Professional Documents

Culture Documents

3 GST Invoice Metro

3 GST Invoice Metro

Uploaded by

metropolyplastOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

3 GST Invoice Metro

3 GST Invoice Metro

Uploaded by

metropolyplastCopyright:

Available Formats

P p

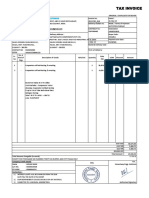

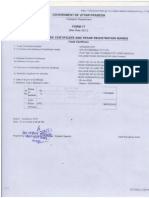

Original For Buyer

METRO POLYPPLAST Duplicate for transporter

मेट्रो पॉली प्लास्ट

Triplicate For Seller

Factory: Regd. Off.7616/4,

Plot No. Plot No.GIDC,

1018/6, GIDC, Ankleshwar,

Ankleshwar, Bharuch,Bharuch,

Gujarat, Gujarat, Pin-393002.

Pin-393002.

Factory:

MFG. ALLPlot No. 7616,PLASTIC

REPROCESS GIDC, Ankleshwar,

GRANULES,Bharuch,

TUBING Gujarat,

ETC. Pin-393002.

MFG. ALL

MO:9824272658, REPROCESS PLASTIC GRANULES, TUBING ETC.

EMAIL-METROPOLYPLAST@GMAIL.COM

GSTN NO: 24ABQPH9725C1ZM

TAX INVOICE

DYNAMIC POLYPACK

PLOT NO.12 YOGI ESTATE 3

Invoice No.:

Challan No.:

3

3

Date :

Date :

METRO POLY PLA

19-04-24

19-04-24

ANKLESHWAR .

DIST.BHARUCH GUJARAT. 393002

P.O. No.:

Name of Transport / VehicleNo :

Date :

GJ16X6348

मेट्रो पॉली प्लास्ट

Regd. Off. Plot No. 1018/6, GIDC, Ankleshwar, Bharuch, G

L.R. No.: Date :

Factory: Plot No. 7616, GIDC, Ankleshwar, Bharuch, Gu

GST TIN NO :24AAUFD2535P1ZW E-way Bill No:

MFG. ALL REPROCESS PLASTIC GRANULES, TUB

No. DESCRIPTION OF GOODS UNIT HSN CODE QTY RATE Amount

1 REPROCESS PLASTIC GRANULES KGS 3901 6225.000 27.50 171187.50

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

OUR GSTN NO: 24ABQPH9725C1ZM

Work Order NO: VERBAL TOTAL ₹ 171,188.00

OUR BANK DETAIL SGST 9.00% ₹ 15,407.00

BANK OF MAHARASHTRA, A/C NO-60040727677,PIRAMAN BR. CGST 9.00% ₹ 15,407.00

ANK-2, IFSC-MAHB0000628, UPI-metropolyplast@mahb IGST 0% ₹ 0.00

₹ 0.00

Two Hundred Two Thousand Two Rupees and No Paises

G. TOTAL ₹ 202,002.00

TERMS & CONDITIONS -

1. the bill should be paid as agreed credit days otherwise interest at prevailing rate will be charged . We reserve

our right to demand and recover the full or part amount of the bill. For, METRO POLY PLAST

2. our risk and responsibility ceases as soon as goods leave our factory godown.

3. we are not responisble for any transit damage/losses.

4. courts in ankleshwar shall have jurisdication in case of any disputes.

