0% found this document useful (0 votes)

138 views7 pagesMYOB Group Assignment

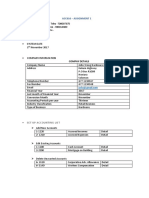

The document provides information for an accounting assignment, including setting up a chart of accounts and opening balances for Adventures Pty Ltd. It lists accounts and their opening balances as of October 1, 2015 and provides additional information to identify values for accounts with question marks. It also provides details for setting up customers, vendors, inventories and payroll in the accounting system.

Uploaded by

Swastika PoonamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

138 views7 pagesMYOB Group Assignment

The document provides information for an accounting assignment, including setting up a chart of accounts and opening balances for Adventures Pty Ltd. It lists accounts and their opening balances as of October 1, 2015 and provides additional information to identify values for accounts with question marks. It also provides details for setting up customers, vendors, inventories and payroll in the accounting system.

Uploaded by

Swastika PoonamCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd