Professional Documents

Culture Documents

Lec 16-Standard Form Contracts

Lec 16-Standard Form Contracts

Uploaded by

Migori Art0 ratings0% found this document useful (0 votes)

5 views23 pagesCopyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

5 views23 pagesLec 16-Standard Form Contracts

Lec 16-Standard Form Contracts

Uploaded by

Migori ArtCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 23

.

Exclusion Clauses & Standard Form Contracts

● Clauses which exclude or limit a party’s liability

● Justification: freedom of contract (a party is free to reject

the clause) AND efficiency

● BUT weaker party may have no capacity to negotiate

● Transaction risk passed to the weaker party even where

co. is negligent.

● The law attempts to limit the effect of such clauses

through legislation & courts

Main Approaches

● 1. Protectionism: Courts should interfere

To correct power imbalances in the market place

● 2. Freedom of contract: Courts should not interfere

with the bargaining process

CONSIDERATIONS

1. Manner of Incorporation

Signed Documents: L’Estrange v Graucob

∏ Bought a cigarette vending machine and signed a sales agreement

without reading it. It contained a broad exemption clause in small

print on poor quality paper.

It stopped working and could not be fixed.

It contained a clause excluding all implied conditions & warranties

not contained in the document.

Held: Scrutton LJ: “When a document containing contractual terms

is signed, then, in the absence of fraud, or I will add

misrepresentation, the party signing is bound…”

NB: If you sign a document, you cant argue you did not read or

understand.

Exception: i. Fraud or Misrepresentation

Curtis v Chemical Cleaning & Dyeing Co.

● Π took a wedding dress for cleaning

● She was asked to sign a document and she asked what it

was.

● Δ told her that it excluded liability for damages to sequins

& beads

● In reality, it excluded them from liability from any sort of

damage

● HELD: she was not bound by her

signature since Δ had misrepresented facts.

ii. Type of Document:

Grogan v Robin Meredith Plant Hire [1996]

● The signed document should be one that ordinarily

contains contractual conditions

Document : Time sheet

Held: a timesheet was not a document which might be

expected to contain contractual clauses

Electronic signatures

● Kenya Information and Communications Act (2/98)

● 83J.Formation and validity of contracts. (83C-83R)

(using electronic messages)

● Evidence Act. (Part VII – Electronic Records) e.g S.106F

“A court shall presume that every electronic record

purporting to be an agreement containing the

electronic signatures of the parties was concluded by

affixing the digital signature of the parties”

Unsigned Documents

1. Time of Notice : Olley v Malborough

● The Olleys booked a hotel room

● They went out and left the key at the reception desk

● Someone took the key & stole Mrs. Olley’s fur coat.

● She asked for compensation and they declined

● Informed that they only refunded items given to hotel for

safekeeping

● The Exclusion was on a wall in their room

HELD: Contract formed at the time of checking in at the

reception desk

Exclusion did not form part of the contract since they read it

after the contract was formed.

Exception: Course of Dealings

Spurling J Ltd v Bradshaw

●Δ had stored orange juice in Π’s warehouse for years.

●He stored 8 barrels of juice

●They were missing when he went to collect them

●He refused to pay the storage charges. He was sued.

●Δ argued Π had been negligent

●Π stated exclusion clause exempted them from liability for

negligent acts

HELD: Clause was valid. Parties had dealt on those terms

previously.

2. Sufficiency/Degree of Notice:

Parker v S.E Railway Parker left his baggage at the railway

station luggage office. He was given a ticket which had

the words “see back”. The back contained a clause

limiting liability for loss of luggage. The luggage was lost

and he sued.

● Held: The test was whether the defendant had done

enough to bring the clause to the notice of the plaintiff.

● It was decided that they had done so and the plaintiff was

bound by the agreement.

Lewis Ralph Dodd v Chandrakant Nandha [1971]

EA 58

● Π left his car at the Δ’s garage for storage. The garage was

negligent and the car was stolen. The garage claimed that

they had exempted their liability by a notice at the back of

the yard. They also argued that the plaintiff had been to the

garage on at least 3 occasions.

● Held: The notice had not been brought to the plaintiff’

attention.

It was very small in size and was not prominently

displayed.

Chapelton v Barry Urban Council

● ∏ hired some deck chairs and was given some small

tickets. He thought it was a receipt

● The back had exclusion clause for damages or accidents

resulting from use of the chairs

● The canvas on a chair collapsed & Π was injured

● Held: the exemption clause had not been sufficiently

brought to his attention.

He would not have automatically assumed that the receipt/

ticket contained contractual terms.

NB: Nature of the document is important

Thornton v Shoe Lane Parking

● ∏ was injured in the Δ’s car park.

● Entrance had a notice showing charges and stating

that parking was done at the owner’s risk.

● Motorist would stop to obtain a ticket.

● The barrier would then lift

● The ticket indicated that it was subject to conditions

displayed on the premises

Thornton case cont’d

● Premises contained several notices spelling out the

conditions

Lord Denning: ‘In order to give sufficient notice, it

would need to be printed in red ink with a red hand

pointing to it”, or something similar..

Held: The notices were NOT sufficiently drawn to the

Π’s attention.

Review: Machine: offer or invitation

to treat?

V.W Nehra v The Commissioner for Transport

● ∏ was travelling from Jinja to Msa. She stopped in

Nairobi for sometime. When she got to Mombasa, her

luggage was lost.

● Δ’s argued that their liability was limited by the

conditions in their tariff handbook

● The EA Railways & Harbours Administration Act

provided that such goods were to be collected within 24

hours.

● HELD: The Act was clear enough to deter her claim.

Construction of the Clause

1. The Contra Proferentum Rule

● Used where a contract is ambiguous

● The exemption clause must be very specific and clear

if a party wishes to rely on it/ the drafter.

● If not, the ambiguity is resolved against the party

seeking to rely on the clause

NB: courts will be more lenient if the clause is a

limitation clause as opposed to an exclusion clause

Houghton v Trafalgar Insurance Co Ltd

● An insurance policy did not provide protection if a

car was carrying an “excess load”

● The car had an accident when it was carrying 6

instead of 5 passengers.

● The insurance company refused to pay

● Held: the word ‘Load’ was ambiguous. It does not

ordinarily refer to passengers.

● The insurance Co. was liable.

Fundamental Breach Theory

● Developed by courts to prevent parties from relying

on exemption clauses to get away with serious

breaches

● If a “central” term was affected, courts would declare

it a fundamental breach.

● The entire contract was then repudiated.

Karsales (Harrow) Ltd v Wallis

● Δ bought a car on hire purchase terms.

● Exemption clause provided that there was no

warranty regarding age, condition, roadworthiness or

fitness for any purpose

● He inspected the car and found it ok.

● BUT on delivery, it was damaged and some items

had been removed.

● HELD: There was a fundamental breach. The

Company could not rely on the exemption clause.

Fundamental Breach (Contd)

● Fundamental breach theory was NOT popular with

all judges because

i) it interfered with the idea of FOC.

ii) Created uncertainty regarding what amounts to a

fundamental breach.

iii) Reluctance to apply it where there was equality in

bargaining power

Photo Productions Ltd v Securicor Transport

● Securicor contracted to provide a night patrol.

● A clause in its terms exempted it from liability for its

employees actions unless they were foreseeable.

● The night officer started a fire which went out of control

and burnt a large part of the factory.

● Trial: The exemption Clause applied

● COA: applied fundamental breach theory

● HOL: parties were free to negotiate their own agreements.

The clause was clear and unambiguous.

● Fundamental breach theory disregarded

● Courts should focus on construction..

Reforms Elsewhere:

● England: Regulation of such clauses via statute.

● Unfair Contract Terms Act 1977

i. Some limitations are VOID: e.g. for death/injury caused

by a party’s negligence

ii. Distinguishes between consumer contracts and

business contracts

● Unfair Terms in Consumer Contracts Regulations 1999

● Unfair term: contrary to good faith; causes a power

imbalance.

Kenya: Consumer Protection Act

S. 88 – clauses which dictate arbitration as the method

of dispute resolution

See also: Competition Act: part 6 (consumer welfare)

You might also like

- Exclusion ClausesDocument17 pagesExclusion ClausesMuhamad Taufik Bin Sufian100% (3)

- Exemption Clauses (Stud - Version)Document66 pagesExemption Clauses (Stud - Version)Farouk Ahmad0% (2)

- 06 Exemption ClausesDocument12 pages06 Exemption ClausesunitNo ratings yet

- Week-6 LiveDocument21 pagesWeek-6 LiveDiana SabuNo ratings yet

- Standard Form of Contracts ....Document16 pagesStandard Form of Contracts ....naveentripathi3012No ratings yet

- Contract FrameworksDocument15 pagesContract FrameworksJjjjmmmmNo ratings yet

- PDF Remedies For Breach of ContractDocument17 pagesPDF Remedies For Breach of ContractaNo ratings yet

- Contract of AdhesionDocument15 pagesContract of AdhesionDebashish DashNo ratings yet

- Terms and RepresentationDocument6 pagesTerms and Representationnicole camnasioNo ratings yet

- Remedies For Breach of ContractDocument16 pagesRemedies For Breach of ContractFatima Tariq100% (6)

- Lec 14 - Terms of A ContractDocument20 pagesLec 14 - Terms of A ContractMigori ArtNo ratings yet

- Contract LawDocument5 pagesContract LawSyed Muhammad AhmedNo ratings yet

- Oblicon NotesDocument6 pagesOblicon NotesJoy RaguindinNo ratings yet

- Exclusion ClauseDocument11 pagesExclusion ClauseAmilia AnuarNo ratings yet

- Unfair Contract Terms: Common Law ControlsDocument4 pagesUnfair Contract Terms: Common Law ControlsSarah AsgharNo ratings yet

- Terms of Contract Lecture NotesDocument12 pagesTerms of Contract Lecture NotesAdam 'Fez' Ferris100% (7)

- Contract of Adhesion - FinalDocument15 pagesContract of Adhesion - FinalDebashish DashNo ratings yet

- Mistake - ContractDocument17 pagesMistake - ContractnishaaaNo ratings yet

- Discharging of A ContractDocument6 pagesDischarging of A ContractRejel RickettsNo ratings yet

- Study Guide Module 4Document20 pagesStudy Guide Module 4sweta_bajracharyaNo ratings yet

- Examption Clauses NotesDocument11 pagesExamption Clauses Notesstevenwang0323No ratings yet

- Contract Terms - First Year StudentDocument15 pagesContract Terms - First Year StudentSahid S Kargbo100% (1)

- Contract Revision SheetDocument106 pagesContract Revision SheetDaniella DanjumaNo ratings yet

- Law of Obligations Content and Discharge of ContractsDocument47 pagesLaw of Obligations Content and Discharge of ContractsAalif IbràhimNo ratings yet

- Conditions, Warranties and Innominate TermsDocument5 pagesConditions, Warranties and Innominate TermsWilliam Mungai KariukiNo ratings yet

- ILLEGALITYDocument14 pagesILLEGALITYOtim Martin LutherNo ratings yet

- Contractual Terms & Vitiating FactorsDocument21 pagesContractual Terms & Vitiating FactorsMeagan MahangooNo ratings yet

- Malaysian Business Law Week-6 Lecture NotesDocument3 pagesMalaysian Business Law Week-6 Lecture NotesKyaw Thwe TunNo ratings yet

- Formation of Contract - Part I (ACCA LW-F4)Document54 pagesFormation of Contract - Part I (ACCA LW-F4)simranNo ratings yet

- AppellantDocument7 pagesAppellantRickyNo ratings yet

- Stand Form ContractDocument3 pagesStand Form ContractHardik SharmaNo ratings yet

- Contract II in A ShellDocument12 pagesContract II in A ShellChawe MphandeNo ratings yet

- Exemption ClauseDocument37 pagesExemption ClauseRana A QudoosNo ratings yet

- No 27 Exclusion ClauseDocument6 pagesNo 27 Exclusion Clauseproukaiya7754No ratings yet

