate 5,500.00 2,000.00 7,500.00

24/01/2023 Feeding allowance for duty trip to Katsina for BBC Debate 5,500.00 2,000.00 7,500.00

25/01/2023 Feeding allowance for duty trip to Katsina for BBC Debate 2,500.00 5,000.00 7,500.00

(a)

TOTALS (to carry forward) = 30,000.00 15,000.00 - (a)

CLAIM AMOUNT 45,000.00

VEHICLE, DRIVER & MILEAGE DETAILS Year to Date TOTAL this claim Carry Forward Driver Declaration Number Advance No (if applic.) ADVANCE AMOUNT (b)

45,000.00

REGISTRATION CC.

If you are claiming mileage for your own or other private vehicle, please confirm if the vehicle is 1) Insured for business use, 2) Has on display a valid vehicle excise duty disc, 3) Serviced and

maintained in accordance with manufacturer’s specifications (although not necessarily by the manufacturer’s agents) and 4) Where applicable, has valid MOT certificate Yes No

CLAIMANT CERTIFICATION AUTHORISATIONS I certify that the expenditure was necessary and to the best of AMOUNT DUE

my knowledge this claim was made in accordance with BBC regulations and was

I certify that the above claim is wholly in respect of BBC duty and the I certify that the above claim is in accordance with BBC Regulations. TO STAFF

incurred in respect of BBC duty. NIL

amounts claimed have been spent by me on the items shown. MEMBER (a-b)

GROSS CLAIM

Please keep a copy of your claim for future reference (EXCL ADVANCES) (LIMIT IN WORDS) NIL

NOT OVER TO BBC

Name

Signature

BLOCK CAPS

Name BLOCK CAPS Tel Ext 'Amount Due' shown above does not take

account of Advance Returns, Transfers or

Tel Ext Date Signature Signature Date incomplete foreign currency conversions.

Office Address Tel Ext Date Office Address

SSC USE ONLY SAP Invoice File Park Date Signature Post Date Signature

Version 1 - 280613