5. CGST, SGST, IGST, etc shall be buyers account

6. The buyer hereby undertakes to furnish immediately the declarations form as per the provisions of CGST, SGST,

IGST and shall pay full rate of taxes and other levies, if such forms is not furnished. Authorised Signatory

You might also like

- Sales Invoice 2221351033 Dated 09.09.2022Document2 pagesSales Invoice 2221351033 Dated 09.09.2022Jyoti PrakashNo ratings yet

- Numerology Course SRDocument2 pagesNumerology Course SRmetropolyplastNo ratings yet

- Access - KA-51-AB-6862Document10 pagesAccess - KA-51-AB-6862Subhan ShaikhNo ratings yet

- GST Config - IndiaDocument29 pagesGST Config - Indiadeepankar sengupta100% (1)

- A Study o Impact of GST On Flipkart1 (Recovered)Document95 pagesA Study o Impact of GST On Flipkart1 (Recovered)Zyan UmarNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)HskslaNo ratings yet

- Refrigerator BillDocument5 pagesRefrigerator BilldharmendraNo ratings yet

- 4 GST Invoice MetroDocument1 page4 GST Invoice MetrometropolyplastNo ratings yet

- 2 GST Invoice MetroDocument1 page2 GST Invoice MetrometropolyplastNo ratings yet

- Tax Invoice: M Rajkrishna Trading PVT LTDDocument1 pageTax Invoice: M Rajkrishna Trading PVT LTDRishab BansalNo ratings yet

- Adobe Scan 08-Feb-2024Document5 pagesAdobe Scan 08-Feb-2024higrover93No ratings yet

- Tax InvoiceDocument4 pagesTax InvoiceSanjay Kumar GhadaiNo ratings yet

- Tax Invoice: M Rajkrishna Trading PVT LTDDocument1 pageTax Invoice: M Rajkrishna Trading PVT LTDRishab BansalNo ratings yet

- Tax Invoice: Honestway Engg. SolutionsDocument1 pageTax Invoice: Honestway Engg. SolutionsmdkhandaveNo ratings yet

- Tax Invoice American Precoat Speciality PVT LTD: Original For Recipient SalesDocument5 pagesTax Invoice American Precoat Speciality PVT LTD: Original For Recipient SalessatendraNo ratings yet

- BPPL 24 551Document2 pagesBPPL 24 551Rishab BansalNo ratings yet

- Adobe Scan 21 Jan 2024Document1 pageAdobe Scan 21 Jan 2024Abhimanyu SinghNo ratings yet

- SahebDocument1 pageSahebMaharshi ThakerNo ratings yet

- MaheshbiilDocument1 pageMaheshbiilSOURAAVNo ratings yet

- KGN TradersDocument2 pagesKGN TradersksbniclNo ratings yet

- Tax Invoice: Patel Material Handling Equipment-2324Document1 pageTax Invoice: Patel Material Handling Equipment-2324IMARAN PATELNo ratings yet

- Form 49 Kamal Steel Olm4n2tDocument1 pageForm 49 Kamal Steel Olm4n2tbasu agarwalNo ratings yet

- Po 300000021011295 Btu-Kmh-Po-0015766 0Document1 pagePo 300000021011295 Btu-Kmh-Po-0015766 0SallyNo ratings yet

- DN 02Document1 pageDN 02abinayaNo ratings yet

- DYNAMICDocument10 pagesDYNAMICKeyur PatelNo ratings yet

- Debit Note 1700093513Document1 pageDebit Note 1700093513manpreet singhNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Avinash Kumar RaiNo ratings yet

- OD430708073377616100Document2 pagesOD430708073377616100RAJ GONDALIYANo ratings yet

- Secured Advance Measurement Sheet of II ND RA BILLDocument2 pagesSecured Advance Measurement Sheet of II ND RA BILLVikas VivenNo ratings yet

- Tax Invoice Cum Challan: Vew HydraulicDocument4 pagesTax Invoice Cum Challan: Vew HydraulicPritesh KoratNo ratings yet

- Clean Zone - Dsmax Stavam - Po No - 155 - 29.08.2023Document2 pagesClean Zone - Dsmax Stavam - Po No - 155 - 29.08.2023Vasundhara DesikachariNo ratings yet

- GST InvoiceDocument1 pageGST InvoiceAruna DasNo ratings yet

- 21 BILL NO RPPL 21-1Document1 page21 BILL NO RPPL 21-1abhijeetbishnoiNo ratings yet

- Store Material ChalanDocument1 pageStore Material ChalanSuryadev singhNo ratings yet

- OD113626379364628000Document3 pagesOD113626379364628000Some Famous FactsNo ratings yet

- Po 657 (Sarvodya)Document1 pagePo 657 (Sarvodya)sarvodayaprintlinksNo ratings yet

- OD427505718206136100Document2 pagesOD427505718206136100Sunil KumarNo ratings yet

- EbillDocument2 pagesEbillBubai SarkarNo ratings yet

- Maruti TechnoDocument1 pageMaruti TechnoJeba SamuelNo ratings yet

- FOC Invoice GST 243010012Document2 pagesFOC Invoice GST 243010012mohitmishra9210No ratings yet

- Eureka Enterprise: Gstin: W.E.F. Pan No. State Code: 24 Gujarat CMYPD2354J 01/07/2017 24CMYPD2354J1ZRDocument1 pageEureka Enterprise: Gstin: W.E.F. Pan No. State Code: 24 Gujarat CMYPD2354J 01/07/2017 24CMYPD2354J1ZRrinkalNo ratings yet

- 27 Dheeraj Kumar Mandoriya PDFDocument1 page27 Dheeraj Kumar Mandoriya PDFyusuf pathanNo ratings yet

- Counter Sale Tax InvoiceDocument2 pagesCounter Sale Tax InvoiceJay PanchalNo ratings yet

- 3rd FLOOR SHOP RENTDocument1 page3rd FLOOR SHOP RENTIT'S ME UjwalNo ratings yet

- File JEETDocument1 pageFile JEETrohitNo ratings yet

- Order 1702045347537Document1 pageOrder 1702045347537Alok ChoudharyNo ratings yet

- 642 GST AR Invoice Items Export - IEL - Nov18Document1 page642 GST AR Invoice Items Export - IEL - Nov18SoyabSuriyaNo ratings yet

- Od329397024618607100 1Document2 pagesOd329397024618607100 1n.d.chudasama143No ratings yet

- InvoiceDocument1 pageInvoiceabhishitewariNo ratings yet

- 51 Shroff PumpDocument2 pages51 Shroff Pumproman reignsNo ratings yet

- SupplyOutward GST 22 23 816Document1 pageSupplyOutward GST 22 23 816nikunjsingh04No ratings yet

- Bill 102Document2 pagesBill 102isntjack40No ratings yet

- TC Renewal New 23 To 28Document1 pageTC Renewal New 23 To 28Mahalaxmi AgenciesNo ratings yet

- Boat Aavante Bar 2000 160 W Bluetooth Soundbar: Grand Total 6999.00Document3 pagesBoat Aavante Bar 2000 160 W Bluetooth Soundbar: Grand Total 6999.00Ram RahimNo ratings yet

- Washing MachineDocument3 pagesWashing MachineAnoy das MahapatraNo ratings yet

- Final Tax Invoice MH48CB3080Document2 pagesFinal Tax Invoice MH48CB3080aakashgupta viaanshNo ratings yet

- Flipkart Labels 10 Mar 2024 10 03Document1 pageFlipkart Labels 10 Mar 2024 10 03riteshk937No ratings yet

- Adobe Scan 02 Jan 2024Document3 pagesAdobe Scan 02 Jan 2024Megha SinghNo ratings yet

- InvoiceDocument1 pageInvoiceimprakhar7No ratings yet

- 7 - 7 W - MergedDocument2 pages7 - 7 W - MergedwearerecyclesolutionsNo ratings yet

- S S TextileDocument1 pageS S TextileKrishna CorporationNo ratings yet

- Khandelwal Agencies PVT - LTDDocument2 pagesKhandelwal Agencies PVT - LTDSabuj SarkarNo ratings yet

- Khandelwal Agencies PVT - LTDDocument2 pagesKhandelwal Agencies PVT - LTDSabuj SarkarNo ratings yet

- Store Details: Glass SutraDocument2 pagesStore Details: Glass SutraglasssutrateamNo ratings yet