- SIT - Bcd1004.lecture4 - ContractContents - TermsDocument52 pagesSIT - Bcd1004.lecture4 - ContractContents - Termsalixirwong99scribdNo ratings yet

- Contract Law Lecture 4 - Terms of A Contract (PowerPoint)Document39 pagesContract Law Lecture 4 - Terms of A Contract (PowerPoint)Tosin YusufNo ratings yet

- Week 6 TutorialDocument5 pagesWeek 6 Tutorialsmitre42100% (1)

- Incorporation of TermsDocument4 pagesIncorporation of TermsJeyshinaa dev kumarNo ratings yet

- VII. 2. Seaoil Petroleum Corporation v. AutocorpDocument2 pagesVII. 2. Seaoil Petroleum Corporation v. AutocorpJoshua AbadNo ratings yet

- Contract Week 7Document5 pagesContract Week 7tupolapelesiaNo ratings yet

- Law Exemption ClauseDocument34 pagesLaw Exemption ClauseClarence Gan100% (4)

- Privity BellDocument20 pagesPrivity BellBellbell Wong100% (1)

- Frustration - CONTRACTDocument10 pagesFrustration - CONTRACTnishaaaNo ratings yet

- LAW 13 Notes - Chapter 9 & 10Document7 pagesLAW 13 Notes - Chapter 9 & 10Jacqueline DeStefanoNo ratings yet

- Privity of Contract Notes &cases.Document5 pagesPrivity of Contract Notes &cases.Emanuel AloyceNo ratings yet

- Tutorial Contract 5 QDocument9 pagesTutorial Contract 5 QMuhamad Aryn RozaliNo ratings yet

- Cases On Exemption ClausesDocument5 pagesCases On Exemption Clauseskatushabe brendaNo ratings yet

- Exemption or Exclusion ClauseDocument50 pagesExemption or Exclusion ClauseDebbie PhiriNo ratings yet

- Contract Law Principles Slades 2023Document35 pagesContract Law Principles Slades 2023Andziso CairoNo ratings yet

- Conditions Warranties and Inominate TermsDocument3 pagesConditions Warranties and Inominate TermsremojamwaNo ratings yet

- Contract Revision NotesDocument18 pagesContract Revision NotesChichi MulondaNo ratings yet

- Contract Law Notes 2 PDFDocument16 pagesContract Law Notes 2 PDFHiranya KarunaratneNo ratings yet

- Lec 2 - MistakeDocument40 pagesLec 2 - MistakeMigori ArtNo ratings yet

- Unit 2 - Standard Form of ContractDocument3 pagesUnit 2 - Standard Form of ContractPrachi NarayanNo ratings yet

- Exclusion ClausesDocument16 pagesExclusion ClausesRach.ccnnNo ratings yet

- Contract 2 Law Assignment CompletedDocument15 pagesContract 2 Law Assignment CompletedhappymbeyuNo ratings yet

- PDF Case LawDocument5 pagesPDF Case LawChristelle SamonsNo ratings yet

- Catungal vs. RodriguezDocument12 pagesCatungal vs. RodriguezRonald TolledoNo ratings yet

- Cape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyFrom EverandCape Law: Texts and Cases - Contract Law, Tort Law, and Real PropertyNo ratings yet

- SQA Tool - 14.12.23Document23 pagesSQA Tool - 14.12.23Migori ArtNo ratings yet

- Lec 15 - Proof of Terms of A ContractDocument17 pagesLec 15 - Proof of Terms of A ContractMigori ArtNo ratings yet

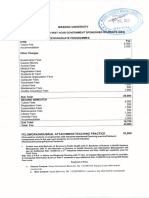

- Fees Structure For FreshersDocument8 pagesFees Structure For FreshersMigori ArtNo ratings yet

- Advertisement KMTC 2019.2020. CleanedDocument2 pagesAdvertisement KMTC 2019.2020. CleanedMigori ArtNo ratings yet

- Active Case FindingDocument23 pagesActive Case FindingMigori ArtNo ratings yet

- Lab Diagnosis of TBDocument73 pagesLab Diagnosis of TBMigori ArtNo ratings yet

- Lec 5 - Classes & OverviewDocument17 pagesLec 5 - Classes & OverviewMigori ArtNo ratings yet

- Introduction & Epidemiology of TBDocument45 pagesIntroduction & Epidemiology of TBMigori ArtNo ratings yet

- Aar Insurance New in Patient Preauthorization Form 2019Document1 pageAar Insurance New in Patient Preauthorization Form 2019Migori Art0% (2)

- Accreditation Report.Document1 pageAccreditation Report.Migori ArtNo ratings yet

- Pep Protocol 2016Document2 pagesPep Protocol 2016Migori ArtNo ratings yet

- SGBV SopDocument72 pagesSGBV SopMigori ArtNo ratings yet

- Genetically Modified Organis1Document17 pagesGenetically Modified Organis1Migori ArtNo ratings yet

- PrEP - A Toolkit For Providers - InspectionCopy - March17Document37 pagesPrEP - A Toolkit For Providers - InspectionCopy - March17Migori ArtNo ratings yet

- Process MapDocument1 pageProcess MapMigori ArtNo ratings yet

- Kenya Natl Guidelines On MGMT of Sexual Violence 3rd Edition 2014Document98 pagesKenya Natl Guidelines On MGMT of Sexual Violence 3rd Edition 2014Migori ArtNo ratings yet

- Knbts-Blood Donation GuidelinesDocument10 pagesKnbts-Blood Donation GuidelinesMigori ArtNo ratings yet

- Fighting Pseudoscience Isn't Free: We Believe We Play An Important Role in Defending Truth and ObjectivityDocument20 pagesFighting Pseudoscience Isn't Free: We Believe We Play An Important Role in Defending Truth and ObjectivityMigori ArtNo ratings yet

- Counsellingthe Cancerpatient: Surgeon'Scounsel : George T. Pack, M.DDocument5 pagesCounsellingthe Cancerpatient: Surgeon'Scounsel : George T. Pack, M.DMigori ArtNo ratings yet

- Disaster Recovery Plan STDocument14 pagesDisaster Recovery Plan STMigori ArtNo ratings yet

- Co Operative Bank Codes As of April 2014 PDFDocument29 pagesCo Operative Bank Codes As of April 2014 PDFMigori Art0% (2)

- Quality Policy Manual V3 PDF 15 122011Document82 pagesQuality Policy Manual V3 PDF 15 122011Migori Art100% (5)

- CCC No: Ministry of Health Effective 01 October 2016 Viral Load Requisition FormDocument1 pageCCC No: Ministry of Health Effective 01 October 2016 Viral Load Requisition FormMigori ArtNo ratings yet

- Kenya Health Policy 2014 2030Document87 pagesKenya Health Policy 2014 2030Migori ArtNo ratings yet

- Guidelines For The Management of Drug Resistant Tuberculosis in Kenya (2010)Document88 pagesGuidelines For The Management of Drug Resistant Tuberculosis in Kenya (2010)Migori ArtNo ratings yet

- Specimen Referral Networks FinalDocument132 pagesSpecimen Referral Networks FinalMigori ArtNo ratings yet

- Kenya Health Sector Referal StrategyDocument64 pagesKenya Health Sector Referal StrategyMigori ArtNo ratings yet

- Kenya NationalPolicyoninjectionDocument18 pagesKenya NationalPolicyoninjectionMigori ArtNo ratings yet

- WHO Lab Quality Management SystemDocument246 pagesWHO Lab Quality Management SystemMigori Art100% (1)

- Ipc GuidelinesDocument210 pagesIpc GuidelinesMigori ArtNo ratings yet

- 12 G.R. No. 96132 Magno V CADocument4 pages12 G.R. No. 96132 Magno V CACovidiaNo ratings yet

- The Philippine Government Structures and The Philippine SocietyDocument47 pagesThe Philippine Government Structures and The Philippine SocietyEnp Titus VelezNo ratings yet

- Sample Document: Residential Tenancy AgreementDocument6 pagesSample Document: Residential Tenancy AgreementA T M SHOWEB 3457No ratings yet