- Bipon SharmaDocument27 pagesBipon SharmametropolyplastNo ratings yet

- Body PART PRESENT PLANETSDocument1 pageBody PART PRESENT PLANETSmetropolyplastNo ratings yet

- Shri Rin Mochan MangalDocument2 pagesShri Rin Mochan MangalmetropolyplastNo ratings yet

- Shri Rin Mochan MangalDocument2 pagesShri Rin Mochan MangalmetropolyplastNo ratings yet

- InvoiceDocument1 pageInvoiceblackcobra33641No ratings yet

- Total: Smart Biomedical ServicesDocument3 pagesTotal: Smart Biomedical ServicesSmart BiomedicalNo ratings yet

- Normal Mensa Delivery 2177155Document1 pageNormal Mensa Delivery 2177155pupudey01No ratings yet

- HealthifyMe TransfrmStudio InvoiceDocument1 pageHealthifyMe TransfrmStudio InvoiceLifekeepers FoundationNo ratings yet

- Mobile Services: Your Account Summary This Month'S ChargesDocument2 pagesMobile Services: Your Account Summary This Month'S ChargesMohd KhalidNo ratings yet

- GST Return 12 DEC 2019Document1 pageGST Return 12 DEC 2019Abasaheb RaskarNo ratings yet

- Wa0006.Document1 pageWa0006.Aun M RizviNo ratings yet

- GST ChallanDocument1 pageGST Challanshaan creationNo ratings yet

- Tally Document For Set 2Document4 pagesTally Document For Set 2Chandu123 ChanduNo ratings yet

- (Original For Recipient) : Billing Address Shipping AddressDocument1 page(Original For Recipient) : Billing Address Shipping AddressVaru NayanNo ratings yet

- GST Practical Questions Vol - 1 (New) by CA Vivek GabaDocument13 pagesGST Practical Questions Vol - 1 (New) by CA Vivek Gabavamshi9686No ratings yet

- 74824bos60500 cp15Document90 pages74824bos60500 cp15soni12c2004No ratings yet

- PDFServlet 4Document2 pagesPDFServlet 4Nayan AhmedNo ratings yet

- VKG - Bill 392Document3 pagesVKG - Bill 392salesNo ratings yet

- 12409/gondwana SF Exp Third Ac (3A)Document2 pages12409/gondwana SF Exp Third Ac (3A)umricsccenterNo ratings yet

- Research Proposal GSTDocument8 pagesResearch Proposal GSTpraveen p s100% (1)

- Sub Order Labels PDFDocument90 pagesSub Order Labels PDFVishal ChauhanNo ratings yet

- DT & Idt Revision Sequence Abc Analysis May 2023 - Ca Mayank TrivediDocument5 pagesDT & Idt Revision Sequence Abc Analysis May 2023 - Ca Mayank TrivediApurva MehtaNo ratings yet

- Hindustan HardwareDocument1 pageHindustan HardwareKunj KariaNo ratings yet

- GST PresentationDocument66 pagesGST PresentationkapuNo ratings yet

- Tax Invoicbeekalane Sampling Dertament PDFDocument1 pageTax Invoicbeekalane Sampling Dertament PDFSanjog DharamshiNo ratings yet

- Cash Segment - Trade Summary Cum Bill Report For TodayDocument2 pagesCash Segment - Trade Summary Cum Bill Report For TodayAlpesh BhesaniyaNo ratings yet

- GST MCQ1Document3 pagesGST MCQ1Sundar RamanNo ratings yet

- Passenger Details:: Electronic Reservation Slip (ERS)Document3 pagesPassenger Details:: Electronic Reservation Slip (ERS)Karan NayakNo ratings yet

- Shri Mata Vaishno Devi Shrine Board KatraDocument2 pagesShri Mata Vaishno Devi Shrine Board Katraravi panchalNo ratings yet

- FL20240125111616552Document1 pageFL20240125111616552mayukh.baraiNo ratings yet