- GO Memo 5476 2007Document2 pagesGO Memo 5476 2007penusila0% (1)

- Breach of Professional Ethics by LawyersDocument10 pagesBreach of Professional Ethics by LawyersMainak DasNo ratings yet

- C - EMSD - Guidance Notes-Solar Water Heating SystemDocument20 pagesC - EMSD - Guidance Notes-Solar Water Heating Systemspeedo3076No ratings yet

- 36 Department of Transportation v. Philippine Petroleum Sea Transport Association, G.R. No. 230107, (July 24, 2018)Document19 pages36 Department of Transportation v. Philippine Petroleum Sea Transport Association, G.R. No. 230107, (July 24, 2018)Jeunice VillanuevaNo ratings yet

- Baysa vs. Santos GR 254328 PDFDocument12 pagesBaysa vs. Santos GR 254328 PDFJantzenNo ratings yet

- Nenita Corp Vs GalaboDocument3 pagesNenita Corp Vs GalaboMarianne Ko50% (2)

- Altura de Instrumento Azimut Cota E0 RumboDocument12 pagesAltura de Instrumento Azimut Cota E0 RumboCesar Leon DiazNo ratings yet

- Advent Capital vs. YoungDocument1 pageAdvent Capital vs. YoungJL A H-DimaculanganNo ratings yet

- P.D. 1143Document2 pagesP.D. 1143BLP Cooperative75% (12)

- Uy v. Bueno, G.R. No. 159119, March 14, 2006Document3 pagesUy v. Bueno, G.R. No. 159119, March 14, 2006Tea AnnNo ratings yet

- Estate Tax Test BankDocument29 pagesEstate Tax Test BankCaptain ObviousNo ratings yet

- Shaheed Sukhdev College of Business StudiesDocument7 pagesShaheed Sukhdev College of Business StudiesrandhawakaranNo ratings yet

- Principles of Administrative LawDocument24 pagesPrinciples of Administrative LawAtif Rehman100% (1)

- CA Bilal Ahmad Resume 1Document1 pageCA Bilal Ahmad Resume 1Anonymous 4TMLA7No ratings yet

- Application Hostel Allotment 22-3-16Document5 pagesApplication Hostel Allotment 22-3-16Mrinal AgarwalNo ratings yet

- CC I Participant Embassy LetterDocument1 pageCC I Participant Embassy LetterCedric MengoteNo ratings yet

- Examples Explanations Criminal Law 8Th Edition John Q La Fond Full ChapterDocument67 pagesExamples Explanations Criminal Law 8Th Edition John Q La Fond Full Chaptersusana.ruiz266100% (4)

- Standard and Sample Contract For Consulting Services, Small Assignments Time-Based Payments DraftDocument15 pagesStandard and Sample Contract For Consulting Services, Small Assignments Time-Based Payments DraftSATRIONo ratings yet

- Supp07 PDFDocument7 pagesSupp07 PDFStrontium ChemNo ratings yet

- Commission Sharing AgreementDocument3 pagesCommission Sharing AgreementHershey Ramos Sabino100% (1)

- The US ConstitutionDocument8 pagesThe US ConstitutiondrtimadamsNo ratings yet

- FED Federal Tort Claims ActDocument32 pagesFED Federal Tort Claims ActMark L. ShortNo ratings yet

- Deed of RestrictionsDocument12 pagesDeed of RestrictionsDyanne DyanNo ratings yet

- Agustin O. Benitez For Petitioner. Benjamin C. Yatco For Private RespondentsDocument12 pagesAgustin O. Benitez For Petitioner. Benjamin C. Yatco For Private RespondentsabethzkyyyyNo ratings yet

- EPC Fiduciary Handbook 3pdfDocument84 pagesEPC Fiduciary Handbook 3pdfmetroid4ever100% (1)

- Malwa Gramin BankDocument9 pagesMalwa Gramin BankJeshiNo ratings yet

- Safety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/ UndertakingDocument9 pagesSafety Data Sheet: SECTION 1: Identification of The Substance/mixture and of The Company/ UndertakingKara WhiteNo ratings yet